Overview

Core banking service providers are indispensable for optimizing financial operations, enhancing customer experiences, and ensuring compliance with regulatory standards—especially as adoption rates are projected to reach 75% by 2025. We recognize the critical features of these services, including:

- Scalability

- Real-time processing

- Integration capabilities

Furthermore, our detailed cost analysis illustrates how these elements contribute to improved operational efficiency and client engagement within a rapidly evolving financial landscape. What challenges are you facing in your current banking operations? By leveraging these core services, we can help you navigate complexities and drive success in your organization.

Introduction

In a world where financial landscapes are shifting rapidly, we recognize that core banking systems have become indispensable tools for financial institutions striving to thrive in a competitive environment. These centralized platforms play a crucial role in:

- Streamlining operations

- Enhancing customer experiences

- Ensuring compliance with ever-evolving regulatory standards

As we increasingly adopt innovative technologies, such as cloud-native solutions and AI-driven processes, the significance of these systems becomes even more pronounced. With a growing emphasis on:

- Scalability

- Real-time processing

- Seamless integration

Understanding the key features and costs associated with core banking solutions is essential for institutions like ours seeking to navigate the complexities of the modern banking era. This exploration delves into the critical aspects of core banking systems, highlighting their importance and the transformative impact they have on the financial sector.

Understanding Core Banking Systems: Definition and Importance

Core banking service providers act as centralized hubs, enabling us to effectively oversee operations across various branches and channels. They are essential for crucial functions such as account management, transaction processing, and client relationship management. The significance of core banking service providers is underscored by their ability to optimize financial operations, enhance customer experiences, and ensure compliance with regulatory standards.

As we approach 2025, the adoption rates of core banking service providers have surged to 75%, reflecting a growing recognition of their value in improving operational efficiency. Recent advancements, including cloud-native platforms and AI-powered solutions, have transformed our landscape, allowing us to automate processes and respond swiftly to market demands. For instance, our implementation of cloud-native central financial technology at Arvest Bank in January 2023 showcased the capabilities of modern financial technologies to automate commercial loans, illustrating the tangible benefits of such integrations.

Our hybrid integration platform plays a pivotal role in this transformation, simplifying complex integrations and providing a secure foundation for financial institutions. As Gustavo Estrada, one of our clients, noted, “Avato has simplified complex projects and delivered results within desired time frames and budget constraints,” which highlights the effectiveness of our integration solutions in achieving operational goals.

We recognize that incorporating advanced technologies into fundamental financial structures is crucial for maintaining competitiveness in a rapidly evolving economic landscape. These frameworks not only streamline operations but also enhance the overall customer experience, positioning us to meet the rising expectations of our clientele. As we move forward into 2025, the importance of these fundamental financial frameworks remains vital, continuously evolving to meet the dynamic demands of the financial sector, ensuring that we can thrive in an increasingly intricate environment. Additionally, a recent report on the Core Banking Software Market indicates significant growth opportunities, further underscoring the critical role of core banking service providers in today’s market.

Key Features of Leading Core Banking Service Providers

Prominent financial service providers offer a range of features that significantly enhance operational efficiency and client engagement. We recognize that among these, the following key attributes stand out:

- Scalability: A crucial feature that enables us to expand in line with growing transaction volumes and customer bases. As we look ahead to 2025, statistics indicate that core banking service providers offering scalable solutions are essential for accommodating the increasing demands of digital banking. We ensure that reliable PEP database integration receives daily updates from representatives in various jurisdictions, which is vital for compliance and operational efficiency.

- Real-time Processing: Instantaneous transaction processing capabilities are vital for enhancing client satisfaction. Recent data shows that banks adopting real-time processing solutions have experienced a significant rise in client retention and engagement.

- Integration Capabilities: The ability to seamlessly integrate with third-party applications and services is paramount. Our secure hybrid integration platform excels in this area, supporting 12 levels of interface maturity and accelerating the integration of isolated legacy systems. This feature delivers a connected foundation that simplifies and modernizes operations, enabling us to offer a wider array of products and services, thereby enhancing our competitive edge in the market.

- User-Friendly Interfaces: Intuitive designs are essential for improving the user experience for both bank staff and clients. A focus on user-centric design can lead to increased efficiency and satisfaction. As Jim Marous states, “Financial institutions must be able to deliver an easy to navigate, seamless digital platform that goes far beyond a miniaturized online banking offering,” which aligns with our commitment to user-friendly interfaces.

- Regulatory Compliance Tools: Built-in features that assist banks in adhering to evolving regulatory requirements are critical. These tools ensure data security and privacy, fostering client trust and adherence to industry standards. The case study titled “Impact of User Rights Management on Data Security” explores how effective user rights management can enhance data security within bank compliance software, concluding that limiting access to sensitive information based on job functions not only ensures compliance but also fosters customer trust in our organization.

Our platform is architected for secure transactions, trusted by banks, healthcare, and government, ensuring 24/7 uptime with no room for defects, errors, or outages. The significance of scalability in fundamental financial solutions is crucial for core banking service providers, as pointed out by industry leaders. Furthermore, incorporating PEP and sanctions list screening within essential financial software has been demonstrated to improve operational efficiency and simplify compliance processes, reinforcing its importance in today’s financial landscape.

As the financial landscape continues to evolve, staying informed about the latest trends in fundamental features is essential for institutions aiming to maintain a competitive advantage. The emphasis on scalability and real-time processing abilities will remain crucial in shaping the future of core banking service providers and their fundamental financial solutions.

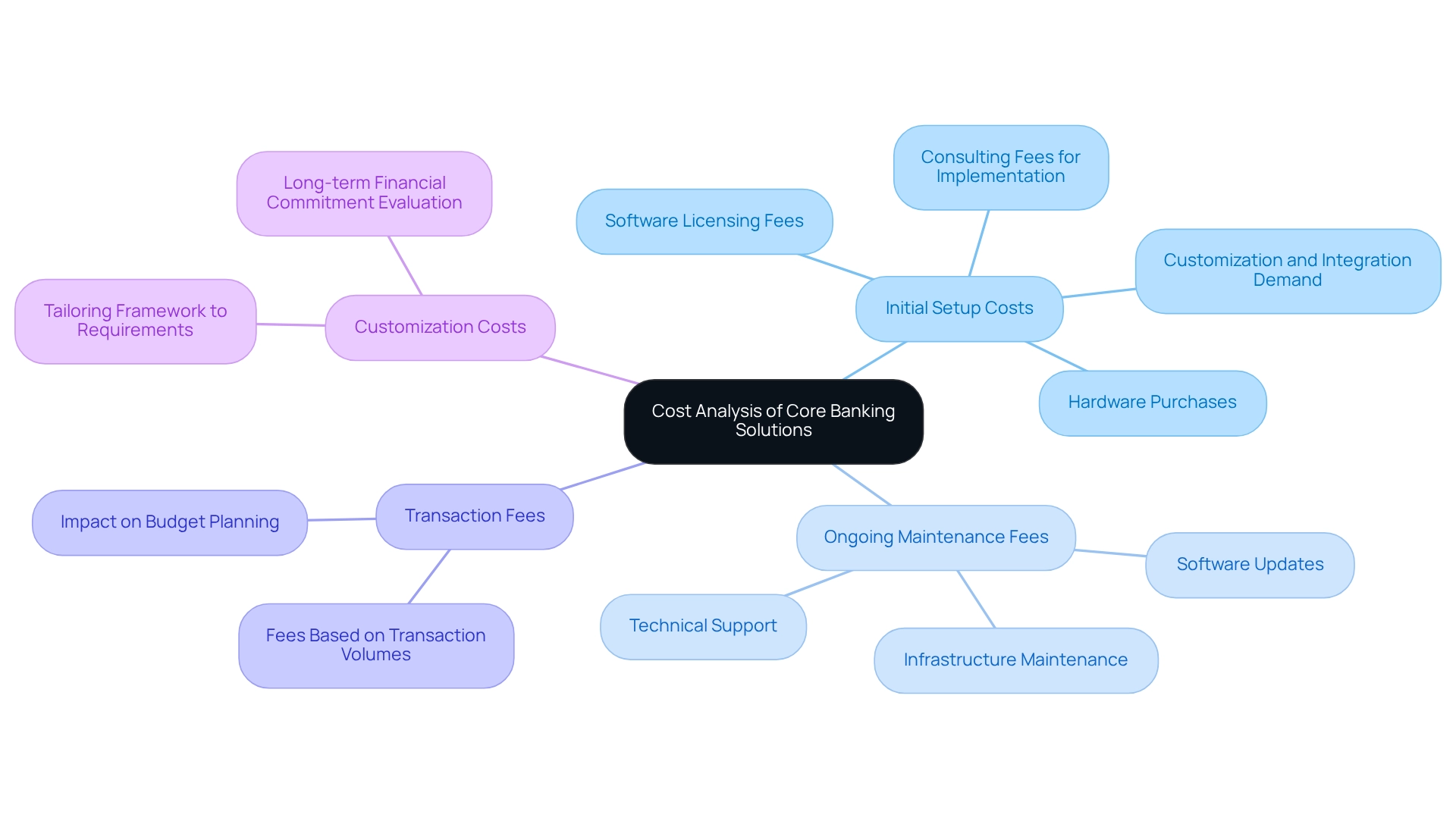

Cost Analysis of Core Banking Solutions: What to Expect

The price of essential financial solutions can vary significantly due to a range of influencing factors, including the supplier, implementation complexity, and required features. We recognize that costs can generally be categorized into several key areas:

- Initial Setup Costs: This encompasses software licensing fees, hardware purchases, and consulting fees for implementation. In 2025, we anticipate that initial setup expenses for core banking service providers will reflect the increasing demand for customization and integration capabilities. Notably, 90 of the world’s top 100 banks are Finastra customers across various products, underscoring the competitive landscape and the prevalence of established providers in the market. To optimize integration strategies, it is crucial for us to effectively mobilize stakeholders to ensure that requirements are accurately captured from the outset.

- Ongoing Maintenance Fees: Regular costs associated with software updates, technical support, and infrastructure maintenance are essential for ensuring optimal performance and security. We must prepare our setup for the future to seamlessly integrate new tools and technologies as they emerge.

- Transaction Fees: Some providers impose fees based on transaction volumes, which can significantly impact overall costs as transaction activity increases. As banks expand their digital services, understanding these fees becomes vital for budget planning. We can leverage the right technology and tools to illustrate current and ideal states, aiding in better financial forecasting.

- Customization Costs: Tailoring the framework to meet specific organizational requirements can incur additional expenses. We encourage organizations to evaluate these costs over several years to grasp the total financial commitment associated with implementing a fundamental financial system. Modeling new business processes and activity flows can assist us in charting a path to success while managing these costs.

In 2025, we expect the average expenses of essential financial solutions to reflect the growing trend toward digital transformation, with numerous institutions investing in updated frameworks to enhance operational efficiency. Factors influencing the cost of essential financial systems offered by core banking service providers include the scale of the institution, regulatory demands, and the degree of integration required with existing systems. Financial analysts emphasize that aligning core implementation costs with organizational priorities is crucial for maximizing return on investment. As Suze Orman wisely stated, “A big part of financial freedom is having your heart and mind free from worry about the what-ifs of life,” highlighting the importance of strategic financial planning.

As illustrated in case studies, such as FIS’s approach to incremental modernization, we can strategically manage costs while adopting new technologies at a sustainable pace. Furthermore, the report on the Core Banking Software Market includes detailed analysis and forecasts for the period 2025-2032, providing timely insights into expected costs and market trends.

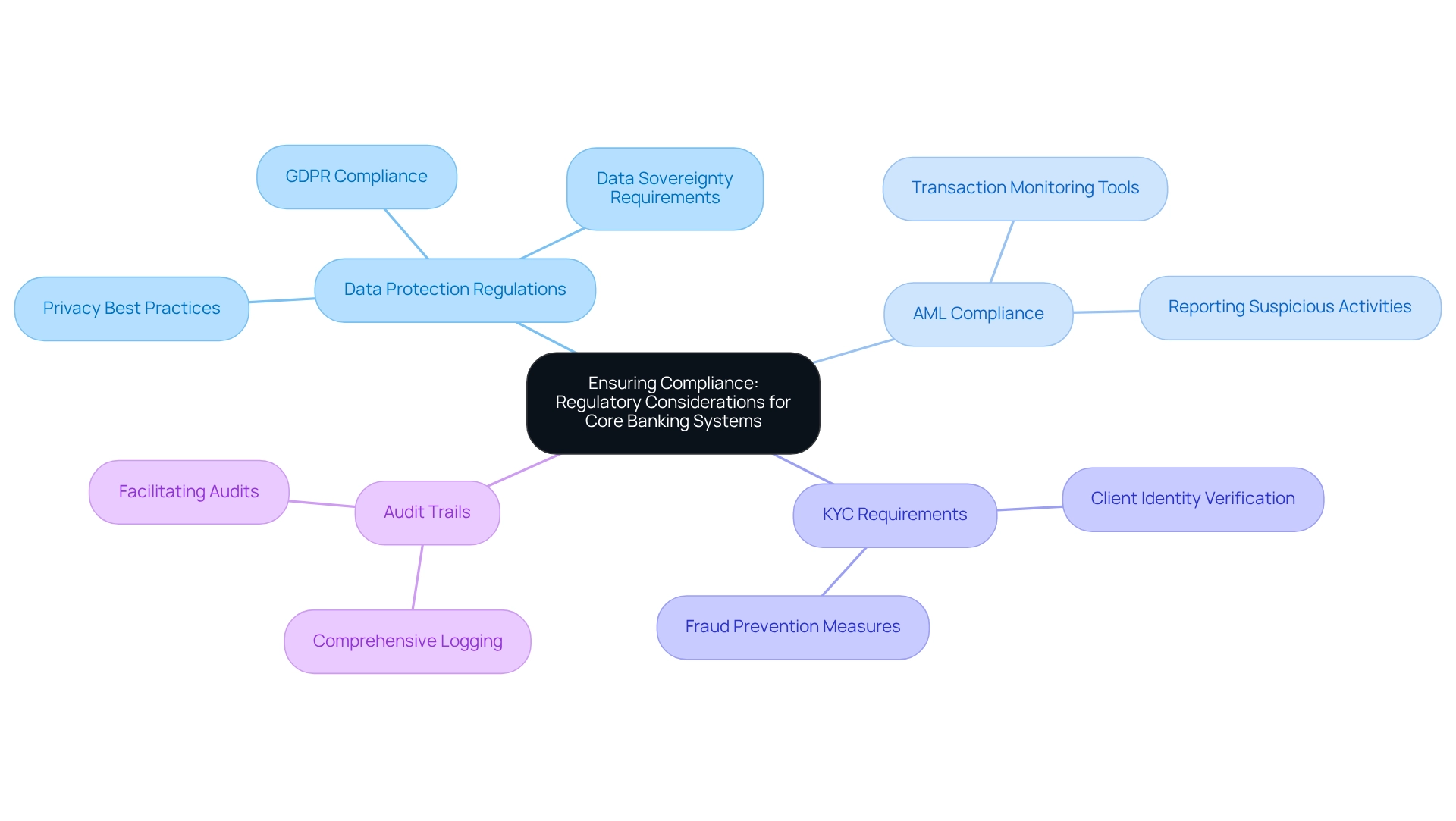

Ensuring Compliance: Regulatory Considerations for Core Banking Systems

In the financial industry, compliance with regulatory standards is not just important; it is essential for operational integrity and client trust. We recognize that core banking frameworks must incorporate features that guarantee adherence to diverse data protection laws, including:

- Data Protection Regulations: Protecting client data in line with regulations like GDPR is imperative. This regulation mandates that organizations understand where their data resides, ensuring compliance with international data sovereignty requirements. As Gal Ringel highlights, the increasing emphasis on data privacy indicates a societal transition towards prioritizing individual data rights, particularly relevant in relation to AI development.

- Anti-Money Laundering (AML) Compliance: We must implement effective systems that incorporate tools for monitoring transactions and reporting suspicious activities, which are crucial for preventing financial crimes.

- Know Your Client (KYC) Requirements: Features that facilitate the verification of client identities are necessary to combat fraud and comply with financial regulations.

- Audit Trails: Comprehensive logging of transactions and system changes is essential for facilitating audits and regulatory reviews, ensuring transparency and accountability.

The significance of these regulations cannot be overstated. Industry experts emphasize that prioritizing compliance not only helps banks avoid substantial fines but also fosters trust among customers and stakeholders. As Jim Liddle notes, organizations must maximize their data intelligence with privacy best practices, asking critical questions about data accuracy, classification, and compliance. As the landscape evolves in 2025, the impact of data protection regulations, particularly GDPR, will continue to shape the strategies of core banking service providers, necessitating robust compliance frameworks. Statistics indicate that many organizations struggle with compliance challenges, underscoring the need for effective governance and data management practices. Furthermore, the rise of biometric technology raises privacy concerns that banks must navigate carefully. By addressing these regulatory considerations, we can enhance our operational capabilities while safeguarding sensitive information. Avato’s reliable and future-proof technology stack, along with our commitment to conducting regular security audits and compliance checks, is essential for adapting to these regulatory changes and ensuring seamless and secure data connectivity.

Conclusion

Core banking systems are not just essential; they are the backbone of the modern financial sector. As we navigate a rapidly changing landscape, the ability of these systems to streamline processes, enhance customer experiences, and ensure regulatory compliance becomes increasingly critical. What’s holding your institution back from embracing this transformation?

Leading core banking providers offer key features such as scalability, real-time processing, and seamless integration. These elements are crucial for improving operational efficiency and customer engagement. Furthermore, user-friendly interfaces and built-in compliance tools not only meet customer expectations but also help us adhere to regulatory standards, enabling us to navigate the complexities of today’s market effectively.

When considering core banking solutions, we must account for:

- Initial setup

- Ongoing maintenance

- Transaction fees

- Customization

Understanding these costs is vital for effective budget planning and maximizing return on investment. A strategic approach to managing these expenses can facilitate sustainable growth and innovation.

In summary, core banking systems are integral to the future of banking. By prioritizing their adoption and optimization, we can ensure operational integrity and foster customer trust. As the financial landscape continues to evolve, implementing core banking solutions will be vital for institutions striving to thrive in this dynamic environment. Let us take this step together, ensuring we remain at the forefront of innovation and customer satisfaction.