Overview

Core banking systems are indispensable for contemporary financial operations, offering centralized solutions for managing critical activities such as account management and transaction processing. This not only enhances efficiency but also significantly improves customer service. Understanding the various types of core banking systems—monolithic, modular, and cloud-native—is essential for financial institutions striving to boost operational efficiency and adapt to the rapidly evolving market demands. As digital finance continues its swift ascent, the need for effective core banking solutions becomes increasingly apparent. Financial institutions must act now to integrate these systems, ensuring they remain competitive and responsive to customer needs.

Introduction

In the rapidly evolving landscape of financial services, core banking systems emerge as the essential framework that underpins modern banking operations. These sophisticated platforms not only streamline critical functions such as account management and transaction processing but also significantly enhance customer engagement and operational efficiency.

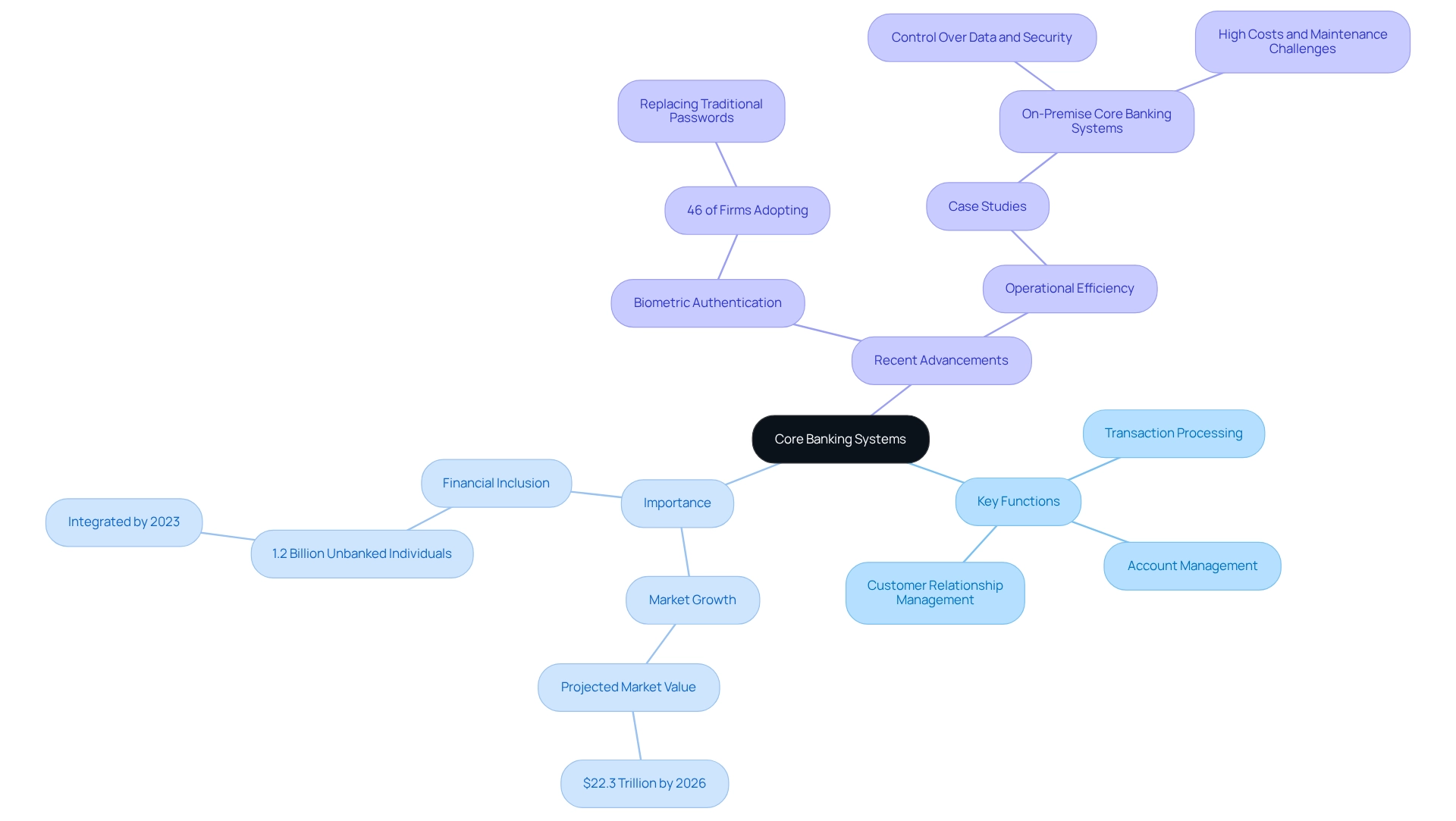

As banks navigate the complexities of a digital-first environment, the necessity of adopting robust core banking solutions becomes increasingly evident, particularly with the global digital banking market projected to soar to $22.3 trillion by 2026.

This article explores the various types of core banking systems, their key features, and the substantial benefits they offer, while also addressing the challenges institutions encounter during implementation. By grasping these dynamics, banks can strategically position themselves to thrive in an increasingly competitive marketplace.

What Are Core Banking Systems? An Overview

Types of core banking systems serve as the bedrock of modern financial operations, providing centralized solutions that empower institutions to manage their activities with remarkable efficiency. These systems facilitate critical financial operations, such as account management, transaction processing, and customer relationship management, across diverse branches and channels. By integrating various financial services into a cohesive framework, essential financial solutions not only streamline operations but also enhance customer service and significantly reduce operational costs.

The importance of foundational financial frameworks cannot be overstated, especially in an era when the global digital finance market is projected to reach a staggering $22.3 trillion by 2026. This anticipated growth is attracting considerable investor interest and underscores the necessity for banks to adopt robust fundamental financial solutions to remain competitive. Additionally, digital financial services have successfully integrated approximately 1.2 billion previously unbanked individuals into the formal financial system by 2023, highlighting the pivotal role that foundational financial infrastructures play in promoting financial inclusion.

Furthermore, as of 2023, nearly 46% of firms in the US have begun replacing traditional passwords with biometric authentication methods, signaling a shift toward more secure and efficient financial practices.

Key functions of core banking systems encompass real-time transaction processing, comprehensive account management, and effective customer relationship management. These capabilities enable banks to respond swiftly to market demands and regulatory requirements, ensuring they remain agile in a rapidly evolving financial landscape. Avato’s hybrid integration platform is instrumental in this context, allowing financial institutions to enhance and extend the value of their legacy technologies while simplifying complex integrations.

This platform guarantees 24/7 availability and reliability, which is critical for the finance, healthcare, and government sectors. Moreover, it provides real-time monitoring and alerts on performance, significantly reducing costs and improving operational efficiency.

Recent advancements in foundational financial frameworks have focused on enhancing operational efficiency and client experience. Successful implementations of these platforms have demonstrated substantial impacts on banks’ operational capabilities, enabling them to streamline processes and shorten time-to-market for new services. As Gustavo Estrada noted, “Avatar has the capacity to simplify intricate projects and produce outcomes within preferred timelines and financial limitations,” illustrating the operational effectiveness that foundational financial frameworks can deliver.

Case studies reveal that institutions leveraging centralized platforms, such as Avato’s, have achieved impressive results, simplifying complex projects and delivering outcomes within desired timelines and budget constraints.

In conclusion, core banking systems are vital in contemporary finance, enhancing operational efficiency and enabling institutions to adapt to the shifting economic landscape. Their role in integrating various financial functions into a unified framework is crucial for institutions aiming to improve service delivery and maintain a competitive edge, particularly when supported by Avato’s dedicated hybrid integration solutions, which stem from a strong commitment to establishing the technological foundation necessary for rich, connected customer experiences.

Exploring Different Types of Core Banking Systems

Core banking systems can be categorized into several types, each offering unique advantages and challenges:

- Monolithic Systems: These traditional, all-in-one solutions encompass all financial functions within a single platform. While they provide a comprehensive suite of features, monolithic architectures often suffer from inflexibility and high maintenance costs. As major financial institutions continue to lead the core banking software sector, the constraints of these platforms may hinder their ability to adapt to rapidly evolving market demands.

- Modular Structures: In contrast, modular structures empower financial institutions to adopt specific modules tailored to their operational needs. This flexibility enables institutions to scale their services efficiently, adding or removing modules as necessary to respond to changing market conditions. The appeal of modular structures is growing among financial institutions aiming to enhance their technology investments.

- Cloud-Native Solutions: Leveraging the power of cloud technology, cloud-native solutions are distinguished by their enhanced scalability, reduced operational costs, and improved accessibility. These frameworks allow financial institutions to implement services quickly and respond to client needs instantaneously, positioning them advantageously in a competitive landscape. With the adoption of cloud technologies in the banking sector projected to surge from 26% to 56% by 2025, the shift towards cloud-native solutions is increasingly evident. Avato’s hybrid integration platform exemplifies how financial institutions can address the challenges of connecting isolated legacy technologies and fragmented data, facilitating a smoother transition to cloud-native solutions. By maximizing and extending the value of legacy infrastructures, Avato simplifies complex integrations, provides real-time monitoring and alerts on performance, and significantly reduces costs, empowering banks to future-proof their operations. As noted by Gustavo Estrada, a customer, “Avato has simplified complex projects and delivered results within desired time frames and budget constraints.”

As the financial sector evolves, understanding these fundamental types of core banking systems is essential for IT managers seeking to efficiently modernize their organizations. The choice between different types of core banking systems, including monolithic, modular, and cloud-native architectures, will significantly impact operational efficiency and the ability to innovate in a fast-paced environment. Implementing a central financial system involves several steps, including requirements gathering, system design, software development, testing and quality assurance, deployment, and training and support, ensuring that the system meets business requirements.

Key Features of Modern Core Banking Solutions

Modern core banking solutions are equipped with several essential features that significantly enhance their functionality and operational effectiveness:

- Real-Time Processing: This feature facilitates immediate transaction processing, which not only enhances customer experience but also boosts operational efficiency. Recent statistics reveal that the adoption of real-time processing in fundamental financial institutions has surged, with approximately 70-85% of these organizations now utilizing this capability. This shift is crucial, as financial institution leaders emphasize core modernization as a strategic imperative, underscoring its role in transforming operations and enhancing customer service. Avato’s Hybrid Integration Platform supports this by enabling seamless integration of legacy systems, ensuring that financial institutions can maximize their existing assets while achieving operational goals. As noted by customer Gustavo Estrada, “Avatar has simplified complex projects and delivered results within desired time frames and budget constraints,” highlighting the effectiveness of modern solutions in achieving operational objectives.

- API Integrations: Contemporary financial solutions leverage API integrations to enable seamless connectivity with third-party applications. This capability empowers financial institutions to provide innovative services, such as personalized financial advice and improved customer engagement through mobile banking applications. Avato’s platform streamlines intricate integrations, allowing financial institutions to respond swiftly to evolving customer demands and enhance their service provisions.

- Automated Compliance Reporting: With regulatory requirements becoming increasingly complex, automated compliance reporting is essential for financial institutions. This feature streamlines the generation of compliance reports, significantly reducing manual effort and minimizing errors. By automating these processes, financial institutions can ensure compliance with regulations while liberating resources for more strategic initiatives. Avato’s secure hybrid integration platform guarantees that compliance is upheld across all integrated networks, reinforcing security and reliability.

- Scalability: Contemporary core financial platforms are designed to accommodate growth, enabling institutions to broaden their offerings without requiring substantial modifications to their infrastructure. This scalability is vital for institutions aiming to adapt to evolving market demands and customer expectations. Avato’s platform is designed to scale alongside your operations, ensuring that integration remains robust as your needs grow.

- Real-Time Monitoring and Alerts: Avato’s Hybrid Integration Platform also provides real-time monitoring and alerts on system performance, enabling financial institutions to proactively address issues before they impact operations. This capability is crucial for maintaining high service levels and ensuring operational reliability.

The impact of these features, particularly real-time processing, cannot be overstated. Case studies have demonstrated that since the emergence of cloud computing in the 2010s, financial institutions have effectively transitioned to cloud-based solutions, improving data security and facilitating the advancement of AI-driven analytics. This transformation has not only enhanced operational capabilities but has also driven competitive differentiation in the marketplace.

For instance, the shift to cloud computing has enabled financial institutions to execute KYC onboarding procedures that confirm the identity of new clients via secure online submission, simplifying the onboarding process and enhancing security.

Expert opinions further reinforce the importance of these features. As industry leaders assert, the capacity to handle transactions in real-time and connect with various applications is no longer optional but a requirement for financial institutions striving to succeed in a digital-first environment. The integration of these essential attributes positions contemporary core financial solutions, particularly those supported by Avato’s Hybrid Integration Platform, as crucial resources for financial institutions aiming to enhance their operational efficiency and customer satisfaction.

Moreover, the cost reduction aspect of Avato’s platform allows banks to optimize their resources, making it a strategic choice for institutions looking to modernize without incurring excessive expenses.

Benefits of Implementing Core Banking Systems

Implementing core banking systems presents a multitude of advantages essential for modern banking operations, including:

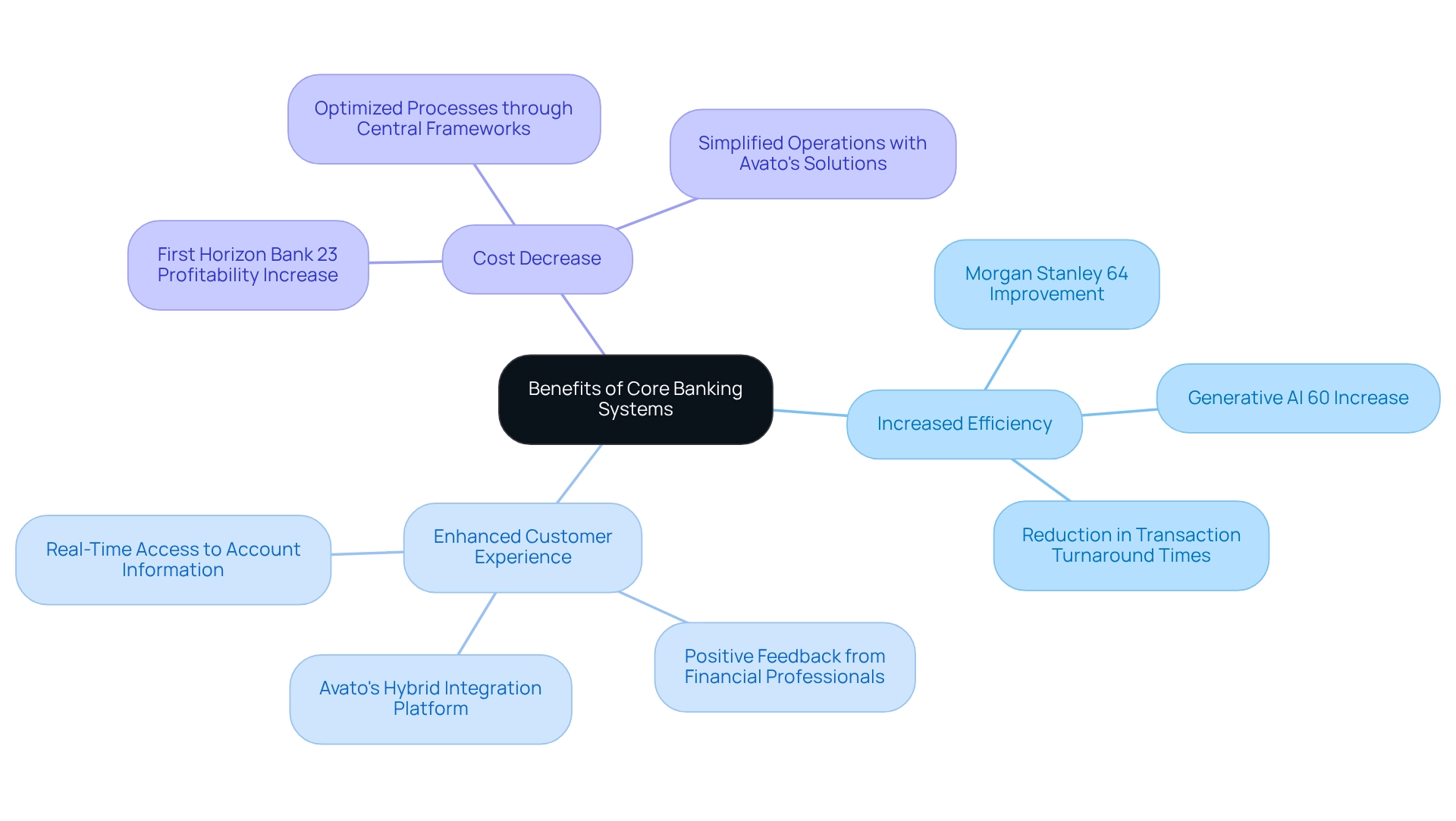

- Increased Efficiency: Automating routine tasks through core banking systems significantly reduces manual errors and accelerates transaction processing times. For instance, Morgan Stanley’s implementation of a regulatory compliance visualization dashboard resulted in a remarkable 64% improvement in efficiency, reducing their quarterly compliance reporting preparation time from 240 person-hours to just 87 person-hours. Statistics indicate that fundamental financial technology has greatly diminished the occurrence of one-day transaction turnaround periods, underscoring the significance of these frameworks in enhancing overall financial efficiency. Furthermore, the integration of generative AI has been pivotal, with a 60% increase in its use for customer experience, particularly in developing sophisticated chatbots and virtual assistants that streamline operations and boost productivity across various departments.

- Enhanced Customer Experience: With real-time access to account information and services, customers enjoy a more responsive financial experience. This immediacy not only fosters customer satisfaction but also strengthens loyalty, as evidenced by the positive feedback from financial professionals who highlight the transformative effect of essential financial platforms on customer interactions. Dr. Bhadrappa Haralayya noted that the increase in work efficiency is attributed to reduced work time and the innovation of numerous machines that facilitate and expedite work processes. Moreover, Avato’s hybrid integration platform accelerates secure integration, ensuring that financial institutions can effectively leverage advanced technologies to enhance customer engagement. As Tony Leblanc from the Provincial Health Services Authority stated, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.”

- Cost Decrease: Optimized processes through central financial frameworks lead to reduced operational expenses. This efficiency allows financial institutions to allocate resources more effectively, ultimately enhancing profitability. For example, First Horizon Bank’s execution of a branch performance visualization dashboard resulted in a 23% increase in branch profitability within just one year, showcasing the tangible benefits of embracing core financial solutions. Avato’s solutions further support this by providing a connected foundation that simplifies and modernizes operations, making it easier for financial institutions to manage costs while improving service delivery.

Enhanced adherence is supported by various types of core banking systems, designed to assist financial institutions in maintaining regulatory standards. Equipped with built-in reporting and monitoring tools, these systems simplify adherence to complex regulations, thereby mitigating the risk of non-compliance. The integration of generative AI also enhances compliance efforts and operational efficiency through improved document processing and report generation.

The advantages of core banking systems extend beyond operational enhancements; they are vital for banks striving to thrive in a competitive environment. As the industry evolves, the ability to adapt to changing demands through a reliable technology framework becomes increasingly critical, with Avato’s role in modernizing outdated infrastructures being key to achieving these objectives. For instance, Avato’s hybrid integration platform has demonstrated its efficiency in providing secure and effective integrations across several case studies.

Challenges in Implementing Core Banking Solutions

Implementing core banking systems can yield substantial benefits; however, it also presents a range of challenges that institutions must navigate effectively.

- Data Migration: The process of transferring data from legacy systems to new platforms is often fraught with complexity. It requires meticulous planning and execution to ensure that only unique, clean data is migrated. Utilizing data deduplication tools can significantly streamline this process, helping to ensure that only unique, clean data is migrated, thereby reducing the risk of errors and ensuring data integrity. Furthermore, leveraging XSLT can enhance this process by efficiently transforming XML data structures, reducing programming errors, and ultimately leading to cost savings.

- Integration Issues: Attaining smooth incorporation between new solutions and current technologies is a frequent challenge, particularly in financial institutions with varied IT settings. A substantial proportion of financial institutions indicate encountering integration challenges during core upgrade processes, emphasizing the necessity for strong integration strategies that can support diverse legacy frameworks. Engaging stakeholders early in the process can help clarify requirements and ensure that the right technology is utilized to illustrate both the current and ideal states of the integration.

- Resistance to Change: Employee opposition to new processes can hinder progress. Comprehensive training and effective change management strategies are essential to facilitate a smooth transition. As noted by industry experts, addressing the human element of technology adoption is crucial for successful implementation. Preparing staff through targeted training programs can help mitigate resistance and foster a culture of adaptability.

- Challenges in Implementation: According to a recent survey, 75% of banks identified digital banking transformation as their top priority, underscoring the urgency of addressing these challenges. Financial institutions that adopt a methodical approach are 2.5 times more likely to complete integration projects on time and within budget compared to those that pursue accelerated implementations, as highlighted by McKinsey & Company. Preparing infrastructures to incorporate new tools with current resources is crucial for lasting success.

- Case Studies on Data Migration: Successful transformations often involve assessing current capabilities and developing a clear roadmap. For example, financial organizations that have adopted digital transformation have converted outdated frameworks into powerful facilitators of innovation, thus gaining a competitive edge. The case study titled “Call-to-Action for Embracing Digital Transformation” illustrates how these strategies can effectively modernize essential financial capabilities while maintaining operational excellence.

In summary, while the shift to contemporary fundamental financial frameworks is essential for remaining competitive, it necessitates careful consideration of data transfer, integration, and employee involvement to tackle the inherent challenges. By optimizing integration strategies and utilizing tools like XSLT, institutions can improve their processes and prepare for the future of finance.

Regulatory Compliance and Core Banking Systems

Regulatory compliance stands as a cornerstone of essential financial frameworks, necessitating adherence to a variety of critical regulations that ensure the integrity and security of financial operations. Key compliance areas include:

- Data Protection Laws: Core banking systems must manage customer data securely, aligning with stringent regulations such as the General Data Protection Regulation (GDPR). This compliance is crucial not only for safeguarding customer privacy but also for preserving trust in financial institutions.

- Anti-Money Laundering (AML): Effective AML measures are essential for detecting and preventing illicit financial activities. Core banking systems are equipped with sophisticated features that monitor transactions for suspicious patterns, enabling financial institutions to report anomalies as mandated by regulatory authorities. This proactive approach is vital in protecting the financial framework from abuse.

- Know Your Customer (KYC): KYC processes are integral to verifying customer identities and preventing fraud. Core financial systems streamline these verification processes, ensuring that institutions can efficiently comply with financial regulations while enhancing customer onboarding experiences. The incorporation of automated compliance tools enables rapid adjustment to changing regulatory environments, as demonstrated by case studies showcasing financial institutions that have effectively managed regulatory shifts in digital finance. For instance, the case study titled “Adapting to Regulatory Changes in Digital Banking” illustrates how banks can implement automated compliance tools and conduct regular audits to remain agile in the face of new regulations.

As we look ahead to 2025, the landscape of regulatory compliance continues to evolve. A striking 77% of corporate risk and compliance professionals emphasize the necessity of staying updated on Environmental, Social, and Governance (ESG) developments. This underscores the increasing convergence of compliance and corporate responsibility in the financial sector.

Moreover, the impact of data protection laws on financial technology cannot be overstated. Institutions that efficiently combine essential financial platforms with strong compliance structures not only satisfy regulatory mandates but also enhance their operational functions. Organizations that have implemented automated compliance tools report a significant improvement in their ability to adapt to new regulations, ensuring they remain competitive and compliant.

In fact, 97% of Secureframe users have enhanced their security and compliance stance, highlighting the significance of strong compliance frameworks in financial technology.

As the regulatory landscape grows more intricate, core banking systems must adapt to address these challenges. They must incorporate features that not only ensure compliance with AML and KYC regulations but also facilitate ongoing monitoring and reporting. Avato’s Secure Hybrid Integration Platform plays a crucial role in this evolution by offering real-time monitoring and alerts on performance, enabling financial institutions to maintain a strong compliance posture while delivering innovative services to their clients.

As noted by Gustavo Estrada from BC Provincial Health Services Authority, ‘Avato has the capability to streamline complex projects and achieve results within specified time frames and budget limitations,’ which is essential for financial institutions navigating the intricate landscape of regulatory compliance. Furthermore, Avato’s platform has demonstrated its effectiveness in real-world applications, such as the successful implementation at Coast Capital, where it supported multiple interfaces and enabled major system transitions with minimal downtime, ensuring 24/7 uptime and reliability while maximizing the value of legacy systems and reducing costs.

Future Trends in Core Banking Technology

The future of essential financial technology is being significantly shaped by several crucial trends:

- Cloud Adoption: A growing number of financial institutions are transitioning to cloud-native solutions, which offer enhanced scalability and flexibility. This shift facilitates more efficient resource management and supports the rapid deployment of new services. Recent trends indicate that cloud adoption among financial institutions is accelerating, as many organizations recognize the necessity for agile infrastructures to meet evolving customer demands. However, security remains a paramount concern, underscored by the data breach suffered by Flagstar Bancorp in March 2021, which resulted in the loss of personal data. This incident highlights the critical need for robust security measures in cloud adoption. Avato’s solutions play a pivotal role in facilitating this transition, equipping financial institutions with the tools necessary to adopt cloud technologies securely and efficiently.

The integration of artificial intelligence into core banking systems is revolutionizing customer service and operational efficiency. Generative AI, in particular, has emerged as a powerful tool, with a 60% increase in its use for enhancing customer experience through sophisticated chatbots and virtual assistants. Additionally, over half of financial professionals are leveraging generative AI for document processing and report generation, streamlining operations and enhancing productivity across various departments. Statistics indicate that financial institutions utilizing AI can enhance their operational efficiency by as much as 30%, significantly diminishing manual workloads and accelerating transaction times. Moreover, the implementation of core banking systems improves operational efficiency by automating processes, resulting in increased productivity and cost reductions. Avato’s offerings are crafted to harness the capabilities of generative AI, enabling financial institutions to improve customer interactions and simplify their operations efficiently.

- Open Finance: The rise of open finance initiatives is compelling financial organizations to adopt more flexible frameworks that can seamlessly connect with third-party services. This trend fosters innovation and competition, allowing financial institutions to deliver improved services and tailored customer experiences. As open finance continues to gain traction, institutions are increasingly investing in technologies that support interoperability and data sharing.

- Future Trends in Essential Financial Technology: Looking ahead to 2025, industry analysts predict that essential financial systems will increasingly incorporate advanced analytics and machine learning capabilities. These technologies will empower financial institutions to make data-driven decisions, optimize operations, and enhance customer engagement. Expert opinions suggest that the focus will shift toward developing more intuitive and user-friendly interfaces, thereby enhancing the customer experience.

- Case Studies on Cloud Adoption: Noteworthy instances of successful cloud adoption in primary financial services include institutions that have migrated to platforms like Microsoft Azure, which has seen a significant rise in usage among financial organizations. Flexera reported that Microsoft Azure Stack usage grew to 37% in 2022, surpassing VMware vSphere. This transition has enabled these organizations to streamline their operations and reduce costs while maintaining high levels of security and compliance. Furthermore, Gustavo Estrada from BC Provincial Health Services Authority praised Avato for its ability to streamline complex projects and deliver results within preferred timelines and financial constraints, emphasizing the efficiency of such solutions in the realm of cloud adoption.

As these trends continue to evolve, the landscape of essential financial technology will undoubtedly transform, presenting both challenges and opportunities for financial institutions. Embracing these advancements, particularly the utilization of generative AI, will be crucial for financial institutions striving to remain competitive in an increasingly digital world.

How to Choose the Right Core Banking System for Your Bank

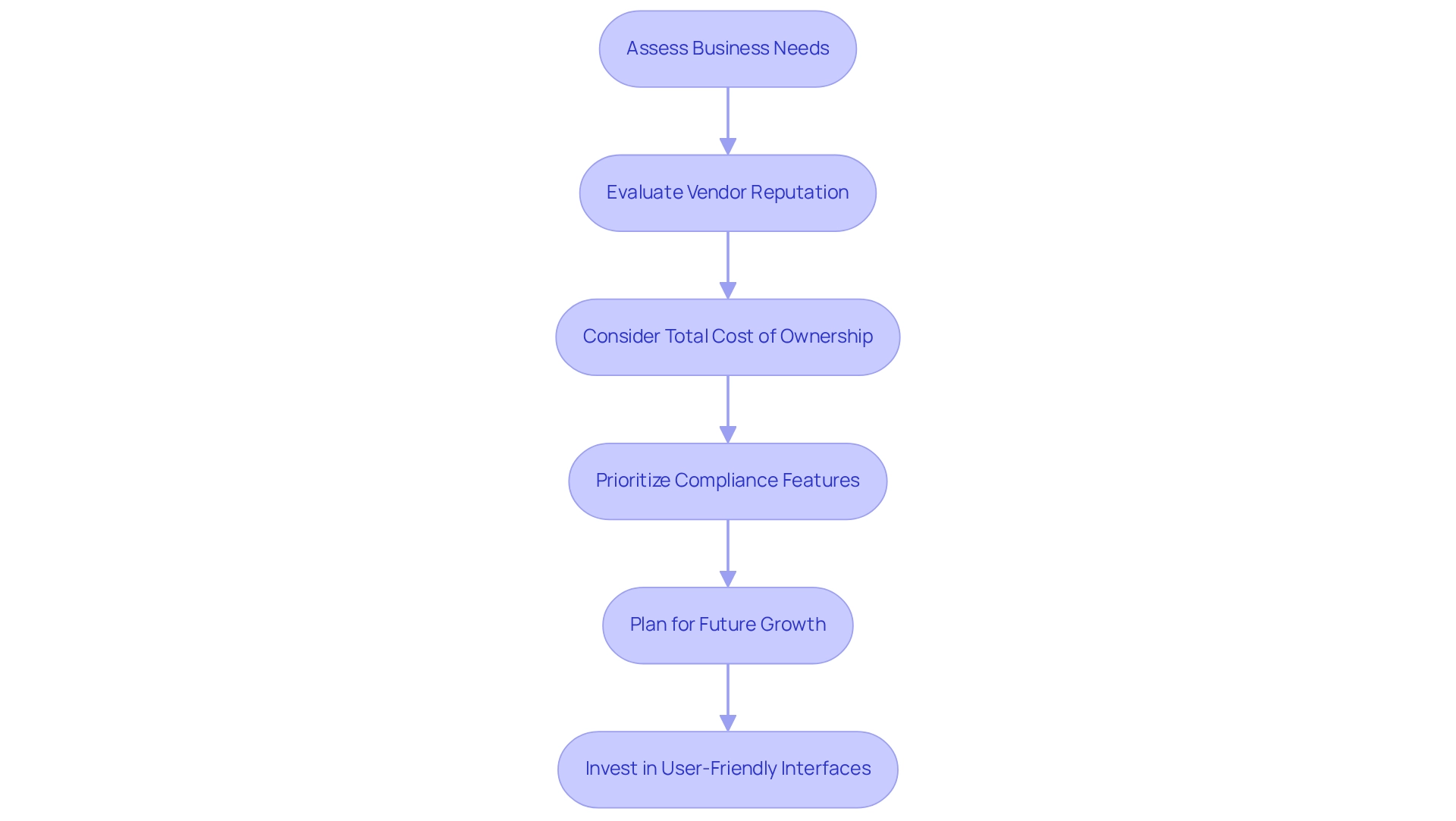

Selecting the appropriate core financial platform is a crucial decision that necessitates a thorough evaluation of several essential elements.

-

Assess Business Needs: Begin by identifying your bank’s specific requirements. This involves assessing scalability to accommodate growth, functionality to support various financial operations, and integration capabilities to ensure seamless connectivity with existing networks. As open financial services become a reality, leveraging existing assets through strategic integration is essential for maximizing efficiency and innovation. Discarding legacy systems in favor of new solutions can lead to wasted resources; instead, consider how to build on what you already have.

-

Evaluate Vendor Reputation: Conduct thorough research on potential vendors. Seek individuals with a demonstrated history in the field, supported by client reviews that emphasize their dependability and efficiency in providing essential financial solutions. For instance, Gustavo Estrada has praised Avato for its ability to simplify complex projects and deliver results within desired time frames and budget constraints. Selecting a vendor that understands the subtleties of open financial integration can offer considerable benefits.

-

Consider Total Cost of Ownership: It is critical to analyze not only the initial acquisition costs but also the ongoing maintenance and operational expenses associated with the core financial framework. This comprehensive financial assessment will help in understanding the long-term investment required, especially as the implementation of core banking systems may introduce additional costs related to compliance and security.

-

Prioritize Compliance Features: Given the highly regulated nature of the financial sector, ensure that the selected framework includes robust compliance tools. These features are vital for meeting regulatory requirements and mitigating risks associated with non-compliance. As open financial services evolve, maintaining stringent security protocols will be crucial to protect consumer data and build trust. Additionally, be aware of potential security vulnerabilities that can arise from integration processes, ensuring that your integration solution is fully compliant with the most stringent security standards.

-

Plan for Future Growth: Choose a central financial framework that is flexible to upcoming technological progress and changing market needs. A forward-thinking approach will allow your institution to stay competitive and responsive to changes in the core banking systems landscape. Preparing your infrastructure for the future will aid in the incorporation of new tools with current resources, guaranteeing a seamless transition as open finance initiatives are carried out.

Alongside these factors, it is crucial to acknowledge that on-premise essential financial platforms frequently require significant internal IT knowledge for efficient management. This requirement can pose significant challenges for banks. Investing in user-friendly interfaces can also enhance operational efficiency, as intuitive designs reduce learning curves and minimize errors, leading to smoother operations and higher employee satisfaction.

For instance, the usability of core financial system interfaces affects operational efficiency, with intuitive designs resulting in smoother operations. By taking these factors into account, banking IT managers can make informed decisions that align with their institution’s strategic goals, particularly in the context of preparing for open banking.

Conclusion

Core banking systems are pivotal in shaping the future of banking, providing a robust framework that enhances efficiency, customer experience, and compliance. What strategies can banks adopt to meet their operational needs and market demands? The exploration of various system types—monolithic, modular, and cloud-native—reveals unique advantages and challenges, underscoring the importance of a thoughtful selection process tailored to an institution’s specific requirements.

Modern core banking solutions are equipped with essential features such as real-time processing, API integrations, and automated compliance reporting. These elements collectively drive significant improvements in operational efficiency and customer satisfaction. The benefits of implementing these systems extend beyond mere functionality; they empower banks to streamline operations, reduce costs, and adapt to regulatory changes with agility. However, transitioning to these advanced systems presents challenges, including data migration, integration issues, and employee resistance. Addressing these hurdles necessitates strategic planning and effective change management.

As the banking landscape continues to evolve, how can financial institutions stay ahead of future trends? Embracing advancements such as cloud adoption, artificial intelligence, and open banking will be crucial. By doing so, banks can enhance their operational capabilities while fostering innovation and competitiveness in an increasingly digital environment. Ultimately, the choice of the right core banking system is a strategic decision that can significantly impact a bank’s ability to thrive in the modern financial ecosystem. The time to act is now—ensure your institution is equipped to navigate the future of banking.