Overview

Digital transformation is not just an option; it is a necessity for banking. We recognize that it enhances operations, improves client interactions, and fosters innovation through the integration of technologies such as AI and data analytics. Successful digital transformation enables us to offer personalized services, leading to increased customer satisfaction and operational efficiencies. This is crucial for banks to remain competitive in a rapidly evolving financial landscape.

What’s holding your team back from embracing this change? We invite you to explore how we can support your journey towards a more innovative and efficient banking experience.

Introduction

As we stand on the brink of a digital revolution in the banking industry, the imperative for transformation has never been clearer. With the rapid advancement of technology and shifting consumer expectations, we are compelled to rethink our operational models and embrace innovative solutions.

Digital transformation is not merely about adopting new tools; it represents a comprehensive overhaul that integrates technology deeply into every aspect of banking, enhancing customer experiences and operational efficiencies.

From leveraging artificial intelligence to streamline services to implementing robust data analytics for personalized offerings, we are discovering that the key to thriving in a competitive landscape lies in our ability to adapt and innovate.

As we delve into the core concepts, significance, and successful case studies of digital transformation in banking, it becomes evident that the future of financial services hinges on these strategic shifts.

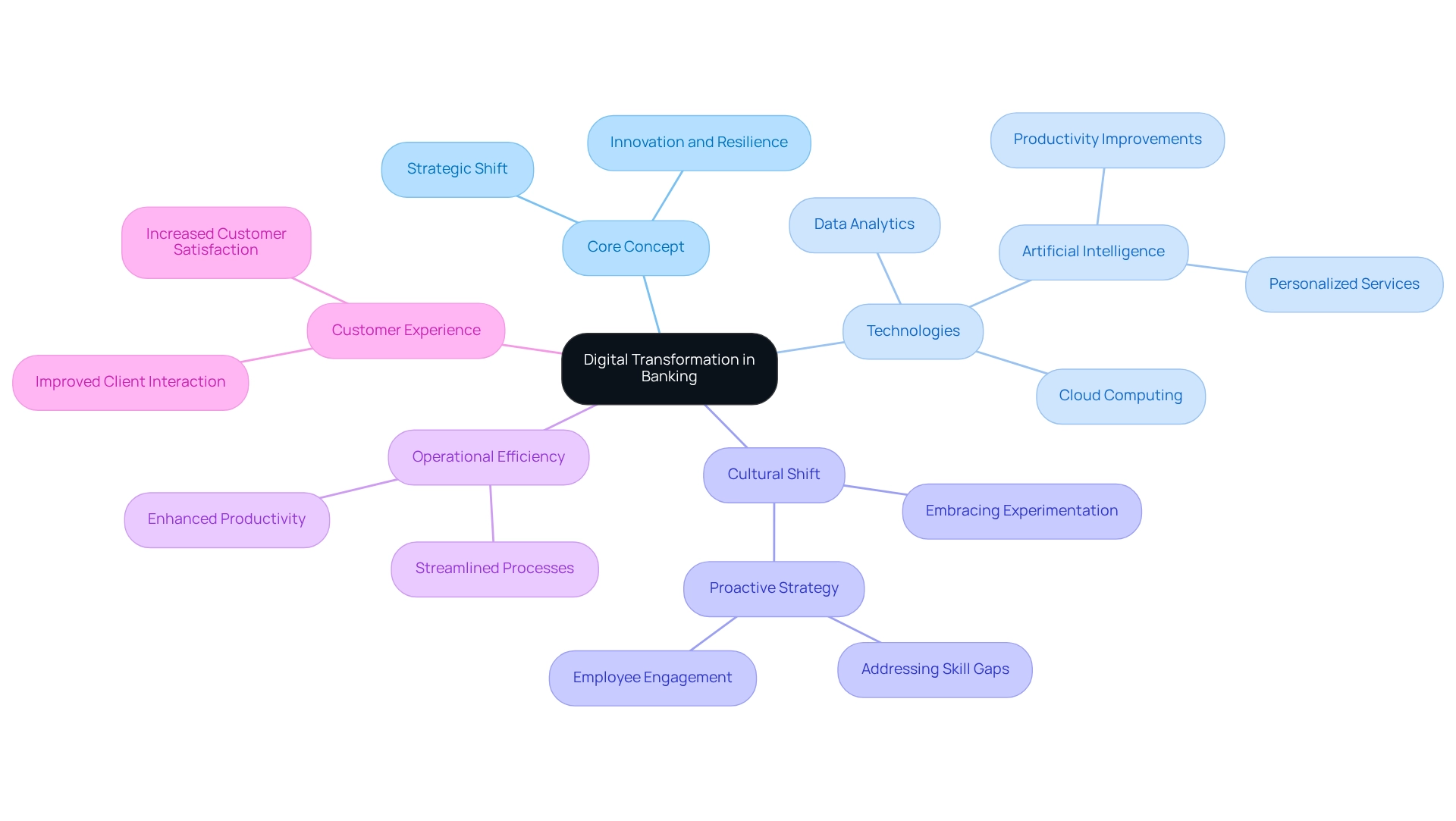

Define Digital Transformation: Understanding Its Core Concept

Technological transformation is not just a trend; it is the extensive incorporation of electronic tools throughout all aspects of our financial institution, fundamentally altering operations and enhancing client value delivery. This evolution goes beyond merely adopting new technologies; it necessitates a cultural shift within our organization, compelling us to consistently challenge existing norms, embrace experimentation, and accept the possibility of failure. In our industry, this change is essential for enhancing client experiences, optimizing operational efficiency, and sustaining competitiveness in a swiftly changing technological landscape. The essential technologies propelling this shift include cloud computing, artificial intelligence, and data analytics, which enable us to innovate and quickly adapt to market changes.

By 2025, we anticipate a substantial influence of technological advancement on our financial operations, with many organizations indicating improved productivity and customer satisfaction. Current statistics reveal that 58% of HR leaders recognize enhancements in overall productivity due to AI integration, a trend increasingly relevant in banking as we leverage AI to streamline operations and elevate service delivery. Furthermore, expert insights from KPMG emphasize that organizations with a risk-averse culture frequently encounter challenges in advancing their technological transformation initiatives, highlighting our necessity to embrace a proactive strategy to tackle these obstacles.

At Avato, which embodies the Hungarian term for ‘dedication,’ we play a crucial role in this transformation by facilitating seamless and secure data connectivity, vital for financial entities aiming to merge legacy systems with contemporary technologies. Successful examples of digital transformation within financial services illustrate its importance. For instance, institutions that have effectively incorporated AI and data analytics into their operations report significant improvements in efficiency and client interaction. These advancements not only streamline our processes but also enable us to offer personalized services, thereby enhancing customer loyalty and satisfaction. The expected expansion of AI services in retail provides a comparative perspective on the potential advantages of AI integration in finance, indicating that we could realize equivalent progress in our industry.

To thrive in technological transformation, we must establish clear objectives and engage our staff at every phase of the process. This approach fosters a culture of innovation while addressing skill gaps through targeted training. Overall, our definition of digital transformation in banking encapsulates a strategic shift towards leveraging technology to foster innovation and resilience in an increasingly competitive landscape, highlighting the benefits of digital transformation with Avato leading the charge in providing the necessary integration solutions. Specific features of our hybrid integration platform, such as its ability to connect disparate systems and facilitate real-time data sharing, are crucial for financial institutions aiming to navigate this transformation effectively.

Contextualize the Importance: Why Digital Transformation Matters Today

In 2025, financial institutions must recognize that digital transformation is not just important; it is critical to leverage the benefits of digital transformation. As consumer expectations shift towards personalized, efficient, and accessible services, we face mounting pressure to adapt. The emergence of fintech companies has intensified competition, compelling us to reevaluate our operational models. The COVID-19 pandemic has further accelerated this transition, underscoring the necessity for robust online services and remote financial capabilities. In fact, as of 2023, 66% of the U.S. population engages with online financial services, with forecasts suggesting this number will surpass 79% by 2029.

Furthermore, regulatory pressures add urgency to our technological transformation, as we must navigate strict security and data protection standards. This environment positions technological transformation as a strategic necessity for banks like ours, aiming to boost client satisfaction, enhance operational efficiency, and promote innovation. Expert insights emphasize that incorporating emerging technologies, such as AI and blockchain, while preserving client trust, is crucial for achieving a competitive advantage in the online finance landscape. Notably, generative AI has emerged as a key player, with a 60% increase in its use for customer experience, particularly in developing sophisticated chatbots and virtual assistants. In 2023, the ability to identify breaches in an individual’s Social Security number was regarded as the most important mobile finance feature by users in the United States, highlighting the essential requirement for security in online services.

As we examine case studies, it becomes evident that the expansion of online finance is creating new investment prospects, with the global online finance market anticipated to achieve $22.3 trillion by 2026, increasing at a CAGR of 8.5%. Companies such as Chime and Revolut have attracted substantial venture capital investment, demonstrating increasing investor trust in online banking as stakeholders seek to benefit from innovative fintech solutions. Additionally, Avato’s hybrid integration platform plays a pivotal role in simplifying complex integrations, enabling us to modernize our operations effectively. As Tony LeBlanc from the Provincial Health Services Authority noted, ‘Good team. Good people to work with. Extremely professional. Extremely knowledgeable.’ This testimonial highlights the effectiveness of Avato in facilitating technological transformation. Statistics on personalization in financial services serve as indicators for our future customer-centric strategies. As we navigate these challenges, the benefits of digital transformation become increasingly evident, serving as a foundation for our future customer-focused strategies.

Explore Key Benefits: How Digital Transformation Enhances Business Operations

Digital transformation is not just an option; it is a necessity for banking institutions to achieve the benefits of digital transformation in enhancing operations and client interactions. By leveraging data analytics and artificial intelligence, we can provide tailored services and products that meet the distinct needs of each individual. This personalized approach not only boosts satisfaction but also fosters loyalty. Our hybrid integration platform is pivotal in streamlining these processes, ensuring seamless data flow between systems and enriching customer interactions. By employing a middle layer for data translation, we further enhance the integration of disparate systems, facilitating effective information sharing across platforms.

Moreover, the automation of routine tasks significantly reduces manual errors and accelerates processes, allowing us to operate more efficiently in a competitive landscape where speed and accuracy are vital. Our integration solutions enable the modernization of legacy systems without sacrificing valuable existing assets, thus improving operational workflows. However, we must acknowledge that integration poses potential security vulnerabilities; therefore, it is essential to develop robust and secure integration strategies.

Adopting digital solutions allows us to significantly lower operational costs. The transition to online services diminishes reliance on physical branches and streamlines workflows, leading to better resource allocation. Our integration methods assist in optimizing existing infrastructure, resulting in notable cost efficiencies. Furthermore, the benefits of digital transformation enable us to swiftly adapt to market changes and evolving client expectations. This agility fosters a culture of innovation, crucial for staying ahead in the fast-paced financial sector. With our hybrid integration platform, we can establish secure and reliable connections between applications, enabling rapid responses to changing market conditions.

Advanced data analytics capabilities provide us with valuable insights into client behavior and market trends. These insights drive strategic decision-making, enhancing our ability to meet client expectations and seize emerging opportunities. The integration of open financial principles promotes better data sharing, enriching these insights further. A notable case study is ING’s implementation of an agile operating model, which dismantled traditional silos and fostered multidisciplinary teams. This reorganization led to an impressive 60% reduction in time-to-market for new products, greatly improving responsiveness to client needs and enhancing return on equity metrics compared to European counterparts. By adopting similar strategic integration methods, we can achieve comparable outcomes in enhancing operational effectiveness and client experience, highlighting the benefits of digital transformation as the financial sector continues to evolve and organizations seek to improve client experience and operational efficiency.

With 22% of executives citing economic uncertainty as a challenge to technological transformation efforts, the urgency for us to innovate and adapt has never been greater. The ongoing advancement of online financial services, highlighted by the expected growth of biometric ATMs from USD 36.3 billion in 2023 to USD 46.7 billion by 2032, underscores the necessity of these transformations to maintain competitiveness. Additionally, regulatory changes like the European Union’s updated Payment Services Directive (PSD2), which mandates financial institutions to share customer data with third-party providers via secure APIs, further emphasize our need to adopt transformation strategies. Understanding that online banking encompasses all web-based transactions and services is crucial for grasping the full extent of these changes.

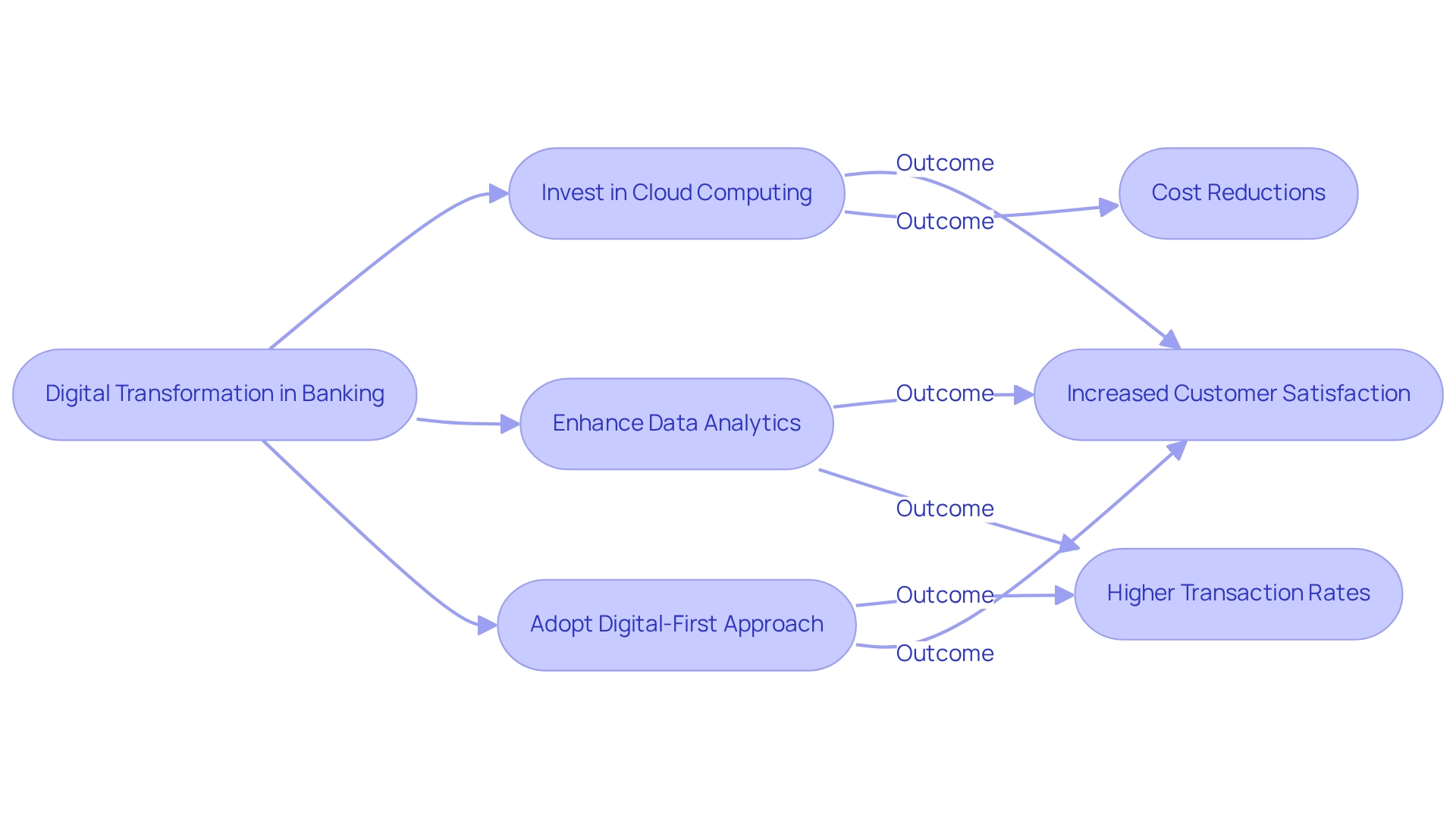

Illustrate with Examples: Success Stories of Digital Transformation Across Industries

We have witnessed numerous banks effectively navigate their digital transformation journeys, showcasing the benefits of digital transformation and setting benchmarks for the industry. By utilizing cloud computing, organizations have significantly improved their data analytics capabilities, leading to more tailored interactions and enhanced risk management. This strategic shift not only streamlines operations but also fosters deeper client loyalty.

Substantial investments in online financial platforms have resulted in extraordinary growth in client interaction and satisfaction. With a keen focus on user experience, we position ourselves as leaders in the online finance sector. Furthermore, adopting a digital-first approach has significantly boosted online transactions and customer retention rates.

These success narratives highlight the transformative possibilities of online initiatives, illustrating how they can offer competitive advantages in the financial sector. As the industry advances, the emphasis on personalization and customer-centric strategies remains crucial. Statistics reveal that 39% of individuals aged 60-78 primarily use online banking, underscoring the increasing need for customized online experiences.

Additionally, digital financial institutions can leverage data analytics and AI, including generative AI solutions, to develop tailored products, enhance user engagement, and capitalize on growth in the digital payments sector. By utilizing Avato’s dedicated hybrid integration platform, we can simplify disparate systems and unlock isolated assets, ultimately enhancing business value and leading the AI revolution in financial services.

For instance, a leading bank implemented our solutions to integrate their customer data across multiple platforms, resulting in a 30% increase in customer satisfaction scores and a 25% reduction in operational costs. Such examples illustrate the benefits of digital transformation as Avato’s hybrid integration platform not only supports it but also drives measurable success in the banking sector.

What’s holding your team back from achieving similar results? Let us partner with you to unlock your potential.

Conclusion

The journey of digital transformation in banking is not merely a trend; it represents a fundamental shift that redefines how we operate and engage with our customers. By integrating advanced technologies like artificial intelligence, cloud computing, and data analytics, we can enhance customer experiences, streamline operations, and foster innovation. The statistics speak volumes—banks that embrace this transformation witness improved productivity, increased customer satisfaction, and greater agility in responding to market demands.

As the competitive landscape intensifies with the rise of fintech companies and shifting consumer expectations, the urgency for traditional banks to adopt digital solutions becomes clear. The COVID-19 pandemic has further accelerated this transition, highlighting the necessity for robust online services and secure digital banking capabilities. With projections indicating a significant increase in online banking usage, our ability to deliver personalized, efficient services is paramount for success.

Successful case studies illustrate that banks leveraging digital transformation not only improve operational efficiencies but also achieve substantial gains in customer loyalty and satisfaction. By focusing on strategic integration and innovative solutions, such as those provided by Avato, we can navigate the complexities of this transformation effectively. The future of banking lies in the hands of those willing to adapt, innovate, and prioritize a customer-centric approach in an increasingly digital world. The time for action is now; embracing digital transformation is essential for thriving in the financial services industry.