Overview

We recognize a critical distinction in customer engagement: digital customers engage primarily through online platforms, expecting personalized and seamless experiences, while traditional customers favor face-to-face interactions and established service standards. This contrast is not merely anecdotal; data reveals that digital customers prioritize speed and convenience.

As a result, we must adopt tailored marketing strategies and integrate technology to enhance customer engagement and loyalty. What strategies are you implementing to meet these evolving expectations? Embracing these changes is essential for fostering strong customer relationships in today’s fast-paced market.

Introduction

In today’s rapidly evolving landscape of consumer behavior, we observe a striking distinction between digital and traditional customers. As we strive to adapt, understanding the unique expectations and preferences of these two groups is crucial for our success.

Digital customers, who engage primarily through online platforms, demand personalized experiences and immediate support. In contrast, traditional customers often value face-to-face interactions and personalized service.

This article delves into the contrasting behaviors of these customer types, highlighting the implications for our business strategies and the role of technology in enhancing customer engagement. By exploring future trends and the impact of AI, we can better position ourselves to meet the diverse needs of our clientele, ensuring loyalty and satisfaction in an ever-competitive marketplace.

Defining Digital Customers and Traditional Customers

Digital customers represent a new breed of individuals who engage with brands primarily through digital platforms—websites, social media, and mobile applications. They demand seamless, personalized experiences and utilize technology to guide their purchasing decisions. In contrast, traditional clients interact with brands through more conventional channels, such as in-person visits, phone calls, or printed advertisements, with their expectations shaped by direct human interactions and established service standards.

As we approach 2025, the distinction between these two client types grows increasingly significant. Digital customers are characterized by their reliance on technology and their expectation for brands to understand their preferences. For instance, 56% of consumers indicate they will remain loyal to brands that demonstrate a profound understanding of their needs, underscoring the critical role of personalization in fostering loyalty among online shoppers. This is particularly relevant in the insurance sector, where tailored services can significantly enhance client satisfaction.

Current trends reveal that firms prioritizing client experience are more likely to thrive in the evolving business landscape. With 96% of clients asserting that service is pivotal to their brand loyalty, it is essential to acknowledge that digital customers expect prompt support and smooth interactions. This expectation is evident in the fact that live chat is the most frequently outsourced function, utilized by 46% of organizations, highlighting the necessity for rapid and effective service. Furthermore, as client expectations escalate, the integration of AI and automation for personalization becomes vital. Our hybrid integration platform plays a crucial role in this transformation by streamlining disparate systems and enhancing organizational value. By connecting legacy systems with modern expectations, we empower enterprises to deliver rich, connected experiences that cater to both digital and traditional users. Specifically, our platform aids in future-proofing enterprises by enabling seamless data sharing, enhancing operational efficiency, facilitating real-time insights, supporting agile deployment of new technologies, and fostering trust with clients. Insights from the case study titled ‘Future Trends in Client Experience’ indicate that businesses prioritizing these trends will be better positioned to meet evolving client expectations. Companies that adeptly navigate these trends will secure a competitive edge in their respective markets.

Contrasting Behaviors and Expectations of Digital vs. Traditional Customers

Digital customers exhibit a distinct inclination for researching products online, reading reviews, and making purchases via e-commerce platforms. They prioritize speed, convenience, and personalized experiences, often expecting us to anticipate the needs of our digital customers based on prior interactions. In contrast, conventional clients tend to favor face-to-face interactions and are more inclined to rely on personal recommendations or advertisements. Their expectations generally encompass a more personal touch and extended interaction periods, as they appreciate the relationship-building element of service. This fundamental difference in behaviors necessitates distinct marketing strategies and customer engagement approaches tailored to each group.

Statistics reveal that shoppers from high-income households (earning $100K or more annually) are 18.2% more likely to shop online compared to those in high-middle income households ($50K to $99K). Moreover, 53% of millennials favor reviewing product information online instead of seeking assistance from store personnel, highlighting the transition towards online interaction. Behavioral economists observe that the typical large-scale e-commerce site can attain a 35.26% rise in conversion rates through enhanced checkout design, emphasizing the significance of refining the online shopping process. This understanding highlights the necessity for enterprises, especially in fields such as banking and healthcare, to adjust their integration approaches to satisfy the changing demands of digital customers. Our Hybrid Integration Platform exemplifies this approach, as it simplifies complex integration projects and delivers results within desired time frames and budget constraints, thereby enhancing operational capabilities and reducing costs. By utilizing generative AI, financial institutions can further improve user experience through advanced chatbots and virtual assistants, streamlining interactions and enhancing service delivery.

Additionally, approximately 49% of e-commerce stores now provide free-return shipping, a strategy that meets the expectations of online shoppers who seek convenience and assurance in their purchases. However, in the context of the insurance sector, companies must concentrate on how these behaviors affect their integration requirements and their strategies for engaging digital customers. These insights highlight the behavioral distinctions between digital customers and traditional clients, stressing the necessity for businesses to modify their marketing approaches accordingly. By grasping these differing expectations, we can improve our client engagement efforts and achieve better results in both online and traditional marketplaces. With our commitment to designing technological frameworks, we are devoted to providing interconnected interactions that satisfy these changing requirements.

Implications for Business Strategies: Engaging Digital and Traditional Customers

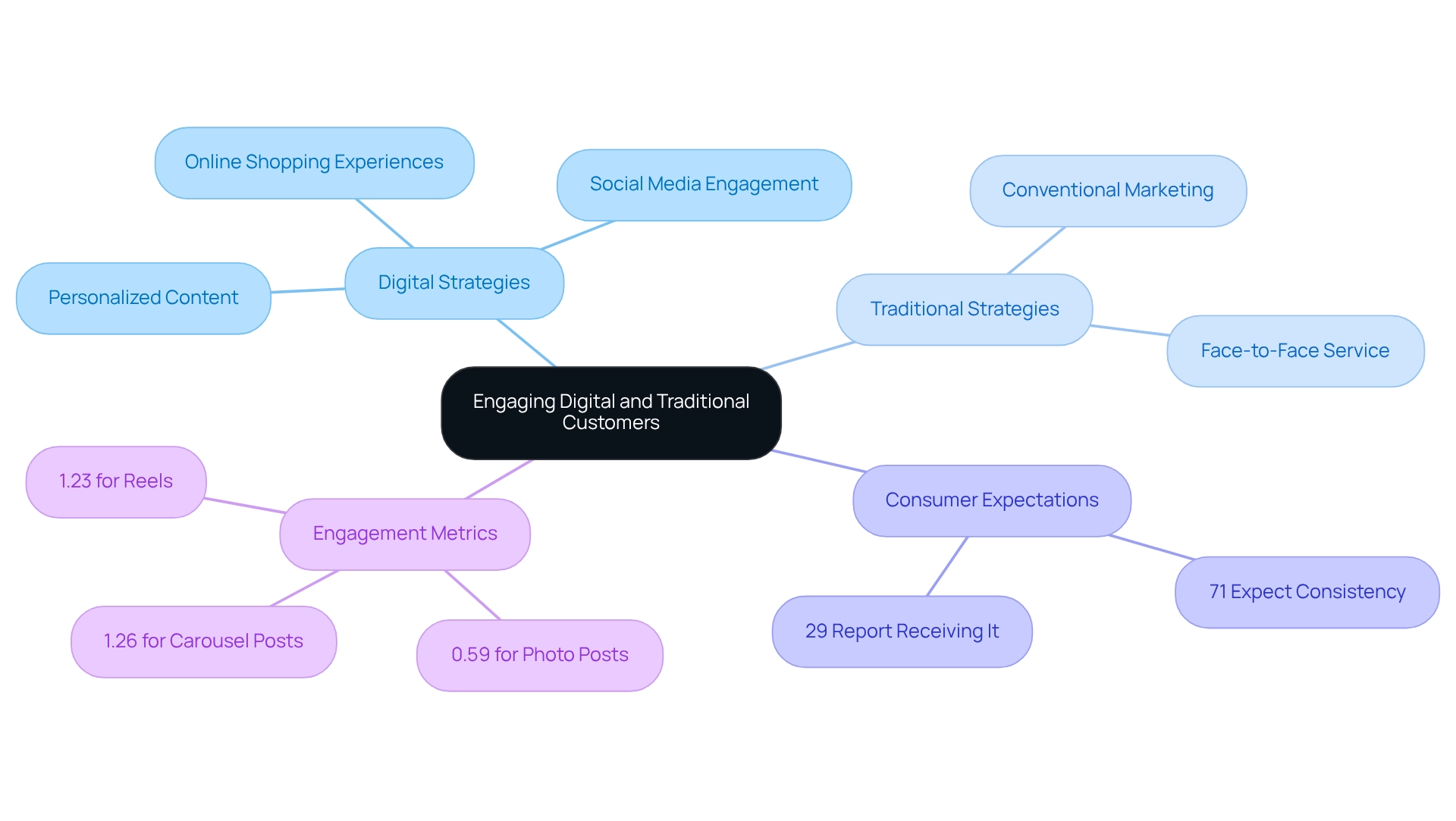

To effectively engage digital customers, we must prioritize robust digital marketing strategies that encompass:

- Personalized content

- Active social media engagement

- Seamless online shopping experiences

By utilizing data analytics, we gain insights into consumer preferences, facilitating personalized offerings that resonate with our audience. For our traditional clients, maintaining robust face-to-face service and employing conventional marketing avenues, such as print and broadcast media, remains essential. Incorporating these methods into a unified omnichannel experience enables seamless transitions for digital customers between digital and conventional interactions, ultimately enhancing their loyalty and satisfaction.

Notably, 71% of consumers expect consistency across all online channels, yet only 29% report receiving it. This gap underscores the need for us to bridge this inconsistency. Furthermore, as mcommerce is projected to grow to 28.9% by 2025, the importance of a well-executed omnichannel strategy becomes increasingly evident. Successful implementation can significantly impact customer engagement, especially for digital customers; shoppers returning products in-store may spend up to 10 times more than those who engage solely online.

Additionally, the average engagement rate for all post types is 0.71%, with:

- 0.59% for photo posts

- 1.26% for carousel posts

- 1.23% for Instagram reels

This indicates varying effectiveness across online marketing formats. Despite acknowledging the significance of omnichannel strategies, many retailers encounter challenges in implementation, with only 8% of companies having mastered these strategies. Thus, a hybrid approach that effectively involves both online and traditional clientele is essential for nurturing loyalty and driving business success.

Technological Impact on Customer Engagement

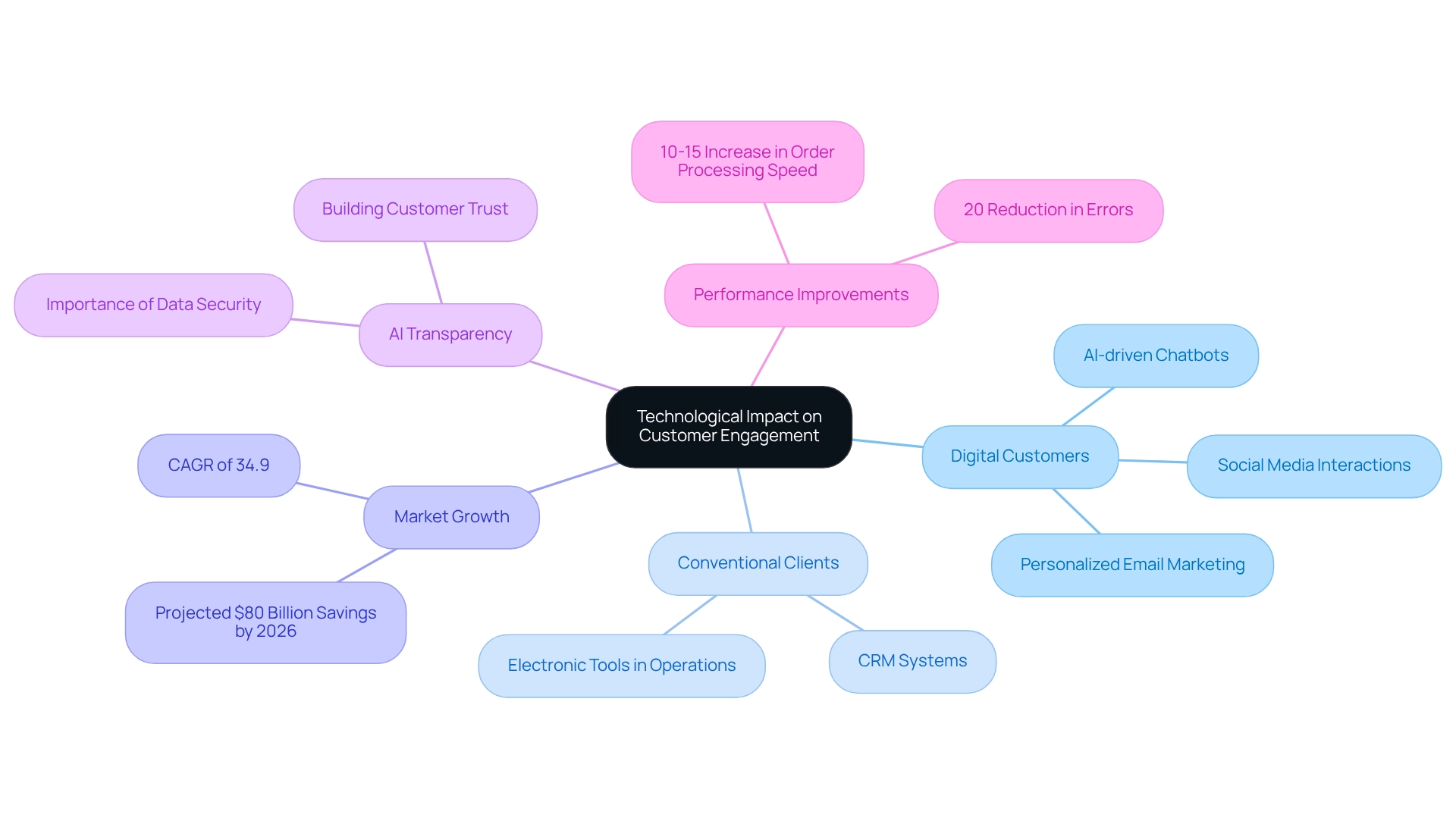

Technology stands as a cornerstone in redefining client engagement strategies, particularly within the insurance industry. For digital customers, AI-driven chatbots, personalized email marketing, and social media platforms facilitate real-time interactions and tailored experiences. These innovations empower us to swiftly respond to inquiries and adapt to preferences, significantly enhancing engagement.

In contrast, conventional clients benefit from technology through CRM systems that meticulously track interactions and preferences, fostering a more personalized service approach. Furthermore, incorporating electronic tools into traditional settings—such as using tablets for order taking in restaurants—can enhance operations and boost client satisfaction.

As the market for AI in client service is projected to expand at a CAGR of 34.9% through 2024, with Conversational AI anticipated to reduce contact center labor expenses by $80 billion by 2026, we must adopt these technological innovations to remain competitive and efficiently serve digital customers as well as traditional clientele.

Notably, early pilots of AI implementations have demonstrated a 10–15% increase in order processing speed and a 20% reduction in errors, underscoring the tangible benefits of embracing these technologies. Furthermore, Avato, founded by a dedicated group of enterprise architects, leverages its hybrid integration platform to bridge legacy systems and modern expectations, empowering businesses to future-proof their operations through seamless data and system integration.

This commitment to simplifying the integration of disparate systems is at the heart of our mission. As experience leaders prioritize transparency and data security in AI usage, insights from the case study on the significance of AI transparency emphasize the necessity of establishing trust while protecting privacy. This focus on improving client interactions through secure and transparent AI practices becomes crucial in the evolving landscape of client engagement.

Future Trends in Customer Behavior

As we advance deeper into the digital era, we recognize that the behaviors of digital customers are poised for substantial transformation. Digital customers are increasingly demanding hyper-personalized experiences, a trend propelled by advancements in AI and data analytics. Notably, 77% of B2B sales and marketing professionals acknowledge that personalization fosters stronger connections with clients, underscoring the necessity for brands to not only meet but anticipate client needs based on previous interactions.

In the banking sector, this trend is particularly significant as institutions strive to enhance client engagement through customized services. By leveraging generative AI, we can implement advanced segmentation and personalization strategies that elevate client satisfaction and loyalty, ultimately driving revenue growth. The integration of AI into financial services facilitates the development of tailored financial products that align with individual profiles, streamlining operations and enhancing productivity across various departments.

Futurists predict that by 2025, consumer expectations will continue to evolve, with a marked increase in the demand for personalized interactions across both online and traditional platforms. Sarah Lee emphasizes, “The statistics highlighted throughout this article paint a clear picture: AI has fundamentally transformed content marketing effectiveness.” Therefore, the integration of AI into our marketing strategies is essential, as balancing AI capabilities with human creativity will be crucial for engaging digital customers.

As consumer behavior evolves, we must continuously innovate to meet the changing preferences of both digital customers and traditional clients. This entails adapting our marketing tactics to align with the shifting landscape of consumer behavior, ensuring we remain competitive in an increasingly complex marketplace. Our hybrid integration solutions can empower financial institutions to lead this AI revolution, connecting legacy systems with contemporary expectations to enhance user interactions.

The NVIDIA 2025 State of AI in Financial Services survey illustrates that AI has transitioned from the periphery to the core of financial services, driving innovation and competitive advantage. Financial institutions must confront the talent challenge and develop flexible infrastructure to effectively harness AI’s potential.

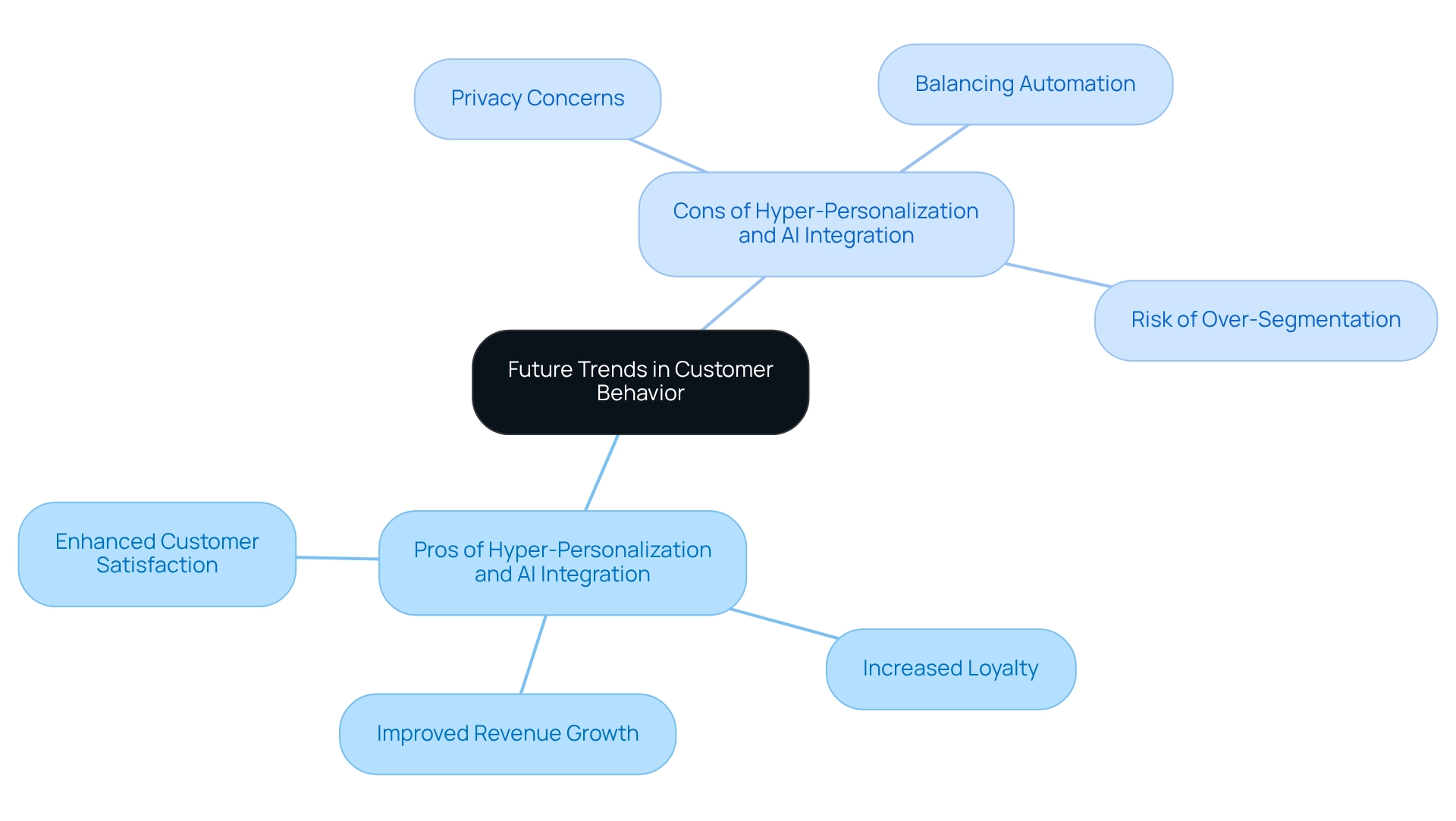

Pros and Cons of Hyper-Personalization and AI Integration:

- Pros:

- Enhanced customer satisfaction through tailored experiences.

- Increased loyalty and retention rates.

- Improved revenue growth through targeted marketing.

- Cons:

- Potential privacy concerns regarding data usage.

- The challenge of balancing automation with a personal touch.

- Risk of over-segmentation leading to missed opportunities.

Conclusion

Understanding the distinct behaviors and expectations of digital and traditional customers is vital for businesses aiming to thrive in today’s competitive landscape. We recognize that digital customers prioritize seamless, personalized experiences and immediate support through online channels, while traditional customers value face-to-face interactions and personal relationships. This divergence necessitates tailored marketing strategies that address the unique preferences of each group.

As technology continues to evolve, integrating AI and automation will be crucial in enhancing customer engagement across both segments. The ability to deliver hyper-personalized experiences will not only foster loyalty but also drive revenue growth, particularly in industries such as banking and insurance. Companies that embrace these technological advancements will be better equipped to meet the rising expectations of their clientele.

In conclusion, the future of customer engagement lies in the successful implementation of hybrid strategies that seamlessly blend digital and traditional approaches. By prioritizing customer experience and leveraging data analytics, we can create a cohesive omnichannel environment that fosters trust, satisfaction, and long-term loyalty. As the landscape shifts, adapting to these emerging trends will be essential for maintaining a competitive edge and ensuring customer success in an increasingly complex marketplace.