Overview

This article delves into the critical compliance software solutions tailored for financial services, pinpointing the leading software options and underscoring their significance in navigating regulatory requirements. Compliance software is not merely a tool; it automates processes and boosts operational efficiency while simultaneously reducing the risks tied to non-compliance. As the regulatory landscape grows increasingly intricate, the projected rise in adoption rates reflects the financial consequences of compliance failures.

Are you prepared to safeguard your organization against these risks? Embracing the right compliance software is not just a choice—it’s a necessity.

Introduction

In the intricate world of financial services, compliance transcends a mere regulatory obligation; it stands as a cornerstone of operational integrity and consumer trust. As institutions confront a rapidly evolving landscape of regulations, the adoption of compliance software emerges as a vital strategy for mitigating risks and enhancing efficiency. Projections indicate a significant rise in compliance software utilization by 2025, making it imperative to understand its features and benefits. This article delves into the essentials of compliance software, exploring its pivotal role in:

- Navigating regulatory complexities

- Safeguarding sensitive data

- Ultimately positioning financial institutions for success in an increasingly scrutinized environment

Understanding Compliance Software in Financial Services

Adherence tools, particularly compliance software for financial services, equip monetary organizations with vital resources to navigate the intricate landscape of regulatory demands while effectively managing risk. These solutions automate essential processes, monitor regulatory changes, and ensure compliance with critical laws such as the Dodd-Frank Act, GDPR, and AML regulations. By 2025, the adoption of compliance software for financial services is projected to increase significantly, driven by the urgent need for organizations to enhance operational efficiency and mitigate the risks associated with non-compliance penalties.

The impact of regulatory software on operational efficiency cannot be overstated. By leveraging compliance software for financial services to streamline regulatory processes, financial institutions can significantly reduce manual workloads and minimize errors, resulting in faster response times and improved accuracy in reporting. Recent trends reveal that 77% of corporate risk and governance professionals prioritize staying informed about the latest developments in Environmental, Social, and Governance (ESG) regulations, underscoring the growing role of technology in managing these evolving requirements.

Moreover, 21% of risk and compliance experts have identified ESG transparency and reporting as a vital regulatory concern, highlighting the demand for advanced solutions.

Real-world examples illustrate the effectiveness of regulatory tools in enhancing compliance. For instance, a case study on third-party risk management indicated that 58% of teams responsible for compliance face challenges in assessing vendor responsiveness, emphasizing the complexities of ensuring that external partners meet regulatory standards. Implementing robust regulatory tools, including compliance software for financial services, can address these challenges by providing resources for monitoring vendor activities and ensuring adherence to regulatory standards.

Furthermore, approximately 60% of organizations maintain over 500 accounts with non-expiring passwords, illustrating just one of the many inadequate security practices that expose organizations to data breaches. This situation underscores the critical role of compliance software for financial services in mitigating security vulnerabilities.

Experts emphasize the benefits of regulatory tools for banking entities in 2025. As organizations face increased scrutiny from regulators, utilizing compliance software for financial services to enhance efficiency and effectiveness in compliance becomes imperative. In conclusion, compliance software for financial services is not merely a regulatory obligation; it functions as a strategic asset that amplifies operational capabilities, mitigates risks, and positions institutions for success in an increasingly complex regulatory environment.

The Importance of Compliance in Financial Services

Compliance in financial services is not just important; it is essential, driven by stringent regulations designed to protect consumers and uphold market integrity. The stakes are high. Non-compliance can lead to severe penalties, reputational damage, and a significant erosion of customer trust. Recent statistics reveal that 53% of businesses leave over 1,000 files containing sensitive data accessible to all employees. This underscores the risks associated with insufficient regulations and the potential for data breaches that can result in hefty fines.

Financial institutions navigate a complex landscape of regulations, with 61% of corporate risk and regulatory professionals acknowledging the necessity to stay informed on regulatory changes as a top strategic priority for the next 12 to 18 months. This dynamic aspect of adherence necessitates robust compliance software for financial services, which serves as an essential resource for efficiently managing regulatory obligations. Such software not only assists organizations in staying ahead of regulatory changes but also mitigates the risks associated with regulatory failures.

The impact of adherence on consumer trust cannot be overstated. In 2025, as monetary organizations grapple with evolving regulations, the ability to demonstrate compliance will be crucial in preserving customer trust. Moreover, 67% of executives find ESG regulations complex, highlighting a growing demand for clearer guidance from regulators. This complexity further emphasizes the importance of compliance software for financial services, which can simplify the management of these obligations.

The consequences of non-compliance are stark, with institutions facing significant penalties. Recent penalties for non-compliance in banking have underscored the financial repercussions of failing to adhere to regulations. In 2023, 58% of security and IT professionals stated, “We need larger budgets for regulations,” reflecting the increasing investment required to meet these challenges.

Furthermore, 27% of security and IT professionals ranked alleviating internal audit fatigue from assessments as their top regulatory challenge. This illustrates the operational burdens that non-adherence can impose and how it detracts from focusing on strategic regulatory initiatives.

In summary, the integration of compliance software for financial services is not merely a legal requirement; it is a strategic necessity for the banking sector. It empowers organizations to manage the intricacies of regulations, protect consumer confidence, and evade the costly repercussions of rule violations.

Key Features to Look for in Compliance Software

When selecting compliance software, financial institutions must prioritize several essential features to ensure effective management of regulatory requirements:

- Automation: Automating routine compliance tasks is crucial for minimizing manual errors and significantly reducing the time spent on repetitive processes. This not only enhances efficiency but also allows oversight teams to focus on more strategic initiatives. Findings from a recent UserEvidence survey reveal that organizations utilizing automated regulatory solutions reported a 30% reduction in errors related to regulations.

- Real-Time Monitoring: The ability to monitor adherence status in real-time is vital for organizations to swiftly address potential issues. This proactive approach mitigates risks and ensures compliance with evolving regulatory standards.

- Reporting Capabilities: Comprehensive reporting tools are indispensable for generating audit-ready reports and tracking compliance metrics. These features enable institutions to maintain transparency and accountability—essential elements in the highly regulated financial sector.

- Integration: The application must seamlessly integrate with existing systems to facilitate a smooth workflow. This interoperability is crucial for leveraging current technology investments and ensuring that regulatory processes are not siloed. Avato’s reliable, future-proof technology stack, which includes features designed to ensure 24/7 uptime and reliability, supports this need, helping businesses adapt to changing demands while ensuring robust integration for complex systems in banking, healthcare, and government.

- User-Friendly Interface: A simple and intuitive interface is key to enhancing user adoption and operational efficiency. As regulatory teams expand, a user-friendly design ensures that all staff can navigate the software effectively, fostering a culture of adherence throughout the organization.

In 2025, the emphasis on automation in regulatory processes is underscored by the findings mentioned above. Moreover, industry specialists advocate for a culture of adherence established early in the organizational lifecycle. ISO Lead Auditor Gurudev Mallesha aptly stated, “Adherence becomes manageable when companies start early.”

Case studies, such as ‘Investing in Compliance Software for Financial Services,’ emphasize the necessity for such software to not only meet current business demands but also adapt to future challenges. This adaptability is increasingly crucial in a rapidly changing regulatory landscape, ensuring that institutions remain competitive and resilient against evolving adherence requirements. Furthermore, Avato’s commitment to minimizing downtime and guaranteeing 24/7 availability for essential integrations supports regulatory requirements in the banking industry.

Regularly performing security audits and regulatory checks is essential to ensure that modernized systems meet all requirements.

Top 7 Compliance Software Solutions for Financial Services

Here are seven leading software solutions for regulatory services in 2025:

- VComply: This platform excels in governance, risk, and regulatory management, establishing itself as a premier compliance software for financial services. With user satisfaction ratings among the highest in the industry, VComply effectively streamlines regulatory processes and enhances operational efficiency.

- IBM OpenPages: Recognized for its robust capabilities in risk management and regulatory reporting, IBM OpenPages integrates seamlessly with existing systems. This integration helps organizations maintain adherence to evolving regulations while minimizing operational disruptions.

- MetricStream: Providing compliance software for financial services through an extensive management platform, MetricStream includes real-time monitoring and analytics. This enables financial organizations to proactively handle regulatory risks, and its market share continues to grow as organizations recognize the value of its integrated approach.

- ComplyAdvantage: Focused on Anti-Money Laundering (AML) regulations, ComplyAdvantage utilizes a data-driven methodology to help institutions effectively identify and mitigate risks. Financial analysts have noted its strong performance in enhancing regulatory workflows.

- Centraleyes: An all-in-one regulatory management platform, Centraleyes simplifies adherence by utilizing compliance software for financial services. It provides a centralized dashboard for tracking regulatory activities, and its user-friendly interface has received favorable feedback from banking organizations aiming to streamline their regulatory efforts.

- LogicGate Risk Cloud: Renowned for its adaptable regulatory solutions, LogicGate Risk Cloud adjusts to various regulatory frameworks, making it a versatile option for the services sector. Organizations utilizing this platform have reported enhanced adherence results and reduced expenses related to regulatory management.

- Fenergo: Specializing in Know Your Customer (KYC) and AML regulations, Fenergo provides compliance software for financial services with customized solutions that tackle the unique challenges encountered by financial institutions. Its effectiveness in real-world applications has been validated through numerous case studies, demonstrating significant improvements in adherence efficiency.

As organizations navigate the complexities of regulations, leveraging technology is essential. According to a report from Moody’s, 79% of companies are either already using, piloting, or contemplating AI to assist with regulations and manage risk. Furthermore, with 67% of global executives finding ESG regulation too complex, the demand for intuitive adherence solutions is more critical than ever.

Investing in regulatory tools not only mitigates risks related to data breaches—where organizations that emphasize employee training can significantly lower expenses—but also enhances overall operational integrity. The monetary dangers linked to regulatory failures underscore the significance of proactive risk management approaches.

Benefits of Implementing Compliance Software

Implementing compliance software offers a myriad of advantages for financial institutions, especially in the face of evolving regulatory landscapes and the pressing need for operational efficiency.

- Cost Reduction: Automating compliance processes can yield substantial savings, enabling organizations to reduce operational costs by streamlining manual compliance tasks. The average expense of adherence in the financial services sector is approximately $30.9 million, emphasizing the significant financial impact of effective adherence management. Additionally, organizations face an average revenue loss of $4 million per non-adherence event, underscoring the critical need for robust regulatory solutions. The integration of generative AI can amplify these savings by automating customer interactions and document processing, allowing institutions to allocate resources more effectively. A recent survey indicates a 60% increase in the use of generative AI for customer experience, showcasing its growing importance in the sector.

- Enhanced Accuracy: Automation is pivotal in minimizing human error, which is essential for ensuring precise regulatory reporting and monitoring. This increased accuracy not only aids in meeting regulatory requirements but also fosters trust with stakeholders. Generative AI technologies contribute to producing precise reports and documentation, thus enhancing overall accuracy.

- Enhanced Efficiency: By streamlining regulatory processes, teams can redirect their focus from administrative tasks to strategic initiatives. This shift is crucial, as 50% of risk and adherence professionals report their programs as mature, indicating a growing trend towards efficiency in management. Avato’s hybrid integration platform accelerates secure system integration, enabling financial institutions to modernize their operations and enhance efficiency. As Tony Leblanc from the Provincial Health Services Authority notes, “Avato accelerates the integration of isolated systems and fragmented data, delivering the connected foundation enterprises need to simplify, standardize, and modernize.”

- Risk Mitigation: Proactive adherence management through technological solutions empowers organizations to identify and address potential risks before they escalate into significant issues. This is particularly vital given that organizations can lose an average of $4 million in revenue per non-compliance event. Furthermore, 58% of oversight teams consider gauging vendor responsiveness their biggest challenge in managing third-party risk, highlighting the need for effective regulatory tools. Avato’s solutions are designed to simplify complex integrations, thereby reducing risks associated with fragmented systems.

- Regulatory Readiness: Governance software ensures that organizations are consistently prepared for audits and regulatory reviews, which is increasingly critical as 77% of corporate risk and oversight professionals emphasize the importance of staying updated on the latest ESG developments. The trend towards automation in regulatory strategies reflects a shift in the regulatory landscape, with many organizations recognizing the need for more efficient and effective management practices. Avato’s commitment to providing a connected foundation enables organizations to navigate these complexities with enhanced agility and assurance.

The incorporation of compliance software for financial services not only enhances operational capabilities but also empowers financial entities to maneuver through the complexities of regulatory adherence with increased agility and confidence, harnessing the transformative power of generative AI.

Challenges in Compliance Management for Financial Institutions

In 2025, financial organizations encounter a multitude of challenges in regulatory management, underscoring the urgent need for compliance software for financial services to navigate an increasingly intricate environment. Key issues include:

- Evolving Regulations: The rapid pace of regulatory changes presents a significant challenge. Financial organizations must continuously adapt to new laws and guidelines, which can be overwhelming and resource-intensive. Recent shifts towards automation technologies are being embraced through compliance software for financial services, aimed at reducing human errors and enhancing efficiency in regulatory processes. This enables organizations to better navigate these evolving rules.

- Data Management: The sheer volume of data that monetary organizations must manage complicates regulatory efforts. Ensuring that this data is not only secure but also compliant with regulations strains resources. A dedicated incident response team can save organizations an average of $14 per record lost or stolen, highlighting the financial implications of data mismanagement. Furthermore, the concern of third-party breaches is significant, with 35% of business and tech executives identifying it as a major cyber threat, emphasizing the need for robust data governance.

- Integration Issues: Integration issues persist, as the seamless integration of compliance software for financial services with existing systems remains a complex task. Numerous organizations face challenges in ensuring that new compliance software operates effectively with legacy systems, which can impede regulatory efforts and result in higher costs. Avato’s proficiency in hybrid integration tackles these challenges by allowing financial organizations to merge new regulatory solutions with current assets effectively, guaranteeing minimal disruption and improved operational resilience. Avato employs sophisticated technology tools to demonstrate both current and optimal conditions, assisting organizations in modeling their processes efficiently.

- Resource Constraints: Limited staffing and budget allocations for regulatory initiatives are common challenges. Many organizations find themselves stretched thin, making it challenging to execute thorough regulatory strategies effectively. A survey carried out by Globalscape and the Ponemon Institute indicated that organizations embracing best practices, such as centralized data governance and regular audits, reported potential savings ranging from $520,000 to $3.01 million, directly addressing these resource constraints.

- Cultural Resistance: The introduction of new regulatory software often meets with resistance from employees. This cultural pushback can significantly impact the success of implementation, as staff may be hesitant to adapt to new processes and technologies. Avato excels in engaging stakeholders to ensure that requirements are precisely captured and that the shift to compliance software for financial services and new systems is seamless, thus minimizing resistance and promoting a culture of adherence.

As Gustavo Estrada pointed out, organizations like Avato excel in simplifying intricate projects and achieving results within targeted timelines and budget limits, which is vital for organizations navigating these regulatory challenges. For instance, Avato’s work with Coast Capital demonstrated a seamless transition with only a 63-second outage during a major system switch, showcasing the transformational impact of Avato’s hybrid integration platform. By tackling these challenges directly, organizations can better position themselves to meet evolving regulatory demands and strengthen their operational resilience.

How to Choose the Right Compliance Software for Your Needs

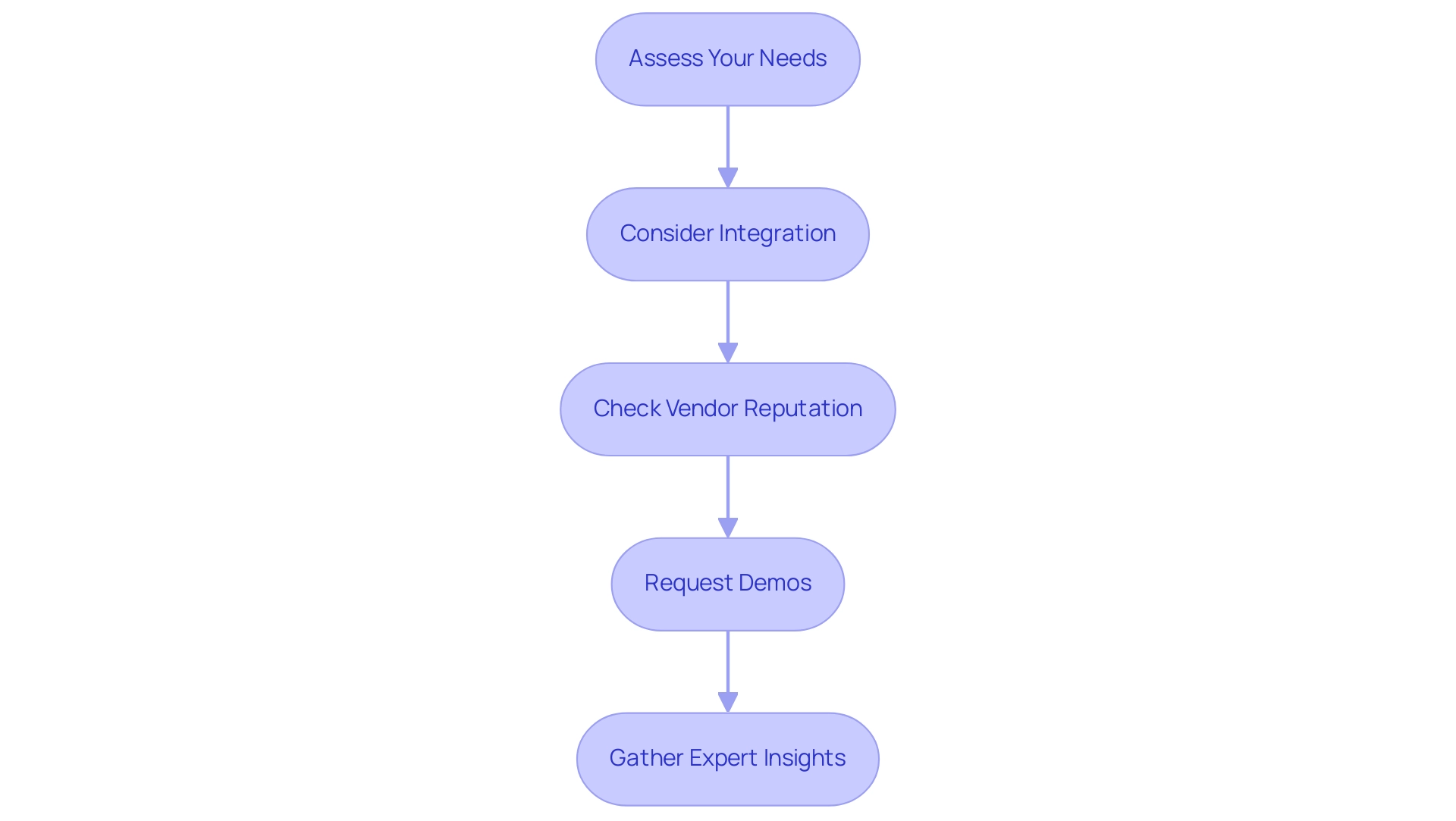

Choosing the suitable regulatory program for financial institutions is a vital procedure that demands careful thought regarding several key steps:

- Assess Your Needs: Begin by identifying the specific compliance requirements and challenges your organization faces. This foundational step ensures that the system you choose aligns with your regulatory obligations and operational goals. Evaluate Features: Look for programs that provide essential features such as automation, real-time monitoring, and robust reporting capabilities. These functionalities are essential for upholding regulations and enhancing operational efficiency. Avato’s hybrid integration platform supports these features while also offering 12 levels of interface maturity, allowing for a tailored approach to integration that meets your specific needs.

- Consider Integration: Ensure that the adherence application can seamlessly connect with your existing systems. This capability is crucial to avoid disruptions and maintain a smooth workflow, especially in environments where legacy systems are prevalent. Avato’s hybrid integration platform is designed to simplify complex integrations, delivering a connected foundation that supports secure transactions across banking, healthcare, and government sectors.

- Check Vendor Reputation: Investigate vendor reviews and case studies to assess their reliability and support. A strong vendor reputation is particularly important in the financial sector, where 35% of business and tech executives express concern over third-party breaches, highlighting the need for trustworthy partners. As Gustavo Estrada pointed out, Avato streamlines intricate projects and produces outcomes within preferred timelines and financial limits, demonstrating the efficacy of dependable regulatory tools. Additionally, 52% of regulatory experts cite insufficient partner information as a significant risk factor, underscoring the importance of thorough vendor evaluation. Request Demos: Interact with vendors to observe the program in action. This hands-on experience allows you to evaluate usability and ensure that the solution meets your team’s needs effectively.

- Gather Expert Insights: Consult industry leaders and regulatory specialists for their perspectives on assessing vendor solutions. Their insights can provide valuable guidance and help you avoid common pitfalls.

- Analyze Statistics: Consider relevant statistics that affect the selection of regulatory tools. Moreover, with 91% of business leaders believing their organization has a duty to address ESG matters, the increasing significance of adherence in this context cannot be ignored.

By following these steps, institutions can make informed choices when selecting compliance software for financial services, ensuring they meet legal obligations while improving operational capabilities. The ongoing transformation in the financial services sector, especially in the area of electronic payments, highlights the essential role of digitization in choosing regulatory tools. Regularly conducting security audits and compliance checks, as emphasized by Avato, ensures that your modernized systems meet all regulatory requirements, highlighting the importance of selecting the appropriate compliance software for financial services.

Conclusion

Implementing compliance software is no longer merely a regulatory necessity; it has evolved into a strategic imperative for financial institutions navigating an increasingly complex regulatory landscape. This article underscores the essential role of compliance software in automating processes, enhancing operational efficiency, and safeguarding sensitive data. Ultimately, it positions organizations for success amid evolving regulations.

As financial institutions confront the mounting challenges of compliance, including stringent regulations and the complexities of data management, the adoption of robust compliance solutions becomes paramount. By automating routine tasks and offering real-time monitoring capabilities, compliance software not only mitigates the risks associated with non-compliance but also fosters consumer trust. The significant financial implications of compliance failures further underscore the necessity for institutions to invest in advanced technologies.

In conclusion, the integration of compliance software empowers financial institutions to streamline operations, reduce costs, and enhance accuracy in compliance reporting. As the financial services landscape continues to evolve, embracing these solutions will be critical for organizations striving to remain agile and resilient. This ensures they meet regulatory demands while maintaining the trust of their customers. The future of compliance lies in leveraging technology to navigate complexities, and those who prioritize these innovations will undoubtedly lead the way in operational integrity and regulatory adherence.