Overview

Mastering integration in software development is not just beneficial; it is essential for our banking success. By enhancing operational efficiency and improving customer service, we create seamless connections between disparate systems. We understand the critical role of APIs, data unification, and middleware solutions in this process. Our case studies illustrate significant improvements in client engagement and compliance achieved through effective integration strategies.

What’s holding your team back from realizing these benefits? We invite you to explore how our integration solutions can transform your operations and elevate your customer experience.

Introduction

In today’s rapidly evolving financial landscape, we recognize that the integration of software systems is not just beneficial—it is essential for banking institutions aiming to enhance operational efficiency and customer satisfaction. Legacy systems often impede innovation, making it vital for us to understand the fundamentals of software integration—such as APIs, middleware, and data management—to successfully navigate this complex terrain.

As we increasingly invest in integration solutions, our ability to connect diverse applications seamlessly not only boosts compliance but also drives better decision-making. What challenges are holding your team back?

This article explores the various types of software integration, the technical and security challenges we face in banking, and the valuable lessons learned from successful case studies, illuminating our path toward a more integrated and efficient banking environment.

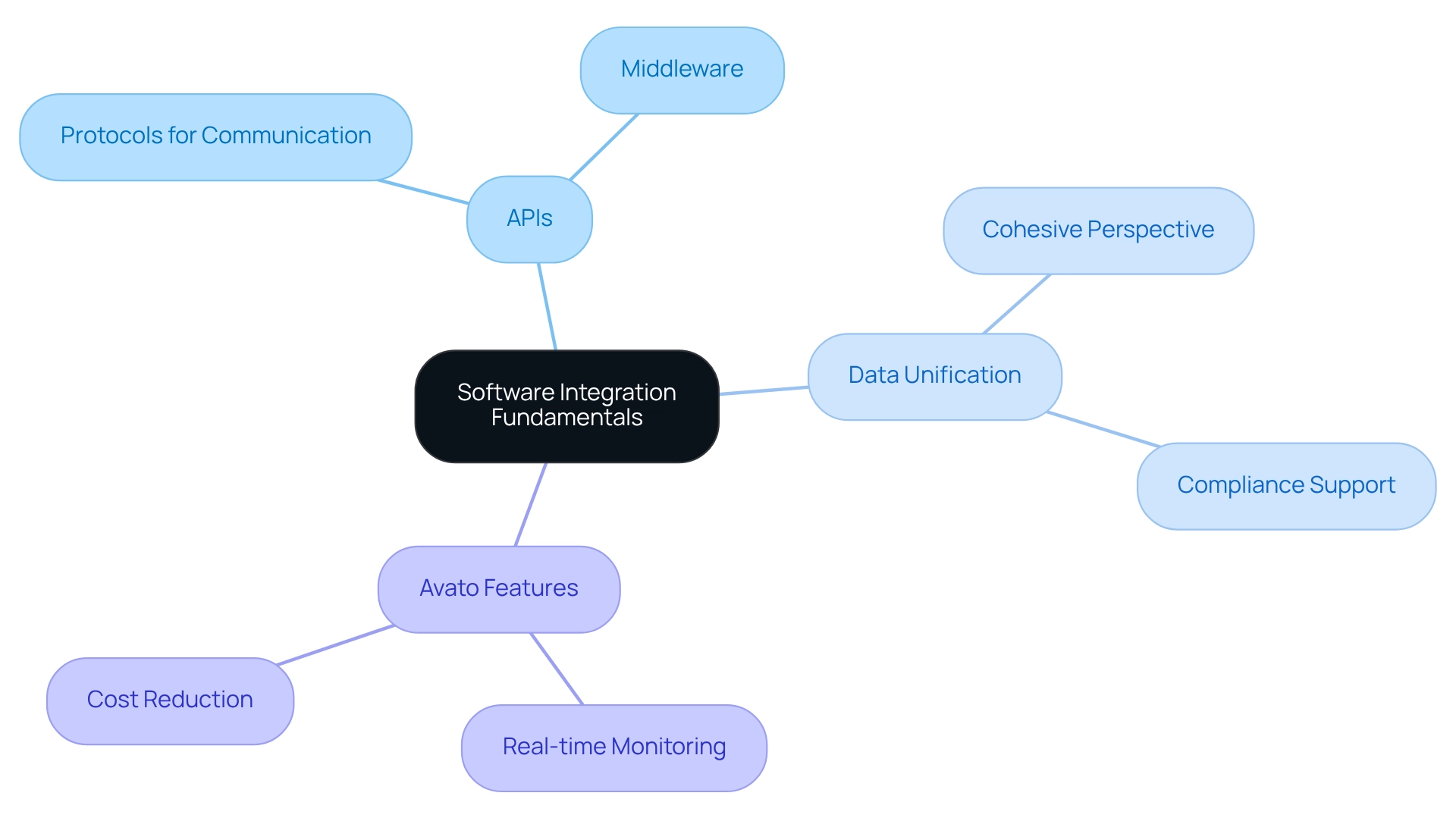

Understand Software Integration Fundamentals

Grasping the essentials of software integration is crucial in today’s financial landscape. Software integration is about linking diverse applications and platforms to function seamlessly—an imperative in an industry often burdened by outdated technologies and the necessity for real-time data exchange. Consider the following key concepts:

- APIs (Application Programming Interfaces): These protocols facilitate smooth communication between various software applications, making them indispensable for integrating financial platforms with third-party services. Effective API management alleviates technical complexities, enhancing workflow and customer satisfaction in financial institutions. This is particularly evident in software development integration, where middleware acts as a bridge between applications, enabling communication and data management. This amalgamation is vital for preserving operational continuity and improving service delivery.

- Data Unification: This process consolidates information from various sources to create a cohesive perspective, essential for compliance and reporting within finance. Accurate data unification not only supports regulatory requirements but also enhances decision-making processes.

At Avato, we provide a hybrid unification platform that exemplifies a dedicated solution for simplifying these intricate connections. Key attributes of our platform include:

- Real-time Monitoring: This feature ensures that system performance is consistently observed, allowing for prompt responses to any issues.

- Cost Reduction: Our platform optimizes connection processes, significantly reducing operational expenses.

By enhancing and extending the value of legacy systems, we empower financial institutions to manage connections efficiently, facilitating seamless integration in software development. Recent statistics underscore the growing emphasis on unification within the financial sector, with 67% of financial firms investing in unification solutions to boost operational efficiency. Furthermore, starting in 2025, the trend toward API utilization is set to rise, as many banking organizations recognize the significance of integration in software development for unified solutions.

By understanding these fundamentals and leveraging Avato’s features, banking organizations can identify the appropriate tools and strategies for their unification projects. This ultimately leads to enhanced operational efficiency and improved client service. We enable banks to utilize APIs, middleware, and data unification effectively, ensuring compliance with regulatory requirements while meeting client expectations.

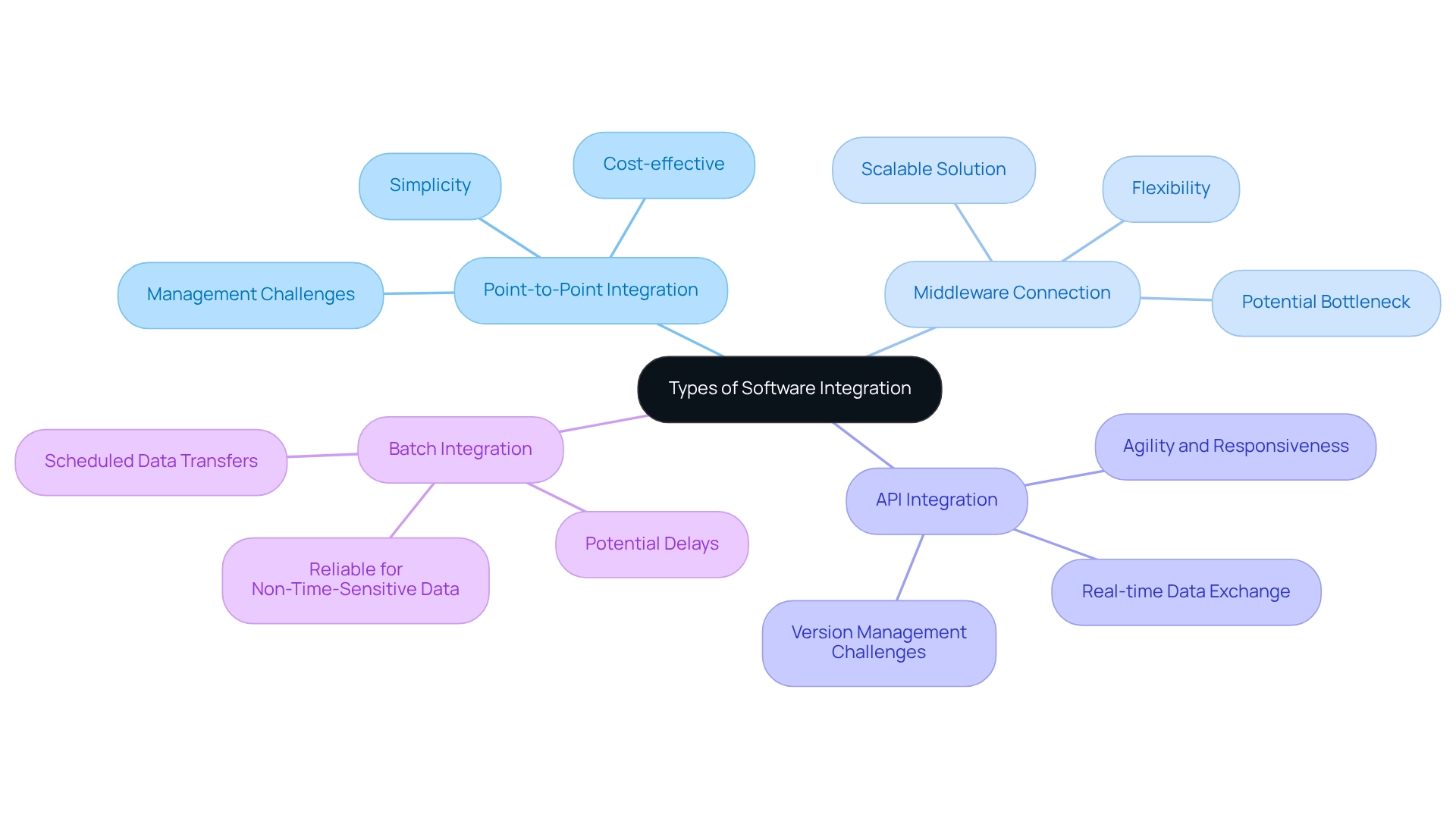

Explore Types of Software Integration

In today’s rapidly evolving financial landscape, banking institutions must leverage software integration to enhance operational efficiency and elevate customer service. We understand that the right integration strategy can transform the way you operate and interact with clients.

Point-to-Point Integration offers a straightforward method that connects two systems directly, providing simplicity and cost-effectiveness. However, as the number of connections increases, complexity can arise, presenting management challenges that may hinder larger organizations. Increased maintenance efforts are a potential drawback as more connections are added.

Middleware Connection presents a scalable and flexible solution, enabling banks to facilitate multiple connections. This is particularly advantageous for institutions with numerous legacy systems in need of modernization. Yet, we must ensure that the middleware is robust enough to handle various connections without becoming a bottleneck.

Embracing APIs for integration allows for real-time data exchange, which is essential for connecting with FinTech solutions and third-party services. This modern approach fosters agility and responsiveness. However, managing API versions and ensuring compatibility across different systems can be challenging. Notably, we have seen a 60% increase in the use of generative AI for customer experience, particularly in developing sophisticated chatbots and virtual assistants that enhance engagement.

Batch Integration, on the other hand, involves the transfer of data in scheduled batches rather than in real-time. While it may not be suitable for time-sensitive operations, it effectively manages less urgent data transfers, providing a reliable solution for specific scenarios. The downside, however, is the potential for delays in data availability, which can impact decision-making.

Choosing the appropriate connection type hinges on the bank’s specific needs, current framework, and overall integration goals. Significantly, 59% of organizations indicate that strong connections enhance their close rates by improving data precision and workflow effectiveness. This underscores the importance of strategic connection planning in achieving business success. As Tony Leblanc from the Provincial Health Services Authority aptly noted, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.”

Moreover, the case study titled “Impact of Connections on Sales” reinforces that 59% of organizations find that these linkages significantly enhance their close rates. This illustrates how robust connections can greatly influence a company’s ability to attract and retain customers. Avato’s hybrid unification platform is designed to accelerate secure system connections for banking, healthcare, and government sectors, ensuring that institutions can effectively modernize their operations. Our platform supports 12 tiers of interface maturity, striking a balance between the speed of incorporation and the complexity necessary to future-proof technology stacks.

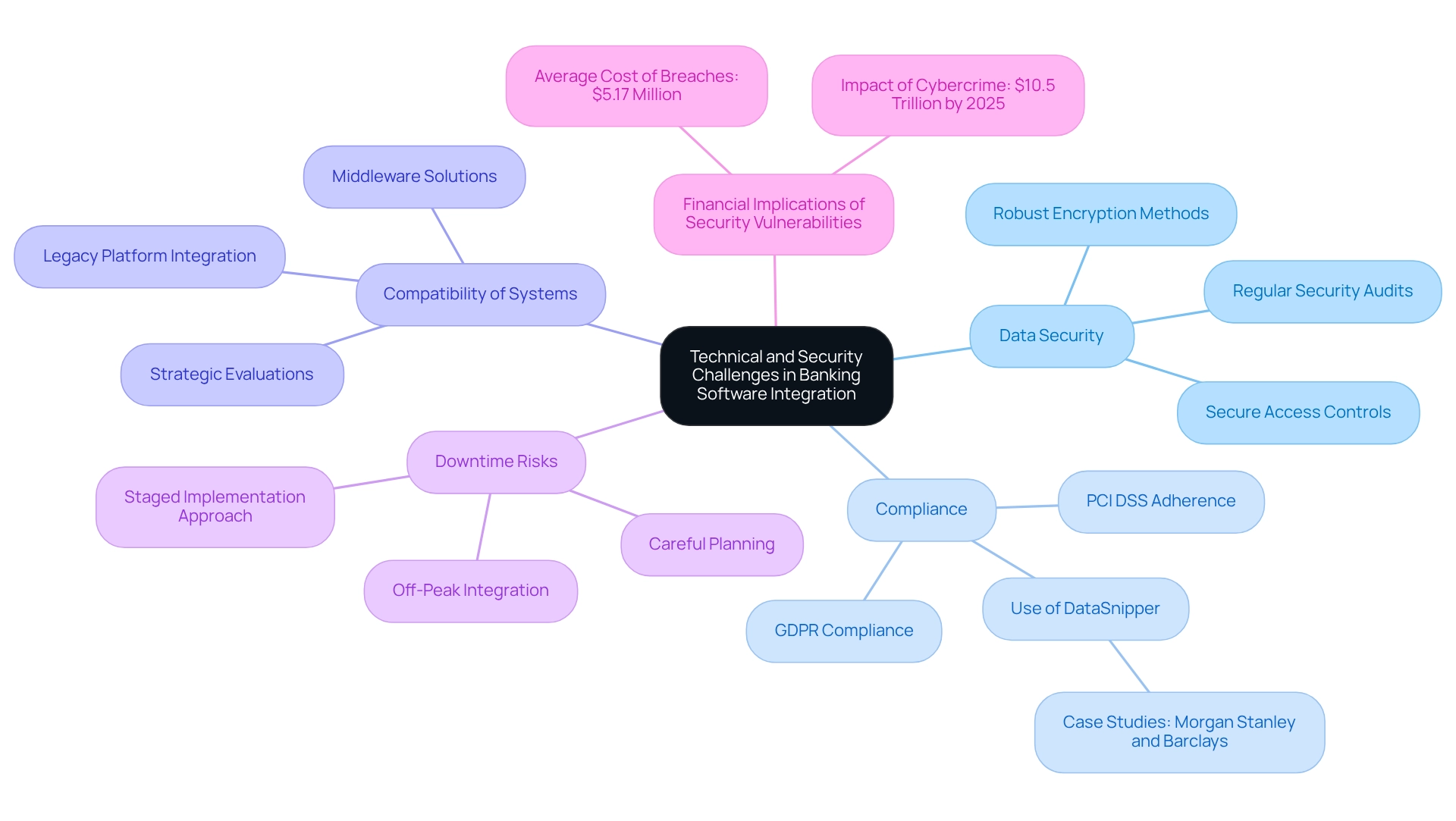

Manage Technical and Security Challenges

Banking institutions face a myriad of technical and security challenges during software integration that necessitate meticulous management. Data Security is paramount; safeguarding sensitive customer information is non-negotiable. We must employ robust encryption methods, implement secure access controls, and conduct regular security audits as essential strategies to shield data from breaches. With cybercrime projected to cost companies up to $10.5 trillion by 2025, we encounter distinct vulnerabilities that demand heightened security measures.

Compliance is another critical aspect; adherence to regulations such as GDPR and PCI DSS is mandatory for us as banks. To avoid severe legal repercussions, our software development integration must be meticulously designed to meet these compliance standards. Notably, we leverage advanced tools like DataSnipper, as seen with banks like Morgan Stanley and Barclays, to ensure regulatory compliance and effectively mitigate associated risks. As an authority in this area has stated, “Compliance is not merely a checkbox; it’s essential for preserving trust and operational integrity in banking projects.”

Compatibility of Systems presents its own challenges; the unification of legacy platforms with contemporary applications often leads to compatibility difficulties. We advocate for comprehensive evaluations of compatibility and the utilization of middleware solutions to facilitate smoother integration in software development, ensuring that legacy setups can communicate effectively with new technologies. This aligns with the strategic evaluation and planning essential for updating frameworks with Avato’s Hybrid Integration Platform.

Downtime Risks are a significant concern; integration projects can inadvertently lead to system downtime, disrupting customer service and eroding trust. To minimize this risk, we emphasize careful planning. Conducting integrations during off-peak hours and applying strategies for minimal disruption can help us maintain operational continuity. A staged implementation approach further enhances adaptability and mitigates risks associated with software integration.

Financial Implications of Security Vulnerabilities cannot be overlooked; the average cost of breaches involving public cloud environments stands at $5.17 million, underscoring the financial risks tied to inadequate security measures. This statistic highlights the critical importance of strong security protocols in the integration of financial software.

By proactively addressing these challenges and avoiding common pitfalls, such as underestimating the complexity of legacy system amalgamation, we can streamline our merging processes, bolster data security, and uphold client trust. Moreover, engaging stakeholders early in the process and designing new business procedures will ensure that our coordination efforts align with institutional objectives and customer requirements. For further assistance, we encourage you to consult the FAQs and user manuals provided by arvato, which offer detailed insights into effective implementation practices.

Learn from Successful Integration Case Studies

We have observed that several banking institutions have successfully navigated integration challenges, providing valuable lessons.

Case Study 1: ABC Bank: Confronted with outdated legacy systems, we adopted an API-based integration strategy that facilitated connections with FinTech partners. This initiative resulted in an impressive 30% rise in client engagement and significantly decreased transaction processing durations, underscoring the transformative power of integration in software development. Furthermore, we utilized generative AI to enhance client interactions through advanced chatbots, further improving the overall client experience.

Case Study 2: XYZ Credit Union: By implementing middleware solutions, we effectively achieved integration in software development between our core banking platform and a new mobile application. This unification not only enhanced client satisfaction ratings by 25% but also lowered operational expenses by 15%, demonstrating the financial advantages of integration in software development. The integration of generative AI in our customer service processes played a crucial role in achieving these results, allowing for more personalized and efficient customer interactions.

Case Study 3: DEF Financial Services: We tackled compliance challenges by creating a robust data governance framework during our unification project. This proactive strategy ensured compliance with regulatory requirements, assisting us in avoiding expensive penalties and emphasizing the significance of security in implementation efforts. Our expertise in hybrid unification solutions provided essential assistance to uphold secure transactions, a crucial element as 91% of clients view security as an important aspect in their financial choices.

These case studies highlight the essential role of strategic planning, suitable technology choices, and a strong emphasis on security and compliance in achieving successful integration in software development results. As Tony Leblanc from the Provincial Health Services Authority states, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.” This perspective is crucial as we adapt to the evolving landscape shaped by technology.

Furthermore, our hybrid integration platform accelerates secure system integration in software development for banking, healthcare, and government, ensuring that institutions can meet the emerging needs of customers in the digital banking landscape.

Conclusion

In today’s rapidly evolving financial landscape, we cannot overstate the critical role of software integration for banking institutions. Understanding the fundamentals—such as APIs, middleware, and data integration—is essential for overcoming the challenges posed by legacy systems. By embracing these integration strategies, we can enhance operational efficiency, improve customer satisfaction, and ensure compliance with regulatory requirements.

Exploring various types of software integration reveals multiple pathways to success. From point-to-point connections to API-based solutions, each integration type offers unique advantages and challenges. A tailored approach, based on the specific needs and infrastructure of our institution, can lead to significant improvements in workflow efficiency and customer engagement.

However, the journey to successful integration is not without its hurdles. Technical and security challenges, including data security, compliance, and system compatibility, must be managed with diligence. Proactive strategies and robust security measures are crucial in safeguarding sensitive information and maintaining customer trust.

Learning from successful case studies further illustrates the transformative potential of effective integration. Institutions like ABC Bank and XYZ Credit Union have demonstrated that strategic planning and the right technological solutions can yield substantial benefits, such as increased customer engagement and operational cost savings.

Ultimately, the integration of software systems is not merely an operational necessity; it is a strategic imperative that shapes the future of banking. By investing in the right integration solutions and prioritizing security and compliance, we can position ourselves for success in an increasingly competitive environment. The path to a more integrated, efficient, and customer-centric banking experience is clear, and the time to act is now.