Overview

We focus on mastering system integration and architecture to enhance banking efficiency. Effective system integration is not merely an operational necessity; it is crucial for achieving operational efficiency, ensuring regulatory compliance, and improving customer service.

What’s holding your team back? Statistics demonstrate that financial institutions adopting robust integration strategies experience significant cost reductions and enhanced performance.

As a result, we invite you to explore how our integration solutions can transform your operations and drive success.

Introduction

In today’s rapidly evolving banking landscape, we recognize that system integration is not just beneficial—it’s vital for success. As financial institutions face the pressing demands for speed, reliability, and compliance, the seamless connection of diverse systems and applications becomes essential. This integration enhances operational efficiency and improves data accuracy, enabling us to respond swiftly to market changes and customer demands.

Yet, we understand that challenges such as legacy system compatibility, data silos, and security vulnerabilities create significant obstacles on the path to effective integration. However, by embracing best practices and leveraging advanced technologies, we can transform these challenges into opportunities for innovation and growth.

The role of integration architecture, particularly through platforms like Avato, is pivotal in maximizing the value of our existing systems while preparing for the future of banking.

What’s holding your team back from achieving this transformation? Let us guide you toward a more integrated and efficient banking experience.

Define System Integration and Its Importance in Banking

In the ever-evolving landscape of financial institutions, the system integration and architecture of diverse networks, applications, and platforms is not just beneficial; it is essential for driving operational efficiency and enhancing data accuracy. As we approach 2025, the financial sector is poised to face increasing demands for speed and reliability. Effective unification empowers us to swiftly adapt to market changes and client needs, a necessity for compliance with regulatory standards, which in turn improves our data management and reporting processes. For instance, the system integration and architecture of core banking platforms with customer relationship management (CRM) tools not only optimizes operations but also significantly enhances customer service and retention by providing real-time access to comprehensive customer data.

At Avato, our commitment—reflected in the Hungarian term for ‘dedication’—is to maximize the value of legacy infrastructures, simplify complex integrations, and drastically reduce costs. Statistics reveal that automated regulatory reporting, as demonstrated at DBS Bank, can cut compliance expenses by 26%, underscoring the financial benefits of strong system integration and architecture. Furthermore, as noted by Erik Brynjolfsson, effective coordination can lead to a 25 percent reduction in agent turnover and fewer inquiries directed to managers, highlighting its profound impact on customer service.

With Avato’s secure architecture designed for 24/7 uptime, financial institutions can rely on our connection projects to function flawlessly, ensuring reliability in critical sectors such as finance, healthcare, and government. As we navigate an environment where data collaboration is a competitive imperative, the importance of system integration and architecture in a well-defined unification strategy cannot be overstated.

Key Benefits of Avato’s Hybrid Integration Platform:

- Maximizes Legacy System Value: We enhance the utility of existing systems.

- Simplifies Complex Connections: Our platform streamlines the integration process for various applications.

- Reduces Costs: We lower operational expenses through effective unification.

- Ensures Secure Operations: Our robust framework guarantees secure transactions.

- Delivers 24/7 Uptime: We ensure reliability for critical banking operations.

Are you ready to elevate your financial institution’s operational efficiency? Let us partner with you to harness the full potential of our integration platform.

Identify Key Challenges in Banking System Integration

Identify Key Challenges in Banking System Integration

We recognize that banks encounter significant challenges in system integration, particularly concerning:

- Legacy system compatibility

- Data silos

- Security vulnerabilities

Legacy architectures frequently lack the required adaptability for contemporary connectivity, making it difficult to connect with newer technologies. This rigidity can lead to operational inefficiencies and hinder innovation. Furthermore, disparate data sources contribute to inconsistencies and errors, complicating data management and reporting processes. Security remains a paramount concern; integrating systems can heighten the risk of data breaches and compliance violations. For instance, financial institutions that fail to protect their connection points risk revealing sensitive customer data, which can lead to significant reputational and monetary consequences.

Addressing these challenges necessitates a comprehensive strategy that includes:

- Thorough assessments of existing systems

- The implementation of robust security protocols

- The adoption of automated compliance tools

All of which are essential to effective system integration and architecture. Notably, we observe that banks utilizing such tools report 67% fewer compliance findings during regulatory examinations, underscoring the importance of proactive measures in mitigating integration risks.

The incorporation of AI technologies is transforming the financial sector. Applications in trading and portfolio optimization are improving decision-making processes and recognizing market trends with unmatched accuracy. Additionally, AI-powered solutions are enhancing customer engagement through personalized service delivery while also bolstering security measures in fraud detection. As Pavel Abdur-Rahman from IBM states, “True AI needs quantum computing to support [it], but ‘Augmented Intelligence’ is transforming industries today.” This emphasizes the role of advanced technologies in addressing connectivity challenges.

Moreover, we find that Avato maximizes the potential of traditional frameworks and enhances operational capabilities, ensuring that financial institutions can adapt to changing demands while maintaining security and compliance. To efficiently mobilize stakeholders and safeguard future operations, we encourage financial institutions to consider collaborating with Avato’s expertise in hybrid connectivity, which can enhance processes and boost overall efficiency.

Implement Best Practices for Effective System Integration

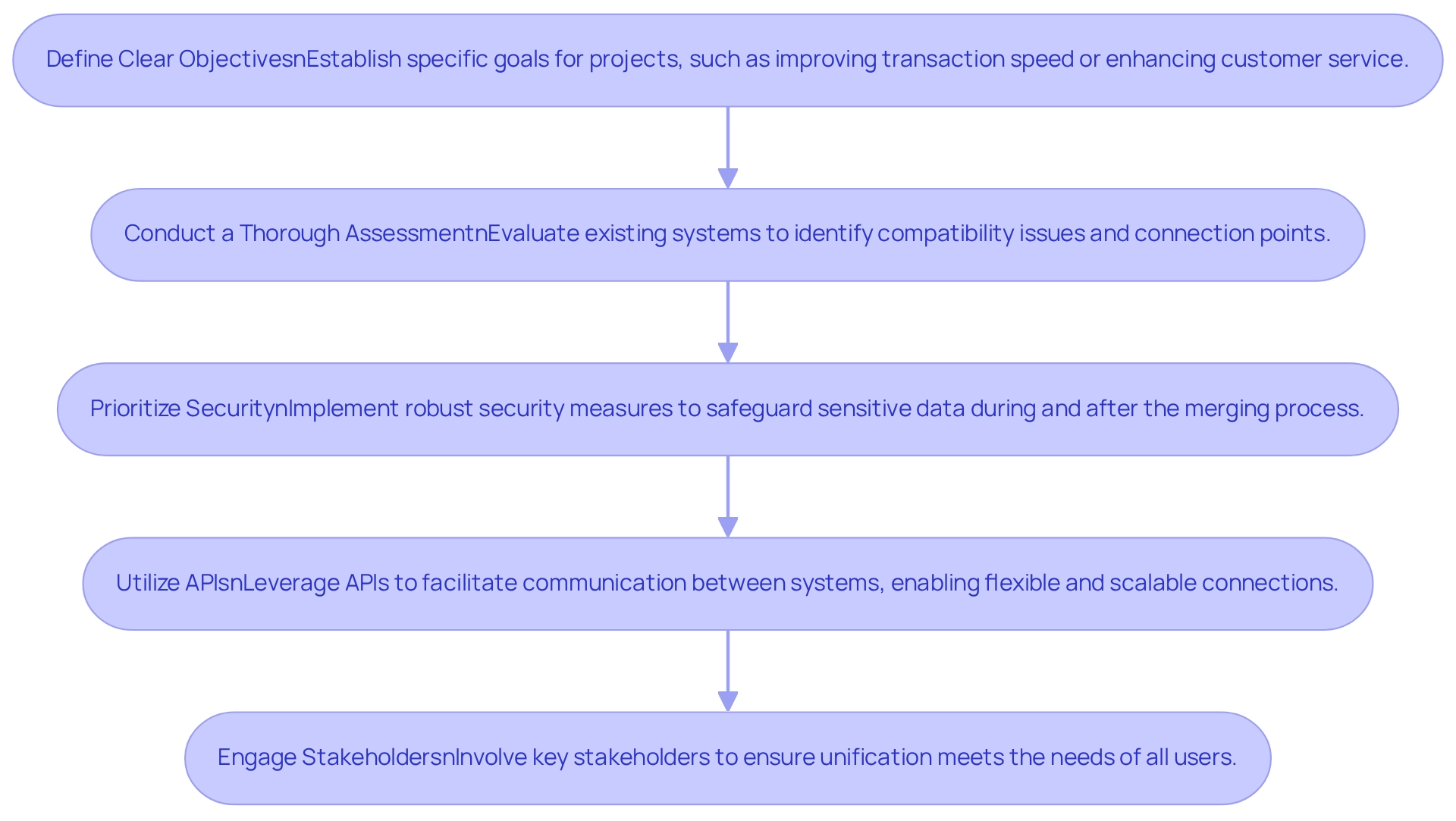

To achieve effective system integration, we must adopt several best practices:

- Define Clear Objectives: We establish specific goals for our projects, such as improving transaction speed or enhancing customer service. Clear objectives are essential, as they direct the merging process and assist in assessing success.

- Conduct a Thorough Assessment: We evaluate existing systems to identify compatibility issues and connection points. This evaluation guarantees that possible obstacles are tackled early in the process, especially as financial institutions prepare for the shift to open systems.

- Prioritize Security: We implement robust security measures to safeguard sensitive data during and after the merging process. Given the regulatory environment in finance, security cannot be compromised. Open financial services will demand even stricter security measures, making it crucial to enhance and clarify connectivity platforms to reduce vulnerabilities.

- Utilize APIs: We leverage application programming interfaces (APIs) to facilitate communication between systems, enabling more flexible and scalable connections. APIs are vital for contemporary financial system unification, enabling effortless data transfer and improved functionality, which is crucial as we aim to innovate in an open financial landscape.

- Engage Stakeholders: We involve key stakeholders from different departments to ensure that unification meets the needs of all users. For instance, a financial institution that effectively combined its loan processing platform with its CRM experienced a 30% decrease in processing time, greatly enhancing customer satisfaction.

By adhering to these best practices, we can enhance our collaboration efforts, ultimately leading to improved operational efficiency and customer experiences. As Jamie Dimon observed, ‘the future belongs to those who master technology,’ making effective network coordination a vital element of financial success. Furthermore, adopting agile practices can significantly impact integration outcomes; for instance, ING reduced its time-to-market for new offerings by 60% through an agile operating model. Additionally, as Gustavo Estrada highlighted, Avato simplifies complex projects and delivers results within desired time frames and budget constraints. Insights from the case study titled ‘Quantified Customer Impact’ also reveal that operational improvements can positively affect customer behavior and lifetime value, driving strategic investments in efficiency.

Leverage Integration Architecture for Operational Efficiency

The system integration and architecture serve as the backbone for seamless communication and collaboration among diverse entities within banking institutions. By adopting a modular architecture, we can significantly enhance operational efficiency while streamlining our IT environments. This strategy enables simpler updates and scalability, allowing the incorporation of new technologies without extensive system overhauls. For instance, a financial institution that embraced a microservices architecture reported a remarkable ability to deploy new features swiftly, thereby enhancing responsiveness to customer needs.

Furthermore, the integration of cloud-based solutions has become progressively crucial, with more than half of surveyed companies acknowledging cloud computing as fundamental to their data protection strategies. This flexibility empowers us to scale operations dynamically, ensuring we remain competitive in a fast-paced market. Statistics reveal that organizations utilizing modular architecture experience a significant decrease in operational expenses and improved service delivery times, underscoring the value of this approach in contemporary banking.

As the landscape evolves in 2025, the advantages of system integration and architecture will endure, with financial institutions that prioritize these strategies likely to experience enhanced efficiency and agility. The shift towards modular architecture not only streamlines processes but also positions us to better manage the complexities of SaaS sprawl, which currently affects the average organization using 254 SaaS applications. By implementing robust governance and management strategies, we can maximize our SaaS investments while minimizing unnecessary expenditures. Moreover, with over half of AWS, Azure, and Google Cloud users adopting serverless computing, the trend towards system integration and architecture is increasingly relevant in the banking sector.

Avato’s hybrid unification platform plays an essential role in this transformation, enabling us to enhance and prolong the value of our legacy frameworks while simplifying intricate connections and significantly lowering expenses. Key functionalities of the Avato platform include:

- Real-time monitoring and alerts on system performance, ensuring operational reliability.

- Streamlined connection processes that improve responsiveness to market changes.

- Cost reduction strategies that allow us to allocate resources more effectively.

As noted, ‘wrapped inside those topics are data analytics, technologies, and software – all of which are enablers not drivers,’ highlighting the critical role of system integration and architecture in facilitating these advancements.

Conclusion

In the rapidly changing landscape of banking, we recognize that effective system integration is a cornerstone for success. By seamlessly connecting various systems and applications, we can significantly enhance operational efficiency, improve data accuracy, and ensure compliance with regulatory requirements. The integration of platforms like Avato not only maximizes the value of legacy systems but also simplifies complex processes, ultimately reducing operational costs and improving customer service.

However, the journey towards effective integration is not without its challenges. Legacy system compatibility, data silos, and security vulnerabilities can impede progress. Yet, by adopting best practices such as:

- Defining clear objectives

- Prioritizing security

- Leveraging APIs

we can navigate these obstacles and transform them into opportunities for growth and innovation. Engaging stakeholders and utilizing agile methodologies further enhances our integration efforts, leading to measurable improvements in operational efficiency and customer satisfaction.

As we prepare for a future that demands agility and responsiveness, the role of integration architecture becomes increasingly vital. Embracing modular and cloud-based solutions equips us to adapt to market changes swiftly while managing the complexities of modern technology landscapes. The adoption of Avato’s hybrid integration platform exemplifies how we can streamline operations, ensuring we remain competitive in an ever-evolving environment.

Ultimately, the path to a more integrated banking experience is clear. By prioritizing system integration and leveraging advanced technologies, we can not only overcome existing challenges but also position ourselves for sustainable growth and success in the future.