Overview

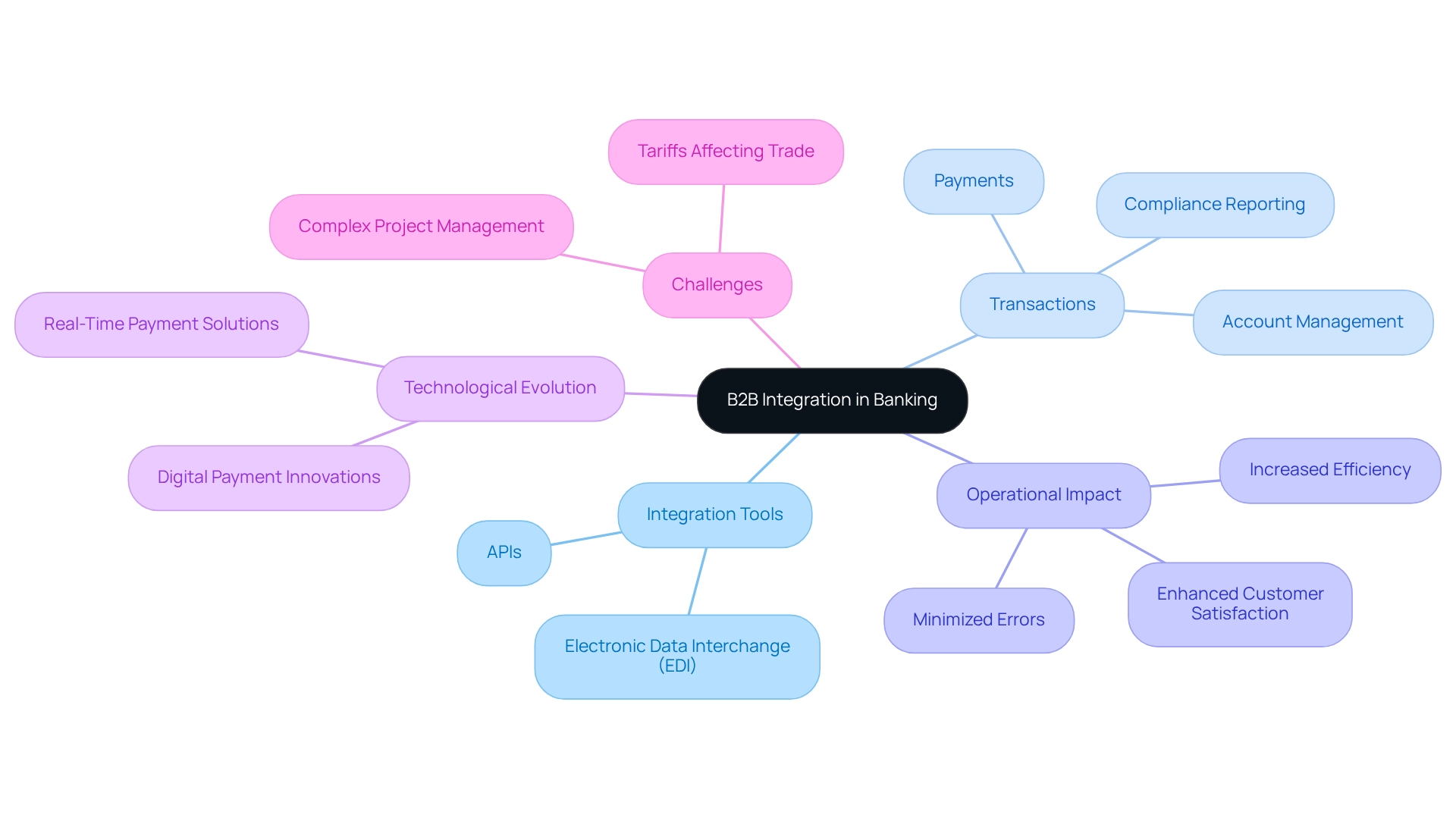

B2B integration tools are indispensable for our success in banking. They automate and optimize collaboration, streamline business processes, and facilitate data exchanges between financial institutions and our corporate clients. By leveraging technologies such as APIs and EDI, we can enhance operational efficiency, minimize errors, and significantly improve customer satisfaction. These factors are critical for maintaining our competitive edge in the ever-evolving financial landscape.

What’s holding your team back from achieving these vital improvements? We invite you to explore how embracing these integration tools can transform your operations and elevate your service delivery.

Introduction

In the rapidly evolving landscape of the banking sector, we recognize that B2B integration has emerged as a critical component for success. By automating and optimizing data exchanges between financial institutions and their corporate clients, we can enhance operational efficiency and improve customer satisfaction.

With an increasing number of organizations investing in integration technologies, such as APIs and Electronic Data Interchange (EDI), the pressure to adapt and innovate has never been greater. As we navigate the complexities of legacy systems, data security, and regulatory compliance, the right integration tools and strategies become indispensable.

This article delves into the significance of B2B integration in banking, the challenges we face, effective tools for implementation, and best practices for monitoring performance—all essential for thriving in a competitive financial environment.

Define B2B Integration in Banking Context

In the banking context, we recognize that B2B integration tools are essential for automating and optimizing collaboration, business processes, and data exchanges between financial institutions and their corporate clients or partners. This combination encompasses a variety of transactions, including payments, account management, and compliance reporting. By utilizing technologies such as APIs and Electronic Data Interchange (EDI), we can significantly enhance operational efficiency, minimize errors, and elevate customer satisfaction.

As we look ahead to 2025, the landscape of B2B connectivity is evolving rapidly, with 67% of companies investing in systems primarily to improve close rates. This investment is essential for us, as it results in increased operational efficiency and heightened customer satisfaction—critical elements for sustaining a competitive advantage in a dynamic financial landscape.

Our Hybrid Connectivity Platform plays a key role in this transformation, allowing us to maximize and extend the value of legacy systems while simplifying intricate connections. The platform is architected for secure transactions, ensuring 24/7 uptime and reliability—essential for the banking sector where there is no room for defects, errors, or outages. Furthermore, it offers real-time tracking and notifications regarding system performance, further improving our operational supervision.

We are committed to addressing intricate challenges, which is evident in the advantages of B2B collaboration for financial institutions. It not only streamlines operations but also fosters better relationships with clients through improved service delivery. For example, companies utilizing automation in accounts receivable have indicated a decrease in late payments from 28 to 23 days, resulting in improved cash flow and operational stability, as noted by Denis Lunev.

Successful instances of B2B collaboration in financial institutions demonstrate the transformative potential of integration tools. The retail and e-commerce sectors, for instance, are witnessing significant growth in B2B payments, driven by the demand for real-time payment solutions. Advancements in digital payments are improving transparency and efficiency, especially in handling substantial transaction volumes, which consequently affects financial operations by requiring quicker and more dependable payment processing.

As Sarah Lee aptly notes, this shift signifies not merely a technological incorporation but a philosophical evolution in how we approach information management. Moreover, we must navigate challenges such as tariffs that affect trade, making effective B2B cooperation even more essential. By adopting B2B integration tools and utilizing our secure hybrid connection platform, we can enhance our operational capabilities and client satisfaction, positioning ourselves for sustained success in an increasingly interconnected world.

Identify Key Challenges in Banking B2B Integration

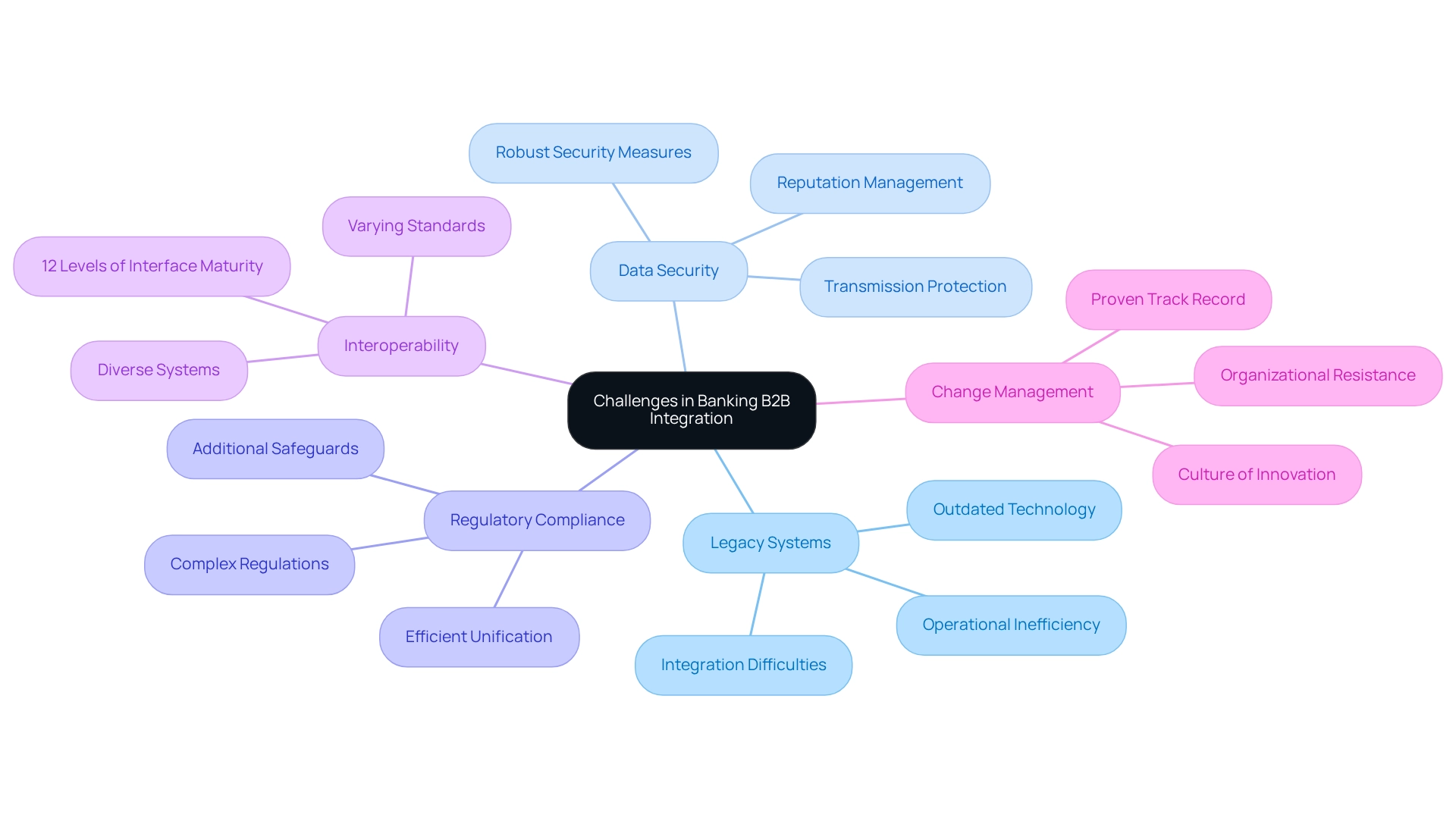

Banking B2B connectivity presents significant challenges that we must navigate to remain competitive and secure. These challenges include:

- Legacy Systems: A substantial number of financial institutions continue to rely on outdated systems that lack the functionalities for modern connectivity. This dependence complicates integration with new technologies, hindering operational efficiency and innovation. Our hybrid platform addresses this issue by streamlining intricate connections, enabling financial institutions to modernize their operations without sacrificing security or efficiency.

- Data Security: Protecting sensitive financial data during transmission is critical. In 2025, data security breaches in financial institutions have become increasingly prevalent, leading to severe financial losses and reputational damage. Ensuring robust security measures is essential to mitigate these risks. Our platform is designed for secure transactions, establishing it as a reliable solution for financial institutions, healthcare, and government sectors.

- Regulatory Compliance: The banking sector is subject to a complex web of regulations governing data sharing and transaction processing. Adhering to these regulations can complicate integration efforts, necessitating financial institutions to implement additional safeguards and procedures. Our expertise in managing these complexities guarantees that unification efforts remain compliant and efficient.

- Interoperability: The diversity of systems and platforms within the banking ecosystem often leads to varying standards and protocols. Achieving seamless communication across these disparate systems is a significant obstacle that we must overcome to enable effective collaboration. Our hybrid connectivity platform supports 12 levels of interface maturity, enabling financial institutions to balance speed of connectivity with the sophistication required to future-proof their technology stack.

- Change Management: Organizational resistance to change can hinder the adoption of new integration tools and processes. This resistance can restrict the effectiveness of unification initiatives, making it essential for financial institutions to cultivate a culture that welcomes innovation and adaptability. Our proven track record, as demonstrated in case studies like our work with Coast Capital, showcases how we can facilitate major system transitions with minimal downtime, reinforcing the reliability needed to tackle these challenges effectively.

Tackling these challenges is essential for financial institutions seeking to enhance their B2B collaboration capabilities by utilizing B2B integration tools and boosting overall operational efficiency. For instance, a case study titled “The Path Forward” highlights how banks can unlock the potential of AI by overcoming legacy system challenges, ultimately leading to improved efficiency and customer experiences. Moreover, we guarantee 24/7 uptime for essential connections, strengthening our dependability in addressing these challenges efficiently. As mentioned by Gustavo Estrada, a customer, we streamline intricate projects and deliver outcomes within preferred timelines and financial limits, demonstrating the potential for successful incorporation in the banking sector.

Select and Implement Effective B2B Integration Tools

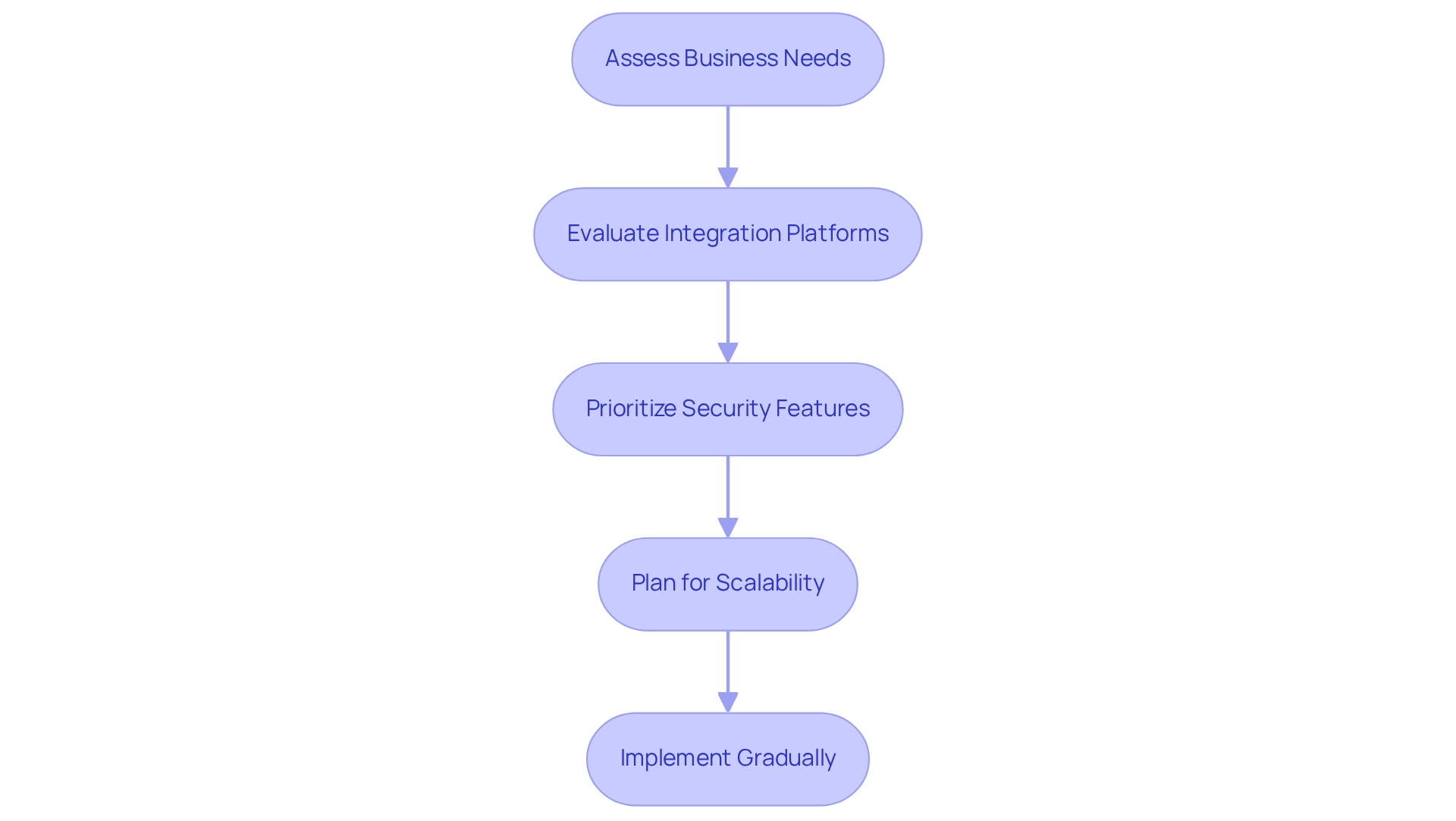

When we choose and apply B2B connection tools, it is imperative that we adhere to crucial steps that ensure our success in the financial sector.

-

Assess Business Needs: We must clearly define our connection requirements by considering our business objectives, transaction volumes, and the complexity of our partner ecosystems. Understanding these factors is essential for effective tool selection.

-

Evaluate Integration Platforms: We should seek platforms that excel in API management, real-time data processing, and seamless compatibility with our existing systems. Leading options in the market include MuleSoft, Dell Boomi, and IBM App Connect, each offering unique strengths tailored to our banking needs. Notably, Avato distinguishes itself by providing unparalleled value through its emphasis on speed, security, and ease of incorporation, establishing it as a formidable option for banks aiming to modernize operations.

-

Prioritize Security Features: Given the sensitive nature of financial data, it is imperative that we choose tools incorporating robust security measures, including encryption and stringent access controls, to safeguard our information against breaches. As open banking evolves, ensuring compliance with the most stringent security protocols will be essential in mitigating risks associated with data sharing.

-

Plan for Scalability: We must opt for solutions designed to scale alongside our organization. This guarantees that as transaction volumes rise and new incorporation needs emerge, our tools can adjust without sacrificing performance. A phased implementation strategy can help minimize risks and enhance adaptability during this transition.

-

Implement Gradually: We should begin the incorporation process with pilot projects to assess our tools in a controlled environment. This method enables essential modifications based on live feedback and performance metrics prior to a complete rollout.

Current trends indicate that 70% of B2B payments for large firms are now handled through real-time payment systems, emphasizing the necessity for us to embrace flexible connection solutions. Moreover, as 92% of financial institutions digitize their payment solutions to reduce payment frictions, the need for B2B integration tools has never been more pressing. Significantly, Typeform users with a Zapier connection are 40% less likely to leave, highlighting the importance of selecting appropriate connection tools to improve customer retention. By adhering to these steps, we can guarantee a successful assimilation strategy that aligns with changing customer expectations and enhances our operational efficiency. Avato’s competitive edge in optimizing the capabilities of legacy systems while lowering expenses further illustrates the advantages of selecting the appropriate connection platform.

Monitor and Optimize B2B Integration Performance

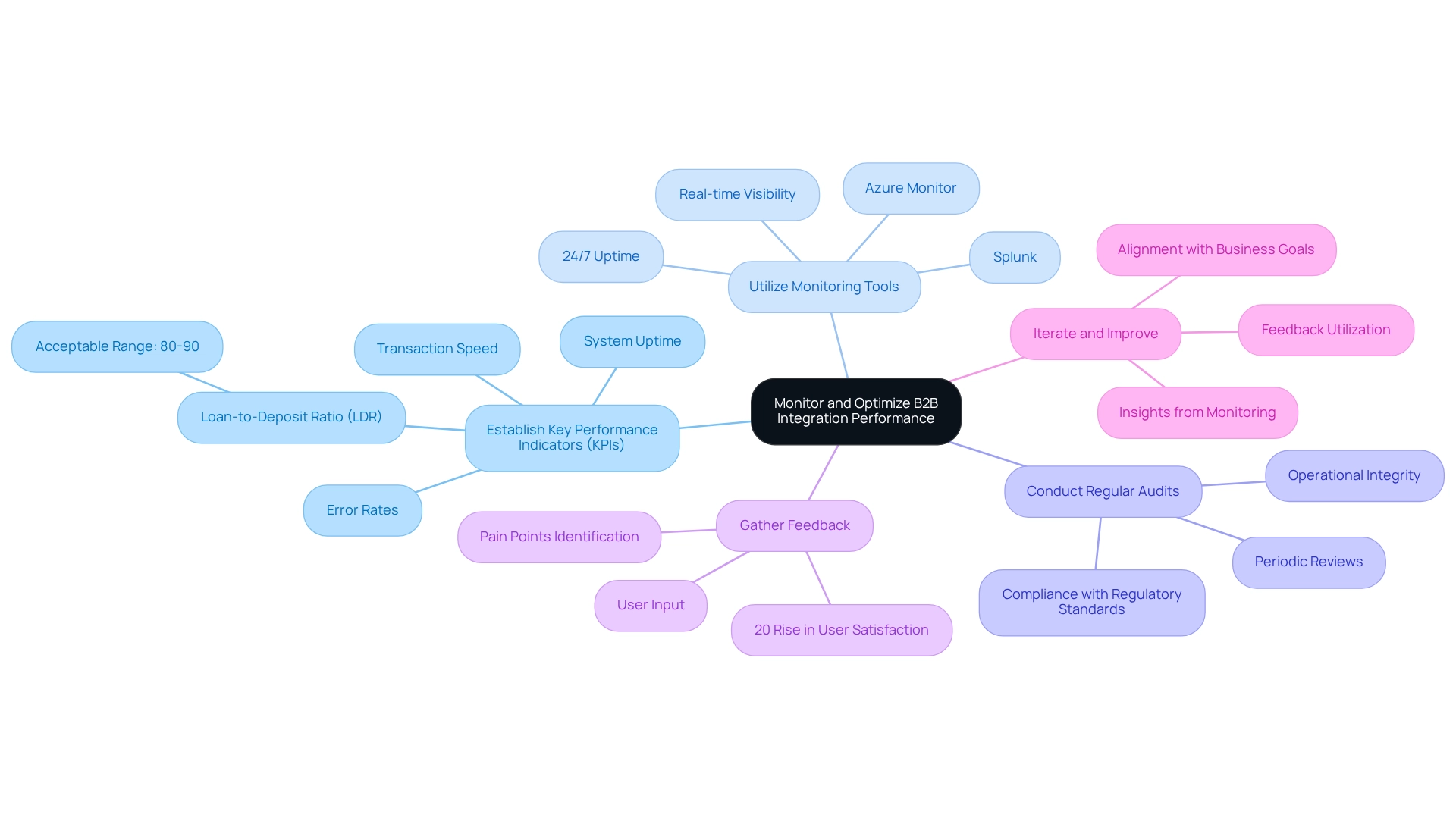

To effectively monitor and optimize B2B connectivity performance, we must adopt best practices that drive our success.

-

Establish Key Performance Indicators (KPIs): We define essential KPIs such as transaction speed, error rates, and system uptime. These metrics are vital for evaluating our success in integrating systems and aligning with emerging trends in banking, which emphasize digital transformation and customer experience. For instance, maintaining a Loan-to-Deposit Ratio (LDR) within the acceptable range of 80-90% indicates our healthy financial performance.

-

Utilize Monitoring Tools: We implement advanced monitoring solutions that provide real-time visibility into our connection processes. Tools like Azure Monitor and Splunk enable us to quickly identify issues and bottlenecks, facilitating timely interventions that enhance our operational efficiency. As Naveen Jain, Founder of CULytics, highlights, compatibility problems with mobile applications and browser banking can obstruct successful merging, making effective monitoring tools crucial. Our secure hybrid connection platform is designed to ensure 24/7 uptime, providing a robust foundation for these monitoring efforts.

-

Conduct Regular Audits: We schedule periodic reviews of our workflow processes and performance metrics. This practice not only helps us identify areas for improvement but also ensures compliance with regulatory standards, which is vital in the highly regulated banking sector. Avato’s architecture supports these audits by securely managing complex systems, ensuring that we uphold compliance and operational integrity.

-

Gather Feedback: We actively solicit input from users and partners to gain insights into their experiences. Understanding pain points in the unification process directs our improvements and encourages stronger cooperation. For instance, a bank that conducted regular feedback sessions experienced a 20% rise in user satisfaction concerning incorporation processes. Utilizing Avato’s connection capabilities can further improve this feedback loop by unlocking isolated assets and facilitating better communication.

-

Iterate and Improve: We utilize insights from monitoring and feedback to make iterative enhancements to our connection strategies. This approach ensures that our collaborative efforts remain in sync with changing business goals and technological progress, ultimately enhancing performance and customer satisfaction. Avato’s commitment to designing technological foundations enables us to accelerate our digital transformation efforts efficiently.

By concentrating on these practices, we can enhance our B2B collaboration performance with integration tools, ensuring we address the needs of a swiftly evolving financial environment while preserving our competitive advantage. Additionally, being aware of common pitfalls, such as neglecting to update monitoring tools or failing to align KPIs with business goals, can further strengthen our integration efforts.

Conclusion

B2B integration is not merely an operational necessity for us as banks; it represents a transformative shift in how we interact with our corporate clients. By automating and optimizing data exchanges, we can significantly enhance efficiency, reduce errors, and ultimately improve customer satisfaction. As organizations increasingly invest in integration technologies like APIs and EDI, the competitive landscape demands that we adapt swiftly to maintain relevance.

However, this journey is fraught with challenges. Legacy systems, data security concerns, regulatory compliance, interoperability issues, and change management must all be addressed to ensure successful integration. By leveraging comprehensive integration platforms such as Avato’s hybrid solution, we can navigate these complexities, modernize our operations, and secure our data while fostering stronger client relationships.

The implementation of effective integration tools is crucial. We must carefully assess our needs, prioritize security, and plan for scalability to ensure that our integration efforts yield the desired outcomes. Monitoring and optimizing integration performance through established KPIs, real-time monitoring, regular audits, and user feedback are essential for continuous improvement in a rapidly evolving financial landscape.

In conclusion, embracing B2B integration is vital for us as banks aiming to thrive in a competitive environment. By overcoming challenges and implementing the right tools and practices, we can enhance our operational capabilities and deliver superior service to our clients. The future of banking lies in our ability to integrate seamlessly, innovate continuously, and adapt to changing demands, ultimately leading to a more efficient and customer-centric financial ecosystem.