Overview

We recognize the significant challenges posed by legacy systems in banking, which hinder operational efficiency, regulatory compliance, and customer satisfaction. Outdated technologies not only lead to high maintenance costs but also create data silos and inflexibility. This is why modernization is not just an option; it is a necessity.

For instance, consider the case of a financial institution that successfully improved its operations and customer service through the implementation of a modern integration platform. By embracing this change, they were able to streamline processes and enhance customer interactions, ultimately driving satisfaction and loyalty.

What’s holding your team back from achieving similar results? We invite you to explore how modern integration solutions can transform your operations and elevate customer experiences. Let us partner with you on this journey towards modernization and efficiency.

Introduction

In the ever-evolving landscape of banking, legacy systems present a formidable challenge for financial institutions seeking modernization. These outdated technologies not only inflate our operational costs but also stifle our innovation and agility, leaving us struggling to meet the demands of a fast-paced market.

What’s holding our teams back? As we grapple with the complexities of integrating modern solutions, the urgency for transformation becomes paramount. By examining the impact of legacy systems and exploring effective strategies for modernization, we can unlock new opportunities for efficiency, compliance, and enhanced customer experiences.

Embracing innovative platforms like Avato’s hybrid integration solution may well be the key to navigating the complexities of this digital age, ensuring that we remain competitive and responsive to the needs of our clients.

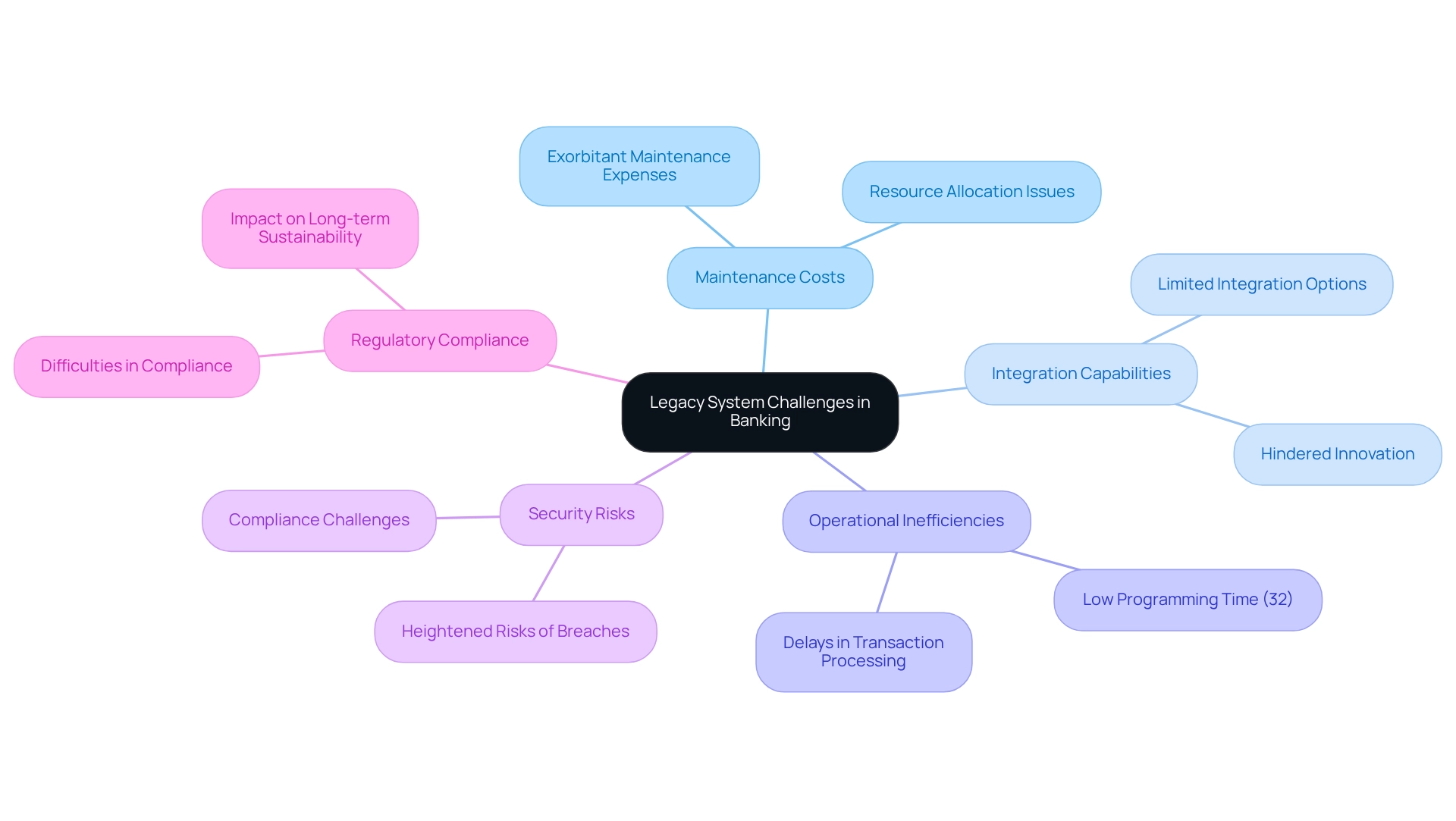

Understanding Legacy System Challenges in Banking

Legacy frameworks in banking present significant challenges. They incur exorbitant maintenance expenses, restrict integration capabilities, and lack the agility needed to adapt to market changes. Many financial organizations still rely on these outdated systems, which were never designed to meet the swift demands of modern financial services. Consequently, financial institutions encounter operational inefficiencies, heightened risks of security breaches, and difficulties in complying with regulatory requirements. For instance, programmers at traditional financial institutions allocate merely 32% of their time to programming, underscoring a considerable inefficiency in resource utilization driven by these outdated limitations.

The repercussions of these antiquated infrastructures extend beyond operational shortcomings; they hinder our capacity to innovate and respond to evolving customer demands. Industry experts note that the limitations of existing core solutions can escalate from mere frustrations to critical business risks, particularly in an era where advancements in AI and shifting customer expectations are reshaping the financial landscape. Antony Jenkins, Founder and CEO of 10x Banking, emphasizes that these challenges impede both routine operations and the long-term transformation efforts of financial institutions, which is evident in a legacy system modernization case study involving a regional financial organization that struggled with integrating its outdated technologies, leading to delays in transaction processing and inefficiencies in customer service.

By adopting a contemporary unification platform designed to simplify complex connections and maximize the value of legacy frameworks, this institution optimized its operations, improved data accessibility, and enhanced overall customer satisfaction. Our hybrid integration platform not only reduces expenses but also provides real-time monitoring and notifications on performance, enabling financial institutions to future-proof their operations through seamless data integration. This legacy system modernization case study underscores the necessity for banks to modernize their technologies to remain competitive and adaptable, as the challenges associated with outdated infrastructures in banking remain urgent as we approach 2025. As institutions endeavor to modernize their technology landscapes, understanding these obstacles is essential for effective transformation. Addressing the inefficiencies and risks linked to outdated technologies is not merely a matter of operational enhancement; it is vital for ensuring long-term sustainability in a rapidly evolving financial environment.

Identifying Key Problems in Legacy Banking Systems

Key problems highlighted in the legacy system modernization case study for banking are significant and demand our immediate attention:

- Data Silos: Legacy systems frequently operate in isolation, leading to fragmented data that obstructs effective decision-making. This issue is compounded by the fact that 70% of banks report significant skills shortages in support for the legacy system modernization case study, intensifying the challenges of data unification and further hindering the ability to leverage data for informed decisions. We address these challenges through our hybrid integration platform, which mobilizes stakeholders to accurately gather requirements and model new business processes, ensuring a more cohesive data environment.

- High Operational Costs: The financial burden of maintaining outdated technology is substantial, with many institutions diverting resources from innovation to cover these costs. As highlighted by Marcia Klingensmith, CEO of FinTech Consulting, the transition from a $3M annual legacy tax to a $12M innovation budget serves as a legacy system modernization case study that illustrates the potential ROI of modernization. This underscores how investing in new technologies can ultimately lead to greater financial flexibility and innovation. Our solutions assist in optimizing operations, gradually lowering these expenses.

- Regulatory Compliance Issues: Outdated technologies often struggle to adapt to evolving regulations, increasing the risk of non-compliance. For instance, in 2025, financial institutions will face challenges regarding the implementation of new data privacy laws and anti-money laundering regulations, necessitating flexible frameworks that can adjust to these complex demands. Our commitment to legacy system modernization case study ensures that financial institutions can incorporate new tools alongside current assets, thereby enhancing compliance capabilities. Additionally, obsolete infrastructures severely restrict the ability to offer modern, customer-focused services, negatively impacting customer satisfaction and retention. Financial institutions that fail to update may witness a decline in Net Promoter Scores (NPS), as clients increasingly expect seamless digital experiences. Those who do not adapt risk losing their competitive edge in an increasingly digital marketplace. Our hybrid integration platform enhances enterprises’ ability to reshape B2B customer experiences by bridging traditional infrastructures with contemporary expectations.

- Inflexibility: The rigidity of legacy frameworks hampers the implementation of new technologies or adaptation to changing market conditions. This inflexibility has impeded financial institutions’ capacity to innovate and respond effectively to customer needs, as shown in a legacy system modernization case study that highlights instances where organizations struggled to integrate mobile banking solutions or react to emerging fintech competitors. Our solutions are designed to streamline various platforms, enabling financial institutions to be more agile and responsive.

The urgency for modernization is underscored by the projected global instant payment volume reaching $8.2 trillion by 2028. This statistic compels financial institutions to prioritize enhancements to avoid the escalating costs of inaction. Effective modernization strategies, as illustrated in a legacy system modernization case study, can significantly mitigate the expenses associated with updating hardware and software, making it imperative for banks to confront these legacy challenges directly.

![]()

Implementing Avato’s Hybrid Integration Platform for Modernization

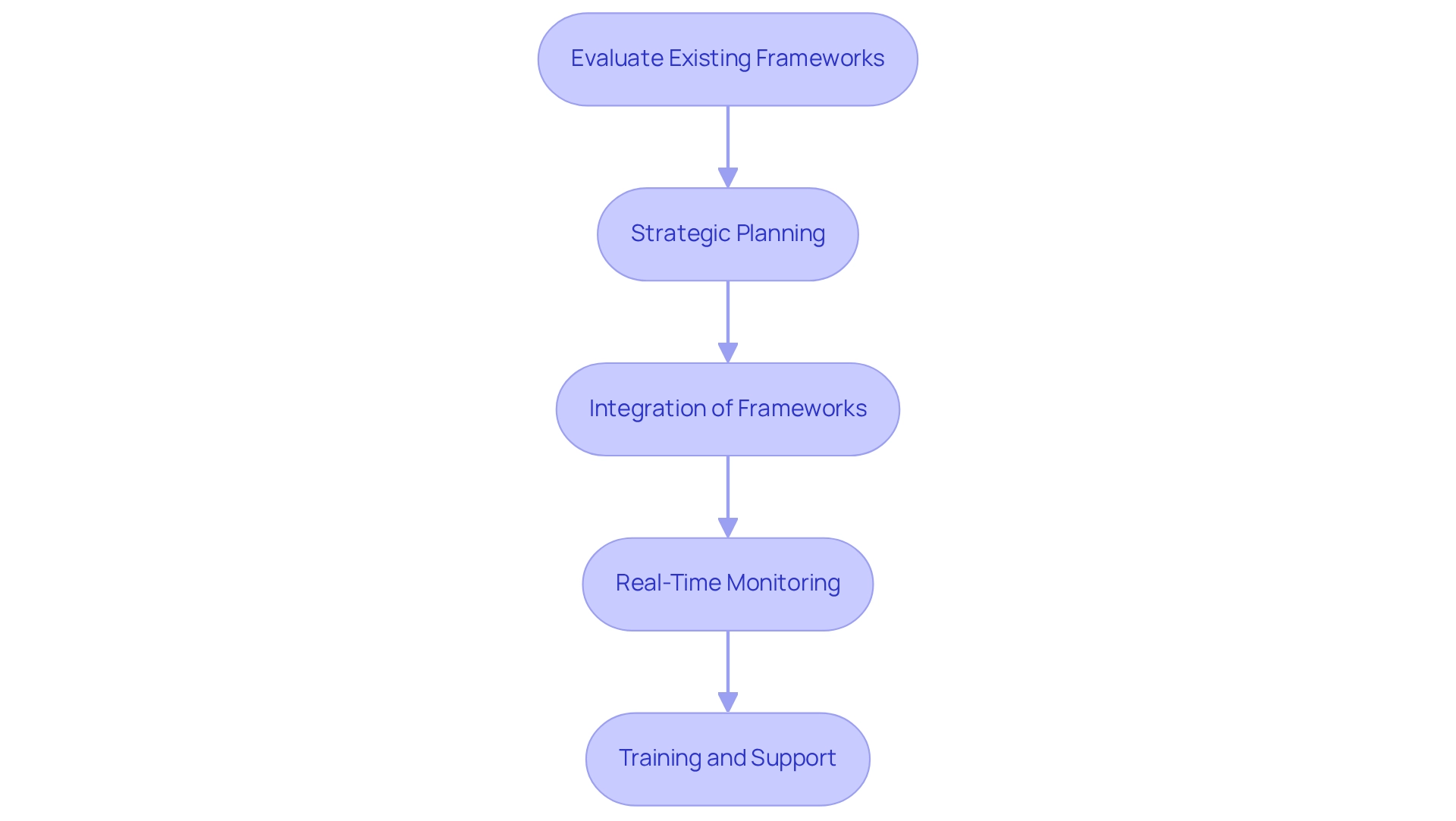

Implementing Avato’s Hybrid Integration Platform requires a strategic approach, as highlighted in a legacy system modernization case study, to ensure a successful transition from legacy frameworks to modern solutions.

Evaluation of Existing Frameworks: We begin with a thorough evaluation of your existing frameworks, identifying areas ripe for modernization. This foundational step is crucial, as a solid assessment significantly influences the success of our legacy system modernization case study efforts. Collaborating with your solution provider, we create a comprehensive plan that aligns with your institution’s objectives and the evolving needs of your customers.

Strategic Planning: Next, we develop a detailed roadmap that outlines the modernization journey, including timelines, resource allocation, and key milestones. A clearly defined strategy is essential for managing the complexities of organizational unification and ensuring alignment with business goals, as demonstrated in the legacy system modernization case study.

Integration of Frameworks: Utilizing Avato’s platform, our legacy system modernization case study demonstrates how we can seamlessly connect legacy infrastructures with modern applications. This integration facilitates smooth data flow across the organization, enhancing operational coherence and responsiveness.

Real-Time Monitoring: Furthermore, we leverage the platform’s robust real-time monitoring features to continuously assess performance. Proactive issue resolution minimizes downtime and supports sustained operational efficiency.

Training and Support: To maximize the advantages of the new framework, we equip staff with the necessary training. Understanding the platform’s functionalities empowers employees to fully leverage its capabilities, fostering a culture of innovation and adaptability.

This structured approach not only mitigates risks associated with digital transformation but also enhances operational efficiency and agility. As financial institutions face mounting pressure to modernize, adopting such comprehensive strategies is vital for maintaining competitiveness in the rapidly evolving digital landscape. To learn more about how we can support you in your modernization journey, reach out to us today or download our resources for additional insights.

Evaluating Results: Impact of Modernization on Banking Operations

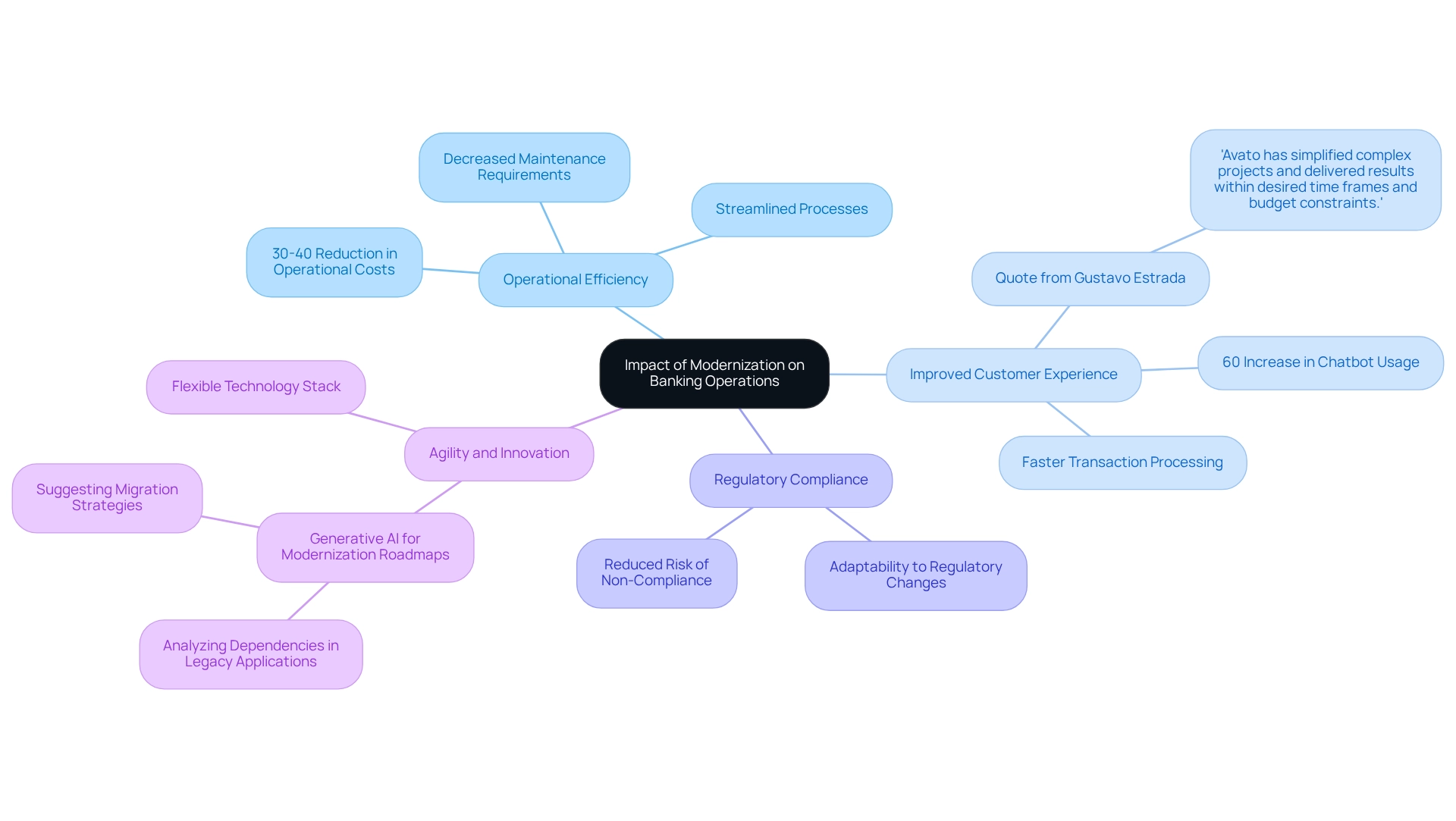

The impact of implementing our Hybrid Integration Platform can be evaluated through several key metrics:

- Operational Efficiency: We observe that banks modernizing their systems report a remarkable 30-40% reduction in operational costs. This improvement stems from streamlined processes and decreased maintenance requirements, highlighting the financial benefits of modernization. Our platform is designed for secure transactions, guaranteeing that projects maintain 24/7 uptime with no room for defects or outages.

- Improved Customer Experience: Our enhanced integration capabilities facilitate faster transaction processing and superior service delivery, resulting in heightened customer satisfaction. As organizations adapt to customer expectations, the ability to provide seamless experiences becomes crucial. Gustavo Estrada, one of our customers, remarked, ‘The company has simplified complex projects and delivered results within desired time frames and budget constraints.’ Furthermore, we harness generative AI to develop sophisticated chatbots and virtual assistants, contributing to a 60% increase in its use for customer experience, thereby further enhancing customer interactions.

- Regulatory Compliance: Our modernized systems are inherently more adaptable to regulatory changes, significantly reducing the risk of non-compliance and the associated penalties. This agility is vital in an industry where regulations are constantly evolving, and our integration solutions support this adaptability.

- Agility and Innovation: A flexible technology stack enables financial institutions to respond swiftly to market demands, fostering innovation in product and service offerings. This adaptability is essential for maintaining a competitive edge in the dynamic banking landscape. Our legacy system modernization case study, titled ‘Accelerating Transition to Target Architectures’, illustrates how generative AI aids in developing modernization roadmaps by analyzing dependencies within legacy applications and suggesting migration strategies, thereby accelerating the transition to modern architectures while minimizing risks associated with the modernization process.

These results underscore the critical importance of investing in modernization to thrive in the ever-evolving banking environment. By prioritizing operational efficiency, we not only enhance our bottom line but also improve customer experiences, ensuring long-term success.

Insights and Lessons Learned from the Modernization Journey

Key insights and lessons learned from our modernization journey include:

- Start Small: We believe in initiating with pilot projects, as this allows us to effectively evaluate the capabilities of Avato’s hybrid integration platform before committing to a full-scale rollout. This approach minimizes risks and provides us with valuable insights into potential challenges.

- Engage Stakeholders Early: Involving key stakeholders from various departments is essential for securing buy-in and addressing concerns throughout the merging process. Effective sponsorship is critical for the success of our change initiatives; as highlighted by industry studies, PMI (2014) states that effective sponsorship is seen as absolutely critical for change success. Utilizing our company’s expertise can facilitate this engagement.

- Focus on Training: Comprehensive training programs are essential to equip our staff with the necessary skills to leverage new technologies effectively. This investment not only boosts user confidence but also maximizes the potential of Avato’s connectivity platform, ensuring that our teams can fully utilize its capabilities.

- Monitor and Adapt: Continuous monitoring of system performance is vital. We must be prepared to modify our strategies according to real-time feedback and changing requirements, ensuring that our unification efforts stay aligned with business goals. Our proficient unification services can assist in this continuous assessment, aiding us in remaining flexible during our modernization endeavors.

- Emphasize Security: We prioritize security measures during the merging process to protect sensitive data and maintain customer trust. Our organization upholds this principle through a dedicated approach, ensuring that safeguarding information becomes a cornerstone of successful unification.

- Leverage Influence: Engaging influential agents within our organization can enhance the success of our change initiatives, ensuring that stakeholder concerns are addressed effectively.

- Utilize Avato’s Hybrid Integration Platform: As a powerful tool, Avato’s hybrid integration platform offers essential assistance during our modernization journey, enabling seamless data and application connection.

These lessons can significantly enhance the success of future modernization initiatives in the banking sector, as demonstrated in the legacy system modernization case study, ensuring that we navigate the complexities of legacy system integration with confidence and efficiency. As William Blake aptly stated, “What is now proved was once only imagined,” highlighting the transformative potential of our modernization efforts.

Conclusion

Legacy systems in banking pose significant challenges that can impede our operational efficiency, stifle innovation, and diminish customer satisfaction. The persistent reliance on outdated technology results in high maintenance costs, inflexible operations, and complications in meeting regulatory compliance. By acknowledging these issues, we can take proactive steps towards modernization, leveraging platforms like Avato’s hybrid integration solution to effectively bridge the gap between legacy systems and contemporary demands.

Modernization is not merely about replacing old systems; it requires a comprehensive approach that encompasses assessing our current operations, strategic planning, and real-time monitoring. Successful implementation can yield remarkable benefits, including reduced operational costs, enhanced customer experiences, and improved regulatory compliance. Organizations that prioritize this transition position themselves to thrive in an increasingly competitive and fast-paced financial landscape.

Ultimately, embracing modernization is essential for us as banks to remain relevant and responsive to the evolving needs of our clients. By investing in innovative integration solutions, we unlock new opportunities for growth and agility, ensuring that we are well-equipped to navigate the complexities of the digital age. The time for action is now; the future of banking depends on it.