The Need for Legacy System Modernization in Finance

The financial services industry is undergoing rapid digital transformation, yet legacy system modernization in finance remains a major roadblock for traditional institutions. Outdated systems consume up to 70% of IT budgets, limiting innovation and agility. Worse, over 80% of digital transformation projects fail, making financial institutions hesitant to modernize. However, with the right strategies and technology, banks and financial firms can overcome these challenges and embrace innovation.

This article explores how financial institutions can successfully navigate legacy system modernization in finance, ensuring a seamless transition while maintaining operational stability.

Challenges of Legacy System Modernization for Finance

Legacy systems, once the backbone of financial institutions, have become anchors holding back progress. These systems, often decades old, consume a disproportionate amount of IT resources, both in terms of budget and manpower. They’re like vintage cars—beautiful in their own right but expensive to maintain and ill-suited for modern highways.

The cost isn’t just financial. Legacy systems also impede agility, making it difficult for institutions to respond to market changes, regulatory requirements, and customer demands. In an era where fintech startups can launch new products in weeks, traditional banks find themselves hamstrung by systems that take months, if not years, to modify.

The Transformation Trap

Many financial institutions recognize the need for change and embark on ambitious transformation projects. However, the statistics are grim – over 80% of these projects fail to deliver on their promises. This high failure rate isn’t just a number; it represents billions in wasted investments, lost opportunities, and, in some cases, damaged reputations.

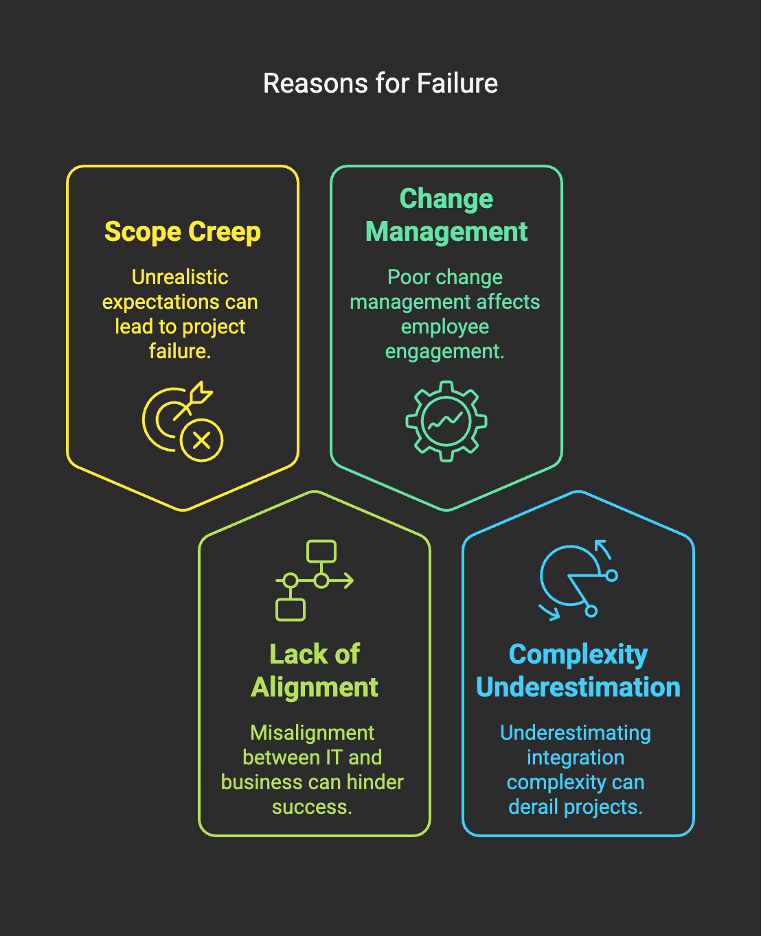

The reasons for failure are multifaceted:

- Scope creep and unrealistic expectations

- Lack of alignment between IT and business objectives

- Inadequate change management and employee buy-in

- Underestimation of the complexity involved in integrating new systems with legacy infrastructure

These failures create a catch-22 situation: institutions know they need to change, but past failures make them risk-averse, further entrenching outdated systems and processes.

The Innovation Imperative

Despite these challenges, innovation isn’t just desirable – it’s imperative. Customers, particularly younger generations, expect digital-first experiences. They want seamless, personalized services available 24/7 across multiple channels. Fintech competitors are raising the bar, offering innovative products and services that challenge traditional banking models.

Moreover, regulatory changes, such as open banking initiatives, force institutions to rethink their data and approach to customer relationships. The ability to innovate isn’t just about staying competitive; it’s about survival in an increasingly digital and interconnected financial ecosystem.

Strategies for Success

So, how can financial institutions navigate these treacherous waters? Based on my experience and the success stories I’ve witnessed, here are key strategies:

1. Prioritize Modernization

Instead of attempting a complete overhaul, focus on modernizing critical systems first. Conduct a thorough assessment to identify high-impact areas where modernization can deliver immediate benefits. Cloud-based solutions can often provide a cost-effective way to reduce reliance on legacy infrastructure.

2. Embrace Middleware Solutions

Middleware can act as a bridge between legacy systems and new technologies. By implementing API layers, institutions can enable communication between old and new systems without needing full replacement. This approach allows for gradual modernization while maintaining operational stability.

3. Adopt Agile Methodologies

Break large transformation projects into smaller, manageable sprints. Foster cross-functional teams to enhance collaboration and reduce silos. Implement continuous feedback loops to identify and address issues quickly. Agile approaches can significantly improve the success rate of transformation projects.

4. Focus on Change Management

Invest in comprehensive change management strategies. These include training and upskilling employees, clearly communicating the vision and benefits of transformation, and ensuring buy-in at all levels of the organization.

5. Leverage Advanced Analytics and AI

Implement AI-driven analytics for improved decision-making and risk assessment. Use machine learning for personalized customer experiences and product recommendations. These technologies can provide a competitive edge and meet evolving customer expectations.

6. Create Innovation Labs

Establish dedicated innovation teams separate from day-to-day operations. These labs can experiment with new technologies and business models without the constraints of existing systems. Partnerships with fintech startups can inject fresh ideas and technologies into the organization.

7. Prioritize Customer-Centric Design

Ensure that all innovation efforts are grounded in customer needs. Conduct regular feedback sessions and market research. Develop and test minimum viable products (MVPs) before full-scale implementation to validate ideas and reduce risk.

The Avato Solution

While these strategies provide a roadmap, implementing them effectively requires the right tools and partners. This is where Avato comes into play, offering a revolutionary approach to addressing the challenges of legacy system modernization and digital transformation.

Avato has developed a deep understanding of the unique challenges faced by financial institutions in connecting legacy systems to modern FinTech and new technology offerings. Their hybrid integration platform offers a compelling solution that addresses the core problems while unlocking new opportunities for innovation.

Key features of Avato’s solution include:

1. Seamless Integration

Avato’s platform enables the integration of previously fragmented and incompatible systems and data. This allows financial institutions to maintain reliable mainframe systems while leveraging cloud-based solutions, preserving investments in core systems while gradually introducing modern technologies.

2. Customization and Flexibility

The platform offers a high degree of customization, allowing banks to tailor products, pricing models, and packages to meet specific customer needs. This flexibility minimizes transition costs and reduces the learning curve for staff, addressing one of the key challenges in transformation projects.

3. Robust Analytics and Data-Driven Decision Making

Avato provides powerful analytics capabilities, enabling deep insights into product performance, customer behaviour, and market trends. This data-driven approach enhances competitiveness and allows for more informed decision-making.

4. Open API Infrastructure

The platform’s open API approach aligns with industry standards like those set by the Banking Industry Architecture Network (BIAN). This facilitates easy integration with other software and services, supporting open banking initiatives and collaboration with fintech partners.

5. Proven Track Record

Avato has successfully implemented hybrid integration solutions in various financial institutions, demonstrating the ability to handle complex integrations and transformations with minimal downtime. For instance, they managed a major telephony system switch with only a 63-second outage, showcasing their expertise in managing critical transitions.

6. Future-Proofing

Avato’s platform is designed to support emerging technologies, including AI and machine learning for advanced predictive analysis and risk assessment. This future-oriented approach ensures that financial institutions can continue to innovate and adapt to changing market conditions.

Real-World Impact

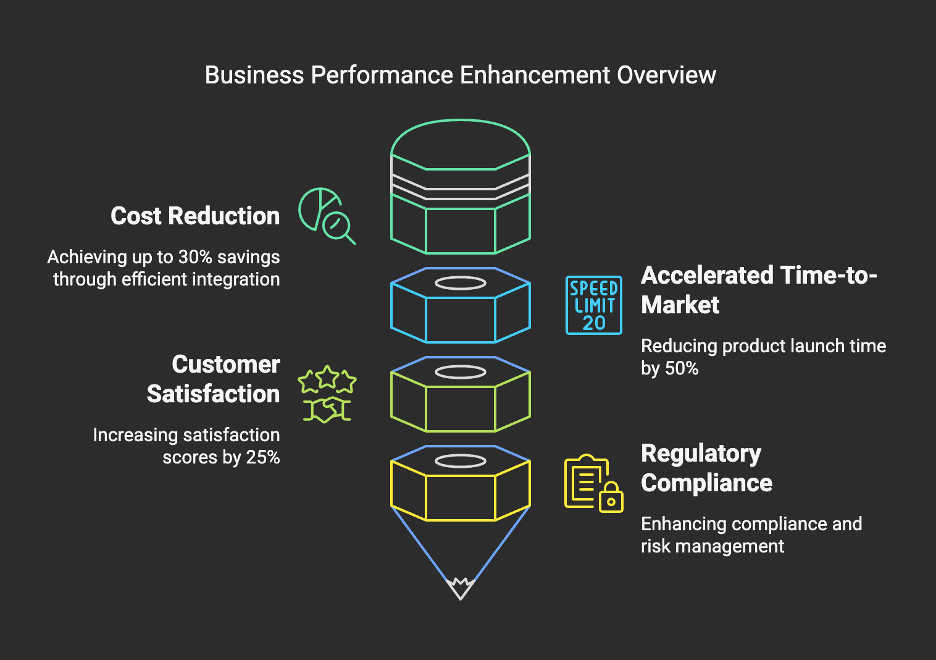

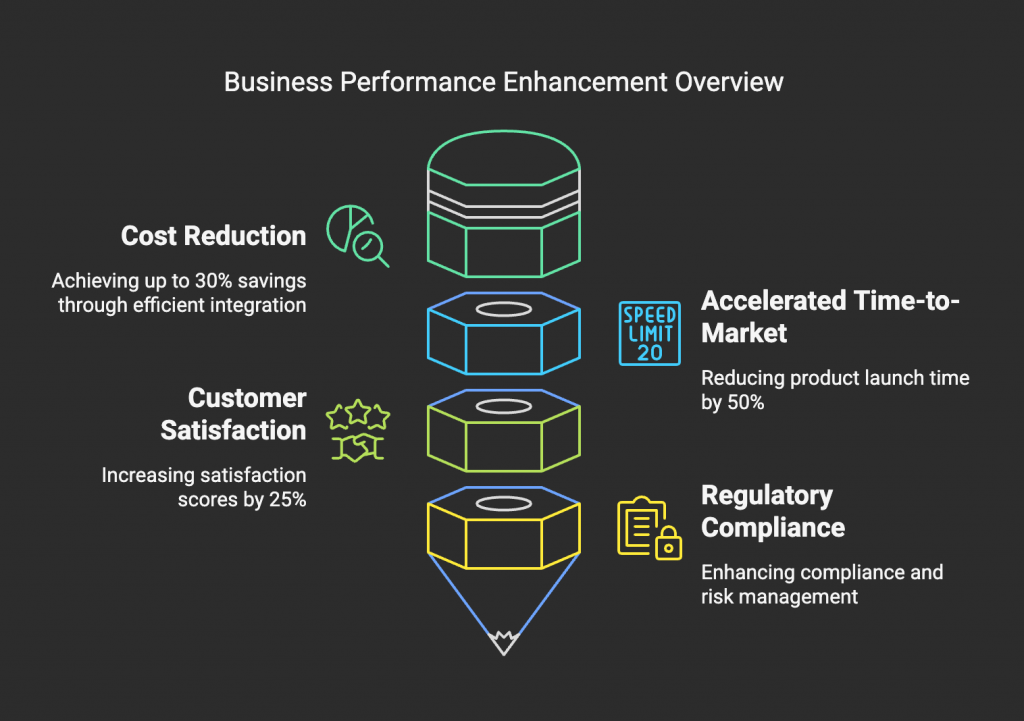

The impact of Avato’s solution goes beyond theoretical benefits. Financial institutions that have implemented Avato’s hybrid integration platform have reported significant improvements:

- Reduced IT costs by up to 30% through more efficient system integration and management

- Accelerated time-to-market for new products and services by 50%

- Improved customer satisfaction scores by 25% due to more personalized and responsive services

- Enhanced regulatory compliance and risk management capabilities

These results demonstrate that with the right approach and technology partner, financial institutions can overcome the challenges of legacy systems and failed transformations to drive meaningful innovation and growth.

Conclusion

The challenges facing financial institutions are significant, but they are not insurmountable. By adopting a strategic approach to modernization, embracing agile methodologies, and leveraging cutting-edge solutions like those offered by Avato, banks and other financial institutions can not only overcome the burdens of legacy systems but also position themselves at the forefront of financial innovation.

The key lies in recognizing that digital transformation is not a one-time project but an ongoing journey. It requires a commitment to continuous improvement, a willingness to embrace new technologies, and a focus on delivering value to customers. With partners like Avato, financial institutions have the tools and expertise needed to navigate this journey successfully.

As we look to the future, it’s clear that the financial institutions that will thrive are those that can balance the stability and reliability of their core systems with the agility and innovation demanded by the digital age. By addressing legacy system challenges, improving transformation success rates, and fostering a culture of innovation, financial institutions can unlock new opportunities for growth and cement their position as leaders in the evolving financial landscape.

The path forward may be challenging, but with the right strategies, technologies, and partners, the future of financial services is bright, innovative, and full of possibilities.

Want to learn more about how Avato can help? Contact us using the form below, or book a meeting to discuss ways to overcome the challenges you’re facing.