Overview

Digital transformation in financial services is not merely an option; it is a necessity for organizations aiming for sustained success. Implementing this transformation requires a structured, step-by-step approach that begins with defining a clear vision and securing executive buy-in. Are your current capabilities aligned with the demands of the market? Assessing these capabilities is crucial, as is developing a comprehensive roadmap that addresses the specific challenges your organization faces.

Furthermore, aligning technological initiatives with customer expectations and operational efficiency is vital. This alignment not only enhances service delivery but also positions your organization as a leader in the industry. Leveraging platforms like Avato can facilitate this integration by addressing legacy system challenges effectively. By doing so, you can enhance your service delivery and meet the evolving needs of your customers.

In conclusion, embracing digital transformation through a well-defined strategy is essential. The benefits of integrating advanced platforms are clear: improved efficiency, enhanced customer satisfaction, and a competitive edge in the financial services sector. Now is the time to act—evaluate your current systems and consider how a structured approach can lead to transformative results.

Introduction

In the rapidly evolving landscape of financial services, digital transformation has emerged as a critical catalyst for success. As institutions strive to meet the growing expectations of tech-savvy consumers, the integration of innovative technologies is reshaping operational processes and enhancing customer experiences. What are the driving forces behind this transformation? This article delves into the multifaceted journey of digital transformation within financial services, examining the drivers, challenges, and benefits that accompany this shift.

From adapting to regulatory pressures and competition from fintechs to harnessing the transformative power of artificial intelligence and cloud computing, financial institutions are navigating a complex terrain. With insights into effective strategies and tools, such as Avato’s Hybrid Integration Platform, organizations can overcome obstacles and unlock significant competitive advantages in an increasingly digital world.

Are you ready to embrace this change and position your institution for future success?

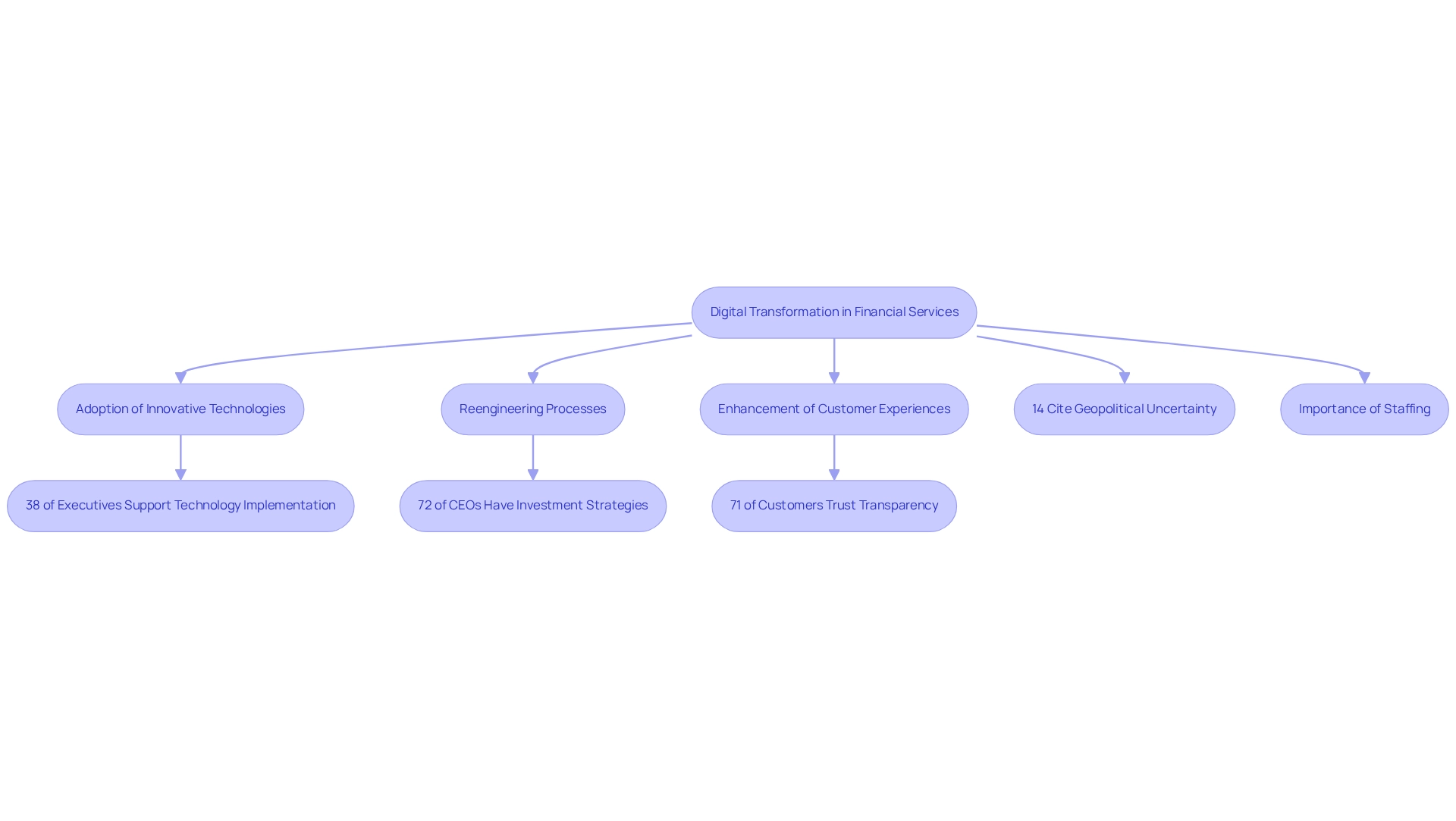

Understanding Digital Transformation in Financial Services

The shift to online methods in monetary services exemplifies the digital transformation within the financial sector, marking a significant convergence of technological advancements that fundamentally alters operational dynamics and value delivery to clients. This transformation encompasses the adoption of innovative technologies, the reengineering of existing processes, and the enhancement of customer experiences. As client expectations continue to rise, financial organizations must adapt to remain competitive in an increasingly dynamic market.

The impact of electronic technologies on financial organizations is particularly pronounced in 2025, characterized by a marked shift towards automation and data-driven decision-making. A recent survey reveals that 38% of executives globally report having the backing of senior leaders for the implementation of emerging technologies, indicating a growing organizational readiness to embrace these tools. Furthermore, 72% of CEOs have articulated bold technological investment strategies, underscoring the urgency of this transition.

However, 14% of leaders cite geopolitical uncertainty as a barrier to advancing technological change, highlighting the challenges that monetary organizations must navigate.

Current trends in technological advancement within monetary services emphasize the critical importance of transparency and trust. Notably, 71% of customers indicate a higher likelihood of trusting a company with their personal data when its usage is clearly communicated. This trend underscores the necessity for monetary organizations to prioritize transparent communication regarding data management practices as they adopt new technologies.

Expert opinions reinforce the essential nature of digital transformation in financial services, with studies indicating that 81% of business leaders deem investment in this transformation vital for achieving organizational success. This sentiment resonates throughout the sector, as organizations recognize that digital transformation is crucial for enhancing efficiency, reducing operational costs, and improving service delivery.

Key considerations regarding technological advancement in monetary services include the need for adequate staffing during peak operational times, such as the 12 p.m. surge in service provider call volumes. This highlights the importance of aligning human resources with digital strategies to ensure optimal customer service.

Avato plays a pivotal role in this transformation by offering a dedicated hybrid integration platform that simplifies the integration of disparate systems and enhances business value. Supporting 12 levels of interface maturity, Avato empowers banks to balance the speed of integration with the sophistication required to future-proof their technology stack.

By unlocking isolated assets, Avato enables banking entities to spearhead the AI revolution, leveraging generative AI to enhance customer experiences and operational efficiency. Successful instances of electronic change in banking illustrate the tangible benefits of these initiatives. Organizations that have effectively integrated electronic technologies report increased client satisfaction and loyalty, demonstrating that a well-executed online strategy can yield significant competitive advantages.

In conclusion, the ongoing shift in monetary services is not merely a trend but a fundamental change that compels organizations to embrace digital transformation and foster continuous innovation. By harnessing emerging technologies and aligning their operations with customer expectations, organizations in the finance sector can enhance their service offerings and solidify their position in a rapidly evolving market.

Key Drivers of Digital Transformation in Financial Services

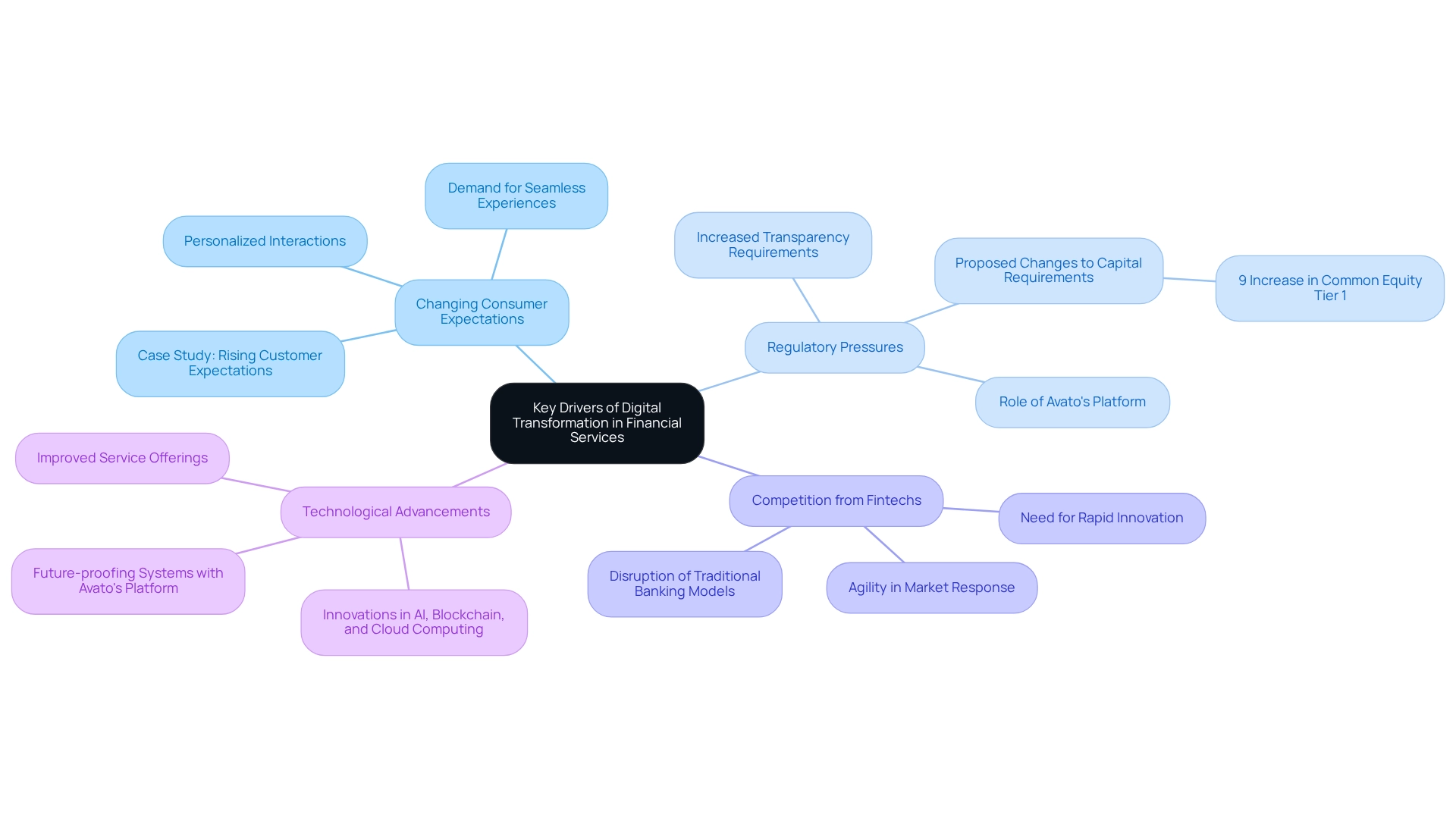

Multiple key factors are driving digital transformation in the banking sector:

- Changing Consumer Expectations: Today’s consumers demand seamless, personalized experiences across all channels. With a significant shift in preferences, many customers are willing to switch brands due to poor service experiences. A recent case study highlights that businesses must adapt to these rising expectations by providing immediate service and personalized interactions to retain customers and drive loyalty. Avato’s Hybrid Integration Platform plays a crucial role in this adaptation by enabling financial organizations to integrate various systems efficiently, ensuring a cohesive customer experience.

- Regulatory Pressures: Financial organizations are contending with growing regulatory demands that require more transparent and efficient operations. Proposed changes to capital requirements are expected to lead to a 9% increase in common equity tier 1 for global systemically important banks. Michael Barr, Federal Reserve Vice Chair, has indicated that he will recommend key broad and material changes to the original proposal to the Federal Reserve Board. Adhering to these regulations frequently necessitates significant technological enhancements, urging organizations to update their systems and processes. Avato’s platform supports this modernization by providing tools to model new business processes and activity flows, ensuring compliance while optimizing operations. Additionally, the platform aids in mobilizing stakeholders to ensure that requirements are accurately captured from the outset.

- Competition from Fintechs: The emergence of FinTech companies has disrupted traditional banking models, compelling established institutions to innovate rapidly to maintain their market share. As banks prepare for the re-proposal of capital requirements, many are decreasing surplus capital and participating in credit risk transfers to improve performance, emphasizing the necessity for agility in a competitive landscape. Avato’s Hybrid Integration Platform facilitates this agility by allowing for seamless integration of legacy systems with new technologies, enabling banks to respond swiftly to market changes. The platform’s functionalities are designed to address the challenges posed by FinTech competition, ensuring that banks can adapt and thrive.

- Technological Advancements: Innovations in artificial intelligence, blockchain, and cloud computing are transforming the services sector related to finance. These technologies allow organizations to improve their service offerings and operational efficiencies, facilitating faster responses to market demands and enhanced customer experiences. By utilizing Avato’s platform, institutions can future-proof their systems, ensuring they stay adaptable to emerging technologies and market trends.

As deposit costs are anticipated to stay high at 2.03% in 2025—considerably above the previous five-year average of 0.9%—institutions must utilize these drivers to navigate the evolving landscape effectively. By adopting technological change through Avato’s Hybrid Integration Platform, they can achieve digital transformation in financial services, which allows them to satisfy regulatory requirements, surpass consumer expectations, and remain ahead of FinTech rivals.

Challenges in Implementing Digital Transformation

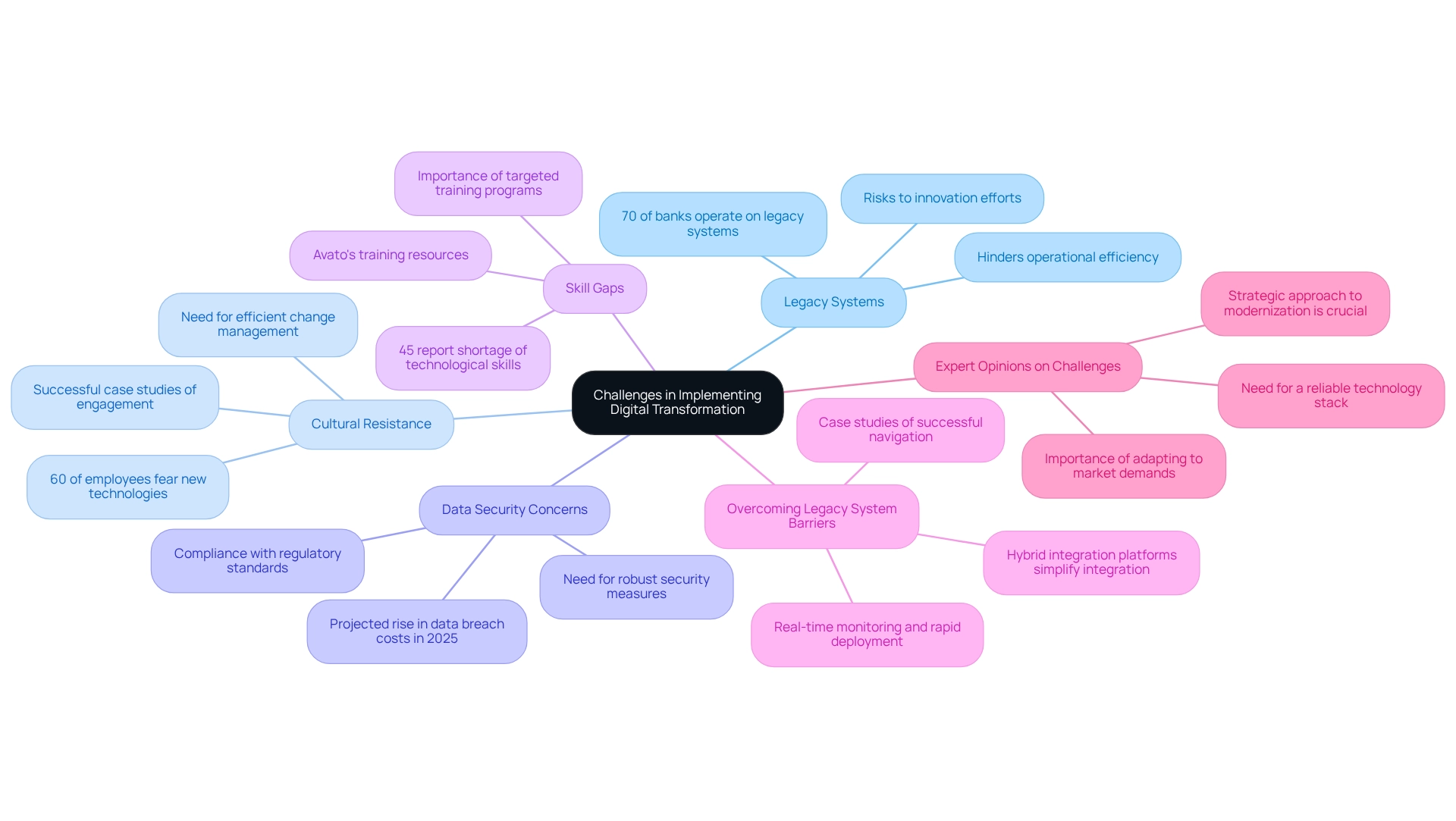

Implementing digital transformation in financial services presents a myriad of challenges, including:

-

Legacy Systems: A considerable number of monetary organizations still rely on obsolete technology, complicating the integration of new electronic solutions. In 2025, statistics indicate that approximately 70% of banks still operate on legacy systems, highlighting the urgent need for modernization. These outdated systems not only hinder operational efficiency but also pose substantial risks to innovation efforts. Avato’s hybrid integration platform addresses these challenges by simplifying the integration of isolated legacy systems, enabling banks to modernize their operations swiftly and securely.

-

Cultural Resistance: Resistance to change is a common hurdle in the banking sector. A recent survey revealed that nearly 60% of employees express apprehension towards adopting new technologies, fearing disruptions to established workflows. Marcus Schwarz observes, “The online banking sector encounters both challenges and opportunities,” highlighting the necessity for efficient change management strategies. Avato can assist in mitigating this resistance by providing tools that facilitate smoother transitions and enhance employee engagement throughout the integration process. Successful case studies demonstrate how monetary organizations have effectively navigated cultural resistance during their technological transformation journeys. By engaging employees early in the process and providing clear communication about the benefits of new technologies, these organizations have fostered a more receptive environment for change.

-

Data Security Concerns: As monetary organizations digitize their operations, they encounter increased risks associated with data breaches and cyber threats. In 2025, the projected costs of data breaches in the banking sector are expected to rise, necessitating the implementation of robust security measures to protect sensitive information and maintain customer trust. Avato’s platform includes advanced security features that help safeguard data during integration, ensuring compliance with regulatory standards.

-

Skill Gaps: The rapid pace of technological advancement often outstrips the existing skill sets of staff. A study discovered that 45% of monetary establishments report a shortage of technological skills among their employees, which can greatly hinder the efficient execution of new technologies and procedures. Addressing these skill gaps through targeted training and development programs is essential for successful technological change. Avato supports organizations by providing comprehensive training resources, including workshops and online courses, that empower employees to leverage new technologies effectively.

-

Overcoming Legacy System Barriers: The challenge of integrating isolated legacy systems is particularly pronounced in banking organizations. Case studies demonstrate that organizations leveraging hybrid integration platforms, such as Avato, have successfully navigated these barriers. By simplifying complex integration projects, Avato has enabled clients to achieve their digital transformation financial services goals within desired time frames and budget constraints, ultimately enhancing operational capabilities and reducing costs. Features like real-time monitoring and rapid deployment are instrumental in this process, allowing for quick adjustments and minimizing downtime.

-

Expert Opinions on Challenges: Industry specialists consistently emphasize the difficulties posed by legacy systems in the banking sector. They contend that without a strategic approach to modernization, organizations risk lagging in an increasingly competitive environment. The need for a reliable, future-proof technology stack is paramount to ensure that banks can adapt to evolving market demands. Avato’s platform is created to offer this crucial groundwork, allowing banks to stay nimble and competitive.

In conclusion, tackling these issues is crucial for monetary organizations seeking to effectively execute electronic change projects. By focusing on overcoming legacy system barriers, managing cultural resistance, and enhancing data security, banks can position themselves for future success with the support of Avato’s innovative integration solutions. Additionally, beginning with a thorough assessment and planning process will ensure that the integration aligns with institutional goals and the evolving needs of customers.

Benefits of Digital Transformation in Financial Services

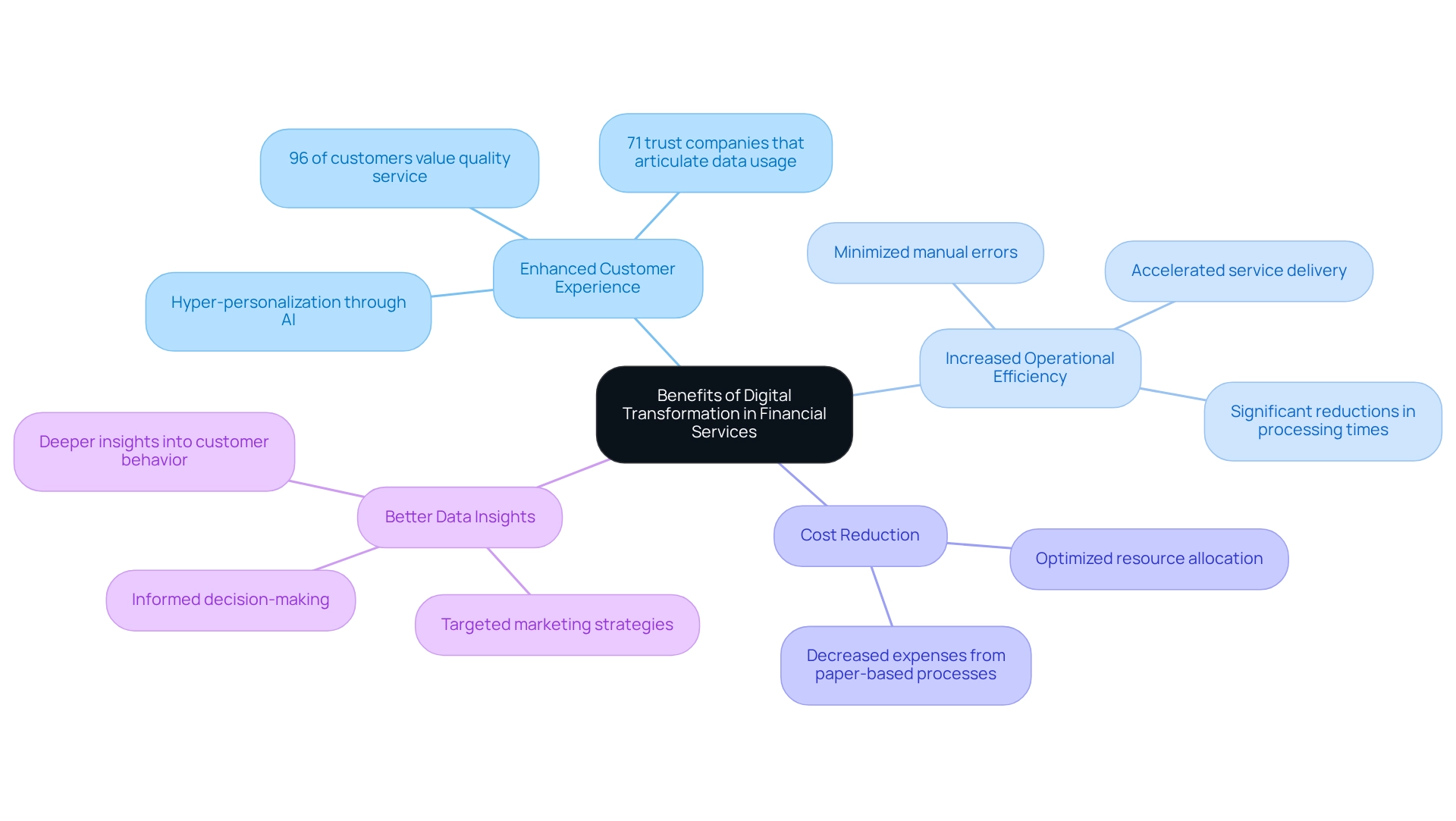

The benefits of digital transformation in financial services are substantial and multifaceted, significantly impacting both customer experience and operational efficiency.

-

Enhanced Customer Experience: Digital tools facilitate hyper-personalization, allowing financial institutions to tailor services to individual customer needs. This approach streamlines interactions and fosters higher levels of customer satisfaction and loyalty. In fact, 96% of customers indicate that quality customer service is crucial in their loyalty to a brand, highlighting the significance of effective online engagement. Furthermore, 71% of clients are more inclined to trust a company with their personal information if its usage is clearly articulated, underscoring the necessity for openness in online interactions. Avato’s hybrid integration platform plays a crucial role in this transformation, enabling seamless data connectivity that enhances customer interactions. As Tony LeBlanc from the Provincial Health Services Authority noted, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable,” showcasing the dedication Avato brings to its partnerships.

-

Increased Operational Efficiency: The automation of processes through digital transformation minimizes manual errors and accelerates service delivery. This efficiency empowers organizations engaged in digital transformation within financial services to react more swiftly to customer demands, ultimately improving their operational capabilities. Organizations that have embraced digital transformation through automation, supported by Avato’s solutions, report significant reductions in processing times, leading to improved service levels and reliability.

-

Cost reduction is achieved as digital transformation enables monetary organizations to significantly decrease expenses linked to conventional paper-based procedures and manual workflows. By optimizing operations with Avato’s integration solutions, organizations can allocate resources more effectively, leading to a more sustainable economic model. This cost efficiency is particularly vital in a competitive landscape where margins are often tight.

-

Better Data Insights: Advanced analytics tools empower services to gain deeper insights into customer behavior and preferences. This data-driven approach enables more informed decision-making and the development of targeted marketing strategies. As organizations leverage these insights, they can anticipate customer needs more accurately, leading to enhanced service offerings. Avato’s dedication to unlocking isolated assets guarantees that monetary organizations can effectively utilize their data as part of their digital transformation.

However, it is essential to recognize the challenges related to digital transformation in financial services. Resistance to change and poor data handling can hinder progress, making it crucial for organizations to address these issues proactively. Avato simplifies complex projects, allowing organizations to achieve transformative goals within desired time frames and budget constraints.

In addition to these benefits, the trend of AI-driven hyper-personalization is reshaping customer experiences in banking. Companies that adopt such technologies can better anticipate customer needs, creating relevant experiences that drive satisfaction and loyalty. As highlighted by industry leaders, the integration of AI tools is revolutionizing trading, customer engagement, and security, further underscoring the importance of Avato’s hybrid integration solutions in this evolving landscape.

Overall, the incorporation of electronic tools not only improves customer experiences but also positions institutions for long-term success in an increasingly online world.

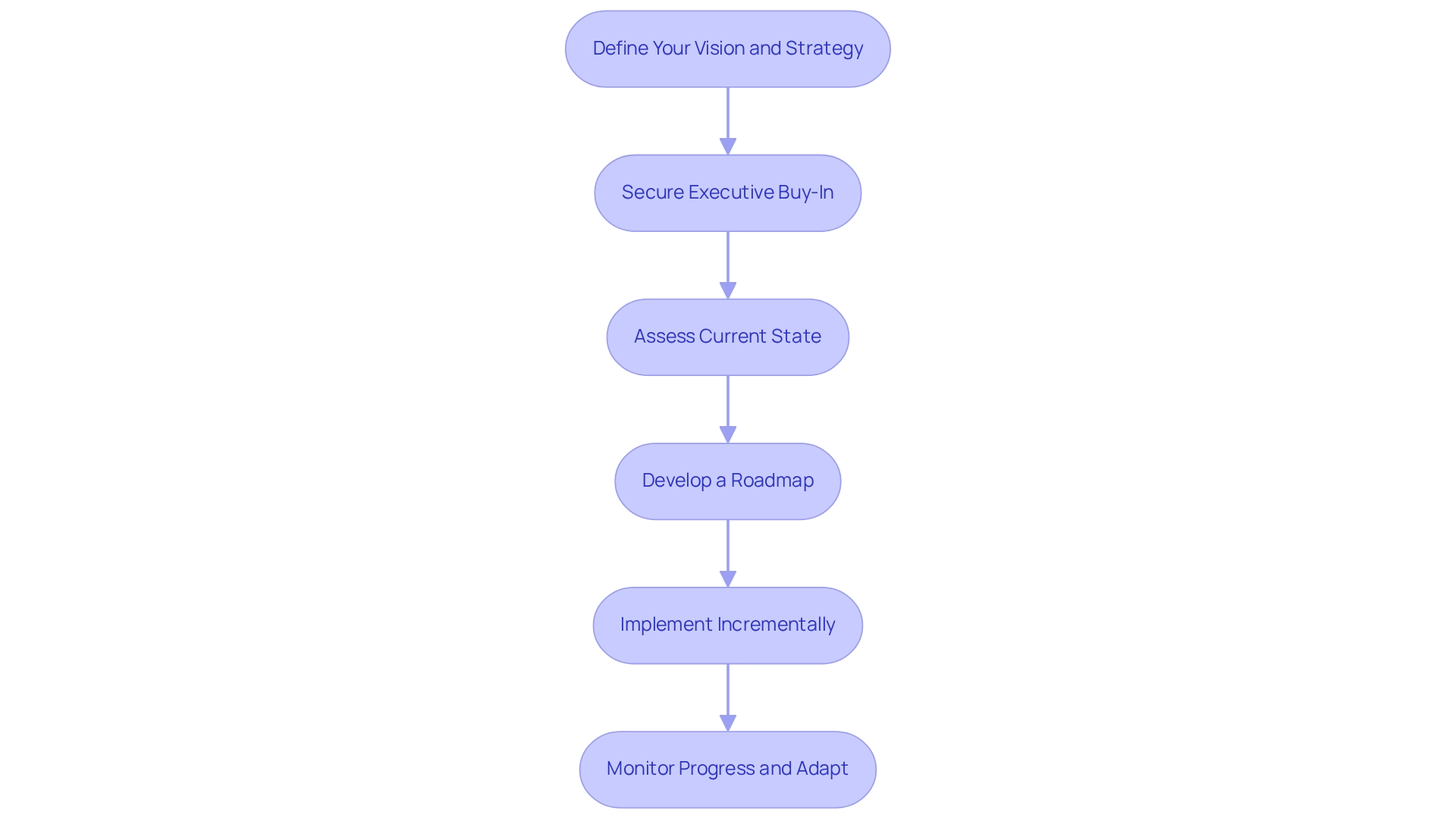

A Step-by-Step Guide to Implementing Digital Transformation

To effectively execute technological change in financial services, particularly in preparation for open banking, it is essential to follow these steps:

-

Define Your Vision and Strategy: Establish clear objectives that align with your overall business goals. This vision should articulate how technological change will enhance customer experiences and operational efficiency. For instance, the success of Erica, the virtual assistant by Bank of America, which has surpassed six million users and processed over 35 million requests, underscores the increasing significance of innovative customer engagement solutions.

-

Secure Executive Buy-In: Commitment from leadership is crucial. Their support not only facilitates resource allocation but also cultivates a culture that embraces change. Industry specialists assert that executive support is fundamental to successful technological initiatives, ensuring alignment with strategic priorities. According to IDC, global expenditure on digital transformation in financial services is projected to reach $3.9 trillion by 2027, emphasizing the necessity of investing in these initiatives.

-

Assess Current State: Conduct a thorough evaluation of existing systems, processes, and capabilities. This assessment will help identify gaps and areas for enhancement, laying the groundwork for targeted change initiatives. The payments industry has evolved significantly due to the COVID-19 pandemic, prompting financial institutions to rethink their strategies for digital transformation. Understanding this context is vital for recognizing the current landscape and the need for adaptation. Remember that leveraging existing legacy systems can be advantageous; resist the urge to discard them in favor of newer solutions without evaluating their potential.

-

Develop a Roadmap: Create a comprehensive plan outlining the necessary steps, timelines, and resources for implementation. This roadmap should include milestones to track progress and ensure alignment with strategic objectives. Consider incorporating a middle layer that can translate existing systems into open formats, facilitating smoother connections as open banking develops. Avato’s integration solutions can play a pivotal role in this process, ensuring that your systems are future-proofed and prepared for new tools.

-

Implement Incrementally: Initiate pilot projects to test new technologies and processes. This incremental approach allows for adjustments based on real-world feedback, minimizing risks associated with large-scale rollouts. Ensure that your integration solutions, such as those provided by Avato, comply with stringent security protocols to protect against potential vulnerabilities.

-

Monitor Progress and Adapt: Continuously evaluate the effectiveness of your change initiatives. Utilize performance metrics and feedback loops to make informed adjustments, ensuring that the change remains aligned with evolving business needs. Digital advancement fosters a culture of creativity and innovation, essential for long-term success. By prioritizing these strategies and leveraging Avato’s expertise, institutions can navigate the complexities of technological change effectively, positioning themselves to adapt and thrive in a competitive environment while optimizing integration strategies.

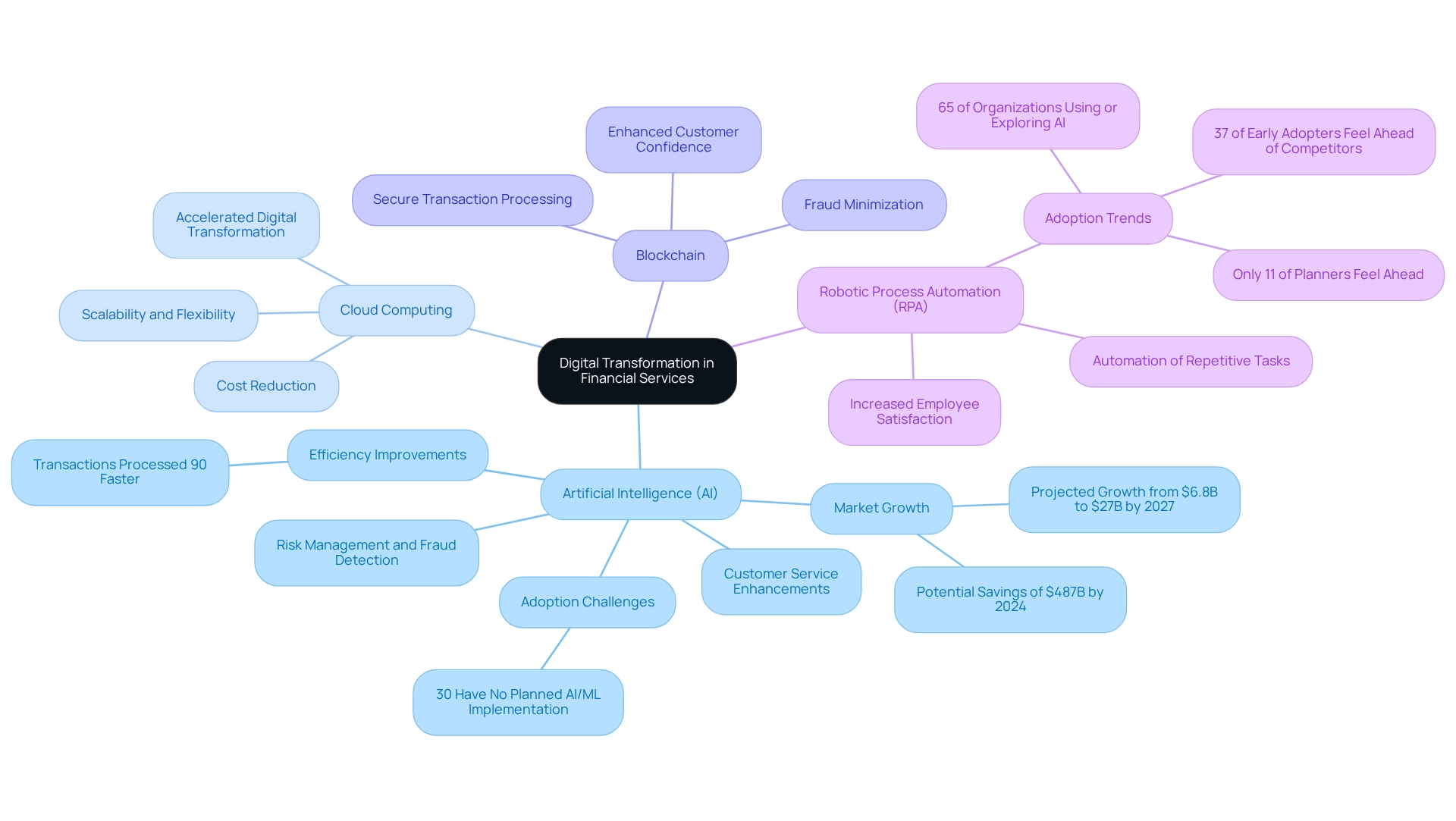

Technologies Driving Digital Transformation in Financial Services

Key technologies driving digital transformation in monetary services include:

- Artificial Intelligence (AI): AI is revolutionizing customer service through the deployment of chatbots and personalized recommendations, significantly enhancing user experience. Furthermore, AI plays a crucial role in risk management and fraud detection, with projections indicating that it could save banks up to $487 billion by 2024, primarily in front and middle-office operations. The AI market in banking is expected to grow from $6.8 billion in 2022 to over $27 billion by 2027, highlighting its increasing importance in the sector. Additionally, AI-driven tools can handle transactions up to 90% quicker than conventional methods, enhancing efficiency in monetary services. Avato’s Hybrid Integration Platform enables banks to seamlessly integrate AI solutions, ensuring they can leverage these advancements effectively. A survey by Gartner reveals that 30% of respondents have no planned AI/ML implementation in finance, underscoring the challenges and gaps in current AI adoption strategies within the industry.

- Cloud Computing: Cloud solutions are crucial for banks, providing the scalability and flexibility required to launch applications quickly and effectively. As organizations embrace cloud technologies, they can enhance their operational capabilities and reduce costs associated with maintaining on-premises infrastructure. Avato’s Hybrid Integration Platform accelerates digital transformation in financial services by providing secure and efficient cloud integration, enabling banks to improve agility and reduce time-to-market for new services.

- Blockchain: This innovative technology ensures secure and transparent transaction processing, which is particularly advantageous for payments and contract management. By utilizing blockchain, monetary organizations can boost trust and minimize the chance of fraud, thus streamlining operations and enhancing customer confidence. Avato’s solutions facilitate the integration of blockchain technology, helping organizations navigate this complex landscape.

- Robotic Process Automation (RPA): RPA is transforming the operational landscape by automating repetitive tasks, allowing employees to concentrate on more strategic initiatives. This shift not only boosts overall efficiency but also enhances job satisfaction as staff engage in more meaningful work. The adoption of RPA is part of a broader trend, with 65% of organizations either using or exploring AI technologies, indicating a strong movement towards automation in the services sector. Avato’s Hybrid Integration Platform supports the implementation of RPA, ensuring that institutions can optimize their processes effectively. A case study on the general adoption of AI in analytics shows that early adopters leverage generative AI for a competitive edge, with 37% believing they are ahead of competitors, while only 11% of planners feel the same, indicating a pressing need for them to adopt AI strategies to remain competitive.

As the financial services industry experiences digital transformation, the integration of these technologies through Avato’s Hybrid Integration Platform will be essential for organizations aiming to stay competitive and meet the demands of a rapidly changing market. To navigate this journey successfully, refer to our guide on digital change and connect with Avato today to explore tailored insights and strategies for effective AI integration. Your guidance in this change is essential—let’s collaborate to succeed in the AI landscape!

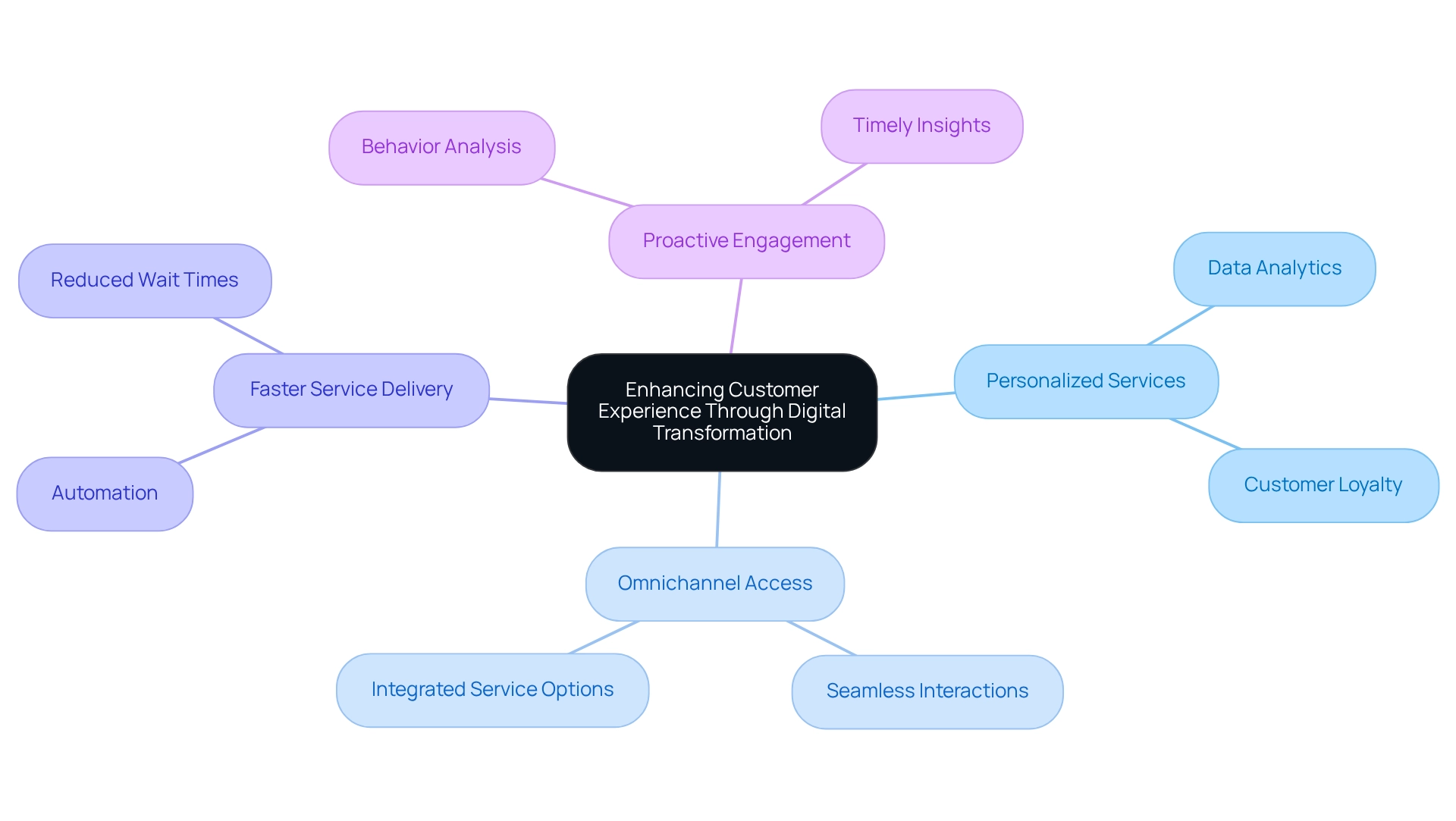

Enhancing Customer Experience Through Digital Transformation

Digital change significantly enhances customer experience in banking services through several key avenues:

- Personalized Services: By leveraging advanced data analytics and generative AI, banks can tailor their offerings to meet the distinct needs and preferences of individual clients. This tailored approach not only cultivates customer loyalty but also drives engagement, as clients feel understood and valued. As Vikram, Vice Chair and US Financial Services Industry Leader at Deloitte, emphasizes, the ability to personalize services is essential in today’s competitive landscape.

- Omnichannel Access: Today’s customers expect seamless interactions across multiple platforms—be it online, mobile, or in-person. Digital transformation in financial services enables organizations to provide a cohesive omnichannel experience, allowing clients to transition effortlessly between channels while ensuring continuity in their service journey. By 2025, omnichannel access is projected to be crucial, with statistics indicating that a significant number of customers will prefer organizations that offer integrated service options.

- Faster Service Delivery: The implementation of automation and streamlined processes, bolstered by generative AI, is revolutionizing service delivery in the banking sector. By reducing wait times and expediting transactions, organizations can significantly enhance customer satisfaction. This efficiency is vital, especially as deposit costs are anticipated to rise to 2.03% in 2025, making it imperative for banks to optimize their operations to remain competitive.

- Proactive Engagement: Digital tools empower financial organizations to engage with customers proactively. By analyzing customer behavior and preferences, banks can provide timely insights and solutions, addressing potential issues before they escalate. This proactive approach not only enhances customer experience but also positions organizations as trusted advisors in their clients’ financial journeys.

Case studies, such as those from Zions Bancorporation, illustrate how incremental modernization strategies can effectively enhance personalized services. These strategies enable banks to upgrade their core systems gradually, utilizing generative AI to facilitate large-scale modernization without necessitating complete system overhauls. As the economic landscape evolves, the importance of personalized services becomes increasingly apparent, with a growing emphasis on ethical AI practices and the development of personalization metrics to refine customer strategies.

Financial organizations must invest in data systems to support their digital transformation initiatives, ensuring they remain at the forefront of technological advancement. Avato’s dedicated hybrid integration platform plays a pivotal role in this journey, simplifying disparate systems and enhancing business value, ultimately empowering institutions to future-proof their operations through seamless data and system integration.

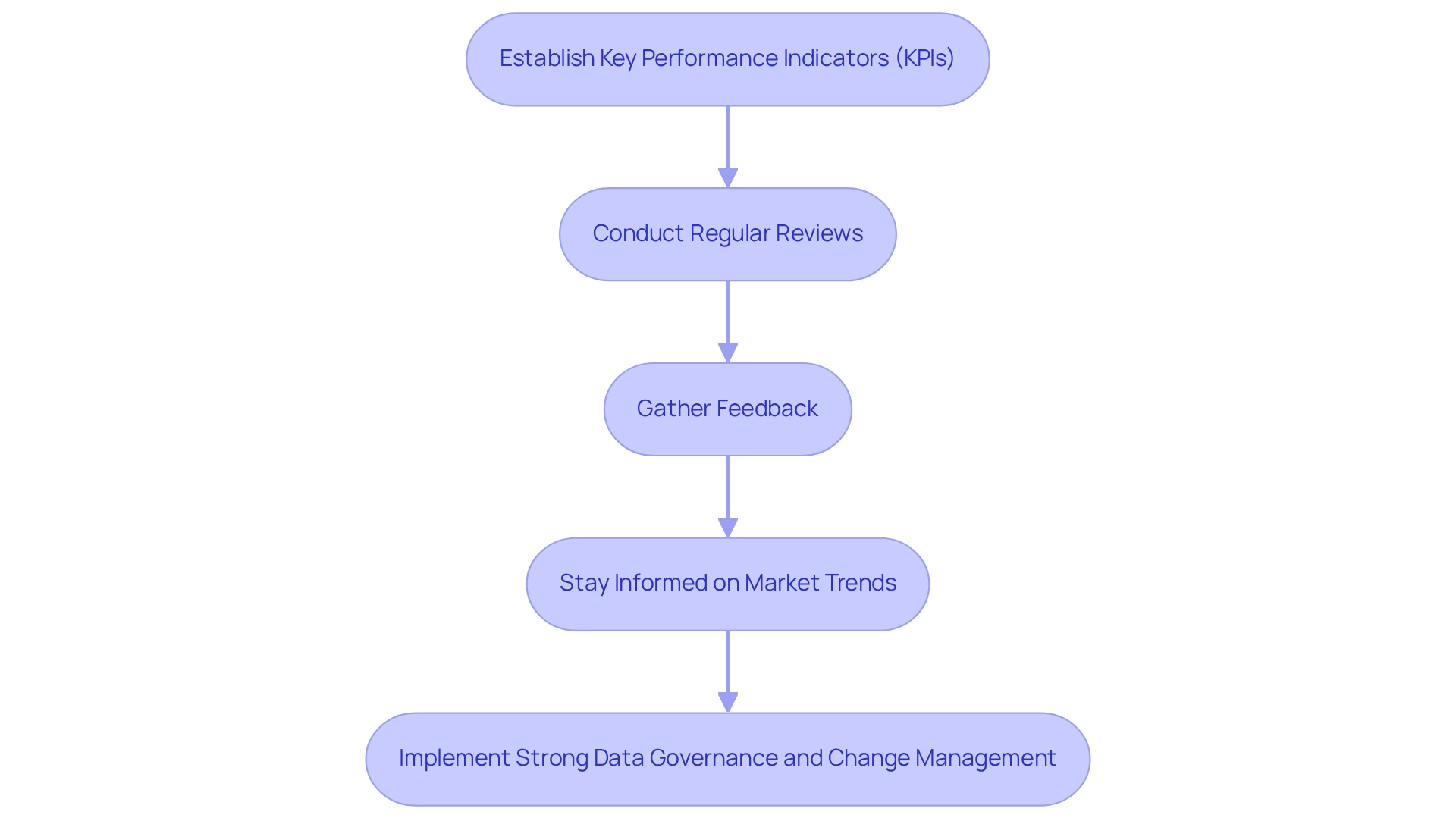

Monitoring and Adapting Digital Transformation Strategies

To guarantee the success of technological shifts in financial services, organizations must take decisive steps:

-

Establish Key Performance Indicators (KPIs): Defining specific metrics to gauge the effectiveness of change efforts is crucial. Key KPIs may encompass customer satisfaction scores, operational efficiency metrics, and data governance benchmarks. By setting clear KPIs, organizations not only chart a pathway for success but also align with findings from BCG, which reveal that only 35% of companies achieve their technological goals. This underscores the necessity for organized evaluation and accountability throughout the change process.

-

Conduct Regular Reviews: Implementing a schedule for periodic assessments against established goals is essential. Regular reviews empower organizations to make timely adjustments to their strategies and tactics, ensuring alignment with evolving market demands. Statistics indicate that organizations engaging in regular assessments of their technological changes are better equipped to adapt and thrive in a competitive environment.

-

Gather Feedback: Actively soliciting input from both employees and customers is vital for identifying areas for improvement. This feedback loop ensures that change initiatives effectively meet the needs of all stakeholders. Engaging with users can also enhance trust; research indicates that 71% of customers are more likely to trust a company with their personal data if its use is clearly explained.

-

Stay Informed on Market Trends: Continuous monitoring of industry trends and emerging technologies is necessary to maintain competitiveness. Traditional financial entities face considerable upheaval from fintech startups and technology giants, necessitating a proactive strategy for modernization. By leveraging innovative solutions, such as Avato’s hybrid integration platform, these institutions can enhance service delivery and operational efficiency, ultimately leading to improved decision-making supported by real-time data.

-

Implement Strong Data Governance and Change Management: To effectively address KPI challenges, organizations must prioritize robust data governance, methodical system integration, and comprehensive change management programs. This includes preparing for open banking by streamlining integration strategies and ensuring compliance with stringent security protocols. These elements are crucial for ensuring that technological change initiatives are sustainable and aligned with business goals. Furthermore, organizations should remain vigilant regarding potential security vulnerabilities associated with open banking, as these can pose significant risks if not properly managed. Incorporating these strategies will not only facilitate a smoother digital transformation process in financial services but also ensure that organizations can effectively measure their success and adapt to the rapidly changing landscape.

Conclusion

The ongoing digital transformation in financial services signifies a profound shift reshaping the industry landscape. By integrating innovative technologies, financial institutions are enhancing operational efficiency and improving customer experiences to meet the evolving expectations of tech-savvy consumers. Key drivers—changing consumer preferences, regulatory pressures, competition from fintechs, and advancements in technology—underscore the urgency for institutions to adapt and innovate.

However, this journey is fraught with challenges. Legacy systems, cultural resistance, data security concerns, and skill gaps present hurdles that must be navigated with care. Institutions that successfully address these challenges unlock substantial benefits, including enhanced customer satisfaction, increased operational efficiency, and reduced costs. The role of platforms like Avato’s Hybrid Integration Platform is critical in this transformation, providing essential tools for seamless integration and modernization.

As the financial services sector continues to evolve, embracing digital transformation is no longer optional; it is essential for survival and success. Institutions prioritizing this journey will not only gain a competitive edge but also position themselves as leaders in delivering exceptional customer value in an increasingly digital world. The call to action is clear: financial institutions must embrace change, leverage technology, and engage proactively with their customers to thrive in this dynamic environment.