Overview

A successful digital transformation strategy for banks requires a comprehensive approach that prioritizes customer-centric services, operational efficiency, and cultural adaptability within the organization. How can banks effectively navigate this complex landscape? This article underscores the necessity of a clear vision, robust stakeholder engagement, and the integration of advanced technologies. These key elements collectively enable banks to enhance client experiences and remain competitive in a rapidly evolving financial landscape. By embracing these strategies, banks not only address current challenges but also position themselves for future success. Are you ready to transform your banking experience?

Introduction

In an era defined by digital innovation, the banking sector finds itself at a pivotal crossroads. Digital transformation in banking transcends the mere adoption of cutting-edge technologies; it signifies a profound rethinking of how banks function and cater to their customers. As traditional institutions grapple with increasing pressure from nimble fintech competitors and shifting consumer expectations, grasping the nuances of this transformation is crucial.

How can banks enhance customer experiences through personalized services? What strategies can they implement to streamline operations for greater efficiency? Navigating this complex landscape, filled with both opportunities and challenges, is essential for success.

This article explores the core elements of effective digital transformation strategies, the key drivers propelling banks forward, and the obstacles they must surmount to thrive in the digital age.

Understanding Digital Transformation in Banking

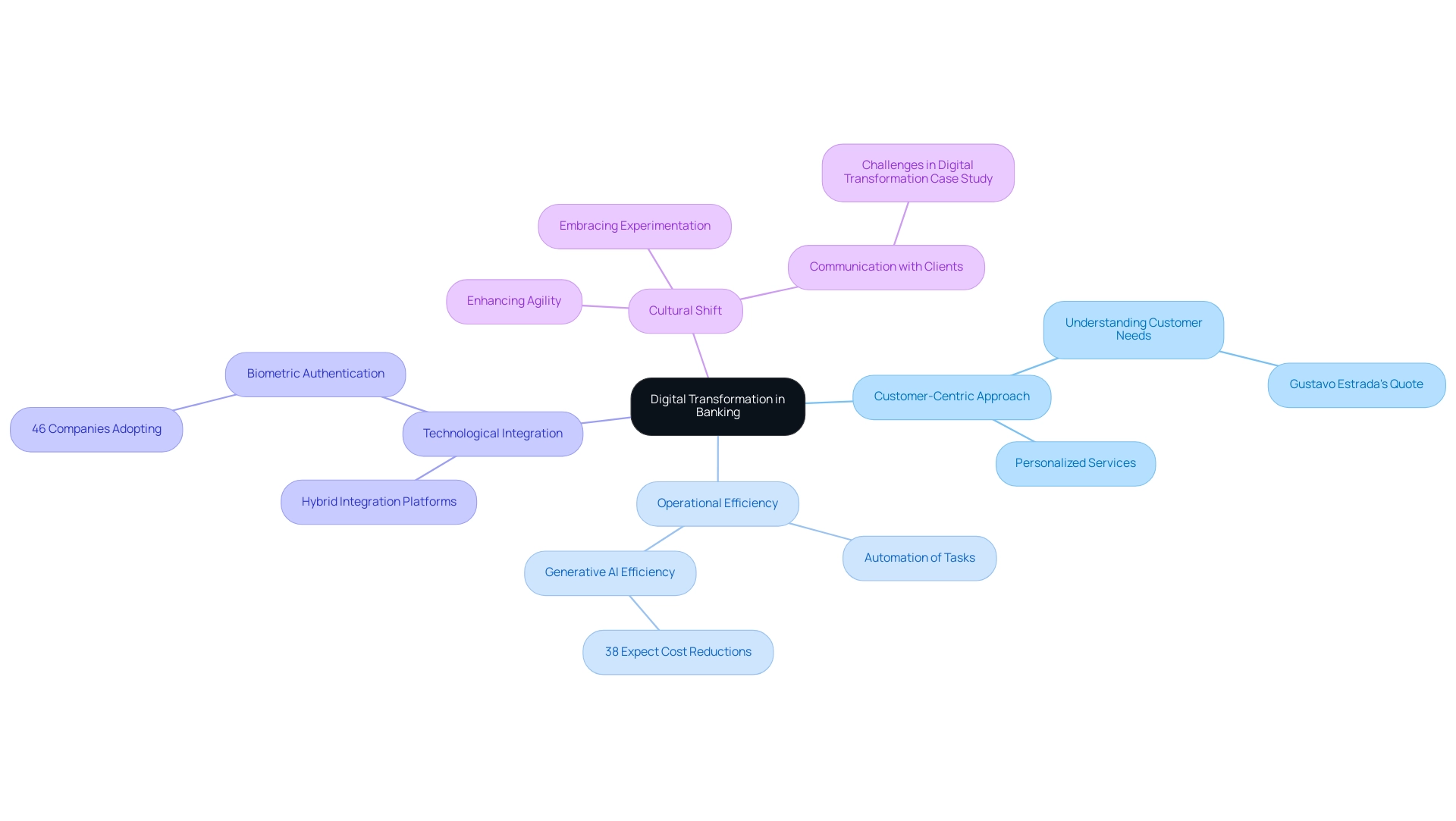

Technological advancement in finance encompasses the comprehensive integration of electronic technologies across all operational dimensions, fundamentally reshaping how financial institutions formulate and implement their bank digital transformation strategy to deliver value to their clients. This evolution goes beyond mere technology adoption; it demands a cultural shift within organizations as part of their bank digital transformation strategy, compelling them to consistently challenge established norms, embrace experimentation, and enhance agility in their operations. Understanding this concept is crucial for financial institutions striving to maintain competitiveness in an increasingly online environment.

Key aspects of digital transformation in banking include:

-

Customer-Centric Approach: Elevating customer experiences through tailored services is paramount. As financial institutions transition towards a more customer-focused model, they can leverage insights within their bank digital transformation strategy to create personalized offerings that resonate with individual needs, thereby fostering loyalty and trust. Gustavo Estrada, a customer, remarked, “Avato has simplified complex projects and delivered results within desired time frames and budget constraints,” underscoring the importance of understanding customer needs in the digital transformation journey. Avato’s expert integration services, including enterprise architecture, software development, and project management, are pivotal in supporting businesses with skilled integration partners, ensuring effective implementation of customer-centric solutions.

-

Operational Efficiency: Streamlining processes is essential for reducing costs and enhancing service delivery. By integrating advanced technologies into their bank digital transformation strategy, financial institutions can automate routine tasks, minimize errors, and boost overall productivity, leading to significant operational improvements. This aligns with the trend where 38% of banking executives foresee that generative AI will yield efficiencies that substantially lower operational costs, emphasizing the necessity for a bank digital transformation strategy to effectively harness such technologies. Avato’s hybrid integration platform, built on Red Hat’s JBoss Middleware, accelerates technological advancement by providing secure and efficient system integration, enabling banks to leverage generative AI capabilities for improved operational efficiency.

Recent trends indicate that as of 2023, nearly 46% of companies in the U.S. have either replaced or are planning to replace traditional passwords with biometric authentication methods, reflecting a broader shift towards enhanced security measures in banking operations. This transition not only bolsters security but also enhances user experience by streamlining access to services, a transformation that Avato can facilitate through its robust integration capabilities.

Successful instances of technological transformation in banking highlight the importance of understanding client requirements within a bank digital transformation strategy. A case study revealed that organizations often rush into technological initiatives without adequately investigating client expectations, leading to dissatisfaction and potential erosion of trust. To mitigate these risks, financial institutions must prioritize clear communication regarding data usage and actively engage with customers to foster trust, a process that is enhanced by Avato’s bank digital transformation strategy, which simplifies complex projects and ensures that integration solutions align with customer expectations.

Expert insights, including those from Vikram Bhat, Vice Chair and US Financial Services Industry Leader at Deloitte, underscore the vital role of a bank digital transformation strategy and technology application in navigating the challenges of transformation. By adopting a customer-focused approach and emphasizing operational efficiency, financial institutions can enhance their service delivery and position themselves for sustainable growth through a bank digital transformation strategy in the technological era.

In summary, the impact of electronic technologies on financial operations in 2025 will be profound, necessitating a proactive stance from financial institutions to adapt and thrive in this dynamic landscape. Avato’s expertise in hybrid integration, bolstered by its partnership with Red Hat, will be instrumental in transforming financial institutions with speed and reliability, ensuring they are well-equipped to meet the challenges of the future.

Key Drivers of Digital Transformation in Banking

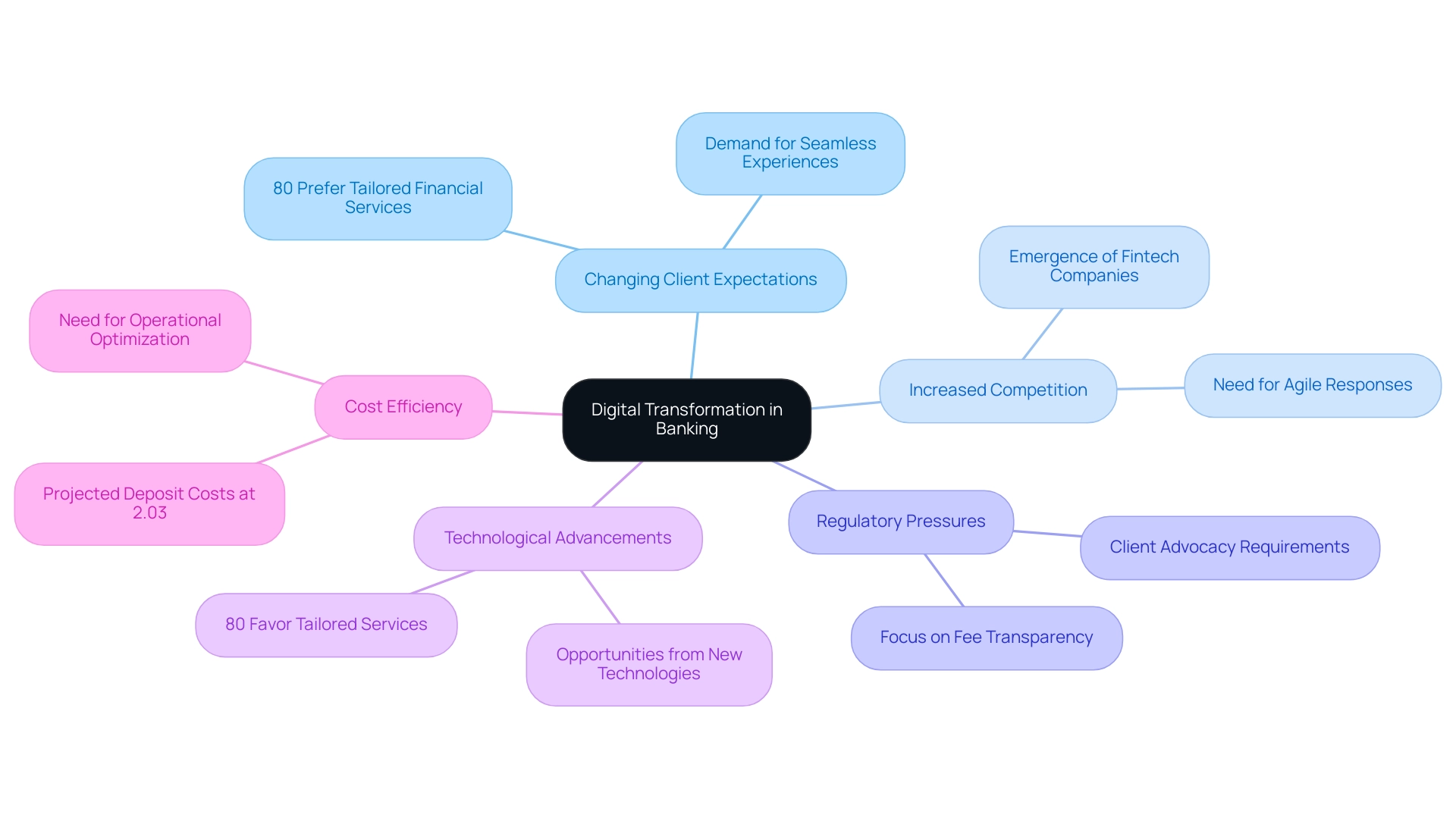

Several key factors are driving financial institutions towards digital transformation:

-

Changing Client Expectations: By 2025, clients increasingly demand seamless and personalized experiences across all channels, with 80% preferring tailored financial services. This shift necessitates that financial institutions adopt a robust digital transformation strategy, leveraging data analytics and AI to create customized products that enhance client engagement and satisfaction. Avato’s hybrid integration platform is pivotal in enabling financial institutions to effectively implement their digital transformation strategies, ensuring that client interactions are both personalized and efficient.

-

Increased Competition: The emergence of fintech companies and neobanks is intensifying competition, compelling traditional financial institutions to respond swiftly to maintain their market position. As these agile competitors offer innovative solutions, established institutions must adapt their digital transformation strategies to retain their clientele. Avato’s solutions empower financial institutions to seamlessly integrate advanced technologies, which is essential for their digital transformation efforts, allowing them to compete effectively in this dynamic landscape.

-

Regulatory Pressures: Compliance with evolving regulations is a pressing concern for financial organizations. The focus on fee transparency and client advocacy requires institutions to adopt a digital transformation strategy that implements more efficient and transparent processes, ensuring compliance with regulatory standards while enhancing client trust. Avato’s hybrid integration platform streamlines data management, facilitating compliance across systems as part of the digital transformation strategy.

-

Technological Advancements: Innovations in technology present significant opportunities for financial institutions to enhance their services and operational capabilities. By embracing new technologies within their digital transformation strategies, institutions can streamline operations and improve customer interactions, ultimately driving growth. A case study titled ‘Emerging Opportunities in Online Banking’ illustrates how the sector is experiencing growth fueled by technological advancements and changing consumer preferences, with 80% of consumers favoring tailored financial services. Avato’s integration solutions are designed to support these advancements, enabling institutions to leverage AI and other technologies effectively.

-

Cost Efficiency: The imperative to reduce operational costs through automation and improved processes remains a significant motivator for digital transformation. With deposit expenses projected to rise to 2.03% in 2025, financial institutions must find ways to optimize operations to sustain profitability while delivering value to clients. Val Srinivas, a senior research leader in finance and capital markets, highlights that institutions must balance short-term gains with long-term investments in client advocacy, focusing on emotional connections to convert satisfied clients into loyal advocates. Avato’s hybrid integration platform enhances operational efficiency and supports the digital transformation strategy, fostering long-term customer loyalty. Moreover, the NVIDIA 2025 survey reveals that nearly 70% of firms reported at least a 5% revenue increase due to AI implementations, underscoring the critical need for integrating AI into digital transformation strategies. Avato’s commitment to developing technology solutions is essential for financial institutions to navigate challenges and seize opportunities presented by AI within their digital transformation strategies.

Challenges in Implementing Digital Transformation

Implementing digital transformation in banking presents a myriad of challenges that institutions must navigate to remain competitive and compliant in an evolving landscape.

- Legacy Systems: A significant number of banks still rely on outdated systems that complicate the integration of modern technologies. These legacy systems not only hinder operational efficiency but also pose risks in terms of security and compliance. As banks confront these challenges, their digital transformation strategy may benefit from the integration of generative AI technologies. This approach offers a pathway to modernize these systems by automating integration processes and rewriting outdated code. Such methods not only streamline operations but also enhance the overall efficiency of online initiatives, particularly when utilizing Avato’s hybrid integration platform, which supports the digital transformation strategy by modernizing legacy systems with speed, security, and simplicity.

- Cultural Resistance: Change is often met with skepticism, particularly in established organizations. Employees may resist modifications to long-standing processes and workflows, fearing disruption or job loss. This cultural inertia can significantly delay the adoption of new technologies and practices. Therefore, it is essential for leadership to foster a culture of innovation and adaptability. Investing in a digital transformation strategy that includes comprehensive training programs and implementing change management strategies, as recommended in Avato’s user manuals, can help ease this transition and empower staff.

- Data Privacy and Security: In an era where data breaches are increasingly common, ensuring compliance with stringent regulations while safeguarding customer information is critical. Banks must implement robust security measures to protect sensitive data, which can complicate the integration of new systems and technologies. Avato’s platform is built with security in mind, helping institutions navigate these complexities effectively.

- Skill Gaps: The rapid pace of technological advancement often outstrips the existing skill sets within banking organizations. There is a pressing need for training and development programs to equip employees with the necessary skills to drive transformation initiatives effectively. Without this investment in human capital, financial institutions may struggle to fully leverage new technologies in their digital transformation strategy. Avato highlights the significance of employee training and change management to ensure that teams are ready for the new technological environment.

- Budget Constraints: Financial limitations can significantly impede the ability to invest in new technologies and training programs. In a low-growth setting, where financial institutions encounter decreasing net interest revenue and elevated deposit expenses, prioritizing digital advancement initiatives can be difficult. Leaders must make strategic decisions regarding resource allocation to ensure that transformation efforts are adequately funded. For instance, case studies reveal that financial institution leaders are increasingly recognizing the need for strategic asset-liability management to navigate these pressures.

In light of these complexities, it is essential to recognize the effectiveness of solutions like Avato in supporting a digital transformation strategy. Avato has been praised for its ability to simplify complex projects and deliver results within desired time frames and budget constraints. As Gustavo Estrada from BC Provincial Health Services Authority noted, “Avato has the ability to simplify complex projects and deliver results within desired time frames and budget constraints,” highlighting the platform’s role in facilitating stakeholder engagement and modeling new business processes. By adopting innovative solutions and promoting a culture of change, banks can position themselves to succeed in the technological era.

Core Elements of a Successful Digital Transformation Strategy

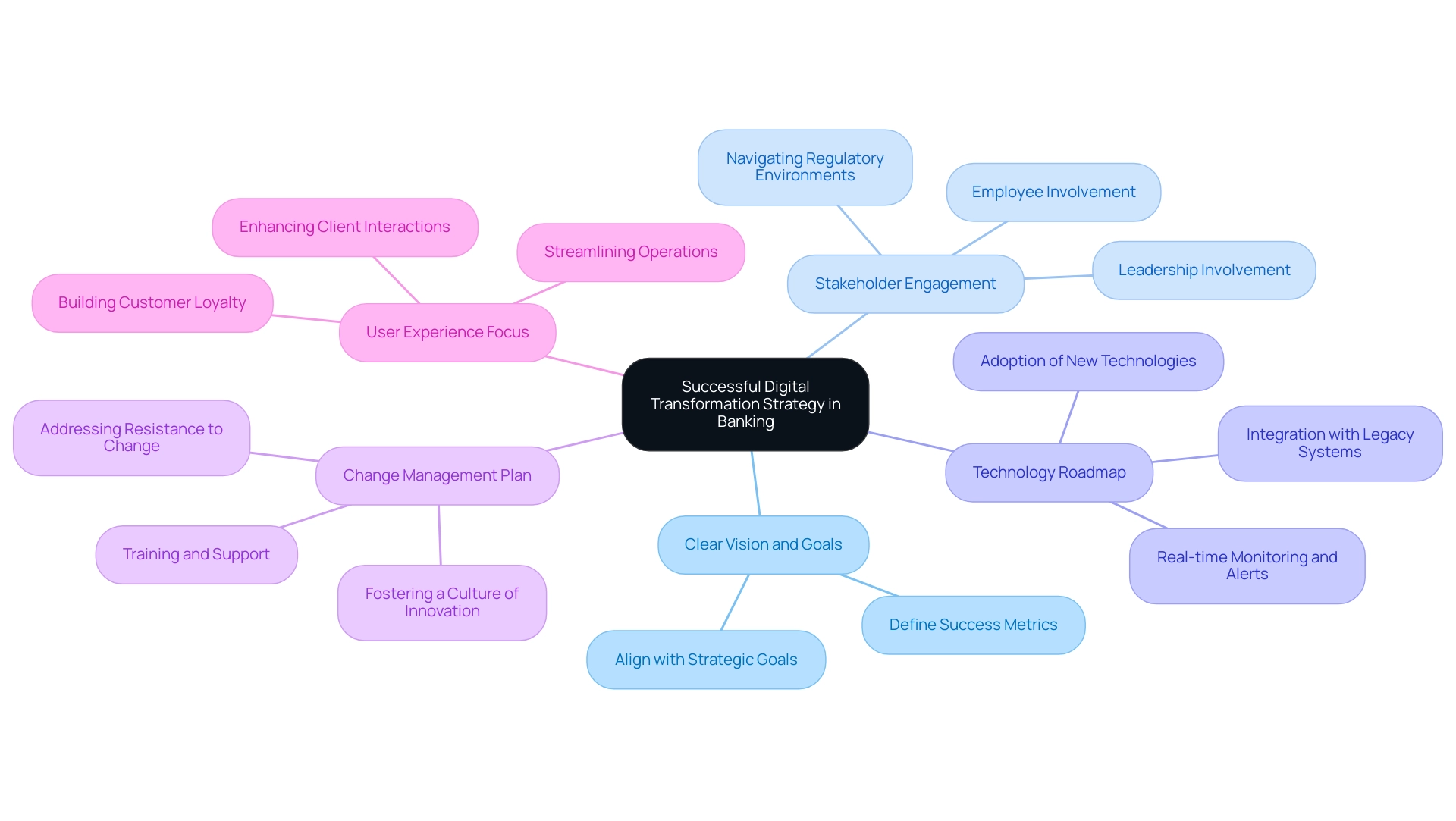

A successful digital change strategy in banking must encompass several key elements:

-

Clear Vision and Goals: Establishing a clear vision is paramount. Organizations must define what success looks like and set measurable objectives that align with their strategic goals. This clarity not only guides the transformation process but also aids in evaluating progress.

-

Stakeholder Engagement: Engaging all relevant stakeholders is crucial for ensuring buy-in and support throughout the transformation journey. This includes not only leadership but also employees at all levels, as their insights and commitment can significantly influence the success of the initiative. In 2025, the significance of stakeholder engagement will be even more pronounced as financial institutions navigate complex regulatory environments and customer expectations.

-

Technology Roadmap: Developing a comprehensive technology roadmap is essential. This plan should outline the adoption of new technologies that align with business objectives, ensuring that investments are made in solutions that will drive efficiency and innovation. Avato’s hybrid integration platform plays a critical role here, enabling financial institutions to maximize and extend the value of legacy systems while simplifying complex integrations and significantly reducing costs. The platform also offers real-time monitoring and alerts on system performance, ensuring that financial institutions can proactively manage their operations. For instance, statistics show that VisualSP significantly speeds up onboarding for new employees in banking systems, highlighting the importance of technology in enhancing operational efficiency.

-

Change Management Plan: Preparing for cultural shifts is vital. A robust change management plan should include strategies for addressing resistance to change and providing necessary training to employees. This approach fosters a culture that embraces innovation and agility, which is critical in the fast-evolving banking landscape. Avato’s expert integration services can support businesses in this area, ensuring that staff are well-equipped to adapt to new systems and processes.

-

User Experience Focus: Enhancing client interactions and satisfaction should be at the forefront of any digital transformation strategy. By prioritizing client experience, banks can build stronger relationships and loyalty, ultimately driving growth. Avato’s hybrid integration platform improves user experience by streamlining operations and ensuring secure, reliable connections between applications. Statistics show that organizations concentrating on customer experience during their technological changes achieve notably enhanced results.

In 2025, effective strategies in banking will increasingly depend on tackling common challenges, such as conflicting priorities and skill deficiencies. Case studies show that organizations that proactively recognize and address these challenges are better equipped to navigate the intricacies of technological change effectively. For instance, Gustavo Estrada from BC Provincial Health Services Authority highlights the importance of simplifying complex projects to achieve results within desired time frames and budget constraints.

Additionally, asset and liability management committees at financial institutions will face challenges in balancing loan and deposit rates, which is crucial for setting strategic goals. By establishing clear visions and involving stakeholders, financial institutions can ensure that their bank digital transformation strategy results in successful and sustainable technological advancements in the long run. Furthermore, Avato sets itself apart from rivals by offering speed, security, and ease of integration, which corresponds with the obstacles financial institutions encounter during technological change.

Avato’s partnerships with managed service providers further enhance their ability to support comprehensive digital transformation projects.

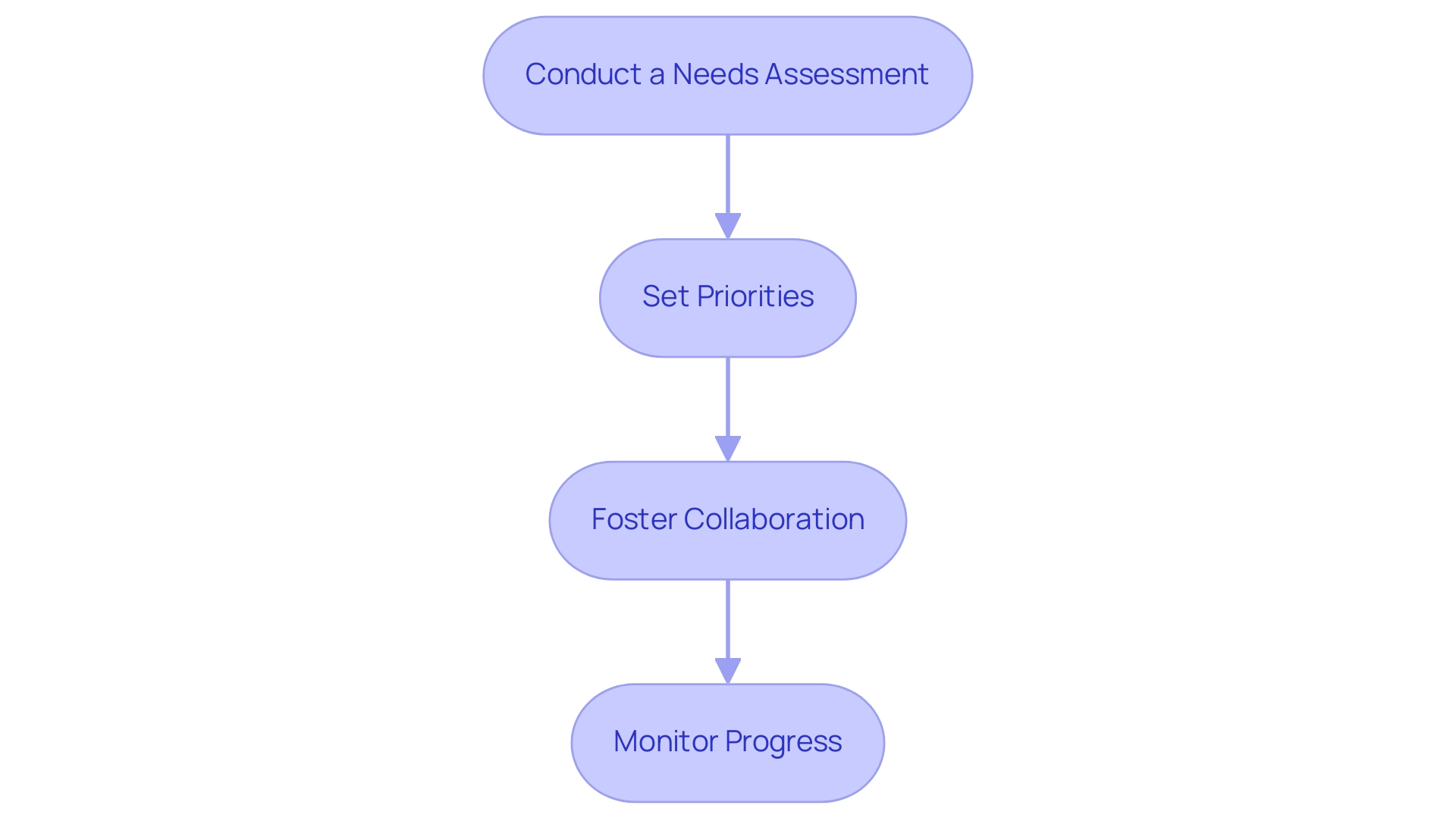

Aligning Technology with Business Objectives

To effectively align technology with business objectives, banks must adopt a strategic approach that encompasses several key steps:

- Conduct a Needs Assessment: Start by identifying the specific needs of the organization. Understanding how technology can address current challenges and enhance operational efficiency is crucial. A comprehensive needs assessment lays the groundwork for informed decision-making regarding technology investments, particularly in integrating AI solutions that have demonstrated significant business outcomes.

- Set Priorities: After identifying needs, prioritize technology initiatives based on their potential impact on achieving business goals. Recent findings indicate that companies implementing AI technologies report an average of 15% higher profitability than their competitors, underscoring the importance of selecting initiatives that yield substantial returns. Insights from the NVIDIA 2025 survey reveal that nearly 70% of firms have experienced revenue increases due to AI implementations, emphasizing the need for financial institutions to focus on high-ROI AI applications.

- Foster Collaboration: Encourage collaboration between IT departments and business units. This synergy is essential for ensuring that technology solutions are not only technically sound but also aligned with the organization’s strategic objectives. As Jamil Jiva, Global Head of Asset Management, states, “the financial industry is poised for a profound technological transformation,” making collaboration more critical than ever. Integrating Avato’s hybrid integration platform can facilitate this collaboration by simplifying disparate systems and enhancing data flow.

- Monitor Progress: Regularly review the progress of technology initiatives to ensure they remain aligned with evolving business objectives. This ongoing evaluation is vital in a rapidly changing landscape, where the impact of technology initiatives on business goals can shift. For instance, a 2024 Citigroup report predicts that AI could boost global banking industry profits to $2 trillion by 2028, reflecting a 9% increase over the next five years. Monitoring such trends can assist financial institutions in adjusting their strategies accordingly. Furthermore, the rise of electronic tools has made fraud more prevalent, as highlighted in the case study titled ‘Industrial Age of Fraud.’ Banking leaders must adapt quickly to meet consumer expectations for fraud protection in this evolving landscape.

By adhering to these steps, banks can ensure that their technology initiatives not only support but also enhance their overall business goals, paving the way for successful technological change in 2025 and beyond. Leveraging Avato’s hybrid integration platform will be crucial in this journey, enabling seamless integration of AI and other technologies to drive efficiency and innovation. Avato’s commitment to designing technology solutions guarantees that organizations can effectively navigate the complexities of transformation, ultimately leading to enhanced business value.

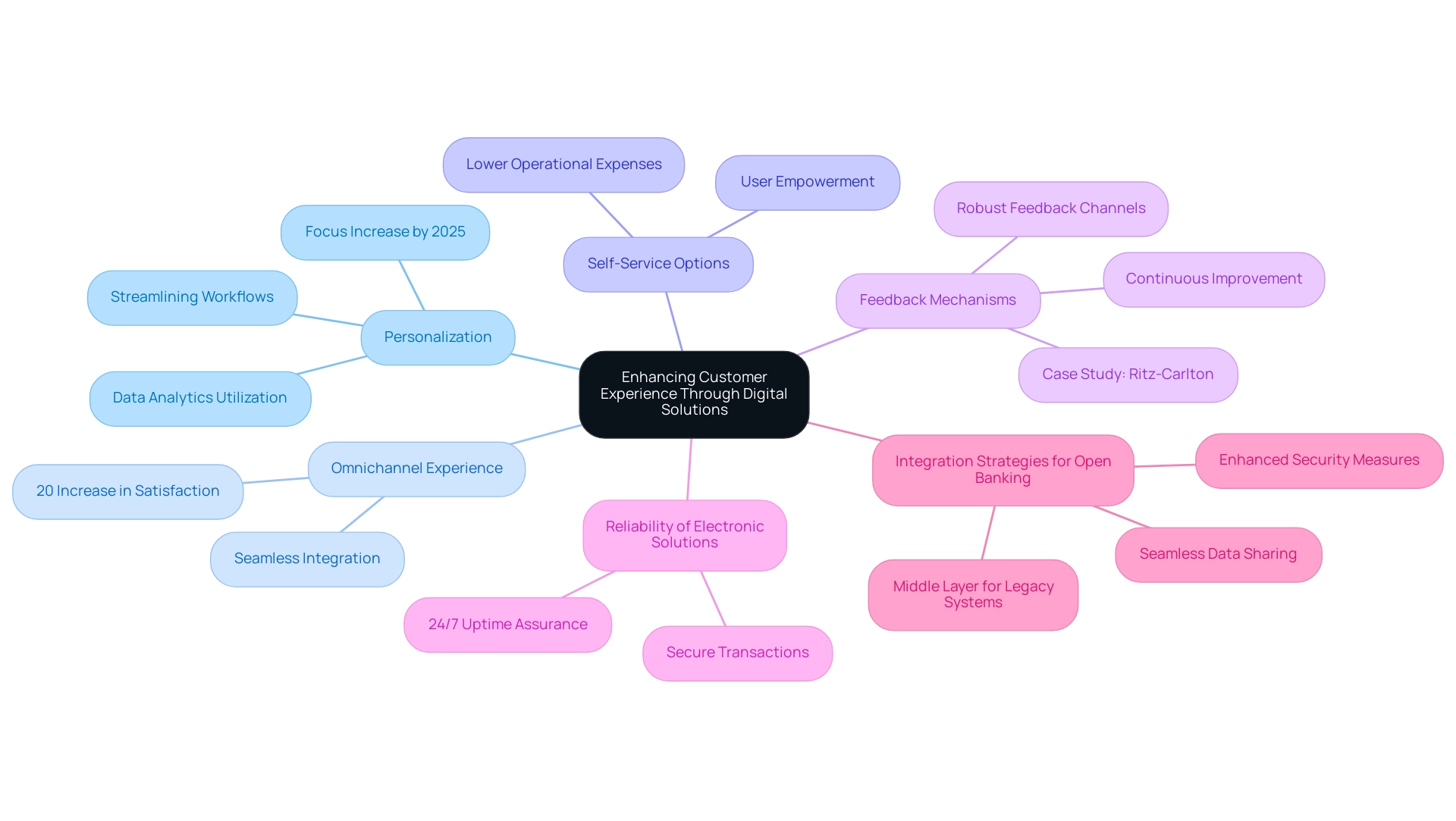

Enhancing Customer Experience Through Digital Solutions

Enhancing customer experience through digital solutions involves several key strategies:

- Personalization: Leveraging data analytics is crucial for tailoring services and communications to meet individual customer needs. In 2025, the focus on personalization in banking is anticipated to increase. Organizations that excel in client experience (CX) will create loyal communities and succeed in a changing business environment. As Tiffany Johnson, Chief Product Officer, notes, there is a significant opportunity for greater personalization in product design within the financial sector, which can streamline workflows and support users’ decision-making processes.

- Omnichannel Experience: Providing a seamless experience across all channels—online, mobile, and in-branch—is essential. Statistics indicate that a well-executed omnichannel strategy can lead to a 20% increase in satisfaction, highlighting the importance of integrating various touchpoints to create a cohesive journey.

- Self-Service Options: Implementing self-service tools empowers users to manage their accounts and transactions independently, enhancing their overall experience. This method not only enhances client satisfaction but also lowers operational expenses for financial institutions.

- Feedback Mechanisms: Establishing robust channels for client feedback is vital for continuously improving services and addressing pain points. By actively monitoring client interactions, financial institutions can identify areas for enhancement, similar to how Ritz-Carlton tracks guest interactions to refine their service offerings. This data-driven approach leads to enhanced satisfaction and loyalty among clients. Avato’s capabilities can assist financial institutions in tracking these interactions effectively, ensuring that they can respond to customer needs promptly.

- Reliability of Electronic Solutions: Avato ensures 24/7 uptime for critical integrations, which is essential for maintaining a reliable infrastructure. Designed for secure transactions, Avato is relied upon by financial institutions, healthcare, and government, providing a robust foundation for digital transformation initiatives. This reliability enhances customer experience by ensuring that services are consistently available, allowing financial institutions to meet customer expectations without interruption.

- Integration Strategies for Open Banking: To prepare for open banking, financial institutions should leverage Avato’s integration strategies that allow for seamless data sharing and connectivity between applications. By utilizing a middle layer to translate existing systems into open formats, financial institutions can enhance their integration capabilities without discarding valuable legacy systems. This approach not only mitigates risks associated with outdated technology but also strengthens security measures, addressing potential vulnerabilities in open banking.

Integrating these approaches into a bank digital transformation strategy will not only improve client experience but also enable financial institutions to adjust to the swiftly evolving requirements of the financial services environment. By leveraging Avato’s speed, security, and simplicity in integration, financial institutions can further strengthen their customer experience initiatives and prepare effectively for the future of open banking. As noted by Tony Leblanc from the Provincial Health Services Authority, “Avato accelerates the integration of isolated systems and fragmented data, delivering the connected foundation enterprises need to simplify, standardize, and modernize.

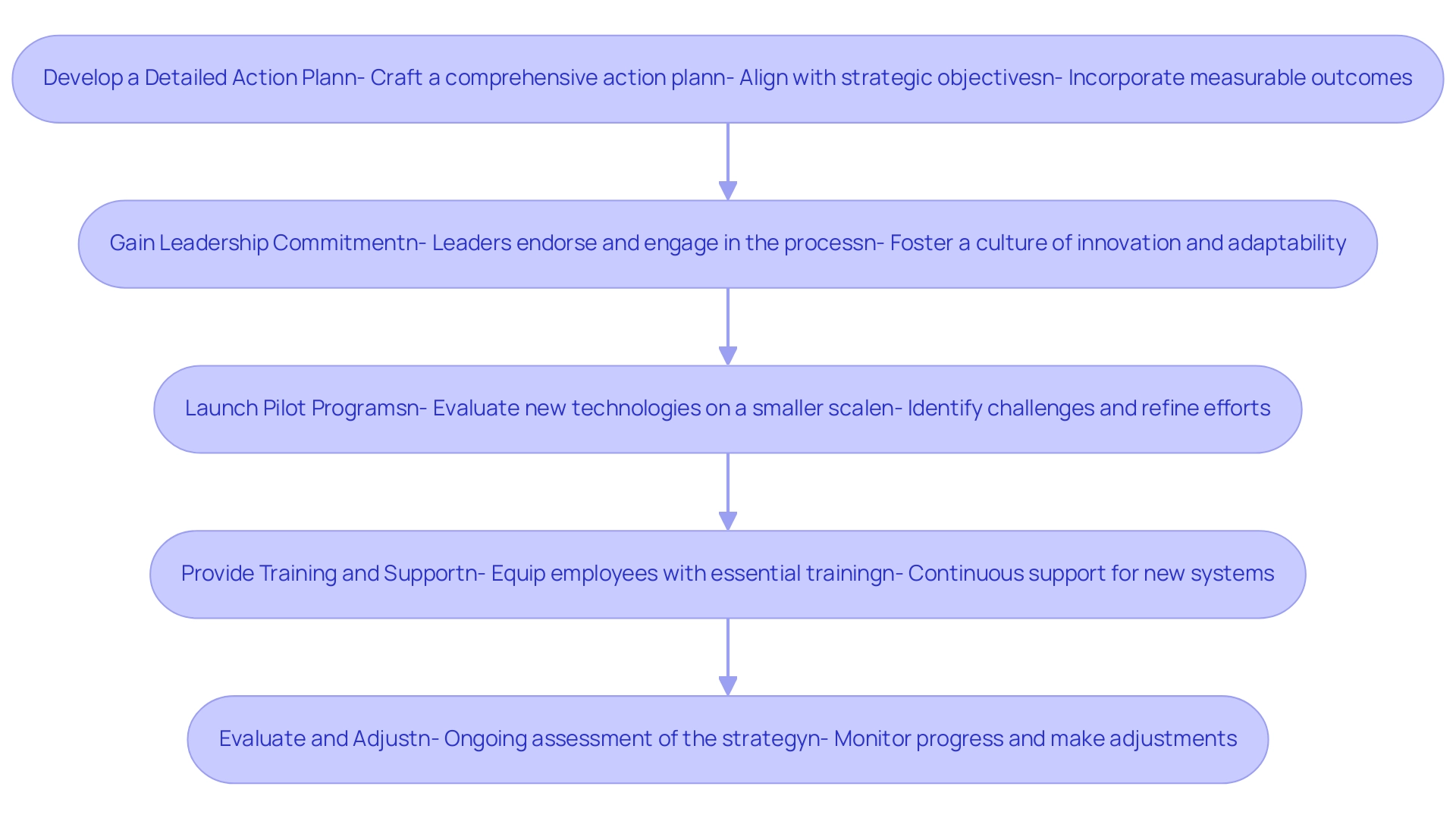

Implementing Your Digital Transformation Strategy

To successfully execute a technological change strategy, financial institutions must adhere to a structured approach:

- Develop a Detailed Action Plan: Craft a comprehensive action plan that delineates specific actions, timelines, and responsibilities for each stage of the change. This plan should align with the bank’s strategic objectives and incorporate measurable outcomes to effectively bolster the bank’s digital transformation strategy and track progress. Utilizing Avato’s hybrid integration platform can streamline this process, ensuring that legacy systems are modernized without necessitating complete overhauls.

Gaining commitment from leadership is paramount for the success of any bank’s digital transformation strategy. Leaders must not only endorse the change but also actively engage in the process, fostering a culture that prioritizes innovation and adaptability. Avato’s expert integration services can facilitate this by providing skilled partners who comprehend the unique challenges of the banking sector.

- Pilot Programs: Launch pilot programs to evaluate new technologies and processes on a smaller scale before full-scale implementation. This strategy enables banks to identify potential challenges and refine their digital transformation efforts based on real-world feedback, thereby minimizing risks associated with broader rollouts. Avato’s phased implementation strategy can ensure these pilots are executed seamlessly, enhancing adaptability.

- Training and Support: Equip employees with the essential training to navigate new systems and processes. Continuous support and resources must be provided to ensure staff can effectively utilize new technologies, thereby enhancing overall productivity and engagement. Cultivating a culture that embraces innovation involves encouraging experimentation and recognizing employees who contribute to the bank’s digital transformation strategy. Avato emphasizes the importance of staff training and change management, ensuring that teams are well-prepared for the transition.

- Evaluate and Adjust: Establish a framework for ongoing assessment of the bank’s digital transformation strategy. Regularly monitor progress against the action plan and remain ready to make adjustments as necessary. This iterative approach not only aids in staying on course but also nurtures a culture of continuous improvement. With Avato’s structured requirements management, financial institutions can effectively evaluate their integration strategies and make informed adjustments.

In 2025, organizations that adopt these strategies can anticipate significant benefits, including enhanced long-term resilience and competitiveness, with many companies reporting over 10% profit growth from technology investments. Furthermore, it is vital to recognize that a considerable portion of participants have indicated a lack of essential infrastructure, highlighting the challenges institutions may encounter during their technological evolution. As Gustavo Estrada noted, organizations such as Avato streamline complex projects, delivering outcomes within desired timelines and financial constraints, which is essential for financial institutions navigating their technological shifts.

Measuring Success and Continuous Improvement in Digital Transformation

To effectively measure success and encourage ongoing enhancement in electronic initiatives, financial institutions should adopt the following strategies:

-

Define Key Performance Indicators (KPIs): Establish clear metrics that align with overarching business objectives. These KPIs should encompass various elements of online initiatives, such as customer engagement, operational efficiency, and financial performance, enabling financial institutions to monitor progress and make informed decisions. Research indicates that technology investments, including generative AI, can yield more than 10% profit growth, underscoring the financial advantages of successful online change initiatives.

-

Conduct Regular Reviews: Establish a timetable for periodic assessments of online change efforts. Regular evaluations are essential for measuring the effectiveness of initiatives, pinpointing areas for enhancement, and ensuring alignment with the bank’s digital transformation strategy. Organizations that conduct regular reviews of their initiatives are more likely to achieve their objectives, with a significant percentage reporting enhanced performance. Notably, 26% of senior executives view high expenses as a primary barrier to technological transformation, emphasizing the importance of these assessments.

-

Solicit Client Feedback: Actively gather opinions from clients to gain insights into their experiences and satisfaction levels. Understanding client perspectives is crucial for enhancing digital services and ensuring they meet evolving needs. Engaging with clients not only fosters loyalty but also provides valuable data that can inform future enhancements. For instance, Gustavo Estrada from BC Provincial Health Services Authority praised Avato for its ability to simplify complex projects and deliver results within desired time frames and budget constraints, illustrating the importance of client feedback in driving successful outcomes. Furthermore, a case study involving a major financial institution demonstrated that by adopting Avato’s hybrid integration platform, they managed to lower operational expenses by 15% while significantly enhancing satisfaction ratings.

-

Leverage Generative AI: Utilize generative AI technologies to improve user experience and streamline operations. With a 60% rise in the utilization of generative AI for client interactions, financial institutions can create advanced chatbots and virtual assistants that enhance service delivery. Additionally, over half of financial professionals are now using generative AI for document processing and report generation, significantly boosting productivity across various departments. A notable example is a financial institution that adopted Avato’s solutions, resulting in a 20% increase in efficiency in their document processing workflows.

-

Adapt Strategies: Maintain flexibility in strategies by being willing to adjust based on performance data and changing market conditions. The financial sector is characterized by rapid technological advancements and shifting consumer expectations, making it essential for institutions to remain agile. By adjusting tactics based on knowledge gained from KPIs and client feedback, financial institutions can ensure continuous success in their bank digital transformation strategy. Additionally, addressing challenges such as competing priorities, skill gaps, and resistance to change is critical for measuring success and adapting strategies effectively as part of the bank digital transformation strategy. In 2025, the focus on measuring success will be more critical than ever, as banks navigate the complexities of digital transformation. By prioritizing these strategies and leveraging Avato’s hybrid integration platform, financial institutions can effectively track their progress and drive meaningful change in their operations, ensuring they remain competitive in an evolving landscape.

Conclusion

Digital transformation in banking represents a pivotal evolution, fundamentally reshaping how institutions operate and engage with their customers. By embracing a customer-centric approach and harnessing the power of data analytics and AI, banks can craft personalized experiences that significantly enhance customer satisfaction. Furthermore, operational efficiency remains crucial; automation and advanced technologies not only reduce costs but also improve service delivery.

However, banks encounter considerable challenges, including outdated legacy systems, cultural resistance, and stringent data security requirements. To effectively navigate these obstacles, it is imperative for banks to establish clear visions, engage stakeholders, and implement robust change management strategies. Innovative solutions like Avato play a vital role in this journey, enabling banks to modernize their operations while ensuring compliance and security.

As we look toward 2025 and beyond, continuous improvement and adaptability must be at the forefront of banking strategies. Defining key performance indicators, actively gathering customer feedback, and leveraging generative AI will be essential for measuring success and refining approaches. By adopting these practices, banks can bolster their operational capabilities and cultivate deeper customer relationships.

In conclusion, successful digital transformation necessitates a steadfast commitment to innovation and a relentless focus on enhancing the customer experience. By proactively addressing challenges and effectively leveraging the right technologies, banks can secure sustainable growth and thrive in the digital age, adeptly meeting the evolving needs of their customers.