Overview

We recognize that effective systems integration is crucial for banking IT managers looking to enhance operational efficiency and customer service. The significance of various integration strategies—vertical, horizontal, and hybrid—cannot be overstated. These methods are not merely technical choices; they are essential pathways that streamline processes, reduce manual errors, and improve data accuracy. As a result, we empower better decision-making and increased customer satisfaction within the banking sector.

What’s holding your team back from embracing these transformative strategies? By adopting these integration methods, we can collectively drive significant improvements in our operational workflows and elevate the overall customer experience. Let us partner together to implement these solutions and witness the positive impact on our banking operations.

Introduction

In the rapidly evolving landscape of banking, we recognize that effective system integration is a cornerstone for operational success. By connecting disparate systems and streamlining processes, we enhance efficiency, improve customer experiences, and foster collaboration across various departments.

What challenges are holding your team back? This article delves into multifaceted approaches to system integration, including vertical, horizontal, and hybrid methods—each offering unique advantages tailored to the complex needs of modern banking.

As we navigate the challenges posed by legacy systems and emerging technologies, understanding the nuances of integration strategies becomes essential for maintaining a competitive edge in an increasingly digital world.

Through a comprehensive exploration of integration techniques and their impact on operational performance, we highlight the critical role of seamless connectivity in driving innovation and delivering superior service to our customers.

Vertical Integration: Streamlining Processes Across Levels

Vertical unification serves as a critical link across various organizational levels, from top management to operational personnel, ensuring alignment and streamlining processes. This approach not only reduces redundancies but also enhances communication, thereby facilitating quicker decision-making and improved service delivery.

For instance, by integrating customer service platforms with back-end systems, we enable real-time data access, allowing our staff to respond to customer inquiries more effectively. In the banking sector, where timely information is essential for maintaining customer trust and satisfaction, vertical consolidation proves particularly advantageous.

Current statistics indicate that organizations employing vertical unification strategies experience enhanced operational performance, with higher Z-Scores correlating to improved financial outcomes. Notably, Avato’s Hybrid Integration Platform guarantees 24/7 availability for vital connections, underscoring the importance of reliable systems in banking operations.

By maximizing the value of legacy systems and simplifying complex connections, we accelerate the merging of isolated systems using systems integration methods, establishing a connected foundation that bolsters operational efficiency. Successful examples in financial services, such as MVG’s utilization of Zabbix for IT infrastructure monitoring, illustrate how this combination fosters a cohesive environment that empowers banking IT managers to make informed decisions swiftly, ultimately benefiting the entire organization.

As Tony LeBlanc from the Provincial Health Services Authority remarked, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.” This perspective highlights the essential role of vertical unification in addressing challenges and enhancing decision-making within financial institutions.

What’s holding your team back from achieving similar success? We invite you to explore how our solutions can transform your operations.

Horizontal Integration: Enhancing Collaboration Between Systems

Horizontal unification is not just a strategy; it is a crucial approach for financial institutions, linking various networks and divisions to promote improved cooperation and information exchange. This approach is particularly vital for us, as we deploy various software solutions across functions such as customer relationship management (CRM) and financial reporting. By combining these platforms, we can obtain a complete view of customer information, simplify operations, and enhance our service provision.

Consider the unification of a CRM platform with a loan processing solution. This integration enables loan officers to quickly access extensive customer records, greatly accelerating loan approvals. Successful examples of horizontal amalgamation in financial institutions illustrate how systems integration methods not only enhance operational efficiency but also promote collaboration between banking systems. A significant case is the partnership between Flywire and Ellucian, which demonstrates how combining software solutions can reduce payment costs and secure transactions, ultimately aiding educational institutions.

The advantages of horizontal collaboration extend beyond mere efficiency; they encompass enhanced data accuracy and consistency, which are essential for informed decision-making. As we increasingly depend on data-driven strategies, the implementation of systems integration methods for effortlessly exchanging information across platforms becomes crucial. By 2025, we anticipate a heightened focus on horizontal collaboration, with statistics suggesting that the cost to assets in banking is projected to decline from 1.3% in 2023 to 0.9% by 2030. This decrease highlights the financial benefits of embracing these systems integration methods, as they enable us to distribute resources more efficiently.

Furthermore, we recognize that utilizing generative AI can significantly improve customer experience and operational effectiveness. With a 60% rise in the use of generative AI for customer interactions, we can create advanced chatbots and virtual assistants that enhance service delivery. Expert insights emphasize that developing a strong API strategy is essential for managing more than 1,000 connections, ensuring that we can adapt to changing technological environments. Additionally, Avato’s Hybrid Integration Platform offers features like real-time monitoring and alerts on performance, which are crucial for ensuring operational reliability and greatly lowering expenses. As industry analysts from Forrester, Gartner, Celent, Omdia, and IDC consistently acknowledge Avato’s category leadership, it becomes clear that collaboration between banking frameworks through horizontal unification not only improves our operational capabilities but also enables us to respond effectively to market demands, ultimately resulting in a more competitive advantage in the sector.

Point-to-Point Integration: Direct Connections for Efficiency

Point-to-point connection establishes direct links between two platforms, enabling efficient data transfer that is essential for tasks like transaction processing and account updates. This approach is particularly advantageous in scenarios demanding speed, such as connecting an online banking platform directly to a core banking network for real-time transaction processing. However, as the number of connections increases, scalability presents a significant challenge. We frequently encounter obstacles in managing numerous point-to-point connections, leading to increased complexity and maintenance costs.

In 2025, the effectiveness of point-to-point connections remains a central concern for our banking IT managers. Statistics reveal that organizations employing this method report customer satisfaction scores 31% higher than industry averages, underscoring its role in enhancing user experience through streamlined processes. Yet, we must heed expert warnings that without a strategic approach, the proliferation of direct connections can impede overall system performance and agility. This realization has prompted successful financial institutions to adopt systems integration methods, such as phased implementation and centralized API management, to address these challenges. These integration strategies not only improve the success rates of connections but also bolster security and developer efficiency, facilitating smoother API linkages. For instance, financial institutions that view APIs as strategic assets position themselves for success, transforming their service delivery and operational efficiency. The Google Cloud API Economy Report highlights that financial organizations investing in developer portals, comprehensive documentation, and sandbox environments experience 3.2x quicker partner onboarding, further emphasizing the importance of a robust API strategy.

Additionally, conducting API maturity evaluations is critical for us to ensure readiness in managing the complexities of connectivity. By utilizing Avato’s Hybrid Connection Platform, which features real-time monitoring and performance metric notifications, we can enhance the value of our legacy frameworks while simplifying intricate linkages and reducing costs. Moreover, addressing potential security issues related to open banking connectivity is crucial, as heightened security measures will be necessary to protect consumer information.

Ultimately, while point-to-point connectivity offers immediate benefits in speed and convenience, we must remain vigilant regarding its scalability challenges. By investing in comprehensive API strategies, effectively engaging stakeholders, and considering the long-term implications of our integration decisions, we can fully leverage the capabilities of our frameworks while maintaining a competitive edge.

Common Data Format Integration: Ensuring Compatibility Across Systems

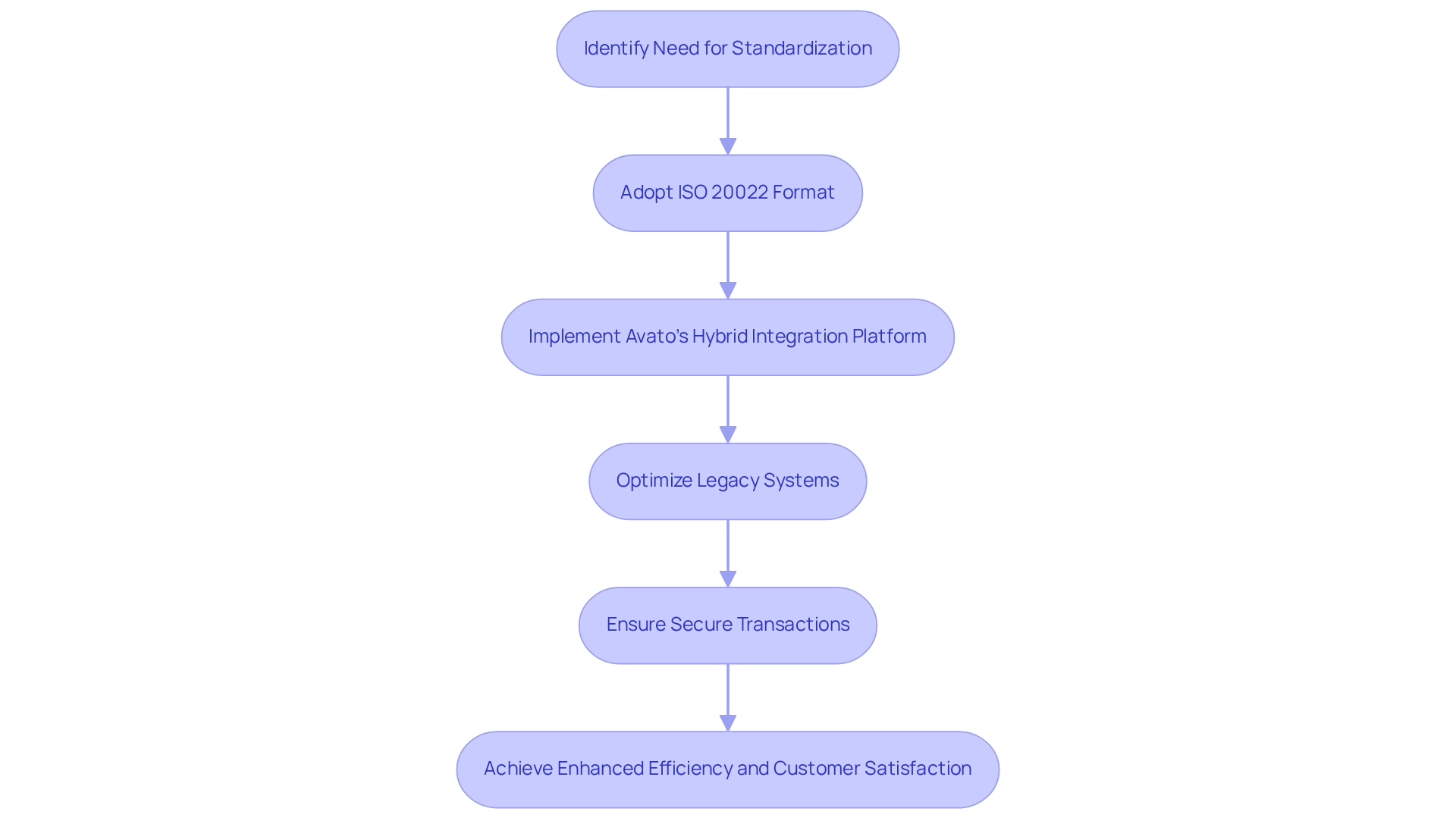

Common format unification is not just important; it is essential for standardizing structures across various banking platforms, ensuring seamless compatibility. As we look to 2025, the acceptance of standard formats becomes paramount, given that financial institutions increasingly rely on diverse frameworks that may utilize different information structures. By adopting standardized formats, such as ISO 20022 for payment messages, we can significantly enhance our information exchange processes, resulting in faster and more reliable transactions.

In this context, Avato’s hybrid integration platform plays a crucial role, enabling us to leverage systems integration methods that optimize the benefits of our legacy systems while streamlining complex integrations. Our platform’s architecture is meticulously designed for secure transactions, guaranteeing 24/7 uptime and reliability—critical factors for banking, healthcare, and government sectors. The significance of standard information formats cannot be overstated; they mitigate errors in financial transactions, often exacerbated by compatibility issues. Statistics indicate that these challenges account for approximately 30% of transaction failures, underscoring the urgent need for standardized formats.

Implementing common information formats allows us to optimize our operations and reduce the risk of costly errors. Successful implementations in financial institutions have yielded tangible benefits. For instance, institutions that have transitioned to ISO 20022 report enhanced efficiency in cross-border transactions, facilitating quicker processing times and improved customer satisfaction. Insights from Deloitte reinforce that updating legacy systems remains a challenge, yet information standardization is a strategic necessity for financial services, enabling organizations to remain competitive in a rapidly evolving landscape.

Case studies illustrate that institutions adopting common information formats experience substantial improvements in their operational capabilities. A recent initiative by a leading bank to standardize its information formats resulted in a 30% reduction in transaction errors and a significant increase in processing speed. Additionally, marketing functions in Sage X3 exemplify how standardized information management can drive operational efficiency and foster business growth. These outcomes highlight the vital role of unified information format integration in modern banking, particularly through the systems integration methods enabled by platforms like Avato, ensuring secure and effective system unification.

In conclusion, the integration of unified information formats is crucial for banking organizations striving to enhance their operational efficiency and reliability. As our sector continues to evolve, embracing standards such as ISO 20022, supported by Avato’s hybrid connection platform, will be vital for ensuring that financial institutions can meet client needs while minimizing risks associated with information incompatibility. Furthermore, a comparative analysis of JSON and XML formats will further illustrate the benefits of adopting standardized structures, enhancing interoperability and long-term cost savings.

Star Integration: Centralizing Connections for Simplified Management

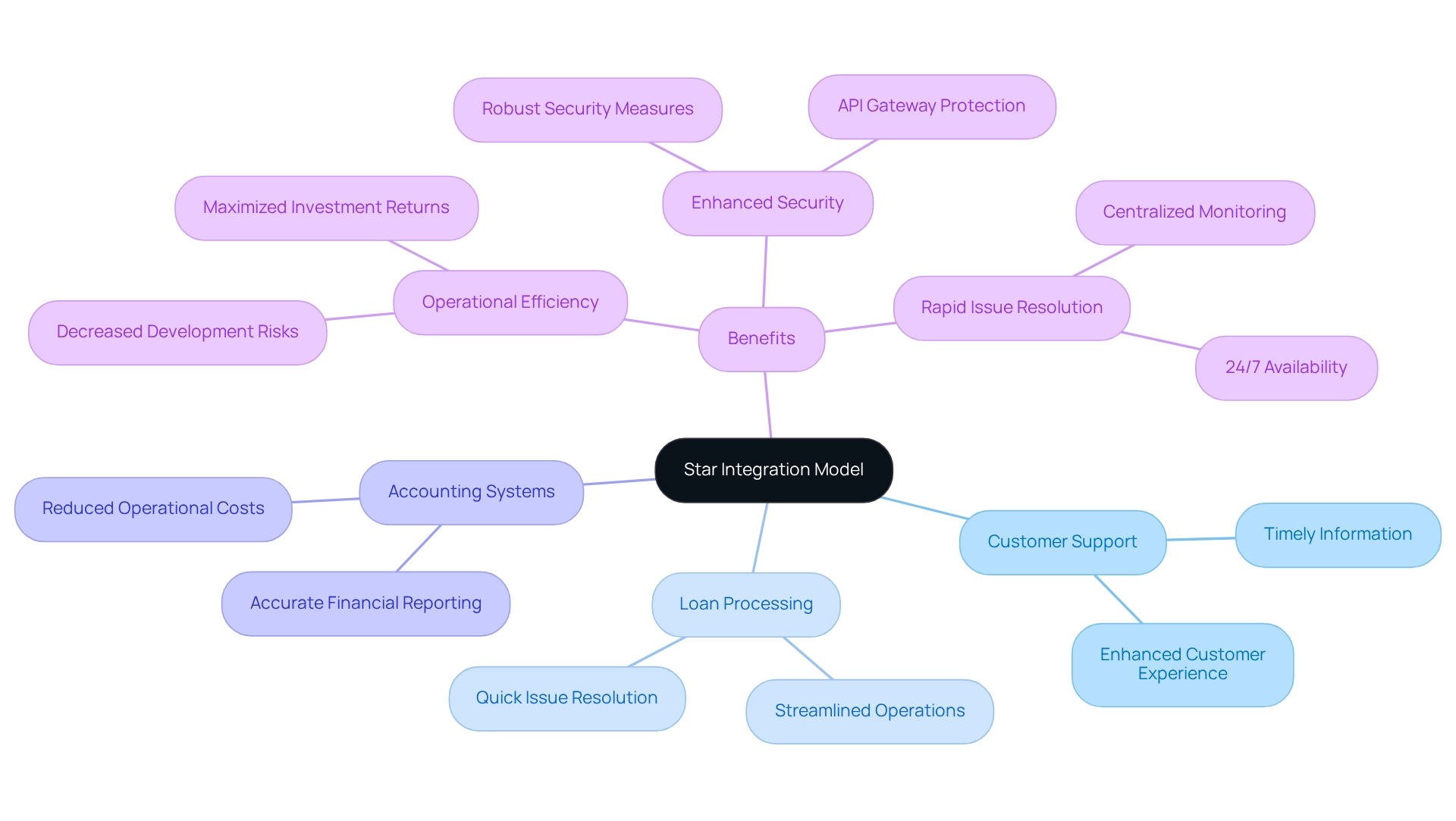

Star unification serves as a pivotal strategy for financial institutions, linking various networks to a central hub and enhancing the administration and oversight of information flows. This model significantly mitigates the complexity associated with point-to-point connections, as all communications are channeled through a single point. For us, as banking institutions, this centralization facilitates the rapid identification and resolution of issues, effectively minimizing downtime.

Consider a financial institution that implements a star connection model to link its customer support, loan processing, and accounting systems. This ensures that all departments have effective access to the same information. Not only does this enhance operational efficiency, but it also elevates the overall customer experience by providing timely and accurate information across various touchpoints.

The advantages of star unification extend beyond operational simplicity; it fosters a more secure environment. By centralizing connections, we can implement robust security measures at the hub, safeguarding sensitive financial data. Avato’s secure hybrid integration platform exemplifies this method, guaranteeing 24/7 availability and dependability for intricate networks in banking. A case study titled ‘API Gateway in Banking Security’ illustrates this point, where the gateway functions as a secure entry point for API requests, ensuring that only authorized access is granted to core banking infrastructure. This protective layer enhances security by authenticating requests and performing necessary checks, thereby mitigating risks associated with data breaches.

Statistics indicate that organizations employing star connectivity experience enhanced management efficiency, with many noting a considerable decrease in operational expenses and development risks. As the banking sector evolves in 2025, we believe that the star unification model will remain a vital strategy for enhancing connectivity and ensuring that banks can adapt to changing demands while maintaining a competitive edge. As Alex Kreger, Founder & CEO, aptly puts it, “Focus and simplicity as a mantra.” Our commitment to enhancing the value of legacy frameworks and streamlining intricate connections further underscores the operational efficiency that the star model can offer.

Hybrid Integration: Combining Methods for Complex Needs

Hybrid unification effectively combines various connection methods, such as point-to-point and common data format unification, to address the multifaceted needs of banking frameworks. This strategy is particularly advantageous for financial institutions that rely on a combination of legacy and modern technologies. By adopting hybrid connectivity, we can preserve the operation of our current frameworks while effortlessly incorporating new technologies. For instance, we may utilize hybrid connectivity to link our conventional core banking framework with cloud-based applications, thereby enhancing operational capabilities without compromising the reliability of our legacy infrastructure.

Current trends indicate that hybrid connectivity is becoming increasingly essential in the financial sector, with organizations acknowledging its potential to streamline operations and improve customer experiences. A significant case study underscores how Coast Capital, a financial institution, improved its operational efficiency through Avato’s hybrid unification solutions. Avato’s platform allowed the bank to support various interfaces and ease major transitions with minimal downtime, demonstrating the effective use of hybrid connection strategies in banking.

Expert insights suggest that we can achieve significant benefits, including reduced costs and enhanced agility, by utilizing systems integration methods that combine connection methods. As shown by Avato’s successful projects, like the smooth transition of Coast Capital’s telephone banking platform with only a 63-second outage, adjusting incorporation strategies to meet changing demands is crucial for preserving a competitive advantage in the financial industry. Organizations implementing hybrid approaches frequently indicate tangible enhancements in operational efficiency, including faster processing times and lower operational expenses.

By 2025, hybrid strategies will continue to develop, aiming to optimize the capabilities of both legacy and contemporary technologies. By adopting systems integration methods, we can manage the challenges of digital transformation while ensuring strong coherence that supports our long-term objectives.

Big Bang Integration: Complete Overhaul for Immediate Results

Big bang integration represents a bold approach, entailing the simultaneous implementation of a new framework across all departments, which leads to immediate operational changes. While this strategy can facilitate rapid improvements, it carries significant risks, including operational failures and potential data loss. For instance, consider a financial institution opting to replace its entire core banking infrastructure in one go; without careful management, this could result in considerable disruptions. Statistics reveal that operational failures during such transitions can reach alarming rates, with some studies indicating failure rates as high as 70%. This underscores the critical need for meticulous planning.

To mitigate these risks, we prioritize extensive testing prior to implementation. This involves conducting simulations to uncover potential issues and formulating robust contingency plans to tackle any challenges that may arise during the transition. Successful case studies in the financial sector, such as those involving Avato’s hybrid unification platform, illustrate that organizations investing in thorough preparation and risk management strategies can achieve seamless large-scale implementations. This ultimately enhances operational capabilities and reduces costs. Furthermore, Avato’s commitment to ensuring 24/7 availability for essential connections highlights the importance of reliability during these transitions, establishing it as a trusted partner for financial institutions.

Additionally, the Avato Hybrid Connection Platform not only enhances but also expands the value of legacy technologies, streamlining complex linkages while significantly lowering expenses. Expert opinions emphasize the importance of balancing speed with security, ensuring that the merging process does not compromise the integrity of the banking network. By implementing these strategies, we can effectively navigate the challenges of large-scale unification, reducing risks while maximizing the advantages of our new frameworks.

System Integration Testing: Validating Functionality and Performance

The integration methods for combining different components are not just important; they are essential for validating interactions among various elements, ensuring cohesive operation. This testing is crucial for identifying potential issues, such as data mismatches or performance bottlenecks, that could disrupt operations. In the banking industry, efficient framework testing not only avoids costly mistakes but also significantly enhances client satisfaction. For instance, comprehensive testing of the connection between our mobile app and core banking framework guarantees that transactions are processed accurately and without delay.

As we look ahead to 2025, the significance of integration testing in banking becomes increasingly clear, driven by the growing complexity of financial networks and the need for seamless functionality across platforms. Robust integration testing can prevent up to 70% of errors that might otherwise occur during system interactions, safeguarding both our institution’s reputation and customer trust. Moreover, applying schemas in information management can substantially reduce costs associated with errors, as early identification of problems is far less expensive than rectifying them post-decision. This underscores the financial advantages of implementing rigorous testing protocols.

A notable case study is the Bank of Luxemburg, which encountered significant challenges during a data conversion project. After struggling for nearly two years with another vendor, they completed the conversion successfully in just two months. A representative from the bank praised the quality of work, timeliness, cooperation, and communication, emphasizing the critical role of effective integration testing in achieving project success.

Expert insights highlight that validating system interactions is not merely a technical necessity but a strategic imperative within systems integration methods. As banking professional John Johnstone observed, “My bank had a very complex information conversion situation.” After working with another vendor for almost two years, we were able to rectify our data in a mere two months. This emphasizes the necessity for thorough testing procedures as part of our systems integration methods to ensure that all components function harmoniously, ultimately leading to enhanced customer experiences and operational efficiency. Additionally, leveraging generative AI can further enhance customer engagement and streamline operations, revolutionizing the banking landscape. For banking IT managers, engaging stakeholders to gather accurate requirements from the outset and employing the appropriate technology can significantly enhance our optimization strategies.

Challenges of System Integration: Anticipating and Mitigating Issues

System unification in the banking sector presents significant challenges, including compatibility issues of information, staff resistance to change, and the complexities of integrating legacy systems with modern applications. As we navigate these hurdles, it is crucial to anticipate potential obstacles and devise effective strategies to mitigate them.

Conducting thorough compatibility evaluations prior to unification allows us to identify data issues early, ensuring a smoother transition. Additionally, investing in comprehensive training and support for our staff is essential. This not only simplifies the transition but also fosters a culture of acceptance towards new technologies, which is vital for successful incorporation.

Statistics indicate that a significant percentage of incorporation projects fail due to resistance from staff, underscoring the need for proactive change management strategies. By involving our staff early in the process and clearly conveying the advantages of unification, we can greatly diminish opposition. Furthermore, developing a cohesive customer profile consolidates information for a comprehensive understanding of each client, highlighting the significance of unification in enhancing customer insights. Moreover, case studies reveal that organizations prioritizing employee participation and training achieve better results in their collaborative efforts. For instance, the case study titled ‘Value of Product Connections’ demonstrates how product connections enhance the value of solutions by facilitating more precise information storage, automating workflows, and improving features such as in-product analytics.

In 2025, we must also focus on embracing cloud-based information platforms and API-driven linkages to enhance information quality and streamline processes. Recent findings highlight that generative AI is revolutionizing customer engagement and operational efficiency in financial services, marking a significant shift in how institutions approach problem-solving and innovation. By directly addressing these prevalent challenges and employing advanced systems integration methods, we can not only enhance our unification capabilities but also maintain a competitive advantage in an increasingly digital environment.

Benefits of System Integration: Communicating Value to Stakeholders

System unification in banking presents a compelling opportunity for enhanced operational efficiency, improved data accuracy, and superior customer experiences. By leveraging systems integration methods, we can streamline processes, significantly reduce manual errors, and provide a more cohesive service to our customers. Studies indicate that organizations adopting unification solutions have experienced operational efficiency improvements of up to 30%, resulting in quicker transaction processing times and decreased customer wait periods.

The transformative impact of AI, particularly generative AI, is reshaping the financial services landscape. According to the NVIDIA 2025 State of AI in Financial Services survey, nearly 70% of firms reported at least a 5% revenue increase attributable to AI implementations, while over 60% noted cost reductions of 5% or more. This underscores AI’s dual role as both a revenue generator and an efficiency enhancer—essential for financial institutions striving to elevate their operational capabilities.

Effectively conveying these benefits to stakeholders is crucial for garnering support for our unification efforts. Presenting persuasive information, such as case studies demonstrating successful merging projects—where financial institutions achieved a 25% rise in customer satisfaction scores—illustrates the concrete value of investing in unification technologies. Furthermore, as highlighted by a Senior Specialist from the Local Environmental and Cultural Bureau, addressing economic and financial parameters in discussions with stakeholders is vital, as these factors often remain unaddressed yet significantly influence project outcomes.

In 2025, the advantages of systems integration methods for financial institutions are more pronounced than ever, as the economic landscape continues to evolve. The case study titled ‘Temporal Dynamics of Stakeholder Interaction’ emphasizes the importance of understanding stakeholder engagement practices throughout the lifecycle of collaborative projects. By utilizing Avato’s hybrid connection platform and adopting systems integration methods, we not only enhance our operational capabilities but also prepare ourselves to adapt to evolving market demands, ultimately preserving a competitive advantage. Engaging stakeholders with clear, data-informed narratives about the impact of merging on customer experience and operational success is vital for advancing these initiatives. Moreover, highlighting the significance of information management and training support ensures a seamless transition and enduring operational effectiveness, addressing potential concerns stakeholders may have regarding the integration process. As Tony LeBlanc from the Provincial Health Services Authority noted, “Avato accelerates the integration of isolated systems and fragmented data, delivering the connected foundation enterprises need to simplify, standardize, and modernize.

Conclusion

In the dynamic world of banking, we recognize that effective system integration is a fundamental driver of operational success. The exploration of various integration strategies—vertical, horizontal, point-to-point, common data formats, star integration, hybrid integration, big bang integration, and robust testing—highlights the unique benefits each method offers. By connecting disparate systems and enhancing communication, we can achieve streamlined operations, improved customer experiences, and increased efficiency.

Vertical integration fosters alignment across organizational levels, while horizontal integration enhances collaboration between systems. Point-to-point integration ensures rapid data exchange, although it requires careful management to avoid scalability issues. The adoption of common data formats is crucial for ensuring compatibility across systems, reducing transaction errors, and improving processing times. Star integration simplifies management by centralizing connections, while hybrid integration combines methods to meet complex banking needs. Although big bang integration can be risky, it can yield immediate results when executed with thorough planning and testing.

Ultimately, we cannot overstate the importance of system integration in the banking sector. As institutions continue to navigate legacy systems and emerging technologies, the ability to integrate effectively will define their competitive edge. By investing in comprehensive integration strategies and robust testing protocols, we can enhance operational performance, drive innovation, and deliver superior service to our customers. As the industry evolves, embracing these integration methods will be key to thriving in an increasingly digital landscape, ensuring that we remain agile and responsive to market demands.