Overview

Digital financial services (DFS) are rapidly becoming the preferred choice over traditional banking. Why? Because they offer unparalleled convenience, lower fees, and faster transaction capabilities—features that particularly resonate with tech-savvy users.

We recognize the growing consumer demand for personalized and efficient services, a trend that has only accelerated during the COVID-19 pandemic. This shift in user preferences toward digital solutions is not just a fleeting moment; it represents a significant transformation in how we engage with financial services.

As we move forward, we invite you to explore how our expertise can help you navigate this landscape and leverage the benefits of DFS for your own needs.

Introduction

The financial landscape is experiencing a seismic shift. As consumers increasingly embrace Digital Financial Services (DFS), traditional banking methods face growing scrutiny. With the rise of mobile applications and online platforms, DFS offers unprecedented convenience and accessibility, catering to a tech-savvy generation eager for instant transactions and seamless management of their finances.

What’s holding traditional banks back? They cling to established practices that prioritize personal relationships and face-to-face interactions. As the demand for innovative financial solutions surges, understanding the distinctions between these two paradigms becomes essential.

We invite you to explore the features, functionalities, and suitability of DFS versus traditional banking, as we delve into the evolving preferences of consumers in a rapidly digitalizing world.

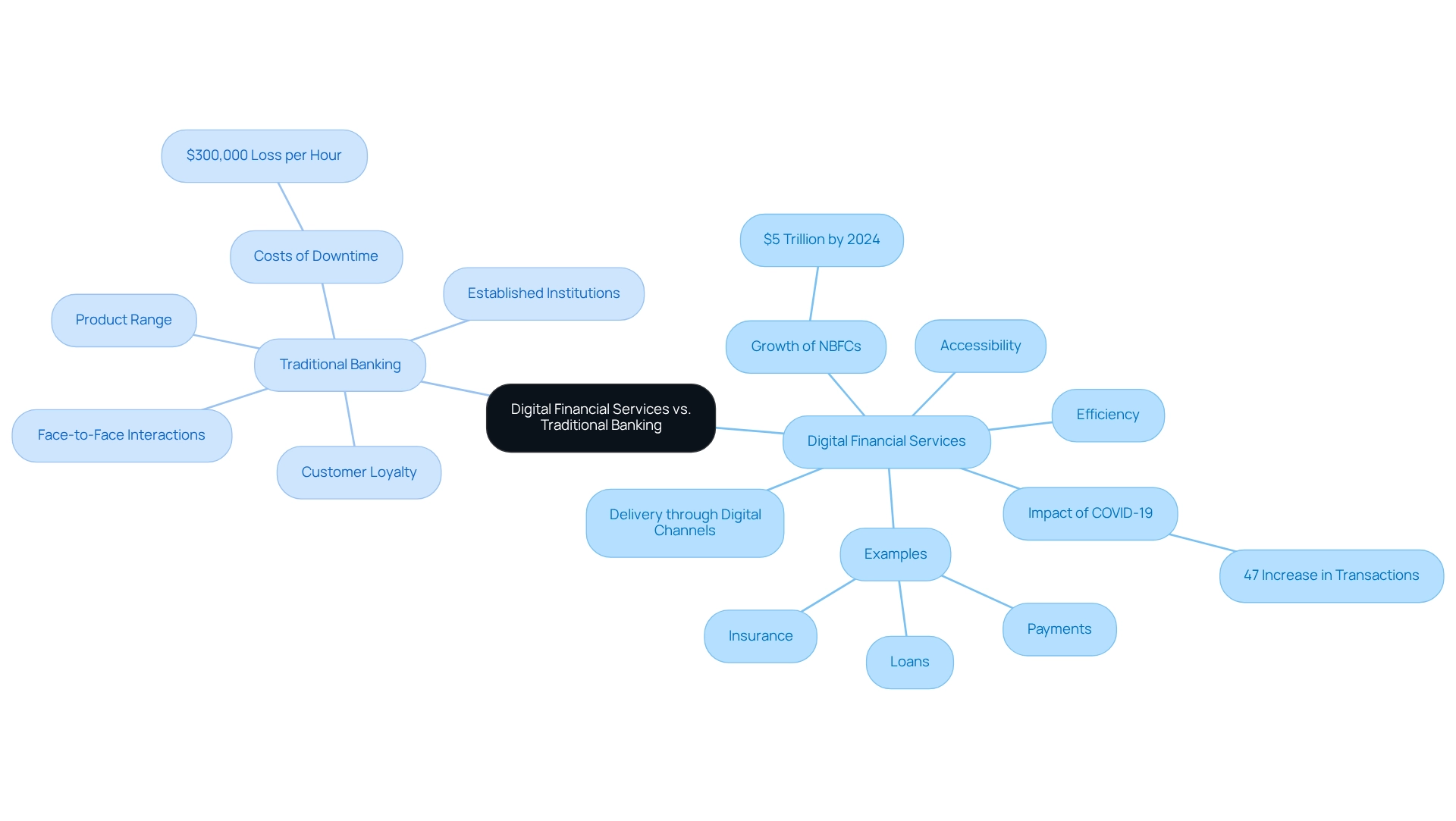

Define Digital Financial Services and Traditional Banking

Digital financial services (DFS) represent a transformative shift in monetary offerings, provided through digital financial channels such as mobile applications and online platforms. These services—encompassing digital financial payments, savings, loans, and insurance—are designed to enhance accessibility and efficiency for consumers. In contrast, Traditional Banking is characterized by established institutions operating through physical branches, offering a broad array of products including checking and savings accounts, loans, and investment options. Traditional banks emphasize personal relationships and face-to-face interactions, fostering trust and customer loyalty.

The core distinction between DFS and Traditional Banking lies in their delivery methods. DFS leverages technology to simplify processes and enhance user experience in the digital financial sector, while Traditional Banking relies on in-person interactions and established practices. By 2025, a significant number of customers are predicted to favor electronic banking options over conventional institutions, signaling a broader movement towards modernization in the financial landscape. This trend is underscored by the anticipated growth of Non-Banking Financial Companies (NBFCs), expected to reach $5 trillion by 2024, reflecting a robust demand for innovative monetary solutions.

Furthermore, the COVID-19 pandemic accelerated the adoption of digital financial applications, leading retail-facing companies to experience an average increase of 47% in gross values transacted in 2020, which showcases the resilience and growth potential of online monetary solutions today. The rise of card-linked wallets in e-commerce, particularly in markets like Singapore, exemplifies the growing trend of digital financial platforms and further highlights the shift in consumer preferences.

Additionally, the importance of reliable digital financial solutions is underscored by the fact that 86% of manufacturing companies report that just one hour of system downtime can lead to losses of at least $300,000, emphasizing the potential costs associated with interruptions in traditional banking systems. Our hybrid integration platform exemplifies how technology can facilitate this transition, empowering organizations to modernize their operations and enhance connected experiences. By partnering with managed solution providers globally, we accelerate technological transformation, ensuring that enterprises can seamlessly integrate diverse systems and unlock new business value.

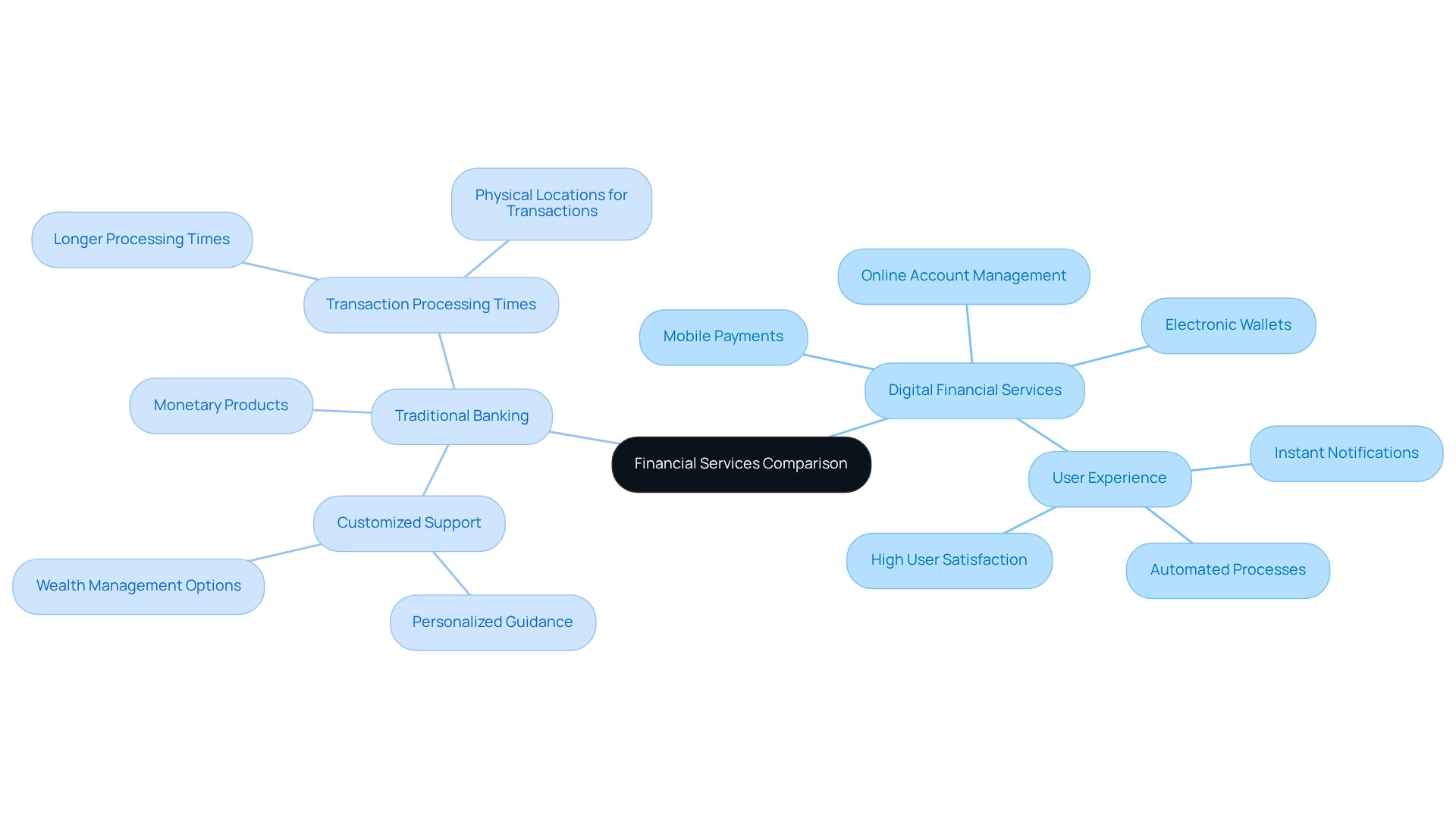

Compare Key Features and Functionalities

Digital financial services (DFS) redefine accessibility, empowering our users to conduct digital financial transactions anytime, anywhere. With intuitive interfaces, instant notifications, and automated processes, we significantly enhance the user experience. Our key functionalities include mobile payments, electronic wallets, and comprehensive online account management, all designed to meet the rising demand for convenience and efficiency. In contrast, traditional banking emphasizes customized customer support, a diverse range of monetary products, and physical locations for cash deposits and withdrawals. While conventional banks excel in personalized guidance and wealth management options, they often fall short in promptness and ease compared to their digital counterparts. Furthermore, traditional financial systems frequently encounter longer transaction processing times, whereas digital financial systems deliver instantaneous capabilities that align with modern consumer expectations.

As consumer preferences shift—80% of individuals indicate a desire for tailored monetary solutions—the divide between these two economic paradigms continues to grow, underscoring the importance of innovation in our sector. Notably, banks like Monzo and Revolut lead the way by offering customized budgeting tools and spending insights, demonstrating how digital financial services cater to consumer needs for personalized economic solutions. Additionally, the increasing use of Artificial Intelligence in digital finance, as highlighted by Alex Malyshev, facilitates customized services such as personalized advice and automated customer assistance. The rapid adoption of open financial APIs opens new avenues for innovation, highlighting the need for strategic integration approaches that ensure secure and efficient connections between applications.

This is where our hybrid integration platform at Avato becomes crucial, enabling financial institutions to modernize their systems while addressing data privacy concerns. Key features of our platform include:

- Seamless integration with existing legacy systems

- Enhanced security protocols to protect consumer data

- Support for open financial standards to facilitate data sharing

- Scalable solutions that grow with your business needs.

With mobile financial services users projected to reach 3.8 billion by 2025, our reliance on digital financial services continues to expand, further illustrating the shift in consumer behavior. User satisfaction levels for digital financial solutions are increasingly favorable compared to conventional banks, emphasizing the necessity for traditional institutions to adapt to these evolving expectations.

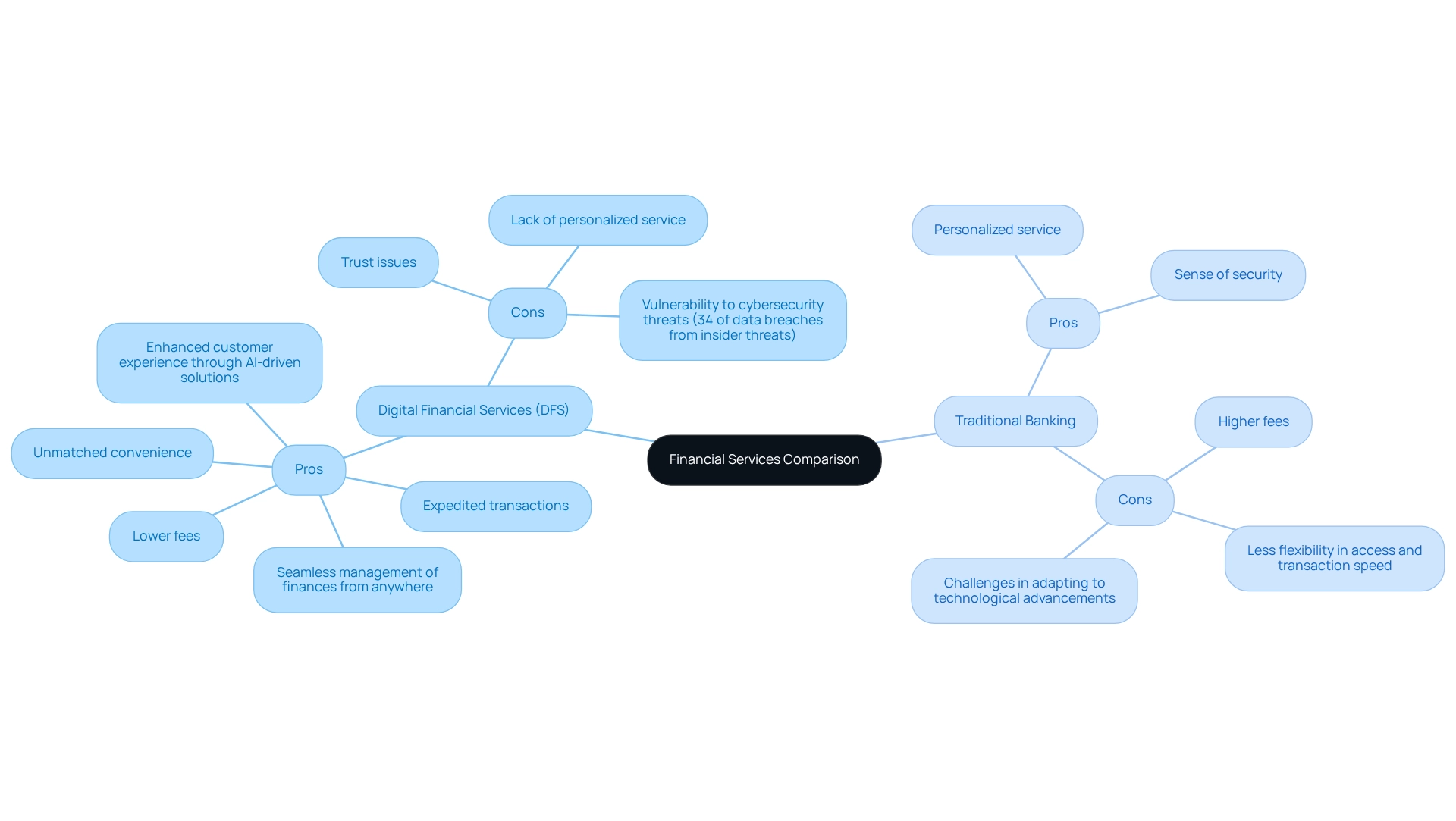

Evaluate Pros and Cons of Each System

Digital financial services (DFS) provide a compelling array of advantages, including lower fees, expedited transactions, and unmatched convenience. We empower users to manage their finances seamlessly from virtually anywhere, often with minimal or no transaction fees. Yet, we recognize that digital financial services may sometimes lack the personalized assistance and trust that traditional banking institutions typically provide. The integration of generative AI is beginning to address these challenges, with a remarkable 60% increase in its use for enhancing customer experience, particularly through the development of sophisticated chatbots and virtual assistants that deliver personalized support. Furthermore, more than half of industry professionals now leverage generative AI for document processing and report generation, streamlining operations and boosting productivity across various departments. This technological advancement plays a crucial role in mitigating some of the trust issues and gaps associated with digital financial systems. For instance, case studies demonstrate that institutions utilizing generative AI have significantly improved customer satisfaction scores, as these AI-driven solutions tailor interactions based on individual customer needs. Nevertheless, we must remain vigilant, as these digital financial offerings are still vulnerable to cybersecurity risks; insider threats account for approximately 34% of all data breaches in banking institutions, highlighting the substantial dangers linked to digital financial services. Conversely, Traditional Banking excels in providing tailored assistance and a sense of security, which many customers highly value. However, this often comes at a cost, with higher fees and reduced flexibility regarding access and transaction speed. Traditional banks may also struggle to adapt to technological advancements, resulting in longer wait times for services and a lack of innovative offerings. As the digital landscape evolves, traditional banks must navigate these challenges to stay competitive, particularly as cybersecurity trends drive the development of new financial products.

Pros and Cons of Digital Financial Services (DFS):

- Pros:

- Lower fees

- Expedited transactions

- Unmatched convenience

- Seamless management of finances from anywhere

- Enhanced customer experience through AI-driven solutions

- Cons:

- Lack of personalized service

- Trust issues

- Vulnerability to cybersecurity threats (34% of data breaches from insider threats)

Pros and Cons of Traditional Banking:

- Pros:

- Personalized service

- Sense of security

- Cons:

- Higher fees

- Less flexibility in access and transaction speed

- Challenges in adapting to technological advancements

Statistics reveal that 49% of Gen X individuals have three or more finance-related apps on their phones, indicating a clear shift towards digital solutions. This trend is further reinforced by case studies indicating that over 79% of Americans are expected to utilize digital financial services online by 2029, underscoring the increasing dependence on digital solutions and the necessity for financial institutions to adapt to evolving consumer behaviors. Additionally, online banking customers report higher satisfaction levels than their traditional banking counterparts, with 80% expressing contentment with their experiences, thereby reinforcing the advantages of digital financial services. In summary, while digital financial services offer significant benefits in terms of cost and convenience, they also face challenges related to cybersecurity and customer support. The integration of generative AI can enhance customer experience and operational efficiency, effectively addressing some of these challenges. On the other hand, Traditional Banking shines in personalized assistance but grapples with flexibility and innovation. Understanding these dynamics is crucial for financial institutions aiming to thrive in the ever-evolving landscape of financial services.

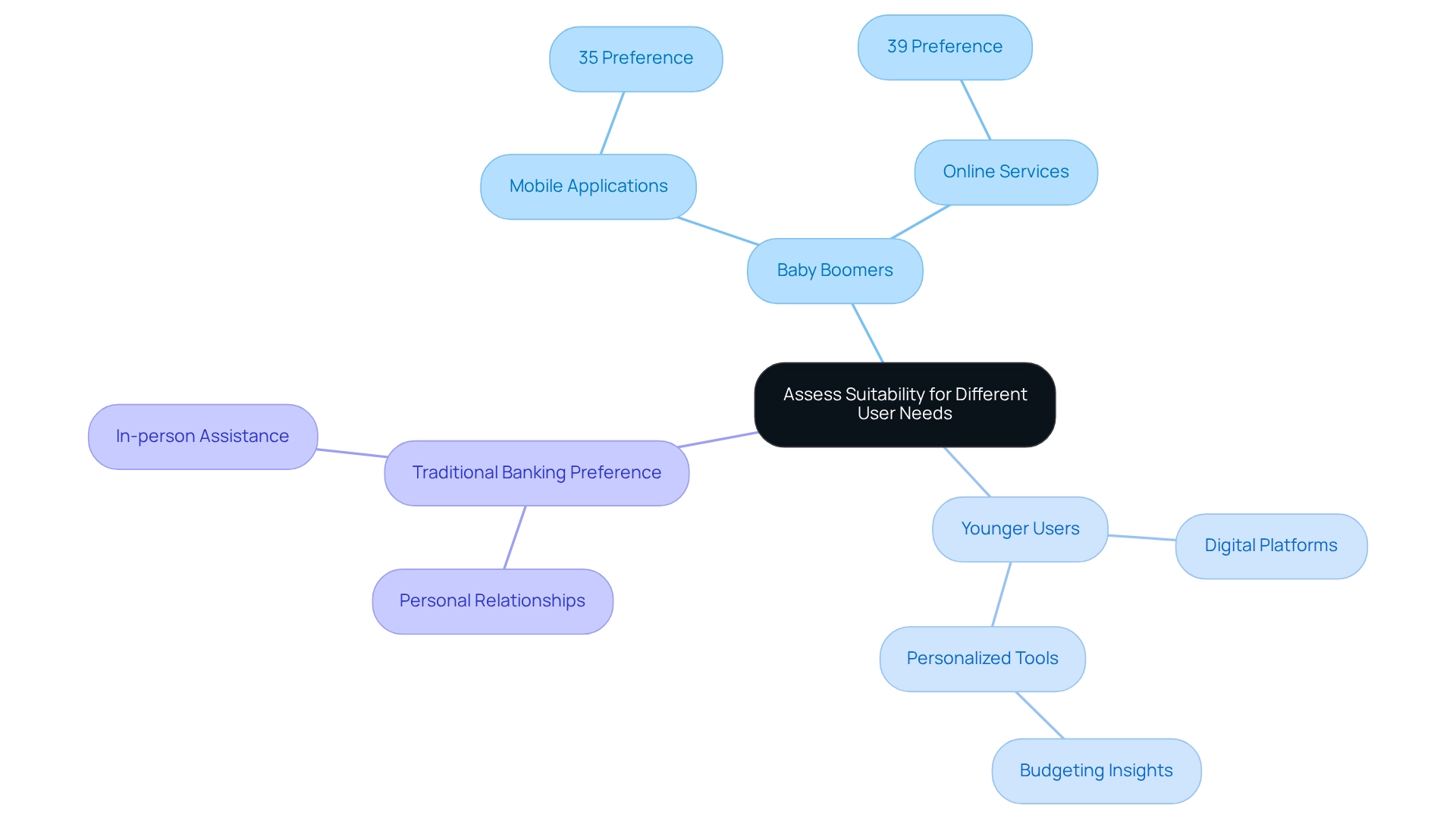

Assess Suitability for Different User Needs

Digital financial services signify a crucial transformation in our financial engagement, especially attracting tech-savvy users who value convenience and speed. In 2024, we observed that 35% of Baby Boomers expressed a preference for mobile financial applications, highlighting a significant transition towards online solutions, even among older demographics. Furthermore, 39% of Baby Boomers favor online financial services, illustrating the evolving landscape of consumer preferences. Conversely, Traditional Banking remains a viable option for individuals who value personal relationships and require in-person assistance, particularly for older generations and those in rural areas with limited internet access, who often prefer the established presence and familiarity of traditional banks.

The suitability of Digital Financial Services varies across different user needs. Younger users, generally more comfortable with technology, benefit from the immediacy and efficiency of digital platforms. For instance, banks like Monzo and Revolut offer personalized budgeting tools and spending insights, enhancing engagement and catering to the preferences of tech-savvy users. In contrast, individuals who seek a more personal touch in their financial experience may find Traditional Services more aligned with their expectations. This demographic variety underscores the importance of comprehending user preferences and economic literacy when assessing financial choices. Furthermore, the COVID-19 pandemic has accelerated the acceptance of digital financial services, reshaping consumer perspectives and making online transactions a necessity for many. As a result, we are increasingly integrating personalized tools, such as budgeting insights, to enhance user engagement. However, the human aspect remains vital; studies suggest that while AI can enhance financial processes, the demand for personal financial guidance persists, especially for complex financial decisions. The case study titled ‘The Human Touch In A Digital Age’ emphasizes this necessity, reinforcing our argument about the varying needs of different demographics. Ultimately, the choice between digital financial services and traditional banking hinges on individual preferences, specific banking needs, and varying levels of comfort with technology.

Conclusion

The financial landscape is undeniably evolving. We are witnessing Digital Financial Services (DFS) rapidly gaining traction over traditional banking methods. DFS offers unparalleled convenience, 24/7 accessibility, and lower fees, appealing to a tech-savvy consumer base that values instant transactions and seamless management of finances. This shift towards digital solutions is not merely a trend; it is a significant transformation driven by consumer demands for efficiency and personalization.

In contrast, traditional banking still holds value for those who prioritize personal relationships and the security that comes from in-person interactions. While these institutions excel in providing tailored financial advice, they often struggle with the flexibility and immediacy that modern consumers expect. The data suggests that the gap between these two paradigms continues to widen, indicating a pressing need for traditional banks to innovate and adapt to the changing preferences of their customers.

Ultimately, the decision between DFS and traditional banking is not a one-size-fits-all scenario. It depends on individual user needs, comfort with technology, and the importance placed on personal service. We must recognize these dynamics and strive to integrate the best features of both worlds to cater to a diverse clientele. The future of banking lies in embracing digital innovation while maintaining the human touch that builds trust and loyalty. As this landscape continues to evolve, staying attuned to consumer preferences will be crucial for our success in the financial sector.