Overview

In today’s rapidly evolving financial landscape, the choice of a core banking provider is paramount. We understand that core banking systems are not merely operational tools; they are vital for enhancing efficiency and adapting to market changes. By comparing various banking core providers, we can identify features, benefits, and suitability tailored to the unique needs of large banks, regional institutions, fintech companies, and community banks. This tailored approach facilitates improved service delivery and ensures regulatory compliance.

What challenges are you facing in your current banking operations? We recognize that each institution has distinct requirements, and our analysis reveals that the right core banking solution can significantly streamline processes and enhance customer satisfaction. By leveraging the expertise of specialized providers, we can unlock the potential for better performance and agility in your operations.

As a result, choosing the appropriate core banking system is not just a decision; it is a strategic move that can redefine your institution’s capabilities. We encourage you to explore the possibilities with us and take the first step toward transforming your banking operations for the better.

Introduction

In the rapidly evolving landscape of financial services, we recognize core banking systems (CBS) as essential tools for institutions striving to enhance operational efficiency and customer satisfaction. These centralized platforms not only streamline vital banking functions but also adapt to the demands of a digital-first world, allowing us to respond swiftly to market changes.

As the adoption of CBS continues to grow, innovations such as Avato’s hybrid integration platform illustrate how legacy systems can be transformed to unlock new business value. This article delves into the key features, benefits, and suitability of various core banking solutions, highlighting their pivotal role in shaping the future of banking amidst increasing competition and evolving customer expectations.

What’s holding your team back from leveraging these advancements? We invite you to explore how embracing these solutions can position your institution for success.

Understanding Core Banking Systems

Banking core providers are the backbone of financial institutions, empowering us to manage operations efficiently across multiple branches. These centralized platforms enhance essential banking functions, including account management, transaction processing, and client relationship management. As we look toward 2025, the adoption of CBS is poised to rise, with a significant percentage of financial institutions recognizing their critical role in boosting operational efficiency and service quality.

Modern CBS are increasingly designed to be flexible and scalable, often leveraging cloud technology to enhance performance and accessibility. This evolution not only facilitates real-time data access but also supports the swift deployment of new services, which is essential in today’s fast-paced financial landscape. Industry experts underscore that centralized platforms are vital for effective operations management, as they provide a unified view of customer interactions and streamline processes across various channels.

Our hybrid integration platform, Avato, plays a crucial role in this landscape by maximizing and extending the value of legacy frameworks. We simplify complex integrations, enabling financial institutions to unlock isolated assets and create substantial business value. Key features of Avato’s platform include real-time monitoring and alerts on system performance, significantly reducing costs and enhancing operational efficiency. For instance, Fiserv, Inc. recently improved access to its core financial APIs, allowing over 500 developers to collaborate on innovative use cases, thus accelerating innovation within the financial services sector. Such initiatives highlight the transformative potential of CBS in driving technological advancement in finance. Moreover, Gustavo Estrada remarked that ‘Avato has the capability to simplify intricate projects and provide outcomes within preferred deadlines and financial limitations,’ emphasizing the efficiency of CBS in managing complex financial operations.

As we navigate the complexities of digital transformation, the role of banking core providers becomes increasingly pivotal. We not only enhance operational efficiency but also enable financial institutions to adapt to changing market demands and maintain a competitive edge. Avato’s platform accelerates this digital transformation through secure and efficient system integration, ensuring that banks can leverage their CBS effectively. Key players in the U.S. fintech industry, such as Finastra and Fidelity National Information Services, Inc. (FIS), are also developing advanced technologies that further enhance CBS capabilities, ensuring their relevance in the digital age. Current statistics reveal an increasing adoption rate of CBS among financial institutions, reinforcing their essential role in the future of finance.

Key Features of Leading Core Banking Providers

Leading banking core providers such as Temenos, Finastra, and Oracle deliver a diverse array of features tailored to meet the evolving demands of the banking sector. We understand that scalability is a critical attribute that enables banks to expand in response to growing transaction volumes and customer bases. This adaptability is essential for us to maintain operational efficiency as market conditions change.

Furthermore, our modular architecture allows banks to implement only the necessary components, simplifying upgrades and enhancing customization. This enables institutions to tailor their systems to specific needs, ensuring they remain competitive in a rapidly evolving landscape.

Real-time processing capabilities are essential for contemporary banking operations. They facilitate immediate transaction handling and enhance client interactions, thereby improving overall service delivery. For instance, Bank of America utilizes SAS Analytics for risk management and fraud detection, showcasing the importance of real-time capabilities in safeguarding operations.

In addition, robust security features, including encryption and multi-factor authentication, are vital for safeguarding sensitive customer information against increasing cyber threats. We recognize that the capacity to smoothly connect with external applications and legacy platforms is essential for banks looking to modernize their operations without undergoing complete infrastructure overhauls. Avato’s Hybrid Integration Platform illustrates this ability, allowing institutions to enhance and broaden the value of their legacy technologies while simplifying intricate integrations and substantially lowering expenses. This flexibility supports a smoother transition to more advanced technologies, as demonstrated by InvestGlass, which integrates seamlessly with any core financial platform to drive digital transformation and improve client engagement.

Moreover, Avato’s platform offers real-time monitoring and notifications regarding performance, ensuring that financial institutions can proactively tackle issues and sustain optimal operational efficiency.

The importance of modular architecture in financial systems is emphasized by industry insights, which highlight that institutions utilizing banking core providers can attain operational excellence and increased client satisfaction. Case studies illustrate how banks that prioritize scalability and modularity can enhance their operational efficiency with our support while meeting regulatory requirements and customer expectations. For example, financial institutions that collaborated with Avato have reported enhanced adaptability in the swiftly changing financial environment. Gustavo Estrada observed that ‘Avato has the ability to simplify complex projects and deliver results within desired time frames and budget constraints.’ This demonstrates the concrete advantages of these essential features and the significance of choosing the appropriate financial software to drive institutions towards operational excellence.

Benefits of Different Core Banking Solutions

Different core banking solutions present unique advantages that can significantly influence our operations.

- Cost Efficiency: Our hybrid integration platform enables us to unlock isolated assets and streamline operations, leading to substantial cost savings. Solutions designed with competitive pricing models can lower operational costs, particularly benefiting smaller institutions. Recent statistics reveal that financial institutions implementing modern core solutions can achieve up to a 30% reduction in operational costs, enhancing their financial sustainability. Moreover, the South American market is set for steady growth due to the increasing acceptance of digital financial solutions, underscoring the importance of affordable frameworks in this region.

- Improved Client Experience: Modern core financial platforms (CFP) feature user-friendly interfaces and expedited service delivery, crucial for enhancing client satisfaction and loyalty. We observe that institutions adopting these solutions report a 25% increase in client satisfaction ratings, directly correlated to improved user experiences. As one of our clients, Gustavo Estrada, stated, “Avato has the capacity to streamline intricate projects and deliver results within preferred timelines and financial limits,” highlighting the practical benefits of efficient core financial solutions. Furthermore, the integration of generative AI tools within these systems enhances personalized service delivery, transforming customer interactions and offering tailored financial advice.

- Regulatory Compliance: Many core financial service providers integrate compliance functionalities that assist us in navigating the complexities of evolving regulations, thereby reducing the risk of costly penalties. This proactive compliance approach is vital in today’s regulatory landscape, especially as we face increasing scrutiny and challenges. Our solutions ensure that compliance is seamlessly integrated into our operational framework, alleviating the burden on financial institutions.

- Innovation Enablement: Cloud-native solutions empower us to swiftly deploy new services and features, ensuring we remain competitive in a rapidly changing market. The ability to innovate quickly is becoming increasingly essential, with predictions suggesting that institutions leveraging such technologies will capture a larger market share by 2025. Our hybrid integration platform facilitates this innovation by providing the necessary infrastructure for flexible and scalable AI applications.

- Utilization of Client Information: The importance of client data in financial software cannot be overstated. By leveraging client data, we can offer customized financial products and enhance security, ultimately improving user experiences. This aligns with the growing trend of personalization in financial services, where core banking providers like us enable superior data management and insights through our integration capabilities.

These advantages highlight the critical importance of selecting the right core financial solution to enhance operational efficiency and customer engagement in the financial sector.

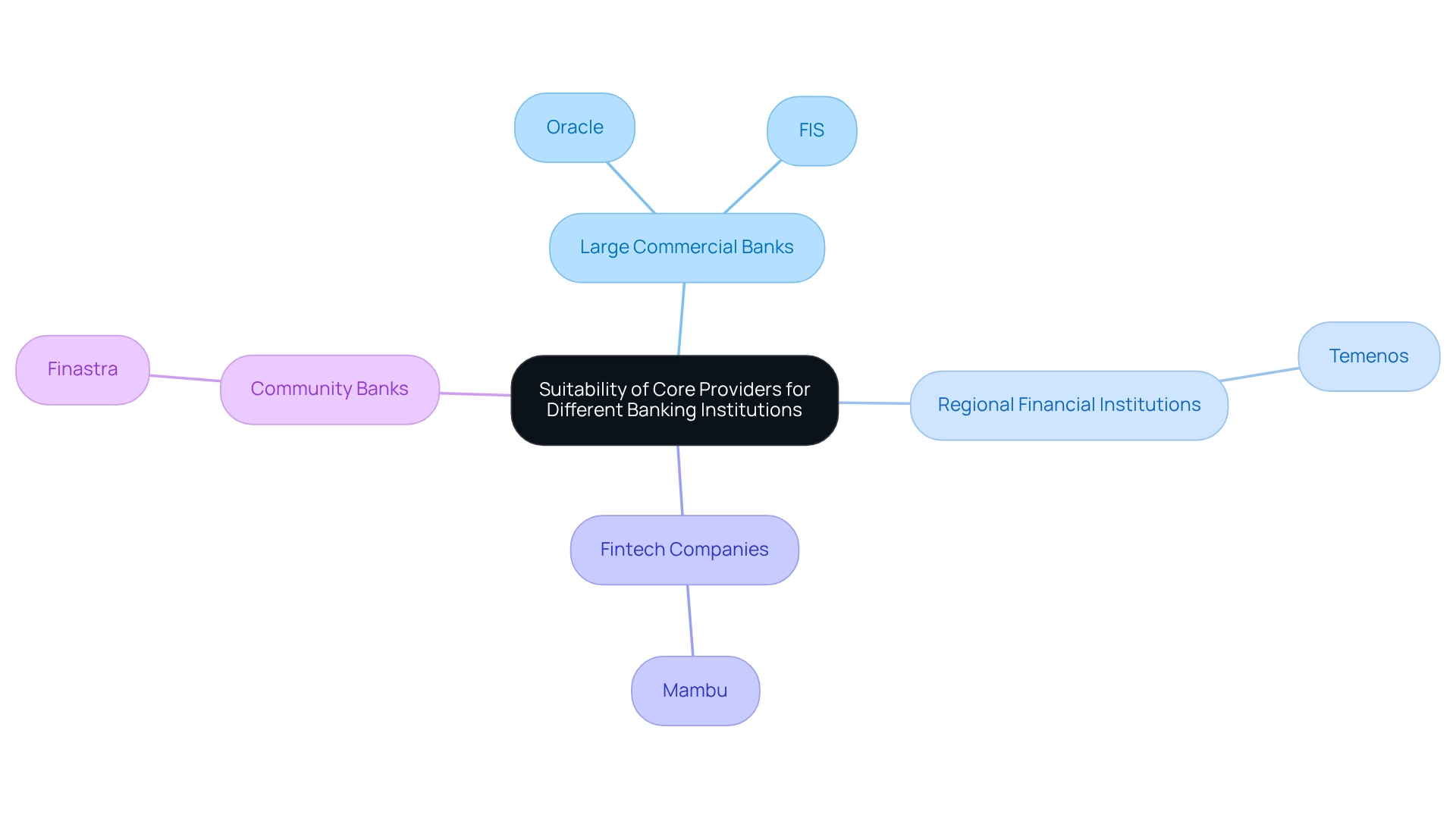

Suitability of Core Providers for Different Banking Institutions

The suitability of core banking providers is a critical consideration for banking institutions. Large commercial banks require robust features and scalability, which is why providers like Oracle and FIS excel in this arena. Their comprehensive solutions are designed to handle large transaction volumes and complex operational demands, ensuring efficiency and reliability for major financial institutions.

For regional financial institutions, flexibility and modularity are paramount. Solutions such as Temenos allow these institutions to customize their systems to meet local requirements without incurring excessive costs. This adaptability is essential as they strive to offer personalized services while maintaining regulatory compliance.

Fintech companies, often new entrants in the financial sector, leverage cloud-native solutions like Mambu. These platforms facilitate rapid deployment and seamless integration, which are essential for fintechs aiming to remain agile and responsive in a fast-evolving market.

Community banks benefit from providers that offer cost-effective solutions with essential features. For instance, Finastra provides tools that enable community financial institutions to compete effectively with larger counterparts, ensuring they can deliver quality services to their customers. As community financial institutions increasingly utilize specialized core solutions, they enhance their ability to provide personalized services while ensuring regulatory compliance.

As the banking landscape continues to evolve, understanding the specific needs and preferences of different banking institutions is vital for selecting the most suitable core banking providers. We recognize that Avato’s hybrid integration platform plays a crucial role in this context, simplifying complex integrations and enhancing business value, especially for banks looking to modernize their systems. We are committed to addressing intricate challenges in a remarkably simpler manner, guaranteeing a strong dedication to building the technological framework necessary for enriched, connected user experiences. According to Gustavo Estrada, a customer, ‘Avato has simplified complex projects and delivered results within desired time frames and budget constraints,’ highlighting the significance of effective integration solutions in the financial industry. Furthermore, the third-party Banking Software Market report underscores important trends that emphasize the need for financial institutions to modify their core systems to satisfy evolving requirements. The impact of COVID-19 on financial institutions has prompted a reevaluation of core banking solutions, as banks navigate the challenges posed by the pandemic and seek to enhance their operational resilience.

Conclusion

Core banking systems (CBS) are not just important; they are essential for financial institutions that seek to enhance operational efficiency and customer satisfaction. In a digital-first world, we must centralize essential functions to adapt swiftly to evolving demands. Innovations such as Avato’s hybrid integration platform demonstrate how legacy systems can be transformed, unlocking new business value while enhancing flexibility and scalability.

The advantages of modern core banking solutions are substantial. They deliver cost efficiency, elevate customer experiences, ensure regulatory compliance, and empower rapid innovation. By effectively utilizing customer data, we can offer personalized services that resonate with today’s digital consumers, ultimately leading to increased satisfaction and loyalty.

Choosing the right core banking provider is crucial for all institutions, whether they are large commercial banks or community banks. Each faces unique challenges that necessitate tailored solutions. As the banking landscape evolves, leveraging innovative technologies and integration capabilities will be vital for successful digital transformation.

In essence, the future of banking is intricately linked to the effective implementation of core banking systems. By investing in the right technologies, we can enhance our operational efficiency and position ourselves for long-term success in a competitive market. Embracing these advancements now will pave the way for a more resilient and customer-centric banking experience.