Overview

This article presents a comprehensive comparison of leading banking software companies, focusing on their features, pricing, and performance. It highlights the pivotal role of technology in transforming financial services. How can banking software companies thrive in a rapidly evolving landscape? The answer lies in advancements such as:

- AI integration

- Customizable solutions

- Robust security measures

These elements are not just enhancements; they are essential for meeting the increasing demands of customers and adhering to regulatory requirements. As a result, these innovations significantly improve operational efficiency and user satisfaction. By embracing these technologies, banking software companies position themselves to excel in a competitive market. The question remains: are you ready to leverage these advancements to elevate your financial services?

Introduction

In the rapidly evolving world of finance, banking software has emerged as a critical component that shapes how financial institutions operate and interact with customers. As digital transformation accelerates, banks are increasingly reliant on sophisticated applications to streamline operations, enhance customer experiences, and maintain compliance with stringent regulations.

With projections indicating substantial growth in the banking software market, understanding the diverse types of software available, their key features, and the importance of security and customization becomes paramount. This article delves into the multifaceted landscape of banking software, exploring emerging trends, pricing models, and the essential metrics for evaluating performance.

Furthermore, it highlights the pivotal role of innovative solutions like Avato’s hybrid integration platform in driving operational efficiency and meeting the unique needs of modern banking institutions.

Are you ready to transform your banking operations and elevate customer satisfaction? Let’s explore the transformative potential of banking software together.

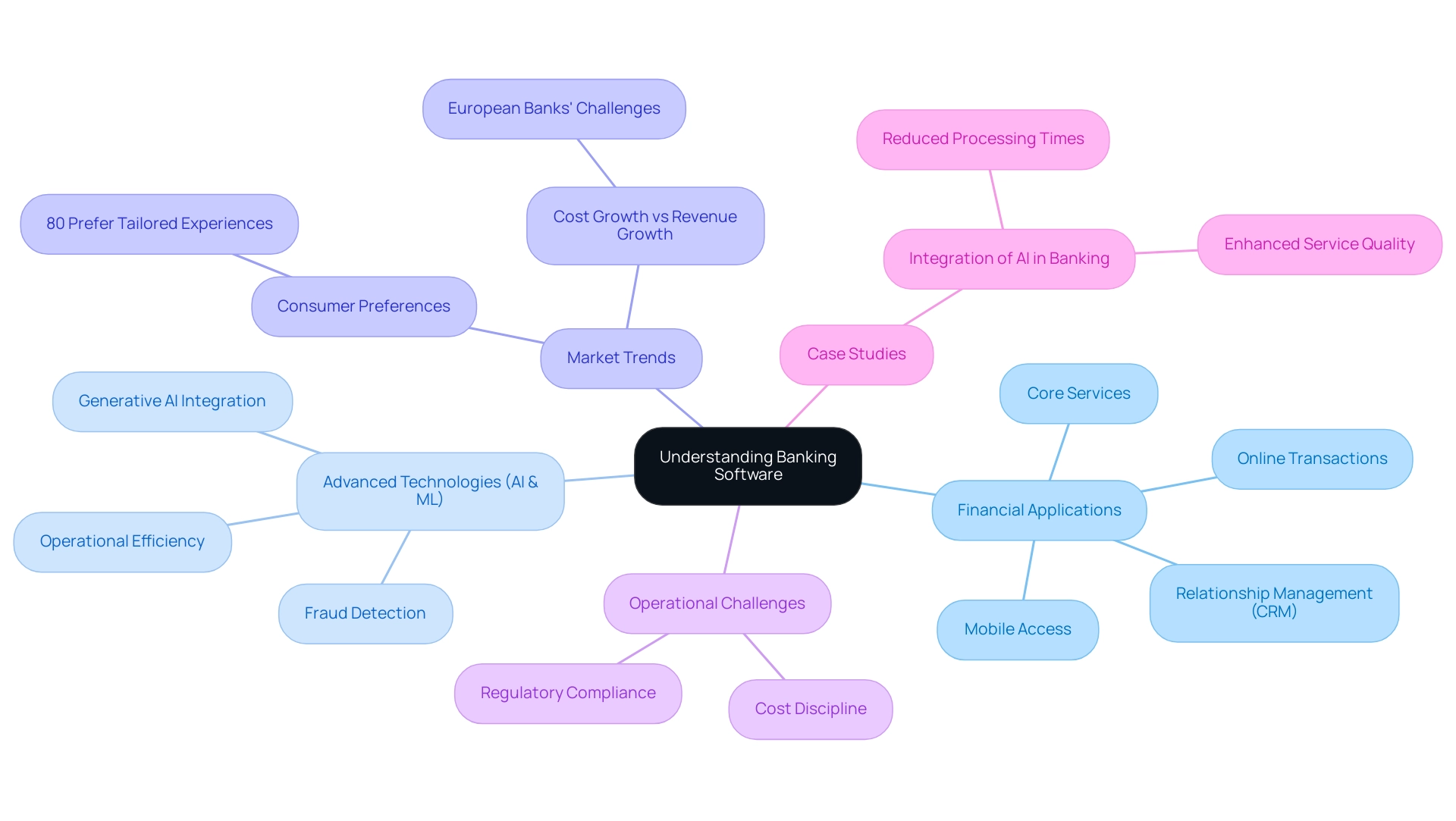

Understanding Banking Software: An Overview

Financial applications encompass a diverse array of tools designed to streamline various financial operations, including core services, online transactions, mobile access, and relationship management (CRM). These systems are essential for effectively managing accounts, processing transactions, and ensuring compliance with stringent regulatory standards. As the banking sector evolves, the incorporation of advanced technologies such as artificial intelligence (AI) and machine learning (ML) by banking software companies is increasingly common, significantly improving both operational efficiency and user experience.

In 2025, banking software companies are poised to achieve a considerable market size, fueled by the rising demand for personalized services. Notably, 80% of consumers now favor customized financial experiences, prompting institutions to adopt innovative solutions that cater to these preferences. The integration of generative AI is revolutionizing customer interactions, enabling financial institutions to offer personalized services and enhance fraud detection capabilities.

This technological advancement is expected to enhance service quality and reduce processing times, ultimately leading to a more efficient financial operation.

Recent trends indicate that European financial institutions are navigating a challenging landscape, with cost growth anticipated to surpass revenue growth as they approach 2025. Deutsche Bank reported a first-half 2024 profit before tax of €2.4 billion, underscoring the financial context in which these banks operate. This scenario highlights the necessity for stronger cost discipline and the adoption of efficient solutions provided by banking software companies.

Case studies illustrate the successful integration of AI in financial services, showcasing how institutions leverage these technologies to streamline operations and enhance customer satisfaction. As Gustavo Estrada noted, Avato is recognized for its ability to simplify complex projects and deliver results within desired time frames and budget constraints.

Avato’s hybrid integration platform plays a crucial role in this landscape by maximizing and extending the value of legacy systems, handling complex integrations with ease, and providing real-time monitoring and alerts on system performance. This ensures that financial institutions can maintain 24/7 uptime and dependability, which is vital for intricate systems in healthcare and government sectors.

The significance of financial applications in operations cannot be overstated. They serve as the backbone of banking software companies, facilitating seamless transactions and ensuring compliance with evolving regulations. As banks continue to navigate the complexities of digital transformation, the role of AI and ML in enhancing efficiency will be pivotal in maintaining a competitive edge in the industry.

Avato’s commitment to architecting the technology foundation required to power rich, connected user experiences is evident in its dedication to delivering innovative integration solutions.

Exploring Different Types of Banking Software

Banking software companies offer a diverse array of systems, each tailored to meet specific operational demands within financial institutions. The primary categories encompass core financial systems, digital financial platforms, and customer relationship management (CRM) systems.

Core financial systems serve as the backbone for managing daily operations, facilitating transactions, account management, and ensuring compliance with regulatory standards. These systems are vital for the efficient and secure functioning of financial institutions, especially as the global core financial software market is poised for rapid recovery, reflecting the sector’s resilience and adaptability.

In contrast, digital financial platforms provide essential online and mobile services, enabling customers to access their accounts, conduct transactions, and interact with their institutions from virtually anywhere. The digital financial services market is anticipated to soar to an impressive $22.3 trillion by 2026, with a compound annual growth rate (CAGR) of 8.5%. This growth underscores the escalating demand for seamless digital experiences in banking.

CRM systems are instrumental in managing client relationships, empowering financial institutions to enhance service delivery and boost client satisfaction. By harnessing data analytics, these systems aid institutions in comprehending customer needs and tailoring their services accordingly.

Understanding the distinctions among these software types is crucial for banking software companies striving to modernize their technology stack. With over 60 nations implementing open financial regulations, regulators are adapting to new technologies to bolster consumer protection. This transition necessitates that financial institutions not only invest in robust core systems but also embrace digital platforms offered by banking software companies to meet evolving customer expectations.

As the landscape of financial software continues to transform, insights from industry professionals underscore the significance of effectively integrating banking software companies’ systems. For instance, leading financial institutions are increasingly adopting biometric authentication methods, with nearly 46% of U.S. companies planning to replace traditional passwords with biometric solutions. This trend signifies a broader movement towards more secure and efficient financial solutions, further emphasizing the imperative for institutions to stay ahead of technological advancements.

Gustavo Estrada from BC Provincial Health Services Authority remarked, “Avato has the ability to simplify complex projects and deliver results within desired time frames and budget constraints,” illustrating how Avato’s dedicated hybrid integration platform can facilitate these modernization efforts. By leveraging Avato’s integration platform, which encompasses features like real-time monitoring and alerts on system performance, financial institutions can maximize the value of their legacy systems, streamline complex integrations, and ensure compliance with evolving regulations. Moreover, with support for 12 levels of interface maturity, Avato empowers banks to future-proof their technology stacks, positioning themselves for success in a rapidly changing landscape.

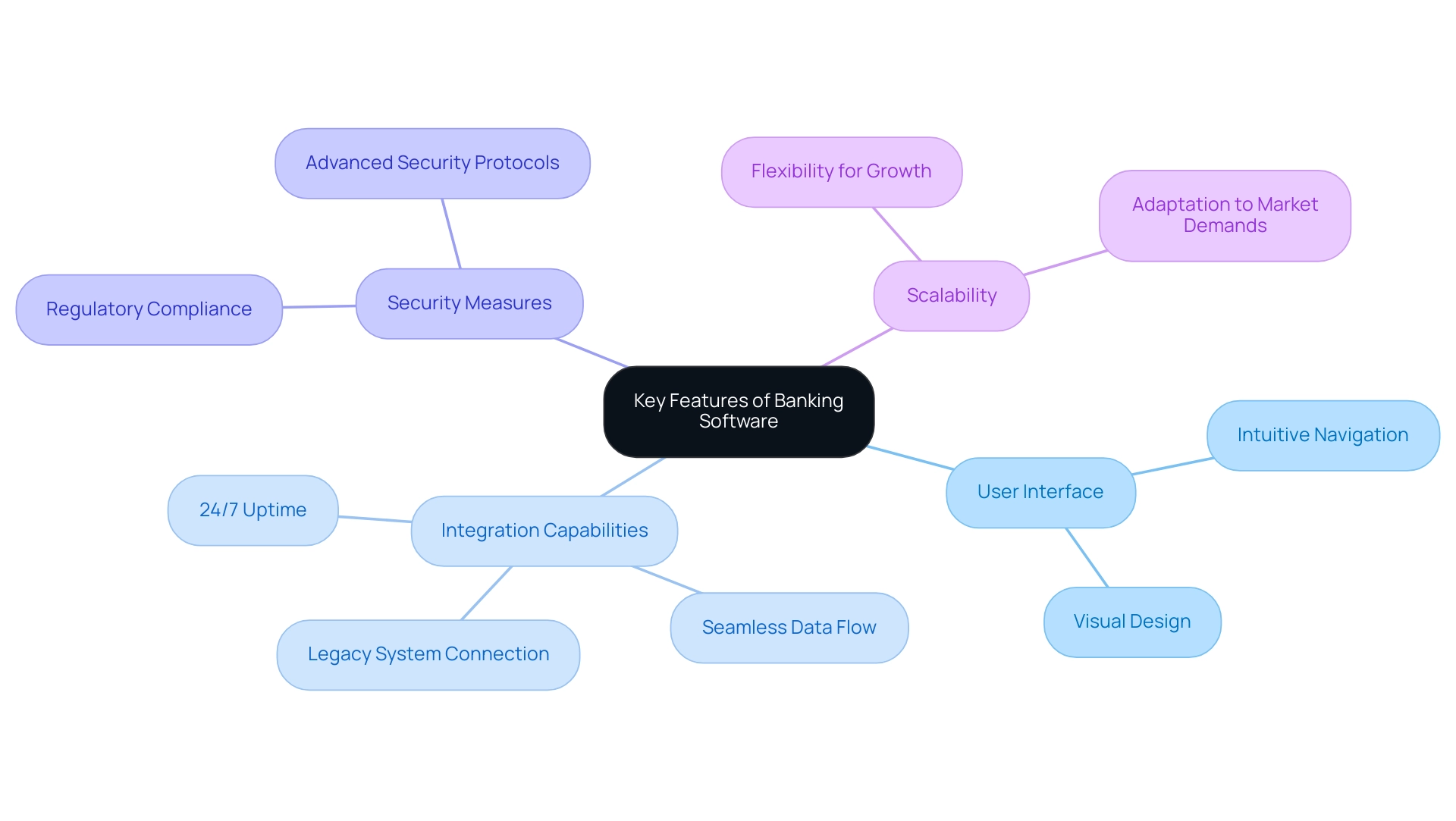

Key Features to Consider in Banking Software

When evaluating banking software companies, several key features warrant careful consideration. A well-designed user interface is crucial, significantly enhancing customer satisfaction and engagement. A notable percentage of digital consumers express comfort in discussing financial products online, underscoring the need for intuitive navigation and appealing visual design in financial applications.

Integration capabilities stand out as another essential feature of banking software companies, facilitating seamless data flow between disparate systems. This is particularly important in today’s fast-paced financial environment, where banking software companies can help connect legacy systems with modern applications to streamline operations and improve service delivery. Avato’s secure hybrid integration platform is specifically designed to ensure 24/7 uptime and reliability, making it an ideal solution for complex systems in finance, healthcare, and government.

Robust integration not only enhances operational efficiency for banking software companies but also supports compliance with industry regulations, which is vital for avoiding legal complications. As Gustavo Estrada pointed out, ‘Avato has the capability to streamline intricate projects and provide outcomes within preferred time limits and financial constraints,’ emphasizing the efficiency of integration functions in financial systems.

Security measures are paramount for banking software companies in safeguarding sensitive financial information. As cyber threats continue to evolve, financial software must incorporate advanced security protocols to protect customer data and maintain trust. Additionally, adherence to regulatory standards is non-negotiable for banking software companies, ensuring that financial institutions operate within legal frameworks while minimizing risks.

Avato’s hybrid integration solutions are developed with strict security measures, equipping financial institutions for the challenges of open finance.

Scalability is another essential element for banking software companies, enabling banks to adjust their solutions as their operations grow. This flexibility is essential for accommodating growth and evolving market demands.

In 2025, the focus on user satisfaction will further influence the ranking of financial application features. According to recent client satisfaction ratings from banking software companies, based on a 1,000-point scale assessing navigation, speed, visual appeal, and content, the significance of a user-friendly interface and effective integration capabilities cannot be overstated. Avato, for example, guarantees 24/7 uptime for essential integrations, enhancing the reliability of financial software solutions.

As the financial sector continues to evolve, banking software companies must prioritize these features to deliver exceptional customer experiences and maintain a competitive edge.

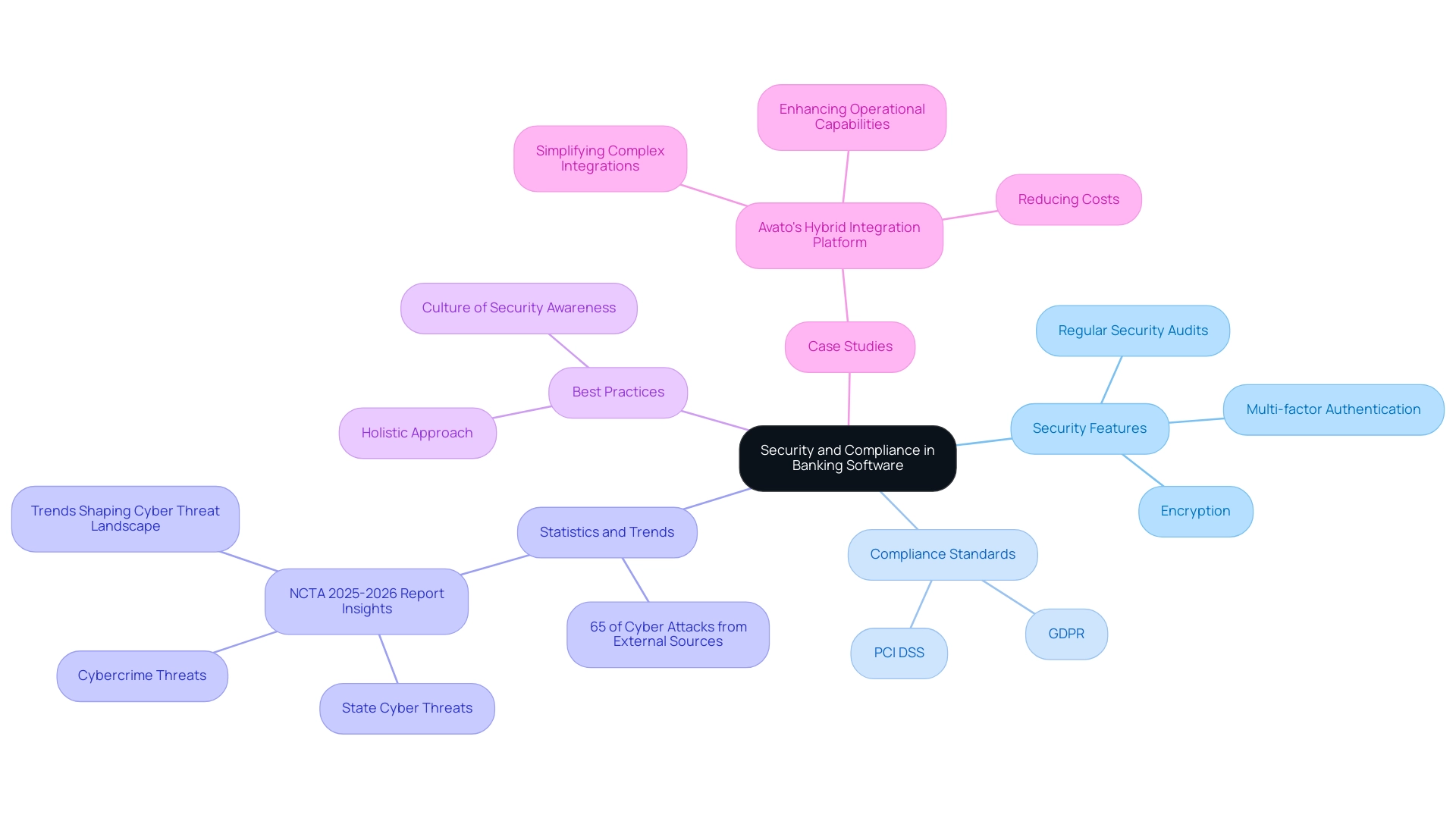

The Role of Security and Compliance in Banking Software

In the banking sector, security and compliance are not just priorities; they are essential imperatives for banking software companies. Data breaches can inflict severe financial losses and irreparable reputational harm, making robust security measures a necessity. Banking software companies must ensure that their applications comply with stringent regulatory frameworks, including the Payment Card Industry Data Security Standard (PCI DSS) and the General Data Protection Regulation (GDPR). These regulations mandate comprehensive security protocols designed to protect sensitive client data.

Key security features such as:

- Encryption

- Multi-factor authentication

- Regular security audits

are essential elements of any financial application solution. For instance, Avato’s Hybrid Integration Platform employs encryption to ensure that data is unreadable to unauthorized users, while multi-factor authentication adds an extra layer of security by requiring multiple forms of verification before granting access. Regular security audits help identify vulnerabilities and ensure compliance with evolving regulations.

Statistics reveal the urgency of these measures: in 2025, it is projected that 65% of cyber attacks will originate from external sources, underscoring the need for proactive security strategies. Compliance with PCI DSS and GDPR not only safeguards customer information but also strengthens the credibility of banking software companies in a competitive market.

Furthermore, adherence rates to compliance standards among banking software companies serve as critical indicators of reliability. Institutions that prioritize compliance, like banking software companies, are better positioned to mitigate risks associated with data breaches and regulatory penalties. Case studies, such as those involving Avato’s Hybrid Integration Platform, demonstrate that organizations implementing comprehensive security features have successfully navigated complex regulatory landscapes while enhancing operational capabilities and reducing costs.

Avato’s platform is particularly noted for maximizing and extending the value of legacy systems, simplifying complex integrations, and providing real-time monitoring and alerts on system performance.

Current best practices in financial system security emphasize a holistic approach, integrating advanced technologies and continuous monitoring to adapt to emerging threats. Industry leaders advocate for a culture of security awareness, ensuring that all employees understand their role in protecting sensitive information. As Jacob Fox aptly noted, “leveraging security statistics can facilitate buy-in from stakeholders,” reinforcing the notion that investing in security is not merely a cost but a strategic advantage that pays dividends in the long run.

This perspective aligns with insights from the NCTA 2025-2026 report, which highlights the evolving landscape of cyber threats and the importance of staying ahead of potential risks.

Customization and Scalability: Meeting Unique Banking Needs

Customization and scalability are paramount in banking systems provided by banking software companies, as each institution operates under distinct requirements and regulatory frameworks. Banking software companies deliver customizable solutions that empower financial institutions to tailor functionalities and features, enabling seamless integration with existing systems and adaptability to evolving regulatory demands. This flexibility is crucial in a landscape where 44% of consumers are uncertain about whether their financial providers are effectively leveraging data to personalize their experiences. This highlights the urgent need for financial institutions to adopt customizable solutions to enhance customer experiences.

Avato’s Hybrid Integration Platform exemplifies this necessity by maximizing and extending the value of legacy systems, simplifying complex integrations, and significantly reducing costs. With support for 12 levels of interface maturity, Avato enables financial institutions to unlock data and systems in weeks rather than months, ensuring that they can adapt swiftly to market changes and regulatory requirements. Furthermore, the platform provides real-time monitoring and alerts on system performance, further enhancing operational efficiency and responsiveness.

Scalability is equally essential, ensuring that financial software can evolve in tandem with the institution’s growth. As transaction volumes increase and service offerings expand, scalable solutions maintain performance integrity, allowing banks to respond swiftly to market changes. For instance, the Biometric ATM Market, valued at USD 35.2 billion in 2022, is projected to reach USD 46.7 billion by 2032, underscoring the growing demand for flexible financial technologies that can scale with increasing transaction volumes.

Case studies demonstrate the effect of customizable financial solutions. Companies like Chime and N26 are leading the charge in promoting financial inclusion through mobile apps, catering to the 1.7 billion adults globally who remain unbanked. Their focus on accessible financial services exemplifies how customization can drive engagement and expand market reach.

Moreover, the COVID-19 pandemic has hastened the transition to digital finance, urging financial institutions to implement robust technological solutions that facilitate remote transactions and improve user experience.

Expert opinions further reinforce the significance of customization in banking systems. As the industry progresses towards 2025, the capability to customize solutions will be essential for financial institutions seeking to enhance client experiences and operational effectiveness. Statistics indicate that a significant percentage of banking software companies are now utilizing customizable software solutions, reflecting a shift towards more personalized and scalable offerings.

Gustavo Estrada, a client, remarked, “Avato has streamlined intricate projects and provided outcomes within preferred timelines and financial limits,” underscoring the efficiency of adaptable solutions in achieving operational objectives in the financial industry.

Furthermore, the integration of generative AI is becoming increasingly important in financial services, with its application in developing sophisticated chatbots and virtual assistants that enhance client interactions. As generative AI continues to evolve, its role in streamlining operations and improving customer experience will be vital for financial institutions.

In conclusion, the integration of personalization and scalability in financial systems not only addresses the immediate operational needs of institutions but also positions them for future growth and innovation in an increasingly competitive landscape.

Comparing Pricing Models of Top Banking Software Companies

Pricing models for banking applications demonstrate significant diversity among providers, mirroring the distinct needs of financial institutions. The primary models include:

- Subscription-based pricing, where financial institutions incur a recurring fee for application access.

- Usage-based pricing, which ties expenses to the volume of transactions processed.

This flexibility empowers financial institutions to select a model that aligns with their operational scale and transaction frequency.

In 2025, the landscape of banking technology pricing is transforming, with many providers embracing tiered pricing structures. These tiers enable banks to choose plans that correspond with their specific requirements, ensuring they pay solely for the features and services they utilize. This strategy not only enhances cost efficiency but also fosters sustainable cost reductions by integrating risk and compliance considerations into transformation initiatives.

Recent insights indicate that ease of integration is paramount for B2B technology buyers, with over 80% of tech companies identifying integration capabilities as a critical requirement for their customers. This trend underscores the imperative for banking software companies to provide seamless integration with existing systems, further shaping pricing strategies. Avato’s dedicated hybrid integration platform plays a pivotal role, empowering banks to future-proof their operations through seamless data and system integration, ultimately enhancing their overall value proposition.

Founded by a team of enterprise architects who recognized the necessity for a simpler approach to complex integration challenges, Avato embodies a commitment to designing technology foundations that support rich, connected experiences.

Examining case studies within the sector reveals that the digital banking landscape is witnessing emerging opportunities driven by technological advancements and shifting consumer preferences. For instance, with 80% of consumers favoring personalized financial services, digital banks are leveraging data analytics and AI to craft customized products, thereby improving client engagement and satisfaction. This demand for customization is prompting service providers to reevaluate their pricing models, balancing subscription and usage-based approaches to deliver enhanced client value.

As financial analysts weigh in on the ongoing debate between subscription-based and usage-based pricing, the consensus suggests that adaptability in pricing strategies will be crucial for banking software companies striving to thrive in a competitive market. Lisa Ross emphasizes, “The bottom line? SaaS companies that can adapt their pricing strategies to offer greater customer value will come out on top.”

The typical pricing structures for financial applications in 2025 are likely to reflect this flexibility, addressing the varied requirements of financial institutions while ensuring they remain competitive in an increasingly digital environment.

In summary, understanding the nuances of subscription versus usage-based pricing in financial applications is essential for IT managers. By evaluating these models, banks can make informed financial decisions that align with their strategic goals and operational demands, leveraging solutions like Avato’s hybrid integration platform to enhance their integration capabilities and overall business value.

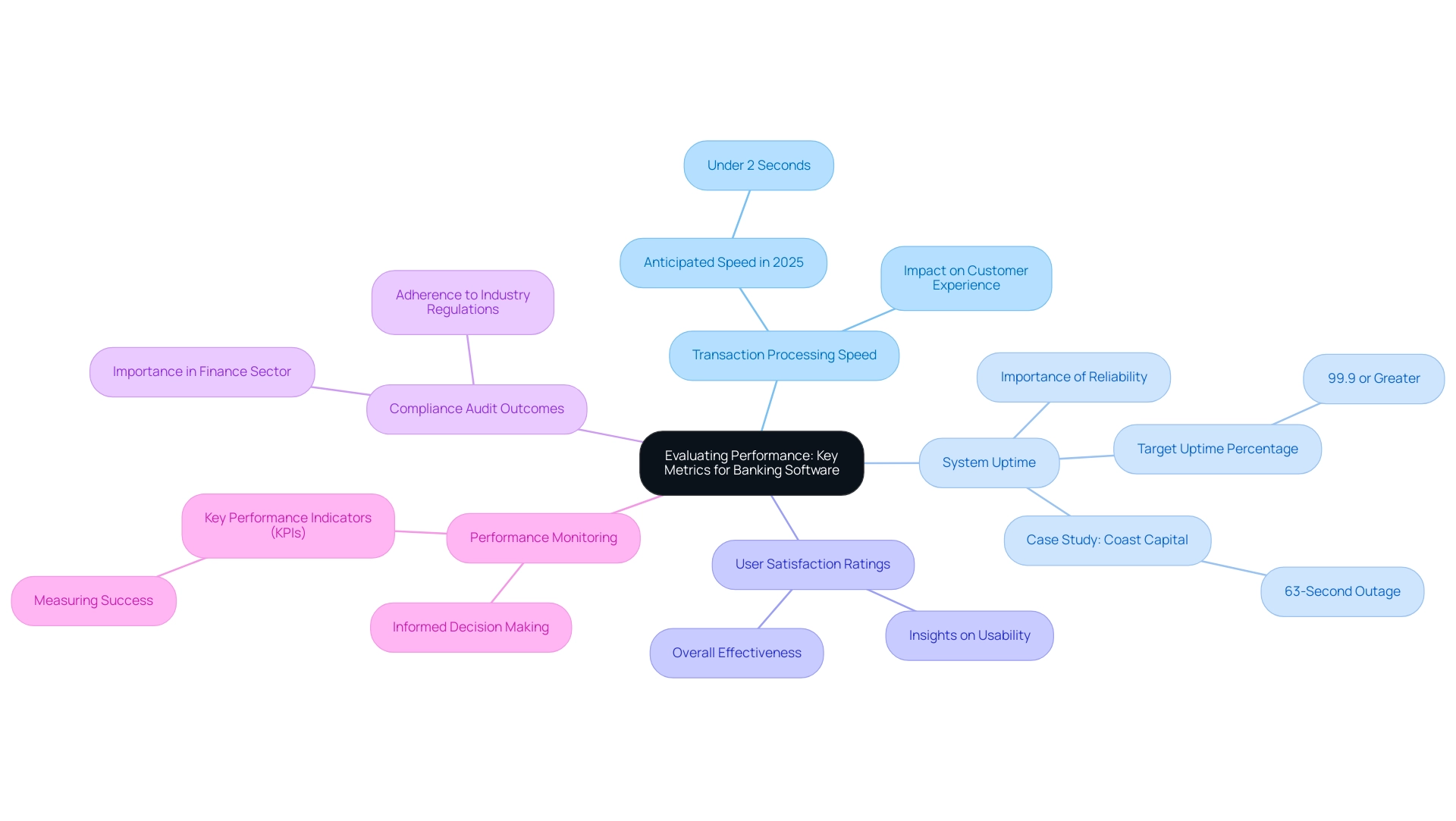

Evaluating Performance: Key Metrics for Banking Software

When evaluating financial applications, several key performance metrics are essential for a comprehensive assessment. Transaction processing speed stands out as a critical factor that directly influences customer experience. In 2025, the average transaction processing speed in financial applications is anticipated to be considerably quicker than in prior years, with benchmarks indicating speeds of under two seconds for most transactions.

This rapid processing capability not only enhances user satisfaction but also positions banks to compete effectively in a fast-paced digital landscape. Avato’s hybrid integration platform plays a pivotal role in achieving these speeds by seamlessly integrating disparate systems, thereby unlocking isolated assets and enabling efficient data flow.

System uptime is another vital metric, ensuring operational continuity and reliability. Leading financial technology solutions strive for an uptime of 99.9% or greater, reducing downtime and guaranteeing that services remain accessible to clients at all times. Avato’s hybrid integration platform has been recognized for successfully maintaining high uptime metrics, which is crucial for institutions operating in regulated environments.

For instance, Avato’s work with Coast Capital demonstrated its ability to facilitate major system transitions with minimal downtime, showcasing the platform’s reliability. During this project, Avato achieved a remarkable 63-second outage during a significant system switch, illustrating its effectiveness in maintaining service continuity.

User satisfaction ratings also play a significant role in assessing financial applications. These ratings provide insights into the program’s usability and overall effectiveness from the end-user perspective. Furthermore, compliance audit outcomes are crucial, as they indicate how effectively the system adheres to industry regulations and standards, particularly in sectors such as finance where adherence is vital.

Avato’s dedication to architecting technology solutions ensures that its platform not only meets but exceeds these compliance standards, reinforcing its commitment to delivering reliable and compliant solutions.

Monitoring these key performance metrics allows banking software companies to assess the effectiveness of their software solutions and make informed decisions about upgrades or changes. As Jiaqi Zhou notes, ‘Key performance indicators (KPIs) measure a company’s success against a set of targets, objectives, or industry peers,’ emphasizing the significance of these metrics in driving strategic enhancements in operational activities. By focusing on transaction processing speed, system uptime, and user satisfaction, financial institutions can leverage solutions like Avato’s to enhance their operational capabilities and maintain a competitive edge.

Emerging Trends in Banking Software Development

Emerging trends in financial software development are significantly reshaping the landscape for banking software companies. Notably, there is a remarkable increase in the adoption of AI and machine learning technologies, which are aimed at delivering personalized user experiences. These advancements enable banks to analyze vast amounts of data, allowing for tailored services that meet individual client needs. Furthermore, the rise of open banking APIs facilitates seamless third-party integrations, enhancing the ability of banking software companies and financial institutions to innovate and expand their service offerings.

This trend fosters collaboration and empowers customers with more choices and control over their financial data.

In addition to these developments, cloud-based solutions are gaining traction for their scalability and flexibility. They enable financial institutions to adapt quickly to changing market demands. As institutions increasingly migrate to the cloud, banking software companies can leverage advanced technologies without the burden of extensive on-premises infrastructure. Avato’s Secure Hybrid Integration Platform plays a crucial role in this transition, ensuring 24/7 uptime and reliability for complex systems in banking, healthcare, and government sectors.

The platform also provides real-time monitoring and alerts on system performance, essential for maintaining operational efficiency and proactively addressing issues.

Moreover, the emphasis on cybersecurity intensifies as financial institutions confront evolving threats in the digital landscape. With 51% of US residents utilizing voice assistants for information, the need for robust security measures to protect sensitive data has never been more critical. Financial institutions are prioritizing investments in cybersecurity to safeguard their operations and maintain customer trust.

This focus is particularly important as the perception of high costs associated with advanced AI technologies may hinder widespread adoption, as noted in the case study titled “Cost Barriers to AI Implementation.”

Staying informed about these trends is vital for financial institutions aiming to innovate and enhance their service offerings. The integration of Avato’s Hybrid Integration Platform not only simplifies complex integrations but also significantly reduces costs, allowing banking software companies to maximize the value of their legacy systems. As the industry continues to evolve, the integration of AI, the expansion of open APIs, and a strong focus on cybersecurity will play pivotal roles in shaping the future of banking software companies’ development.

Furthermore, trends in AI investment suggest that the financial sector is well-positioned to leverage AI technologies for future growth and innovation. As Gustavo Estrada, a customer, noted, “Avato has the ability to simplify complex projects and deliver results within desired time frames and budget constraints,” highlighting how Avato’s features, such as real-time monitoring, contribute to customer satisfaction and operational efficiency.

Choosing the Right Banking Software Development Partner

Choosing the ideal financial application development collaborator from banking software companies is a multifaceted endeavor that requires careful assessment of several critical factors. First and foremost, the partner’s experience within the financial sector is vital. A collaborator with a proven track record of delivering successful financial solutions can greatly enhance the effectiveness of banking software companies, ensuring alignment with the institution’s specific needs and adaptability to changing market conditions.

Security and compliance are non-negotiable in the financial industry, making it imperative to understand how banking software companies tackle these issues. Recent insights reveal that 75% of sponsor financial institutions have faced losses exceeding $100,000 due to compliance violations in their embedded finance partnerships. This statistic highlights the necessity of selecting banking software companies that prioritize rigorous compliance measures and provide features that enable real-time monitoring and risk management.

Avato’s integration services offer robust compliance tools that empower financial institutions to navigate these challenges effectively, ensuring adherence to regulatory requirements.

Moreover, ongoing support and updates are essential components of a fruitful partnership. The banking landscape is evolving rapidly, and banking software companies must ensure their software is consistently updated to meet new regulatory requirements and customer expectations. A partner like Avato, with its international team of expert integration partners, delivers reliable ongoing support, enabling financial institutions to adapt seamlessly to these changes.

Additionally, Avato provides project rescue services to assist financial institutions in overcoming integration challenges and ensuring project success.

Strong communication and collaboration between banking software companies and financial institutions are also crucial for successful implementation. This synergy fosters a deeper understanding of the institution’s objectives, ensuring that the development process aligns with its strategic goals.

Furthermore, statistics indicate that 67% of companies invest in integrations to enhance sales close rates, underscoring the significance of seamless integration in boosting operational efficiency. This is particularly relevant in collaborations with banking software companies, where effective integration can lead to improved user experiences and operational success. As the digital financial services landscape becomes increasingly competitive, institutions must deliver exceptional online experiences to meet client expectations.

By selecting a partner like Avato, which excels in these areas—including leveraging generative AI for enhanced customer experience and operational efficiency—banks can strategically position themselves for success in an ever-evolving digital banking environment.

Conclusion

The exploration of banking software underscores its pivotal role in transforming financial institutions and enhancing customer experiences. The landscape is diverse, encompassing core banking systems, digital platforms, and customer relationship management tools, each meticulously tailored to meet specific operational needs. Furthermore, the integration of advanced technologies, such as AI and machine learning, streamlines processes and enables banks to offer personalized services that resonate with the evolving expectations of consumers.

Security and compliance remain paramount; robust measures are essential to protect sensitive data and adhere to regulatory standards. The emphasis on customization and scalability ensures that banking software can adapt to the unique requirements of each institution, facilitating seamless integration with legacy systems and supporting growth in a competitive market.

Emerging trends, including the rise of open banking APIs and cloud-based solutions, are shaping the future of banking software development. These innovations empower banks to innovate and enhance their service offerings while prioritizing cybersecurity to safeguard customer trust. The importance of selecting the right software development partner cannot be overstated, as it directly impacts the effectiveness and adaptability of banking solutions.

Ultimately, the right banking software can propel institutions towards operational excellence and customer satisfaction. As the financial landscape continues to evolve, embracing these technologies and trends will be vital for banks aiming to maintain a competitive edge and meet the demands of a digitally savvy clientele. Investing in a robust banking software solution, such as Avato’s hybrid integration platform, can facilitate this transformation, ensuring that institutions are well-equipped for the future.