Overview

We present a comprehensive comparative analysis of digital banking software vendors for 2025, underscoring the critical features, benefits, and suitability of various vendors tailored to diverse banking needs.

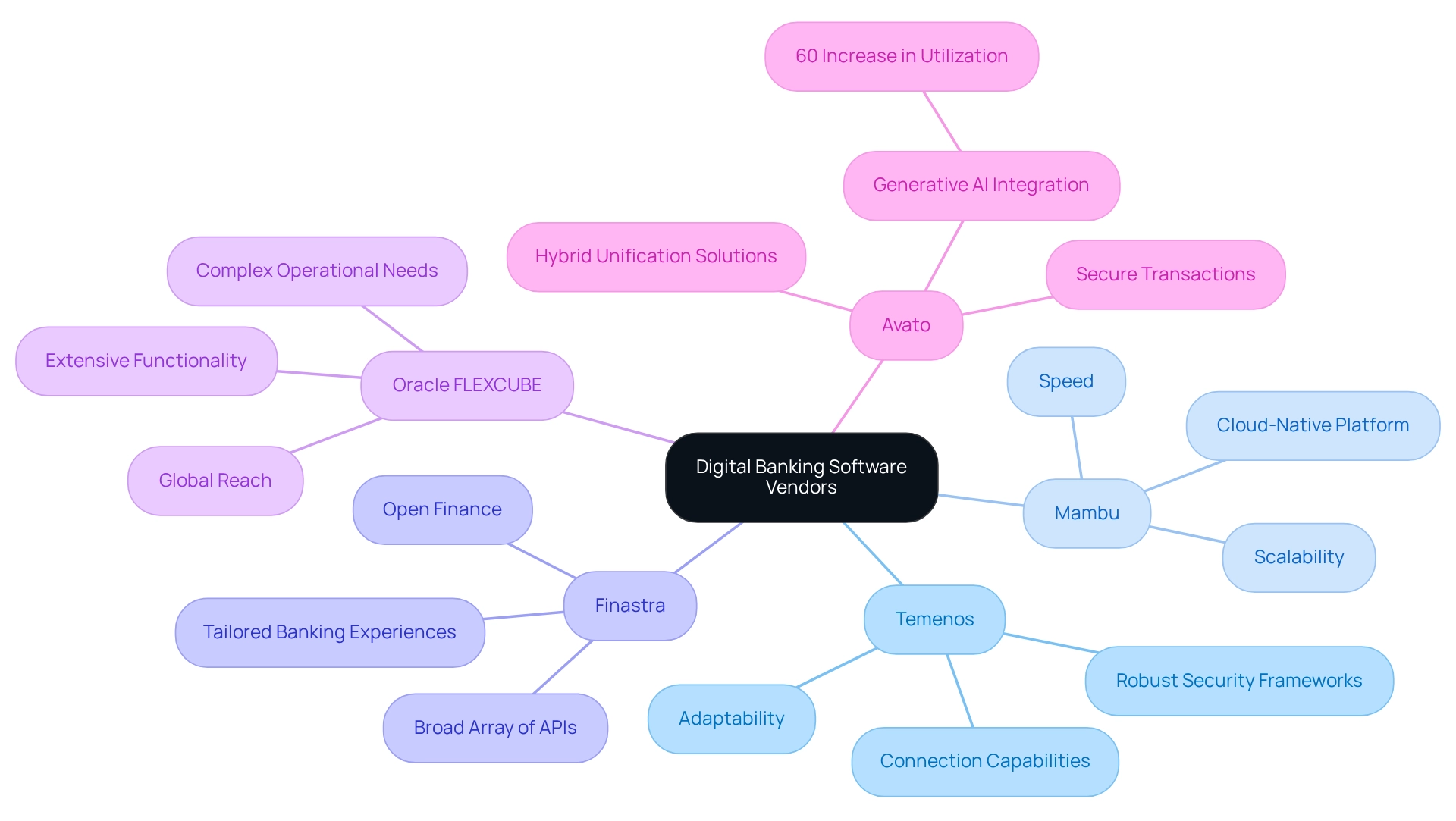

In an era where security, integration capabilities, user experience, and real-time processing are paramount, we detail how vendors such as:

- Temenos

- Mambu

- Finastra

- Oracle FLEXCUBE

- Avato

uniquely meet the evolving requirements of financial institutions.

What challenges are you facing in your digital transformation journey?

Our analysis not only highlights the strengths of each vendor but also provides insights into how they can address your specific challenges. As a result, we empower you to make informed decisions that align with your institution’s strategic goals. Let us guide you in navigating this complex landscape and uncovering the solutions that will elevate your banking experience.

Introduction

In the rapidly evolving landscape of finance, we recognize that digital banking software has emerged as a cornerstone for institutions striving to enhance their services and meet the demands of tech-savvy customers. What’s holding your team back from fully embracing this transformation?

From robust security features that protect sensitive data to seamless integration capabilities that streamline operations, the right software can fundamentally transform the way banks operate.

As we navigate our digital transformation journeys, understanding the unique strengths of leading vendors becomes essential. This article delves into the key features of digital banking software, compares top vendors, and evaluates how different solutions cater to various banking needs.

Ultimately, we aim to guide institutions toward making informed choices that align with their strategic goals.

Understanding Digital Banking Software: Key Features and Importance

Digital financial software, offered by digital banking software vendors, encompasses a diverse array of features designed to elevate online financial services. We recognize that these key features are not just enhancements; they are essential components that can transform our operations and client experiences.

- Security is paramount. We implement robust security measures, including encryption, multi-factor authentication, and strict compliance with regulations such as GDPR and PCI DSS, to safeguard sensitive client data. In fact, financial institutions that prioritize technological transformation have reported reductions in operating costs ranging from 20% to 40% by 2025, underscoring the economic benefits of investing in secure systems.

- Integration Capabilities are equally vital. Seamless integration with existing systems—such as core financial platforms and third-party services—enhances our operational efficiency. By adopting a modular architecture in our online financial platforms, we empower our development teams to scale and expand functionalities without the need for a complete system overhaul, allowing us to swiftly adapt to evolving client needs.

- User Experience cannot be overlooked. Intuitive interfaces and personalized services significantly boost client satisfaction and engagement. We utilize integrated survey functionalities to categorize clients into distinct cohorts, enabling us to provide tailored services that meet their varied requirements.

- Real-Time Processing is a game changer. Immediate transaction handling and real-time data analysis empower us to respond swiftly to client demands and market fluctuations. As client expectations for prompt service continue to rise, this capability becomes increasingly critical for financial institutions like ours that are committed to modernizing operations and enhancing client experiences through digital banking software vendors. It is a crucial element in any comparative assessment of online financial software providers. Together, let us embrace these advancements to secure our position as leaders in the financial technology landscape.

Comparative Analysis of Leading Digital Banking Software Vendors

In 2025, we recognize that several digital banking software vendors set themselves apart through innovative solutions designed to address the evolving needs of the financial sector.

- Temenos: With an extensive range of financial solutions, we see Temenos excel in connection capabilities and robust security frameworks. Its adaptability allows financial institutions to tailor services, effectively addressing various market segments and enhancing client satisfaction.

- Mambu: As a cloud-native financial platform, Mambu distinguishes itself through its speed and scalability. It is particularly favored by fintech companies and neobanks, facilitating swift product launches that meet the demands of a dynamic market.

- Finastra: With a strong emphasis on open finance, Finastra offers a broad array of APIs that enable seamless integration with third-party services. This approach enhances client engagement by providing tailored banking experiences, a crucial aspect in today’s competitive landscape.

- Oracle FLEXCUBE: Esteemed for its extensive functionality and global reach, Oracle FLEXCUBE is ideally suited for large financial institutions with complex operational needs, providing a robust foundation for comprehensive banking solutions.

- Avato: As a leader in hybrid unification solutions, Avato accelerates the integration of isolated systems and fragmented data, delivering the connected infrastructure enterprises need to simplify, standardize, and modernize. With a focus on secure transactions, Avato earns the trust of banks, healthcare, and government sectors. Its platform supports 12 levels of interface maturity, enabling organizations to balance connection speed with the sophistication necessary to future-proof their technology stack. The incorporation of generative AI within Avato’s solutions enhances user experience and operational efficiency, reflecting a significant shift in how institutions approach problem-solving and innovation. Notably, a recent survey indicates a 60% increase in the utilization of generative AI for customer experience, underscoring Avato’s commitment to leveraging advanced technology. Understanding the unique advantages of digital banking software vendors is essential for banks aiming to select the right software for their transformation journey. As Jamie Dimon emphasizes, mastering technology is vital for future success. By utilizing the appropriate online financial platform, we can significantly impact an institution’s ability to innovate and thrive in a rapidly changing environment.

Evaluating Benefits and Suitability for Different Banking Needs

When we evaluate digital banking software vendors, it is imperative that we carefully assess our unique requirements to ensure optimal alignment with our operational goals.

For Large Institutions: Solutions such as Oracle FLEXCUBE and Temenos emerge as leaders, thanks to their extensive features and ability to manage complex operations across multiple regions. These platforms are designed to support the intricate needs of large-scale financial operations, ensuring compliance and efficiency.

For Fintechs and Startups: Mambu is particularly advantageous, offering the agility and speed essential for rapid product development and market entry. Its cloud-native architecture enables fintechs to innovate swiftly, effectively addressing market demands and user needs. Mambu’s capability to optimize workflows and shorten time-to-market establishes it as a favored option for newcomers in the financial sector.

For Customer-Focused Financial Institutions: Finastra’s open finance framework facilitates substantial personalization and seamless connection with external services. This approach enhances customer involvement and satisfaction, enabling us to tailor our services to meet specific client requirements.

In addition to these proven solutions, Avato’s dedicated hybrid connection platform plays a vital role in streamlining the unification of diverse systems. By effectively mobilizing stakeholders and modeling new business processes, Avato empowers us to future-proof our operations. This platform not only enhances business value generation but also addresses the challenges of vendor-supplied integration solutions in connected finance.

The ongoing transition towards cloud technology, accelerated by the pandemic, has led to a significant increase in the adoption of online financial solutions. Statistics reveal that 88% of cloud-powered companies have implemented an enterprise-wide data strategy, underscoring the critical role of cloud infrastructure in modern banking. As we navigate our technological transformation journeys, the selection of digital banking software vendors becomes crucial, directly impacting our capacity to compete in a dynamic marketplace. Ultimately, the suitability of each vendor hinges on our institution’s size, market focus, and specific operational challenges, making this assessment essential for successful technological transformation.

Conclusion: Choosing the Right Digital Banking Software for Your Institution

Selecting the right digital banking software vendors is pivotal for financial institutions aiming to thrive in a competitive landscape. We understand that key considerations include:

- Alignment with Business Goals: Our software must align with strategic objectives, such as enhancing user experience, improving operational efficiency, or expanding market reach. A recent survey indicates that 25% of customers feel increasingly unsafe while shopping due to perceived payment fraud, underscoring the necessity for robust security measures that not only protect customers but also align with our business goals. Avato’s hybrid connection platform addresses these concerns by streamlining digital transformation through structured requirements management, ensuring that security protocols are incorporated into the software from the outset.

- Scalability and Flexibility: We advocate for solutions that can evolve with your institution and adapt to shifting market dynamics. As banks prioritize investments in data management and cloud infrastructure to harness AI’s potential, scalability becomes essential for accommodating future growth and technological advancements. Avato’s method for modernization highlights utilizing existing legacy systems, enabling institutions to enhance their current resources while gearing up for future advancements.

- Connection Features: We emphasize platforms that enable smooth connectivity with current systems, reducing interruption during execution. The ability to integrate effectively can significantly enhance operational capabilities and reduce costs, as evidenced by Deutsche Bank’s realization of US$1.3 billion in savings as part of its Operational Efficiency plan. This demonstrates how effective integration can lead to substantial financial benefits. Avato’s solutions are designed to ensure secure and reliable connections between applications, which is critical as financial institutions prepare for the upcoming open banking landscape.

Additionally, as Deloitte notes, the re-proposal eliminates some of the stricter standards, which can impact how institutions align their software choices with regulatory expectations. By thoroughly evaluating these factors and leveraging insights from industry trends and case studies, we can make informed decisions that propel our digital transformation initiatives forward with the help of digital banking software vendors, ensuring we remain competitive and responsive to customer needs. Get your copy now.

Conclusion

Selecting the appropriate digital banking software is not just a choice; it is a strategic imperative for financial institutions aiming to thrive in an increasingly competitive landscape. The essential features that define effective software—robust security, seamless integration, user-friendly experiences, and real-time processing—are critical for enhancing operational efficiency and customer satisfaction. By understanding these features, we can identify solutions that align with our specific needs and strategic objectives.

Our comparative analysis of leading vendors reveals the unique strengths of platforms such as Temenos, Mambu, Finastra, Oracle FLEXCUBE, and Avato. Each vendor offers distinct capabilities tailored to various segments of the banking industry, from large institutions to agile fintech startups. This diversity underscores the necessity of evaluating the unique requirements of each bank to select a solution that effectively addresses their operational challenges and market focus.

As we navigate our digital transformation journeys, prioritizing software that aligns with our business objectives, offers scalability, and facilitates integration will be pivotal. By leveraging insights from industry trends and case studies, we can make informed decisions that not only enhance our competitive edge but also ensure we remain responsive to evolving customer demands. Embracing the right digital banking software transcends mere technology; it is about fostering a secure, efficient, and customer-centric banking experience that drives long-term success.