Overview

This article delves into best practices for implementing integrated software systems in banking, underscoring the critical importance of:

- Clear objectives

- Stakeholder involvement

- The selection of appropriate technology

Why are these practices essential? They are pivotal for enhancing operational efficiency, ensuring regulatory compliance, and fostering innovation.

Case studies and expert insights provide compelling evidence of successful integration outcomes, illustrating the necessity for continuous improvement in a rapidly evolving financial landscape. As you navigate these challenges, consider how these strategies can transform your approach to software integration.

Introduction

In the fast-evolving landscape of banking, integrated software systems have emerged as a vital component for operational success and regulatory compliance. These systems facilitate the seamless connection of diverse applications, enhancing data flow and enabling banks to respond swiftly to the demands of a globalized economy. As financial institutions grapple with the complexities of digital transformation, the integration of technology becomes paramount—not only for improving customer service but also for ensuring data accuracy and security.

What if your institution could navigate these challenges with ease? This article delves into the multifaceted benefits of integrated software systems, outlining best practices for successful implementation, common challenges faced during integration, and the critical role of real-time monitoring. Through case studies and expert insights, the discussion highlights how institutions, like Avato, are leading the charge in simplifying integration processes. As a result, banks are ultimately positioned for sustained growth and innovation in an increasingly competitive environment.

Understanding Integrated Software Systems in Banking

Integrated software systems in banking represent the seamless connection of various applications and platforms that manage financial transactions, customer information, and regulatory compliance. These systems are essential for financial institutions, enabling smooth data transfer across departments and roles. For instance, integrating a core banking framework with customer relationship management (CRM) software provides real-time updates on customer interactions, significantly enhancing service delivery and operational efficiency.

As of 2023, the total value of imports and exports of goods reached 41,756.8 billion yuan, highlighting the interconnected nature of global finance. This statistic underscores the critical role of integrated software systems in navigating the complexities of financial dealings and regulatory compliance, which are increasingly vital as institutions operate in a globalized economy. By 2025, the emphasis on these systems will intensify, as banks strive to modernize their technology to meet evolving customer expectations and regulatory demands.

The benefits of integrated software systems in banking are extensive. They streamline operations while enhancing data accuracy and accessibility—key factors for informed decision-making. Additionally, these systems aid in meeting regulatory requirements, reducing the risk of fines, and improving overall governance.

The effective merging of banking applications can be illustrated through case studies like that of a Hybrid Connection Platform. This company has earned recognition for its commitment to simplifying complex project implementations, delivering results within expected timelines and budgets. This capability is particularly crucial in banking, where operational efficiency and cost reduction are paramount.

Avato provides a reliable, future-ready technology framework that enables financial institutions to adapt to changing demands and maintain a competitive edge, all while significantly lowering integration costs.

Recent trends indicate a growing reliance on integrated software systems, driven by the need for agility and responsiveness in a rapidly evolving financial landscape. For example, banks are increasingly adopting cloud-based solutions and leveraging artificial intelligence to enhance connectivity. Expert insights emphasize the importance of integrated software systems in fostering innovation and sustaining competitive advantage.

As financial entities navigate the complexities of digital transformation, the unification of integrated software systems will remain a cornerstone of their strategic initiatives, with Avato leading the way in offering specialized hybrid connection solutions that address the challenges of integration in the banking sector.

Key Best Practices for Successful Implementation

To achieve successful implementation of integrated software systems, banks must adhere to several best practices.

- Define Clear Objectives: Establish specific goals for what the unification should achieve, such as improved customer service or enhanced data accuracy. This clarity is essential; organizations that establish clear objectives are more likely to achieve successful assimilation results.

As Michael Barr, Federal Reserve Vice Chair, emphasizes, adjusting to significant broad and material changes is essential for financial institutions to thrive in a rapidly evolving landscape, particularly with the advent of open banking.

- Involve Stakeholders Early: Engaging key stakeholders from various departments is crucial. Their contributions ensure that the system fulfills diverse requirements and fosters a sense of ownership, significantly enhancing the incorporation process.

By involving stakeholders early, institutions can also identify potential challenges and opportunities that may not be readily visible, especially as they prepare for the transformative effects of open banking.

- Choose the Appropriate Technology: Selecting connection tools that align with the institution’s existing infrastructure and future growth plans is vital. The right technology not only enables smoother assimilation but also promotes scalability and adaptability in a swiftly evolving financial environment.

For instance, financial institutions such as BBVA have reported achieving a 40% quicker time-to-market for new products by utilizing suitable connection technologies, illustrating how correct selections can yield substantial operational benefits. This is particularly relevant as banks aim to update their frameworks in preparation for open banking. Moreover, leveraging current frameworks instead of discarding them can conserve resources and enhance integration initiatives.

- Conduct Thorough Testing: Before full deployment, extensive testing is critical to identify and resolve any issues that may arise. This step ensures that integrated components operate as planned and meet established goals, ultimately facilitating a smoother transition. Given the complexities introduced by open banking, rigorous testing becomes even more essential.

- Plan for Change Management: Creating a change management strategy is vital to assist staff in adjusting to new frameworks and processes. This approach minimizes resistance and disruption, ensuring that employees are well-prepared to embrace the changes. A well-implemented change management strategy can significantly improve user adoption rates and overall satisfaction with the new solution.

As the demand for personalized banking services rises—80% of consumers now prefer tailored financial solutions—these strategies will be crucial for maintaining a competitive edge in the open banking landscape.

- Ensure Security Compliance: As open banking introduces new data-sharing opportunities, it also heightens the need for stringent security measures. Banks must ensure that their unification solutions comply with the most rigorous security protocols to protect consumer data and maintain trust.

This emphasis on security will be critical as financial institutions navigate the complexities of open banking. By adhering to these best practices, institutions can manage the challenges of integrated software systems more effectively, ensuring that their systems not only satisfy current needs but also prepare them for future expansion. Furthermore, as emphasized in recent reports, financial executives should prioritize strategic actions to ensure sustainable growth in 2025, making these best practices even more relevant in today’s dynamic environment.

Addressing Common Challenges in Banking Integration

Banks face several significant challenges when integrating software systems:

- Regulatory Compliance: Adhering to financial regulations is crucial for institutions during the merging process. It is essential to implement thorough compliance checks and balances throughout the unification process to avert potential legal repercussions. As the landscape evolves, particularly in 2025, financial institutions must proactively adapt to regulatory changes to ensure ongoing compliance.

- Data Security: Protecting sensitive customer information is paramount. Banks must adopt advanced security measures, including encryption, multi-factor authentication, and regular security audits, to safeguard data against breaches. With 83% of organizations prioritizing product connections, the urgency for robust security protocols intensifies to maintain customer trust and meet regulatory requirements.

- Legacy Compatibility: Many financial institutions still rely on outdated platforms, complicating connections with modern technologies. A phased approach to merging can mitigate compatibility issues, allowing institutions to gradually transition to more efficient frameworks without disrupting operations. Digital-only institutions have shown that such transitions can result in 60-73% lower operating costs per customer and a 93% reduction in transaction processing times through automation. This underscores the financial implications of effective unification, especially considering that the typical customer acquisition cost (CAC) for digital-only banks is $20-40, compared to $200-300 for traditional banks. The company plays a vital role in transforming these legacy systems, streamlining complex integrations, and offering cost-effective solutions that enhance operational efficiency. Avato’s hybrid unification platform is specifically designed to address these challenges, providing a secure and reliable foundation for seamless integration of diverse components.

- User Resistance: Change often meets resistance from employees accustomed to existing workflows. To facilitate a smoother transition, banks should offer comprehensive training and communicate the benefits of the new systems clearly. Involving employees in the unification process can alleviate concerns and foster a culture of adaptability.

These challenges highlight the complexities of integrated software systems for banking unification, especially in a rapidly changing regulatory environment. By proactively addressing these issues, banks can enhance their operational capabilities and ensure a successful unification process. As noted by Gustavo Estrada, a client of the company, “The organization has simplified complex projects and delivered results within desired time frames and budget constraints,” illustrating the effectiveness of strong combined solutions in overcoming these challenges.

Additionally, Tony Leblanc from the Provincial Health Services Authority remarked, “Good team. Good people to work with. Extremely professional. ‘Extremely knowledgeable,'” further reinforcing the company’s commitment to leveraging innovative technologies for improved service delivery. The integration of generative AI has emerged as a game-changer, with a 60% increase in its application for customer experience, particularly in the development of sophisticated chatbots and virtual assistants, showcasing Avato’s dedication to enhancing operational efficiency.

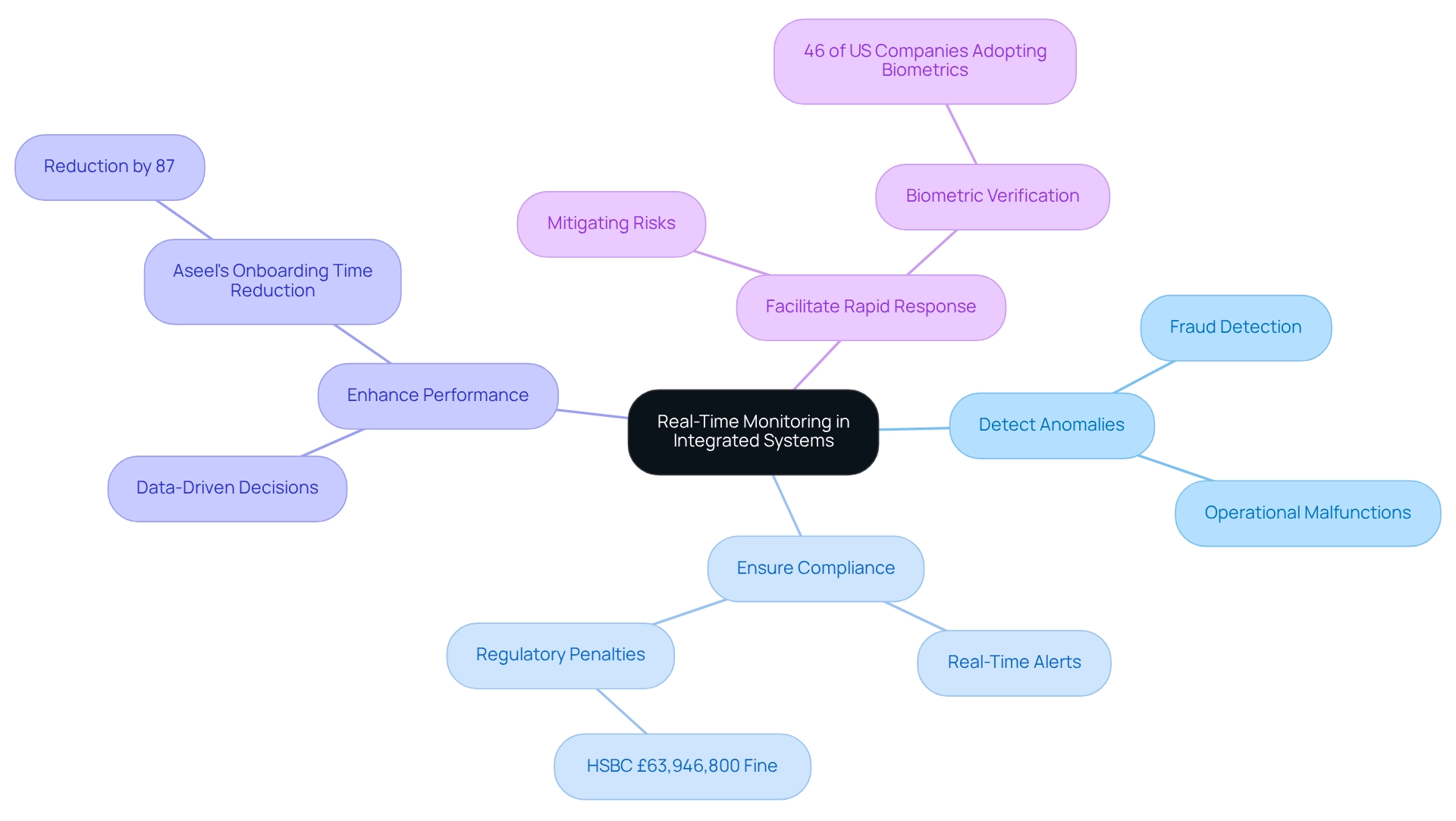

The Role of Real-Time Monitoring in Integrated Systems

Real-time monitoring stands as a cornerstone for the effective functioning of integrated software systems in the banking sector. Its significance is underscored by several key functions that enhance operational integrity and security.

-

Detect Anomalies: Ongoing observation is essential for recognizing atypical patterns that may indicate fraudulent activities or operational malfunctions. Consider this: banks utilizing advanced anomaly detection technologies can greatly diminish the risk of financial losses. Case studies illustrate enhanced fraud detection rates through real-time analytics. The Hybrid Platform maximizes the value of legacy technologies, enabling smooth connectivity and real-time insights.

-

Ensure Compliance: Real-time alerts play a crucial role in compliance management. By notifying compliance officers of potential breaches as they occur, institutions can take immediate corrective actions, thereby minimizing the risk of regulatory penalties. This proactive approach is critical, particularly in light of recent penalties imposed on organizations like HSBC, which faced a £63,946,800 penalty for failing to establish a transaction monitoring process. Avato’s platform simplifies complex integrations, ensuring that compliance measures are effectively monitored and managed.

-

Enhance Performance: Observing performance metrics enables financial institutions to make informed, data-driven choices that improve operational efficiency and client satisfaction. By analyzing real-time data, banks can identify bottlenecks and optimize processes, leading to improved service delivery and reduced operational costs. Aseel’s case study illustrates this, as they utilized Focal’s real-time transaction monitoring solution to streamline their onboarding process, achieving a reduction in onboarding time by more than 87%. The company’s unification solutions further enhance the optimization of isolated legacy technologies, ensuring that performance metrics are easily accessible and actionable. Furthermore, the platform notably lowers expenses related to combining systems and upkeep, offering a complete solution for financial institutions.

-

Facilitate Rapid Response: In the event of a failure or security breach, real-time monitoring enables swift action to mitigate risks and minimize downtime. This capability is critical in maintaining trust and reliability in banking services, especially as the industry increasingly adopts biometric methods for digital identity verification. Nearly 46% of US companies are moving away from traditional passwords, highlighting the need for robust real-time monitoring to support these evolving technologies. The proficiency in hybrid connection guarantees that financial institutions can react swiftly to incidents, preserving operational integrity.

The significance of real-time oversight in integrated software systems cannot be emphasized enough, particularly as organizations encounter changing threats and regulatory requirements. By implementing robust real-time monitoring solutions, banks can enhance their fraud detection capabilities, ensuring a secure and efficient operational environment. As Gustavo Estrada from BC Provincial Health Services Authority notes, the company has the ability to simplify complex projects and deliver results within desired time frames and budget constraints. This further underscores the value of effective unification solutions in enhancing operational integrity and security. Avato remains committed to not only improving operational efficiency but also ensuring cost-effectiveness in the integration process.

Training and Support: Ensuring User Adoption and Success

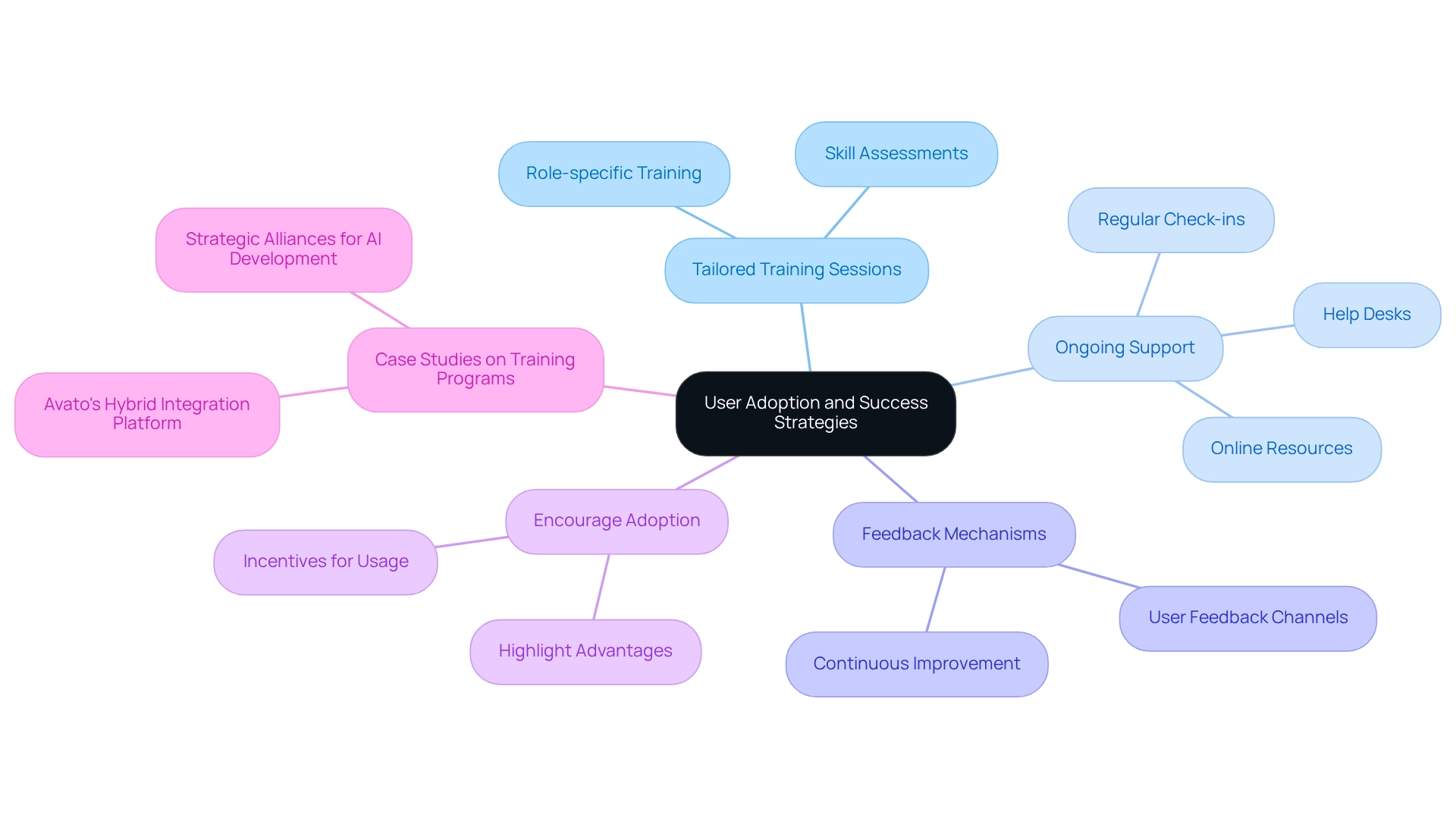

To ensure successful user adoption of integrated software systems, banks must implement comprehensive training and support programs that address the unique challenges of the banking environment.

-

Tailored Training Sessions: Design training sessions that cater to various user roles within the bank. This method guarantees that all employees, from front-line staff to management, are equipped with the necessary skills to use the new processes effectively, thereby enhancing overall operational efficiency.

-

Ongoing Support: Continuous assistance is vital for sustaining user confidence and operational effectiveness. Establish help desks, provide access to online resources, and conduct regular check-ins to address any issues that may arise post-implementation. This commitment to support can significantly reduce downtime and enhance user satisfaction, as evidenced by Avato’s dedication to ensuring 24/7 uptime for critical integrations. Such ongoing support is essential, especially in light of the rising demand for personalized banking services, with 80% of consumers preferring tailored financial services. Furthermore, utilizing strong analytics capabilities enables banks to consistently track performance, enhance operations, and elevate customer experiences.

-

Feedback Mechanisms: Establish avenues for users to offer feedback on the platform. This allows for ongoing improvements and adjustments based on real user experiences, fostering a culture of collaboration and responsiveness within the organization.

-

Encourage Adoption: Motivate employees to embrace new processes by clearly conveying the advantages and providing rewards for effective utilization. Highlighting the advantages of integrated software systems can motivate employees to engage with the technology, ultimately leading to higher adoption rates.

-

Case Studies on Training Programs: Successful financial institutions have implemented training programs that not only focus on technical skills but also on user engagement strategies. For example, financial institutions that have embraced the hybrid integration platform have reported notable enhancements in project delivery durations and budget compliance. As Gustavo Estrada, a customer, noted, “Avato simplifies complex projects and delivers results within desired time frames and budget constraints,” showcasing the effectiveness of well-structured training initiatives.

By prioritizing these strategies, financial institutions can boost user acceptance of integrated software systems, ensuring that their investments in technology yield the desired operational enhancements and competitive benefits.

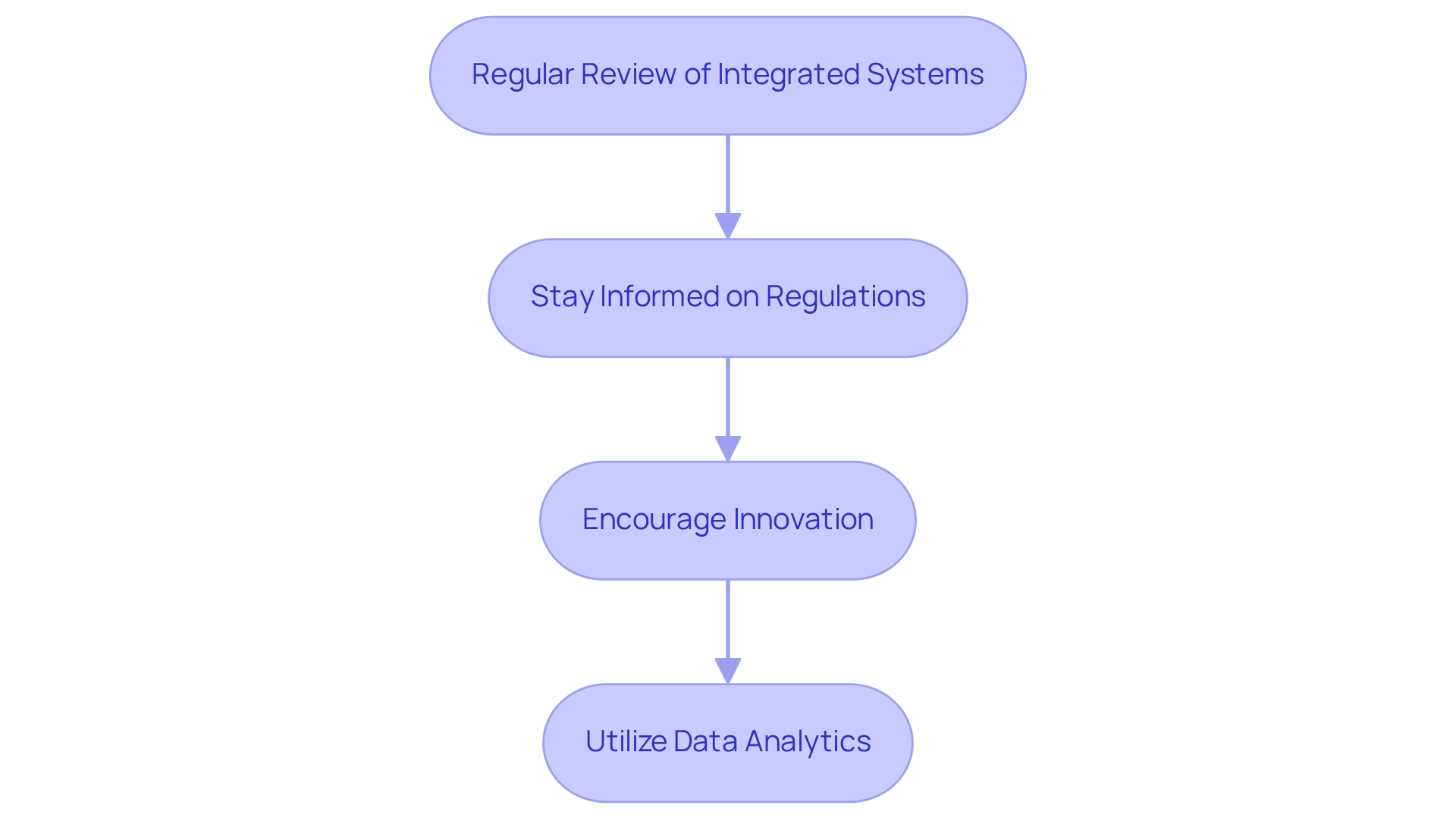

Continuous Improvement: Adapting to Change in Banking Integration

Ongoing enhancement is crucial for the enduring success of integrated software systems in the banking sector. To effectively adapt to the evolving landscape, banks should implement the following strategies:

- Regularly review integrated software systems: Conduct periodic evaluations of integrated software systems to identify areas for enhancement. This proactive strategy guarantees that frameworks align with current business requirements and operational objectives. As Richard Rosenthal mentioned in a recent report, ongoing evaluations are essential for preserving operational effectiveness. The hybrid connectivity platform illustrates this by allowing smooth evaluations and modifications to connection strategies, ensuring that financial institutions can react promptly to evolving needs.

- Stay Informed on Regulations: It is crucial to remain updated on changes in banking regulations. By modifying processes accordingly, financial institutions can uphold compliance and reduce risks linked to regulatory changes. Asset and liability management committees will face challenges in balancing loan and deposit rates, making this awareness even more critical. Avato’s expertise in hybrid connections aids banks in managing these complexities with speed and reliability.

- Encourage Innovation: Cultivating an organizational culture that promotes innovation is vital. Motivating staff to suggest enhancements and fresh concepts for usage and incorporation can result in substantial progress in operational efficiency. Organizations that prioritize continuous improvement have reported achieving 98% fewer errors in processes through automation, underscoring the tangible benefits of these practices. The integration of generative AI, as highlighted in recent trends, can further enhance customer experience and operational efficiency, making innovation a key focus area.

- Utilize Data Analytics: Leveraging data analytics offers valuable insights into performance and user behavior. This information is crucial in directing future improvements and adjustments, ensuring that structures develop in accordance with user requirements and technological progress. The rise of artificial intelligence in banking, particularly in consumer interaction strategies, highlights the importance of leveraging data analytics for continuous improvement. The platform facilitates this by unlocking isolated data assets, enabling banks to make informed decisions based on real-time analytics.

Incorporating these strategies not only enhances the effectiveness of integrated software systems but also positions banks to navigate the complexities of a rapidly changing financial landscape. For instance, the case study titled ‘Avato’s Hybrid Integration Platform’ illustrates how Avato has successfully addressed integration challenges in the banking sector, thereby providing a real-world example of the benefits of continuous improvement. As the finance sector evolves, the ability to balance technological innovation with human expertise will be crucial in navigating a complex risk environment effectively.

Conclusion

The integration of software systems in banking transcends a mere technological upgrade; it stands as a strategic necessity for financial institutions striving for operational success and compliance within a rapidly evolving landscape. This article has illuminated the multifaceted benefits of integrated systems, underscoring their pivotal role in enhancing data accuracy, operational efficiency, and regulatory compliance. By delving into best practices for implementation, addressing common challenges, and highlighting the significance of real-time monitoring, it becomes evident that a deliberate approach to integration can markedly enhance service delivery and customer satisfaction.

Furthermore, the case studies, particularly those highlighting Avato’s Hybrid Integration Platform, vividly illustrate the tangible advantages of effective integration strategies. These examples reinforce how banks can adeptly navigate the complexities of digital transformation, reduce operational costs, and sustain a competitive edge in an increasingly globalized economy.

As banks progress, prioritizing training and ongoing support for users will be crucial in fostering adoption and ensuring that integrated systems are leveraged to their fullest potential. Continuous improvement and adaptation to regulatory changes will further empower financial institutions to flourish amidst emerging challenges.

In conclusion, embracing integrated software systems is not merely about keeping pace with technological advancements; it is about positioning banks for sustained growth and innovation. With the right strategies in place, financial institutions can unlock the full potential of their systems, ultimately enhancing both their operational capabilities and customer experiences in the evolving banking landscape.