Overview

We present an insightful overview with our article titled “7 Banking Software Free Solutions for Small Businesses in 2025,” which meticulously identifies and describes free banking software options available for small businesses in the upcoming year. Our focus encompasses various solutions, including:

- Wave

- QuickBooks Online

- FreshBooks

We highlight their features and benefits tailored to meet the financial management needs of small enterprises. These tools are essential for efficient bookkeeping and financial oversight, empowering businesses to thrive in a competitive landscape.

Introduction

Navigating the financial landscape is no small feat for small businesses. As we strive to remain competitive in an ever-evolving market, the challenges can feel overwhelming. However, with the rise of technology, a wealth of free banking software solutions is available to simplify our financial management and enhance operational efficiency. In this article, we explore seven of the best free banking software options for small enterprises in 2025, each offering unique features tailored to meet the diverse needs of today’s business owners. But with so many choices, how can we determine which software will truly elevate our financial management without compromising on quality or security?

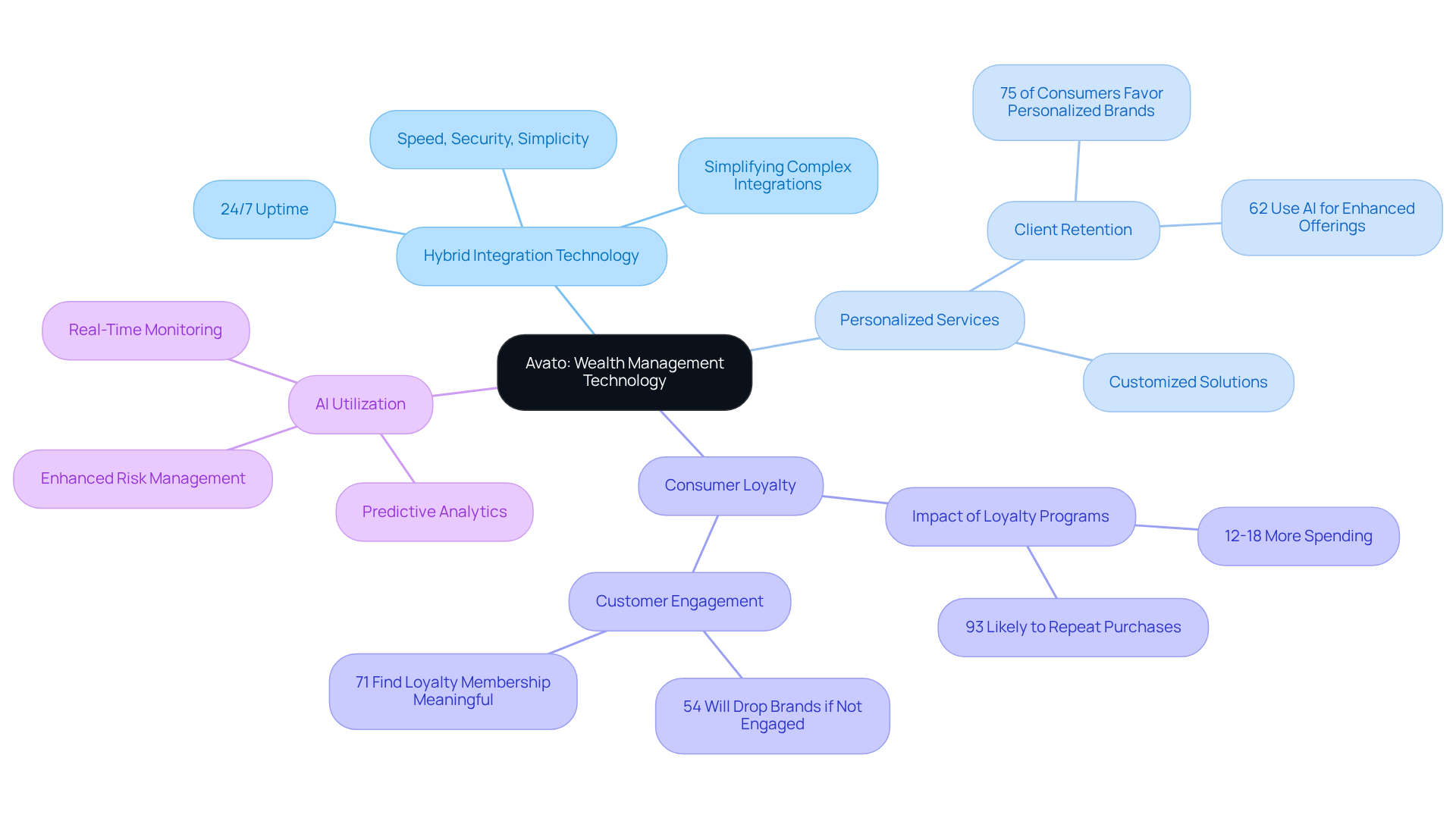

Avato: Secure Hybrid Integration Platform for Banking

At Avato, we emerge as a leading secure hybrid integration platform specifically designed for the financial sector, facilitating seamless connectivity between legacy systems and modern applications. This capability is crucial for monetary organizations aiming to innovate without compromising security.

With advanced features such as real-time monitoring and support for 12 levels of interface maturity, we empower banks to modernize operations efficiently, significantly reducing downtime and enhancing customer experiences.

In highly regulated environments, where compliance and security are paramount, our platform proves particularly beneficial. Successful implementations, such as the transition of Coast Capital’s telephone banking infrastructure with only a 63-second outage, underscore our reliability and effectiveness in navigating complex integrations.

As monetary institutions prioritize secure integration solutions in 2025, we stand out as a crucial partner in achieving operational excellence and regulatory compliance.

Dext: Real-Time Financial Data Management for Small Businesses

At Dext, we recognize the pressing challenges faced by minor enterprises in managing their data effectively. Our groundbreaking solution offers real-time data management that automates essential bookkeeping tasks, allowing users to effortlessly capture receipts and invoices. By leveraging advanced optical character recognition (OCR) technology, we ensure accurate and efficient data entry, significantly reducing the time spent on manual processes and enhancing compliance checks. Furthermore, our seamless integration with various accounting software enhances economic visibility and control, positioning Dext as a crucial element of a cohesive tech stack for minor enterprises.

By automating bookkeeping, we empower enterprises to enhance their economic operations, resulting in improved management practices and greater precision in records. What’s holding your team back from achieving this level of efficiency? We invite you to explore how Dext can transform your bookkeeping processes and elevate your business management to new heights. Let us partner with you on this journey toward streamlined operations and enhanced accuracy.

Wave: User-Friendly Accounting Software for Small Enterprises

At Wave, we understand the challenges that small businesses face when it comes to managing finances. Our banking software free is designed specifically for minor businesses, offering a comprehensive suite of features that streamline resource management. With Wave, you can create, send, and track invoices effortlessly, with no limits on the number of invoices per month. Additionally, our platform allows you to track expenses and manage payroll seamlessly from a single interface.

Our user-friendly design caters to non-accountants, empowering entrepreneurs to navigate the software with ease and focus on growth rather than getting bogged down by complex financial tasks. As we look towards 2025, the demand for intuitive accounting solutions is set to rise, with 71% of local entrepreneurs currently relying on accounting software to manage their finances.

Wave’s commitment to offering banking software free of charge, along with robust functionality, has established us as a preferred choice among independent entrepreneurs. Our users frequently share testimonials about how Wave has simplified their financial management, with many highlighting that our software’s simplicity significantly boosts their operational efficiency. One satisfied user remarked, “For banking software free, you can’t get much better than Wave.”

While we offer a free plan, it is essential to note that our payroll service includes a base fee of $40 per month plus $6 per active employee or contractor. This transparency in our pricing structure ensures that users can make informed decisions regarding payroll features. We invite you to explore how Wave can transform your financial management experience today.

Crassula: Customizable Banking Solutions for Small Businesses

At Crassula, we understand the pressing need for customizable financial solutions that empower emerging enterprises to swiftly and effectively create personalized financial products. Our white-label financial software enables companies to seamlessly introduce their own financial services, integrating essential functionalities such as payment processing and account management.

In the competitive landscape of 2025, this adaptability is not just an advantage; it is vital for enhancing customer satisfaction and loyalty. With over 60% of minor enterprises planning to expand operations this year, leveraging our platform allows them to effectively address specific customer needs, positioning themselves for sustainable growth.

What’s holding your team back from seizing this opportunity? Fintech specialists emphasize that the ability to deliver unique, customer-focused financial solutions can significantly enhance a small business’s competitive edge. This makes our offerings particularly pertinent in the current market.

We invite you to explore how Crassula can elevate your financial services and drive your success forward.

FIS Digital One: Comprehensive Digital Banking Platform

FIS Digital One represents a revolutionary digital financial platform, expertly designed to meet the evolving demands of financial institutions. Our modular framework empowers banks to create tailored experiences that significantly boost customer engagement and satisfaction. With key features such as mobile services, online account management, and advanced analytics, we enable seamless digital interactions across all channels. This adaptability is particularly advantageous for small enterprises aiming to leverage technology for enhanced financial operations.

As we look ahead to 2025, the influence of modular financial solutions on customer engagement is poised to be transformative. Financial institutions are increasingly recognizing the importance of customized services. Industry experts highlight that modular frameworks allow banks to respond promptly to customer needs, thereby fostering loyalty and satisfaction. For example, banks utilizing FIS Digital One have reported improved customer interactions, resulting in higher retention rates and overall satisfaction.

Statements from financial experts underscore the significance of these modular solutions:

- “The ability to customize financial experiences is crucial in today’s competitive landscape,” asserts a leading industry executive.

- Another specialist emphasizes, “Modular frameworks not only simplify operations but also cultivate a more engaging customer experience, which is vital for contemporary financial success.”

We observe numerous monetary institutions effectively employing FIS Digital One, including regional banks that have transformed their customer interaction strategies by integrating mobile services and personalized account management tools. These implementations have yielded enhanced customer feedback and a marked increase in user engagement, demonstrating the platform’s efficacy in improving banking experiences.

To maximize the value of these modular solutions, we recommend integrating Avato’s Hybrid Integration Platform, which can significantly streamline complex integrations with legacy systems. This integration not only facilitates real-time monitoring and alerts on system performance but also aids in reducing costs associated with outdated technologies. By adopting Avato’s Hybrid Integration Platform, we can help banks navigate the challenges of integrating new technologies with legacy systems, ensuring a seamless transition into the digital age.

Avaloq: Wealth Management Technology for Enhanced Client Experience

At Avato, we stand at the forefront of hybrid integration technology, significantly enhancing client experiences through our unwavering focus on personalized services and operational efficiency. Designed for integration projects that demand 24/7 uptime, we deliver a rock-solid foundation for digital transformation initiatives, ensuring no room for defects, errors, or outages.

By combining a comprehensive range of monetary products and services, we empower wealth managers to provide customized solutions that meet individual client requirements. Our platform supports 12 levels of interface maturity, striking a balance between rapid integration and the sophistication needed to future-proof technology stacks.

This emphasis on personalized service is not merely beneficial; it is crucial. Studies indicate that 75% of consumers are more likely to remain loyal to brands that understand them on a personal level. Furthermore, as we approach 2025, wealth managers increasingly recognize that personalized services are vital for client retention, with 62% already leveraging AI to enhance their offerings.

We also provide real-time monitoring and alerts on system performance, significantly reducing costs and simplifying complex integrations. As the wealth management landscape evolves, the ability to deliver customized experiences will be a key differentiator for firms striving to maintain a competitive edge.

What steps will you take to ensure your firm is among those leading the charge?

Receipt Bank (Dext): Simplified Invoicing for Small Businesses

We understand that managing invoices and receipts can be a daunting task for small businesses. That’s why we developed Receipt Bank, now part of Dext, to simplify this process. By automating the capture and processing of receipts and invoices, we empower our users to handle their monetary documents effortlessly, significantly reducing the time spent on manual data entry.

With features like automated categorization and seamless integration with popular accounting software, Receipt Bank enhances both accuracy and efficiency. Imagine a world where business proprietors can maintain organized financial records without dedicating excessive time to bookkeeping. This is not just a dream; it’s a reality we deliver.

Are you ready to transform your invoicing process? Let us help you streamline your financial management and reclaim your time. Together, we can make bookkeeping a breeze.

Zoho Books: Integrated Accounting Software for Small Enterprises

At Zoho, we understand that effective financial management is crucial for small businesses striving for growth. Zoho Books is a comprehensive accounting application that offers banking software free, meticulously designed to enhance money management through an array of integrated features. With our platform, users can seamlessly manage invoices, track expenses, and generate detailed financial reports—all from a single interface. Our user-friendly design, combined with robust automation capabilities, simplifies accounting tasks, allowing small business owners to concentrate on strategic initiatives and expansion while utilizing banking software free.

Furthermore, Zoho Books integrates effortlessly with other Zoho applications, creating a holistic solution for effective financial management. This integration not only streamlines operations but also enhances data accuracy, empowering businesses to make informed financial decisions swiftly. As we move into 2025, automation continues to reshape the accounting landscape, with nearly 75% of accounting tasks becoming automatable. We recognize Zoho Books as an indispensable tool that offers banking software free for businesses aiming to refine their management processes.

Moreover, as the accounting sector is projected to grow to $735.94 billion by 2025, tools like Zoho Books are vital for improving financial literacy. Alarmingly, 45% of small business owners have lost at least $10,000 in earnings due to inadequate financial understanding. In fact, 32% of entrepreneurs believe that enhanced financial literacy would help them improve budgeting and cash flow management. This is where we come in—Zoho Books is not just a tool; it is an essential partner in navigating these challenges. Let us help you enhance your financial management today.

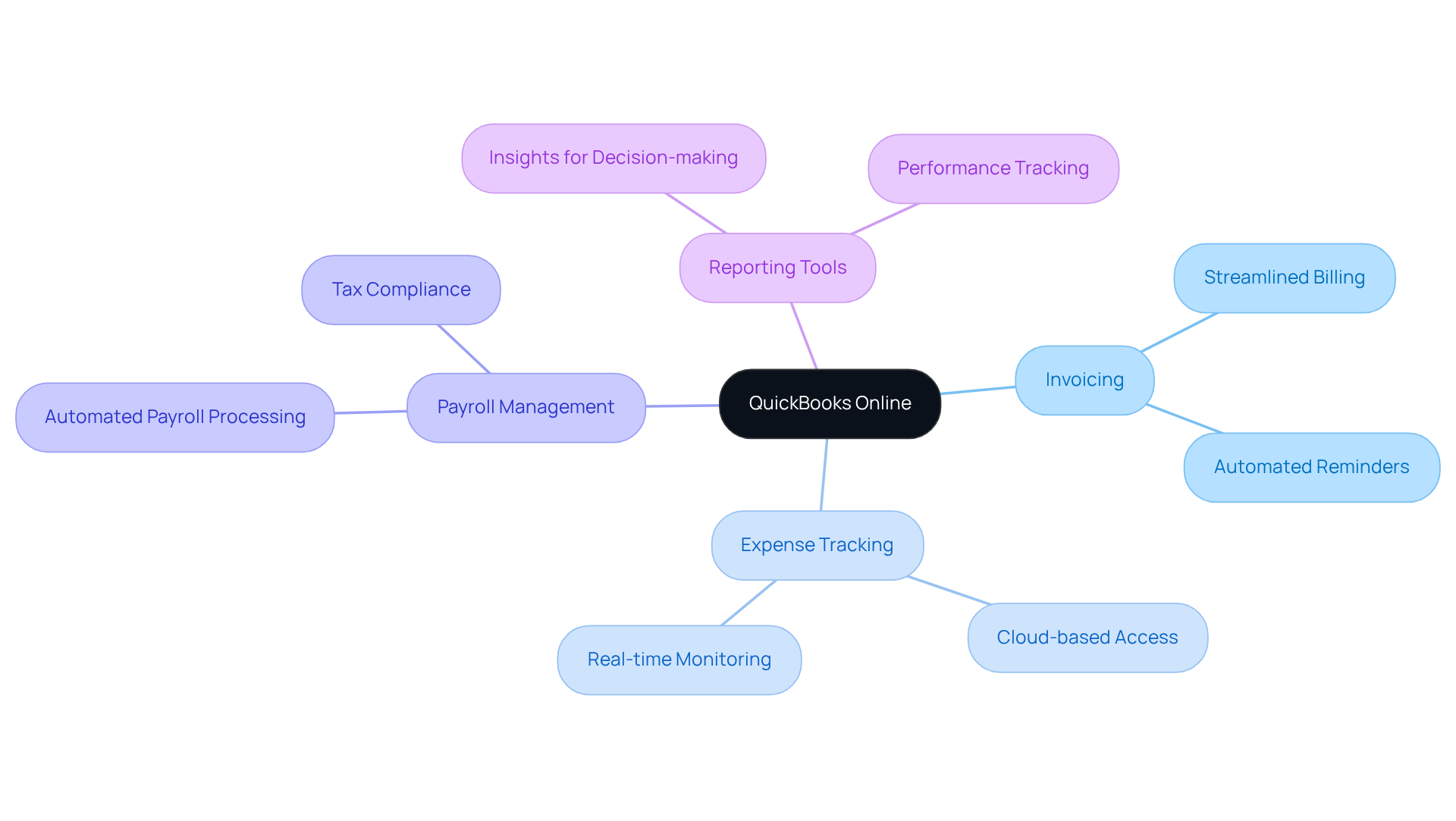

QuickBooks Online: Versatile Accounting Software for Small Businesses

At a time when small enterprises face numerous challenges, QuickBooks Online emerges as a crucial ally in effective financial management. We understand the complexities of running a business, and our versatile banking software free solution effectively addresses your varied requirements. With features such as invoicing, expense tracking, and payroll management—all accessible from a cloud-based platform—we empower you to oversee your finances from any location. This flexibility is essential for those of you who are always on the go.

Furthermore, our powerful reporting tools provide valuable insights into your performance, enabling informed decision-making. As cloud accounting gains momentum—67% of accountants favoring it for organizational success—businesses utilizing cash flow reporting, management applications, and e-commerce tools have experienced growth up to 3 percentage points faster. In light of the economic difficulties that small enterprises encounter, including reductions in income and job expansion, using banking software free like QuickBooks Online is indispensable for enhancing fiscal management in 2025.

What’s holding your team back from optimizing its financial processes? Testimonials from independent business owners underscore the effectiveness of our cloud-based financial management, highlighting its significant impact on operational efficiency and decision-making. We invite you to explore how QuickBooks Online can transform your accounting practices and drive your business forward.

FreshBooks: Invoicing and Expense Tracking for Small Business Owners

At FreshBooks, we understand the challenges small enterprise owners face in managing their finances. Our intuitive banking software free for invoicing and expense tracking is designed to empower you to create professional invoices, track billable hours, and manage expenses effortlessly. With key features like automated payment reminders and customizable invoice templates, we enhance your billing process, ensuring prompt payments and giving you more time to focus on growth.

Recognized as the most affordable banking software free for 2025, we invite you to take advantage of our 30-day free trial, allowing you to explore our capabilities without any commitment. Our user-friendly interface and mobile application enable you to efficiently manage your finances while concentrating on what truly matters—your business.

In 2025, minor enterprises utilizing FreshBooks have reported significant advancements in financial management. Many users commend our software for simplifying expense tracking and improving overall operational efficiency. In fact, users have experienced a remarkable 3x growth in their business due to employing FreshBooks, and we are proud to hold a rating of 4.5 out of 5 for ease of use. This solidifies our position as a preferred solution among small business owners.

What’s holding your team back? Join us at FreshBooks and experience the difference for yourself. Let’s simplify your financial management together.

![]()

Conclusion

Navigating the financial landscape as small business owners presents significant challenges, yet we recognize that the right banking software can alleviate this burden. Our exploration of seven free banking software solutions for small enterprises in 2025 unveils a diverse array of tools designed to enhance financial management, operational efficiency, and customer satisfaction. Each option, from Avato’s secure integration platform to FreshBooks’ intuitive invoicing capabilities, offers unique features tailored to the specific needs of small businesses.

We emphasize key insights that highlight the importance of automation, customization, and user-friendly interfaces in today’s financial software. Solutions like Dext streamline data management, while Wave and Zoho Books provide comprehensive accounting functionalities that empower entrepreneurs to focus on growth rather than becoming bogged down by complex financial tasks. Furthermore, platforms such as FIS Digital One and Crassula underscore the necessity of modular and customizable services to meet evolving customer demands.

As technology continues to reshape the financial landscape, we must leverage these free banking software solutions to enhance our financial management practices. Embracing these tools not only simplifies operations but also positions us for sustainable growth and competitive advantage. The future of financial management for small businesses is bright, and we are confident that the right software can make all the difference in achieving success.