Overview

We recognize that modernizing legacy applications is crucial for enhancing banking efficiency and security. Outdated systems expose financial institutions to increased cyber threats and operational inefficiencies. By modernizing, we can significantly improve security through advanced protocols, streamline processes to boost productivity, and ensure compliance with regulatory standards. Ultimately, this leads to better customer satisfaction and reduces the risks of costly breaches.

What’s holding your team back from taking this vital step? Let us partner with you to navigate this complexity and unlock the full potential of your operations.

Introduction

In the rapidly evolving landscape of banking, we recognize that legacy systems are becoming a significant liability, exposing our institutions to a myriad of risks that could jeopardize both security and operational efficiency. As cyber threats escalate and regulatory demands tighten, we increasingly understand the urgent need to modernize our outdated technologies.

The costs associated with data breaches and compliance failures are staggering, prompting our shift towards innovative solutions that promise not only to enhance security but also to streamline operations and improve customer satisfaction.

This article delves into the critical importance of identifying risks associated with legacy systems, explores the transformative benefits of modernization, and outlines effective strategies for aligning our technological upgrades with overarching business objectives, ensuring that we can thrive in an increasingly competitive and digital world.

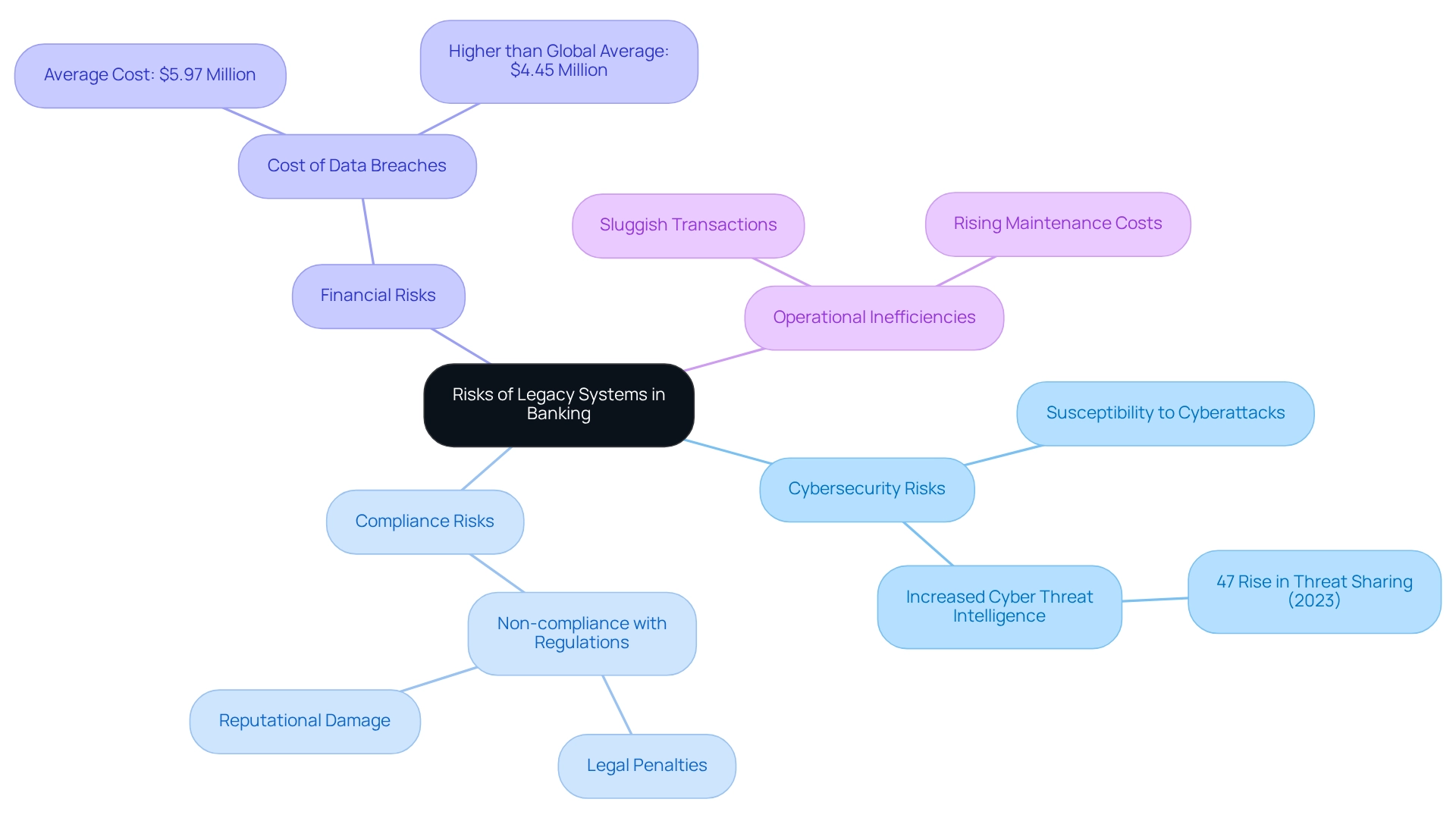

Identify the Risks of Legacy Systems

Legacy infrastructures in banking pose significant risks that jeopardize both security and operational efficiency. A major concern is their susceptibility to cyberattacks; many of these outdated infrastructures lack the advanced security features necessary to protect sensitive financial information, making them appealing targets for hackers. The financial sector has seen a notable increase in cyber threats, with a 47% rise in cross-border threat intelligence sharing among institutions in 2023. This underscores the urgency for robust security measures.

Furthermore, a significant portion of banks employing outdated technologies are discovered to be non-compliant with current regulatory standards, which can result in serious legal penalties and reputational damage. While the exact percentage of non-compliance varies, it is critical to recognize that this non-compliance can significantly increase the risk of costly breaches. The typical expense of a data breach in financial services has reached $5.97 million, considerably surpassing the global average of $4.45 million across all sectors. This emphasizes the financial consequences of cybersecurity incidents.

Operational inefficiencies are another critical risk associated with legacy technology. Obsolete infrastructures frequently lead to sluggish transaction processing durations and rising maintenance expenses, negatively impacting customer satisfaction and confidence. As highlighted by industry professionals, dependence on outdated infrastructures continues to be a significant obstacle to understanding why modernizing legacy applications is essential for attaining the contemporary efficiency and security that today’s banking landscape requires. This indicates that modernization can lead to significant financial benefits.

Our Hybrid Integration Platform plays a vital role in tackling these vulnerabilities by simplifying intricate integrations and enhancing the value of outdated technologies. With features that enable real-time monitoring and alerts on performance, we help financial institutions enhance their operational capabilities while ensuring secure transactions. Gustavo Estrada, a client, remarked that ‘Avatohttps://avato.co has streamlined intricate projects and provided outcomes within expected deadlines and financial limitations,’ highlighting the difficulties financial institutions encounter in handling outdated frameworks. Addressing these vulnerabilities is essential for financial institutions aiming to enhance their operational capabilities and secure their data against evolving threats.

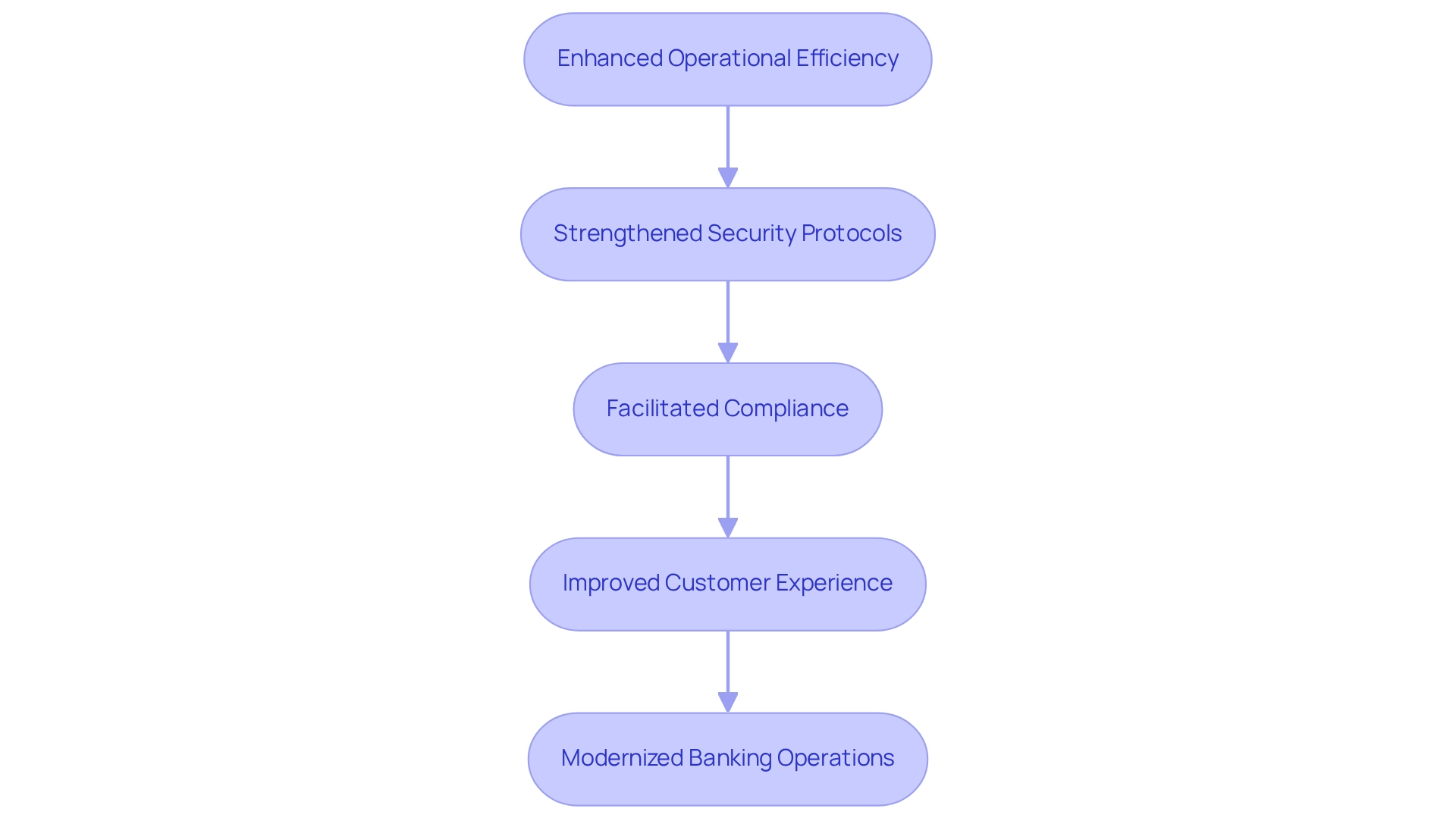

Explore the Benefits of Modernization

Updating traditional frameworks is not merely beneficial; it is essential for transforming banking operations, particularly through the capabilities of Avato’s Hybrid Integration Platform. We recognize that one of the primary advantages is enhanced operational efficiency, achieved by streamlining processes and minimizing transaction times. For instance, financial institutions leveraging cloud-based solutions have reported significant improvements in transaction speeds, with some noting reductions of up to 50% in processing times. This acceleration not only boosts productivity but also enhances data accessibility, enabling quicker decision-making. Furthermore, our platform’s real-time monitoring and alerts feature empowers financial institutions to proactively manage system performance, further optimizing operations.

In addition to efficiency, modernization strengthens security protocols. By integrating advanced encryption methods and multi-factor authentication, we can help financial institutions more effectively safeguard sensitive information against potential breaches. This is particularly vital in an era where data protection is paramount, especially considering that 79% of entities are actively addressing deficiencies in their IT capabilities. This underscores the necessity for financial institutions to upgrade their infrastructure to remain competitive and secure.

Moreover, modern systems, such as those enabled by Avato, are designed to facilitate compliance with ever-evolving regulatory requirements, thereby mitigating the risk of costly penalties. As regulations become more stringent, having a robust, modern infrastructure ensures that financial institutions can adapt swiftly without compromising their operational integrity.

The customer experience also significantly improves through modernization. Enhanced systems enable banks to offer personalized services and faster response times, aligning with the rising expectations of today’s consumers. As highlighted in recent case studies, including the integration of generative AI in financial services, institutions are not only modernizing their operations but also enhancing service delivery and customer engagement. This integration illustrates how updating processes can lead to tangible outcomes, boosting both productivity and customer satisfaction.

In summary, the transition towards contemporary frameworks is crucial for sustainable development in the financial sector. As noted by industry experts, including Roman Chuprina, “Digital transformation is set to change the global economy — over 50% of the world’s enterprises will digitize their processes by the year 2023,” emphasizing the critical nature of modernization. Understanding why modernize legacy applications in banking systems in 2025 highlights benefits that extend beyond operational improvements to encompass security, compliance, and customer satisfaction, making it a strategic imperative for financial institutions. Moreover, viewing digital transformation as an ongoing process rather than isolated initiatives will ensure that financial institutions remain adaptable and responsive to future challenges. To effectively mobilize stakeholders and model new business processes, we encourage financial institutions to engage with their integration solution provider to develop a comprehensive plan that aligns with their goals.

Outline Effective Modernization Strategies

To effectively update outdated infrastructures, we must understand why modernize legacy applications and adopt a phased strategy that prioritizes crucial areas for enhancement. A thorough evaluation of current frameworks is essential to understand why modernize legacy applications, as it helps to pinpoint challenges and aspects requiring urgent focus. Our specialized integration services, including enterprise architecture and project management, can aid in this evaluation, ensuring that enhancement efforts align with our institution’s objectives and customer requirements. Following this assessment, it becomes clear why modernize legacy applications, as implementing modular upgrades allows for incremental changes that minimize disruption and enhance system functionality. Furthermore, leveraging cloud technology is pivotal, offering scalability and flexibility while significantly reducing maintenance costs.

Investing in staff training is crucial to ensure that our employees are well-equipped to navigate new technologies and processes. Collaborating with fintech associates, like us at Avato, can further accelerate advancement efforts, providing access to innovative solutions and specialized knowledge.

Statistics show that the path of advancement involves continuous evolution and adaptation to trends, emphasizing that progress is an ongoing process rather than a one-time endeavor. Case studies from industry leaders demonstrate the effectiveness of these strategies, highlighting the significance of careful planning to maximize returns on investment while reducing unnecessary expenses. Moreover, as highlighted by tech journalist Alexey Porubay, understanding why modernize legacy applications is critical, as regulatory compliance is a primary reason financial institutions are investing in digital transformation, which lowers the risk of costly penalties and boosts customer trust. By concentrating on these optimal strategies, including utilizing established BaaS providers and our hybrid integration platform to mitigate risks related to new service deployment, we can manage the challenges of legacy system upgrades while enhancing our return on investment.

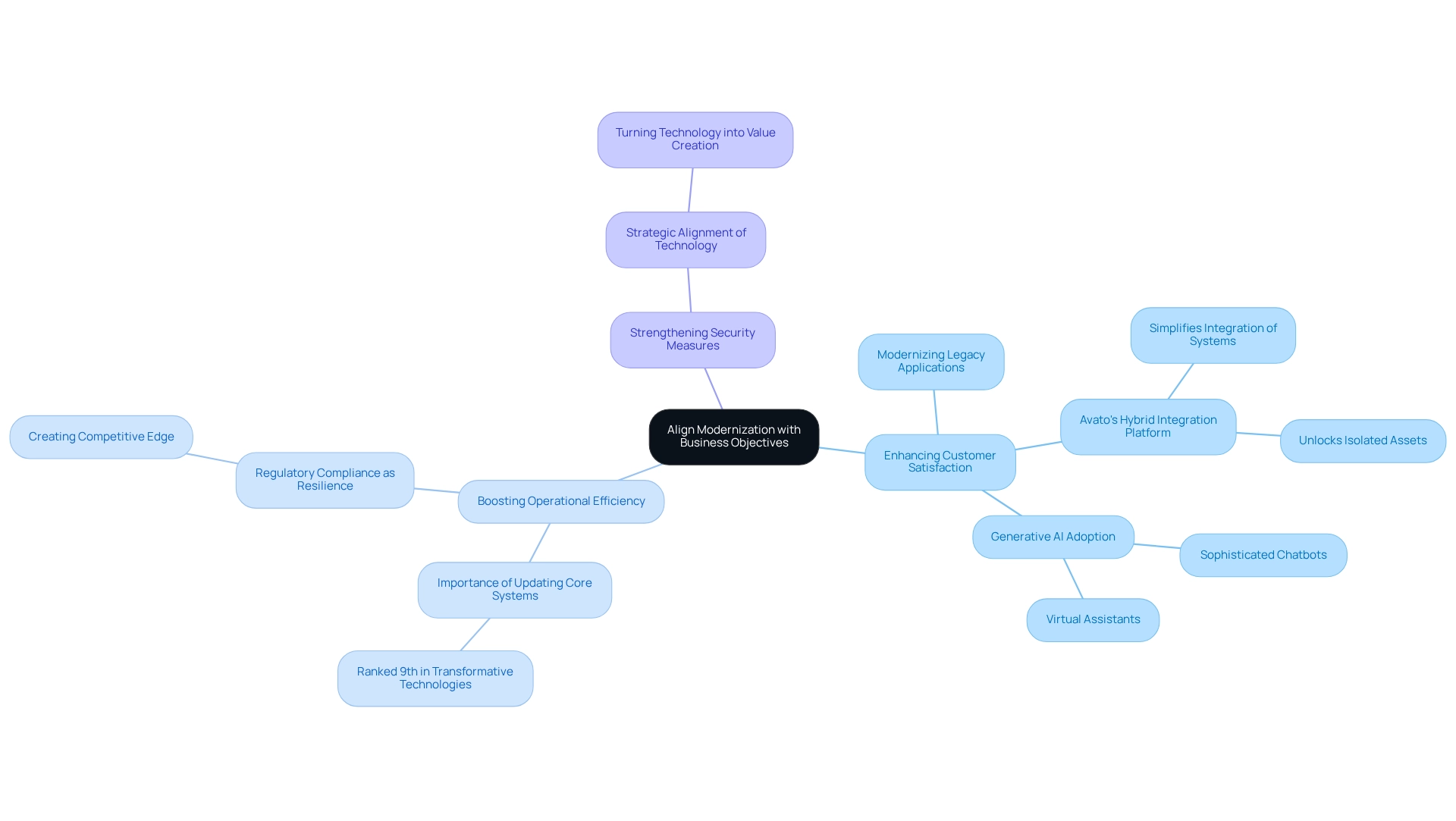

Align Modernization with Business Objectives

Aligning enhancement initiatives with business goals is essential for maximizing the advantages of technology investments in banking. We must start by clearly defining our strategic goals, such as:

- Enhancing customer satisfaction

- Boosting operational efficiency

- Strengthening security measures

If our goal is to enhance customer experience, we should explore why modernize legacy applications and focus on updating customer-facing services. Avato’s dedicated hybrid integration platform plays a pivotal role in this process by simplifying the integration of disparate systems, enabling us to unlock isolated assets and enhance business value creation.

Consistently evaluating and modifying these strategies guarantees that we remain adaptable and reactive to changing market conditions. Research indicates that successful alignment of technology with business strategies significantly contributes to competitive advantage in the banking sector. Notably, updating core systems has been recognized as a transformative technology, ranking 9th in importance, which emphasizes why modernize legacy applications is a necessary initiative for us to prioritize.

Additionally, viewing regulatory compliance as a chance for resilience can establish a competitive advantage, enabling us to manage challenges effectively. Case studies, such as Latinia’s role in shaping next-generation financial experiences, illustrate why modernize legacy applications is essential for institutions to meet emerging needs and preferences, reinforcing the importance of aligning modernization efforts with strategic goals.

Furthermore, the adoption of generative AI is reshaping the financial services landscape, with a significant increase in its use for enhancing customer experience through sophisticated chatbots and virtual assistants. As Aamer Baig, Senior Partner at McKinsey, states, ‘Our research indicates an opportunity to elevate banks’ approach to technology, turning it from a budget line item into an uncontested enabler of value creation.’ This perspective highlights the critical role of strategic alignment in leveraging technology for enhanced banking efficiency and security.

Conclusion

Legacy systems in banking present significant risks, jeopardizing both security and operational efficiency. With vulnerabilities to cyberattacks and regulatory non-compliance, the financial repercussions can be severe, as evidenced by the alarmingly high average cost of a data breach in our sector. This reality underscores the urgent need for modernization; solutions like Avato’s Hybrid Integration Platform are critical for enhancing our security and operational capabilities.

Modernizing these systems offers us numerous benefits, including increased efficiency, improved security protocols, and better compliance with regulations. By upgrading, we can deliver personalized services and faster response times, ultimately enhancing customer satisfaction and loyalty. As the digital landscape continues to evolve, embracing modern technologies is essential for our sustainable growth and competitiveness.

To successfully navigate modernization, we should adopt strategies that align our technological upgrades with core business objectives. A phased approach, combined with staff training and partnerships with fintech providers, can ensure a smooth transition and maximize our returns on investment. By treating modernization as an ongoing process and regularly reviewing our alignment with strategic goals, we will remain agile in a dynamic market.

In conclusion, the imperative to modernize legacy systems in banking is critical. By identifying risks, leveraging the benefits of modernization, and implementing effective strategies, we can secure our future in an increasingly competitive digital landscape. Embracing this necessity will enable us to thrive and meet evolving challenges and customer expectations head-on.