Overview

We present a comprehensive five-step approach to mastering partner integration strategies:

- Defining objectives

- Selecting partners

- Outlining success metrics

- Documenting the approach

- Reviewing and adapting the strategy as needed

Each step underscores the significance of clarity, stakeholder engagement, and data-driven decision-making. By enhancing our operational capabilities and customer experiences, we ensure successful partnerships that drive our business success. What could be more critical than aligning our objectives with the right partners? Let us guide you through this transformative process.

Introduction

In an era where seamless connectivity is not just an advantage but a necessity, we must navigate the complexities of partner integration to elevate our operational capabilities and enhance customer experiences. A well-defined integration strategy transcends mere technical requirement; it stands as a strategic imperative that can profoundly influence our business success.

From identifying our objectives and selecting the right partners to implementing robust systems and continuously optimizing performance, every step is crucial in ensuring that our integrations yield meaningful results. This article explores the essential components of crafting a successful partner integration strategy, offering actionable insights that empower us to thrive in an increasingly interconnected landscape.

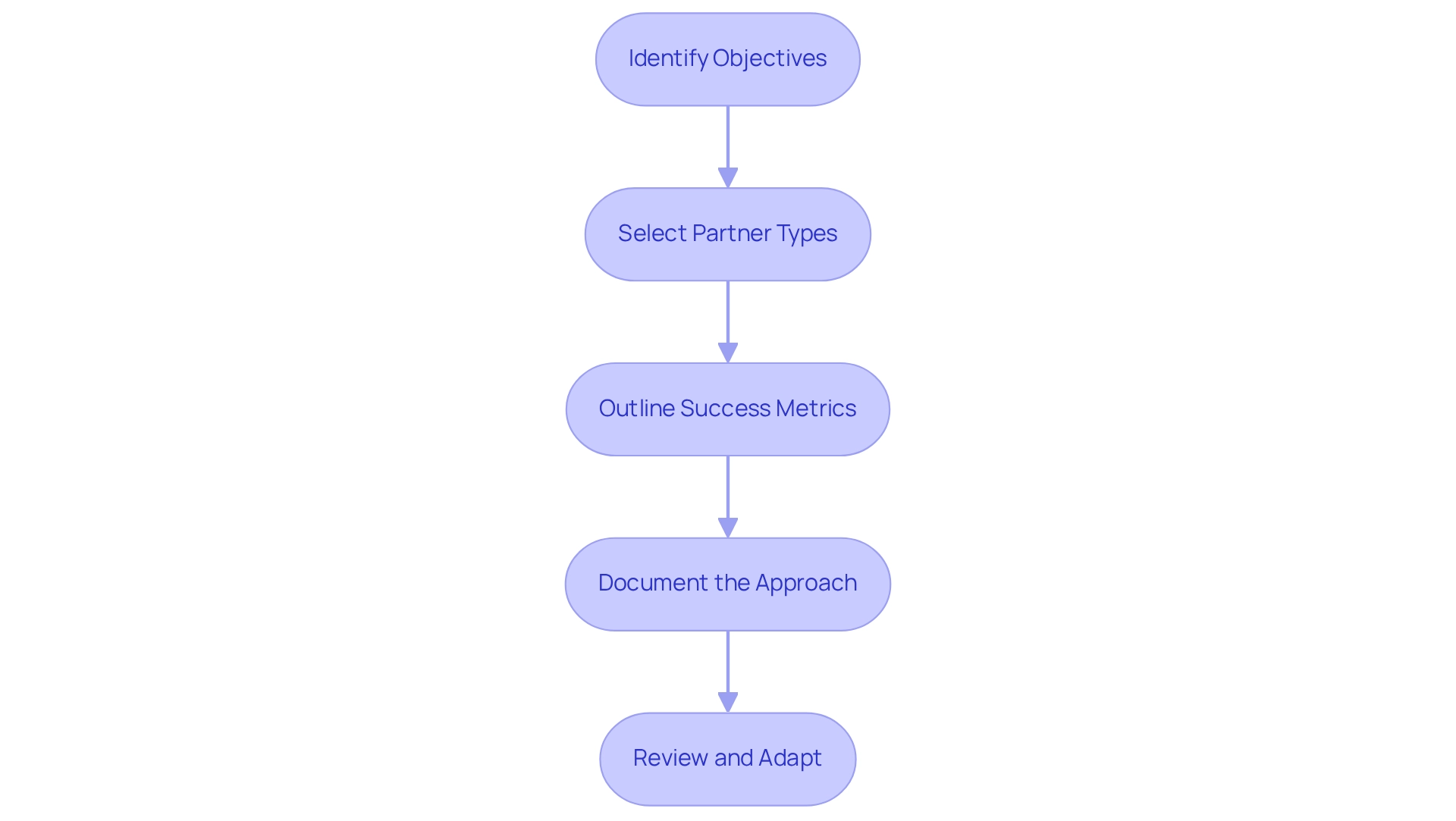

Define Your Partner Integration Strategy

To effectively define our partner integration strategy, we must consider the following steps:

- Identify Objectives: We need to clearly articulate our unification goals, such as enhancing customer experience, boosting operational efficiency, or broadening market reach. A well-defined objective is crucial, as 38% of managers attribute failed partnerships to a lack of trust and communication. This underscores the need for clarity from the outset to ensure all parties are aligned.

- Select Partner Types: It is essential to choose partners that align with our strategic objectives. This may include technology providers, service vendors, or industry-specific partners. The appropriate partners can greatly influence our merging success. In the financial sector, strategic alignment is vital, as partnerships can lead to enhanced service offerings and improved customer satisfaction. Our worldwide collaborations and managed service skills can enhance your internal team, guaranteeing you possess the appropriate expertise for your incorporation requirements.

- Outline Success Metrics: We should set up essential indicators to assess the success of the merging process. Metrics such as time to market, customer satisfaction scores, and revenue growth are essential for tracking progress. Businesses are progressively concentrating on connection metrics such as usage and adoption to enhance their strategies, illustrating the value of a data-driven approach. For example, monitoring these metrics can assist organizations in grasping the effect of their amalgamations on retention and overall business results. Our hybrid unification platform offers real-time monitoring and alerts, allowing you to remain aware of system performance and make data-driven choices.

- Document the Approach: We must create a formal document outlining our incorporation plan, including objectives, partner types, and success metrics. This documentation ensures clarity and alignment among stakeholders, facilitating smoother execution. As emphasized by the case study on Metrics Tracking for Combining Systems, having a clear plan enables companies to assess the efficiency of their unification efforts and make informed modifications. Our expertise in enterprise architecture and project management can assist you in creating a thorough plan that aligns with your business goals.

- Review and Adapt: Regularly evaluating our approach in relation to current market conditions and organizational objectives is crucial. Effective partner collaboration approaches in financial services frequently include iterative enhancements grounded in performance data and evolving business requirements. The risks linked to insufficient application coordination can result in substantial financial losses, making it crucial to stay agile and responsive. Utilizing our secure hybrid connection platform guarantees round-the-clock uptime and dependability for intricate systems in banking, healthcare, and government, enabling you to adjust quickly to changing demands. By adhering to these steps, we can create a strong partner integration strategy that not only boosts operational capabilities but also enhances customer experiences, ultimately propelling business success. As indicated by Forbes, an impressive 95% of Microsoft’s commercial income arises from its partner ecosystem, emphasizing the essential role that effective collaborations play in attaining success.

Assess Current Systems and Integration Needs

To effectively evaluate our current systems and connectivity needs, we must follow these essential steps:

- First, we need to inventory existing systems. Compiling a detailed inventory of all current systems, applications, and data sources involved in the merging process is foundational. This step ensures that no critical component is overlooked.

- Next, we evaluate system compatibility. A thorough analysis of the compatibility of our existing systems with potential partners is crucial. We must concentrate on essential elements like data formats, APIs, and overall connectivity capabilities. Understanding how AI-driven technologies, with which 26% of customers express satisfaction, can fit into our ecosystem is essential for enhancing our incorporation efforts. Utilizing Avato’s hybrid connectivity platform will streamline this procedure, ensuring smooth connections across various systems.

- We must then identify integration gaps. Pinpointing any gaps in functionality or data flow that our system must address is vital. This includes identifying manual tasks or data silos that obstruct efficiency. As the integrated network economy is projected to reach 25% of the total economy by 2030, addressing these gaps is essential for our future competitiveness. Avato’s commitment to providing a reliable, future-proof technology stack will help us overcome these challenges effectively.

- Afterward, we will gather stakeholder input. Engaging with key stakeholders across various departments will allow us to collect insights on their needs and expectations from the unification. This partner integration strategy ensures a comprehensive understanding of requirements, aiding in a more seamless incorporation process. By leveraging Avato’s expertise in hybrid connections, we can transform our operations, enhancing customer experiences and expediting legacy system incorporation.

By methodically assessing these elements, we will be better prepared for successful unions that enhance our operational capabilities and propel our digital transformation.

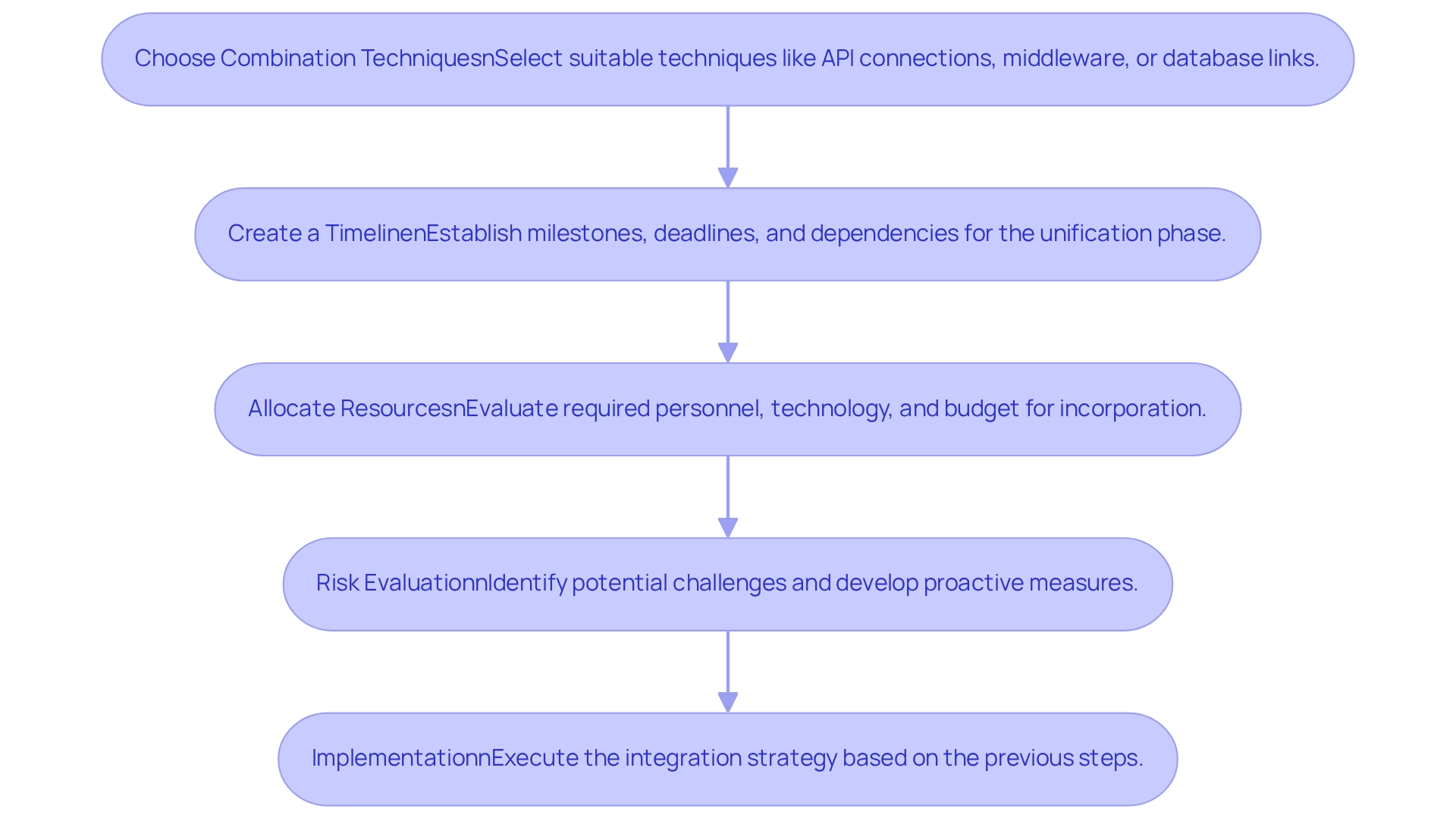

Plan Your Integration Approach

To effectively plan our incorporation strategy, we must consider the following steps:

- Choose Combination Techniques: We select the most suitable combination techniques for our business needs. Options include API-based connections, middleware solutions, and direct database links. API-driven connections are especially efficient in financial services, enabling smooth data exchange and improved operational effectiveness. Our Hybrid Connection Platform simplifies complex linkages, allowing us to maximize the value of our legacy systems while ensuring compatibility with contemporary applications. Remember, leveraging existing legacy systems rather than discarding them can save us time and resources.

- Create a Timeline: We set up a detailed timeline that highlights essential milestones, deadlines, and dependencies during the unification phase. On average, successful implementation projects in enterprises can take several weeks to months, depending on complexity and resource availability. We guarantee round-the-clock availability for essential connections, highlighting the significance of dependability in the linking process, particularly in the banking industry, where system functionality is crucial. Additionally, real-time monitoring and alerts on system performance are vital to maintaining operational efficiency.

- Allocate Resources: We evaluate the resources required for incorporation, including personnel, technology, and budget. Clearly defining roles and responsibilities ensures accountability and simplifies the merging process. Our phased implementation approach minimizes risks and enhances adaptability, allowing us to allocate resources effectively.

- Risk Evaluation: We conduct a comprehensive risk evaluation to identify potential challenges that may occur during the merging process. Developing proactive measures to address these risks ensures a smoother transition and minimizes disruptions. As open banking develops, ensuring adherence to strict security measures is vital to safeguard consumer information and uphold trust, which is essential for our partner integration strategy, especially regarding hybrid systems in 2025. Expert perspectives highlight that a well-organized approach not only improves operational capabilities but also enables us to adjust to changing demands, preserving a competitive advantage in the banking industry. As Gustavo Estrada pointed out, we streamline intricate projects and provide outcomes within specified timelines and financial limits, demonstrating the efficiency of a dependable, future-ready technology stack in attaining unification objectives. Case studies emphasize the success of organizations that have adopted these methods, demonstrating the concrete advantages of a systematic approach to unification.

Implement the Integration Strategy

To effectively implement our integration strategy, we must adhere to the following steps:

- Establish Technical Infrastructure: We begin by ensuring that our technical infrastructure is robust and secure. This involves establishing servers, networks, and security protocols tailored to the specific requirements of banking connections, including compliance with regulations such as PCI DSS. A clearly established infrastructure is essential; over 40% of companies recognize application unification as a major challenge, particularly in managing isolated applications and data within the banking industry. By leveraging Avato’s Hybrid Integration Platform, we can maximize and extend the value of our legacy systems while ensuring compliance with stringent security protocols and reducing costs.

- Execute Unification Tasks: Next, we proceed with executing the unification tasks outlined in our strategic plan. It is crucial that all team members are aligned and aware of their roles and responsibilities to enable a seamless transition. Utilizing a middle layer for unification can simplify complex tasks and enhance the overall efficiency of our operations.

- Monitor Progress: We implement continuous monitoring of the merging process. By utilizing established Key Performance Indicators (KPIs), we can track metrics and swiftly identify any issues that may arise. Consistent oversight not only aids in sustaining progress but also ensures that our incorporation aligns with organizational objectives. Avato’s platform provides real-time monitoring and alerts on system performance, which is vital for maintaining operational efficiency. As Sarah Lee aptly states, “With each statistical insight and every data point, we shape the future of technology—one innovative solution at a time.”

- Communicate Regularly: We encourage open dialogue among all stakeholders throughout the merging process. Frequent updates and conversations assist in addressing concerns promptly and keep everyone informed about the project’s status. This cooperative approach is essential for tackling shared obstacles encountered during the implementation process in banking, particularly as a partner integration strategy is crucial to address the new complexities introduced by open banking.

- Evaluate and Enhance: After the initial execution, we conduct a comprehensive assessment of the incorporation plan. Gathering feedback from all involved parties and analyzing performance data allows us to identify areas for improvement. This iterative process is crucial for refining our unification strategy and ensuring sustained success in a rapidly evolving technological environment. The transformative impact of AI and advanced unification solutions can further enhance customer engagement and operational efficiency, making this review process even more critical.

By adhering to these steps, we can navigate the intricacies of unification and prepare our organizations for success.

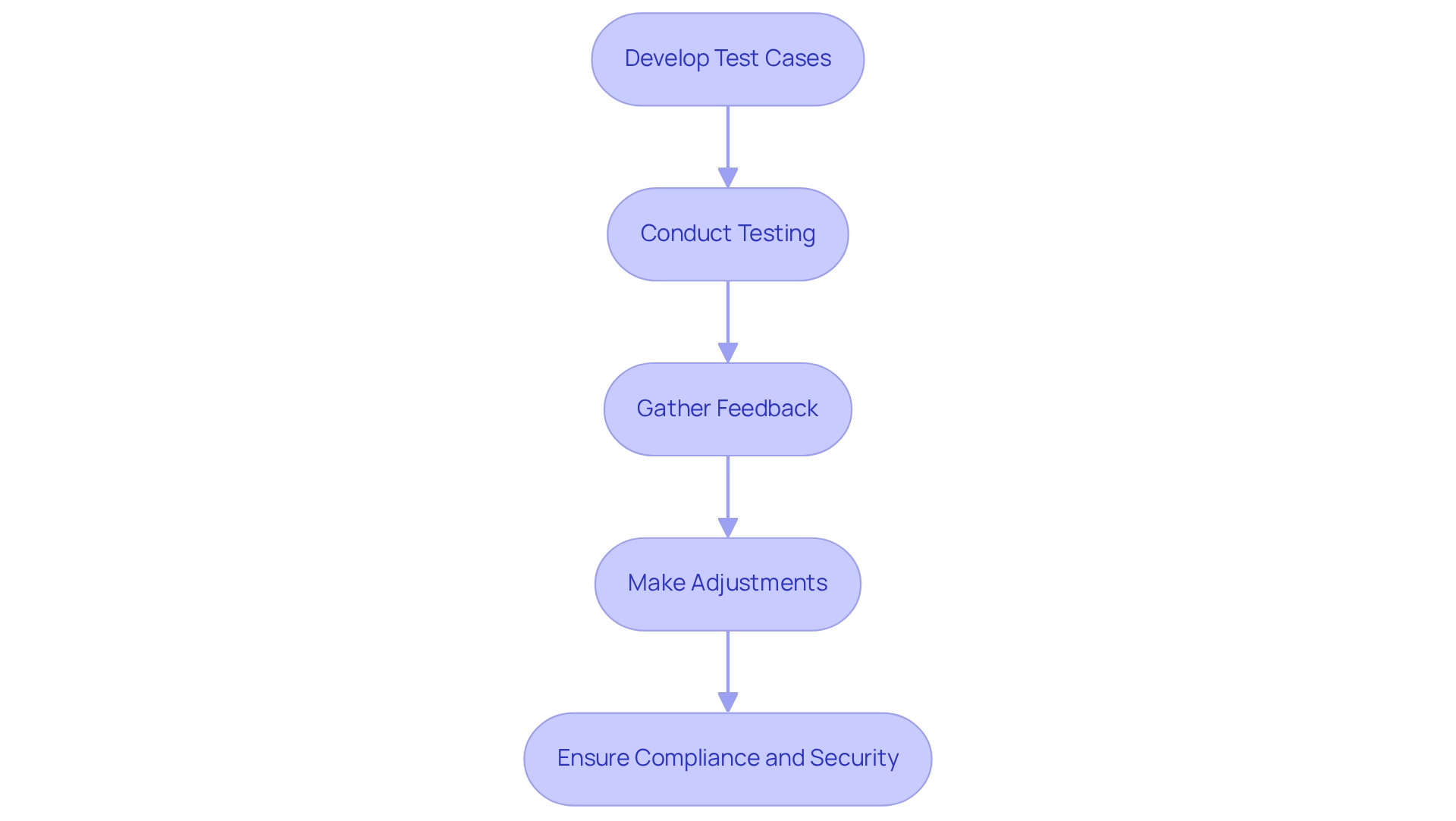

Test and Validate the Integration

To effectively test and validate our integration, we must adhere to the following steps:

- Develop Test Cases: We begin by formulating detailed test cases that encompass all facets of our combination, including data flow, functionality, and user experience. This foundational step is crucial for ensuring comprehensive coverage, especially when leveraging XSLT, a highly-tuned declarative programming language closely linked with XPath, for efficient XML data transformation. This approach significantly reduces programming errors and labor costs.

- Conduct Testing: Next, we implement the test cases within a controlled environment, mimicking real-world scenarios to uncover potential issues. This approach is essential, particularly as the software testing landscape evolves with trends like DevOps and IoT testing gaining traction. Furthermore, employing schemas during this phase can improve error detection and simplify the merging process.

- Gather Feedback: We actively solicit feedback from users and stakeholders throughout the testing phase. This input is essential for recognizing usability issues and functional shortcomings, ensuring that our system meets user expectations. As Jon Gitlin, Senior Content Marketing Manager, observes, “Furthermore, in contrast to the earlier statistic, this one originates from the buyer’s viewpoint—which adds even more credibility to the notion that connections are essential for sales.”

- Make Adjustments: Utilizing the insights gained from our testing results and feedback, we refine our incorporation. Making necessary adjustments is key to achieving optimal performance and reliability. In this context, leveraging generative AI can enhance operational efficiency and customer engagement, further aiding the success of our amalgamation.

- Ensure Compliance and Security: Throughout our merging process, we prioritize regulatory adherence and carry out security audits to protect sensitive information and preserve trust with stakeholders. This step is crucial in the financial sector, where adherence to regulations is paramount.

In 2025, the significance of thorough testing in combined projects cannot be exaggerated, especially as the worldwide mobile application market is expected to hit $407.31 billion by 2026. This growth highlights the necessity for strong testing methodologies to ensure quality and security in financial services connections. Additionally, with 11.2% of software testers using German as their second language, we must consider diverse teams in our testing approach. By prioritizing these steps and adapting to the changing trends in software testing, we can improve our partner integration strategy and maintain a competitive advantage.

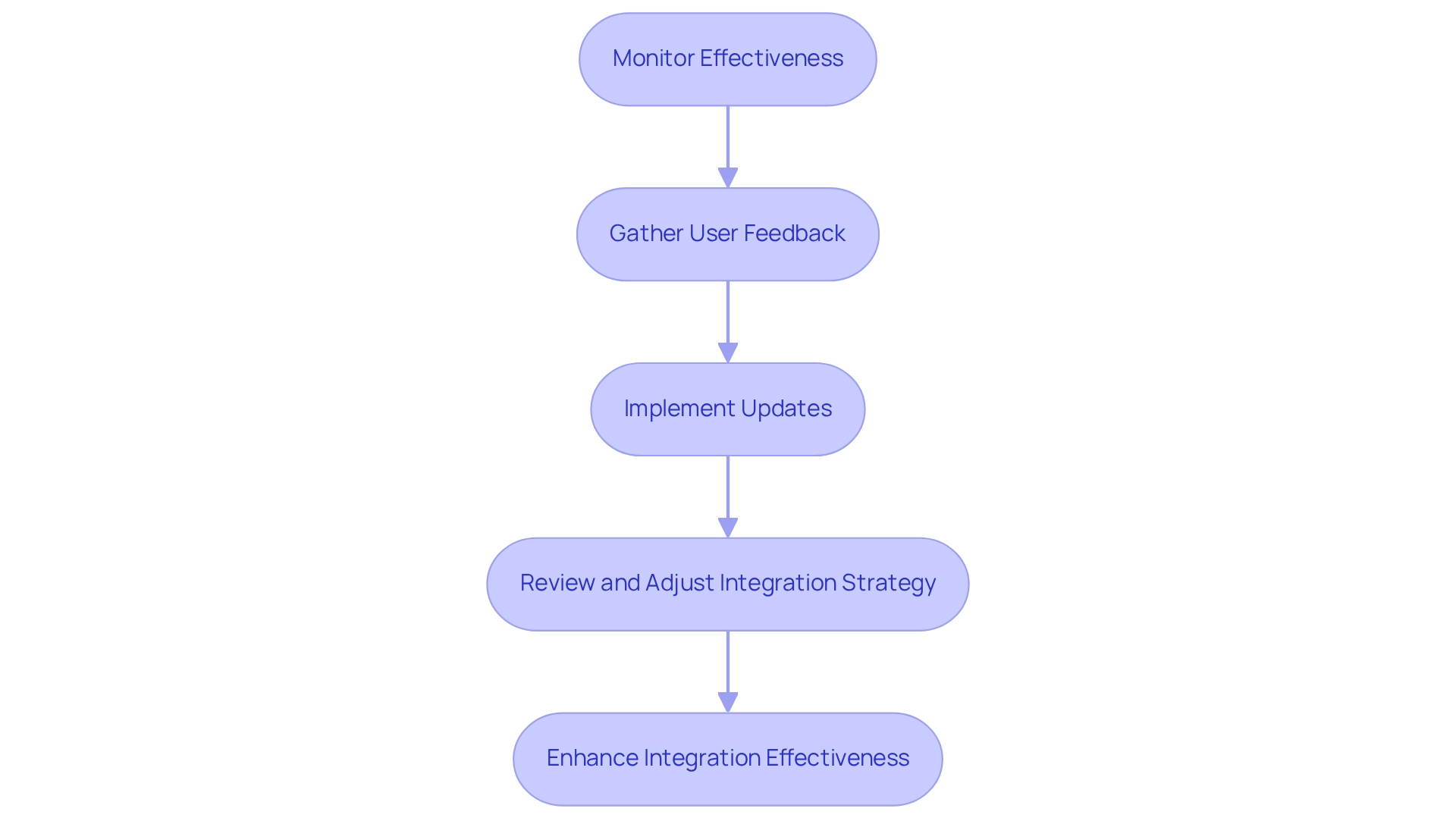

Maintain and Optimize the Integration

To effectively maintain and optimize our integration, we must consider the following steps:

- Monitor Effectiveness: We should establish key performance indicators (KPIs) to routinely evaluate system efficiency. This proactive approach enables us to identify areas requiring enhancement, ensuring our systems function at peak efficiency. Our Hybrid Integration Platform offers robust analytics features for ongoing monitoring, guaranteeing 24/7 availability for essential links and emphasizing the significance of steady oversight.

- Gather User Feedback: Continuously soliciting feedback from users allows us to gain insights into their experiences. Recognizing user challenges is essential for making informed modifications that enhance the experience.

- Implement Updates: Staying abreast of updates to partner systems and technologies is vital. Timely implementation of necessary changes ensures compatibility and optimizes performance, particularly in fast-evolving sectors like banking and healthcare.

- Review and adjust our partner integration strategy regularly to ensure it aligns with our business goals. This iterative process permits modifications that can significantly improve results, ensuring our incorporation efforts remain pertinent and efficient. Utilizing cutting-edge technologies, such as those highlighted in the case study ‘Generative AI: The New Frontier in Financial Services,’ can streamline processes and enhance productivity, which is crucial for maximizing efficiency.

By concentrating on these best practices, we can not only sustain but also enhance our integration effectiveness, leading to improved operational capabilities and a competitive edge in the marketplace. Additionally, visualizing metrics is crucial for understanding and communicating performance insights effectively.

Conclusion

Crafting a successful partner integration strategy is not just beneficial; it is essential for businesses like ours that aim to thrive in today’s interconnected environment. By clearly defining our objectives, selecting the right partners, and establishing success metrics, we can create a robust foundation for our integration efforts. Assessing current systems and identifying integration needs ensures that all critical components are accounted for, paving the way for smooth implementation.

A well-structured integration approach, which encompasses choosing suitable methods, developing timelines, and conducting thorough risk assessments, is vital for minimizing disruptions and maximizing efficiency. Furthermore, continuous monitoring during the integration process helps maintain alignment with our organizational goals, while regular communication fosters collaboration among stakeholders.

Testing and validating the integration through comprehensive test cases and user feedback is crucial for identifying potential issues and refining our process. Finally, maintaining and optimizing the integration through performance monitoring, user insights, and timely updates ensures that we remain agile and competitive in a rapidly evolving market.

By following these steps, we can enhance our operational capabilities and improve customer experiences, ultimately driving success in an increasingly complex landscape. Embracing a proactive and strategic approach to partner integration will not only yield immediate benefits but also position us for long-term growth and resilience. What’s holding your team back from implementing these strategies? Let’s take action together and secure our competitive advantage.