Overview

We recognize that the landscape of electronic financial services is rapidly evolving, and by 2025, several key trends will be pivotal in shaping its future. Our analysis reveals significant developments, including:

- The rise of AI-driven customer experiences

- Enhanced cybersecurity measures

- The impact of open banking

- The growth of digital wallets

These elements are not just trends; they are essential for financial institutions to remain competitive and effectively meet the evolving expectations of consumers. What steps are you taking to adapt to these changes? We invite you to explore how embracing these innovations can position your organization at the forefront of the financial services sector.

Introduction

In the rapidly evolving landscape of financial services, we recognize that innovation and adaptability are paramount. As institutions strive to meet the increasing demands of tech-savvy consumers, the integration of advanced technologies such as AI, blockchain, and digital wallets is reshaping how financial transactions are conducted. By 2025, we understand that the emphasis on personalization, enhanced cybersecurity, and regulatory compliance will be crucial for maintaining customer trust and satisfaction.

This article delves into the transformative trends defining the future of finance, highlighting how platforms like Avato enable financial organizations to navigate complexities and seize opportunities in this dynamic environment. From the rise of open banking to the prioritization of sustainable finance, we are poised to redefine the customer experience and operational efficiency in unprecedented ways.

Avato: Leading Hybrid Integration Platform for Financial Services

At Avato, we stand as a leading hybrid integration platform, specifically tailored for electronic financial services within the banking sector. Our commitment to simplifying complex integrations is evident in our advanced architecture, which accommodates 12 levels of interface maturity. This capability allows institutions to effectively balance speed and sophistication in their integration initiatives.

By ensuring 24/7 uptime and reliability, we empower banks and financial organizations to pursue innovation in electronic financial services while maintaining security and operational efficiency. Such capability is crucial in highly regulated environments, like banking and healthcare, where compliance and data integrity are non-negotiable.

The European Union’s revised Payment Services Directive (PSD2) mandates that banks share client data with third-party providers through secure APIs, highlighting the necessity of robust integration solutions for electronic financial services. Furthermore, as the industry advances, the incorporation of tailored budgeting tools and spending insights—led by banks such as Monzo and Revolut—demonstrates the increasing demand for improved client engagement through effective data integration, a necessity that we fulfill with our innovative features.

Our platform’s ability to access data and systems in weeks, not months, significantly lowers expenses and simplifies intricate integrations, making it a vital tool for banking institutions. Additionally, we provide real-time monitoring and alerts on system performance, further enhancing our value proposition.

The transition to biometric authentication in banking highlights the significance of secure integration solutions, as leading banks implement these technologies to enhance client verification processes. In this landscape, our dedication to reducing downtime and enhancing integration effectiveness establishes us as an essential partner for institutions navigating the complexities of digital transformation through electronic financial services.

AI-Driven Customer Experience Enhancements in Financial Services

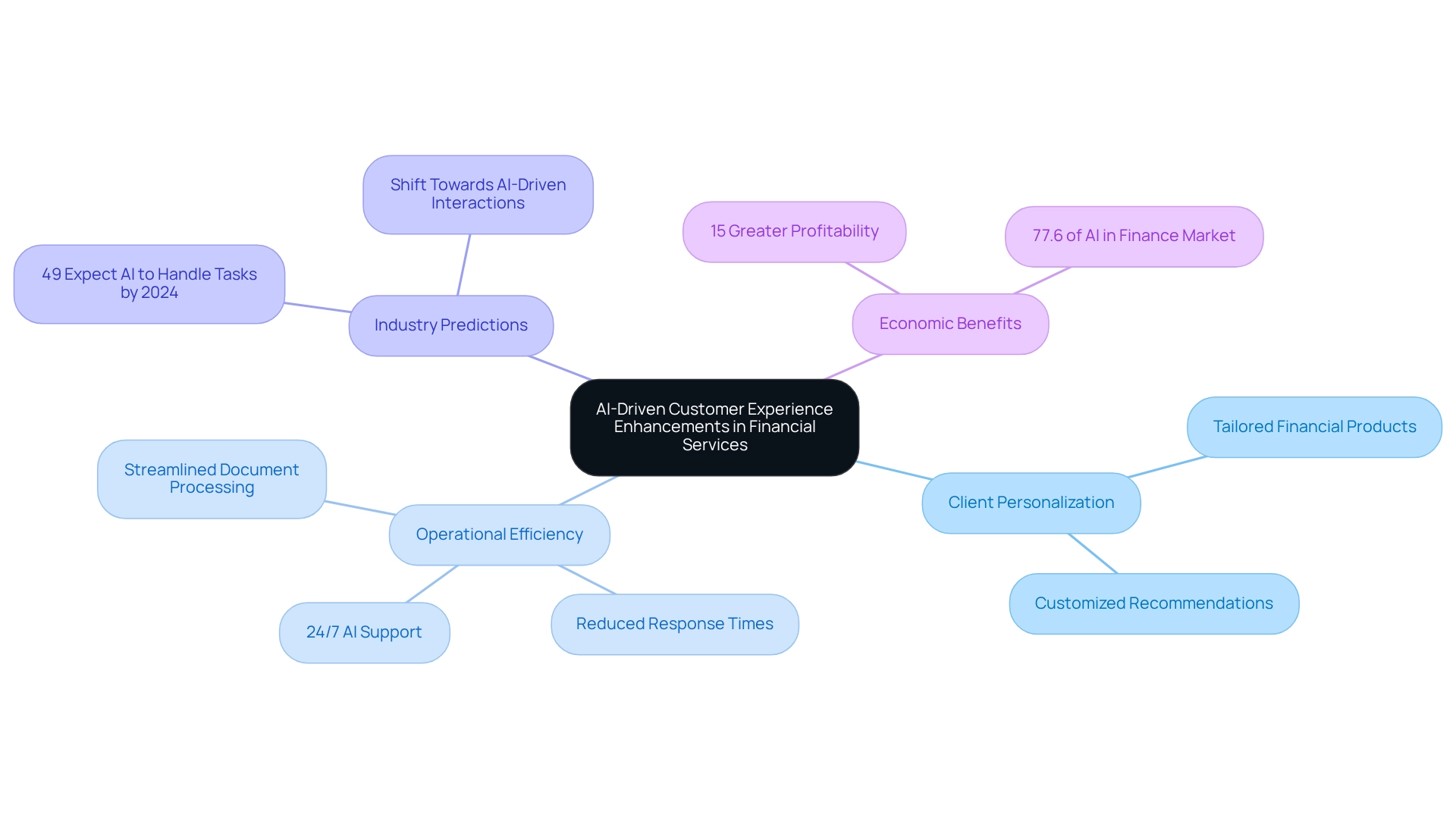

In 2025, we anticipate that AI technologies will fundamentally transform client experiences within the financial sector. Financial organizations are increasingly leveraging generative AI to analyze client data, anticipate needs, and provide personalized services. For instance, advanced AI chatbots and virtual assistants now deliver 24/7 support, drastically reducing response times and significantly enhancing satisfaction. A recent survey indicates a 60% rise in the use of generative AI for client experience, underscoring its growing importance in our industry. Furthermore, over half of economic professionals are utilizing generative AI for document processing and report generation, streamlining operations and enhancing productivity across various departments.

Based on industry predictions, 49% of service professionals believe that AI will autonomously handle most service tasks by 2024, marking a pivotal shift towards standard AI-driven interactions. Additionally, AI algorithms excel at customizing financial products to meet individual preferences, ensuring that clients receive relevant offers and guidance. This level of personalization not only boosts customer engagement but also fosters loyalty and trust. Firms that integrate AI report an average of 15% greater profitability than their competitors, highlighting the economic benefits of adopting these technologies. Moreover, AI solutions accounted for 77.6% of the AI in the finance sector in 2021, emphasizing the dominance and significance of AI in our industry.

As AI continues to advance, its role in enhancing client experiences within financial sectors will only expand, making it a crucial component of digital transformation strategies. Insights from the case study titled “Future Predictions for AI in Customer Service” suggest that businesses expect AI to assist in various roles, with 24/7 assistance and reduced wait times becoming the norm. This further emphasizes the operational efficiency that AI contributes to client support, ultimately transforming how banking institutions engage with their clients. To remain competitive in this AI-driven landscape, we invite you to connect with Avato today to explore tailored insights and strategies that can elevate your business.

Enhanced Cybersecurity Measures for Financial Institutions

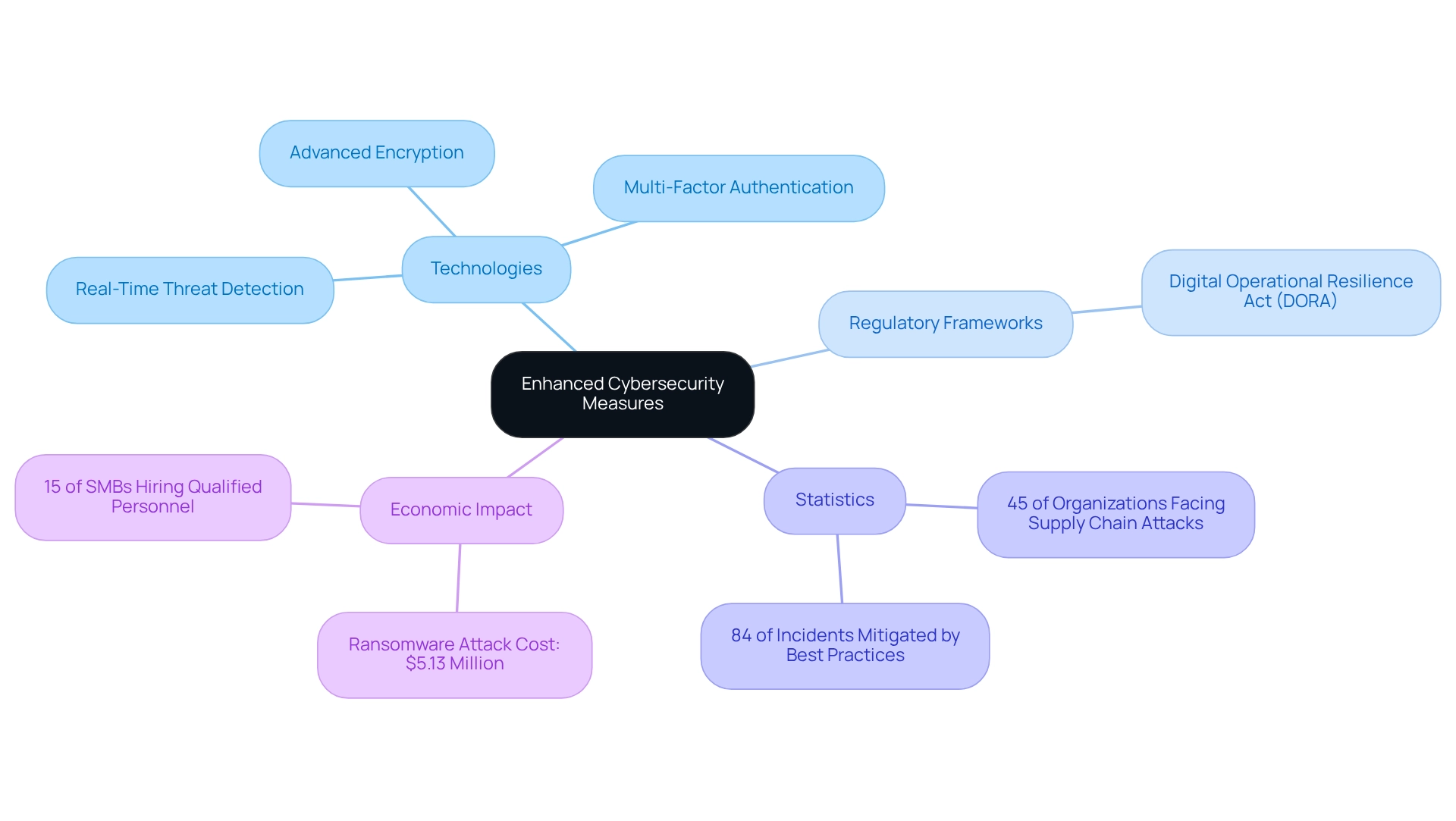

In 2025, we recognize that banking institutions are prioritizing enhanced cybersecurity measures to combat increasingly sophisticated cyber threats. The implementation of advanced encryption technologies, multi-factor authentication, and real-time threat detection systems stands as a testament to our commitment to safeguarding operations. Regulatory frameworks, particularly the Digital Operational Resilience Act (DORA), impose stringent cybersecurity protocols, compelling us to invest significantly in robust security infrastructures. This proactive strategy not only protects customer information but also bolsters confidence in monetary services.

What’s holding your team back from adopting these critical measures? With Gartner predicting that by the end of 2025, 45% of global organizations will have faced a supply chain attack, the urgency for fortified cybersecurity has never been greater. Moreover, an astonishing 84% of critical infrastructure incidents could have been mitigated through adherence to security best practices, underscoring the necessity for institutions to embrace comprehensive cybersecurity strategies.

The economic impact of cyber threats is stark, with the typical expense of a ransomware attack in 2023 reaching $5.13 million. This figure emphasizes the need for investment in cybersecurity. Additionally, many small and medium-sized businesses (SMBs) remain underprepared for cyber threats, with only 15% having hired qualified personnel for cybersecurity, leaving them vulnerable to attacks. As the landscape evolves, we understand that institutions that embrace these measures will be better positioned to protect their operations and maintain a competitive edge. Let us guide you in fortifying your cybersecurity posture today.

Open Banking: Revolutionizing Access to Financial Services

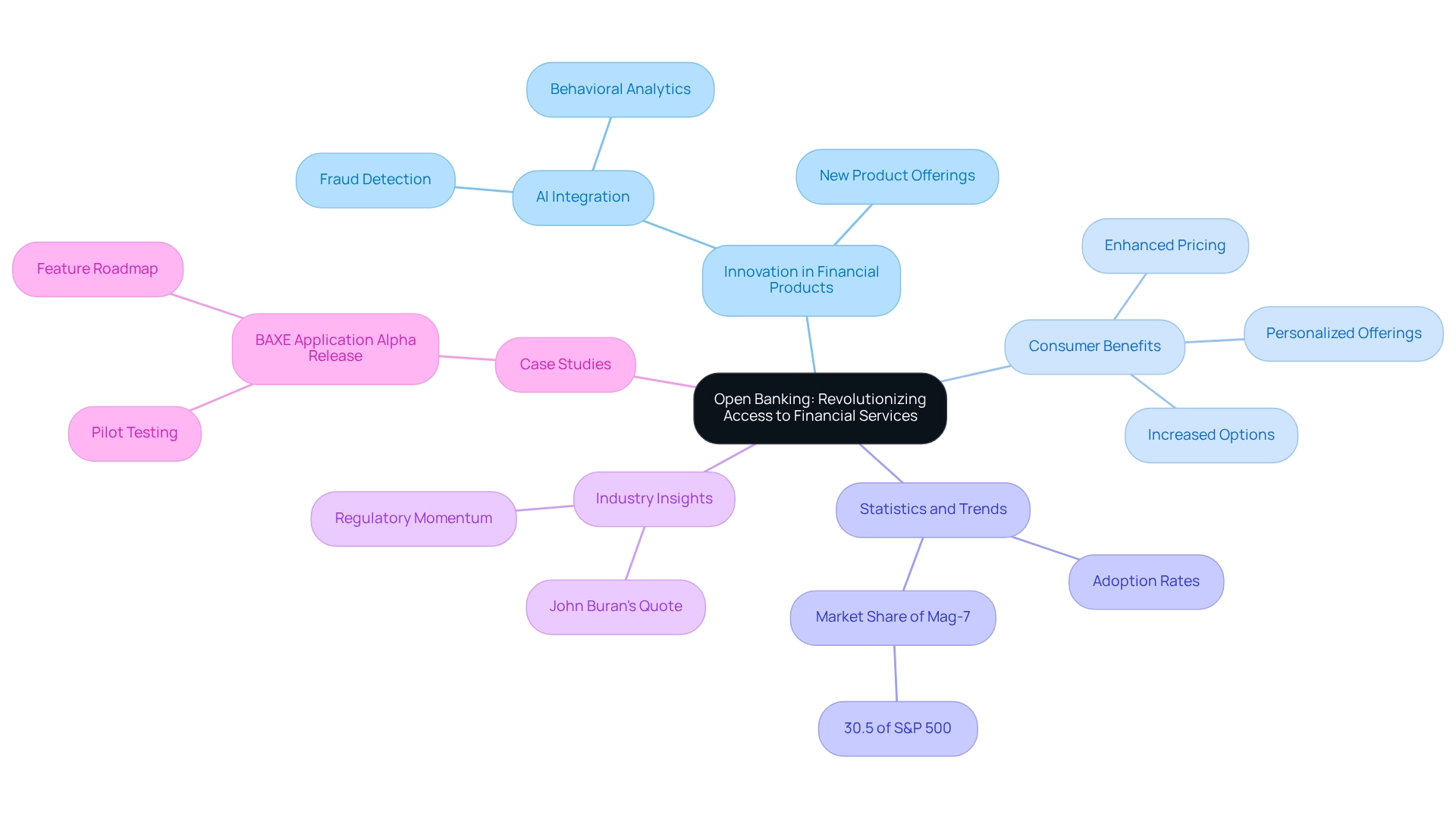

Open banking is poised to revolutionize access to electronic financial services in 2025 by enabling third-party providers to securely retrieve user data through APIs. This paradigm shift not only fosters innovation but also facilitates the development of new products and offerings tailored to consumer needs. As we progressively partner with fintech firms, our clients stand to benefit from enhanced offerings, including personalized monetary guidance and efficient electronic financial services. The integration of generative AI into these services is particularly noteworthy, witnessing a 60% increase in usage for customer experience, especially in the development of sophisticated chatbots and virtual assistants that elevate customer interactions. Moreover, over half of finance professionals are leveraging generative AI for document processing and report generation, thereby enhancing electronic financial services, streamlining operations, and boosting productivity across various departments. The regulatory momentum behind open financial systems and electronic financial services further empowers consumers, granting them greater control over their financial data. In 2025, the impact of electronic financial services will be evident in various ways:

- Innovation in Financial Products: The integration of AI and behavioral analytics will play a crucial role in detecting and preventing fraudulent transactions, enhancing security in financial operations. Generative AI’s capabilities in handling and analyzing data will be vital in this context.

- Consumer Benefits: Open financial systems will offer consumers increased options and enhanced pricing, as competition among providers intensifies. The application of AI-driven insights will enable more personalized offerings, ultimately boosting client satisfaction, and our collaboration with fintechs in electronic financial services allows us to harness their technological expertise, resulting in innovative solutions that meet evolving consumer demands. The implementation of generative AI in these collaborations will further enhance the provision of assistance and operational efficiency.

Statistics indicate that open systems are gaining traction, with a significant proportion of institutions planning to adopt open strategies by 2025. This trend is underscored by insights from industry leaders, who emphasize the necessity of adapting to the new landscape of electronic financial services to remain competitive. For instance, John Buran, CEO of Flushing Financial Corporation, underscores that banks must innovate through open access to enhance delivery and meet client expectations.

Case studies, such as the BAXE Application Alpha Release, illustrate the successful application of open access principles, showcasing how collaborative efforts can lead to a truly digital-first economy. This case exemplifies how we can leverage partnerships with fintechs to create innovative solutions that benefit consumers. As we advance deeper into 2025, the evolution of open finance, supported by generative AI, will undoubtedly transform the financial sector by enhancing electronic financial services, fostering innovation and improving user experiences. To fully capitalize on these changes, we must prioritize open banking strategies that enhance consumer engagement and satisfaction with electronic financial services.

Growth of Digital Wallets in Consumer Financial Transactions

The growth of digital wallets is not just a trend; it is a defining force in 2025, with global spending projected to exceed $10 trillion. This surge reflects a significant shift in consumer preferences, as individuals increasingly favor the convenience and speed that digital wallets offer for transactions. We are witnessing financial institutions proactively integrating electronic financial services, such as digital wallet capabilities, into their offerings, enabling users to execute seamless payments, manage their finances, and access loyalty programs—all from a single platform. This evolution enhances the customer experience and drives operational efficiencies for banks.

As we look ahead, the usage of digital wallets for monetary transactions is expected to rise significantly, with a notable increase in the number of consumers adopting these solutions. Statistics reveal that 526 partners can now identify devices based on information transmitted automatically, showcasing the technological advancements supporting this trend. This capability is crucial for enhancing security and streamlining the user experience in digital wallet transactions. Furthermore, financial executives are increasingly recognizing the importance of integrating digital wallets. Insights suggest that as security concerns intensify, a broader range of industries will leverage digital wallets, mirroring the success seen in the e-commerce sector. As Ryan O’Holleran of Airwallex notes, “As the focus on security intensifies, we can expect a wider range of industries to tap into digital wallets and mirror the e-commerce sector’s success.”

Moreover, as banking organizations prepare for open banking, strategic integration approaches become essential. Leveraging existing systems while ensuring compliance with stringent security protocols will be critical in establishing secure and reliable connections for digital wallet transactions. Case studies demonstrate the successful application of digital wallet solutions by various monetary organizations, particularly emphasizing the ‘Real-Time Monitoring and Alerts’ feature that improves operational efficiency. These features enable organizations to unlock data and systems within weeks rather than months, facilitating quicker digital transformation. The effect of digital wallets on consumer payment behavior is significant, enabling faster transactions and promoting a more interconnected economic system. As we progress through 2025, the expansion of digital wallet transactions in banking will continue to transform the landscape of electronic financial services, establishing digital wallets as a key element of contemporary banking strategies.

Navigating Regulatory Changes in Financial Services

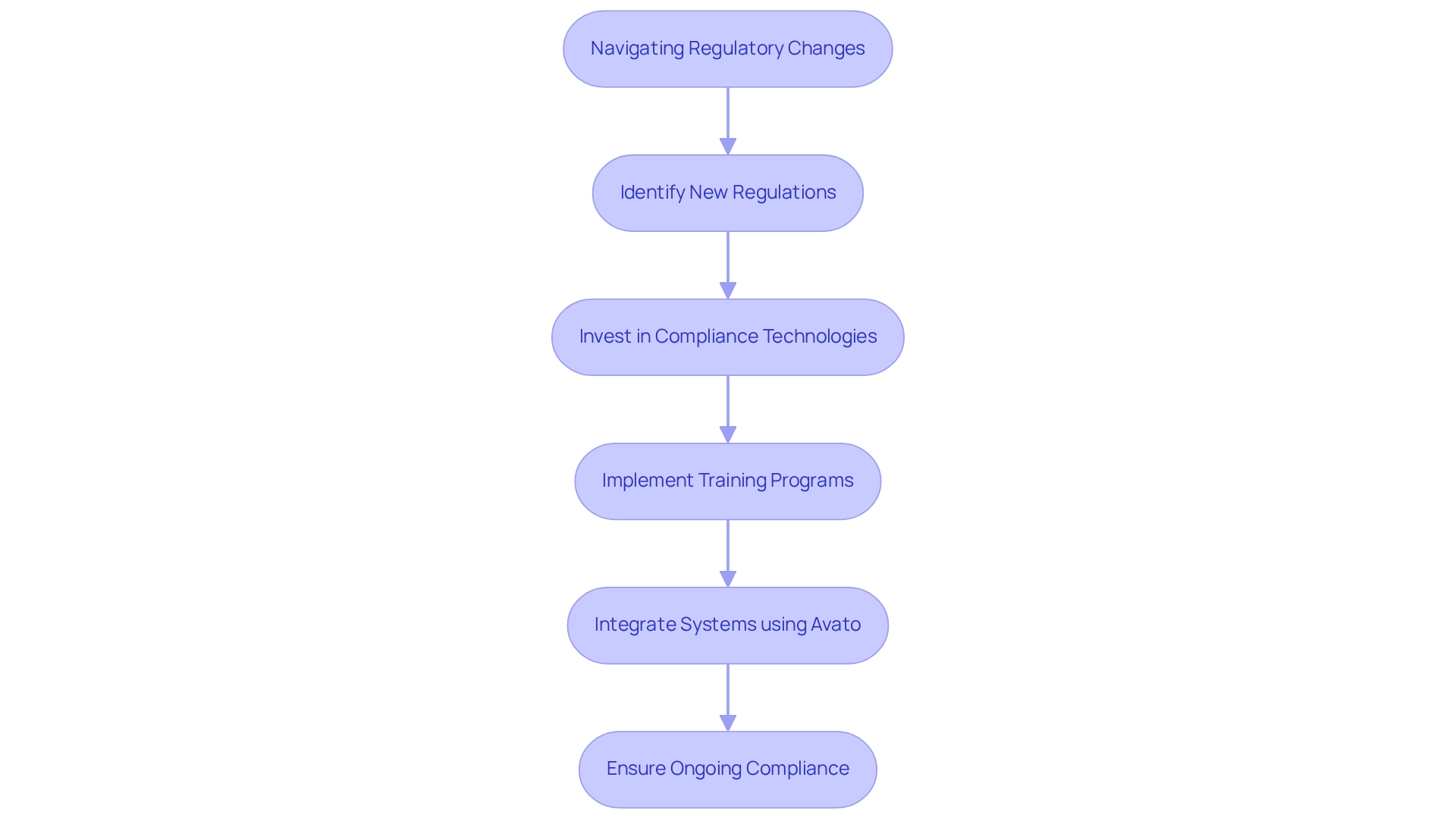

As monetary services evolve, we recognize that navigating regulatory changes is becoming increasingly complex. In 2025, institutions must adapt to new regulations aimed at enhancing consumer protection and data security. This includes compliance with the Digital Operational Resilience Act (DORA) and other emerging frameworks that mandate rigorous risk management practices. We understand that financial institutions are investing in compliance technologies and training programs to ensure they meet these regulatory requirements while continuing to innovate and serve their customers effectively.

That’s why Avato’s dedicated hybrid integration platform plays a crucial role in this landscape. By simplifying the integration of disparate systems, we enable institutions to unlock isolated assets and enhance their business value. Leveraging our expertise allows organizations to future-proof their operations and ensure seamless data integration, which is essential for navigating the complexities of regulatory compliance. Together, we can navigate these challenges and drive success in an evolving regulatory environment.

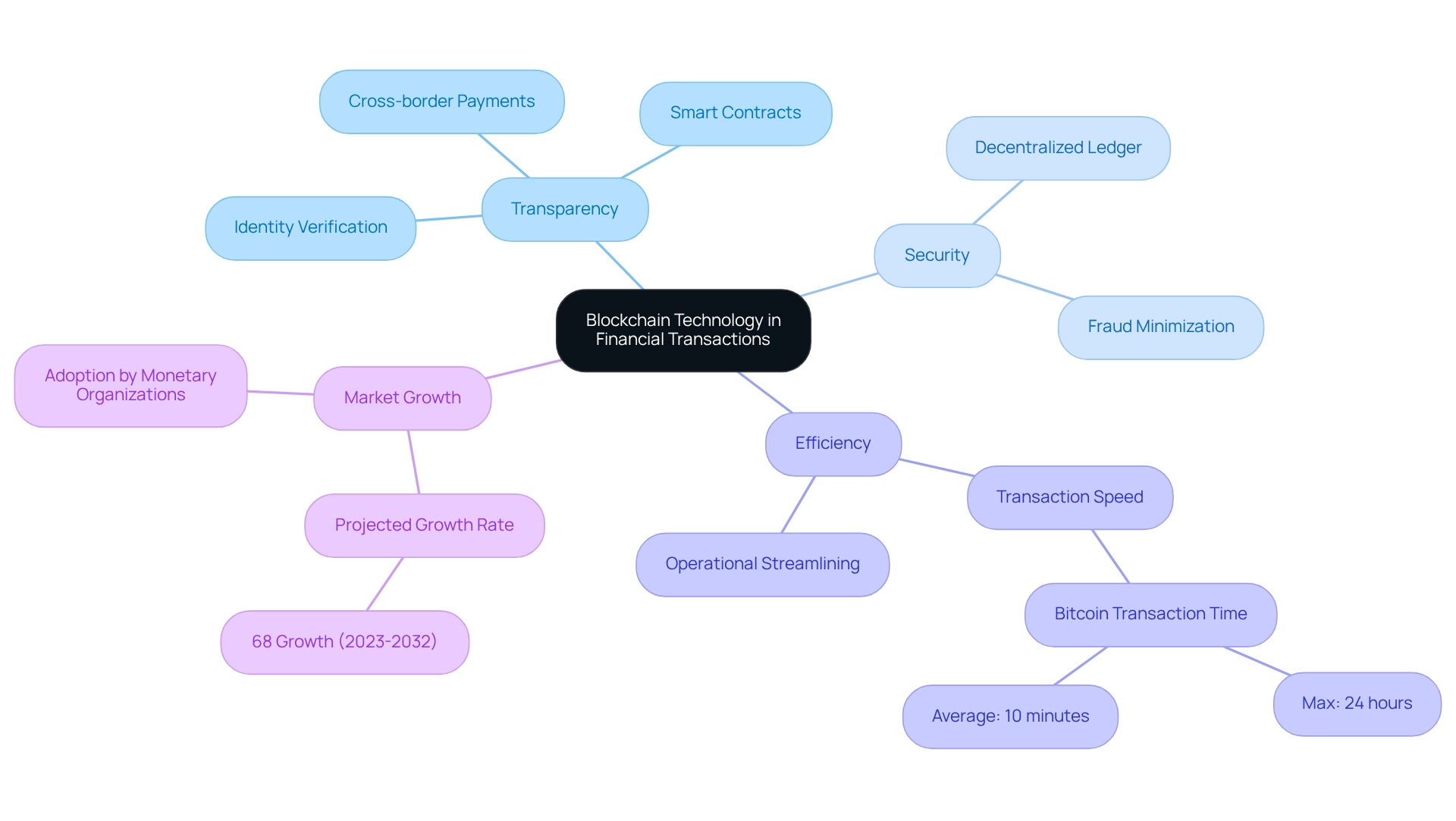

Blockchain Technology: Increasing Transparency in Financial Transactions

Blockchain technology is revolutionizing monetary systems by significantly enhancing transaction clarity and security. By leveraging a decentralized ledger, we enable real-time tracking of transactions, which minimizes the risk of fraud and errors. By 2025, we anticipate that monetary organizations will increasingly adopt blockchain for applications such as cross-border payments, smart contracts, and identity verification. This transition streamlines operational processes and fosters greater trust among consumers and businesses.

The market for blockchain in monetary services is projected to expand at an impressive rate of 68% between 2023 and 2032, underscoring the urgency for institutions to integrate this technology. We are already witnessing banks leverage blockchain to facilitate cross-border payments, which have traditionally involved lengthy processing times. For example, while a Bitcoin transaction can take up to 24 hours, the typical duration is merely 10 minutes, showcasing the efficiency that blockchain can bring to monetary transactions.

Industry leaders recognize blockchain’s potential to enhance transaction transparency. As Gustavo Estrada noted, “Avato simplifies complex projects, enabling organizations to achieve results within desired time frames and budget constraints.” This sentiment reflects a broader consensus among experts regarding blockchain’s role in promoting transparency and security in monetary transactions. Furthermore, with Avato’s hybrid integration platform, we can guarantee 24/7 uptime, which is crucial for the seamless operation of blockchain applications in monetary sectors.

As electronic financial services continue to evolve, our adoption of blockchain technology, supported by reliable integration solutions like those offered by Avato, will be essential in addressing the needs of a rapidly changing landscape.

Sustainable Finance: Prioritizing Environmental Responsibility

In 2025, sustainable finance emerges as a pivotal focus for monetary institutions, driven by our commitment to environmental responsibility. This shift entails the incorporation of Environmental, Social, and Governance (ESG) criteria into our investment strategies and the creation of green funding products. As consumer awareness of environmental issues rises, we recognize that banks embracing sustainable practices are positioned to attract a growing demographic of eco-conscious clients.

Significantly, over 4 million content learners have participated in sustainable finance education, illustrating the growing demand for responsible monetary practices. Furthermore, regulatory bodies are enforcing transparency in sustainability reporting, compelling institutions to adopt more responsible operational practices. Companies that proactively prepare for new ESG requirements will be better equipped to navigate the changing business landscape.

This trend not only reflects a societal shift towards sustainability but also underscores the competitive advantage for banks that proactively align with these evolving consumer expectations and regulatory demands. As Gun Gun Febrianza aptly stated, “Profits drive our society to humanity’s detriment,” highlighting the ethical considerations that are driving the shift towards sustainable finance.

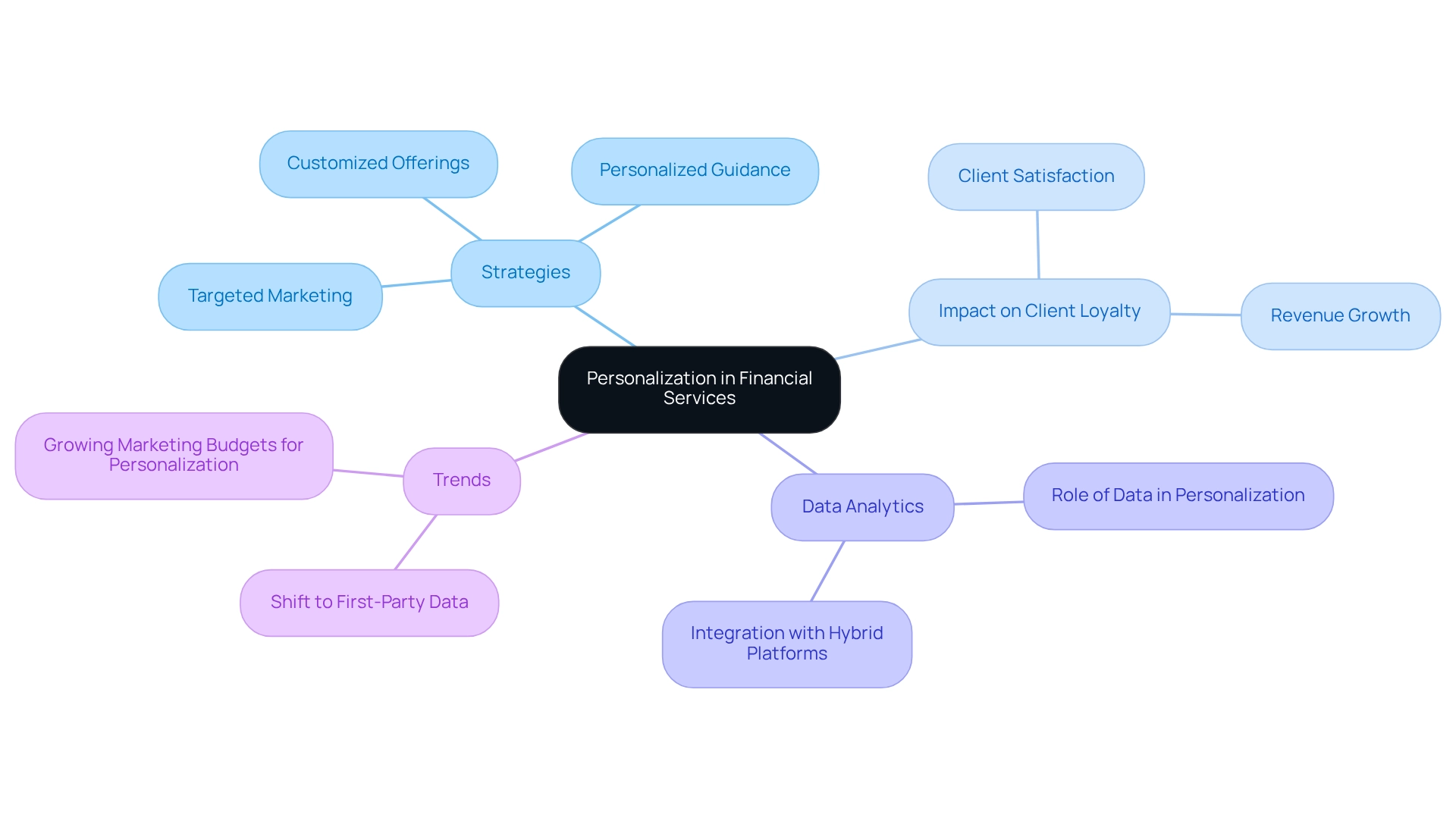

Personalization in Financial Services: Meeting Consumer Expectations

In 2025, personalization in banking services emerges as a pivotal strategy for institutions aiming to meet evolving consumer expectations. By harnessing data analytics and artificial intelligence, we can create customized offerings that resonate with individual client needs, preferences, and behaviors. This includes personalized financial guidance, tailored product suggestions, and focused marketing initiatives designed to engage clients effectively.

The impact of these strategies on client loyalty is profound. Banks that skillfully apply personalization experience notable rises in client satisfaction, as patrons feel more appreciated and understood. Institutions prioritizing data-driven personalization not only enhance customer experiences but also drive revenue growth. Statistics indicate that companies with rapid revenue growth in consumer sectors are more likely to focus on personalization, underscoring its importance in maintaining a competitive edge.

Furthermore, recent trends show that 61% of high-growth companies are shifting towards first-party data for their personalization strategies, highlighting the essential role of data analytics in crafting customized financial experiences. Our hybrid integration platform plays a crucial role in this landscape by simplifying complex integration projects, enabling banks to leverage data effectively and provide tailored solutions. This platform facilitates the integration required for open banking, improving operational efficiency and allowing banks to respond swiftly to client needs.

As we continue to innovate, those utilizing our features will stand out, delivering unique, tailored offerings that foster stronger client engagement and loyalty. For instance, banks employing our platform have successfully implemented data analytics to refine their offerings, demonstrating how effective integration strategies can lead to enhanced customer experiences. This trend signifies a fundamental shift in the provision of electronic financial services, with personalization at the forefront of strategic initiatives. As Thomas Radavicius, an email marketing expert, notes, “1 in 3 marketers spend at least half their marketing budgets on personalization,” emphasizing the growing importance of these strategies in the financial sector.

Remote Banking Solutions: Adapting to Consumer Preferences

The acceleration of electronic financial services in 2025 is a response to the growing consumer demand for convenience and accessibility. We observe that financial institutions are enhancing their electronic financial services, which now include advanced mobile applications, comprehensive online account management, and responsive virtual assistance. This evolution not only elevates customer experience but also significantly reduces operational costs for banks. With 74% of millennials favoring digital finance, the imperative for institutions to adapt is clear. As electronic financial services become the norm, it is essential for banks to ensure their digital platforms are secure, user-friendly, and equipped to meet the diverse needs of their clientele.

Furthermore, the expansion of electronic financial services in India is projected at an impressive 23.1% annually from 2022 to 2030, underscoring the global shift towards digital solutions. Organizations such as Monzo and Revolut exemplify this trend by leveraging data analytics and AI to deliver customized solutions, catering to the 80% of consumers who prefer personalized economic experiences. Additionally, 72% of online financial service users value the ability to pay friends and family digitally, highlighting the demand for user-friendly features.

As we delve deeper into 2025, our capacity to provide seamless, secure, and personalized electronic financial services will be vital for institutions aiming to thrive in a competitive landscape. We at Avato play a pivotal role in this transformation by accelerating the integration of isolated systems and fragmented data, delivering the connected foundation enterprises require to simplify, standardize, and modernize their operations. By utilizing Avato’s hybrid integration platform, banks can future-proof their technology stack, ensuring they meet the evolving expectations of their customers while maintaining 24/7 uptime and security. As Saisuman Revankar notes, understanding these consumer preferences is crucial for developing effective digital financial strategies. Financial institutions must harness these insights to enhance their electronic financial services and meet the demands of a rapidly changing market.

FAQs:

- How does Avato ensure secure transactions in remote banking? Avato’s hybrid integration platform is designed for secure transactions, positioning it as a trusted choice for banks, healthcare, and government sectors.

- What are the benefits of using Avato’s integration solutions? Avato accelerates the integration of isolated systems, creating a connected foundation that simplifies and modernizes operations.

Testimonials:

“Good team. Good people to work with. Extremely professional. Extremely knowledgeable.” – Tony LeBlanc, Provincial Health Services Authority.

Conclusion

The financial services landscape is undergoing a profound transformation, driven by technological advancements and evolving consumer expectations. We recognize that the integration of platforms like Avato is essential for financial institutions to navigate the complexities of digital transformation, ensuring seamless connectivity and operational efficiency. As we have highlighted throughout this article, the adoption of AI, open banking, and digital wallets is pivotal in enhancing customer experiences and engagement.

Furthermore, the emphasis on cybersecurity, regulatory compliance, and sustainable finance underscores the necessity for institutions to prioritize security and ethical practices in their operations. The growing trend of personalization in financial services illustrates the shift towards customer-centric approaches, enabling banks to tailor their offerings to meet individual preferences.

As the industry moves forward, aligning innovative technologies with a commitment to customer satisfaction will be crucial for maintaining a competitive edge. Financial institutions that embrace these transformative trends will not only enhance their operational capabilities but also foster stronger relationships with their customers. The future of finance is not just about technology; it’s about creating meaningful experiences that resonate with consumers while ensuring security and sustainability. We invite you to join us in this journey towards a more connected and customer-focused financial landscape.