Overview

Digital finance services (DFS) are revolutionizing the financial landscape, outpacing traditional banking in accessibility, user experience, and adaptability. We recognize that technology enables 24/7 transactions and tailored services, which is a game-changer for consumers. While conventional banks grapple with legacy systems and regulatory constraints, DFS are swiftly becoming the preferred choice among consumers. Statistics reveal a significant shift towards digital platforms for financial interactions, highlighting this growing reliance. As we navigate this evolution, it’s crucial to embrace the advantages that DFS offer, positioning ourselves at the forefront of this transformation.

Introduction

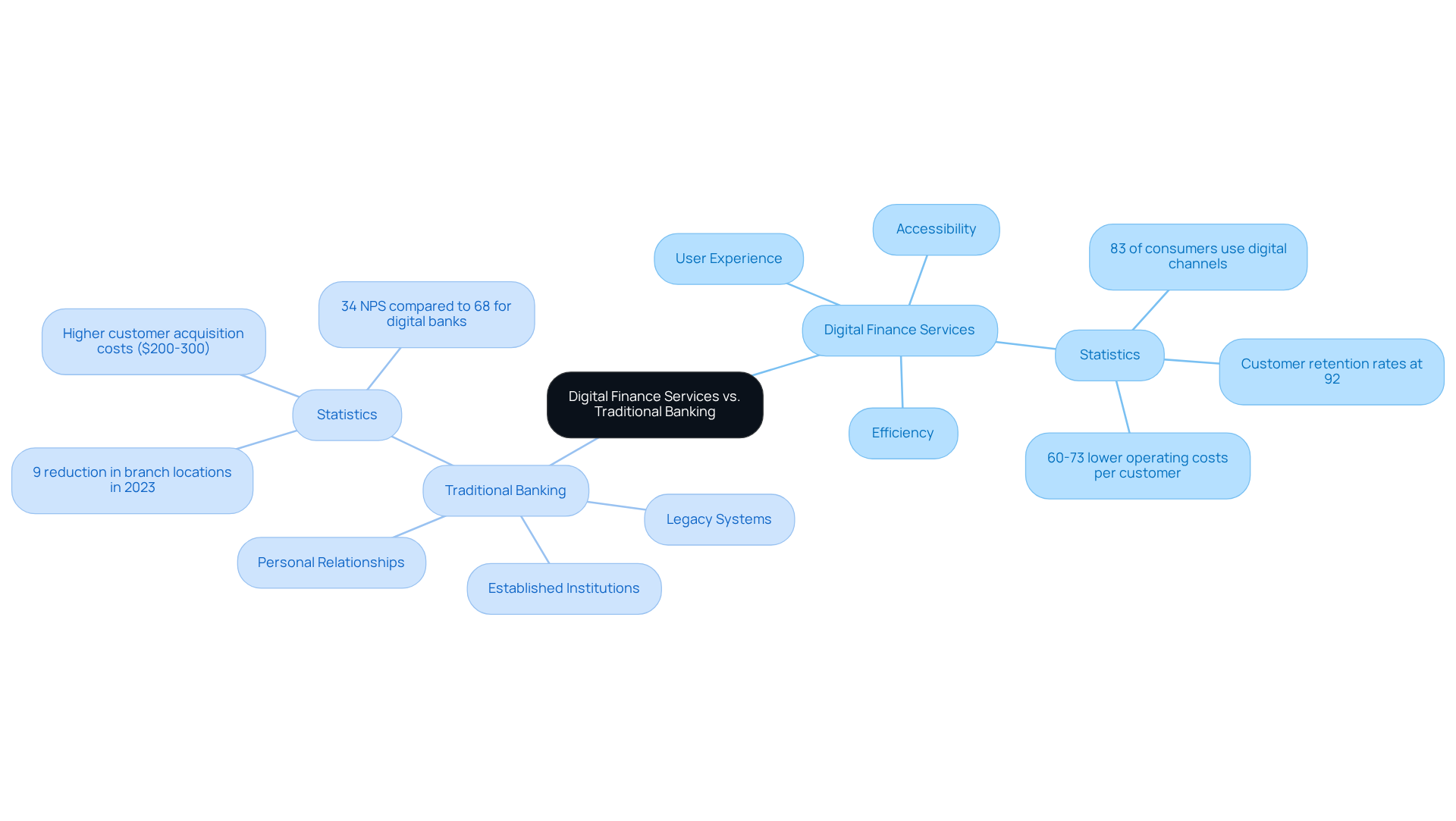

We are witnessing a seismic shift in the financial landscape as digital finance services (DFS) emerge as formidable contenders to traditional banking. With a staggering 83% of consumers now engaging with digital banking channels, the demand for convenience and efficiency has never been higher. This article delves into the critical comparisons between these two paradigms, exploring how digital solutions not only enhance user experience but also challenge the very foundation of conventional banking practices.

As the battle for consumer loyalty intensifies, what must traditional banks do to adapt and thrive in this rapidly evolving environment?

Defining Digital Finance Services and Traditional Banking

Digital finance services (DFS) represent a transformative shift in monetary solutions, providing technology-driven options that enhance accessibility, efficiency, and user experience. These services include online banking, mobile payments, and electronic wallets, enabling users to conduct transactions anytime, anywhere. In stark contrast, conventional banking is characterized by established institutions operating through physical branches, relying on legacy systems and in-person interactions. While conventional banks benefit from a long-standing reputation and robust regulatory frameworks, they often struggle with flexibility and innovation compared to their digital counterparts.

The primary distinction between these two models lies in their delivery methods and customer engagement strategies. Digital finance services prioritize convenience and speed, addressing the rising demand for instant access to financial services. For instance, in 2023, 83% of consumers utilized digital banking channels, with 47% exclusively relying on these platforms for all their financial interactions. Conversely, conventional banking focuses on building personal relationships and trust, developed over time through face-to-face interactions.

Experts note the profound impact of technology on financial institutions, with digital-only entities achieving a Net Promoter Score (NPS) of 68, significantly higher than the 34 recorded by conventional institutions. This trend illustrates a growing consumer preference for personalized and efficient banking experiences. Moreover, online financial services have demonstrated their ability to enhance user experience through features like real-time monitoring and notifications—capabilities that traditional banks often find challenging to implement due to their reliance on outdated systems.

As the economic landscape evolves, the competition between digital finance services and conventional banking intensifies, with digital solutions capturing 28% of all new banking relationships in 2023. This shift underscores the necessity for traditional financial institutions to adapt and innovate to meet changing consumer expectations and maintain their market position. We recognize that Avato’s Hybrid Integration Platform is pivotal in this transformation, enabling institutions to modernize their legacy systems and integrate seamlessly with Temenos T24, ensuring secure and efficient connectivity. This modernization empowers financial institutions to streamline operations and enhance customer interactions, ultimately bridging the gap between conventional banking and digital finance services.

Comparing Accessibility and User Experience

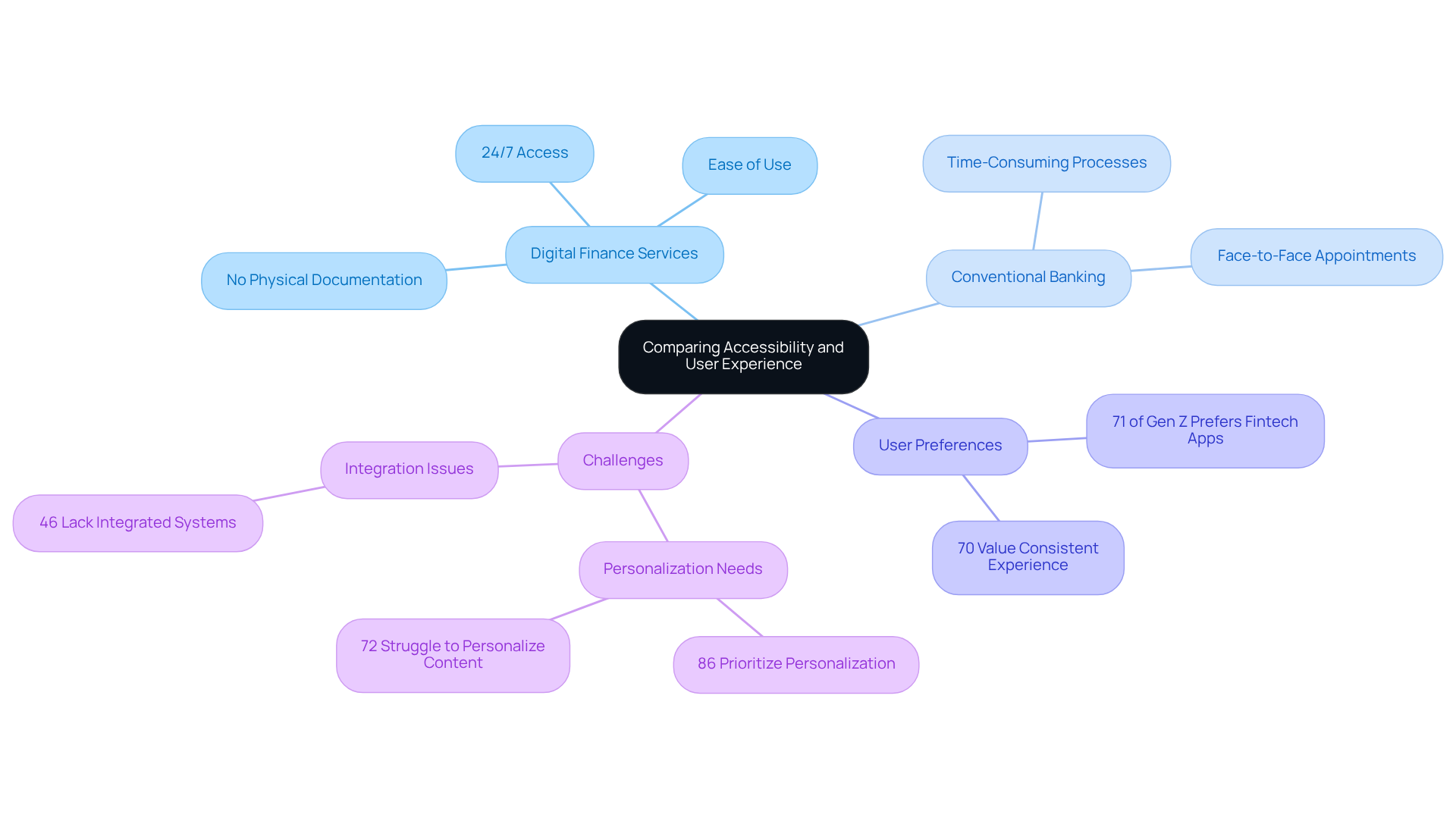

Digital finance services significantly surpass conventional banking in terms of accessibility, providing 24/7 access to financial products through mobile applications and websites. We understand that users can effortlessly utilize digital finance services to open accounts, transfer funds, and manage investments with just a few clicks, often bypassing the need for physical documentation. In contrast, conventional financial institutions generally necessitate face-to-face appointments for account establishment and transactions, which can be both time-consuming and inconvenient.

Although conventional financial institutions have made strides in improving their online offerings, they still face challenges in providing a smooth user experience. Notably, 71% of Gen Z consumers express a preference for fintech apps over traditional banks, citing the intuitive interfaces and ease of use as key factors. This trend emphasizes the rising demand for digital finance services that prioritize user experience and accessibility, particularly among younger generations.

Furthermore, 86% of monetary institutions prioritize personalization in their digital strategy, underscoring the need for tailored services to meet customer expectations. Avato’s Hybrid Integration Platform plays a crucial role in this landscape by simplifying complex integrations and delivering cost-effective solutions that enable traditional banks to modernize their systems. With support for 12 levels of interface maturity, we enable institutions to balance speed of integration with the sophistication necessary to future-proof their technology stack.

Moreover, 72% of companies find it challenging to tailor content to customer requirements, highlighting the need for efficient digital finance services in the finance industry. By combining isolated systems and fragmented information, Avato accelerates the transformation process, ensuring that financial institutions can address the changing needs of their customers.

As Tony LeBlanc from the Provincial Health Services Authority states, ‘Good team. Good people to work with. Extremely professional. Extremely knowledgeable.’ This testimonial reflects the trust and reliability that we bring to our clients.

Evaluating Regulatory Compliance and Security Risks

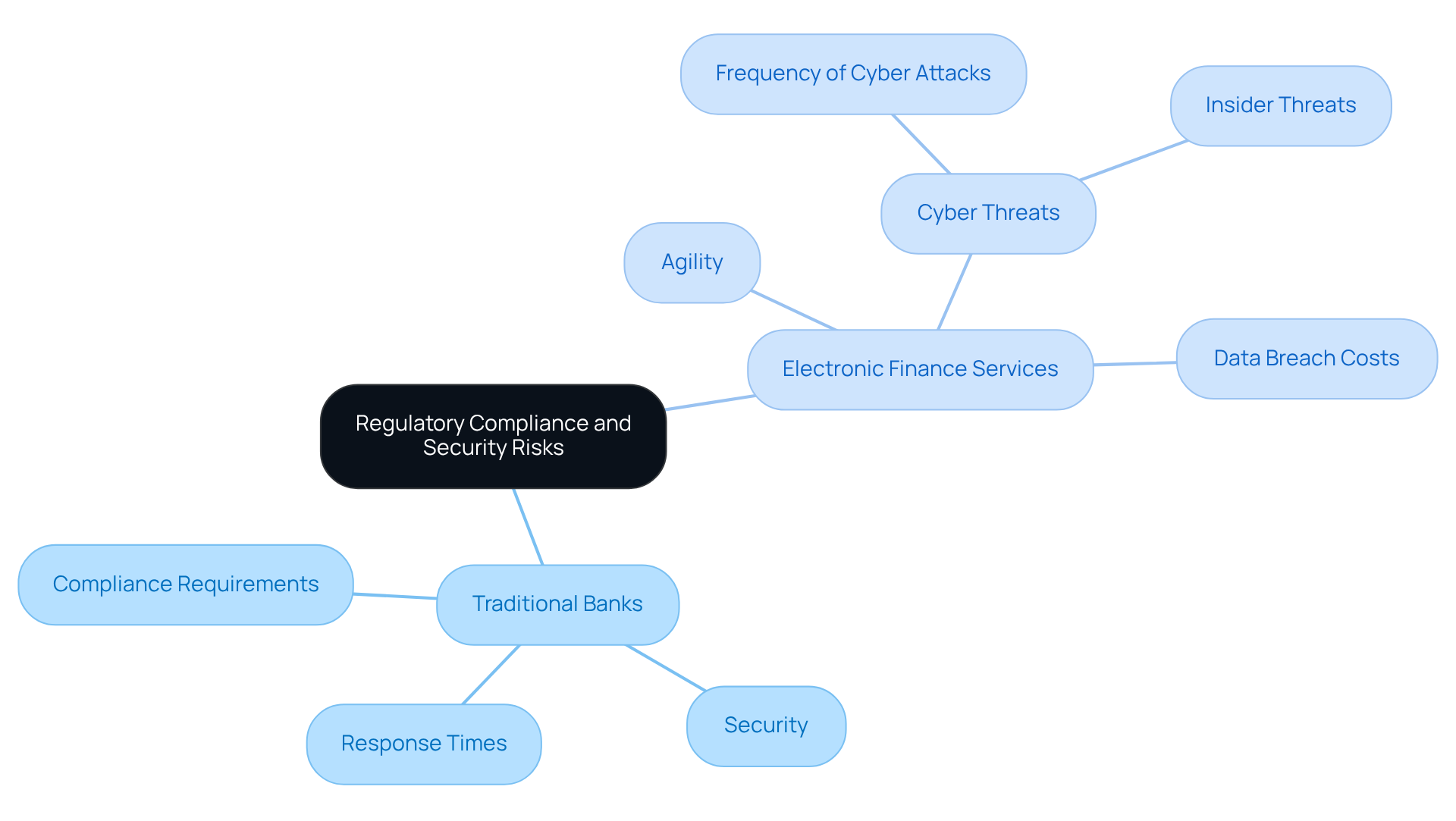

Traditional banks operate within a well-defined regulatory framework, providing a significant level of security and trust for consumers. They adhere to stringent compliance requirements, including anti-money laundering (AML) and know your customer (KYC) regulations. However, this can result in slower response times and bureaucratic hurdles.

Conversely, electronic finance services, while often more agile, face unique security challenges. The rapid pace of technological advancement can outstrip regulatory measures, leading to potential vulnerabilities. For instance, cyber threats are a major concern for online platforms, with the banking sector experiencing an average of 700 cyber attacks each week—a staggering 53% increase annually. The typical cost of a data breach in the finance sector is $5.85 million, underscoring the economic implications of these cyber threats.

Moreover, 34% of data breaches involve customer personal information, highlighting the vulnerabilities encountered by online finance services. Insider threats account for approximately 34% of all data breaches in monetary organizations, further complicating the security landscape.

Consequently, while conventional financial institutions may offer a sense of stability, it is essential for digital finance services to continually innovate to ensure compliance and protect user data. As Ayush Saxena notes, organizations are increasingly turning to compliance programs to build trust with clients and stakeholders, avoid fines and penalties, and strengthen their cybersecurity posture.

Assessing Integration Capabilities and Legacy System Challenges

Digital finance services are transforming the financial landscape, created for seamless integration via APIs and cloud-based solutions that link with numerous financial tools and platforms. This adaptability empowers us to respond swiftly to market dynamics and evolving customer expectations.

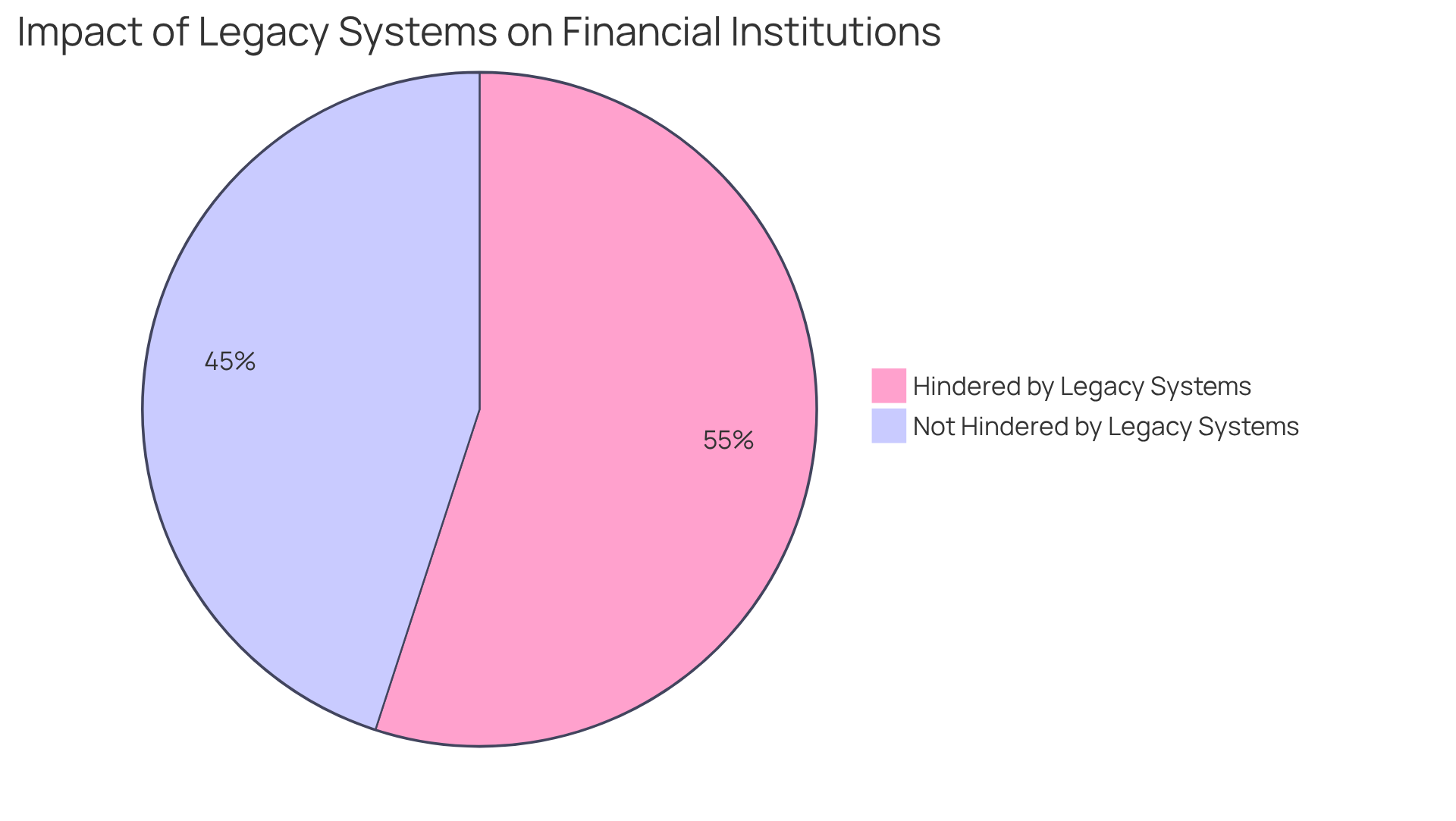

In contrast, we recognize that established financial institutions often grapple with the weight of outdated systems, which stifle innovation. These legacy infrastructures lead to inefficiencies, escalating operational costs, and significant hurdles in embracing new technologies. Notably, 55% of financial institutions identify legacy systems as a primary barrier to technological transformation, with many citing challenges related to their online banking framework. This predicament can severely limit their ability to compete effectively in a rapidly changing environment.

Therefore, while we can rapidly roll out new features and services, traditional banks face the formidable challenge of investing substantial resources into modernizing their systems to remain relevant and competitive.

What’s holding your institution back from embracing this transformation? We stand ready to support your journey toward innovation and efficiency.

Conclusion

Digital finance services are not just transforming; they are imperative for how we interact with our finances. With unparalleled convenience and efficiency, these services stand in stark contrast to traditional banking, which, despite its long-standing trust and regulatory frameworks, often falls short in flexibility and innovation. This shift in consumer preferences signals a critical need for financial institutions to adapt swiftly to an evolving landscape.

In this article, we explore essential comparisons between digital finance services and traditional banking, focusing on:

- Accessibility

- User experience

- Regulatory compliance

- Integration capabilities

Digital finance services offer 24/7 access and streamlined processes, particularly appealing to younger generations, while traditional banks grapple with outdated systems and bureaucratic obstacles. Moreover, we emphasize the importance of security and regulatory compliance, noting that digital platforms face unique challenges that demand continuous innovation to maintain consumer trust.

As the financial ecosystem evolves, embracing digital finance services is not merely an option but a necessity for traditional banks that wish to remain competitive. We must prioritize modernization and integration to meet consumer demands and navigate the complexities of the digital landscape. The insights presented here serve as a call to action for financial institutions to rethink their strategies, invest in technology, and ultimately enhance their service offerings in an increasingly digital world.