Overview

We recognize the pressing need for banks to maximize efficiency in their operations. By implementing Enterprise Service Bus (ESB) services, we can facilitate seamless integration and communication among diverse banking applications. This not only enhances operational efficiency but also reduces costs and improves data management. As a result, we empower banks to rapidly adapt to market changes and customer demands.

What’s holding your team back from achieving this level of operational excellence? Let us guide you in harnessing the full potential of ESB services to transform your banking operations.

Introduction

In today’s fast-paced banking environment, the necessity for seamless integration between diverse applications and legacy systems is more critical than ever. We recognize the transformative power of the Enterprise Service Bus (ESB), a pivotal middleware architecture that streamlines communication and enhances operational efficiency across financial institutions.

As we strive to modernize our operations and adapt to evolving market demands, ESBs are becoming indispensable tools for facilitating real-time data exchange and accelerating service deployment. With a notable increase in adoption rates, the role of ESBs in reshaping banking operations is increasingly significant, reflecting a shift towards more agile and cost-effective integration strategies.

This article delves into the multifaceted benefits of ESB services, outlines best practices for successful implementation, and highlights the transformative impact of platforms like Avato in navigating the complexities of modern banking integration.

What’s holding your team back from embracing this essential technology?

Define Enterprise Service Bus (ESB) and Its Role in Banking

ESB services represent a pivotal middleware architecture that enables seamless communication among diverse applications and services within the financial sector. As we look towards 2025, the importance of ESB services becomes increasingly evident; they are essential for bridging legacy infrastructures with modern applications, facilitating real-time data exchange, and significantly enhancing operational efficiency.

By serving as a central hub, we streamline the complexities associated with interactions, allowing various banking applications to communicate effectively without direct dependencies on one another. This decoupling not only enhances flexibility but also accelerates the deployment of new services—an essential capability in the rapidly evolving financial landscape.

Current trends indicate a growing acceptance of cloud-native ESBs and an increased reliance on APIs, signaling a shift towards more adaptable and efficient connection strategies. Recent reports reveal that the adoption of ESB services in financial services has surged by 30% over the past year, underscoring their escalating significance.

As we continue to modernize our operations, ESB services will play a crucial role in facilitating these transformations, ensuring that we can swiftly adapt to changing market demands while upholding robust security and operational integrity.

Our hybrid merging platform exemplifies this evolution, empowering banks to enhance and extend the value of their legacy frameworks while simplifying complex connections and significantly reducing costs. For instance, Gustavo Estrada, one of our valued customers, remarked, ‘Avato has the ability to simplify complex projects and deliver results within desired time frames and budget constraints,’ highlighting the tangible benefits of implementing ESB services.

Furthermore, continuous innovation and advanced security measures are vital for us, as providers of ESB services, to sustain growth in this competitive landscape.

Highlight Benefits of ESB Services for Banking Operations

Implementing ESB services in banking operations presents a multitude of advantages that significantly enhance overall efficiency and effectiveness. We understand that in today’s fast-paced financial landscape, the need for seamless integration is paramount.

- Improved Unification: Our Hybrid Unification Platform simplifies the connection of various financial frameworks, including core finance, customer relationship management (CRM), and payment processing platforms. This combination promotes a unified perspective of customer data and transactions, allowing us to provide a seamless customer experience while enhancing the benefits of legacy systems.

- Increased Agility: By facilitating the rapid deployment of new services and applications, we empower banks to swiftly adapt to market fluctuations and evolving customer demands. This agility is crucial in a competitive landscape where responsiveness can dictate success, particularly in sectors like banking, healthcare, and government.

- Cost Efficiency: Our platform reduces the dependence on direct connections, which are frequently costly and labor-intensive. This reduction leads to lower operational costs and allows for more strategic resource allocation, ultimately enhancing profitability and simplifying complex integrations.

- Improved Data Management: With robust real-time data processing capabilities, we enhance data accuracy and availability. This improvement supports informed decision-making and ensures compliance with stringent regulatory requirements, which are paramount in the banking sector. Furthermore, our platform offers real-time monitoring and alerts on performance, enabling banks to proactively tackle issues and uphold operational integrity.

- Scalability: As banks expand and adapt to new technologies, our Hybrid Integration Platform offers the scalability necessary to integrate additional systems without requiring extensive modifications to existing infrastructure. This flexibility is vital for maintaining operational continuity and supporting future growth.

The advantages of ESB services not only improve operational efficiency but also enhance client experiences, foster innovation, and provide a competitive edge in the financial services industry. As Tony LeBlanc noted, ‘The firm’s responsiveness and professionalism’ exemplify the benefits that ESB services can provide to organizations. Moreover, insights from the research methodology for the Global Enterprise Service Bus Market Report emphasize the market dynamics and trends, reinforcing the significance of ESB in contemporary financial operations. Statistics indicate that organizations leveraging ESB services experience significant improvements in operational efficiency and client satisfaction, further validating the strategic value of these services. What’s holding your team back from embracing these transformative solutions?

Implement Best Practices for ESB Integration in Banking

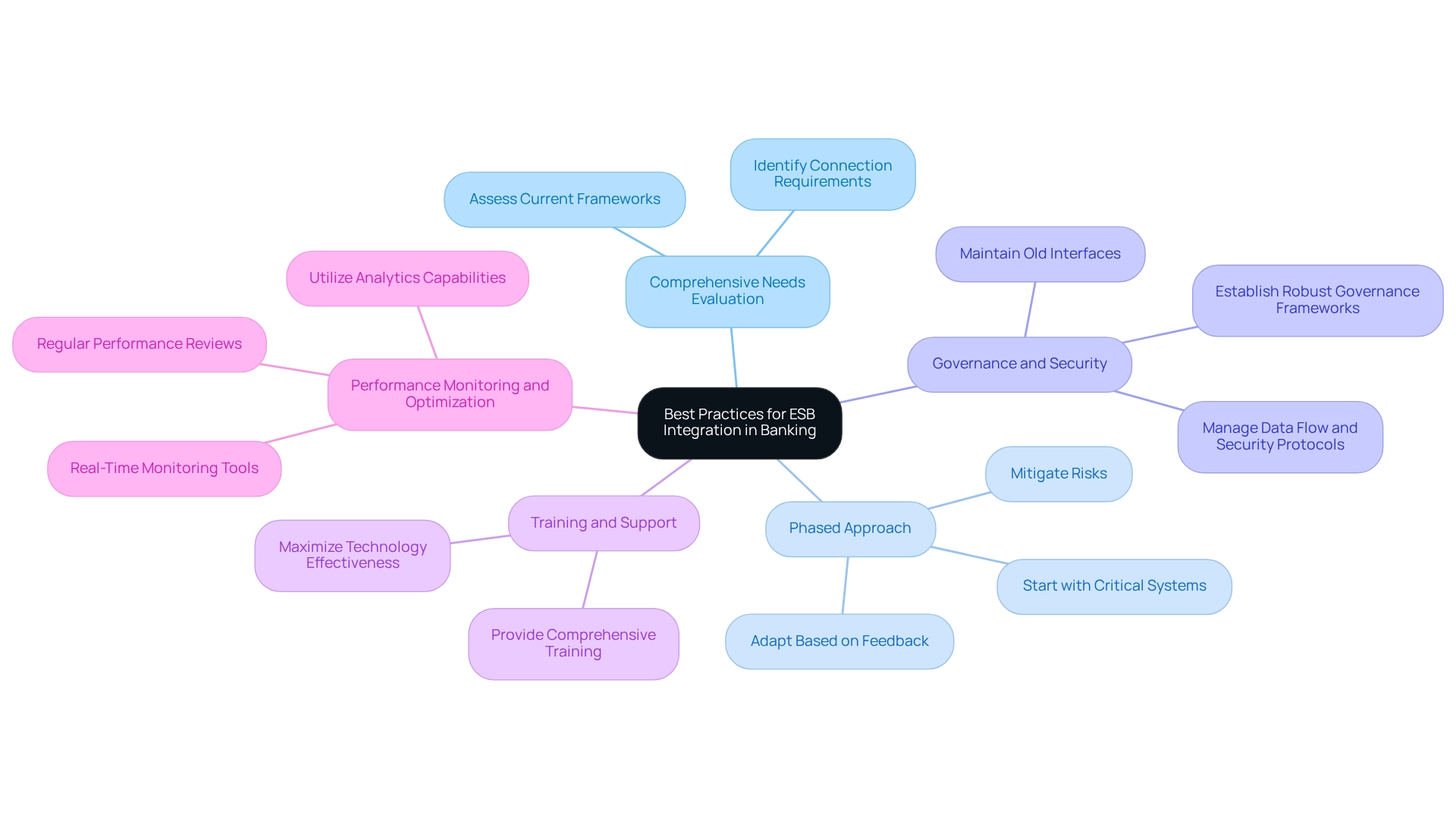

To effectively implement ESB integration in banking, we must consider several best practices that can significantly enhance our operational efficiency.

- Conduct a Comprehensive Needs Evaluation: We should start by assessing our current frameworks to pinpoint specific connection requirements. This assessment is crucial for selecting an ESB solution that aligns with our strategic business objectives.

- Adopt a Phased Approach: Implementing ESB integration in stages allows us to mitigate risks and adapt based on feedback from initial deployments. By starting with critical systems and gradually expanding, we ensure a smoother transition and minimize disruption.

- Ensure Strong Governance and Security: Establishing robust governance frameworks is essential for managing data flow and security protocols, particularly in our sector where data sensitivity is paramount. This includes maintaining old interfaces until all consumers have transitioned to new versions, ensuring continuity and reliability.

- Invest in Training and Support: Providing comprehensive training for our staff on ESB services functionalities and best practices is vital for maximizing the effectiveness of the technology. Well-informed employees can leverage the ESB to its full potential, enhancing operational efficiency.

- Monitor and Optimize Performance: Utilizing strong analytics capabilities and real-time monitoring tools allows us to continuously track the performance of ESB services and make necessary adjustments to enhance connection processes. Regular performance reviews can identify areas for improvement, ensuring the ESB continues to meet our evolving business needs and enhances customer experiences.

Implementing these best practices can lead to significant improvements in operational efficiency. For instance, a staged ESB implementation has been proven to enhance project success rates by 30%, showcasing the effectiveness of this method in managing the challenges of coordination. Furthermore, entities such as Coast Capital have indicated a 20% decrease in operational expenses after implementing ESB architecture, highlighting the financial advantages of a well-executed unification strategy. The case study titled “Navigating Challenges in ESB Integrations” illustrates how Avato’s hybrid unification platform simplifies challenges through a staged execution method and robust governance framework, reinforcing the effectiveness of the recommended practices. Lastly, we must be aware of common pitfalls, such as underestimating the complexity of combining systems or neglecting to involve key stakeholders, which can hinder the success of ESB implementation.

- Call to Action: To learn more about how we can support your ESB integration journey, visit our website or contact us for tailored solutions.

Conclusion

The transformative potential of Enterprise Service Bus (ESB) technology in the banking sector is indeed profound. We recognize that ESBs serve as vital middleware solutions that enhance integration across diverse applications, enabling banks to modernize operations and respond effectively to market demands. The benefits of implementing ESB services are manifold:

- Improved integration

- Increased agility

- Cost efficiency

- Enhanced data management

- Scalability

Each of these advantages contributes to a more streamlined operation, ultimately leading to a superior customer experience and a stronger competitive position in the financial services industry.

Furthermore, we emphasize the importance of adopting best practices for successful ESB integration. Conducting thorough needs assessments, implementing in phases, ensuring robust governance, and investing in staff training are critical steps that can significantly improve the chances of success. By following these guidelines, we can navigate the complexities of integration while minimizing risks and maximizing operational efficiency.

In conclusion, the role of ESBs in modern banking is not only pivotal but also increasingly essential as we strive to remain agile in a fast-evolving landscape. Embracing this technology allows us to leverage our existing systems while paving the way for future growth. As the financial sector continues to embrace digital transformation, adopting ESB solutions is a strategic move that can yield substantial long-term benefits. The time to act is now; the potential for improved performance and customer satisfaction awaits those ready to take the leap into a more integrated future.