Overview

The foremost advantages of banking integration encompass:

- Enhanced operational efficiency

- Improved customer experience

- Minimized risk through streamlined processes and real-time data management

Integration enables:

- Automation

- Superior reporting

- Compliance

This empowers financial institutions to swiftly adapt to market demands while upholding regulatory standards and enriching customer engagement.

How can your institution leverage these benefits to stay ahead in a competitive landscape? By embracing integration, you position your organization to not only meet but exceed customer expectations, ensuring a resilient and responsive operational framework.

Introduction

In the rapidly evolving landscape of modern finance, banking integration emerges as a critical component for success. Financial institutions are under pressure to enhance operational efficiency and elevate customer experiences, making the seamless connection of various banking systems essential.

With the rise of digital transformation, integrating advanced technologies such as artificial intelligence and blockchain not only streamlines processes but also fosters robust data management and compliance.

This article explores the multifaceted benefits of banking integration, examining its role in driving automation, improving reporting accuracy, and ultimately transforming the customer experience. By delving into current trends and successful case studies, we find that embracing integration is not merely an option; it is a necessity for financial institutions aiming to thrive in a competitive marketplace.

Understanding Banking Integration: A Key to Modern Finance

The merging of diverse financial networks and technologies is a strategic initiative aimed at optimizing operations, enhancing information sharing, and enriching customer experiences. As we approach 2025, the urgency of digital transformation becomes increasingly apparent, making a comprehensive understanding of this concept essential for financial institutions seeking to maintain a competitive edge. Banking integration empowers institutions to unify disparate systems, facilitating seamless communication and data flow—elements that are crucial for effective decision-making and operational efficiency.

The benefits of financial unification are substantial. It enables institutions to reach new clients and deliver personalized banking experiences, a necessity in today’s customer-centric marketplace. With the acceleration of digital transformation efforts, banks are leveraging advanced technologies such as artificial intelligence, blockchain, and robotic process automation to enhance their connectivity capabilities.

Avato’s hybrid connection platform is instrumental in this evolving landscape, maximizing and extending the value of legacy systems while simplifying complex linkages and significantly reducing costs.

Industry specialists underscore the importance of financial system unification in propelling digital transformation. For instance, Gustavo Estrada from BC Provincial Health Services Authority emphasizes that effective coordination streamlines complex projects, yielding results within desired timelines and budget constraints. This perspective resonates throughout the industry, where successful digital financial transformation strategies prioritize a customer-centric approach, robust data analytics capabilities, and stringent cybersecurity measures.

Avato’s secure hybrid connection platform is meticulously designed for safe transactions, ensuring 24/7 uptime and reliability—an essential feature for sectors like finance, healthcare, and government.

Current trends in financial consolidation for 2025 indicate a shift towards more sophisticated and secure frameworks. Financial institutions are increasingly prioritizing measurable outcomes, establishing key performance indicators (KPIs) to monitor their digital transformation progress. The case study titled “Defining Criteria for Success in Digital Banking” illustrates this point, demonstrating how KPIs facilitate the assessment of revenue growth, service delivery rates, and customer interactions, thereby identifying areas for improvement.

Successful examples of banking integration reveal the tangible advantages of this approach. Organizations that have embraced a unified strategy, particularly through Avato’s solutions, report enhanced operational capabilities and reduced expenses, enabling them to adapt to evolving demands and maintain a competitive advantage. As the landscape of modern finance continues to evolve, the importance of financial unification cannot be overstated; it is a fundamental component for financial entities aspiring to thrive in an increasingly digital environment.

Enhanced Control Over Your Financial Data

One of the most significant benefits of banking integration is the enhanced control it provides over financial information. By merging platforms, banks can consolidate information management, ensuring that all details are precise, current, and readily available. This centralized control not only enhances information integrity but also aids in adhering to regulatory requirements, enabling institutions to oversee and handle their information flows more effectively.

As Canada prepares for open banking, it is crucial for banks to adopt strategic banking integration approaches that leverage existing legacy systems rather than discarding them in favor of new solutions. This method can conserve time and resources while improving information management practices.

A troubling statistic indicates that only 9% of financial institutions use techniques to safeguard against online threats. This highlights the pressing need for strong information management practices. Enhanced control leads to better risk management and informed decision-making, ultimately driving business success. As emphasized by the Federal Reserve Board, regulatory agencies impose fines and penalties for failing to protect customer information and adhere to industry-specific cybersecurity standards, making it essential for banks to prioritize information integrity.

The effect of centralized information management is clear in case studies, such as the Target incident, where cyber attackers took advantage of weaknesses in payment networks, compromising the details of roughly 110 million customers. This incident underscores the vital necessity of securing payment systems and implementing centralized information management strategies to greatly lower the risk of similar breaches. Furthermore, financial professionals stress that banking integration through centralized information management not only improves control over financial information but also optimizes operations, resulting in enhanced efficiency and lower expenses.

Key cybersecurity measures, such as securing network components, implementing multi-factor authentication, and continuous monitoring of user activities, are essential for effective information management. As the terrain of finance keeps changing, the benefits of improved oversight over financial information grow more essential for preserving a competitive advantage and guaranteeing adherence in a complicated regulatory landscape. Furthermore, with phishing ranking as the second most frequently employed infection vector in attacks, representing 33% of occurrences, the necessity for improved information management strategies in the banking sector is more urgent than ever.

At Avato, we suggest utilizing our hybrid connection solutions to efficiently manage and safeguard your data. Our approach emphasizes the importance of integrating existing systems with modern technologies to ensure compliance and enhance operational efficiency. For banking IT managers aiming to apply these strategies, we recommend examining our FAQs and user manuals for practical insights on enhancing your connection processes.

Streamlined Operations and Increased Efficiency

Banking integration is pivotal in streamlining operations, automating processes, and minimizing manual interventions. This transformation not only enhances efficiency but also significantly reduces the time required to complete tasks that once took hours or even days. For example, integrating payment systems with accounting software facilitates real-time transaction updates, drastically cutting down reconciliation time.

Such efficiencies empower banks to allocate resources more effectively, enhance service delivery, and respond swiftly to customer needs, ultimately providing a substantial competitive edge in the market.

Statistics indicate that automation can dramatically boost operational efficiency. In the insurance sector, for instance, automation has reduced quote generation time from 14 days to just 4 minutes. This trend is mirrored in the financial sector, where the benefits of automation—such as increased productivity and reduced errors—far outweigh the challenges associated with implementation, including resource allocation and data security concerns. Navigating these challenges is essential to fully harness the potential of unification.

Moreover, industry leaders acknowledge the significance of these advancements. As Gustavo Estrada noted, the ability to simplify complex projects and achieve results within desired timelines is crucial for success in today’s fast-paced financial landscape. With the ongoing integration of artificial intelligence in banking processes, it is projected that by 2028, 70% of employees will utilize AI to automate or enhance their tasks.

This shift is already visible; nearly 70% of firms reported at least a 5% revenue increase attributable to AI implementations, underscoring the necessity of embracing these technologies for operational efficiency.

Avato is instrumental in this transformation, accelerating the unification of isolated systems and fragmented information. It provides the connected foundation that enterprises need to simplify, standardize, and modernize their operations. Designed for secure transactions, Avato is trusted by banks, healthcare, and government sectors, ensuring 24/7 uptime with no room for defects or outages. With support for 12 levels of interface maturity, Avato enables organizations to balance the pace of incorporation with the complexity required to future-proof their technology stacks, enhancing operational visibility and problem resolution across various departments.

Avato’s hybrid unification platform offers robust information management capabilities, ensuring seamless connectivity and compliance with regulatory standards. As Tony Leblanc from the Provincial Health Services Authority stated, “Avato speeds up the unification of isolated systems and fragmented information, providing the connected foundation enterprises require to simplify, standardize, and modernize.” This testimonial highlights Avato’s effectiveness in addressing the challenges faced by financial institutions on their digital transformation journeys.

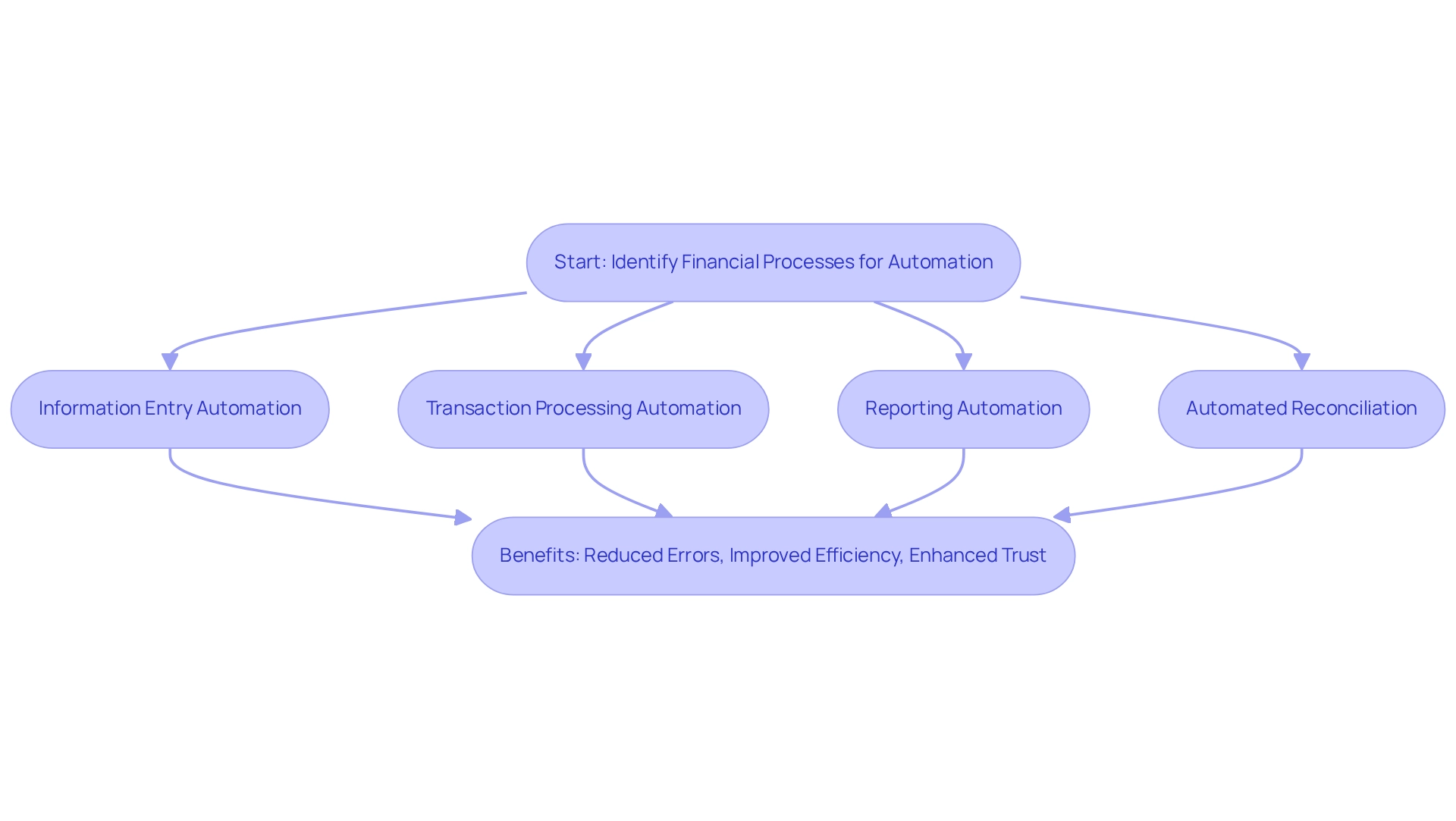

Automation of Financial Processes for Better Accuracy

Automation stands out as a pivotal advantage of banking integration, empowering financial institutions to refine their operations and enhance accuracy. By automating essential tasks such as information entry, transaction processing, and reporting, banks significantly minimize the risk of human errors that can result in costly mistakes. For instance, automated reconciliation processes swiftly identify and rectify discrepancies, thereby bolstering the reliability of financial reporting. This not only enhances operational efficiency but also fosters trust among customers and regulatory bodies.

Avato’s Hybrid Connection Platform plays a vital role in this automation journey. It enables organizations to maximize and extend the value of their legacy technologies while simplifying complicated connections. With support for 12 levels of interface maturity, Avato allows banks to access data and networks in weeks, not months, ensuring that integration efforts are both efficient and future-proof.

Statistics indicate that organizations utilizing automation in their financial processes have seen error reduction rates of up to 70%. This highlights the transformative effect of technology on accuracy. Furthermore, financial analysts emphasize that automation streamlines workflows and allows for real-time monitoring and alerts, which are crucial for maintaining compliance and operational integrity. Avato’s platform offers these capabilities, significantly lowering costs and improving performance.

Case studies illustrate the effectiveness of automation in enhancing banking integration. For example, a leading bank reported a 50% decrease in processing time for transactions after implementing banking integration with automated systems. This resulted in improved customer satisfaction due to faster service delivery. Additionally, a case study titled “Stress Factors in Data Entry Jobs” highlights the challenges associated with manual information entry, such as monotony and accuracy pressures. It underscores how automation can alleviate these issues by reducing the repetitive nature of the work.

Moreover, utilizing XSLT (eXtensible Stylesheet Language Transformations) can further improve automation efforts by offering a highly-tuned declarative programming language for transforming XML structures. XSLT’s connection with XPath and its extensive library of data manipulation functions significantly reduces labor in creating transformative tasks. It also catches programming errors early in the development process, leading to substantial cost savings.

Such outcomes highlight the significance of automation in reducing human mistakes and improving the overall precision of financial procedures. This establishes it as an essential element of contemporary financial system strategies. As noted by Gustavo Estrada, Acting Provincial Director at BC Provincial Health Services Authority, “Avato simplifies complex projects and delivers results within desired time frames and budget constraints,” further emphasizing the effectiveness of automation in achieving these goals. Furthermore, variance reports serve as a valuable tool for identifying hidden issues and opportunities within banking processes, aligning with the theme of improving accuracy through automation.

Improved Reporting and Data Analytics

Banking integration significantly enhances reporting and analytics capabilities for financial institutions. By consolidating information from diverse sources, integrated systems facilitate thorough analysis and reporting, leading to precise financial forecasts, improved risk assessments, and enhanced performance metrics. For instance, banks employing integrated analytics tools can effectively identify trends in customer behavior, optimize product offerings, and refine overall business strategies.

This strategic approach not only drives growth but also boosts profitability.

Moreover, the impact of banking integration on reporting accuracy is profound. With a unified view of data, institutions can minimize discrepancies, ensuring decision-makers have access to reliable information. This is particularly crucial in regulated environments, where banking integration is vital for maintaining compliance and accuracy.

Avato’s commitment to guaranteeing 24/7 uptime for critical integrations underscores the dependability of these frameworks in preserving accurate reporting.

Success stories abound in the realm of banking integration systems. Institutions embracing these technologies report significant enhancements in their data analytics capabilities, particularly through improved banking integration. A recent case study highlighted how a major bank streamlined its reporting processes, achieving a 30% reduction in the time needed to generate financial reports.

Such efficiencies not only enhance operational capabilities but also enable banks to respond swiftly to market changes, showcasing the transformational impact of Avato’s hybrid integration platform on cost reduction and faster product delivery.

Additionally, generative AI plays a vital role in enhancing customer experience and operational efficiency within these integrated frameworks. By leveraging generative AI, financial institutions can develop sophisticated chatbots and virtual assistants that improve customer interactions and streamline processes.

Expert opinions further emphasize the importance of integrated reporting systems. Financial analysts assert that organizations utilizing banking integration alongside integrated information analytics are better equipped to navigate the complexities of the financial environment. As Miro Kazakoff points out, “In a world of increased information, the companies with more information-literate individuals are the ones that are going to succeed.”

This underscores the necessity of having personnel skilled in information literacy to effectively leverage analytics within the context of banking integration. Furthermore, Hilary Mason highlights the significance of the human element in analytics, asserting that the integration of intuition and the right inquiries is essential for interpreting information effectively. In a data-driven world, those who can interpret and act on insights will undoubtedly lead the way, further emphasizing the need for enhanced unification strategies and stakeholder engagement.

To achieve successful unification, it is essential to mobilize stakeholders and utilize the right technology and tools to accurately illustrate the current and ideal states of the organization.

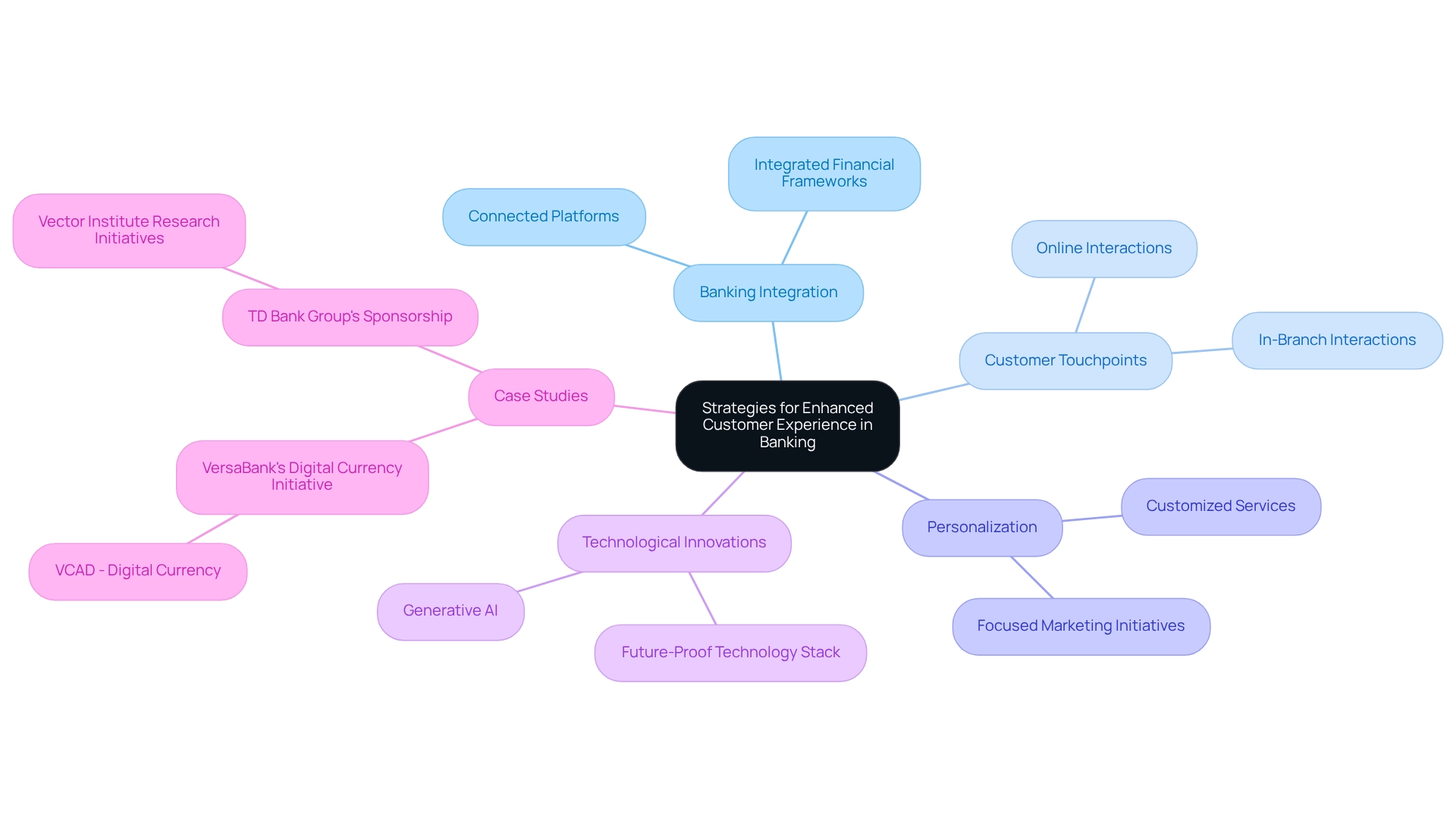

Enhanced Customer Experience and Engagement

Banking integration is essential for elevating customer experience and engagement in today’s competitive financial landscape. By seamlessly connecting various customer touchpoints, banks can deliver a cohesive experience across both online and in-branch interactions. This unification enables financial organizations to provide customized services, utilizing extensive client information to adjust their offerings efficiently.

For example, connected platforms support focused marketing initiatives that correspond with customer preferences and behaviors, greatly improving satisfaction and loyalty. A recent study suggests that personalized financial experiences can result in a 20% rise in customer retention rates, highlighting the economic advantages of such strategies.

Furthermore, the execution of integrated financial frameworks has been demonstrated to enhance customer experience metrics. Avato, recognized for its strong unification solutions, speeds up the connection of isolated systems and fragmented data, offering a connected foundation that streamlines and modernizes financial operations. This capability is crucial for institutions aiming to enhance customer engagement and operational efficiency with banking integration.

Avato’s solutions support 12 levels of interface maturity, enabling banks to balance speed of incorporation with the sophistication needed to future-proof their technology stack.

A notable case is VersaBank’s initiative to launch VCAD, a digital currency backed by Canadian dollar bank deposits. This innovative method not only boosts customer involvement but also establishes the bank as a progressive leader in the digital currency sector, demonstrating how Avato’s incorporation abilities directly foster such advancements.

Furthermore, the continuous sponsorship of the Vector Institute by TD Bank Group emphasizes the significance of research initiatives in financial collaboration, further endorsing the necessity for tailored services in finance. Banking professionals increasingly recognize that understanding and anticipating customer needs is crucial for success in a crowded marketplace. Moreover, the growth of generative AI in financial services, demonstrated by a 60% rise in its application for customer experience, shows how advanced technologies can transform customer interaction and operational effectiveness.

Ultimately, an enhanced customer experience, fueled by efficient banking integration and innovative solutions like those provided by Avato, which emphasize secure transactions, results in greater retention and revenue for financial institutions, establishing it as a strategic necessity for contemporary banking operations.

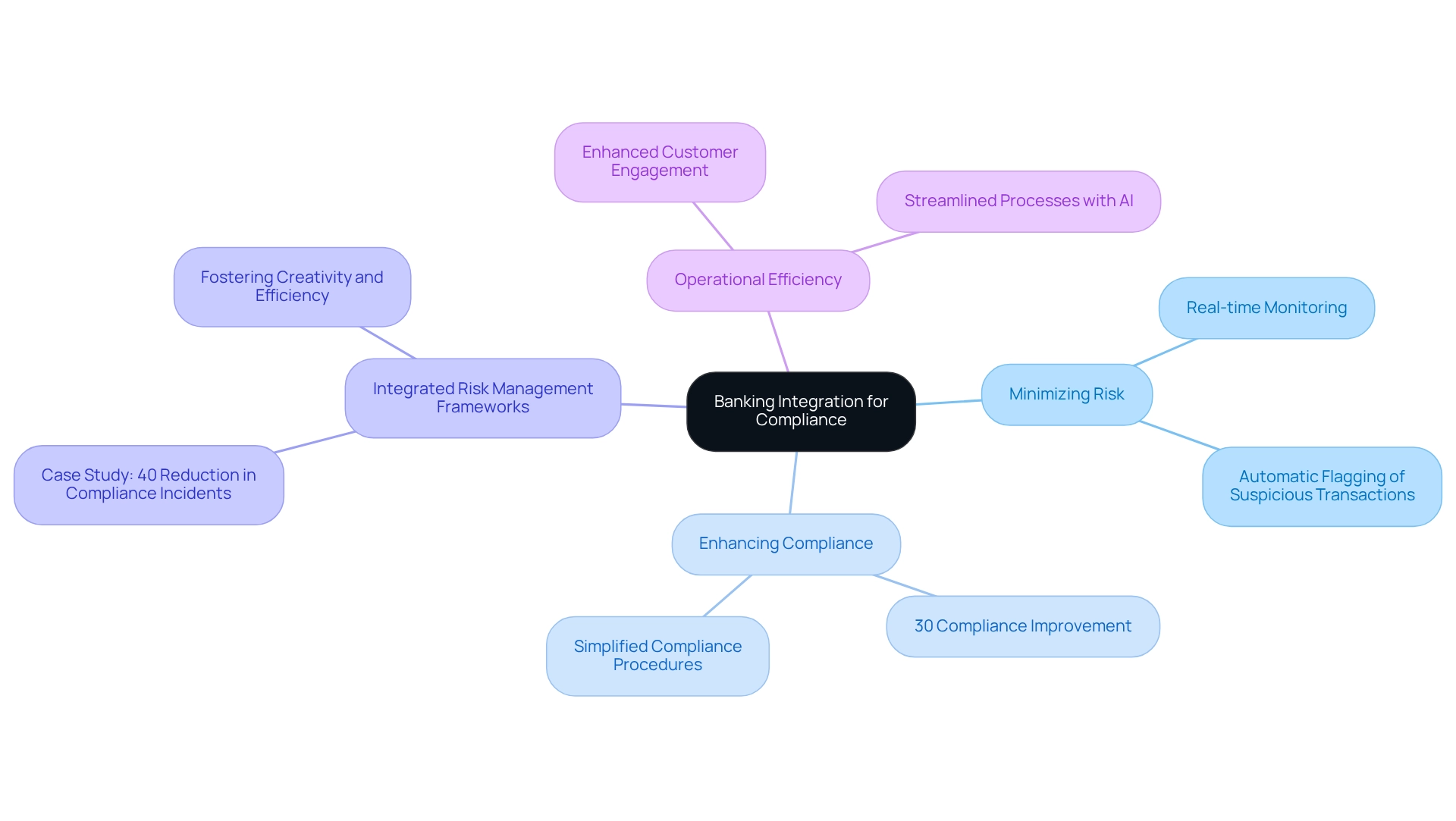

Minimized Risk and Enhanced Compliance

Banking integration plays a pivotal role in minimizing risk and enhancing compliance within financial institutions. By seamlessly linking various platforms, Avato’s hybrid unification platform ensures that all operations adhere to regulatory standards and internal policies. This banking integration facilitates real-time monitoring of transactions and activities, which is crucial for the immediate detection of anomalies or compliance breaches.

Consider integrated risk management frameworks, which can automatically flag suspicious transactions for further investigation. This capability significantly reduces the risk of fraud and potential regulatory penalties.

Statistics reveal that organizations utilizing integrated solutions have seen compliance improvement rates soar by as much as 30%, underscoring the effectiveness of these strategies in ensuring adherence to regulations. Furthermore, expert opinions highlight that banking integration frameworks not only simplify compliance procedures but also enhance overall operational efficiency. As Claire Cook, a writer and motivational speaker, aptly stated, “If plan A doesn’t work, the alphabet has 25 more letters – 204 if you’re in Japan,” emphasizing the necessity for adaptability in compliance strategies.

Case studies further illustrate the advantages of unification in risk management. For example, Avato’s hybrid connectivity platform has been instrumental in fostering creativity and efficiency across various sectors, akin to how banking integration through Avato’s combined frameworks encourages collaboration and innovation. Notably, a leading bank reported a 40% reduction in compliance-related incidents after implementing Avato’s integrated approach to banking integration in their operations.

This clearly demonstrates how Avato’s unification solutions not only mitigate risk but also cultivate a culture of compliance within financial organizations. In an era of increasing regulatory scrutiny, the ability to swiftly adapt to evolving compliance landscapes through Avato’s banking integration systems is invaluable for safeguarding the integrity of financial operations. Moreover, the integration of generative AI technologies is revolutionizing customer engagement and operational efficiency, further empowering banks to enhance their service offerings and streamline processes.

Conclusion

Banking integration is not just important; it is vital in the rapidly evolving financial landscape. It enables institutions to connect various systems and leverage cutting-edge technologies like artificial intelligence and blockchain. This integration streamlines operations, enhances data management, and significantly improves customer experiences.

The advantages of banking integration are profound. It fosters automation, leading to greater operational efficiency and reduced processing times. Centralized data management ensures better control and compliance with regulatory standards, while also improving risk management. Institutions that embrace integrated systems often see substantial cost reductions and enhanced reporting accuracy, which are essential for informed decision-making.

Crucially, the focus on customer experience is paramount. Integrated systems allow banks to provide personalized services tailored to customer preferences, enhancing loyalty and retention in a competitive market. As customer expectations continue to rise, delivering seamless interactions becomes increasingly important.

In conclusion, banking integration is not merely a strategic option; it is essential for financial institutions that aim to thrive in a digital world. By prioritizing integration, banks can boost operational efficiency, ensure compliance, and enhance customer experiences. This positions them for long-term success in the modern financial ecosystem. Embracing this transformative approach is crucial for navigating the complexities of today’s financial environment.