Overview

This article presents ten compelling examples of digital transformation within the banking sector, illustrating how institutions harness advanced technologies to elevate customer experiences and enhance operational efficiency. Notable case studies, such as those of JP Morgan Chase and Revolut, underscore the vital importance of innovation and strategic technology investments in overcoming challenges and sustaining competitiveness in an ever-evolving financial landscape.

How are you adapting to these changes? The insights provided here not only highlight successful strategies but also serve as a roadmap for your institution’s journey towards digital excellence.

Introduction

In an era where digital innovation is fundamentally reshaping the banking landscape, financial institutions must embrace transformative technologies to remain competitive. The integration of advanced tools—such as artificial intelligence, cloud computing, and big data analytics—is not merely a trend; it is a necessity for banks seeking to enhance customer experiences and streamline operations.

As the industry evolves, both established institutions and new entrants are navigating the complexities of digital transformation, grappling with challenges that range from overcoming legacy systems to meeting regulatory demands.

This article explores the pivotal role of digital transformation in banking, showcasing inspiring case studies of leading banks that have successfully harnessed technology to drive growth, improve security, and foster customer trust.

By examining these examples, the urgency for banks to innovate and adapt to the digital age becomes unmistakable, highlighting a future where agility and customer-centricity reign supreme.

Understanding Digital Transformation in Banking

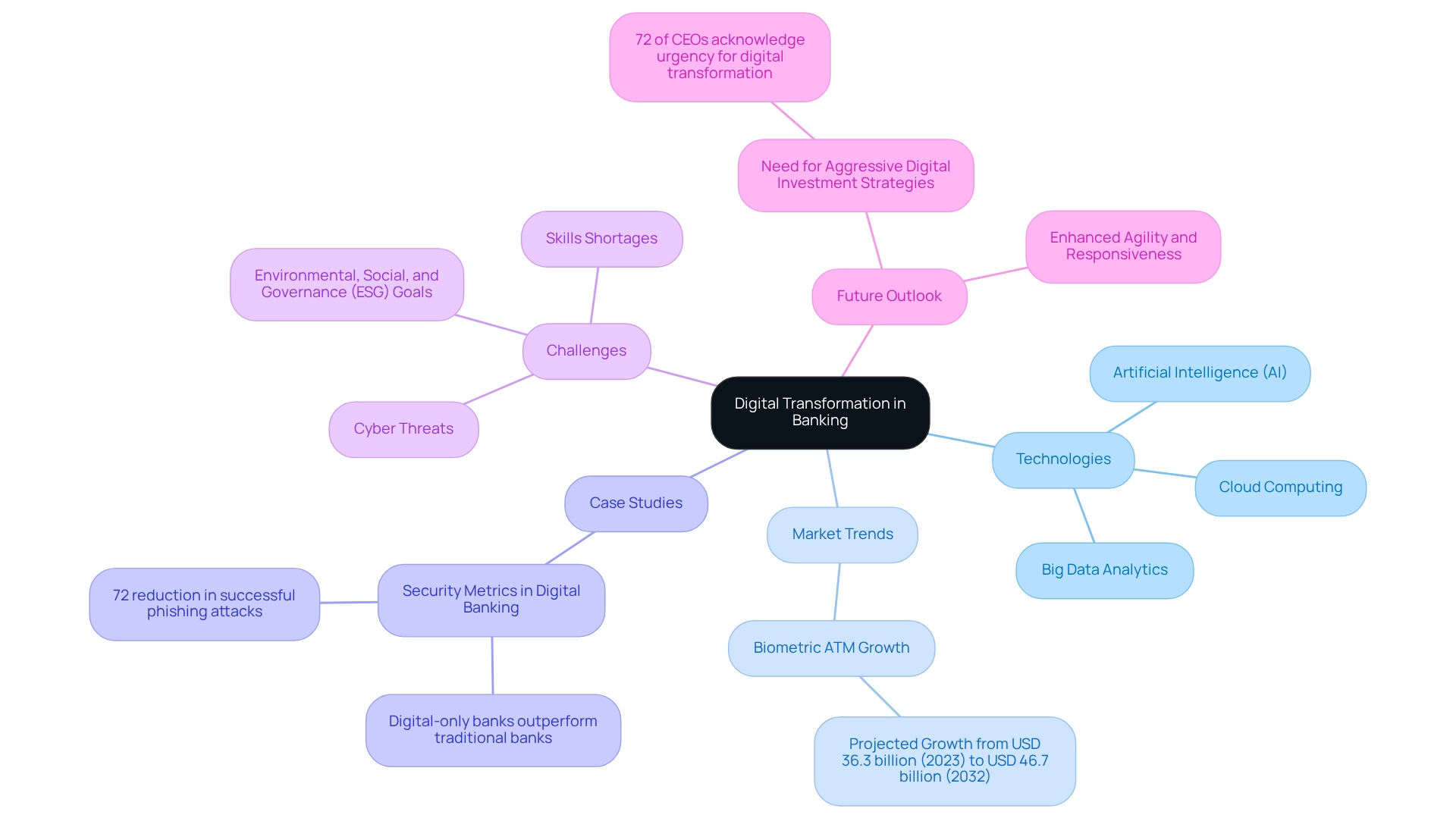

Digital transformation in banking exemplifies the comprehensive integration of digital technologies across all operational facets, fundamentally reshaping how financial institutions function and deliver value to their clients. This transformation utilizes a range of advanced technologies, including artificial intelligence (AI), cloud computing, and big data analytics, enabling financial institutions to enhance client experiences, improve operational efficiency, and refine decision-making processes.

In 2025, the financial sector is witnessing a rise in the adoption of these technologies, driven by the necessity to meet changing client expectations and navigate dynamic market conditions. For instance, the biometric ATM sector is projected to grow from USD 36.3 billion in 2023 to USD 46.7 billion by 2032, highlighting a significant trend toward improved security and user convenience in financial services.

Furthermore, established digital-only institutions are setting benchmarks for security and operational efficiency, surpassing traditional organizations on essential metrics. A notable case study reveals that these banks experience a 72% reduction in successful phishing attacks, showcasing their advanced systems and security-focused architectural designs that foster enhanced client trust.

Avato, founded by a dedicated team of enterprise architects, is at the forefront of this digital transformation, pioneering hybrid integration solutions that empower financial institutions to lead the AI revolution. The name Avato, derived from the Hungarian term for ‘dedication,’ reflects the company’s commitment to designing the technological foundation necessary for rich, connected user experiences. By unlocking isolated assets and enabling seamless data connectivity, Avato’s platform enhances operational efficiency and user engagement.

The integration of generative AI, evidenced by a 60% increase in its application for customer experience in financial services, illustrates how institutions are developing sophisticated chatbots and virtual assistants to streamline operations and boost productivity. Specific examples of Avato’s solutions in action include successful implementations that have improved data flow and enhanced customer interactions, demonstrating the tangible benefits of the hybrid integration platform. However, the journey toward digital transformation in banking is fraught with challenges. Key obstacles such as cyber threats, environmental, social, and governance (ESG) goals, and a shortage of skilled professionals continue to hinder progress.

Regulators must also balance innovation with stability, evolving frameworks that address digital-specific risks while enabling responsible innovation. According to KPMG, 72% of CEOs acknowledge that the urgency for digital transformation in banking underscores the need for financial institutions to innovate while maintaining stability and security through assertive technological investment strategies.

As we look ahead, the influence of AI and cloud computing on financial operations, as demonstrated in various digital transformation banking examples, is expected to be significant, allowing organizations to enhance their agility and responsiveness. By adopting these electronic technologies, along with Avato’s hybrid integration solutions—featuring real-time data processing and robust security measures—financial institutions can optimize their operations and position themselves competitively in an increasingly virtual landscape, ensuring they remain relevant and capable of meeting their clients’ needs in 2025 and beyond.

Why Digital Transformation is Essential for Banks

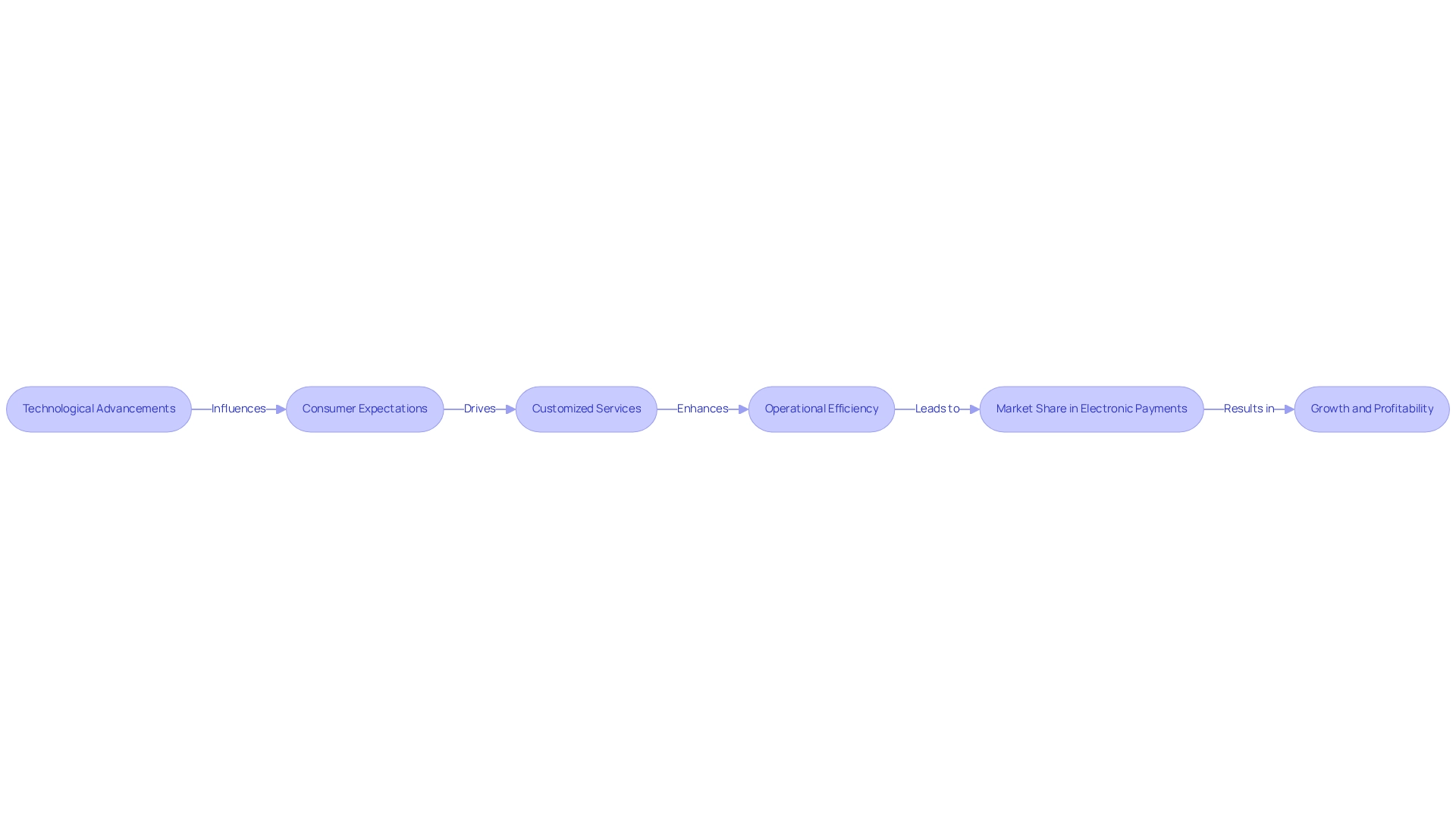

Digital transformation in banking exemplifies how technological advancements have become essential for financial institutions aiming to stay competitive in an ever-evolving online landscape. As FinTech companies set benchmarks for digital transformation, they reshape consumer expectations, compelling traditional financial institutions to innovate to retain existing clients and attract new ones. This transformation enables financial institutions to offer personalized services, significantly enhancing client engagement and satisfaction.

By 2025, a substantial portion of financial entities is expected to provide customized services through online platforms, serving as prime examples of digital transformation in banking. The integration of financial technology solutions has yielded particularly successful outcomes, illustrated by the rising demand for electronic payments. This trend allows financial institutions to leverage innovations for improved client onboarding and modern payment options. Consequently, financial institutions captured the largest market share in the electronic payments sector in 2023, showcasing the effectiveness of FinTech collaborations in enhancing customer experiences.

Notably, the financial sector is projected to experience the highest compound annual growth rate (CAGR) during the forecast period, underscoring the urgent need for financial organizations to embrace digital transformation in banking.

Moreover, examples of digital transformation in banking highlight its vital role in boosting operational efficiency and reducing costs. By modernizing outdated legacy systems with Avato’s Hybrid Integration Platform, financial institutions can optimize these systems, manage complex integrations effortlessly, and significantly lower expenses. This modernization facilitates better compliance with regulatory requirements and mitigates associated risks.

The ability to adapt to evolving demands is further bolstered by a reliable, future-proof technology stack, crucial for navigating the complexities of the financial services landscape and ensuring compliance. Additionally, Avato’s platform provides real-time monitoring and notifications regarding system performance, empowering financial institutions to proactively address issues and enhance operations.

As Balázs Czímer noted, financial entities and non-financial organizations are currently competing in five distinct areas, including everyday finance and banking as a service (BaaS). This competition highlights the necessity for financial institutions to continuously innovate to remain relevant. Embracing digital transformation in banking not only fosters a seamless client experience but also drives growth and profitability, equipping financial institutions to thrive in an increasingly competitive environment.

Furthermore, fintech firms are encouraged to concentrate on establishing a robust core business, which emphasizes the competitive pressures faced by banks and the imperative for them to innovate and adapt. The utilization of generative AI further enhances user experience and operational efficiency, revolutionizing trading, client engagement, and security through advanced integration solutions.

Case Study 1: JP Morgan Chase’s Digital Innovations

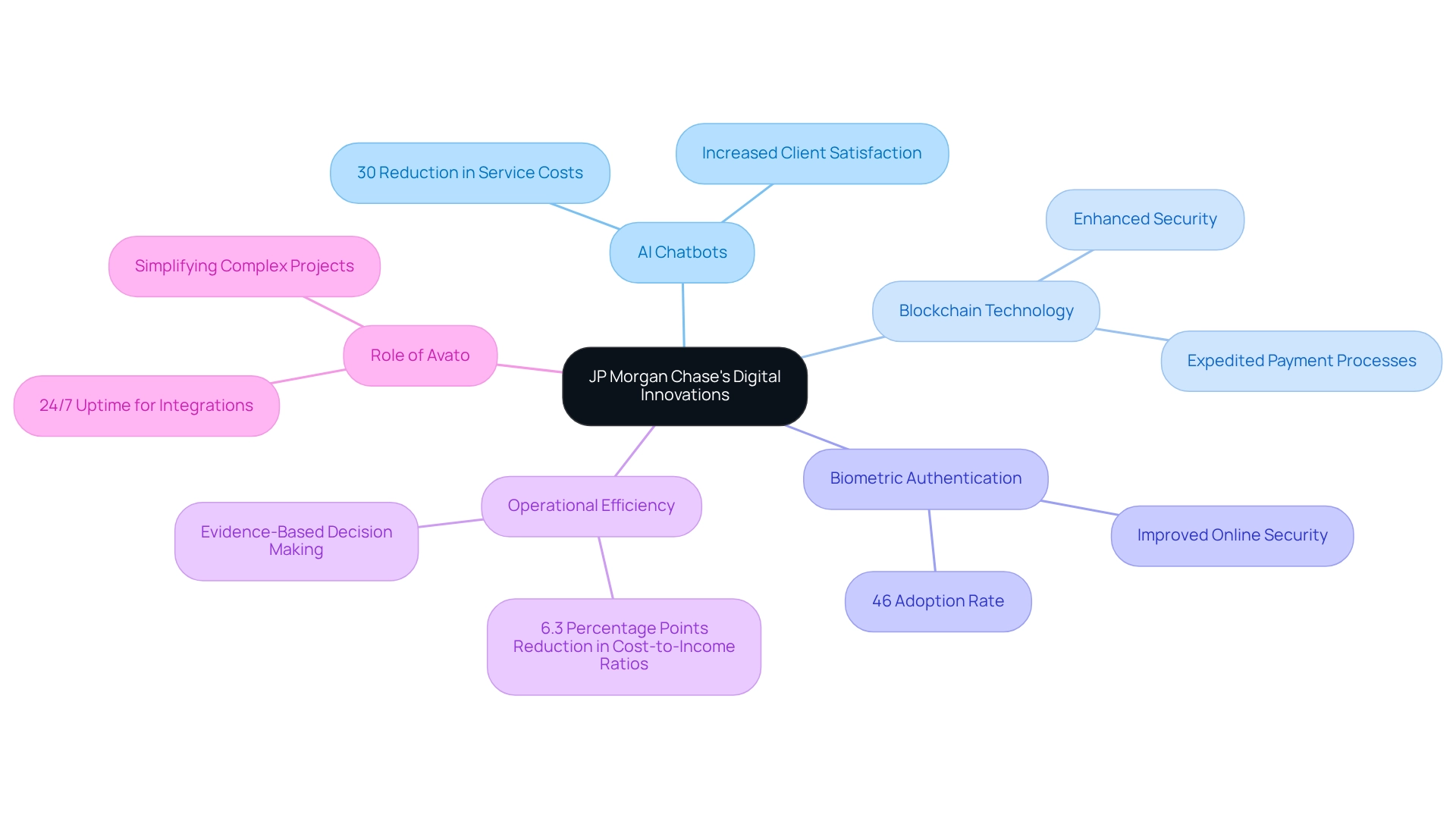

JP Morgan Chase has established itself as a leader in digital innovation within the banking sector, directing significant investments into technology that enhances user experiences and optimizes operational efficiency. The institution’s deployment of AI-powered chatbots has revolutionized service delivery, significantly reducing wait times and boosting response efficiency. Indeed, banks leveraging AI chatbots have reported a notable increase in client satisfaction, with studies suggesting a potential decrease in service costs by as much as 30%.

This trend aligns with the broader adoption of generative AI in financial services, which has experienced a 60% surge in applications focused on improving user experience. Furthermore, JP Morgan Chase has adopted blockchain technology to ensure secure and transparent transactions, which has notably expedited payment processes. This strategic integration of blockchain not only enhances security but also fosters trust among clients—a vital component in maintaining a competitive advantage in the financial services landscape.

As of 2023, nearly 46% of companies in the U.S. have begun replacing traditional passwords with biometric authentication methods, reflecting a growing shift towards more secure online interactions.

The institution’s commitment to transformation is evident in its ability to streamline operations while enhancing customer satisfaction. For example, banks that implement collaborative data strategies, akin to those employed by JP Morgan Chase, have reported an average reduction of 6.3 percentage points in their cost-to-income ratios over a three-year period. This data partnership not only boosts profitability but also enables evidence-based decision-making, further solidifying JP Morgan Chase’s position as a leader in the financial sector.

Avato, a leader in hybrid integration, plays a crucial role in this transformation by ensuring 24/7 uptime for essential integrations, which is imperative for sustaining operational efficiency in transformation initiatives. Avato’s expertise in integrating emerging technologies such as AI and blockchain, while maintaining client trust, is essential for achieving a competitive edge in the financial sector. The organization’s ability to simplify complex projects and deliver results within desired timelines and budget constraints has been highlighted by industry experts, underscoring the effectiveness of such initiatives in the financial services domain.

In conclusion, JP Morgan Chase’s innovative application of AI and blockchain technologies exemplifies key digital transformation strategies that are reshaping the financial sector, ensuring they remain at the forefront of technological advancement. Avato’s hybrid integration platform accelerates secure system integration across financial services, healthcare, and government, amplifying the transformative impact of AI on client engagement and operational efficiency.

Case Study 2: Revolut’s Disruption in Banking

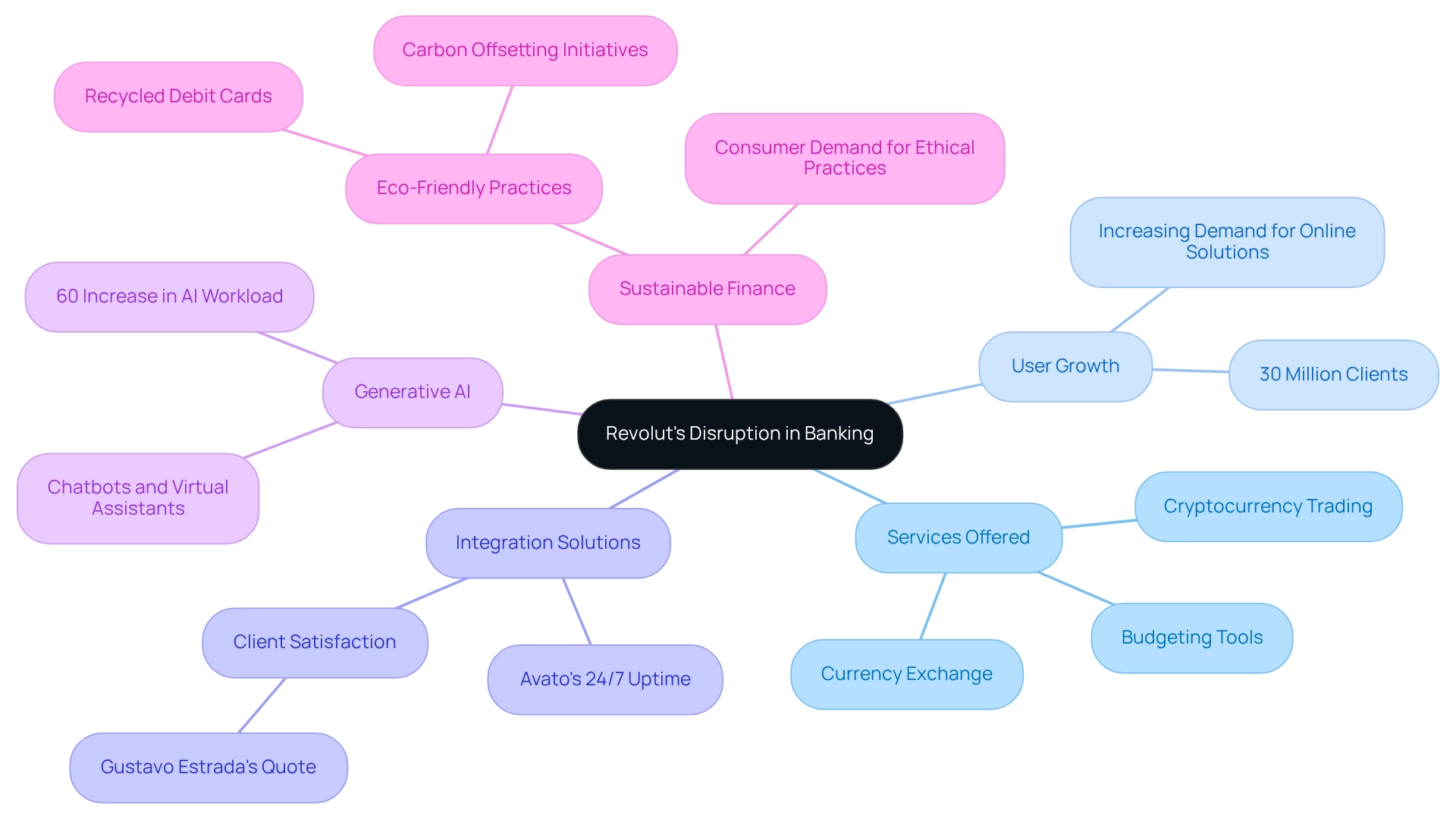

Revolut has emerged as a formidable disruptor in the financial sector, transforming the landscape with its fully electronic services that transcend the limitations of traditional financial systems. By offering a comprehensive suite of services—including currency exchange, cryptocurrency trading, and budgeting tools—Revolut guarantees that all functionalities are effortlessly accessible through a user-friendly mobile app. This strategic application of cutting-edge technologies enables the company to provide significantly lower fees and faster transaction speeds compared to conventional banks.

By 2025, Revolut has witnessed remarkable user growth, boasting over 30 million clients worldwide. This surge underscores its innovative approach and the increasing demand for online financial solutions. Industry experts assert that the rise of mobile finance applications like Revolut has greatly enhanced customer engagement, with users valuing personalized financial management tools that cater to their specific needs.

However, as the online finance landscape evolves, the importance of reliability in integration solutions must not be overlooked. Companies like Avato ensure 24/7 uptime for critical integrations, which is vital for maintaining seamless financial operations. Avato’s secure hybrid integration platform is designed for complex systems in banking, healthcare, and government, providing a robust foundation for transformation initiatives.

Avato supports 12 levels of interface maturity, empowering financial institutions to balance integration speed with the sophistication necessary to future-proof their technology stack. This reliability is crucial for financial institutions that rely on uninterrupted service to meet client expectations.

Moreover, client satisfaction is paramount in this competitive landscape. Gustavo Estrada, a client, remarked on Avato’s ability to streamline intricate projects and deliver results within desired timelines and budget constraints, highlighting the efficiency of robust integration platforms in facilitating digital transformation. The integration of generative AI into financial services has also been groundbreaking, with a notable increase in its application for enhancing user experience through advanced chatbots and virtual assistants.

For instance, a survey indicates generative AI as the second-most-utilized AI workload in financial services, showcasing a 60% increase in its use for client experience, particularly in developing chatbots.

In conjunction with exploring innovative financial solutions like Revolut, it is advisable for Financial IT Managers to investigate and assess neobanks based on fees, interest rates, services, and user reviews to identify the ideal match for their financial needs. This informed decision-making process is essential in selecting the right online financial partner. Furthermore, the trend of sustainable finance is gaining traction, with neobanks prioritizing eco-friendly practices, such as offering debit cards made from recycled materials and carbon offsetting initiatives.

This shift not only enhances client interaction but also aligns with the growing consumer demand for ethical financial practices.

In conclusion, Revolut’s technological disruption in finance exemplifies one of the key digital transformation banking cases, illustrating how innovation can redefine financial services. Simultaneously, the integration features provided by platforms like Avato emphasize the importance of reliability and client satisfaction in the future of finance, where flexibility, user experience, and cost-effectiveness are paramount.

Case Study 3: Santander’s Digital Journey

Santander has embarked on a transformative online journey designed to enhance client engagement and optimize operational efficiency. The institution’s substantial investments in updating essential financial systems have paved the way for the introduction of AI-driven solutions, which personalize client interactions and elevate service delivery. By embracing a client-focused strategy, Santander has significantly improved its online offerings, including mobile services and web solutions, leading to a remarkable increase in client satisfaction and loyalty.

This strategic focus on innovation underscores the advantages of technological transformation within a traditional banking framework while aligning with industry trends. Digital transformation in banking demonstrates that personalized banking can enhance customer retention by as much as 62%. Furthermore, Avato’s Hybrid Integration Platform exemplifies digital transformation in banking, accelerating Santander’s technological evolution by providing a reliable, future-ready technology stack that simplifies complex integrations and ensures secure transactions. This capability is vital for financial institutions, healthcare, and government sectors, where 24/7 uptime is non-negotiable, and any defects or outages are unacceptable.

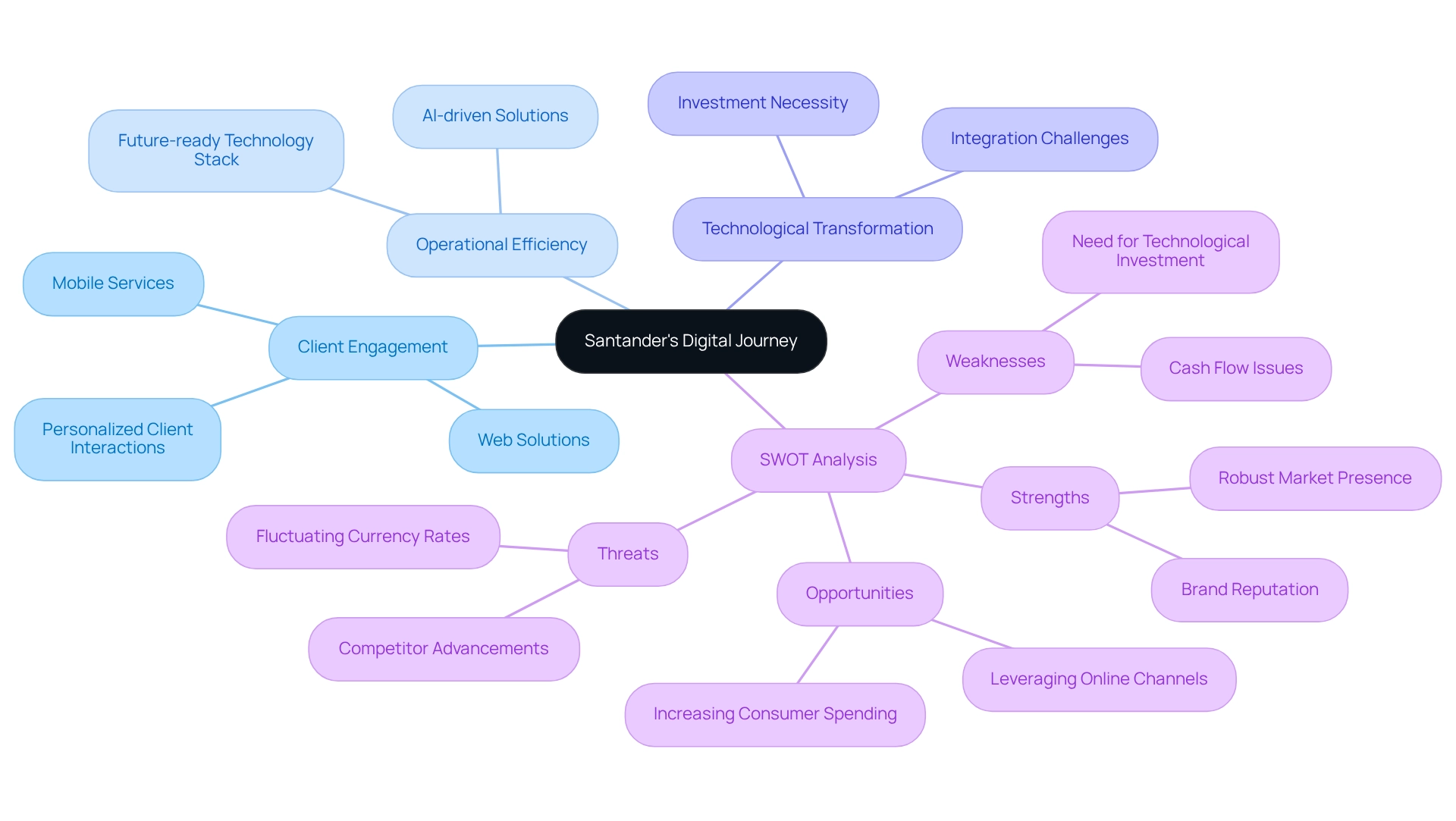

Avato’s support for 12 levels of interface maturity enables Santander to balance the speed of integration with the sophistication necessary to future-proof its technology stack. As Santander continues to refine its online environment, the integration of advanced technologies, bolstered by Avato, stands as a prominent example of digital transformation in banking. This positions the bank to adapt to evolving customer demands and maintain a competitive edge. According to Tony Leblanc from the Provincial Health Services Authority, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.”

Additionally, a SWOT analysis of Santander reveals its robust market presence and brand reputation, while also pinpointing challenges such as the necessity for technological investment. Significant barriers to technological transformation in 2024, including the complexity of the current landscape and a lack of technical expertise, further contextualize Santander’s endeavors as they navigate these challenges.

Case Study 4: Natwest’s Approach to Digital Banking

Natwest has made remarkable strides in modernizing its financial services through a comprehensive transformation strategy, leveraging Avato’s Hybrid Integration Platform to enhance system integration and operational efficiency. The platform’s features, such as seamless data integration and real-time analytics, have been crucial in allowing Natwest to launch a variety of online tools, prominently including a mobile app created to provide personalized financial guidance and budgeting functionalities. This app not only enables users to manage their finances more effectively but also improves their overall financial experience.

Significantly, online-only financial institution clients perform 2.8 times more financial transactions, although with a 37% lower average value compared to conventional financial institution customers. This statistic highlights the profound influence of electronic tools on client behavior.

In 2025, Natwest has strategically collaborated with prominent technology companies, including Avato, to enhance its online capabilities, concentrating on improving client interactions and optimizing operational processes. These partnerships have been crucial in allowing Natwest to remain competitive in a swiftly changing financial environment, underscoring the concrete advantages of technological transformation in conventional finance. As the financial sector experiences essential reorganization, with institutions and non-institutions competing in diverse fields, Natwest’s efforts are particularly significant.

Furthermore, Natwest’s dedication to advancement is evident in its use of essential technological tools that enable smooth financial experiences. For example, the financial institution’s online services, backed by Avato’s integration solutions, have been crucial in improving client engagement and satisfaction, with statistics showing a notable rise in user adoption rates. Firms that concentrate on their primary operations are 1.6 times more inclined to achieve superior returns, which aligns with Natwest’s strategic emphasis in its technological evolution.

Moreover, the case study on security metrics in electronic finance emphasizes that established online-only institutions surpass conventional organizations in specific security metrics, including a 72% lower occurrence of successful phishing attacks and 43% quicker fraud detection response times. This demonstrates how Natwest’s online tools, supported by Avato’s integration solutions, may enhance security and client trust, aligning with broader trends in the industry. As McKinsey observes, generative AI could contribute the equivalent of $2.6 trillion to $4.4 trillion each year across different applications, highlighting the significance of innovation in finance and its connection to Natwest’s initiatives.

Natwest’s proactive strategy not only establishes it as a leader in the industry but also provides digital transformation banking examples, demonstrating how conventional institutions can effectively utilize technology, including generative AI, to address the evolving needs of their clients. The institution’s initiatives serve as digital transformation banking examples, showcasing the successful incorporation of technology within financial services and illustrating the critical role of technological transformation in achieving operational excellence and customer loyalty.

Case Study 5: Commonwealth Bank’s Technological Advancements

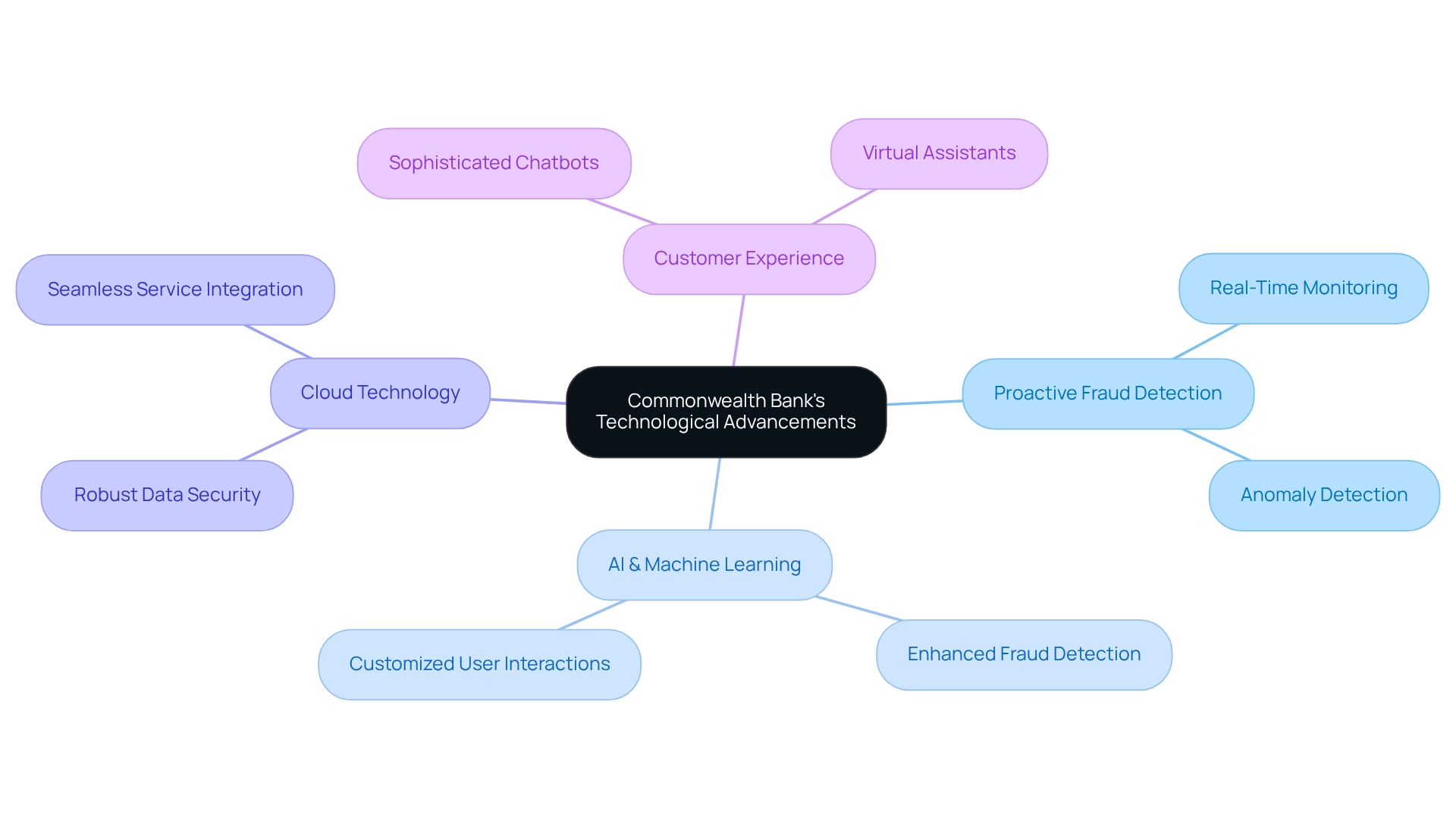

Commonwealth Bank has made significant strides in technological advancements, showcasing digital transformation banking examples that position it at the forefront of the banking sector. By implementing artificial intelligence (AI) and machine learning, the bank has significantly enhanced its fraud detection capabilities, shifting from reactive to proactive strategies. This shift is essential as financial organizations increasingly acknowledge the significance of advanced technologies in protecting client assets and sustaining trust.

Indeed, financial institutions are progressively adopting proactive fraud detection strategies, reflecting the changing environment of financial technology.

In 2025, Commonwealth Bank’s investment in AI and machine learning is expected to yield substantial advancements in fraud detection rates, with data indicating a notable rise in efficiency and accuracy. The integration of these technologies not only streamlines operations but also tailors user interactions, thereby enhancing overall service quality. Industry leaders have observed that the use of AI in finance is altering client experiences, making services more responsive and customized to individual requirements.

Furthermore, the institution’s commitment to cloud technology has fortified its operational structure, ensuring robust data security and seamless integration of services. This strategic emphasis on innovation has not only improved operational efficiency but has also bolstered customer trust, illustrating the crucial role of technology in contemporary financial services. As Gustavo Estrada pointed out, Avato simplifies intricate projects and delivers outcomes within preferred timelines and budget limits, underscoring the efficiency of technology in achieving financial objectives.

A case study of Commonwealth Bank serves as a valuable source of digital transformation banking examples, illustrating how the institution employs AI for fraud detection. By leveraging machine learning algorithms, the bank can analyze transaction patterns in real-time, identifying anomalies that may indicate fraudulent activity. This proactive approach has proven effective in mitigating risks and enhancing the overall security of financial operations.

Moreover, Avato’s Hybrid Integration Platform demonstrates how such platforms can address the challenges of integrating isolated legacy systems and fragmented data, which is pertinent to the modernization efforts of the financial sector. The platform empowers financial institutions to maximize and extend the value of their legacy systems while simplifying complex integrations and significantly reducing costs. Additionally, the real-time monitoring and alerts feature of Avato’s platform ensures that institutions can respond swiftly to any potential issues, further enhancing operational reliability.

As the artificial intelligence market is projected to reach USD 390.91 billion in 2025, with a compound annual growth rate (CAGR) of 35.9% through 2030, Commonwealth Bank’s early adoption of these technologies positions it well to capitalize on future trends and maintain a competitive edge in the financial services landscape.

The reliable, future-proof technology stack provided by platforms like Avatar is essential for businesses to adapt to changing demands, further emphasizing the importance of technological advancements in the banking sector. Moreover, the integration of generative AI has significantly improved customer experience, particularly in developing sophisticated chatbots and virtual assistants, streamlining operations and enhancing productivity across various departments.

Challenges in Digital Transformation for Banks

Banks are navigating a complex environment during their technological transformation journeys, facing significant challenges that can hinder progress. One of the most urgent concerns is the dependence on outdated systems, which frequently lack the adaptability required to effectively incorporate new technological solutions. In reality, a staggering 70% of banks indicate that outdated technology is a significant obstacle to their technological initiatives.

This dependence not only hinders innovation but also raises operational expenses. Effective technological transformation can produce cost reductions of up to 30% for banks, making it a critical area for improvement.

Furthermore, regulatory compliance complicates the application of innovative technologies. Banks must navigate a labyrinth of regulations that can delay or even derail online projects. For instance, the necessity to ensure data security and privacy compliance can slow down the adoption of new systems, as institutions must rigorously vet technologies to meet stringent standards. Cultural resistance within organizations also poses a significant barrier.

Employees may be hesitant to embrace new processes and technologies, fearing disruption to their established workflows. This resistance can be particularly pronounced in traditional financial environments, where long-standing practices are deeply ingrained. To overcome this, financial institutions must promote a culture of innovation and offer sufficient training and support to enable staff to adapt to new digital tools.

Case studies serve as digital transformation banking examples that illustrate how these organizations are addressing these challenges. For instance, digital-only financial institutions secured 28% of all new financial relationships in 2023, even though they held merely 11% of total financial assets. Their achievement is linked to reduced client acquisition expenses, averaging between $20 and $40, in contrast to $200 to $300 for conventional financial institutions.

This efficiency generates significant competitive pressure, forcing established institutions to innovate and adjust to maintain market share.

To address these challenges effectively, financial institutions should consider digital transformation banking examples as part of a comprehensive approach to transformation, which includes strategic investments in technology and empowering leadership with the appropriate tools. Avato’s expertise in hybrid integration can simplify complex projects and deliver results within desired time frames and budget constraints. This highlights the importance of leveraging effective solutions to overcome the hurdles posed by legacy systems and regulatory compliance.

Moreover, harnessing generative AI can significantly enhance customer experience and operational efficiency in financial services. As organizations like Premier NX invite companies to explore customized solutions for a technology-driven future, they propose practical measures that financial institutions can adopt to improve their transformation initiatives. In summary, tackling the hurdles of outdated systems, regulatory adherence, and cultural resistance is essential for financial institutions seeking to effectively manage their transformation initiatives. By adopting a holistic approach and utilizing Avato’s capabilities, financial institutions can prepare themselves for a digitally empowered future.

Benefits of Embracing Digital Transformation in Banking

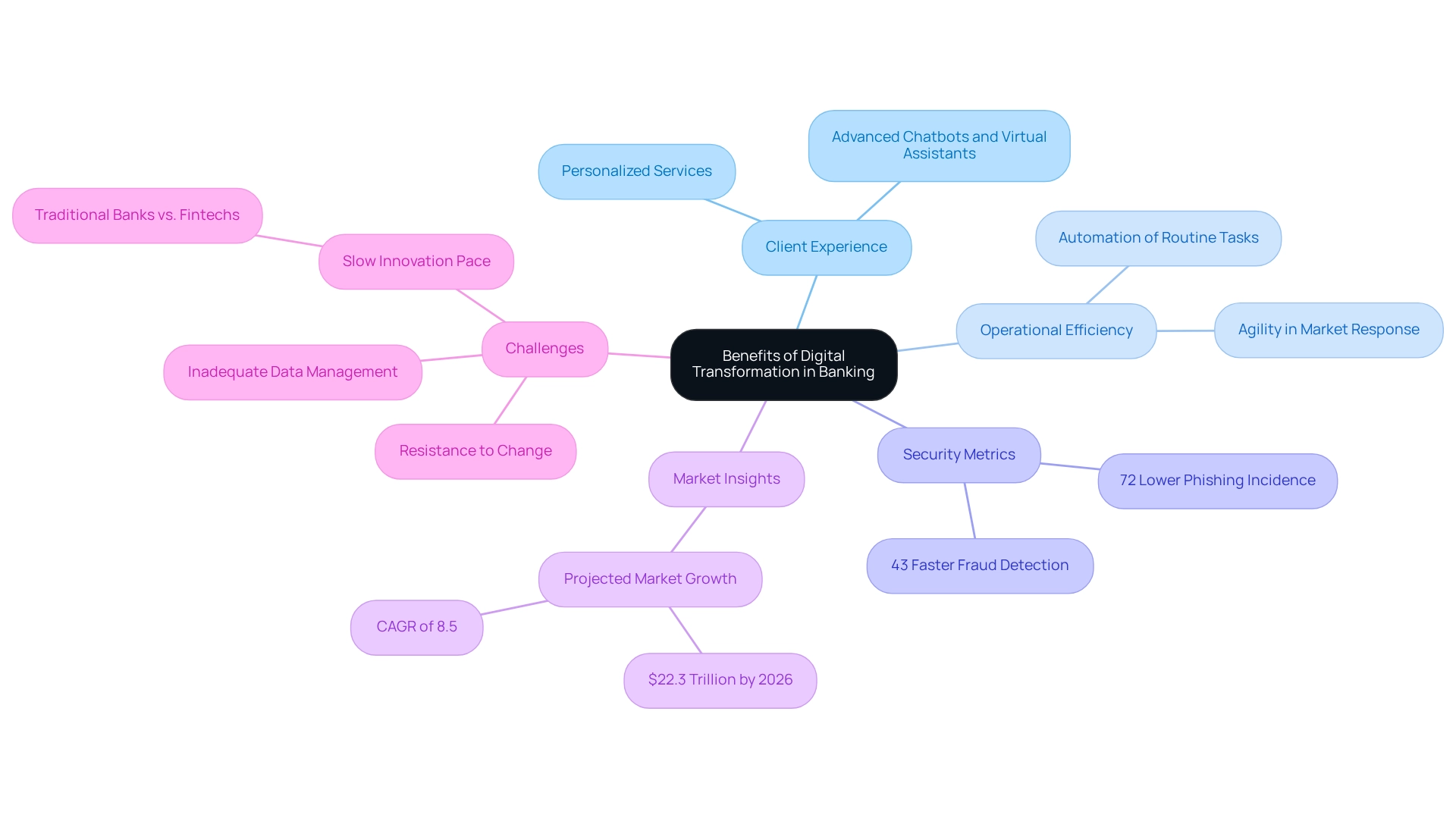

Adopting digital transformation offers numerous benefits for financial institutions, significantly enhancing client experiences, increasing operational efficiency, and reducing expenses. By leveraging advanced technologies, such as Avato’s Hybrid Integration Platform, financial institutions can deliver personalized services tailored to the evolving preferences of their clients. For example, digital-only banks have achieved remarkable success, reporting a 72% lower incidence of successful phishing attacks and a 43% faster fraud detection response time compared to traditional institutions.

These metrics not only signify enhanced security but also foster greater trust in data protection.

Furthermore, technological transformation streamlines financial operations by automating routine tasks, thereby minimizing manual errors and accelerating service delivery. This agility empowers financial institutions to swiftly respond to market changes and client demands, ultimately driving growth and profitability. With the global digital banking market projected to reach $22.3 trillion by 2026, boasting a compound annual growth rate (CAGR) of 8.5%, the urgency for banks to innovate is unmistakable.

The integration of generative AI further enhances user experience and operational efficiency in financial services. Recent studies reveal a 60% increase in the utilization of generative AI for user experience, particularly in the development of advanced chatbots and virtual assistants. This technology not only streamlines operations but also revolutionizes customer interaction, enabling financial institutions to provide timely and relevant services.

However, the journey toward technological transformation is fraught with challenges. Large banks often lag in innovation compared to fintechs and neobanks, which can introduce new features every two to four weeks, whereas traditional banks may require four to six months. This sluggish pace can result in abandoned technological transformation efforts.

Expert insights highlight the necessity of addressing challenges such as resistance to change and inadequate data management to ensure successful transformation. According to Akhil Babbar, a knowledge expert at McKinsey, “70 percent of technological transformations exceed their original budgets, and 7 percent end up costing more than double the initial projection.” This underscores the imperative for financial institutions to adopt effective strategies that not only enhance client experiences but also improve operational efficiency.

Successful case studies serve as compelling examples of digital transformation in banking, illustrating the tangible benefits of technological advancement. For instance, financial institutions that have effectively implemented Avato’s Hybrid Integration Platform report significant improvements in customer satisfaction and operational performance, providing clear examples of digital transformation in banking that demonstrate the potential for enhanced service delivery and a competitive edge in an increasingly online landscape. To learn more about how Avato can facilitate your bank’s technological transformation journey, consider exploring our offerings and case studies.

Key Takeaways: Inspiring Examples of Digital Transformation in Banking

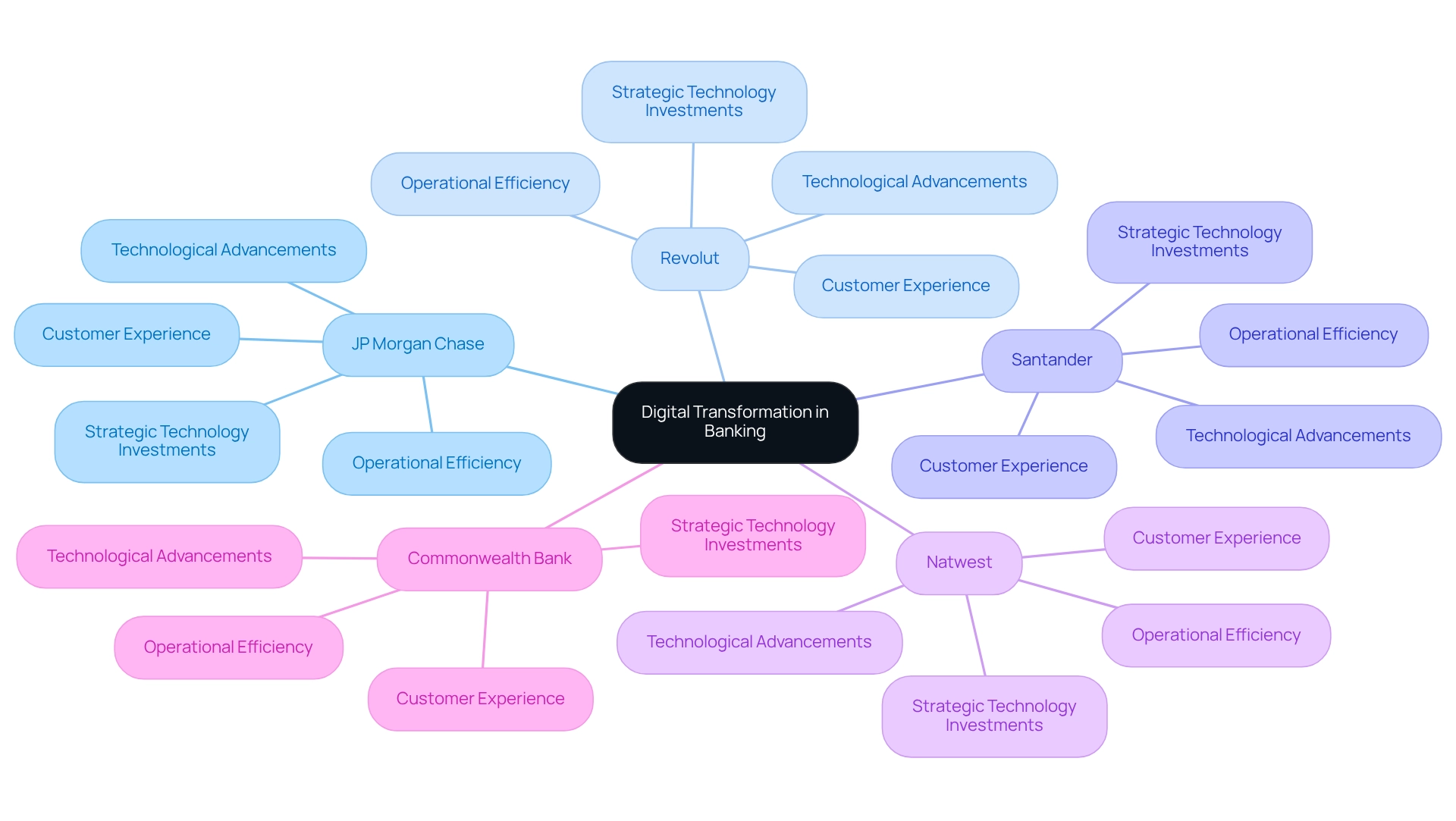

The case studies of JP Morgan Chase, Revolut, Santander, Natwest, and Commonwealth Bank exemplify the profound impact of technological advancements on the banking sector through digital transformation. Each institution has adeptly navigated its technological transformation journey, embracing innovation, enhancing customer experiences, and streamlining operational efficiency with advanced integration solutions.

Key takeaways from these examples underscore the critical importance of investing in technology. Financial institutions prioritizing technology investments are better positioned to adapt to market changes, as evidenced by NVIDIA’s 2025 State of AI in Financial Services survey. This research reveals that companies leveraging emerging technologies, particularly generative AI, can significantly enhance their competitive advantage.

The survey indicated that nearly 70% of companies reported at least a 5% revenue increase linked to AI applications, highlighting its transformative effect on revenue growth and operational efficiency. Moreover, fostering a culture of innovation is essential for financial institutions aiming to thrive in the digital era. Institutions that promote creative thinking and agile methodologies are more likely to overcome the challenges posed by legacy systems.

The experiences of these prominent financial institutions demonstrate that addressing such challenges directly is vital for successful transformation. As Gustavo Estrada points out, Avato’s ability to streamline complex projects while achieving outcomes within specified time limits and budgetary constraints showcases the value of strategic technology investments.

Avato’s hybrid integration platform plays a crucial role in expediting secure system integration across financial services, healthcare, and government sectors. This platform not only facilitates the implementation of automation technologies but also enables financial institutions to swiftly adjust to market fluctuations, aligning with the overarching theme of technological transformation.

As the financial landscape continues to evolve, these motivating examples serve as a guide for successful technological transformation, emphasizing the importance of strategic technology investments. By learning from the successes and challenges faced by these institutions, other banks can better position themselves for sustained growth and innovation in 2025 and beyond. Furthermore, client testimonials reinforce Avato’s commitment to delivering effective integration solutions, highlighting the significance of robust infrastructure in facilitating digital transformation.

Conclusion

Digital transformation in banking is no longer an optional strategy; it has become a critical necessity for institutions aiming to thrive in an increasingly competitive landscape. The integration of advanced technologies—such as artificial intelligence, cloud computing, and big data analytics—has proven to enhance customer experiences, streamline operations, and foster greater trust. Case studies from leading banks like JP Morgan Chase, Revolut, Santander, Natwest, and Commonwealth Bank illustrate how these institutions have successfully navigated their digital journeys by prioritizing innovation and embracing new technologies.

Banks that invest in digital transformation are better equipped to meet evolving customer expectations and adapt to changing market dynamics. The remarkable improvements in customer engagement, operational efficiency, and security metrics underscore the tangible benefits of adopting a technology-driven approach. Furthermore, building a culture of innovation within these institutions is crucial for overcoming challenges posed by legacy systems and regulatory demands.

Looking ahead, the urgency for banks to innovate cannot be overstated. As the digital banking market continues to grow, those banks that leverage technology effectively will not only enhance their service delivery but also position themselves for sustained growth and profitability. By learning from the successes and challenges of their peers, financial institutions can chart a path towards a digitally empowered future, ensuring they remain relevant and competitive in 2025 and beyond.