Overview

The article highlights the critical steps and strategies necessary for the successful integration of core banking systems. It asserts that a meticulously planned integration process, bolstered by cutting-edge technologies and ongoing stakeholder engagement, is vital for boosting operational efficiency, enhancing customer satisfaction, and ensuring compliance in an increasingly dynamic banking environment.

Are you ready to transform your banking operations? Embrace these strategies to not only meet the challenges of today but to thrive in the future.

Introduction

In the ever-evolving landscape of banking, the integration of core banking systems stands as a pivotal strategy for financial institutions aiming to enhance operational efficiency and customer satisfaction. As banks confront the challenges posed by outdated legacy systems and the escalating demand for seamless digital experiences, the urgency for cohesive integration becomes paramount.

This article explores the intricacies of core banking system integration, detailing its benefits, common challenges, and best practices. With insights into innovative platforms like Avato’s hybrid integration solution, it underscores how banks can streamline their operations and future-proof their technology stacks to meet the demands of a rapidly changing market.

As the industry progresses toward 2025, understanding and implementing effective integration strategies will be crucial for banks seeking to maintain a competitive edge and deliver superior value to their customers.

Understanding Core Banking System Integration

The process of core banking system integration is pivotal, as it combines various banking services and functions into a cohesive framework. This unification is essential for banks striving to streamline operations, enhance customer experiences, and improve data management. By implementing core banking system integration to connect legacy systems with modern applications, banks can ensure that all components work seamlessly together, which is crucial for operational efficiency.

In 2025, recent trends in core banking unification highlight the increasing importance of adopting hybrid connection platforms that support multiple levels of interface maturity. Such platforms enable banks to adapt swiftly to evolving market demands while mitigating risks associated with digital transformation. With the ability to access data and networks in weeks rather than months, Avato significantly reduces the time and costs typically associated with project implementations.

For instance, DBS Bank has effectively utilized a collaborative data ecosystem, achieving a remarkable 37% reduction in ATM network downtime and facilitating real-time credit decisions. This underscores the tangible benefits of integrating external data sources into core financial operations.

The advantages of core financial connectivity are extensive. It not only boosts operational efficiency but also substantially enhances customer satisfaction by offering personalized services. Notably, DBS Bank increased mobile usage by 64% through tailored financial insights, illustrating the impact of effective integration on customer engagement.

Moreover, the hybrid unification platform simplifies complex connections, allowing financial organizations to maximize the value of their legacy systems while ensuring continuous availability and reliability. Supporting 12 levels of interface maturity, the platform strikes a balance between speed and sophistication, effectively future-proofing technology stacks.

Successful cases of core banking unification demonstrate the strategic benefits of a unified system. For example, wealth management firms are responding to fee compression pressures and customer dissatisfaction by improving their service offerings. The hybrid integration platform is instrumental in aiding these firms with core banking system integration, addressing challenges in a competitive landscape and ensuring efficient modernization of their operations.

Furthermore, the company’s services, including enterprise architecture and project management, provide essential support for organizations navigating digital transformation.

Expert opinions emphasize the necessity of cohesive structures in banking. Michael J. Hsu, Acting Comptroller of the Currency, remarked that some banks may “feel like hostages” to their legacy technology. Avato’s solutions can alleviate these concerns by delivering a reliable technology stack that empowers banks to modernize their infrastructure and maintain a competitive edge.

Additionally, the integration of generative AI into financial services is increasingly vital, enhancing customer experience and operational efficiency.

In summary, the integration of core banking systems transcends mere technical necessity; it is a strategic imperative that enables banks to thrive in a rapidly changing environment. By embracing interconnected systems through platforms like Avato’s, banks can unlock new growth opportunities, enhance operational capabilities, and ultimately deliver superior value to their customers.

Benefits of Core Banking System Integration

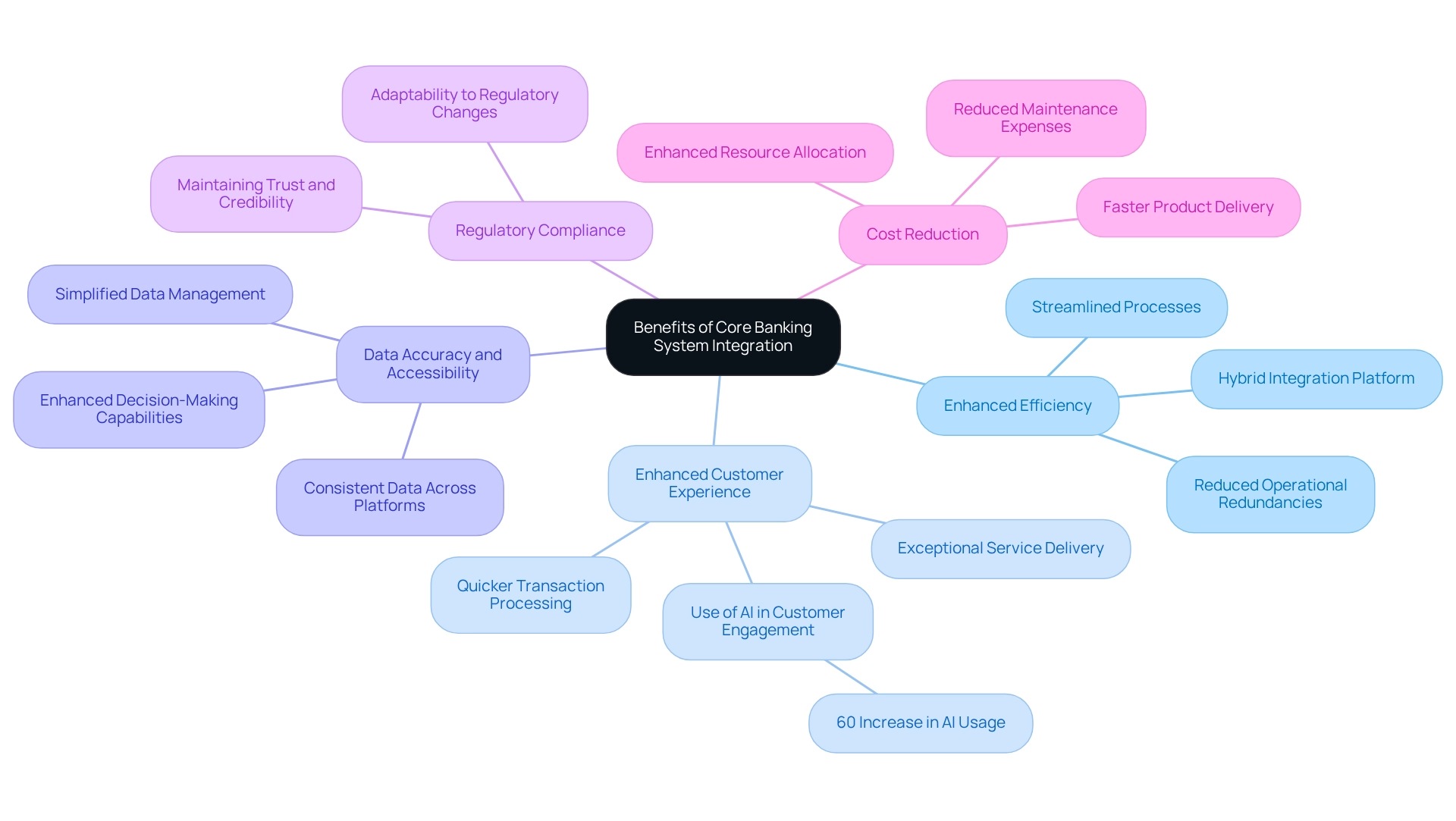

Integrating core banking systems offers a multitude of advantages that can significantly transform banking operations:

- Enhanced Efficiency: Streamlining processes through unification reduces operational redundancies, enabling banks to serve their customers more effectively. This efficiency is crucial in a competitive landscape where speed and accuracy are paramount. The hybrid integration platform accelerates this process, ensuring that institutions can modernize their operations without sacrificing reliability.

- Enhanced Customer Experience: A consolidated core financial framework facilitates quicker transaction processing and exceptional service delivery. This not only enhances customer satisfaction but also fosters loyalty, as clients increasingly expect seamless interactions with their financial institutions. The rise of generative AI, particularly in developing sophisticated chatbots and virtual assistants, has further elevated customer engagement, with a reported 60% increase in its use for enhancing customer experience.

- Data Accuracy and Accessibility: Integration ensures that data remains consistent across all platforms, reducing errors and enhancing decision-making capabilities. Accurate data is vital for banks to respond swiftly to market changes and customer needs. Avato’s solutions support this by providing a connected foundation that simplifies data management across various departments.

- Regulatory Compliance: A well-integrated core financial platform can adapt more readily to regulatory changes, ensuring that banks remain compliant with evolving financial regulations. This adaptability is essential for maintaining trust and credibility in the banking sector, especially as institutions face increasing scrutiny.

- Cost Reduction: By merging various platforms into a single integrated solution, banks can significantly reduce maintenance expenses and enhance resource allocation. This financial efficiency allows institutions to invest more in innovation and customer service. The company’s expertise in hybrid combining not only lowers expenses but also speeds up product delivery, improving overall operational performance.

Furthermore, Avato guarantees round-the-clock availability for essential connections, highlighting the dependability of interconnected setups. The impact of core banking system integration extends beyond operational enhancements; it fundamentally improves the customer experience. For instance, Rhonda Fullawka, Finance Manager at Crossroads Credit Union, observed that their hierarchical unification method simplified procedures and granted prompt access to data, leading to quicker attainment of benefits from their financial management tools.

Such case studies underscore the concrete advantages of unification, emphasizing its significance in the contemporary financial sector.

As we approach 2025, the benefits of core banking system integration will only continue to grow, with industry leaders stressing the necessity for banks to enhance customer experiences through seamless core banking system integration. Arkadiusz Gruca states, “The future of central finance appears bright,” emphasizing the optimistic outlook for organizations that prioritize unification. Additionally, for those eager to discover more about financial software connections, Bank offers consultations that can provide valuable insights.

Organizations that emphasize unity will likely sustain a competitive advantage in delivering outstanding service.

Common Challenges in Core Banking Integration

The challenges presented by core banking system integration are numerous, and financial institutions must navigate them to achieve successful modernization. Key obstacles include:

- Legacy System Limitations: A considerable number of banks still depend on obsolete systems that lack compatibility with modern connection technologies. This limitation complicates the merging process, often requiring extensive modifications or complete overhauls. Avato’s hybrid integration platform simplifies these complex projects, enabling banks to leverage existing assets rather than discarding them, thus delivering results within desired time frames and budget constraints. This highlights the importance of addressing legacy issues effectively.

- Data Migration Challenges: The transfer of data from outdated frameworks to new platforms presents significant risks, including possible data loss or corruption. Effective management strategies are essential to mitigate these risks and ensure data integrity throughout the migration process. Studies suggest that small discrepancies in AI technologies can develop into significant issues, highlighting the necessity of careful planning and implementation in this field.

- Regulatory Compliance: Navigating the complex landscape of regulatory requirements is a critical aspect of integration. Ensuring that the new system adheres to all relevant regulations can be both intricate and time-consuming, demanding thorough planning and execution. Notably, 69% of banking professionals view the risks associated with migrating to newer technologies as a significant barrier to deploying next-generation solutions. Avato highlights the significance of regulatory compliance and security audits in its hybrid connectivity solutions, ensuring that institutions can confidently address these challenges while upholding a commitment to security compliance.

- Resistance to Change: Organizational culture plays a pivotal role in the success of integration initiatives. Workers may show reluctance to embracing new methods and procedures, which can cause implementation delays and adversely affect morale. Engaging staff through training and clear communication is essential. Avato provides essential strategies for staff training and change management, helping alleviate concerns and fostering a smoother transition.

- Integration Costs: The financial implications of core banking system integration can be substantial. Institutions must carefully budget and plan for these costs to avoid overruns and ensure that the merging aligns with overall business objectives. Avato’s method for enhancing connectivity strategies can assist banks in managing these expenses efficiently.

In 2025, a strong risk management framework is more essential than ever for the integration of core banking systems during project migration. Professional perspectives indicate that effective financial unification relies on core banking system integration to surpass legacy constraints. For instance, collaborations with FinTech companies have enabled financial institutions to expand their service offerings and enter new markets, enhancing customer loyalty and generating additional revenue streams.

Furthermore, the implementation of AI-driven core financial platforms has revolutionized customer experiences by forecasting behavior, identifying fraud, and streamlining processes, ultimately resulting in enhanced operational efficiency and risk management. These instances demonstrate that although obstacles in core financial incorporation are considerable, they are not impossible to overcome. By utilizing cutting-edge technologies and strategic collaborations, like those provided by Avato, banks can successfully manage these challenges and prepare for future achievements, guaranteeing their frameworks are safeguarded and equipped for the changing environment.

Planning Your Core Banking Integration Strategy

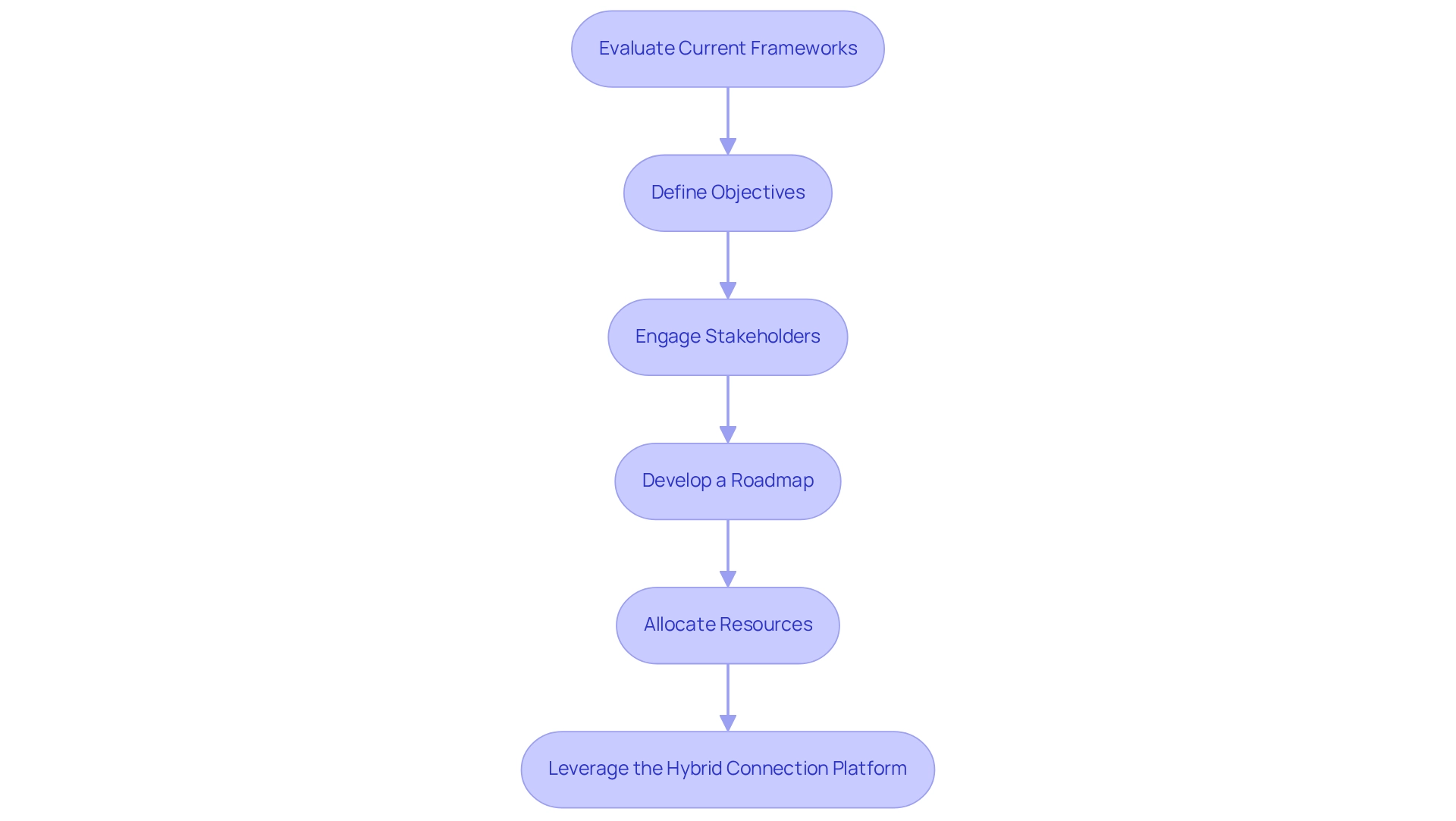

To effectively plan your core banking unification strategy, consider these essential steps:

-

Evaluate Current Frameworks: Conduct a thorough assessment of existing frameworks to identify their strengths and weaknesses. This evaluation should focus on unification needs, ensuring all critical components are addressed for a seamless transition. Leveraging legacy systems can be advantageous, as they often house valuable data and functionalities that can be integrated into new frameworks without starting from scratch.

-

Define Objectives: Clearly outline the goals of the amalgamation. Objectives may include improving operational efficiency, enhancing customer service, or ensuring compliance with regulatory standards. Setting measurable objectives will guide the unification process and assist in assessing success. As open banking evolves, aligning these objectives with regulatory compliance and security audits is crucial for maintaining consumer trust and safeguarding data.

-

Engage Stakeholders: Actively involve key stakeholders from various departments, including IT, compliance, and customer service. Their insights are invaluable in addressing diverse needs and concerns, significantly influencing the success of the merging process. Effective stakeholder engagement fosters collaboration and ensures that all voices are heard. Consider utilizing specific stakeholder engagement KPIs such as stakeholder satisfaction score, engagement levels, retention rate, Net Promoter Score (NPS), and influence impact to evaluate your engagement efforts.

-

Develop a Roadmap: Create a comprehensive roadmap that outlines the incorporation process, including timelines, milestones, and key deliverables. This roadmap should serve as a strategic guide, keeping the project on track and aligned with the defined objectives. Incorporating phased implementation strategies can minimize risks and enhance adaptability as the merging progresses.

-

Allocate Resources: Ensure that sufficient resources, including budget and personnel, are designated to support the unification efforts. This involves investing in technology that guarantees 24/7 uptime for essential connections, thereby reducing disruptions and improving operational reliability. As noted by Gustavo Estrada, the company simplifies complex projects and delivers results within desired time frames and budget constraints, highlighting the importance of selecting the right collaboration partner. The company’s proficient unification services provide access to talented individuals who can assist your unification journey, ensuring smooth data and network merging with worldwide assistance.

-

Leverage the Hybrid Connection Platform: Utilize the hybrid connection solution to streamline the process, minimizing risks and enhancing adaptability. This platform facilitates the efficient merging of legacy systems with contemporary applications, ensuring a seamless shift to open finance.

By adhering to these steps, financial institutions can establish a robust foundation for successful core banking system integration, ultimately leading to enhanced performance and customer satisfaction while preparing for the transformative possibilities of open finance. For further details on how Avato can assist with your incorporation needs, consider contacting us for a demo or downloading our resources.

Essential Technologies for Core Banking Integration

Key technologies that facilitate core banking system integration include:

-

Application Programming Interfaces (APIs): APIs enable seamless interaction and data exchange between various platforms, making them essential for integration.

Middleware Solutions: Middleware acts as a bridge between legacy systems and new applications, ensuring smooth data flow and interoperability.The hybrid platform excels in this domain, empowering banks to maximize and extend the value of their legacy frameworks while simplifying complex connections. The company is committed to addressing intricate challenges, guaranteeing that integration is not only effective but also efficient.

Cloud Computing: Cloud-based solutions provide the scalability and flexibility necessary for banks to adapt their systems as required. -

Data Management Tools: Robust data management tools are crucial for maintaining data integrity and accuracy throughout the migration process. The company underscores the importance of schemas in upholding data integrity and compliance, which are vital for successful core banking system integration.

Security Protocols: Strong security measures are imperative to protect sensitive financial information during the integration process.Avato’s platform implements secure merging practices, including encryption and access controls, to safeguard this data.

Furthermore, the platform provides real-time monitoring and alerts on performance, enabling banks to proactively manage their connections. By leveraging Avato’s hybrid merging platform, banks can access isolated data and networks in weeks—not months—while future-proofing their operations through seamless data and network integration.

Best Practices for Successful Integration

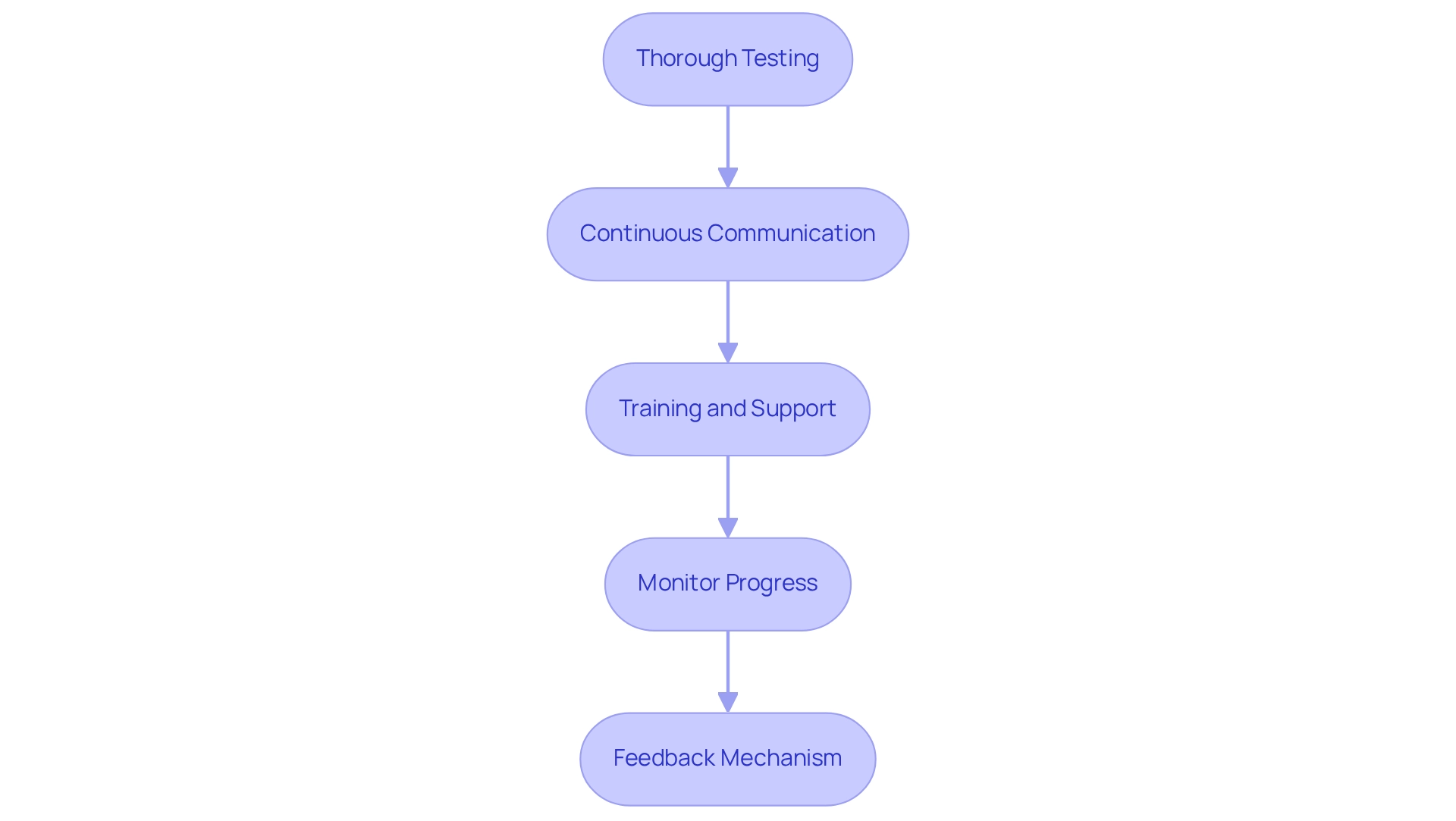

To ensure a successful core banking integration, consider the following best practices:

-

Thorough Testing: Conducting extensive testing of the integrated setup is crucial. This process helps identify and resolve potential issues before the system goes live, minimizing disruptions and ensuring a smooth transition. Experts emphasize that rigorous testing can significantly reduce the risk of operational failures, which is particularly vital in the highly regulated banking sector. As Gustavo Estrada from BC Provincial Health Services Authority noted, Avato has simplified complex projects and delivered results within desired time frames and budget constraints, underscoring the importance of thorough testing in achieving successful outcomes.

-

Continuous Communication: Keeping open channels of dialogue among all stakeholders during the unification process is vital. This practice fosters collaboration and ensures that everyone is aligned with the project goals, timelines, and expectations. Frequent updates and conversations can assist in proactively tackling issues and promoting a more unified collaboration effort. In the context of the current macroeconomic environment, where banks are recalibrating their business models to sustain growth, continuous communication becomes even more critical.

-

Training and Support: Providing comprehensive training for employees is critical to ensure they are comfortable and proficient with the new system. A well-prepared workforce can utilize the full capabilities of the hybrid platform, enhancing overall productivity and decreasing the chances of errors during the transition. This aligns with the need for banks to adapt to the evolving financial landscape, as highlighted by the Consumer Data Right (CDR) in Australia, which promotes data sharing across various sectors.

-

Monitor Progress: Regularly tracking the incorporation process against the established roadmap is vital to ensure that timelines are met and objectives are achieved. This proactive approach allows for timely adjustments and resource allocation, which is particularly important in the context of the challenges banks face in a low-growth, lower-rate environment, as discussed in Deloitte’s 2025 Banking Industry Outlook. Ongoing observation and analysis are essential in optimizing performance, guaranteeing that the solutions stay effective and adaptable to evolving requirements.

-

Feedback Mechanism: Establishing a feedback mechanism to gather insights from users post-integration is essential for continuous improvement. This practice not only helps identify areas for enhancement but also fosters a culture of adaptability within the organization. By paying attention to user experiences, banks can enhance their operations and methods, ensuring they stay competitive in a swiftly changing financial environment. Real-world instances of banks adjusting to macroeconomic circumstances demonstrate the significance of this feedback mechanism in managing the intricacies of contemporary financial operations.

Implementing these optimal strategies, combined with utilizing Avato’s expert incorporation services and organized requirements management, can greatly improve the success of core banking system integration. This approach enables financial institutions to manage the complexities of modern financial operations effectively while ensuring they are well-prepared for the open financial environment.

Ensuring Compliance and Security During Integration

To ensure compliance and security during the incorporation of core financial systems, it is essential to adhere to the following guidelines:

- Regulatory Framework: Grasp the regulatory landscape governing banking operations, including GDPR and other pertinent standards. Align your unification strategy with these regulations to mitigate compliance risks, especially as the financial sector increasingly emphasizes adherence in the context of core banking system integration.

Data Encryption: Implement robust encryption protocols to safeguard sensitive data both in transit and at rest. Effective data encryption is crucial, as statistics indicate that conventional monitoring methods can yield false positives between 95-98%, whereas advanced AI-driven solutions have improved this to 60-70%. This underscores the necessity for reliable data protection measures, particularly as generative AI becomes more prevalent in enhancing customer experience and operational efficiency. - Access Controls: Enforce stringent access controls to limit access to sensitive information. This ensures that only authorized personnel can access or modify essential data, thus enhancing security and maintaining the integrity of your unification strategy.

Regular Audits: Schedule periodic audits of the integrated system to verify compliance with regulatory requirements. Continuous monitoring is vital, especially as emerging trends in transaction monitoring highlight the significance of data quality and algorithm sophistication. This proactive approach is essential in sustaining trust and compliance in an increasingly regulated environment. - Incident Response Plan: Develop a comprehensive incident response plan to swiftly address potential security breaches. This proactive method is crucial for maintaining trust and adherence in a progressively regulated landscape, particularly as the incorporation of core banking system integration evolves with new technologies.

Implementing these strategies not only enhances security but also aligns with the growing focus on compliance in financial partnerships. According to the UK Government, half of businesses (50%) report experiencing some form of cybersecurity breach or attack in the last 12 months, emphasizing the urgency of robust security measures. For instance, Tide, a digital bank from the UK, effectively improved its adherence to GDPR’s Right to Erasure by automating the identification and tagging of personally identifiable information, showcasing the success of strategic incorporation practices.

As we approach 2025, ensuring adherence in core banking system integration will be critical, with expert perspectives underscoring the need for a reliable, future-ready technology framework, such as that provided by Avato, to adapt to evolving requirements. Furthermore, emerging trends in transaction monitoring suggest that future compliance strategies will depend on enhancements in data quality, algorithm sophistication, and greater cohesion across banking systems, thereby boosting overall operational capabilities.

FAQs:

- How can we mobilize stakeholders to ensure effective coordination?

- What technologies should we consider for optimizing our merging strategy?

Case Study: A noteworthy example is Avato’s collaboration with a prominent financial institution, where they successfully implemented a hybrid unification platform that not only streamlined compliance processes but also enhanced operational efficiency through the use of generative AI, demonstrating the transformative impact of strategic unification in the finance sector.

Post-Integration Monitoring and Optimization

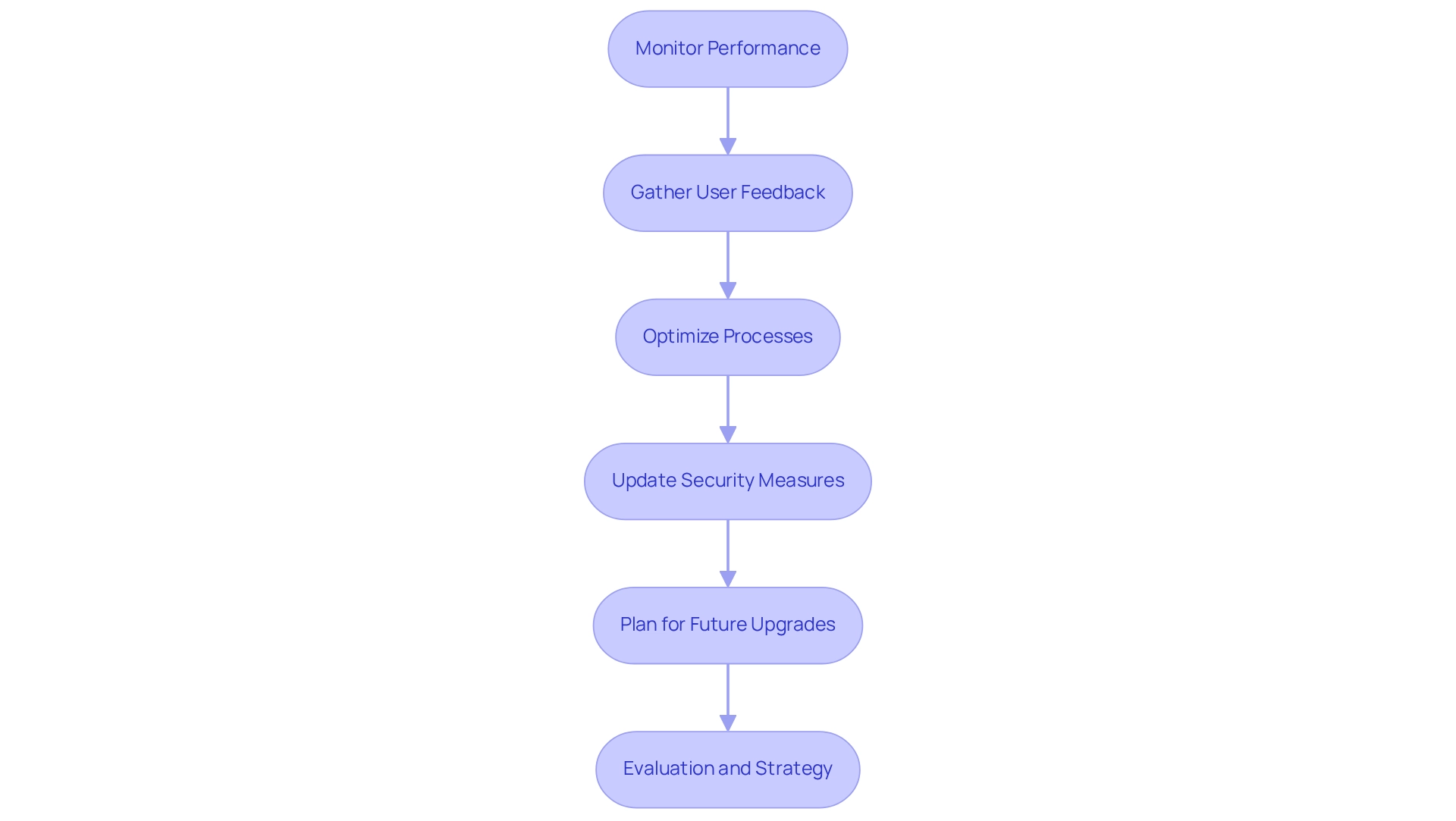

Following the finalization of core banking frameworks, several essential actions must be undertaken to guarantee continued success and efficiency.

- Monitor Performance: Implement robust monitoring tools to continuously track performance. This proactive approach allows for the early identification of issues, ensuring that any disruptions are swiftly addressed. Statistics reveal that organizations focusing on post-merger monitoring experience significantly fewer operational downtimes, with many achieving 24/7 uptime for critical connections, as guaranteed by Avato’s expert services.

- Gather User Feedback: Actively collect feedback from users to assess their experiences with the new platform. This feedback is invaluable for identifying areas that require enhancement and for understanding how the integration affects daily operations. Involving users in this manner not only improves usability but also fosters a culture of ongoing enhancement. As noted by Gustavo Estrada, the company possesses the ability to simplify complex projects and deliver results within desired time frames and budget constraints, underscoring the importance of effective integration in creating positive user experiences.

- Optimize Processes: Regularly evaluate and improve processes to enhance operational efficiency. This involves analyzing workflows and identifying bottlenecks that may have emerged post-integration. By optimizing these processes through core banking system integration, banks can improve service delivery and reduce operational costs, ultimately leading to a more agile organization. The structured requirements management approach can assist in converting unstructured information into actionable insights, ensuring that processes align with institutional goals.

- Update Security Measures: In the ever-evolving landscape of cybersecurity threats, it is essential to regularly review and update security protocols. This guarantees that the integrated networks remain secure against new vulnerabilities, protecting sensitive financial information and upholding customer trust.

- Plan for Future Upgrades: Stay abreast of technological advancements and industry trends to inform future upgrades. A forward-thinking approach enables banks to adapt to changing market demands and leverage new technologies that can enhance their competitive edge. Collaborating with specialists in connections can provide valuable insights into the latest innovations and best practices in the industry.

- Evaluation and Strategy: As you progress through these stages, consult the User Manuals supplied by the company for organized assistance on evaluating your existing setups and strategizing for modernization. This will ensure that your unification corresponds with your institution’s objectives and the evolving requirements of your clients.

By adhering to these best practices, financial institutions can not only guarantee the seamless function of their combined frameworks but also prepare themselves for enduring success in a swiftly evolving landscape. Engaging with industry experts and leveraging user feedback can further enhance the effectiveness of these strategies, leading to optimized core banking system integration that meets the evolving needs of customers. Get in touch with arvato today to learn more about how our expert integration services can support your organization’s modernization efforts.

Conclusion

The integration of core banking systems stands as a pivotal strategy for financial institutions determined to excel in a competitive landscape. By unifying diverse banking services and functions, banks can streamline operations, enhance customer experiences, and improve data management. The benefits of such integration are significant, encompassing increased operational efficiency, heightened customer satisfaction, and superior data accuracy. Innovative platforms, such as Avato’s hybrid integration solution, are essential in empowering banks to modernize their systems, respond to market demands, and ensure adherence to regulatory standards.

However, the path to successful integration is fraught with challenges. Banks must confront legacy system limitations, data migration hurdles, and resistance to change. Overcoming these obstacles necessitates meticulous planning, active stakeholder engagement, and the application of best practices, including thorough testing and ongoing communication. As the financial landscape progresses toward 2025, the focus on effective integration strategies will intensify, highlighting the necessity of adopting advanced technologies and upholding robust security measures.

Ultimately, the integration of core banking systems transcends mere technical necessity; it is a strategic imperative that enables banks to deliver exceptional value to their customers. By embracing innovative solutions and cultivating a culture of adaptability, financial institutions can position themselves for long-term success, unlocking new growth opportunities and enhancing their operational capabilities in an increasingly digital world. The time to act is now; the future of banking hinges on the ability to integrate effectively and efficiently.