Overview

We outline four key practices essential for effective enterprise connectivity solutions within banking:

- Assess connectivity needs to ensure alignment with operational goals.

- Choose secure technologies that protect sensitive data, which is paramount in our industry.

- Integrate legacy systems with modern solutions, facilitating seamless transitions that enhance efficiency.

- Implement continuous monitoring to proactively address potential issues.

Each of these practices is supported by case studies and statistics that demonstrate their critical role in optimizing operations, enhancing compliance, and improving customer engagement. By adopting these strategies, we can transform our connectivity approach and drive significant value in the banking sector.

Introduction

In the rapidly evolving landscape of banking, where technology and regulatory demands are in constant flux, we recognize an urgent need to enhance our connectivity strategies. A thorough assessment of our existing systems and workflows is crucial for identifying the specific integration needs that underpin our daily operations. By engaging various stakeholders and understanding compliance mandates, we can streamline our processes and improve efficiencies.

This article delves into the essential steps for optimizing connectivity in the banking sector, from selecting secure technologies to integrating legacy systems and implementing continuous monitoring practices. Through compelling case studies and expert insights, we highlight how financial institutions can leverage modern integration solutions to not only meet regulatory requirements but also elevate customer experiences and drive operational success.

Assess Banking-Specific Connectivity Needs

To effectively assess our banking-specific connectivity needs, we must initiate a comprehensive analysis of our existing enterprise connectivity solutions and workflows. This process entails recognizing vital applications, data flows, and connection points that are necessary for our daily operations and support our enterprise connectivity solutions. Involving stakeholders from different departments—such as IT, regulatory, and operations—offers us a comprehensive perspective on our enterprise connectivity solutions needs. It is crucial to consider regulatory mandates, including data protection laws and industry standards, which may dictate specific enterprise connectivity solutions and the necessary security measures. By carefully outlining these requirements, we can prioritize our implementation projects related to enterprise connectivity solutions, ensuring that the chosen options are both effective and compliant.

A notable case study highlights a regional bank that conducted a connectivity assessment, uncovering significant inefficiencies in their enterprise connectivity solutions related to data transfer processes. By addressing these gaps, they implemented enterprise connectivity solutions through a hybrid unification platform that streamlined operations and enhanced compliance with regulatory standards, achieving a remarkable 30% reduction in processing times. This example underscores the critical role of enterprise connectivity solutions in optimizing banking operations and maintaining regulatory adherence. Additionally, as noted by Rich Corriss, Director of Customer Success at Avato, “What really stood out to me during this period of the pandemic is that banks of all sizes stepped up their agility to preserve the customer relationship. And they did it all while adhering to the rules and regulations.” This adaptability is crucial, especially as data collaboration is redefining what constitutes a bank, emphasizing networks of specialized capabilities. Furthermore, the statistic that DBS Bank increased engagement by 64% through personalized financial insights delivered via mobile banking illustrates the positive impact of effective enterprise connectivity solutions on customer engagement and operational success in banking.

To improve our organization’s connectivity approach, we invite you to download our guide to effective unification methods and discover how to engage stakeholders and design our business processes for success. By utilizing generative AI and Avato’s hybrid connectivity offerings, we can enhance customer experiences and operational efficiency through enterprise connectivity solutions, ensuring we remain competitive in a swiftly changing environment.

Choose Compliant and Secure Technologies

When we consider enterprise connectivity solutions, it is imperative for banks to prioritize technologies that deliver robust security features and regulatory capabilities. Our secure hybrid integration platform is meticulously architected for secure transactions, establishing it as a trusted choice for banks, healthcare, and government sectors. This platform offers encryption, secure access controls, and regular security updates, ensuring compliance with critical regulations such as GDPR and PCI DSS. These measures significantly mitigate risks associated with data breaches and help prevent substantial penalties for non-compliance. Furthermore, by leveraging technologies that provide real-time monitoring and alerts, we enhance security, enabling proactive threat detection and response.

The financial impact of phishing attacks is staggering, with losses averaging $17,700 every minute. This statistic underscores the urgency for banks to implement robust security measures. Additionally, a case study titled “Phishing as a Major Cyber Threat” reveals that phishing attacks cost an average of $4.9 million in 2023, highlighting the dire financial repercussions of inadequate security.

Implementation Tip: We recommend conducting an extensive vendor evaluation that includes security certifications, regulatory history, and customer testimonials. This due diligence ensures that the selected enterprise connectivity solutions, including our hybrid connection platform, align with the bank’s security and compliance objectives, ultimately safeguarding sensitive data and preserving client trust. As Tony LeBlanc from the Provincial Health Services Authority remarked, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.” Moreover, with an estimated 3.5 million unfilled cybersecurity jobs globally by 2025, investing in secure technologies is crucial for banks to effectively manage their security needs.

Integrate Legacy Systems with Modern Solutions

Combining outdated frameworks with contemporary alternatives demands a strategic approach that encompasses both technical and operational dimensions. We must begin by assessing the capabilities of our current frameworks and identifying opportunities for integration with new technologies. Enterprise connectivity solutions, such as Middleware solutions like Enterprise Service Buses (ESBs) and Integration Platform as a Service (iPaaS), are essential in facilitating seamless communication between legacy and modern technologies. Furthermore, implementing APIs allows for real-time data exchange, significantly enhancing overall interoperability.

Our expertise in hybrid unification is exemplified through a significant case study involving a major financial organization that faced considerable challenges in merging its legacy core banking framework with new digital services. By adopting an API-first strategy and utilizing our enterprise connectivity solutions, this institution successfully integrated its legacy systems with modern applications. This transition not only improved customer experiences but also accelerated service delivery, showcasing the effectiveness of contemporary integration strategies. The phased approach to modernization, which involved early engagement with compliance teams, proved vital in navigating regulatory challenges and ensuring adherence to stringent security protocols.

Statistics reveal that 69% of senior IT decision-makers express concerns about the risks associated with migrating to newer technologies, potentially hindering the deployment of next-generation solutions. This underscores the necessity for a well-planned integration strategy that addresses these apprehensions while facilitating modernization. As Rituparna, a tech writer, aptly states, “Don’t let outdated platforms take that away.” The obstacles presented by outdated frameworks can impede speed, innovation, and compliance, making it imperative for financial organizations to prioritize middleware approaches and API strategies.

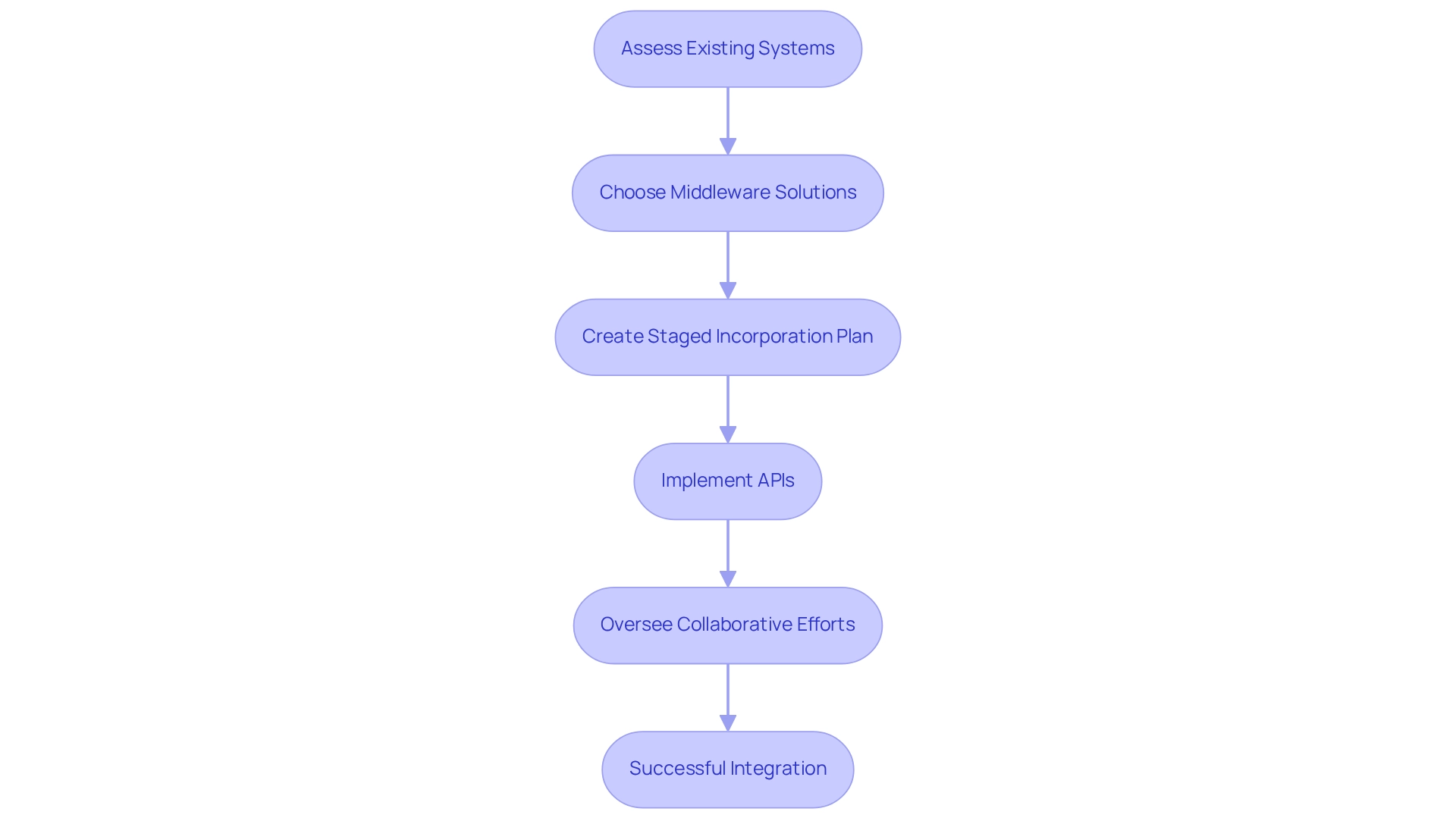

To effectively implement middleware and API strategies, we recommend the following steps:

- Assess existing legacy systems and identify integration points.

- Choose suitable middleware solutions (e.g., ESBs, iPaaS) based on specific needs.

- Create a staged incorporation plan that includes compliance considerations.

- Implement APIs to enable real-time data exchange and enhance interoperability.

- Oversee collaborative efforts to identify and address common challenges, such as insufficient testing or lack of stakeholder involvement.

By following these steps, we can help financial institutions navigate the complexities of legacy integration and position themselves for future growth, leveraging our hybrid integration platform to enhance business value and customer satisfaction.

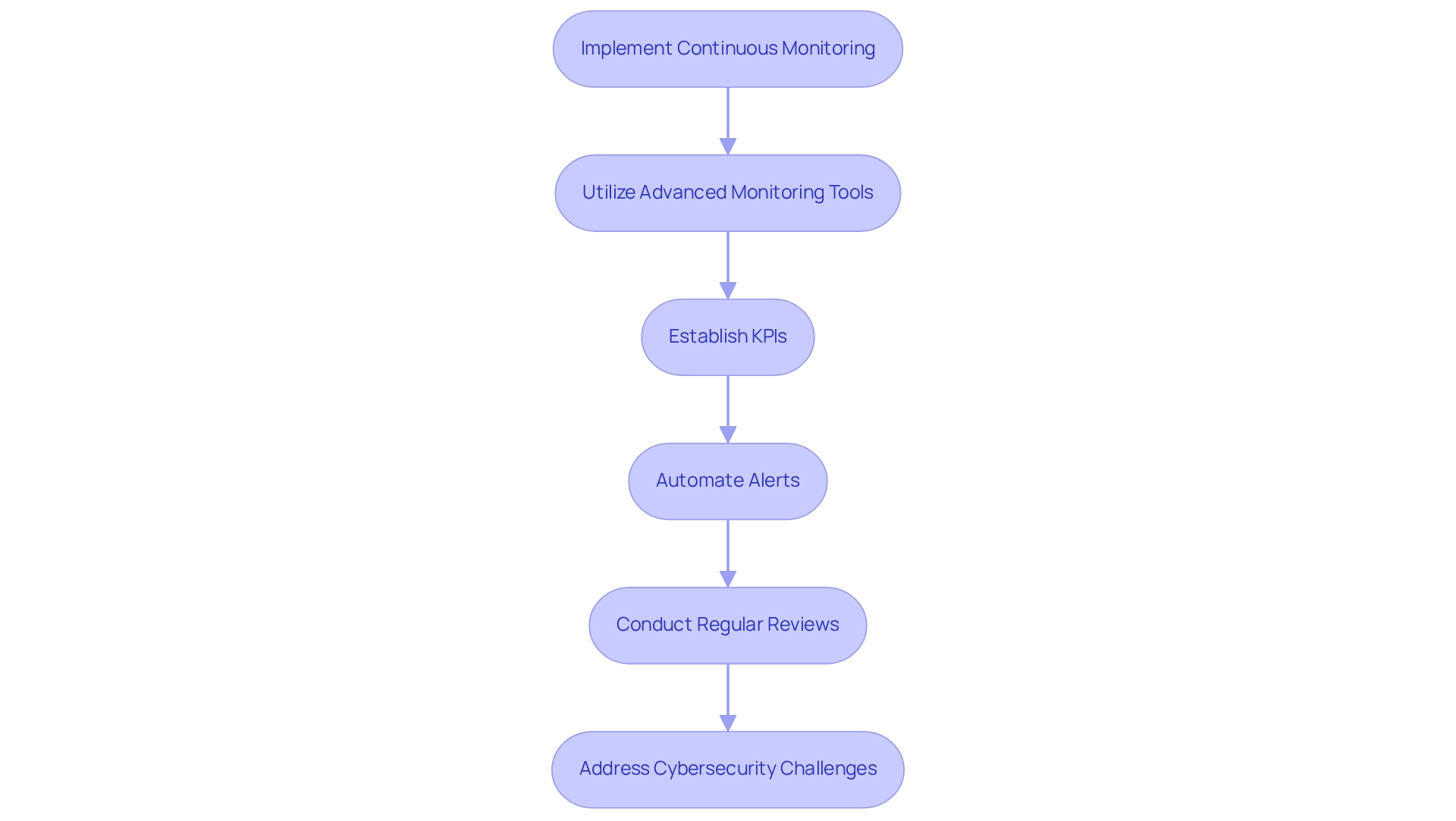

Implement Continuous Monitoring and Performance Evaluation

To enhance the effectiveness of our enterprise connectivity approaches, we must prioritize continuous monitoring and performance evaluation practices. By utilizing advanced monitoring tools, we gain real-time insights into performance, data flows, and potential security threats, which are essential for preserving our operational integrity. Our hybrid amalgamation solutions provide strong analytics features that enable us to consistently oversee our hybrid systems, enhancing operations and elevating customer experiences. Establishing key performance indicators (KPIs) allows us to assess the success of our integration efforts and pinpoint areas needing improvement. Regular performance reviews and audits are essential to ensure compliance with regulatory standards and alignment with our operational goals.

What’s holding your team back? Automating alerts for critical performance metrics, such as latency and error rates, facilitates proactive issue resolution. This strategy not only bolsters system reliability but also fosters a culture of continuous improvement within our organization. In 2025, the emphasis on continuous monitoring in enterprise connectivity will be paramount, particularly in the banking sector, where our ability to scale operations and increase efficiency through reduced cycle times is vital. Case studies emphasize that organizations utilizing digital transformation for post-merger unification have observed substantial enhancements in operational efficiency and customer experiences. However, we must address challenges concerning cybersecurity and data privacy. As noted in risk prioritization practices, evaluating risks allows us to focus our management efforts where they are most needed. By concentrating on performance assessment practices, banking institutions can guarantee their enterprise connectivity solutions are robust and responsive to evolving demands. To optimize our integration strategies, we should identify key performance indicators (KPIs) relevant to our unification goals. We must select and implement monitoring tools that provide real-time analytics. Furthermore, establishing automated alerts for critical performance metrics will enhance our responsiveness. Conducting regular performance reviews and audits will help us assess compliance and operational alignment. Finally, we need to continuously refine our monitoring practices based on feedback and evolving requirements.

For more insights on optimizing our integration strategies and to access additional resources, we invite you to visit our website and subscribe to our blog for the latest updates.

Common pitfalls to avoid include:

- Failing to define clear KPIs, which can lead to ineffective monitoring

- Overlooking the importance of regular audits and reviews

- Neglecting to adapt monitoring practices as our business needs evolve

Conclusion

Enhancing connectivity in the banking sector transcends mere regulatory compliance; it stands as a pivotal strategic initiative that can redefine our operational success and elevate customer experiences. By conducting thorough assessments of our existing systems, we can pinpoint critical integration needs and prioritize projects that align with our compliance and efficiency objectives. Engaging stakeholders across departments fosters a collaborative approach, ensuring our connectivity strategies are well-informed and effective.

Selecting secure, compliant technologies is paramount in safeguarding sensitive data and maintaining customer trust. The adoption of robust hybrid integration solutions, such as those we offer, empowers us to mitigate risks while streamlining operations. Furthermore, integrating legacy systems with modern solutions through middleware and APIs enables us to enhance interoperability and deliver improved services, effectively addressing the challenges posed by outdated infrastructures.

Continuous monitoring and performance evaluation practices are essential for upholding the integrity of these connectivity solutions. By establishing key performance indicators and leveraging advanced analytics, we can proactively identify areas for improvement, ensuring our systems remain responsive to evolving demands. This commitment to ongoing evaluation not only enhances our operational efficiency but also reinforces compliance with regulatory standards.

Ultimately, our journey toward optimized connectivity in banking is a multifaceted endeavor that necessitates strategic planning, collaboration, and a willingness to adapt. By embracing these essential steps, we position ourselves for sustained success in a rapidly changing landscape, enhancing both our operational capabilities and customer satisfaction.