Overview

Bank automation is not just a trend; it is a crucial advancement that enhances efficiency and security within financial institutions. We streamline processes, reduce operational costs, and bolster data protection, addressing the pressing challenges our industry faces. By implementing real-time monitoring of systems, conducting automated compliance checks, and integrating AI technologies, we foster a more agile and secure banking environment.

What’s holding your team back from embracing these transformative solutions? We invite you to explore the myriad benefits of automation and join us in creating a future where operational excellence is the standard.

Introduction

In the ever-evolving landscape of modern banking, we recognize that the integration of automation technologies stands as a pivotal force, fundamentally transforming operations and enhancing efficiency throughout the sector.

As we navigate the complexities posed by legacy systems, regulatory compliance, and rising customer expectations, we find that platforms like Avato’s Hybrid Integration Platform provide essential solutions to streamline our processes, reduce operational costs, and elevate service delivery.

By accelerating loan approvals and strengthening data security, automation addresses our immediate operational needs while positioning our institutions for sustained success in a rapidly changing market.

This article explores the numerous ways automation is reshaping the banking industry, underscoring its crucial role in driving innovation, enhancing customer experiences, and ensuring compliance in an increasingly competitive environment.

Avato: Streamline Legacy System Integration for Enhanced Banking Efficiency

At Avato, we understand the challenges that financial institutions face in linking disconnected legacy systems. Our hybrid unification platform is expertly designed to enhance operational efficiency through bank automation by streamlining the integration of disparate systems. This not only minimizes the time and complexity traditionally associated with such processes but also empowers financial institutions to prioritize innovation and customer service.

In the fast-paced banking sector, where legacy systems can stifle agility and responsiveness to evolving market demands, our bank automation solution is essential. By adopting Avato, financial institutions can cultivate a more integrated technology environment through bank automation, leading to improved service provision and operational effectiveness. Our commitment to designing technology solutions is evident in our ability to optimize and enhance the value of legacy systems while significantly reducing costs.

Recent statistics reveal that:

- 76% of executives view information silos as barriers to effective cross-departmental collaboration.

- 74% perceive these obstacles as competitive disadvantages.

We tackle these challenges head-on by enabling financial institutions to dismantle silos and enhance their operational capabilities through bank automation, thus fostering a more unified approach to data management. Furthermore, the impact of hybrid connection platforms on financial efficiency is underscored by case studies that showcase successful transitions from legacy systems.

For instance, our collaboration with Coast Capital, initiated in 2013, exemplifies our capability to facilitate significant system transitions with minimal downtime, allowing financial institutions to operate more efficiently. Such transitions necessitate meticulous planning and stakeholder buy-in, especially regarding bank automation, as emphasized in recent discussions surrounding modernization strategies.

Importantly, our platform also supports bank automation by providing real-time monitoring and notifications regarding system performance, further bolstering operational efficiency. In this context, we invite IT managers in the finance sector to attend a special breakfast seminar on cloud-native solutions for financial institutions, scheduled for 5th February 2025 in Copenhagen. This presents a timely opportunity to explore innovative amalgamation strategies.

As we continue to assist financial institutions in merging legacy systems through bank automation throughout 2025, Avato positions itself as an essential ally in driving operational excellence and securing a competitive advantage. We encourage banking IT managers to evaluate their current legacy systems for integration opportunities and consider how our solutions can facilitate bank automation, leading to a smoother transition to a more efficient and responsive banking infrastructure.

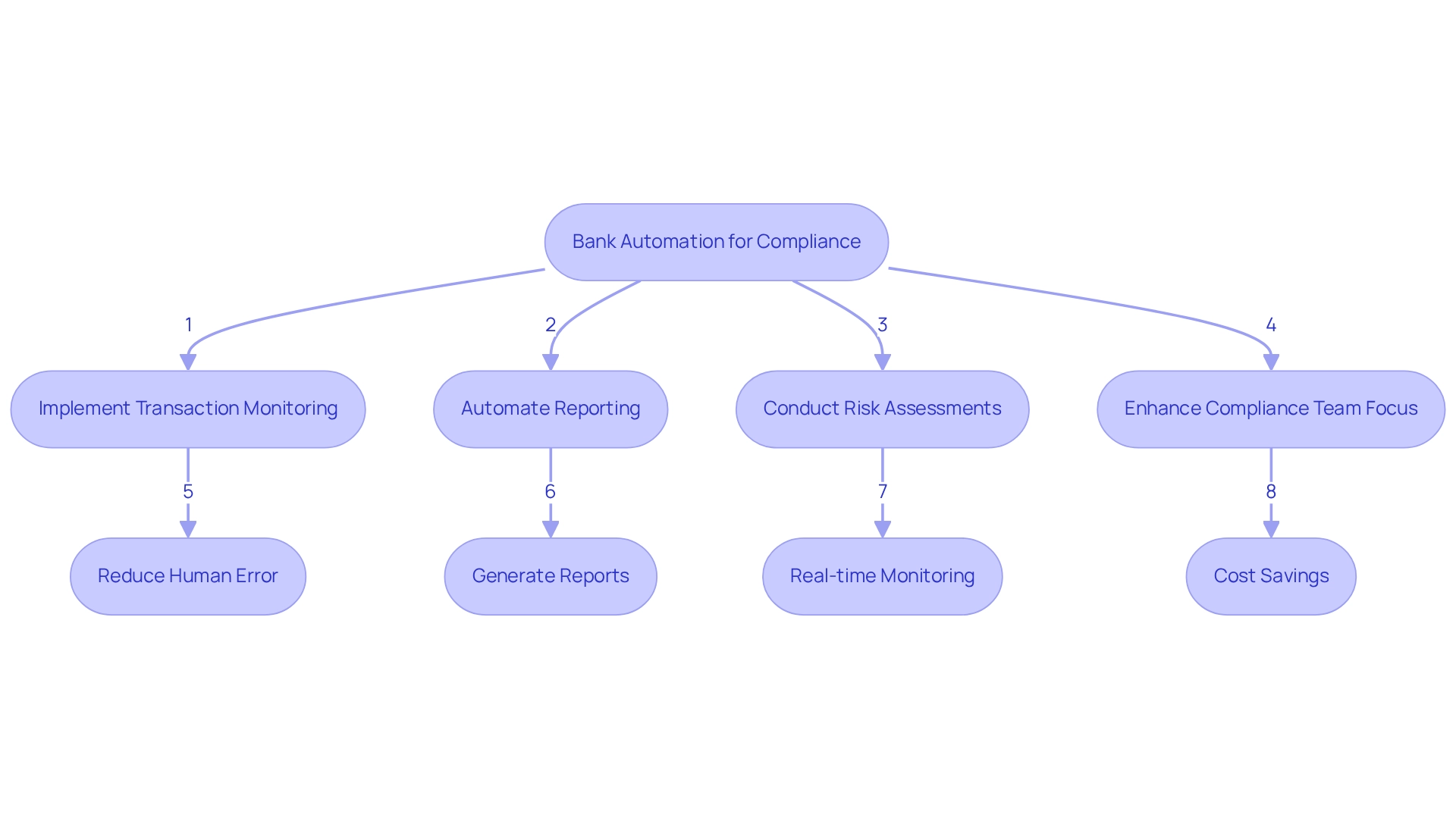

Regulatory Compliance: Automate Processes to Meet Banking Standards

Automation is not just beneficial; it is essential for financial institutions striving to meet regulatory compliance requirements effectively. By implementing bank automation for critical processes such as transaction monitoring, reporting, and risk assessments, we can ensure consistent adherence to regulatory standards. This strategy significantly mitigates the risk of human error and allows compliance teams to focus on strategic initiatives that drive value. With advanced tools that automate compliance checks and generate comprehensive reports, we can maintain a robust compliance posture while minimizing operational risks.

Our Secure Hybrid Integration Platform enhances this process by maximizing and extending the value of legacy systems, enabling us to manage complex interactions with ease and efficiency. With real-time monitoring and alerts on system performance, we ensure 24/7 uptime and reliability—crucial elements for maintaining compliance in a highly regulated environment. Furthermore, our platform’s capability to unlock data and systems within weeks, rather than months, facilitates the swift integration of isolated legacy systems, allowing banks to adapt rapidly to evolving regulatory requirements.

Current trends indicate that bank automation in banking compliance is not merely a luxury; it is a fundamental necessity. As organizations face increasing regulatory scrutiny, the integration of bank automation solutions has become vital. The International Organization for Standardization (ISO) has established 24,780 international compliance standards, with 1,412 new standards introduced in 2022 alone. This expanding landscape of compliance obligations necessitates that banks leverage technology to keep pace and adapt to changing needs, ensuring they maintain a competitive edge in the sector.

Case studies highlight the financial advantages of bank automation in compliance. Managing compliance is often perceived as a financial burden; however, it can serve as a cost-saving measure. The costs associated with a data breach can far surpass the initial investment in compliance protocols. By implementing bank automation in these processes, we not only prepare for potential breaches or audits but also enhance stakeholder confidence and achieve long-term savings. This perspective aligns with the case study titled “Cost Savings through Compliance,” which underscores that investing in quality compliance protocols equips organizations for potential breaches or audits, ultimately resulting in financial savings.

Expert insights reveal that bank automation is transforming how banks approach regulatory compliance. Compliance officers emphasize that bank automation streamlines processes, reduces manual workloads, and enhances accuracy, leading to a more efficient compliance environment. Moreover, with approximately 60% of organizations managing over 500 accounts with non-expiring passwords, automated processes can address inadequate security practices that expose organizations to data breaches. As the banking industry continues to evolve, embracing bank automation processes, supported by our Hybrid Integration Platform, will be essential for ensuring compliance and achieving operational excellence.

Cost Efficiency: Reduce Operational Expenses Through Automation

Cost Efficiency: Decrease Operational Expenses Through Bank Automation

Introducing bank automation in banking processes can lead to significant cost reductions by reducing manual labor and minimizing errors. Bank automation enables automated systems to adeptly handle repetitive tasks such as data entry, transaction processing, and customer inquiries, allowing us to strategically reallocate resources. This optimization not only reduces operational costs but also enhances profitability, empowering us to reinvest in customer service and innovation.

For instance, a recent case study titled ‘Maximizing Legacy System Potential’ illustrates how a major financial organization achieved a 30% decrease in operational expenses within a year of implementing automated technologies. This method, supported by our specialized hybrid connection platform, maximizes the potential of legacy systems while managing complex linkages effortlessly, significantly lowering expenses and improving operational capabilities. Such changes are becoming increasingly essential as we encounter pressure to adapt to evolving market requirements, and statistics indicate that banks that embrace bank automation can save up to 40% in operational costs by 2025, underscoring the importance of incorporating advanced technologies.

Our hybrid unification platform guarantees 24/7 availability for critical connections, which is vital for preserving operational efficiency. Financial analysts emphasize that bank automation is a key factor in reducing operational expenses, with expert opinions suggesting that organizations adopting bank automation solutions will retain a competitive advantage in the sector. Varun Ganapathi, Chief Technology Officer and Co-Founder at AKASA, states, ‘Solutions that employ cutting-edge GenAI, coupled with guiding expertise from industry veterans, are the best answer to help us create the premier revenue cycle management department of the future.’

Additionally, clients have praised us for our ability to simplify complex integrations, with one client noting, ‘Avato’s platform transformed our operations, allowing us to focus on innovation rather than integration challenges.’ As bank automation continues to evolve, its role in enhancing efficiency and security within banking operations becomes ever more critical.

Customer Experience: Leverage Automation for Faster, Personalized Banking Services

Bank automation empowers us to deliver quicker, more tailored services, significantly enhancing the customer experience. By leveraging AI-driven chatbots and bank automation through automated workflows, we can address customer inquiries in real-time, expedite transaction processing, and provide customized financial advice tailored to individual customer profiles. This prompt responsiveness not only boosts customer satisfaction but also fosters loyalty, as clients increasingly value the convenience and effectiveness that bank automation brings to their banking interactions.

Statistics reveal that up to 70% of customer service tasks can be automated, with 79% of companies recognizing the critical role of bank automation in enhancing the overall customer experience. As Uttam Kumar Dash, a digital marketing strategist, observes, “Companies that understand this and integrate AI strategically will set themselves apart by providing faster, more personalized, and efficient service.”

Furthermore, insights from a case study on generative AI indicate a 60% increase in its application for customer experience, particularly in developing sophisticated chatbots and virtual assistants. As we continue to adopt these innovations, we are enhancing operational efficiency with bank automation and also establishing new standards for personalized service in the financial sector.

Ashley Ross, SVP at Bank of America, underscores the importance of providing employees with immediate feedback to enhance customer experience, further highlighting the role of bank automation in modern banking. By incorporating Avato’s Hybrid Connection Platform, which offers seamless information unification and enhanced bank automation capabilities, we can effectively harness these advancements. The urgency for AI integration is evident; those who act now will lead the AI-driven revolution in finance.

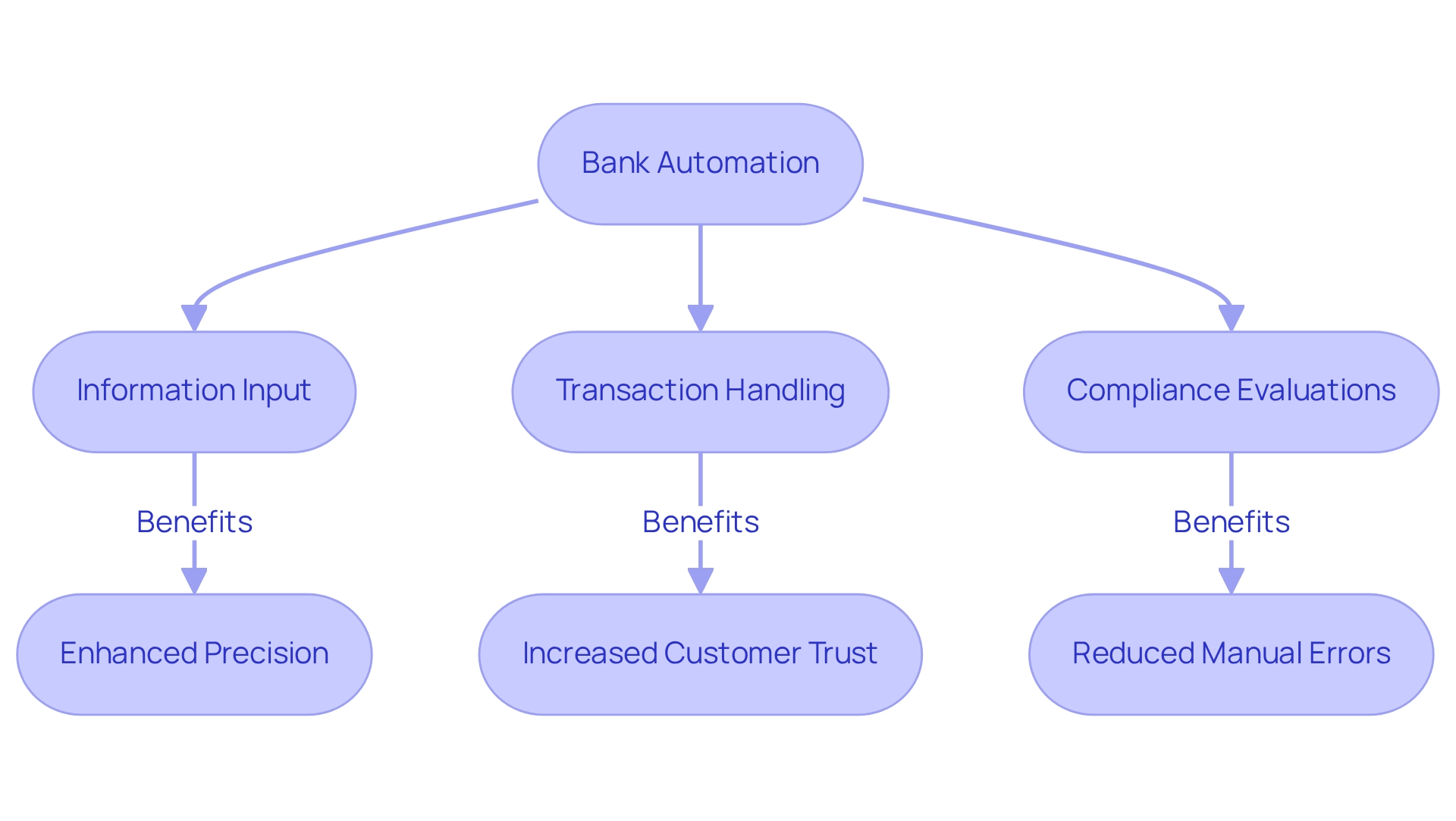

Error Reduction: Improve Accuracy with Automated Banking Processes

Bank automation is essential for minimizing human error, which is crucial for preserving the integrity of financial transactions. By incorporating mechanization in tasks such as information input, transaction handling, and compliance evaluations, we can significantly enhance the precision and reliability of our operations. This transition not only builds customer trust but also mitigates the risk of costly mistakes associated with manual interventions.

In light of new regulatory sustainability reporting mandates, we recognize that 99% of financial institutions are preparing for stricter disclosure requirements. This highlights the urgency for us to adopt bank automation solutions that ensure compliance and accuracy. For instance, financial institutions that have implemented bank automation in their information entry procedures report a notable decrease in errors, as evidenced by case studies that illustrate the effectiveness of combining automation with thorough employee training and change management techniques. By investing in targeted training programs, such as hands-on workshops and continuous learning opportunities, we can ensure our staff are comfortable with new technologies, fostering a culture of innovation essential for successful implementation.

Moreover, the integration of sophisticated algorithms and high-quality data is vital for effective future monitoring. As we increasingly utilize bank automation to enhance our operations’ efficiency and precision, we can achieve operational excellence and meet evolving customer expectations. The application of generative AI, particularly in developing advanced chatbots and virtual assistants, has shown a 60% improvement in customer experience, further optimizing operations and boosting productivity across various departments.

Experts emphasize the necessity of preserving transaction integrity through mechanization. Many banking professionals advocate for the adoption of advanced technologies, particularly bank automation, to improve accuracy in financial transactions. By leveraging automation and investing in staff training, including engaging stakeholders to gather precise requirements, we not only enhance our operational capabilities but also position ourselves to adapt to the changing regulatory landscape.

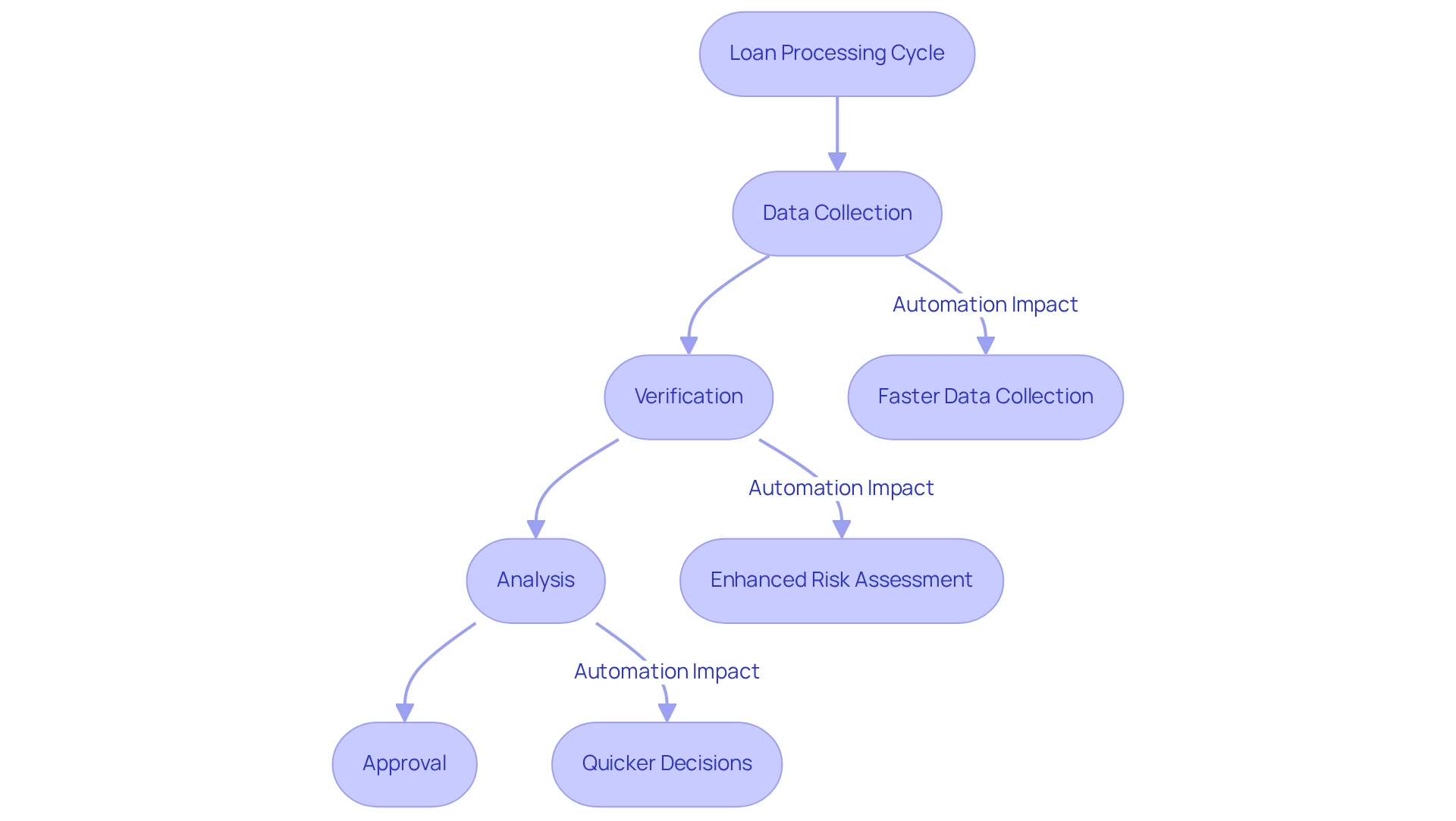

Loan Processing: Accelerate Approvals with Automation Technologies

Bank automation technologies are fundamentally transforming the loan processing cycle by streamlining data collection, verification, and analysis. We harness the power of AI and machine learning to swiftly evaluate borrower eligibility and risk, resulting in significantly faster loan approvals. This transformation not only enhances the customer experience by reducing wait times but also enables us to manage a larger volume of loans effectively, ultimately boosting revenue growth.

Recent statistics reveal that mechanization can cut loan processing durations by as much as 50%, allowing us to address customer needs more efficiently. For instance, banks implementing AI-driven solutions report a marked decrease in approval times, with some institutions achieving decisions in as little as 24 hours. The NVIDIA 2025 State of AI in Financial Services survey highlights that nearly 70% of firms experienced at least a 5% revenue increase due to AI implementations, underscoring the financial benefits of adopting such technologies.

Expert insights indicate that the future of loan processing will increasingly rely on automated technologies, emphasizing personalization and data-driven decision-making. As Chirag Bharadwaj, AVP – Technology, states, ‘AI’s future in mortgage lending will likely center on enhanced mechanization, personalization, and data-driven decision-making.’ This perspective underscores our need to adopt bank automation technologies to remain competitive in a rapidly evolving environment. Moreover, case studies show that banks leveraging automation have achieved substantial improvements in operational efficiency. Institutions that adopted AI tools for loan processing as part of their bank automation reported enhanced accuracy in risk assessment and a reduction in manual errors, further expediting the approval process. The survey also indicates that over 60% of financial services professionals noted cost reductions of 5% or more due to AI, reinforcing the operational advantages of these innovations.

Furthermore, the incorporation of information collaboration has shifted from a creative advantage to a competitive necessity in banking, highlighting the importance of efficient information management in loan processing. Avato’s hybrid integration platform plays a crucial role in this transformation, enabling seamless data connectivity and enhancing the efficiency of loan processing systems.

As technology advances to reshape loan approvals in 2025, it is evident that adopting these innovations is crucial for financial institutions aiming to improve efficiency and security while satisfying the needs of contemporary consumers. We urge the mortgage industry to embrace AI to avoid being left behind in a rapidly evolving technological landscape. Banking IT managers are encouraged to connect with us at Avato to explore tailored automation solutions that can drive their digital transformation efforts.

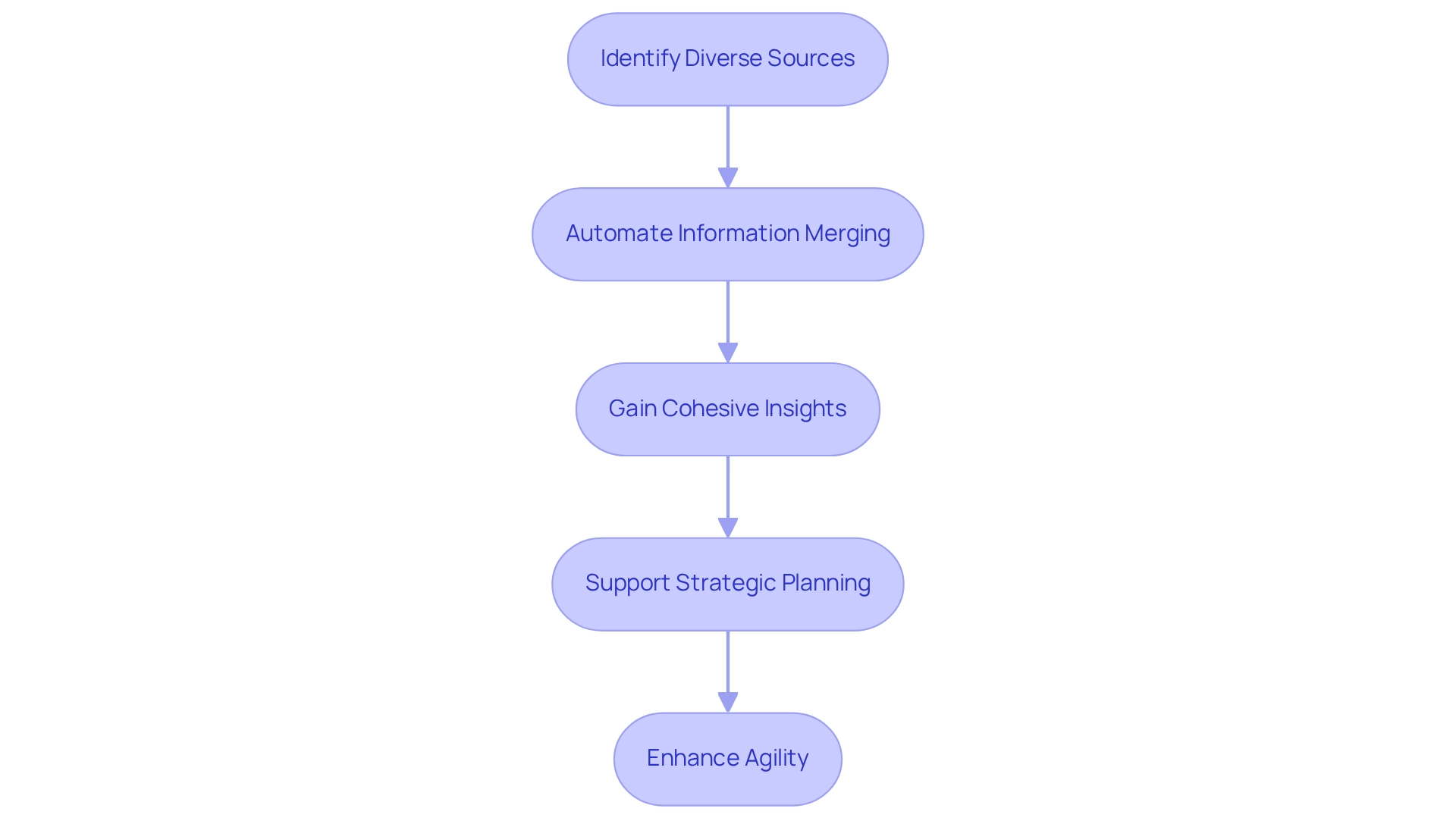

Data Consolidation: Achieve Unified Insights with Automated Systems

Automated systems are essential in merging information from diverse sources, empowering financial institutions to gain cohesive insights that are vital for efficient decision-making. By seamlessly integrating information across various departments and systems, we can cultivate a comprehensive understanding of our operations, customer behaviors, and prevailing market trends. This holistic perspective not only supports informed strategic planning but also enhances our agility in responding to dynamic market conditions.

Statistics reveal that employees spend 60% to 80% of their time searching for information, leading to significant productivity losses. By automating information unification with Avato’s hybrid connection platform, we can drastically reduce this time and significantly lower costs, allowing our personnel to focus on higher-value activities. Our platform simplifies complex integrations and maximizes the value of legacy systems, providing real-time monitoring and alerts on system performance—essential for maintaining operational reliability.

Current trends indicate a growing emphasis on information consolidation through bank automation, as financial institutions recognize the competitive advantage it provides. Case studies illustrate the success of banks that have adopted bank automation systems for information consolidation. Institutions utilizing Avato’s hybrid integration platform have reported streamlined integration processes and timely results, ultimately enhancing their operational capabilities and reducing costs. As Hilary Mason, a data scientist and founder of Fast Forward Labs, aptly states, “the information alone cannot provide you with all the answers you’re seeking.” This underscores the importance of effective information usage in our decision-making processes. Additionally, as Ernest Dimnet emphasizes, companies that fail to leverage their data effectively risk falling behind, as innovation and growth are intertwined with the quality of the data collected.

To effectively mobilize stakeholders, we should involve them early in the process to ensure that requirements are accurately captured. Future-proofing our systems is also vital, enabling the integration of new tools alongside existing assets. In summary, the integration of bank automation not only streamlines data consolidation but also empowers financial institutions to extract actionable insights, fostering innovation and growth in a competitive landscape.

Scalability: Use Automation to Support Growth in Banking Operations

Automation empowers us to expand our operations with remarkable efficiency. As customer demand fluctuates, our automated systems seamlessly adjust to accommodate increased workloads without necessitating substantial additional resources. This intrinsic scalability allows us to maintain service quality during high-demand periods while optimizing expenses, enabling rapid adjustments to growth prospects in the market.

Significantly, the global financial technology sector is projected to expand at a compound annual growth rate (CAGR) of over 14.2%, reaching $20.7 billion by 2032. This growth underscores our increasing reliance on bank automation to support scalable banking operations. Moreover, with 99% of companies preparing for stricter disclosure requirements due to new regulatory sustainability reporting mandates, it is imperative for us to enhance our operational frameworks to meet these challenges effectively.

Case studies illustrate how the convergence of Robotic Process Automation (RPA), Artificial Intelligence (AI), and hyper-automation is reshaping our business strategies. For instance, institutions like XYZ Bank have successfully implemented RPA to streamline compliance processes, resulting in reduced operational costs and improved accuracy. The NVIDIA 2025 survey highlights that nearly 70% of firms reported at least a 5% revenue increase attributable to AI implementations, showcasing AI’s dual role as both a revenue generator and an efficiency enhancer. The hyper-automation sector alone is anticipated to achieve $600 billion by 2025, emphasizing the necessity of RPA for financial institutions aiming to remain competitive.

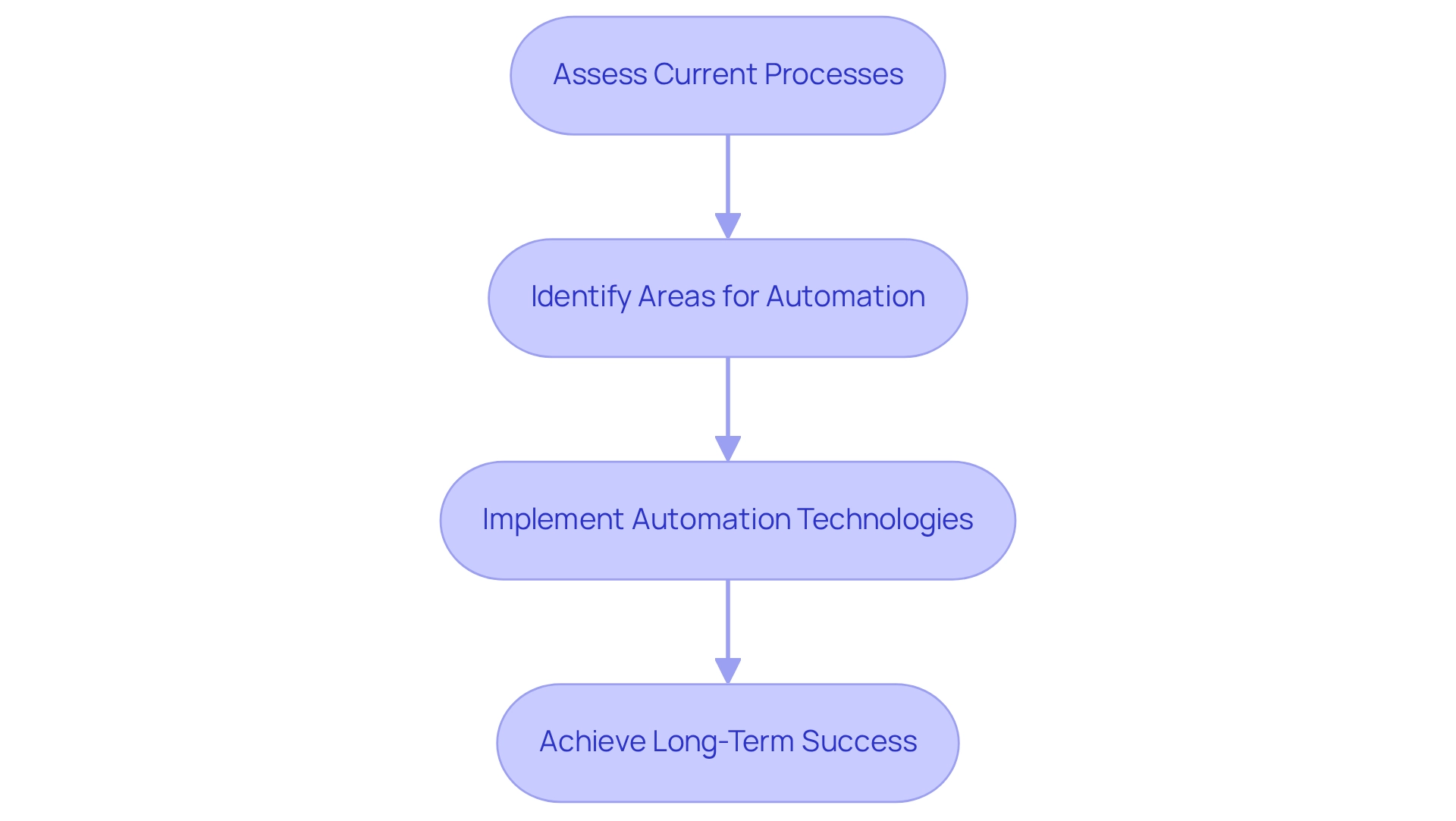

Furthermore, the return on investment from process improvement extends beyond simple efficiency gains; it revolutionizes operations and significantly enhances both employee and customer satisfaction. By leveraging technology, we can simplify procedures and improve resource distribution, ensuring we are well-prepared to address evolving market needs. To initiate the application of technology strategies, we recommend that banking IT managers evaluate existing processes, identify areas for enhancement, and explore collaborations with technology providers focused on bank automation solutions, such as Avato, which offers a hybrid integration platform designed to accelerate secure system integration for banking, healthcare, and government sectors.

Future-Proofing: Ensure Long-Term Success with Banking Automation

Investing in bank automation technologies is essential for financial institutions like us seeking to future-proof our operations. By adopting bank automation solutions, we can significantly enhance our agility and responsiveness to market fluctuations, ensuring we maintain a competitive advantage in a constantly changing environment. Bank automation not only streamlines our existing processes but also allows us to harness emerging technologies, such as artificial intelligence and machine learning, fostering ongoing innovation and growth.

Our Hybrid Integration Platform exemplifies how we can maximize the value of legacy systems while simplifying complex integrations. This platform ensures 24/7 uptime and reliability for critical systems, which is essential for maintaining service continuity and minimizing downtime. Moreover, it offers real-time monitoring and notifications on system performance, enabling us to proactively tackle issues before they affect operations.

Recent case studies demonstrate how financial institutions are effectively incorporating technology to ensure long-term success. For instance, organizations featured in the ‘Laws of Automation’ case studies have reported enhanced operational efficiency and decreased expenses through the implementation of robotic process technology (RPA), allowing them to allocate resources more efficiently. Data indicates that financial institutions utilizing technology experience a significant rise in productivity, with many attaining 24/7 uptime for essential integrations, thus improving service reliability.

Industry leaders highlight the significance of mechanization for sustainable growth. As Brett Wharton from NexusMKTG observes, employing AI to automate routine tasks enables us to concentrate on distinctly human abilities, such as customer service and strategic decision-making. This viewpoint aligns with our current tendency to emphasize bank automation as a strategy to secure our operations for the future, ensuring we can adapt to evolving needs and maintain a competitive edge.

Furthermore, the incorporation of generative AI is transforming customer interaction and operational effectiveness, additionally boosting the significant influence of bank automation in financial services. In conclusion, the adoption of bank automation and other technological advancements is not just a trend but a strategic necessity for banks like us. By investing in bank automation solutions, we can enhance our operational capabilities, streamline processes, and position ourselves for long-term success in a rapidly changing environment.

To begin implementing automation technologies, we should assess our current processes and identify areas where automation can deliver immediate benefits, ensuring a smoother transition into a more efficient operational framework.

Security Enhancement: Strengthen Data Protection with Automated Solutions

Automated solutions through bank automation are essential for enhancing information security within our banking operations. By implementing bank automation with automated monitoring systems, we can swiftly detect and address potential security threats in real-time, significantly minimizing the risk of breaches. For instance, security mechanization enables continuous network monitoring, allowing us to receive instant alerts and execute automated responses to suspicious activities. This proactive approach not only mitigates the impact of cyberattacks but also eliminates delays associated with manual processes.

Statistics indicate that remote workers have been responsible for security breaches in 20% of organizations during the pandemic, highlighting the urgent necessity for robust automated solutions. Furthermore, mechanization simplifies adherence to privacy regulations, ensuring that we maintain the highest security standards while protecting sensitive client information. Current trends suggest a significant shift towards bank automation systems, which enhance information security by detecting unusual behavior and supervising access to resources. Recent advancements in security technology have empowered us to adopt sophisticated solutions that strengthen our operational resilience. For example, institutions leveraging bank automation have reported enhanced efficiency in threat detection and response, enabling us to maintain a competitive edge in an increasingly complex regulatory landscape. By specifically addressing challenges such as monitoring access to data and identifying anomalous behavior, bank automation solutions are vital for enhancing data security and preserving customer trust in the evolving banking sector.

Conclusion

The banking industry is not just evolving; it is undergoing a significant transformation driven by automation technologies that enhance efficiency, customer experience, and regulatory compliance. By leveraging platforms like Avato’s Hybrid Integration Platform, we can effectively integrate legacy systems, reduce operational costs, and streamline processes. The integration of automation accelerates loan processing and improves compliance, while minimizing human error, thereby fostering a more accurate and reliable banking environment.

As automation continues to evolve, its role in delivering personalized customer experiences has become increasingly vital. We recognize that banks embracing AI-driven solutions can respond to customer needs more swiftly, enhancing satisfaction and loyalty. Furthermore, the ability to consolidate data through automated systems enables financial institutions to gain unified insights, empowering them to make informed strategic decisions.

The future of banking lies in our successful adoption of automation technologies that ensure scalability and long-term success. As market demands evolve, we must prioritize automation as a strategic imperative to maintain a competitive edge. By investing in these solutions, we are not only enhancing our operational capabilities but also positioning ourselves to thrive in a rapidly changing landscape.

In conclusion, the integration of automation in banking is not merely a trend; it is a necessity for achieving operational excellence and security. Financial institutions that proactively embrace these technologies will be well-equipped to meet the challenges of the future, ensuring they remain resilient and responsive to the needs of their customers and the demands of the market.