Overview

We recognize that operational efficiency is paramount for financial institutions. In our article, we explore ten core banking capabilities that can significantly enhance this efficiency. By adopting modern technologies—such as hybrid integration platforms, modular systems, and cloud-based solutions—we can improve flexibility, reduce costs, and empower banks to respond swiftly to market changes and customer demands.

What’s holding your team back from embracing these transformative solutions? The integration of these technologies not only streamlines operations but also positions financial institutions to meet evolving market needs with confidence. We invite you to consider how these advancements can drive your organization forward.

Introduction

As the financial landscape rapidly transforms, we recognize that the integration of advanced technologies is paramount for banks striving to enhance operational efficiency and customer satisfaction. This article explores the pivotal role of hybrid integration platforms, modular architectures, and cloud-oriented solutions in modernizing core banking systems.

By examining innovative approaches from industry leaders like Avato and Skaleet, we highlight how these technologies not only tackle the challenges posed by legacy systems but also empower financial institutions to adapt to shifting market demands.

With a focus on real-time monitoring, regulatory compliance, and the importance of customization, we underscore the necessity for banks to embrace these advancements to thrive in an increasingly competitive environment.

What’s holding your team back from leveraging these transformative solutions? Let’s delve deeper into how we can navigate this complex landscape together.

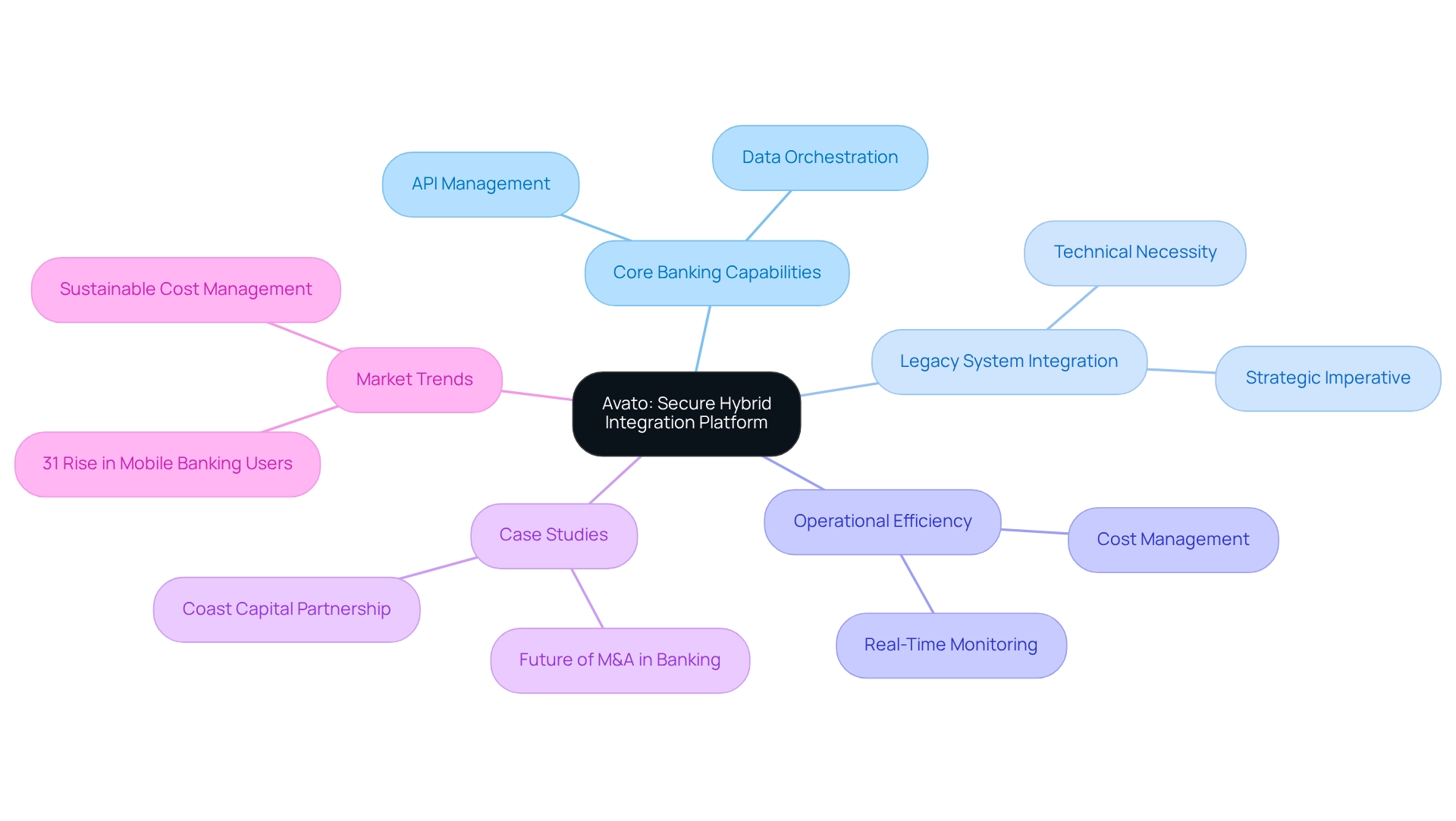

Avato: Secure Hybrid Integration Platform for Core Banking Success

We established our hybrid connection platform in 2010 to enhance the unification of various banking systems and strengthen our core banking capabilities, enabling secure and efficient data flow. By addressing the challenges presented by legacy systems, we empower financial institutions to modernize operations and enhance their core banking capabilities without compromising security. Our platform’s core banking capabilities accommodate multiple integration levels, including API management and data orchestration, allowing financial institutions to swiftly adapt to evolving market demands while ensuring compliance with regulatory standards.

With robust real-time monitoring features, we significantly improve operational efficiency, establishing ourselves as a vital resource for financial institutions aiming to enhance service delivery and elevate customer experiences through core banking capabilities. As we look to 2025, focusing on sustainable cost management will be essential for financial organizations, especially as they navigate the challenges of digital transformation.

The growth of mobile finance is substantial, with a reported 31% yearly rise in active users among financial institutions that have embraced customized mobile features. This trend underscores the necessity for financial institutions to effectively integrate legacy systems to meet customer expectations and maintain competitiveness, emphasizing that core banking capabilities can be enhanced through expert insights on the importance of hybrid unification platforms in improving banking security and efficiency.

Industry leaders assert that integrating legacy systems is not merely a technical necessity but a strategic imperative for banks aiming to thrive in a rapidly changing landscape by enhancing their core banking capabilities. Our platform exemplifies this approach by delivering tangible benefits that enhance operational capabilities, particularly core banking capabilities, while reducing costs.

Recent case studies illustrate successful implementations of hybrid solutions in financial institutions, showcasing how we have simplified complex projects and delivered results within desired time frames and budget constraints. For instance, our partnership with Coast Capital demonstrated our capability to enable significant system changes with minimal downtime, thereby strengthening the platform’s reliability and effectiveness.

Furthermore, the analyst document titled ‘A Guide to Hybrid Integration Platforms’ highlights the essential role of hybrid frameworks in improving operational efficiency and security, further supporting our solutions. As the financial sector continues to evolve, we remain at the forefront by offering core banking capabilities through a dependable, future-proof technology stack that enables institutions to adapt to shifting demands and maintain a competitive edge.

Moreover, findings from the case study ‘Future of M&A in Banking’ suggest that hybrid unification will be crucial in influencing M&A strategies, particularly for smaller financial institutions aiming to diversify portfolios and enter new markets.

Oracle Core Banking Solutions: Enhancing Flexibility and Digital Connectivity

We recognize that in today’s fast-paced financial landscape, operational adaptability is not just a luxury; it’s a necessity. Our hybrid integration platform offers a comprehensive framework that empowers financial institutions to enhance their operational flexibility and digital connectivity dramatically. Designed for real-time data processing and improved customer engagement, we enable financial institutions to swiftly adapt to market dynamics. Our platform’s modular design facilitates the rapid deployment of new services and products, ensuring that you can maintain a competitive edge in an ever-evolving financial environment.

Statistics reveal that approximately 95% of new products fail, underscoring the critical need for operational adaptability and effective innovation within the financial sector. We prioritize security and compliance, equipping financial institutions to navigate the complexities of regulatory requirements while fostering innovation. A pertinent case study, “Regulatory Compliance and Core Modernization,” illustrates how updating core banking capabilities enhances compliance capabilities, allowing institutions to adjust swiftly to regulatory changes and avert penalties or operational constraints.

This strategic approach not only mitigates compliance risks but also positions banks to seize emerging market opportunities. As David Grinberg, Director of FinTech at TechMagic, aptly states, “The optimal approach is also to ensure continuity during the gradual introduction of modernization.” As the financial sector evolves, the ability to integrate modular solutions becomes crucial for operational efficiency and customer satisfaction. By harnessing generative AI, our platform further elevates customer experience and operational efficiency, revolutionizing trading, customer engagement, and security through advanced integration solutions.

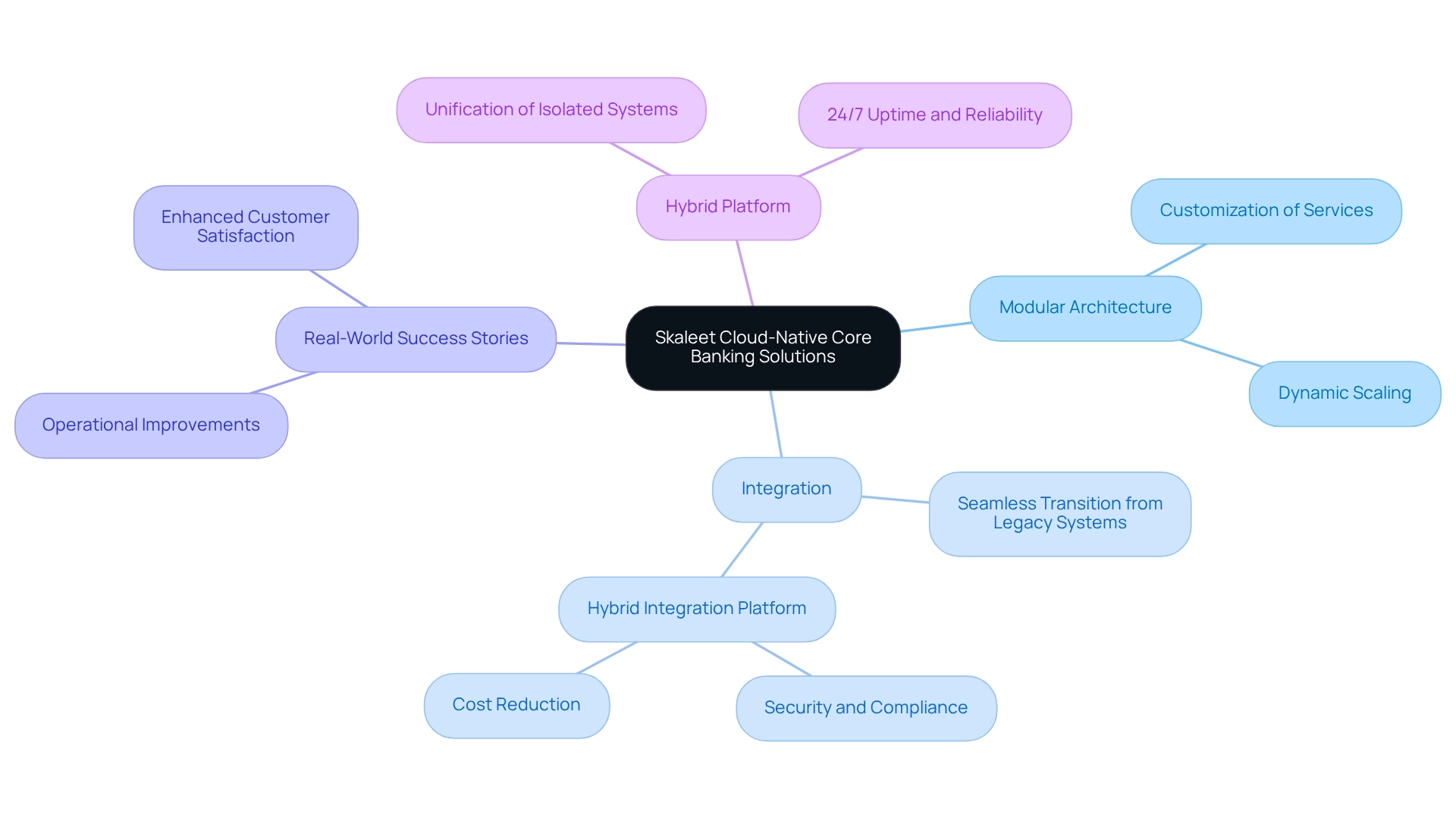

Skaleet Cloud-Native Core Banking Solutions: Driving Modernization and Efficiency

We recognize that core banking capabilities are pivotal in driving modernization and operational efficiency within financial institutions. By utilizing a modular architecture, we enable financial institutions to customize their services and dynamically scale operations based on demand. This adaptability is essential for enhancing customer experiences and optimizing internal processes. Furthermore, our solutions ensure seamless integration with existing systems, allowing financial institutions to transition effortlessly from outdated legacy infrastructures to modern, agile platforms that foster innovation.

As the financial sector increasingly adopts cloud-native solutions, statistics indicate a significant uptick in their implementation, with many institutions recognizing the need for flexibility and efficiency. Notably, growth in total noninterest expenses has surpassed net revenue growth for financial institutions with over US$10 billion in assets, emphasizing the financial pressures that our cloud-native solutions can assist in alleviating. Industry leaders, including Val Srinivas, a senior research leader in banking and capital markets, emphasize that “in most scenarios, inflation should not be a pressing concern entering 2025,” suggesting a favorable environment for modernization efforts.

Real-world examples demonstrate how banks leveraging our solutions have successfully navigated the complexities of modernization, achieving substantial improvements in operational capabilities and customer satisfaction. Moreover, the significance of efficient combination is emphasized by our Hybrid Platform, which accelerates the unification of isolated legacy systems and fragmented data, ensuring 24/7 uptime and reliability. This platform streamlines intricate integrations, enhances the value of legacy systems, and highlights security and compliance in open financial services. Additionally, Avato’s platform significantly reduces costs, making it an attractive option for financial institutions looking to enhance their operational efficiency. As Tony LeBlanc from the Provincial Health Services Authority states, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.” This trend highlights the essential role of core banking capabilities in shaping the future of financial services.

Portfolio+: Evolution of Core Banking Systems Towards Modular Platforms

Portfolio+ represents a significant advancement in core banking capabilities, as we embrace modular platforms that enhance flexibility and customization. This transition enables us to implement specific functionalities as needed, leading to a substantial reduction in the complexity and costs associated with traditional monolithic systems. By leveraging a modular approach, we can swiftly respond to market dynamics, seamlessly integrate emerging technologies, and elevate our service delivery. This evolution is vital for financial institutions like ours that strive to maintain competitiveness in a rapidly digitizing environment.

The adoption of modular core banking capabilities is gaining momentum, with statistics indicating that implementation rates have surged by over 30% among institutions in the past year. As we prioritize customer experience through innovations such as mobile banking applications and AI-driven analytics, modular platforms facilitate these enhancements by enabling tailored solutions that meet specific customer needs. The hybrid integration platform plays a crucial role in this process, providing the necessary infrastructure for smooth data sharing and integration, which is essential for effectively deploying new technologies.

Real-world examples illustrate this trend, as several banks have successfully adopted Portfolio+ to achieve greater operational flexibility. These institutions report improved service delivery and responsiveness to customer demands, showcasing the tangible benefits of modular systems. Gustavo Estrada, a customer, noted, “Avato has the ability to simplify complex projects and deliver results within desired time frames and budget constraints,” emphasizing the practical advantages of adopting such systems.

Moreover, the challenges posed by legacy systems with limited core banking capabilities, often rigid and costly to maintain, hinder our ability to innovate and meet modern customer expectations. As the core financial landscape continues to evolve, regulatory initiatives like PSD2 further pressure us to adopt modular platforms, making the enhancement of core banking capabilities a strategic necessity for financial organizations aiming to thrive in the digital age. By incorporating these solutions, we can secure our operations for the future and improve our overall efficiency.

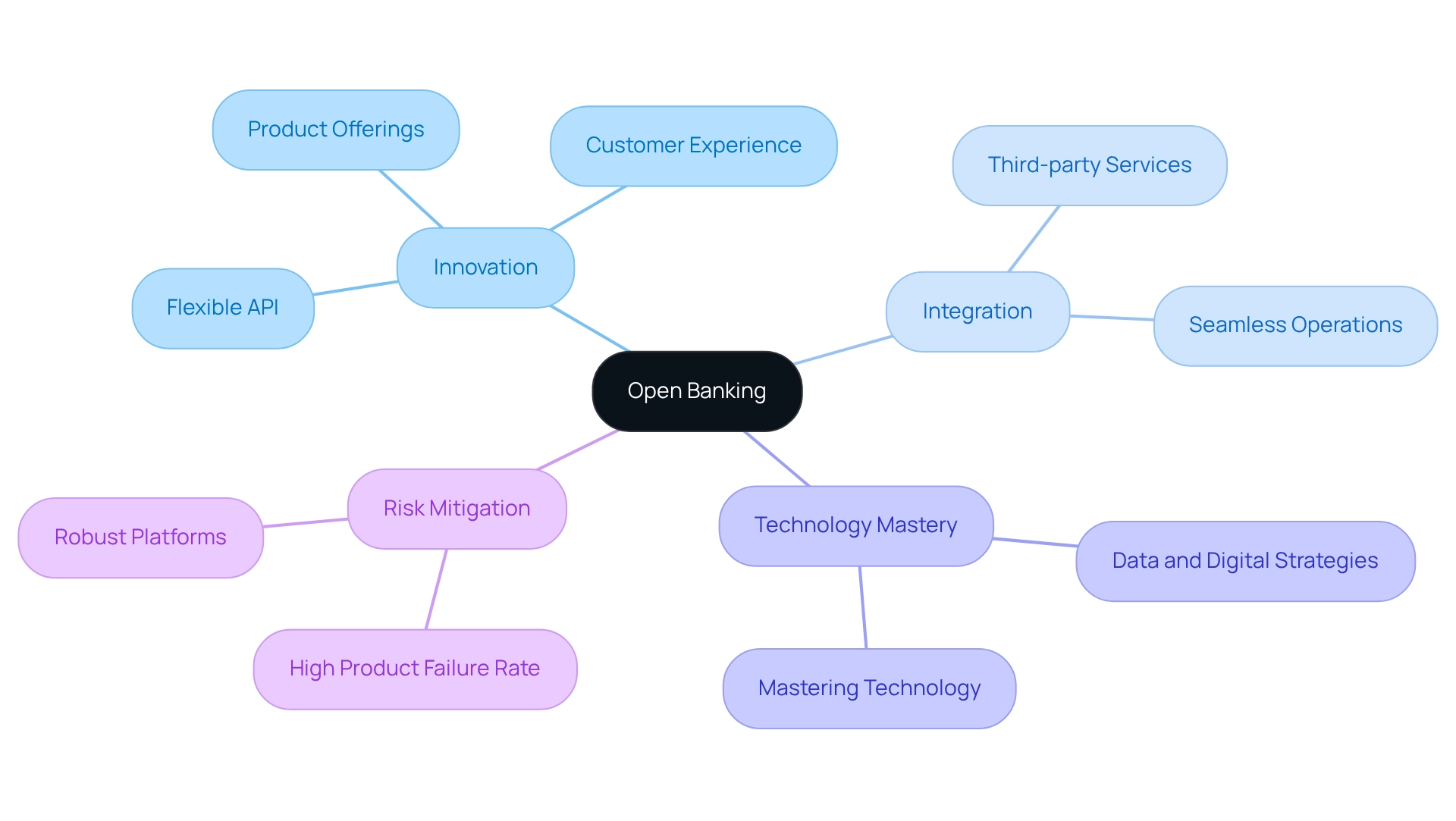

Tuum: Embracing Open Banking for Innovation and Competitive Edge

We stand at the forefront of the open finance revolution, empowering financial institutions to innovate and secure a competitive advantage. Our flexible, API-first platform enables banks to seamlessly integrate third-party services, enhancing their product offerings and improving customer experiences. This strategic approach fosters innovation and meets the evolving expectations of consumers who seek personalized and efficient financial solutions.

As the financial services landscape evolves, our commitment to open banking positions us as a key player in shaping the industry’s future. Jamie Dimon emphasizes that mastering technology is crucial for future success—a sentiment echoed by Gustavo Estrada, who praises our ability to streamline complex projects and deliver results within intended timeframes and budget constraints.

With approximately 95% of new products failing, adopting robust platforms like ours is essential for mitigating risks associated with innovation. By leveraging insights from industry experts and practical examples, we align ourselves with the demands of contemporary finance, ensuring that our connection solutions are not only secure but also adaptable to market changes.

Microservices Architecture: Essential for Scalable Core Banking Operations

Microservices architecture is essential for scalable core banking capabilities, allowing us to create and implement applications with remarkable efficiency. By breaking down applications into smaller, independent services, we can significantly enhance our agility and responsiveness to market fluctuations. This architecture facilitates ongoing collaboration and delivery, allowing us to swiftly implement new features and updates. As a result, our operational efficiency improves, time-to-market for new products decreases, and we better meet customer expectations in an ever-evolving financial landscape.

The adoption of microservices in banking has been transformative. For instance, organizations leveraging microservices have reported a substantial increase in application uptime, effectively mitigating the unacceptable downtime associated with monolithic applications. We guarantee continuous uptime for essential connections, improving failure resilience and enabling independent operations, allowing us to innovate without the constraints of conventional deployment cycles. With support for 12 levels of interface maturity, our Hybrid Integration Platform simplifies complex integrations, maximizes the value of legacy systems, and significantly reduces costs.

Statistics indicate that a growing number of financial institutions are embracing microservices architecture, with many reporting improved scalability and operational efficiency. As technology leaders advocate for this approach, the consensus is clear: microservices represent not just a trend but a necessary evolution for banks aiming to thrive in a competitive environment. Gustavo Estrada, a customer, noted that we have the ability to simplify complex projects and deliver results within desired time frames and budget constraints. The ability to adapt quickly to changing requirements while maintaining secure and reliable operations makes microservices a crucial component of modern core banking capabilities. Furthermore, microservices can be composed using various third-party tools and services, ensuring smooth interactions and secure data transfer.

Cloud-Oriented Core Banking Solutions: Reducing Costs and Enhancing Service Delivery

Core banking capabilities that are cloud-oriented offer significant advantages in reducing operational costs while enhancing service delivery. By transitioning to the cloud, we can substantially lessen our reliance on extensive on-site infrastructure, which in turn diminishes maintenance and operational expenses. This transition not only cuts costs but also improves scalability, allowing us to adjust resources dynamically based on demand. Such flexibility is essential in today’s fast-paced financial landscape, enabling us to deliver services more swiftly and efficiently, thereby boosting overall customer satisfaction.

Recent trends indicate that by 2025, 30% of financial workloads are expected to operate on edge computing infrastructure, with 55% of large financial institutions adopting sovereign cloud solutions for sensitive workloads. These advancements signify a broader industry shift toward more sophisticated cloud technologies that address both regulatory and operational challenges. Furthermore, institutions utilizing automated compliance tools have reported an impressive 67% reduction in compliance findings during regulatory assessments, underscoring the efficiency improvements associated with cloud migration.

Our commitment to ensuring 24/7 availability for critical connections enhances the reliability of cloud-focused solutions, a crucial factor for IT managers in the finance sector. The hybrid connection platform simplifies the integration of diverse systems, empowering us to protect our operations through seamless data connectivity. Expert insights underline the importance of mastering technology for future success in the financial sector. As Jamie Dimon points out, leveraging advanced cloud solutions is vital for enhancing core banking capabilities and maintaining a competitive edge. Additionally, co-founder Will Montgomery emphasizes that implementing small, regular modifications through cloud connectivity is far more reliable than infrequent, extensive upgrades, further solidifying the case for core banking capabilities that are cloud-centric.

Real-world examples illustrate these benefits, with numerous institutions, including those that have partnered with us, reporting significant cost savings and enhanced operational capabilities following their transition to cloud-based systems. Our expertise in hybrid integration has transformed financial institutions with speed and reliability, as evidenced by customer testimonials from organizations like OSME Pacific and BC Provincial Health Services Authority, which highlight the effectiveness of our solutions in simplifying complex projects and delivering results within desired time frames. As the industry evolves, the impact of cloud migration on the efficiency of financial service delivery will only grow, making it a vital consideration for institutions striving to excel in a competitive landscape.

Real-Time Monitoring: Key to Operational Efficiency in Core Banking

Real-time monitoring is not just important; it is essential for ensuring operational efficiency in our core banking capabilities. By continuously monitoring system performance and transaction flows, we can swiftly identify and address potential issues before they escalate, significantly reducing downtime and enhancing the reliability of our financial services. This proactive approach safeguards against disruptions and allows us to optimize our operations, ensuring we meet customer demands promptly and efficiently.

As we look towards 2025, the importance of real-time monitoring cannot be overstated; it directly impacts operational efficiency. Industry experts, including Jamie Dimon, emphasize that the future belongs to those who excel in technology, underscoring our need to implement advanced monitoring solutions. Our commitment to guaranteeing 24/7 availability for essential connections illustrates how effective monitoring can enhance our operational capabilities while mitigating risks. Avato’s groundbreaking hybrid unification solutions empower us to seamlessly connect diverse systems, enabling real-time insights that drive our operational excellence.

Case studies reveal that banks utilizing real-time monitoring have observed significant enhancements in their operational efficiency. By implementing these solutions, we can streamline our processes and enhance customer satisfaction through timely service delivery. Furthermore, the incorporation of generative AI technologies has transformed customer interactions, enabling sophisticated chatbots and virtual assistants that elevate our service delivery. This highlights the transformative potential of real-time monitoring and integration in the financial sector, showcasing its critical role in enhancing our core banking capabilities.

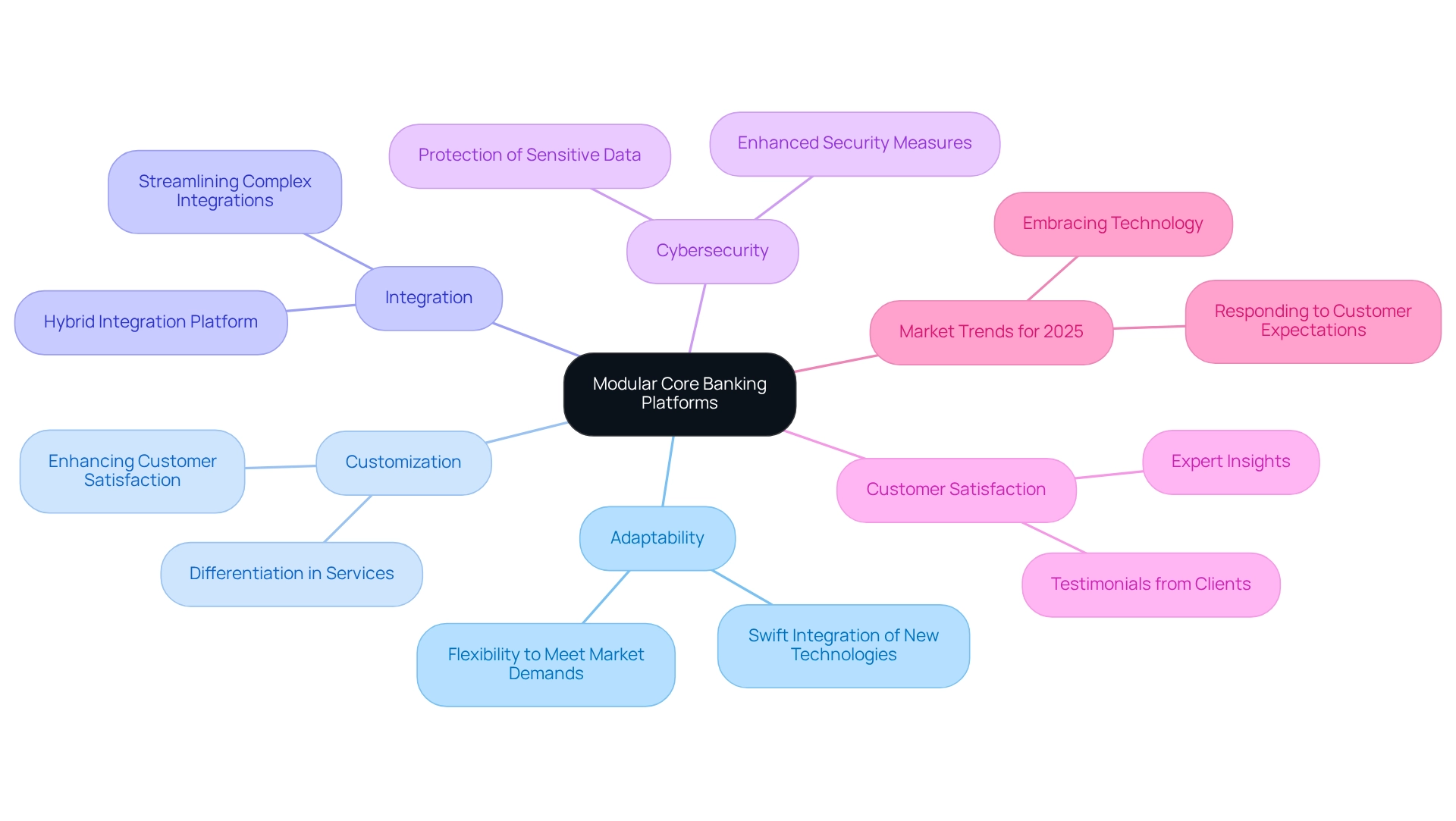

Modular Core Banking Platforms: Customization for Market Adaptability

Modular core banking capabilities empower us as financial institutions with the flexibility to customize our systems to meet evolving market demands. This adaptability enables us to implement targeted functionalities that address specific customer needs, thereby enhancing our service offerings. By utilizing modular architecture, we can swiftly integrate new technologies and comply with changing regulatory requirements, ensuring we maintain a competitive edge in a fast-paced financial landscape.

Our expert unification services, including enterprise architecture, project management, and technical analysis, further support this adaptability, providing skilled collaboration partners and customer-centric solutions that accelerate digital transformation. Our hybrid integration platform, constructed on Red Hat’s JBoss Middleware, aims to streamline intricate integrations, facilitating us to modernize our legacy systems while ensuring secure transactions.

In fact, approximately 95% of new products fail, highlighting the critical need for us to innovate effectively. Furthermore, as cybersecurity threats continue to rise, enhanced security measures within modular systems are essential for protecting sensitive financial data. Our platform is designed for 24/7 uptime, providing a robust foundation for digital transformation initiatives in financial services, healthcare, and government sectors.

Customization abilities are essential for us as financial institutions seeking to differentiate ourselves and enhance customer satisfaction. As Tony LeBlanc from the Provincial Health Services Authority noted, ‘Good team. Good people to work with. Extremely professional. Extremely knowledgeable.’ This testimonial illustrates how we are successfully adapting to market demands through modular systems, showcasing the tangible benefits of this approach.

As the financial sector increasingly embraces technology, expert insights highlight the significance of customization in core banking capabilities, reinforcing their role in shaping the future of financial services. As William Blake once said, ‘What is now proved was once only imagined,’ reminding us that innovation and adaptability are crucial in this evolving landscape. Additionally, with the latest trends in modular financial systems for 2025, we are better positioned to respond to market changes and customer expectations.

SaaS Solutions: Enhancing Innovation and Scalability in Banking

SaaS solutions are fundamentally transforming the banking sector, significantly enhancing both innovation and scalability. We recognize that these cloud-based platforms enable financial institutions to utilize advanced technologies without incurring substantial upfront infrastructure expenses. By embracing SaaS, we can swiftly roll out new features and services, thereby improving our responsiveness to evolving customer demands. Furthermore, many SaaS solutions include integrated compliance and security measures, allowing us to prioritize innovation while upholding adherence to regulatory standards. This strategic approach not only enhances operational efficiency but also positions us for sustainable growth in an increasingly competitive environment.

Recent statistics indicate that approximately 95% of new products fail, underscoring the critical need for organizations like ours to adopt solutions that align with our unique business journeys rather than merely following market trends. As the landscape of core banking capabilities evolves, the focus is shifting toward finding the right fit for specific business needs, which SaaS solutions adeptly provide. Case studies reveal that many financial institutions face challenges when integrating legacy systems with modern cloud solutions, complicating migration processes. However, by employing a step-by-step merging strategy and utilizing middleware solutions such as a Hybrid Platform, we can transition to cloud technologies gradually. This approach maximizes the value of our legacy systems while minimizing risks and enhancing our operational capabilities. The platform simplifies intricate connections, greatly lowers expenses, and provides real-time oversight and notifications, making it an ideal option for financial institutions aiming to modernize their systems without disrupting ongoing operations.

In 2025, the effect of SaaS on financial innovation is anticipated to be significant, with financial analysts observing that scalability is a crucial benefit of these solutions. Real-world examples illustrate how banks are enhancing their core banking capabilities through SaaS, which enables them to adapt to changing market demands and maintain a competitive edge. As the financial sector continues to evolve, the integration of SaaS solutions, particularly through our offerings, will be pivotal in driving innovation and operational efficiency. Additionally, the increasing use of generative AI in financial services, as highlighted in recent case studies, showcases its role in improving customer experience and streamlining operations, further emphasizing the importance of integrating advanced technologies in banking.

Conclusion

The integration of advanced technologies such as hybrid platforms, modular architectures, and cloud-oriented solutions is no longer a choice but a necessity for us as banks aiming to modernize our core systems. As demonstrated through the examples of industry leaders like Avato and Skaleet, these innovations not only address the challenges posed by legacy systems but also significantly enhance our operational efficiency and customer satisfaction. The importance of real-time monitoring, regulatory compliance, and customization has been underscored as essential components for financial institutions striving to thrive in a competitive landscape.

Furthermore, the shift towards modular and cloud-native solutions reflects a broader industry trend that prioritizes adaptability and innovation. We, as banks that embrace these technologies, can respond swiftly to market demands, implement new services with ease, and improve our overall service delivery. The evidence from successful case studies highlights the tangible benefits of these advancements, showcasing how institutions can achieve substantial improvements in both operational capabilities and customer engagement.

In conclusion, as the financial services sector continues to evolve, the imperative for us is clear: leveraging transformative solutions like those offered by Avato and Skaleet is essential for not only meeting current customer expectations but also positioning ourselves for future success. Embracing these technologies will empower us to navigate the complexities of the modern banking landscape, ensuring we remain competitive and resilient in an ever-changing environment. Now is the time for us to take decisive action and harness the potential of these innovations to secure our place at the forefront of the industry.