Overview

ISO 20022 compliance is not just an option; it is a pivotal standard that revolutionizes electronic data exchange among financial institutions, significantly modernizing our payment processes. We recognize that approximately 70% of banks see its potential to enhance interoperability, improve data quality, and support real-time payments. This compliance empowers us to innovate and effectively meet the evolving demands of regulations and customer expectations. As we navigate the complexities of the financial landscape, embracing ISO 20022 compliance positions us at the forefront of industry advancement.

Introduction

In the rapidly evolving landscape of banking, we recognize that the adoption of ISO 20022 is not merely a trend but a critical necessity for financial institutions aiming to thrive in a competitive environment. This international messaging standard revolutionizes the way we communicate, enabling the seamless exchange of structured and rich data, which paves the way for enhanced interoperability and real-time payment capabilities.

As we increasingly acknowledge its transformative potential, understanding the compliance requirements and implementation strategies becomes paramount. What challenges do legacy systems pose, and how can we ensure data integrity?

The journey towards ISO 20022 compliance is fraught with complexities that demand strategic planning and expert guidance. By exploring the essential steps and addressing potential obstacles, we can harness the power of ISO 20022 to not only meet regulatory demands but also elevate customer experiences and operational efficiency.

Define ISO 20022 and Its Importance in Banking

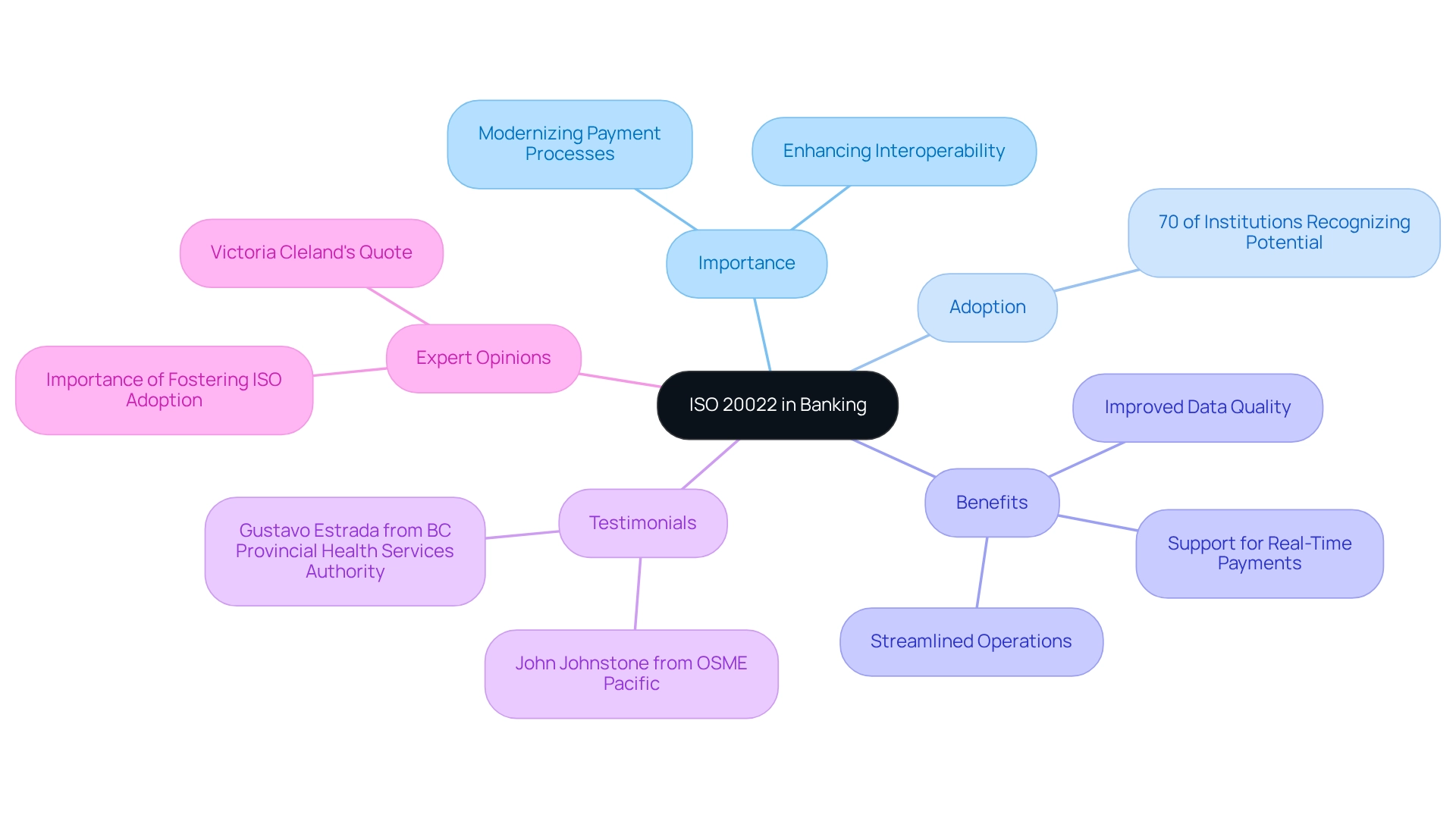

ISO, which defines what is ISO 20022 compliant, stands as an international messaging standard that facilitates electronic data exchange among financial institutions. By enabling the transmission of structured and rich data, it plays a pivotal role in modernizing our payment processes. As we approach 2025, the adoption of ISO 20022 compliance is on the rise in banking, with approximately 70% of institutions recognizing its potential to transform the payments ecosystem. This standard enhances interoperability among diverse systems, improves data quality, and supports the growing demand for real-time payments.

Understanding what is ISO 20022 compliant goes beyond mere compliance; it represents a strategic initiative that empowers us to innovate and meet evolving regulatory demands and customer expectations for quicker, more secure transactions. Leading financial organizations have reported tangible advantages from adopting ISO standards, including streamlined operations and enhanced customer experiences. For instance, Victoria Cleland, Executive Director of Payments, noted, “What we plant in the soil of contemplation, we shall reap in the harvest of action,” underscoring the proactive approach necessary for successful adoption.

Practical examples illustrate the effective incorporation of ISO standards within various financial organizations. Clients such as John Johnstone from OSME Pacific and Gustavo Estrada from BC Provincial Health Services Authority have praised the standard for simplifying complex projects, enabling them to achieve their objectives swiftly and effectively. These testimonials highlight the efficiency of ISO in facilitating smooth banking operations, a process further accelerated by the hybrid platform designed to unlock isolated assets and enhance operational visibility.

At Avato, founded by a dedicated group of enterprise architects, we are committed to addressing complex integration challenges. Our platform’s features, including support for 12 levels of interface maturity and a design focused on secure transactions, establish us as a significant player in the transformation driven by ISO 20022 compliance. As the financial industry evolves, it is essential for us to grasp what is ISO 20022 compliant, including recent advancements in data security measures and improved interoperability standards, to maintain our competitive edge. The standard’s capacity to deliver richer and more secure data positions it as a cornerstone for future innovations in financial services. Expert opinions stress that fostering ISO adoption is crucial for maximizing its benefits, ensuring that we can adapt to evolving demands and sustain a competitive advantage in our respective markets.

Outline ISO 20022 Compliance Requirements

To achieve ISO compliance, we recognize that financial institutions must navigate several key requirements.

- Message Definition: We utilize the official ISO message definitions, which outline the structure and content of messages. Our hybrid integration platform facilitates this by providing seamless connectivity, ensuring that message definitions are correctly implemented across disparate systems.

- Data Quality: High-quality data is essential; ISO emphasizes rich and structured data for effective communication. By leveraging our solutions, organizations can access isolated data assets, thereby improving data quality and integrity.

- System Compatibility: Current systems must handle ISO messages, which may necessitate enhancements or substitutions of outdated systems. Our commitment to connecting legacy systems with contemporary expectations guarantees that institutions can attain compatibility without significant overhauls.

- Testing and Validation: Thorough testing is paramount to ensure that systems can send and receive ISO messages accurately. Our specialists in system connectivity provide essential assistance, aiding in the validation of systems and guaranteeing adherence to the new standards.

- Regarding regulatory compliance, banks must ensure that their ISO 20022 implementation aligns with the relevant regulatory requirements set by the Federal Reserve for Fedwire transactions. We highlight the significance of regulatory compliance and security assessments in our hybrid solutions, ensuring that institutions adhere to all required guidelines. Our solutions are designed to facilitate adherence to these regulations through automated compliance checks and reporting features.

- Training and Support: Staff training on the new standards and systems is critical for smooth operations post-implementation. We provide crucial approaches for employee training and change management, enabling teams to adjust to the new landscape effectively. By offering customized training sessions and continuous assistance, we guarantee that our clients are well-prepared to handle the intricacies of ISO compliance.

Implement ISO 20022: Steps for Successful Integration

Implementing ISO 20000 is a strategic endeavor that requires several critical steps to ensure a smooth transition and successful incorporation.

First, we assess our current systems. We begin by evaluating existing systems to identify gaps in compatibility with ISO 20022 compliance. This evaluation is vital; 65% of specialists believe that risks related to merging have risen in the past year, underscoring the necessity of comprehensive preparation. Utilizing XSLT can streamline this process by transforming XML data structures efficiently, thereby reducing the labor involved in identifying these gaps.

Next, we develop a migration plan. A detailed migration plan must outline timelines, resources, and responsibilities. This plan should proactively address potential challenges, as many organizations encounter difficulties during the migration process. As Gustavo Estrada pointed out, effective unification solutions can simplify complex projects, aiding in delivering results within desired time frames and budget limitations. Incorporating schemas into our planning can also help catch programming errors early, leading to significant cost savings.

We then upgrade our infrastructure. Investing in necessary technology upgrades is crucial to ensure ISO 20022 compliant messaging. A dependable, future-ready technology stack is essential for adapting to evolving needs and guaranteeing sustained success throughout the implementation process. The hybrid connectivity platform can facilitate this upgrade by linking diverse systems and enhancing overall business value.

Engaging stakeholders is also critical. Involving key stakeholders—including IT, compliance, and operations teams—ensures alignment and support throughout the unification process. Their input is vital for addressing concerns and fostering collaboration. A structured approach to requirements management can help clarify expectations and streamline communication.

Conducting thorough testing follows. We perform extensive testing of the new messaging system to identify and resolve any issues before going live. This step is critical to minimize disruptions and ensure a seamless transition. Leveraging XSLT during testing can help automate data transformation tasks, making the process more efficient.

We implement training programs. Training sessions for staff familiarize them with the new processes and systems. Effective training significantly reduces the learning curve and enhances operational efficiency. Our dedication to streamlining connections serves as a beneficial asset during this phase.

Finally, we go live. Launching the ISO messaging system requires ensuring that support is available to address any immediate challenges. A well-planned go-live strategy mitigates risks and enhances user confidence. Continuous monitoring of the system’s performance post-launch is essential for maintaining compliance and optimizing operations.

After implementation, we monitor and optimize. We continuously monitor the system’s performance and make necessary adjustments to optimize operations. Regular assessments help maintain compliance and improve overall efficiency. Utilizing analytics tools within Avato’s hybrid integration platform offers insights into system performance and areas for enhancement.

By adhering to these steps and leveraging the features of Avato’s hybrid integration platform, we can effectively manage the intricacies of ISO 20022 compliant integration, ensuring we remain competitive in a changing financial environment.

Address Challenges in Achieving ISO 20022 Compliance

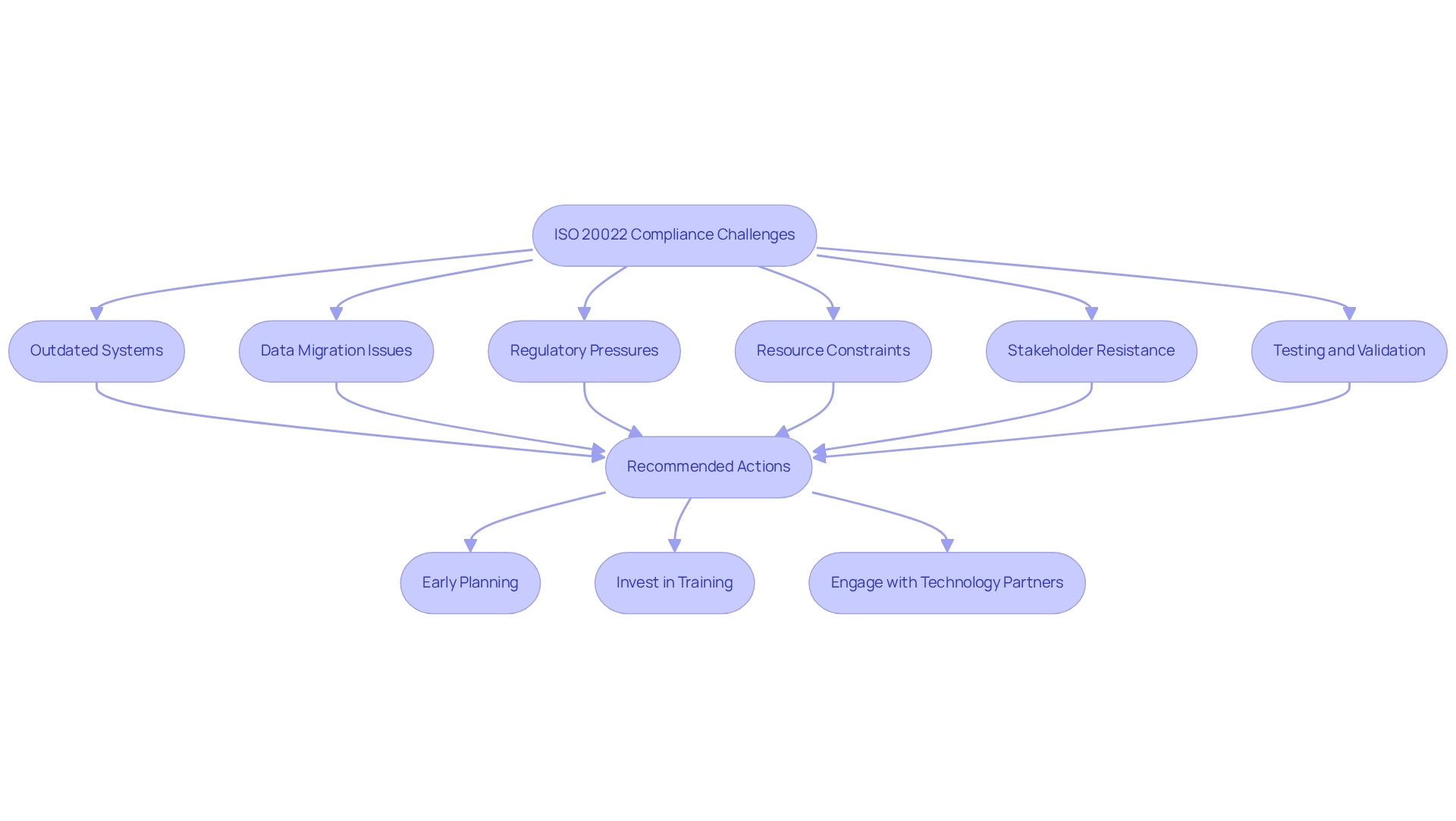

Achieving ISO compliance is a formidable challenge that many banks face today. Our industry is often hindered by outdated systems that fall short of ISO 20022 compliance, necessitating substantial upgrades or replacements. We offer a hybrid solution designed to simplify these intricate unification challenges, unlocking isolated assets and facilitating seamless connections with current systems.

Data migration issues are another hurdle; transitioning existing data to the new format can be complex and may jeopardize data integrity if not managed with precision. Our expertise in converting unstructured information into structured requirements models ensures a smoother data migration process, as evidenced by our previous successful projects.

Moreover, regulatory pressures continue to evolve, complicating compliance efforts. Collaborating with expert service providers like us grants access to skilled partners who navigate these complexities efficiently, ensuring that compliance is achieved without interruption.

Resource constraints, including limited budgets and personnel, can further hinder the implementation of necessary changes. Our dedicated team of specialists is here to assist whenever and wherever needed, enhancing resource distribution to maximize effectiveness.

Finally, stakeholder resistance can impede progress; effective change management is critical. We prioritize stakeholder involvement, ensuring that all parties remain aligned and informed throughout the integration journey, a strategy that has proven essential in past implementations.

Testing and validation are also paramount. Ensuring that all systems operate correctly with ISO messages requires comprehensive testing, which can be time-consuming. Our thorough approach to integration includes robust testing protocols to validate system functionality, ensuring a smooth transition.

To address these challenges, we encourage banks to prioritize early planning, invest in training, and engage with technology partners like us, who can clarify what ISO 20022 compliance entails and are committed to architecting the technology foundation necessary for successful integration.

Conclusion

The journey toward ISO 20022 compliance is not merely a regulatory requirement; it is a pivotal opportunity for us as financial institutions to modernize our operations and enhance customer experiences. By adopting this international messaging standard, we can facilitate the seamless exchange of structured and rich data, ultimately improving interoperability and supporting the demand for real-time payments.

Throughout this discussion, we have highlighted key challenges such as legacy system limitations, data migration issues, and regulatory pressures. However, with strategic planning, robust integration solutions, and expert guidance, we can effectively navigate these obstacles. The role of technology partners, like Avato, is essential in providing the necessary tools and support to ensure our successful implementation and compliance.

As the banking landscape continues to evolve, embracing ISO 20022 is critical for us to maintain a competitive edge. By prioritizing compliance and leveraging the benefits of this standard, we can not only meet regulatory demands but also position ourselves for future innovations in financial services. The proactive steps we take today will pave the way for a more efficient, customer-centric banking experience tomorrow.