Overview

Core banking software is indispensable for financial institutions, enabling critical operations such as customer account management, transaction processing, and loan management. This functionality allows us to deliver efficient services across multiple branches. We recognize the significance of these systems in modern banking, especially as advancements in technology, regulatory compliance, and customer engagement strategies drive their evolution.

What challenges are you facing in your financial operations?

As we navigate the digital transformation of the financial sector, the integration of robust banking software is not just beneficial; it is essential. We invite you to explore how embracing these advancements can position your institution for success.

Introduction

In the rapidly evolving landscape of financial services, we recognize that core banking software serves as a crucial pillar for institutions striving to modernize and enhance their operations. These sophisticated systems not only streamline essential banking functions—such as account management and transaction processing—but also empower us to deliver seamless services across multiple branches.

As digital transformation reshapes the banking sector, the integration of modern core banking solutions becomes imperative for achieving operational excellence and meeting the growing demands of tech-savvy consumers.

With the rise of open banking and the increasing importance of compliance, understanding the functionalities and evolution of core banking software is vital for any financial institution looking to thrive in this competitive environment.

What’s holding your team back from embracing these advancements? Let’s explore how we can partner together to navigate these challenges and unlock your institution’s full potential.

Defining Core Banking Software: Functions and Purpose

What is core banking software? It is the backbone of our financial institutions, enabling essential operations such as customer account management, transaction processing, and loan management. These frameworks empower us to provide services across multiple branches, allowing customers to access their accounts and perform transactions effortlessly, regardless of their location. What is core banking software primarily used for includes processing deposits and withdrawals, managing loans, and maintaining comprehensive customer records. By centralizing these operations, we significantly enhance efficiency and elevate customer service standards, making these systems vital in the contemporary financial landscape.

As we embark on our digital transformation journeys, leveraging Avato’s Hybrid Integration Platform is a key step in ensuring successful integration of our systems. This platform offers functionalities like seamless data integration, real-time analytics, and improved security protocols—essentials for modern financial operations. Recent statistics indicate that intuitive and user-friendly interfaces in fundamental financial platforms can greatly reduce employees’ learning curves, thereby enhancing productivity. As the financial sector evolves, understanding what is core banking software is underscored by the ongoing shift towards digital services, with companies investing heavily in digital experiences to meet consumer demands. These investments are crucial as they amplify the functionalities of essential banking software, which raises the question of what is core banking software, enabling us to adapt to evolving customer expectations and enhance service delivery.

Moreover, regulatory initiatives like the Payment Services Directive 2 (PSD2) have spurred the emergence of open banking, compelling financial institutions to open their APIs to external providers. This fosters safe data sharing and collaboration, allowing us to utilize innovative fintech solutions to improve our service offerings. As Deloitte observes, substituting current fundamental frameworks with cloud-native or SaaS solutions is becoming increasingly essential for banks to remain competitive. By integrating legacy systems with modern solutions, we can accelerate our digital transformation efforts, ensuring we meet the demands of the future.

Looking ahead to 2025 and beyond, understanding what is core banking software will be essential as its role in our institutions expands, enhancing its importance in promoting operational excellence and customer satisfaction. The forecast period for market growth from 2025 to 2032 further highlights the anticipated development and significance of essential financial software in the near future. This aligns with the strategies outlined in the Comprehensive Guide to Digital Transformation, providing us with a structured approach to navigate these changes.

The Evolution of Core Banking Software: Historical Context and Development

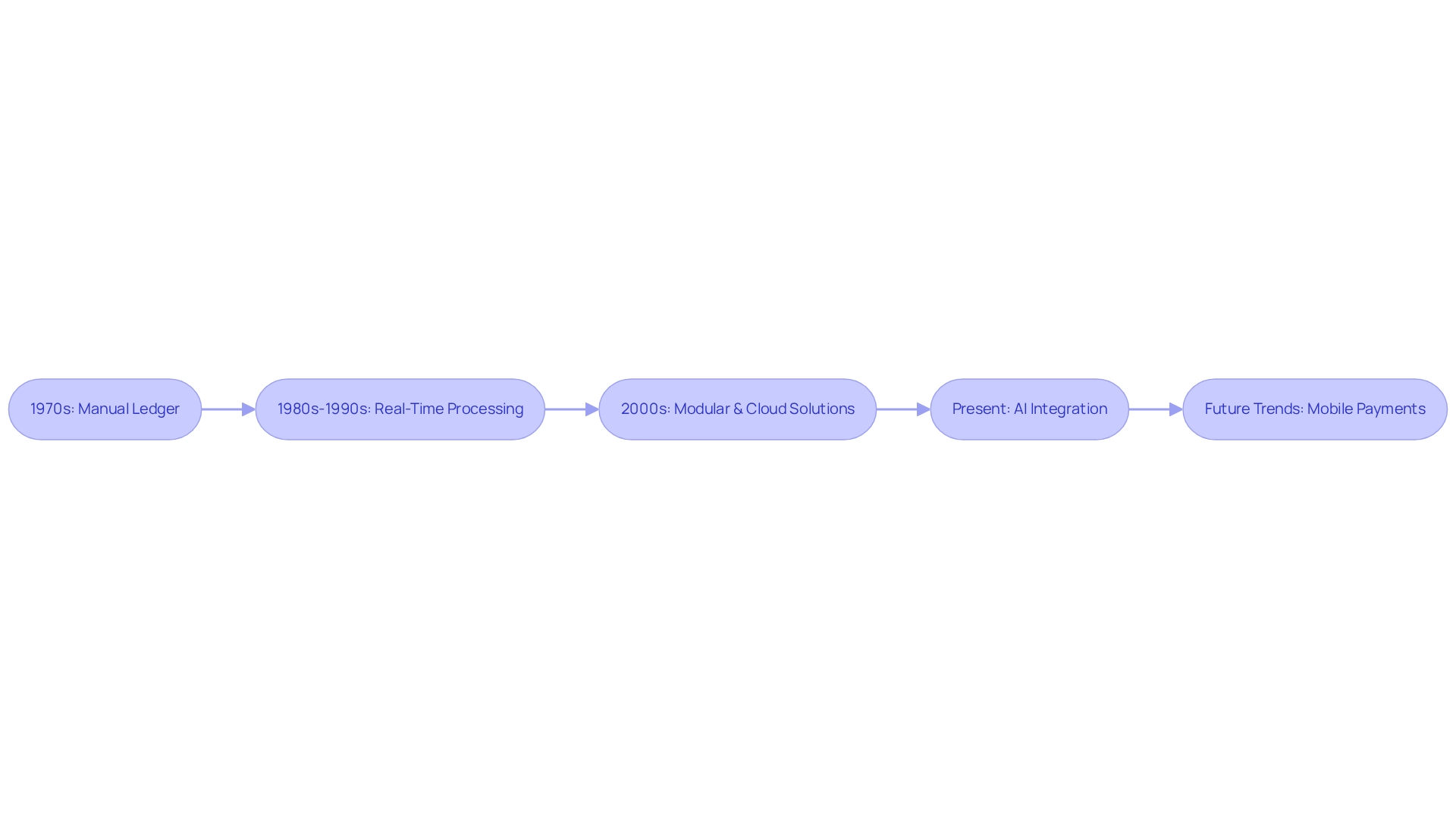

The evolution of what is core banking software represents a pivotal shift from manual ledger methods to automated processes, a transition that began in the 1970s. Initially, we relied on mainframe-oriented frameworks focused on fundamental transaction processing. However, the 1980s and 1990s ushered in advanced solutions that enabled real-time processing and multi-branch connectivity, essential for our expanding financial operations. As technology progressed, the 2000s marked a notable shift towards modular architectures and cloud-based solutions, allowing us to achieve greater scalability and flexibility in our operations, which raises the question of what is core banking software. Today, our foundational financial frameworks are increasingly integrated with digital financial platforms, leveraging artificial intelligence and machine learning to enhance customer experiences and operational efficiency. Generative AI has become a crucial tool in this integration, evidenced by a 60% increase in its application for customer experience, particularly in developing sophisticated chatbots and virtual assistants. This trend reflects a broader industry movement, as mobile payments gain traction, offering a convenient alternative to traditional financial methods. Furthermore, investment in essential financial systems is expected to yield returns within three years, underscoring the economic viability of modernizing these critical infrastructures.

Historical case studies from the 1980s and 1990s illustrate our gradual transition from manual to automated systems, highlighting the importance of security measures in data centers, such as temperature regulation and uninterruptible power supplies (UPS). These advancements not only enhanced our operational capabilities but also addressed the financial implications of over-reliance on technology, emphasizing the necessity for careful cost considerations and potential cost-sharing among banks to mitigate expenses. As noted by Gulnur Muradoglu, social factors play a significant role, particularly the state’s requirement to maintain job levels, which adds complexity to the development of essential financial software. Our commitment to simplifying complex integrations and providing cost-effective solutions exemplifies our ongoing pursuit of innovation and efficiency within the financial sector.

Key Features of Modern Core Banking Software: Components and Capabilities

Modern core banking software represents not just an upgrade; it is a transformative force that significantly enhances functionality and user experience. Real-time transaction processing stands out as a primary feature, enabling financial institutions to update customer accounts instantly, a necessity in today’s demand for immediate financial services. We recognize that security is paramount, and robust measures are implemented to safeguard sensitive data against breaches. This critical aspect is addressed by Avato’s Hybrid Integration Platform, which ensures compliance with stringent security protocols.

Furthermore, comprehensive reporting tools are essential for regulatory compliance, allowing banks to meet stringent requirements efficiently. API integrations have become the cornerstone of contemporary frameworks, facilitating seamless connectivity with third-party applications and services, thereby enhancing operational flexibility. Our platform simplifies complex integrations, maximizes the value of legacy technologies, and significantly reduces expenses—an essential strategy for financial institutions seeking to modernize without discarding existing assets.

Other vital capabilities include customer relationship management (CRM) functionalities that promote enhanced customer engagement and automated compliance reporting that streamlines adherence to regulatory standards. Moreover, support for digital financial channels is essential as it aligns with the transition towards a more client-focused financial experience.

Statistics indicate that by 2034, real-time payment solutions are expected to represent 68% of global market revenue. This highlights the urgency for institutions to embrace these technologies to remain competitive in a swiftly changing environment. As the financial landscape continues to evolve, integrating these key features—supported by Avato’s strategic implementation of hybrid integration platforms, including real-time monitoring and alerts on performance—will be vital for institutions aiming to enhance operational capabilities and maintain a competitive edge. As we prepare for open access, utilizing current frameworks through efficient integration strategies will be crucial for optimizing opportunities and ensuring adherence.

The Importance of Core Banking Software in Digital Transformation and Compliance

Understanding what is core banking software is indispensable for the digital transformation of financial institutions, enabling the modernization of operations and enhancing customer engagement. As we progressively adopt digital channels, these frameworks provide the robust infrastructure necessary to ensure services are available anytime and anywhere. Significantly, 70% of financial institutions are now embracing digital platforms that utilize what is core banking software, indicating a transition toward more agile financial practices.

Our hybrid integration platform plays a crucial role in this transformation by optimizing integration strategies that engage stakeholders effectively. By involving stakeholders from the outset to accurately gather requirements, we ensure that financial institutions can model their new business processes and activity flows, paving the way for successful implementation. This approach aligns with our FAQs, which explain how we assist financial institutions in navigating these complexities.

Adherence to regulatory requirements remains a top priority for financial institutions, and contemporary central financial platforms are equipped with advanced compliance features that streamline automated reporting and enhance risk management. For instance, a case study on financial institutions utilizing central financial frameworks for regulatory adherence revealed that these entities reported a 30% improvement in efficiency and a notable reduction in operational risks. This dual focus on innovation and adherence reinforces what is core banking software as a cornerstone of successful financial operations in the digital age.

Furthermore, what is core banking software plays a crucial role in digital transformation by mitigating risks associated with outdated frameworks, such as technical downtimes and vulnerabilities. Our commitment to future preparedness enables financial institutions to seamlessly integrate new tools with existing resources, enhancing adaptability and scalability.

Case studies illustrate that contemporary fundamental financial infrastructures, through modular designs, empower banks to respond swiftly to evolving market demands. As Arkadiusz Gruca observes, ‘The future of fundamental financial services appears encouraging,’ highlighting the continuous evolution of these frameworks in addressing both client needs and regulatory challenges.

With sustainability and ethical financial practices gaining traction among consumers, central software supports these initiatives by providing the necessary tools for transparency and accountability. In 2025, the integration of core banking systems, which exemplifies what is core banking software, will be pivotal in shaping the future landscape of banking, ensuring that institutions remain competitive and compliant.

Conclusion

The significance of core banking software in the financial services landscape cannot be overstated. These systems serve as the backbone for essential banking operations, facilitating everything from transaction processing to customer account management. As we embark on our digital transformation journeys, embracing modern core banking solutions becomes imperative in meeting consumer demands and enhancing operational efficiency.

The evolution of core banking software has been remarkable, transitioning from basic manual systems to sophisticated, cloud-based solutions. This evolution has not only improved operational capabilities but has also fostered greater flexibility and scalability, allowing us to adapt quickly to the ever-changing market landscape. The integration of advanced technologies, such as artificial intelligence and real-time analytics, further enhances the functionality of these systems, ultimately leading to improved customer experiences and service delivery.

Moreover, as regulatory demands increase, core banking software plays a critical role in ensuring compliance through automated reporting and risk management features. The shift towards open banking exemplifies the need for robust core systems that can seamlessly integrate with third-party solutions, fostering innovation and collaboration within the industry. By leveraging hybrid integration platforms, we can maximize our existing assets while preparing for the future.

In conclusion, the future of core banking software is bright, with its role in digital transformation and compliance at the forefront of our sector’s evolution. Institutions that prioritize modernization and embrace these advancements will be well-positioned to thrive in an increasingly competitive environment. The path forward is clear: investing in core banking solutions is not just a strategic choice, but a necessity for achieving operational excellence and delivering exceptional customer service in the digital age.