Overview

Legacy banking systems represent traditional financial infrastructures that rely on outdated technologies, resulting in operational inefficiencies and heightened risks. These systems significantly impede banks’ capacity to modernize, adapt to regulatory changes, and fulfill customer expectations. This situation underscores an urgent need for financial institutions to invest in modernization strategies.

By adopting advanced technologies such as AI and cloud solutions, banks can enhance their competitiveness and better serve their clients. Are you ready to take action and transform your banking operations? The time to modernize is now.

Introduction

In an era where technology evolves at an unprecedented pace, legacy banking systems represent a formidable barrier for financial institutions striving to remain competitive. These outdated platforms, often reliant on antiquated programming languages and hardware, not only hinder operational efficiency but also expose banks to significant security risks and compliance challenges. As customer expectations shift towards real-time, personalized services, the urgency for modernization becomes increasingly critical. With approximately 70% of banks still dependent on these legacy systems, the potential for operational failures and increased costs looms large.

However, the integration of modern technologies such as artificial intelligence and cloud solutions offers a beacon of hope, promising to streamline operations and enhance customer experiences. This article delves into the pressing need for banks to transition from legacy systems, exploring the myriad challenges they face and the innovative strategies that can pave the way for a more agile and responsive banking landscape.

Defining Legacy Banking Systems: An Overview

The legacy banking system comprises traditional financial platforms characterized by outdated technology structures still in use by financial institutions, despite their obsolescence. These frameworks often rely on older programming languages, databases, and hardware, resulting in inflexibility and challenges in integrating with modern technologies. They primarily facilitate core banking functions, including account management, transaction processing, and compliance reporting.

Understanding outdated frameworks is crucial, as they underpin numerous financial organizations, yet they present significant challenges in today’s rapidly evolving digital landscape. A staggering 70% of banks are still reliant on the legacy banking system as of 2025, underscoring the urgent need for modernization.

The repercussions of outdated technology in banking are substantial. Organizations that cling to these legacy frameworks frequently face heightened operational costs, reduced flexibility, and increased risks of security breaches. For example, a recent case study revealed that financial institutions utilizing the legacy banking system encountered a 30% higher rate of operational failures compared to those that embraced modern solutions.

Conversely, the integration of generative AI tools has been shown to boost operational efficiency, with over 60% of financial services professionals reporting marked improvements in their processes.

Current trends indicate a shift in the financial services landscape, with fintech firms offering modular, API-driven solutions that enable traditional institutions to enhance their capabilities without necessitating complete infrastructure overhauls. This strategy allows banks to modernize their operations incrementally while minimizing disruption. Additionally, the NVIDIA 2025 survey reveals that nearly 70% of firms reported at least a 5% revenue increase attributable to AI implementations, highlighting AI’s potential to drive significant business outcomes.

Insights from industry professionals emphasize the importance of understanding traditional financial networks. A recent report states, “Statistics provide the compass that guides strategic decision-making in digital banking. Banks that effectively harness and interpret data gain a significant competitive advantage in customer acquisition, retention, and service optimization.”

This understanding highlights the necessity for financial institutions to not only recognize the limitations of their legacy banking systems but also to invest in skills and culture that facilitate a successful transition to contemporary technologies.

Moreover, the World Economic Forum has pointed out a global shortage of experts skilled in both traditional frameworks and modern FinTech architectures, further complicating modernization efforts for many financial institutions. As digital-only financial services continue to grow—evidenced by a 23% year-over-year increase in users—traditional institutions must adapt to remain competitive and relevant within the financial ecosystem. Investing in talent and culture is essential for AI adoption, which includes upskilling current employees and recruiting AI specialists necessary for banks transitioning from outdated infrastructures to contemporary technologies.

Avato’s hybrid integration platform can play a pivotal role in this transformation, simplifying complex integrations and providing cost-effective solutions that enhance operational visibility and issue resolution. With Arvato, financial institutions can effectively address the challenges posed by outdated frameworks and position themselves for success in the AI-driven future of finance. Don’t wait!

Connect with Arvato today to explore how we can help you thrive in the evolving financial landscape.

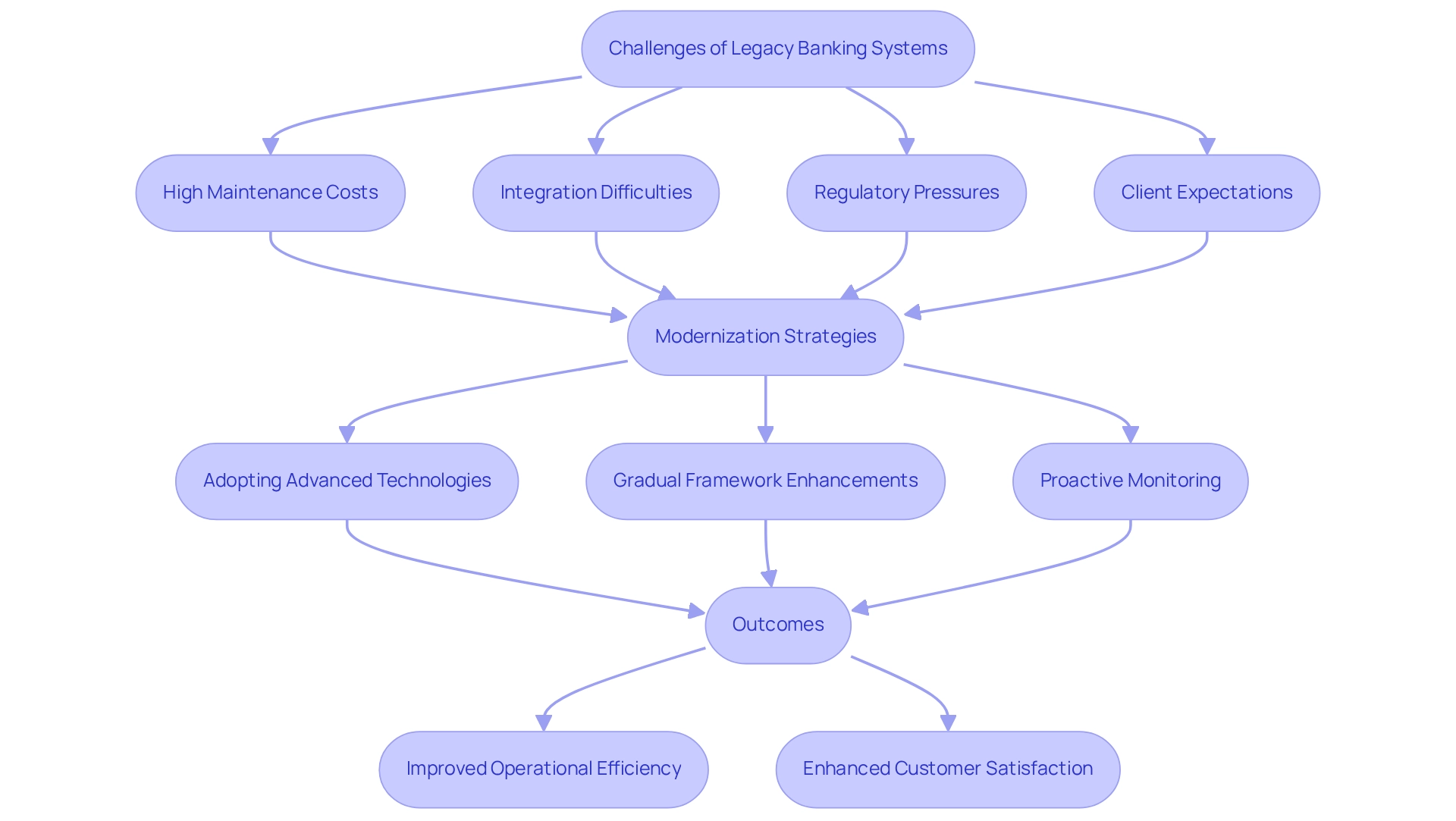

The Need for Modernization: Challenges Faced by Legacy Banking Systems

The legacy banking system faces a multitude of challenges that significantly hinder operational efficiency and stifle innovation. One of the most pressing issues is the elevated maintenance expenses associated with these outdated technologies, which can consume up to 80% of a financial institution’s IT budget. This financial strain is exacerbated by the difficulty of integrating antiquated infrastructures with modern technologies, resulting in silos that obstruct data flow and agility.

As client expectations shift towards immediate services and personalized experiences, financial institutions that cling to the legacy banking system find themselves at a competitive disadvantage. The inability to swiftly scale operations in response to market demands further compounds this problem. Moreover, regulatory pressures continue to mount, necessitating more agile and responsive systems that can adapt to evolving compliance requirements.

A recent study reveals that 70% of financial institutions acknowledge the necessity for modernization to remain competitive and compliant in today’s fast-paced financial landscape.

Examples of financial institutions successfully navigating these challenges highlight the potential benefits of modernization. Organizations that have adopted gradual strategies for enhancing their frameworks report significant improvements in operational efficiency and customer satisfaction. This approach mitigates the risks associated with the high-stakes big-bang method of modernization, enabling smoother transitions.

These institutions leverage advanced technologies, including generative AI, to provide real-time monitoring and maintenance insights, facilitating proactive issue resolution and ensuring reliability. As Tony Leblanc from the Provincial Health Services Authority states, “Avato speeds up the integration of isolated networks and fragmented information, providing the connected basis enterprises require to simplify, standardize, and modernize.”

To effectively engage with Avato’s solutions, stakeholders must accurately mobilize requirements, employ the right technology to illustrate current and ideal states, and model new business processes for successful outcomes. Expert insights underscore the urgency of addressing these modernization challenges. Banking experts emphasize that without a strategic approach to modernizing the legacy banking system, banks risk falling behind in an increasingly digital environment.

The call for modernization is not merely a trend; it is a critical component of survival in the competitive financial sector. Case studies from organizations such as OSME Pacific and BC Provincial Health Services Authority illustrate how effective integration solutions can streamline complex projects, delivering results within desired time frames and budget constraints. These testimonials underscore the transformative impact of updating traditional financial infrastructures, paving the way for enhanced operational capabilities and improved customer experiences.

Furthermore, Avato’s reliable, future-proof technology stack is essential for helping businesses adapt to evolving demands, reinforcing the significance of robust integration platforms in the modernization process.

Technological Limitations: Risks and Challenges of Legacy Systems

The legacy banking system is fundamentally built on outdated technologies, lacking the flexibility and scalability essential for modern banking operations. Typically characterized by monolithic architectures, these systems pose significant challenges in implementing changes and integrating new applications. This rigidity not only stifles innovation but also introduces substantial risks, including security vulnerabilities, data integrity issues, and compliance challenges.

As cyber threats evolve in complexity, the outdated security protocols inherent in older infrastructures leave financial institutions vulnerable to potential breaches. Recent studies reveal that nearly 60% of financial institutions have encountered security incidents directly linked to their legacy banking systems. These vulnerabilities can manifest in various forms, such as inadequate encryption protocols, unpatched software, and insufficient access controls, all of which jeopardize sensitive customer data and may result in regulatory penalties.

Industry experts emphasize the urgency of addressing these risks. Leaders in the field assert that without modernizing their infrastructure, financial institutions will struggle to meet compliance requirements and defend against emerging threats. Gustavo Estrada, a customer, remarked, “Avato has simplified complex projects and delivered results within desired time frames and budget constraints,” underscoring the effectiveness of contemporary solutions in overcoming these challenges.

A case study titled ‘Legacy Banking System as a Barrier to Innovation’ demonstrates how financial institutions face obstacles such as data silos and limited scalability, hindering their ability to leverage advanced technologies like generative AI. To fully capitalize on AI’s potential, banks must upgrade their frameworks by establishing unified data lakes, implementing hybrid architectures, and utilizing APIs to facilitate seamless data flow and interoperability.

The risks associated with outdated financial technologies are more pronounced than ever. Financial institutions must prioritize updating their aging frameworks to mitigate security weaknesses and enhance operational resilience. By doing so, they can not only safeguard their assets but also position themselves to thrive in an increasingly competitive landscape.

Furthermore, Avato’s Hybrid Integration Platform provides real-time monitoring and maintenance insights, enabling teams to proactively address issues and ensure reliability—an essential component of contemporary financial operations. This platform not only enhances and prolongs the value of outdated technologies but also streamlines complex integrations, significantly reducing costs and accelerating the connection of isolated legacy systems.

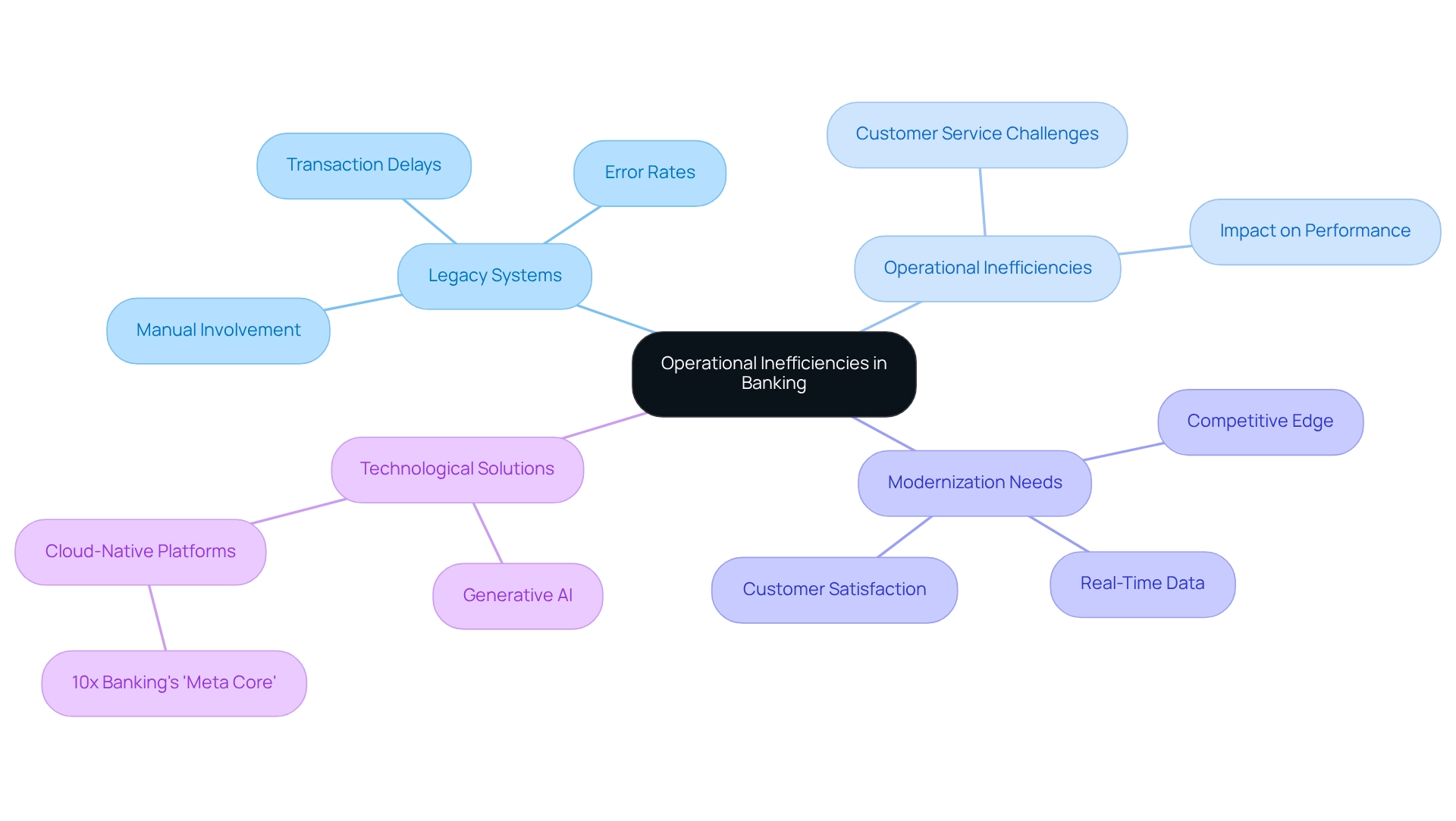

Operational Inefficiencies: How Legacy Systems Affect Banking Performance

Operational inefficiencies arising from the legacy banking system can significantly impact a bank’s overall performance. These outdated frameworks often necessitate extensive manual involvement, which not only delays transaction processing times but also increases the likelihood of errors. A staggering 69% of banking professionals identify perceived risks associated with migrating to newer technologies as a major barrier to deploying next-generation solutions, further entrenching these inefficiencies.

The legacy banking system’s inability to provide real-time data severely hinders decision-making and customer service capabilities. Financial institutions frequently struggle to deliver prompt responses to client inquiries or execute transactions swiftly, resulting in diminished customer satisfaction and loyalty. As competition from FinTech firms intensifies, the urgency for financial institutions to modernize their operations within the legacy banking system becomes increasingly critical.

Expert insights underscore that operational inefficiencies can also impede strategic agility. Lee Vanderpool, a chief accounting officer, asserts that “extracting key insights from data fuels competitive advantage and enables agility in decision-making.” This emphasizes the necessity for financial institutions to transition from the legacy banking system to more flexible, data-oriented platforms.

Case studies demonstrate the tangible benefits of modernization. For instance, 10x Banking’s introduction of the ‘meta core’ cloud-native platform aims to provide financial institutions the flexibility to launch innovative products and tailored services quickly and at scale. Such advanced solutions are designed to address the challenges posed by the legacy banking system, allowing financial institutions to evolve without the risks and trade-offs typically associated with outdated technologies.

Moreover, generative AI can play a pivotal role in summarizing documentation for non-experts, offering strategic applications that unlock value for organizations in their modernization initiatives. This technology can assist financial institutions in navigating the challenges of transitioning from outdated infrastructures, enhancing customer experience and operational effectiveness. Notably, there has been a 60% increase in the use of generative AI for customer experience, underscoring its growing significance in the financial sector.

In summary, the impact of the legacy banking system on transaction processing durations and overall banking performance is substantial. As financial institutions strive to enhance operational efficiency and remain competitive, updating processes within the legacy banking system is not merely advantageous but essential. Avato’s reliable, future-ready technology stack, designed for secure transactions and integration, can facilitate this transition by mobilizing stakeholders, modeling new business processes, and ensuring that financial institutions can adapt to evolving demands and maintain a competitive edge.

Regulatory Compliance: Navigating Challenges with Legacy Systems

Traditional financial infrastructures often struggle to adapt to the rapidly evolving regulatory landscape imposed by financial regulators. These outdated frameworks frequently lack the essential functionalities for automated compliance monitoring, impeding financial institutions’ ability to efficiently respond to new regulations. As a result, these institutions face increased risks of non-compliance, which can lead to severe financial penalties and reputational damage.

In fact, the average penalties for non-compliance in the financial sector are projected to rise in 2025, underscoring the urgency for institutions to address these vulnerabilities.

The intricate characteristics of legacy technologies further complicate financial audits and reporting processes, making it increasingly difficult for institutions to demonstrate compliance. However, Avato’s hybrid integration platform presents a transformative solution. By simplifying complex integrations and offering cost-effective solutions, Avato empowers financial organizations to enhance their operations effectively.

A case study on Core Banking Platforms (CBPs) exemplifies how modern solutions can mitigate these challenges by providing low maintenance costs and scalability, enabling financial institutions to swiftly adapt to regulatory demands.

As the monolithic structure of the legacy banking system necessitates comprehensive updates to introduce new functionalities, banks often face extended product launch timelines, hindering their responsiveness to consumer needs. Avato’s expertise in hybrid integration accelerates secure system integration across financial, healthcare, and government sectors, ensuring institutions can adapt promptly to changing market conditions.

Expert insights underscore the critical risks associated with non-compliance in banking. Val Srinivas, a Senior Research Leader in Banking & Capital Markets, emphasizes that failing to adjust to regulatory changes not only exposes financial institutions to penalties but also jeopardizes their operational integrity. Data indicates that approximately 30% of financial institutions operating within the legacy banking system have faced penalties due to non-compliance with outdated frameworks, highlighting the urgent need for modernization.

Thus, investing in advanced integration solutions such as those offered by Avato is essential for financial institutions aiming to enhance their compliance capabilities, reduce costs, and improve customer satisfaction while mitigating risks associated with obsolete platforms.

“Avato has been a game changer for us. Their integration solutions have streamlined our processes and significantly reduced our compliance risks,” states Tony LeBlanc from the Provincial Health Services Authority.

For potential clients considering engagement with Avato, common inquiries include:

- How can we mobilize stakeholders to ensure requirements are accurately captured from the outset?

- What technology and tools are necessary to effectively illustrate our current and ideal states?

- How can we prepare our infrastructure to integrate new tools with existing resources?

Investing in Avato’s hybrid integration platform not only addresses these concerns but also positions banks to thrive in a complex regulatory environment.

Leveraging Modern Technologies: AI and Cloud Solutions for Transformation

Contemporary technologies, particularly artificial intelligence (AI) and cloud computing, present substantial opportunities for transforming traditional financial infrastructures. Avato’s Hybrid Integration Platform is engineered to maximize and extend the value of legacy banking systems, simplifying complex integrations and significantly reducing costs. AI enhances operational efficiency by automating routine tasks, improving customer service through advanced chatbots, and enabling predictive analytics that facilitate informed decision-making.

Consider this: a notable 21% of organizations have redesigned workflows due to the deployment of generative AI, underscoring its impact on operational processes. As Gustavo Estrada, a customer, remarked, “Avato has simplified complex projects and delivered results within desired time frames and budget constraints,” which highlights the tangible benefits of these technologies in banking.

Furthermore, cloud solutions amplify this transformation by providing the scalability and flexibility necessary for adapting to evolving market demands. By migrating to cloud-based platforms, financial institutions can significantly diminish their reliance on legacy banking systems, streamline operations, and enhance their capacity for innovation. This transition is particularly vital for financial institutions striving to maintain competitiveness in a rapidly changing economic landscape.

Avato’s dependable technology stack, designed for secure transactions and trusted by banks, healthcare, and government entities, plays a pivotal role in this process, aiding businesses in adapting to changing demands and sustaining a competitive edge.

Moreover, Avato’s platform offers real-time monitoring and alerts on system performance, ensuring organizations can proactively address issues and optimize their operations. Current trends reveal that C-level executives are increasingly leveraging generative AI, with 53% reporting regular usage at work, emphasizing the technology’s growing importance across various financial functions. As banks adopt these modern technologies, they not only enhance operational capabilities but also position themselves to effectively tackle future challenges, ensuring sustained growth and relevance in the industry.

Best Practices for Modernizing Legacy Banking Systems

To effectively modernize outdated banking infrastructures, financial institutions must implement a phased strategy that strategically targets key areas for improvement. The initial step involves conducting a thorough evaluation of existing frameworks to identify inefficiencies and challenges. This foundational assessment allows institutions to prioritize upgrades effectively, aligning with their strategic objectives and the evolving needs of their clients.

Utilizing modular architectures is crucial for fostering gradual improvements, enabling financial institutions to integrate new technologies without overwhelming their operations. Additionally, investing in staff training is imperative, equipping employees with the skills necessary to navigate and manage these new processes efficiently. Essential strategies for staff training and change management will prepare teams for the transition, minimizing resistance and maximizing adoption.

Furthermore, collaboration with fintech firms can provide financial institutions access to innovative solutions that enhance operational capabilities. Such partnerships can streamline fragmented customer journeys, significantly reducing friction and reallocating resources towards differentiation and digital sales growth. As Gustavo Estrada, a customer of Avato, noted, “Avato has simplified complex projects and delivered results within desired time frames and budget constraints,” underscoring the advantages of modernization.

Statistics reveal that outdated technologies often lead to sluggish performance, adversely affecting employee productivity. Therefore, adopting a phased modernization strategy not only mitigates disruption but also aligns with the organization’s strategic goals. Successful case studies, particularly those focusing on regulatory compliance during modernization, illustrate that proactive compliance strategies—including regular audits and staff training—are vital for maintaining regulatory standards throughout modernization efforts.

By adhering to these best practices, financial institutions can navigate the challenges of upgrading their legacy banking systems and position themselves for future success. Moreover, banks should evaluate whether a revolutionary or evolutionary approach to modernization best fits their specific needs and resources, tailoring their strategies accordingly. Harnessing generative AI can further elevate customer experience and operational efficiency, transforming trading, customer engagement, and security through advanced integration solutions.

In addition, engaging stakeholders to accurately collect requirements and designing new business processes are essential measures for ensuring a successful transition to updated frameworks.

The Future of Banking: Innovations and Trends in Legacy System Modernization

The financial landscape stands on the cusp of a significant transformation as institutions increasingly embrace innovative strategies to modernize their legacy banking systems. A pivotal trend is the rise of open banking, fostering interoperability among financial services. This shift allows for seamless data sharing and enhances customer experiences, meeting evolving consumer expectations while aligning with regulatory demands for transparency and competition.

In parallel, the adoption of blockchain technology is gaining momentum, providing a secure framework for transactions that enhances trust and efficiency. As financial institutions explore these innovations, the integration of artificial intelligence (AI) and machine learning is set to revolutionize service delivery. Generative AI, in particular, has emerged as a powerful tool, evidenced by a 60% increase in its use for customer experience, especially in developing sophisticated chatbots and virtual assistants. These technologies empower financial institutions to offer tailored financial solutions, enhance risk management, and optimize operations, ultimately boosting customer satisfaction.

Looking towards 2025, financial institutions are anticipated to face a challenging environment characterized by sluggish economic growth and rising consumer debt. In this context, the urgency for modernizing legacy banking systems becomes even more pronounced. Statistics indicate that in 2024, 15 out of 26 large European financial institutions will encounter cost increases surpassing revenue growth, underscoring the necessity for efficient cost management and innovative service delivery.

Furthermore, European banks are under heightened pressure to manage costs and are committing to stronger cost discipline as they approach 2025. As banks strive to cultivate stronger relationships with clients, substantial investments in technology will be essential to provide tailored services. Avato’s hybrid integration platform plays a crucial role in this transformation, facilitating secure system integration across financial services, healthcare, and government sectors. With support for 12 levels of interface maturity and a commitment to 24/7 uptime, Avato ensures that enterprises can simplify, standardize, and modernize their operations without room for defects or outages.

This transition from generic solutions to more personalized financial guidance reflects a broader trend towards customization in the financial sector. As Vikram, Vice Chair and US Financial Services Industry Leader at Deloitte, observes, financial institutions must adapt their strategies to sustain growth amidst these challenges.

In summary, the future of modernization in finance hinges on the successful integration of open banking, blockchain, and AI technologies. By embracing these innovations, particularly through solutions like Avato’s, banks can enhance their operational capabilities and secure their position in an increasingly competitive financial landscape.

Conclusion

The pressing need for banks to modernize legacy systems is undeniable. Financial institutions are grappling with outdated technologies that hinder operational efficiency, expose them to security risks, and impede compliance. The urgency for transformation is evident, especially considering that approximately 70% of banks still rely on these antiquated systems. This reliance leads to increased operational costs and diminished customer satisfaction as they struggle to keep pace with evolving market demands.

Modern technologies, such as artificial intelligence and cloud computing, present promising pathways to overcome these challenges. By adopting a phased modernization approach, banks can leverage modular architectures and innovative solutions to enhance their capabilities while minimizing disruption. Successful case studies illustrate that integrating generative AI and cloud solutions not only streamlines operations but also significantly improves customer experiences, enabling banks to remain competitive in a rapidly evolving landscape.

Looking ahead, the future of banking hinges on embracing innovations like open banking, blockchain, and AI. These technologies are poised to redefine service delivery and customer engagement, allowing banks to provide personalized financial solutions that cater to today’s consumers. As institutions invest in modern integration platforms, such as Avato’s, they position themselves not just to survive but to thrive in an increasingly complex financial ecosystem. The time for action is now; modernizing legacy systems is essential for banks to secure their future and enhance their operational resilience.