Overview

Integration technology in banking is not just beneficial; it is essential for facilitating seamless communication between disparate applications and enhancing operational efficiency. This ultimately leads to improved customer experiences.

We recognize the challenges financial institutions face in today’s fast-paced environment. Key components such as:

- APIs

- Cloud solutions

enable real-time data exchange and interoperability, allowing us to optimize our operations and adapt to market demands effectively. By leveraging these technologies, we can transform potential friction into streamlined processes, ensuring that our clients remain competitive and responsive.

What’s holding your team back from embracing this change? We invite you to explore how integration technology can elevate your operations and drive success in an ever-evolving landscape.

Introduction

In today’s rapidly evolving banking landscape, digital transformation is not just a trend; it is a necessity. Integration technology stands as a pivotal force, driving efficiency and enhancing customer experiences. We empower financial institutions to seamlessly connect disparate applications and data sources, enabling real-time data exchange and improved operational agility.

With the advent of cloud computing and advanced integration solutions, we are not only optimizing our legacy systems but also positioning ourselves to respond swiftly to the ever-changing market demands.

As we navigate increasing competition and rising customer expectations, understanding the critical components and real-world applications of integration technology is essential for maintaining our competitive edge in this dynamic environment.

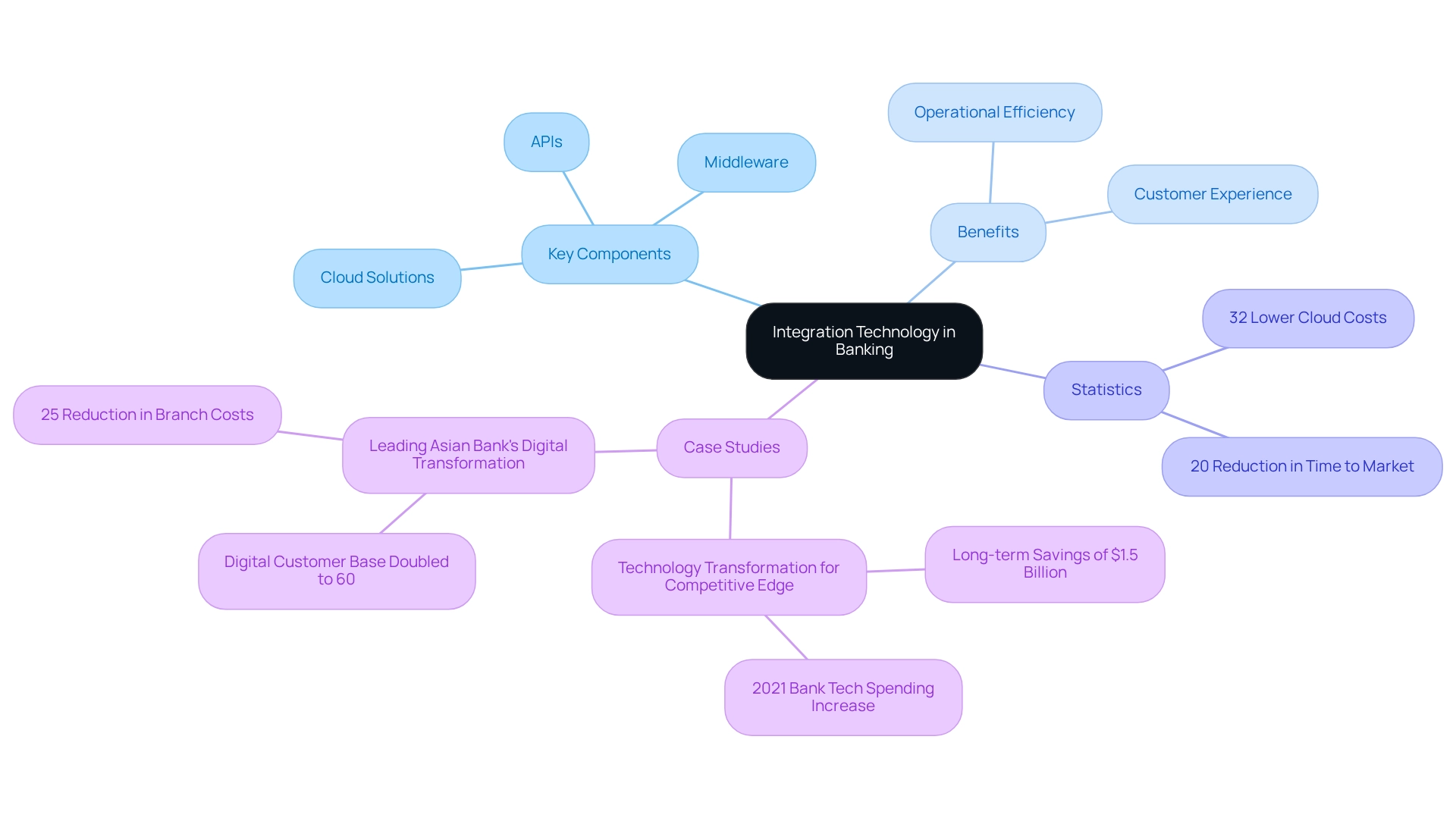

Define Integration Technology in Banking

Integration tech in banking serves as the backbone of seamless communication between disparate banking applications and data sources. This innovation is crucial for modern financial institutions, as it consolidates various services, enhances operational efficiency, and elevates customer experiences. Our dedicated hybrid unification platform plays a pivotal role in this landscape by maximizing and extending the value of legacy systems, simplifying complex connections, and significantly reducing costs. By merging legacy systems with modern solutions, we enable financial institutions to optimize operations and provide a unified service offering to clients.

Key components of integration tech—APIs, middleware, and cloud-based solutions—facilitate real-time data exchange and interoperability across various financial platforms. Our platform also provides real-time monitoring and notifications on system performance, ensuring that financial institutions maintain optimal operational efficiency.

Recent statistics underscore the strategic importance of cloud adoption in banking; institutions with mature financial operations (FinOps) capabilities report 32% lower cloud costs compared to their peers. A notable case study from 2021 illustrates this trend: one of the world’s largest financial institutions increased its tech spending by over 10% to accelerate its transformation, aiming to transition over 70% of its applications to the cloud. This initiative is projected to yield long-term savings of $1.5 billion and a 20% reduction in time to market for new products. Furthermore, a leading Asian bank’s digital transformation resulted in a doubling of its digital customer base to 60%, along with a 25% reduction in branch and contact center costs. These examples highlight the essential function of integration tech, particularly our hybrid platform, in enhancing operational efficiency and sustaining competitiveness in the rapidly evolving banking environment.

As Steven Alexopoulos noted, “This method leads to investments being distributed too broadly, rather than being concentrated in a few key areas of emphasis,” emphasizing the necessity for targeted funding in unifying systems. Therefore, cloud adoption is not merely advantageous; it is a strategic necessity for financial institutions striving to remain competitive in the digital era.

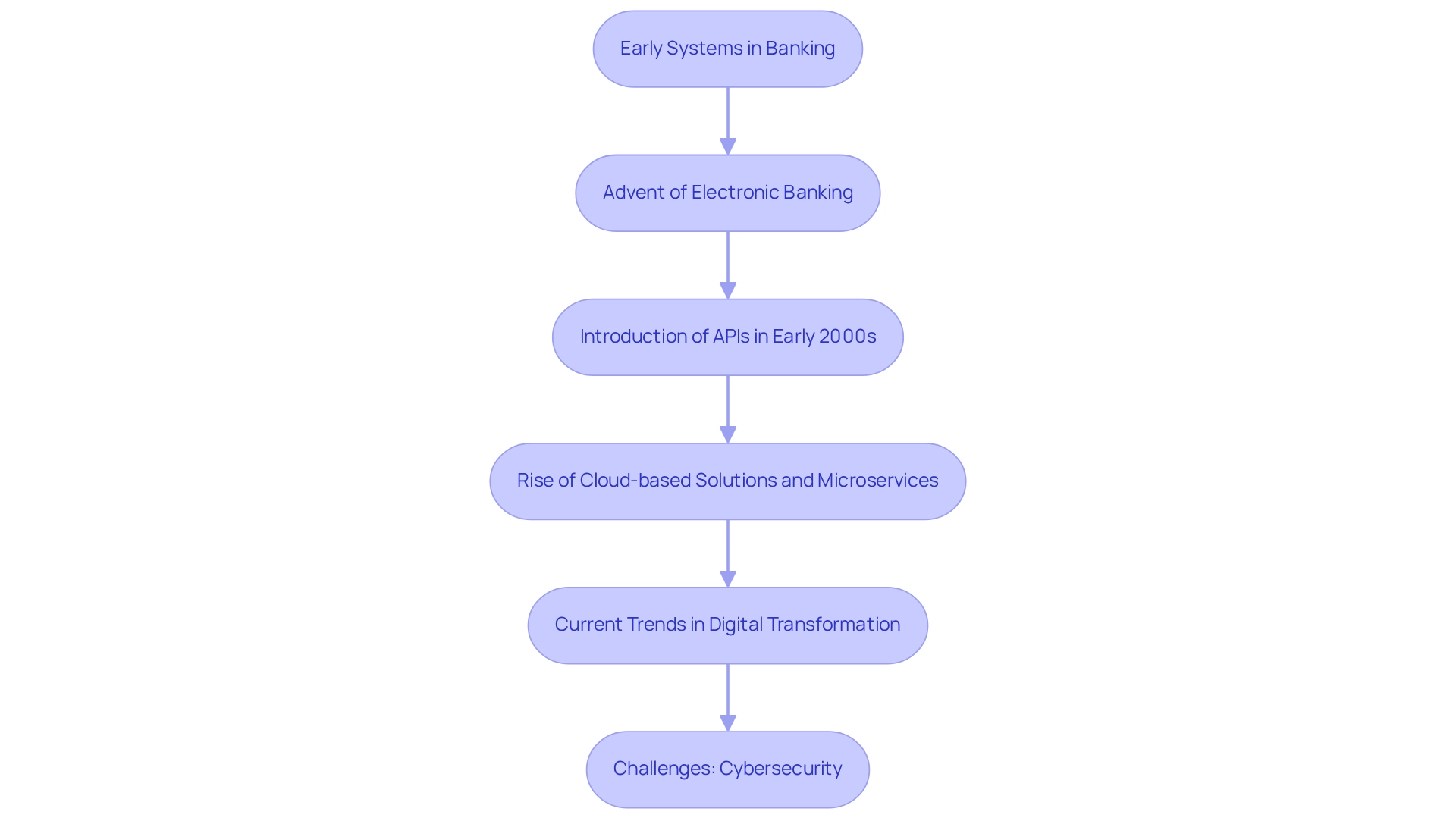

Explore the Evolution of Integration Technology

The evolution of merging systems in banking has been significantly influenced by the advent of electronic banking, which established fundamental systems for enabling transactions. As client expectations have escalated and technological advancements have emerged, we have seen financial institutions progressively adopt more sophisticated integration tech solutions.

A pivotal moment occurred in the early 2000s with the introduction of APIs, which provided flexible and scalable connection options. This transformation has empowered financial institutions to broaden their service offerings and enhance operational efficiency with the use of integration tech. By 2023, an impressive 70% of SMEs reported utilizing digital financial services, underscoring the growing reliance on advanced connection systems.

Today, the landscape has evolved further with the emergence of integration tech like cloud-based solutions and microservices architectures, allowing financial institutions to deploy new services rapidly and adapt to changing market demands. This progression reflects a broader trend towards digital transformation within the financial sector, where integration tech, agility, and customer focus are essential for maintaining a competitive edge.

Recent innovations in financial solutions have also underscored the critical importance of cybersecurity, with advancements such as quantum cryptography becoming vital for safeguarding sensitive financial data. As Jamie Dimon aptly stated, the future belongs to those who master technology, emphasizing the need for banks to embrace these innovations.

Moreover, Avato’s Hybrid Integration Platform illustrates how organizations can adeptly navigate these advancements. It enhances the value of legacy systems, streamlines complex connections, ensures real-time monitoring and notifications regarding system performance, and guarantees continuous uptime and reliability, particularly in sectors like finance, healthcare, and government.

Through practical applications, including successful collaboration projects with financial institutions, we demonstrate our ability to expedite digital transformation and improve operational efficiencies, ultimately leading to cost reductions and enhanced customer satisfaction.

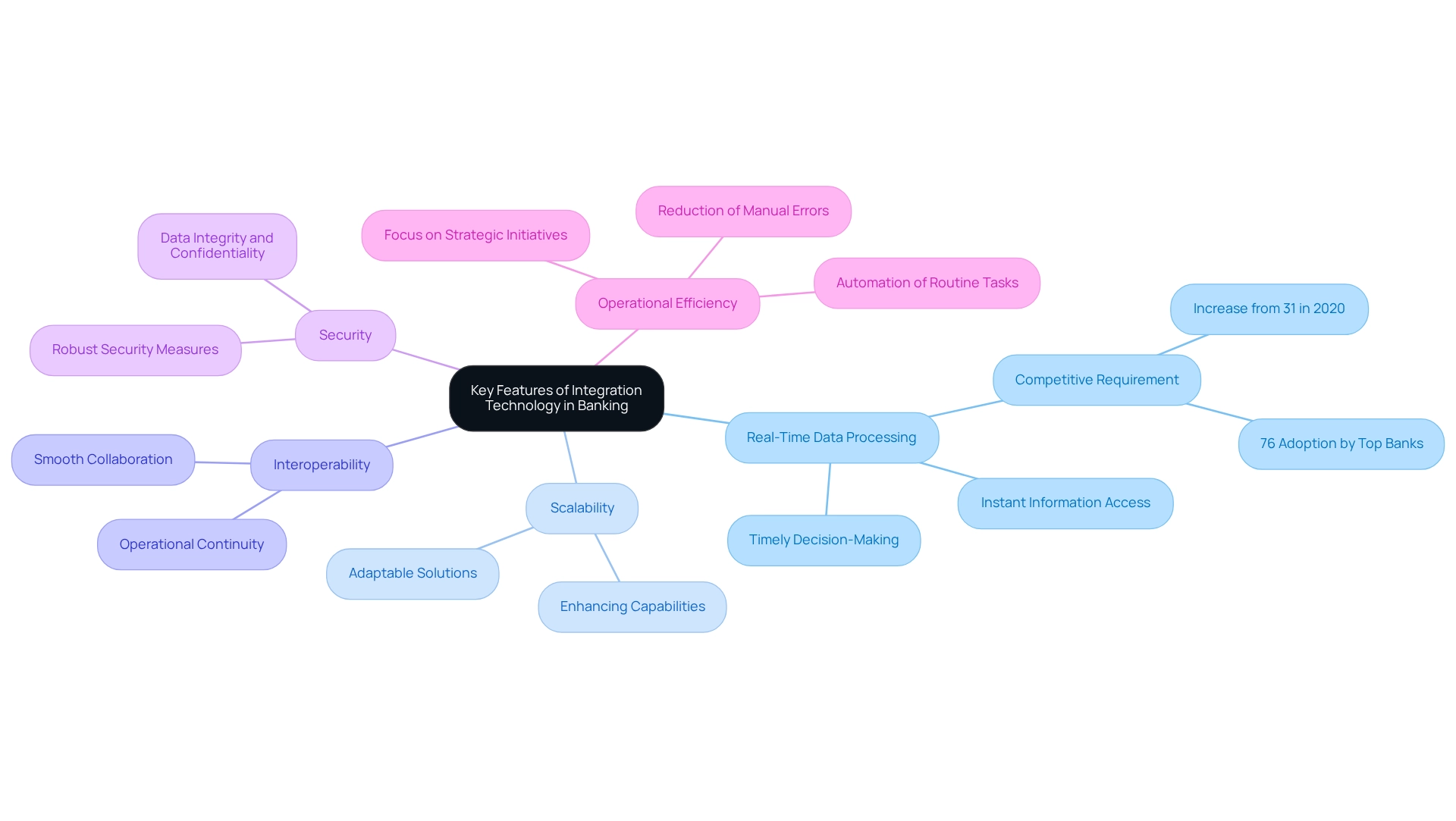

Identify Key Features of Integration Technology

Key features of integration tech in banking are essential for enhancing operational efficiency and customer service. We recognize that in today’s competitive landscape, real-time data processing is not just an advantage—it’s a necessity. This capability allows us to access information instantly across various systems, enabling timely decision-making and significantly enhancing customer service. The significance of real-time data processing has turned into a competitive requirement, as evidenced by the fact that 76% of the world’s top 100 financial institutions are now adopting edge computing solutions, a considerable rise from 31% in 2020.

Furthermore, scalability is a critical aspect of integration tech solutions. We must ensure these solutions are adaptable, allowing us to enhance our capabilities effortlessly as we develop or as new innovations arise. This adaptability is crucial in a rapidly evolving financial landscape.

In addition, interoperability is vital. Efficient integration tech guarantees that varied systems and applications can collaborate smoothly, irrespective of their foundational technologies. This feature is essential for maintaining operational continuity and enhancing service delivery.

Security cannot be overlooked. Robust security measures are integral to protecting sensitive financial data during transmission and storage. As we increasingly depend on digital solutions, ensuring data integrity and confidentiality is crucial. Moreover, integration tech plays a crucial role. By automating routine tasks, integration methods reduce manual errors and enhance operational efficiency. This optimization of processes enables us to concentrate on strategic initiatives instead of daily operations.

Collectively, these features empower us to provide exceptional services while complying with regulatory standards, ultimately positioning us for success in a competitive market. What’s holding your team back from leveraging these transformative technologies?

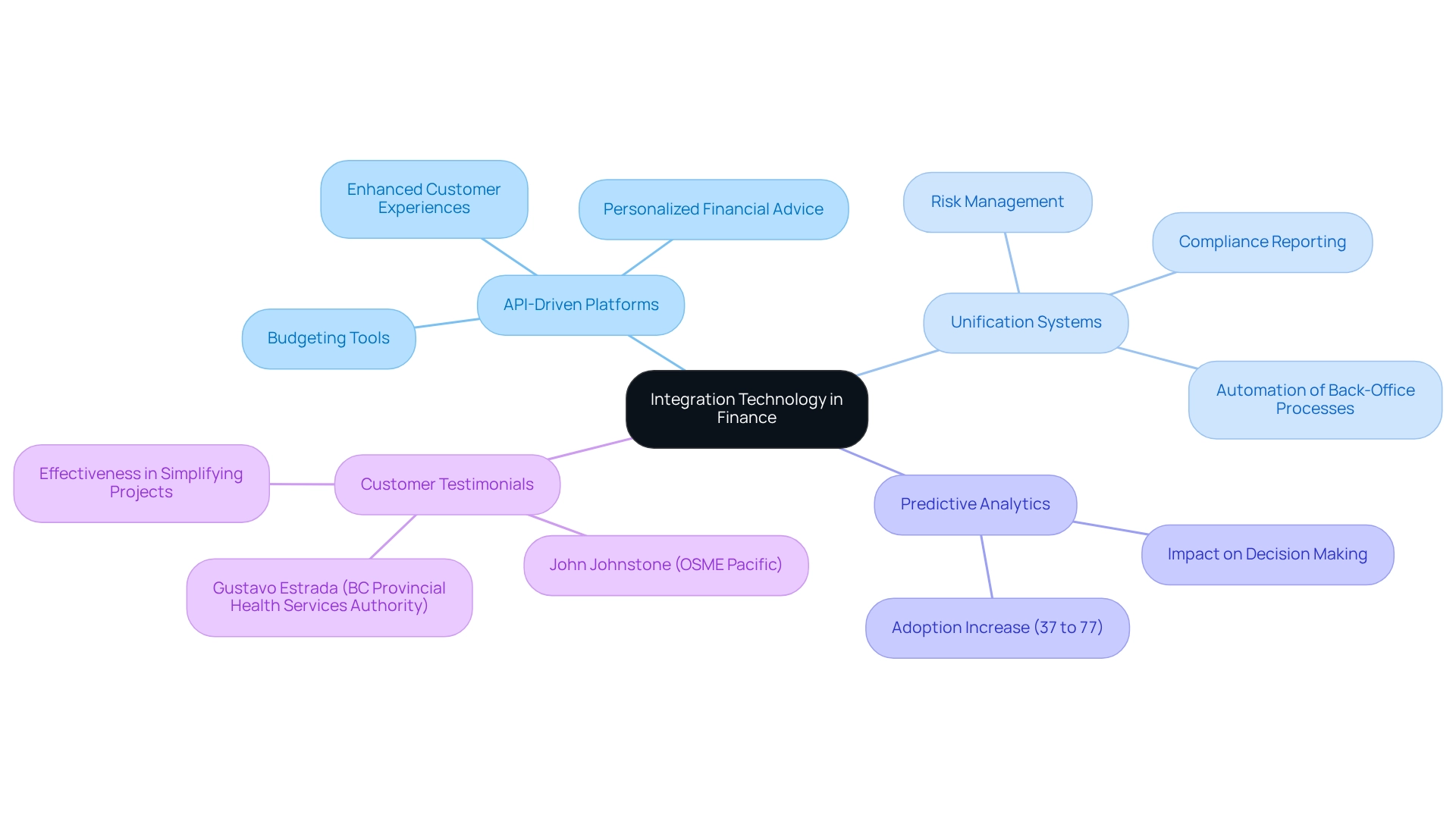

Examine Real-World Applications in Banking

Integration tech in finance is transforming the landscape of our industry. A notable trend is the adoption of API-driven platforms, which empower us and third-party developers to create applications that enhance customer experiences, such as budgeting tools and personalized financial advice. These platforms facilitate seamless interactions between financial institutions and external services, thereby improving user engagement and satisfaction.

Furthermore, unification systems play a crucial role in refining our back-office processes. For instance, they automate compliance reporting and risk management, significantly reducing manual effort and increasing accuracy. A prime illustration is the integration tech of core financial systems with customer relationship management (CRM) tools, enabling us to provide personalized services based on comprehensive customer data. The COVID-19 pandemic underscored the importance of unified systems. We quickly adapted our services to meet the surge in demand for digital solutions, highlighting the essential role these systems play in maintaining business continuity and ensuring customer satisfaction.

As we progressively adopt predictive analytics—rising from 37% to 77% in just five years—it becomes clear that unification technology is not merely a trend but a fundamental component for future growth and competitiveness in the financial services sector. Our hybrid unification platform exemplifies this trend, accelerating secure system connectivity for banking, healthcare, and government, and delivering a robust foundation for digital transformation initiatives.

Customer testimonials from John Johnstone of OSME Pacific and Gustavo Estrada of BC Provincial Health Services Authority reinforce our effectiveness in simplifying complex projects and delivering results within desired time frames and budget constraints. This highlights our commitment to leveraging integration tech to anticipate and meet evolving customer needs, ultimately helping us maintain a competitive edge in our respective industries.

Conclusion

The integration of technology within the banking sector is not merely a trend; it is a critical component of our operational success and customer satisfaction. By consolidating disparate applications and data sources, we can enhance efficiency and deliver superior service offerings. Key features such as real-time data processing, scalability, interoperability, security, and automation enable us to navigate the complexities of a digital landscape while maintaining compliance and operational continuity.

The evolution of integration technology has been marked by significant advancements, particularly with the rise of APIs and cloud-based solutions, which empower us to respond swiftly to market demands. Real-world applications demonstrate the transformative power of these technologies, as seen in the successful integration of core banking systems with CRM tools and the rapid adaptation to digital banking needs during the COVID-19 pandemic. The case studies highlighted underscore the strategic imperative for us to invest in integration technology to remain competitive and relevant.

Ultimately, as the banking landscape continues to evolve, embracing integration technology will be essential for financial institutions like ours aiming to thrive. The ability to connect systems, streamline operations, and enhance customer experiences will not only drive operational efficiencies but also position us for sustainable growth in an increasingly digital future. Investing in robust integration solutions is not just advantageous; it is a necessary step towards achieving long-term success in the dynamic banking environment.