Overview

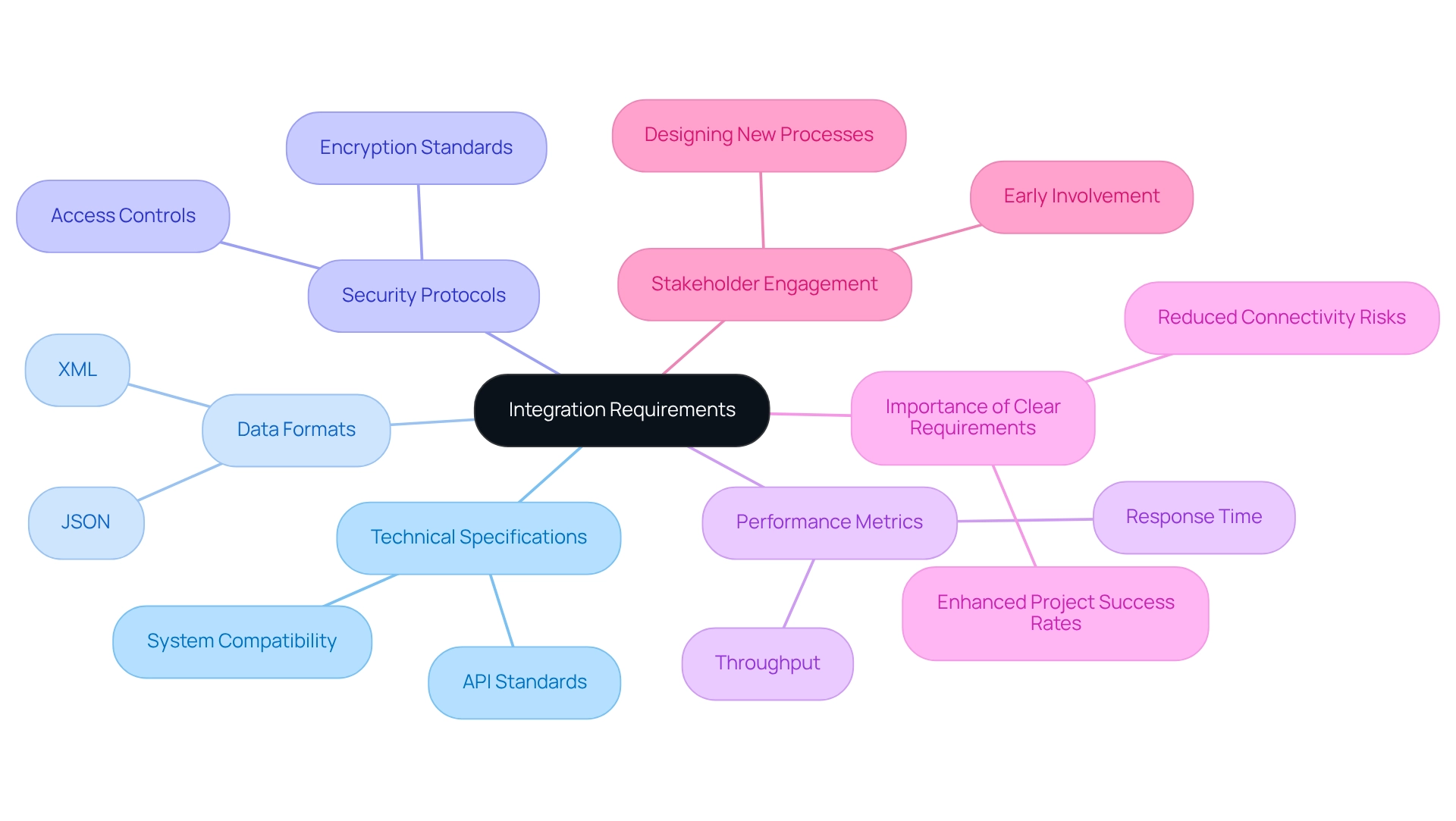

Integration requirements are not just essential; they are the backbone of effective communication between different systems. By encompassing technical specifications, data formats, security protocols, and performance metrics, we ensure seamless interactions. Clearly defined integration requirements pave the way for successful incorporation projects.

Consider the case of Coast Capital; their experience illustrates how well-outlined criteria can significantly enhance operational efficiency and mitigate risks during digital transformation efforts.

What’s holding your team back from achieving similar success? Let us help you navigate these complexities with clarity and assurance.

Introduction

In an increasingly interconnected world, we recognize that the ability of systems to communicate seamlessly is paramount for organizations striving to maintain a competitive edge. Integration requirements serve as the backbone of this connectivity, outlining the essential criteria that facilitate effective collaboration between diverse systems.

From technical specifications to security protocols, these requirements not only streamline processes but also enhance operational efficiency, particularly in sectors like banking and healthcare. As we embark on our digital transformation journeys, understanding and articulating these integration needs becomes crucial.

What challenges are holding your team back from achieving optimal integration? This article delves into the significance of defining integration requirements, explores their role in successful digital initiatives, and highlights key components that we must consider to navigate the complexities of system integration effectively.

Defining Integration Requirements: What They Are and Why They Matter

Integration requirements are the essential conditions and criteria that allow different systems to communicate and function together effectively. These criteria encompass technical specifications, data formats, security protocols, and performance metrics that are essential for fulfilling integration requirements. Clearly outlining these specifications is vital; they create a strong basis for successful incorporation projects by meeting the integration requirements, ensuring that all parties involved share a common vision of the incorporation’s goals. This highlights the significance of flexibility in outlining incorporation specifications.

Moreover, 76% believe that the secret to overcoming software development obstacles lies in a blend of ongoing education, adaptable methods, and effective communication. This further emphasizes the necessity for a versatile approach in implementation strategies. On the other hand, vaguely outlined combined specifications can result in project holdups, increased expenses, and ultimately, failure to meet business objectives. Indeed, firms that allocate resources to continuous training initiatives—65% have done so—are better prepared to handle technological shifts and improve their integration requirements for incorporation strategies.

Successful incorporation projects frequently arise from clearly outlined requirements. For instance, our partnership with Coast Capital illustrates how well-defined criteria can streamline complex projects and provide timely, cost-effective solutions. The shift of Coast Capital’s complete telephone banking and contact center telephony system was executed with just a 63-second outage, demonstrating our capability to manage connections with speed and reliability. This case study emphasizes the main advantages of specifying connectivity needs, including enhanced project success rates and diminished risks related to connectivity challenges.

Expert views consistently highlight that a dependable, future-ready technology stack, underpinned by integration requirements that clearly define collaboration criteria, is crucial for organizations seeking to adjust to changing demands and sustain a competitive advantage in the swiftly evolving technology environment.

To efficiently engage stakeholders in outlining these integration requirements, it is important to employ the appropriate technology and tools, as detailed in the FAQs. Involving stakeholders early and designing new business processes can greatly improve the clarity and effectiveness of unification strategies.

The Role of Integration Requirements in Digital Transformation

Integration requirements are essential for successful digital transformation, as they enable us to link various platforms and information sources efficiently. As we progressively adopt digital technologies, the need for seamless unification intensifies. These criteria ensure that our platforms can exchange information instantly, significantly enhancing our operational efficiency and decision-making capabilities. In the banking industry, for instance, unification needs bridge the gap between traditional frameworks and contemporary applications, resulting in improved customer experiences and streamlined operations.

Our Hybrid Integration Platform plays a pivotal role in this process, designed for secure transactions and trusted by banks, healthcare, and government entities. It simplifies complex integrations while maximizing and enhancing the value of legacy frameworks, substantially reducing costs. With support for 12 levels of interface maturity, we empower organizations to balance the speed of integration with the sophistication required to future-proof their technology stack. Furthermore, our platform offers real-time monitoring and alerts on system performance, enhancing operational visibility.

A notable case study is Empresas CMPC, Chile’s largest paper manufacturer, which successfully integrated digital processes across its production chain. This initiative not only boosted employee motivation but also improved visibility across the value chain, enabling better service delivery to clients. Such examples underscore the importance of well-defined connectivity specifications and integration requirements in managing the complexities of digital transformation, mitigating risks, and amplifying the benefits of technology investments.

Tony LeBlanc from the Provincial Health Services Authority remarks, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.” Current trends indicate that firms with greater digital advancement are 23% more profitable than their less advanced peers, emphasizing the critical role of collaboration in achieving digital maturity. Additionally, a Salesforce study reveals that 71% of clients are more inclined to trust a company with their personal information if its usage is clearly articulated, highlighting the importance of cohesive needs in establishing customer confidence—especially in the banking sector, where information security is paramount. As we develop our digital transformation plans for 2025 and beyond, understanding and implementing the integration requirements for robust connectivity needs will be vital for linking platforms and ensuring the success of our initiatives.

Key Components of Integration Requirements: Characteristics and Considerations

Connectivity requirements are essential for optimizing information flow in today’s complex environments. We recognize that effective information mapping, robust security protocols, performance metrics, and stringent user access controls are critical components that organizations must prioritize. Information mapping is particularly vital, as it dictates how data is transformed and transferred between systems, ensuring both compatibility and accuracy. By leveraging XSLT for XML information transformation, we significantly reduce the effort involved in these processes. Its integration with schemas not only helps identify programming mistakes early but also leads to substantial cost savings for our clients. Given that organizations typically manage around 15,000 exposures within their environments, it becomes clear that ongoing security measures are indispensable for mitigating risks related to information exposure in a multifaceted threat landscape.

Security protocols play a crucial role in protecting sensitive information during transmission, especially in regulated sectors like banking and healthcare. The rise of generative AI has introduced new risks, necessitating a layered security strategy. This strategy includes:

- Educating employees on secure platform usage

- Implementing loss prevention tools

As Nick Edwards emphasizes, organizations must acknowledge how these tools can potentially compromise or expose sensitive information, highlighting the urgent need for robust security measures tailored for the banking industry. Performance metrics empower us to establish clear integration requirements for success in integrating systems, such as response times and data throughput, ensuring that our connections meet operational requirements. Additionally, user access controls are vital for limiting interactions with integrated systems according to integration requirements, ensuring that only authorized personnel can interact and thereby protecting against potential breaches. By thoroughly addressing these components, we can develop a comprehensive unification strategy that aligns with our operational needs while enhancing overall security. Insights from case studies, such as Liat Hayun’s focus on utilizing information while managing associated risks, further underscore the importance of a proactive approach to information mapping and security protocols in project amalgamation. Our commitment at Avato to architect technology foundations for seamless and secure information connectivity exemplifies the dedication required to navigate these complexities.

Examples of Integration Requirements in Banking and Healthcare

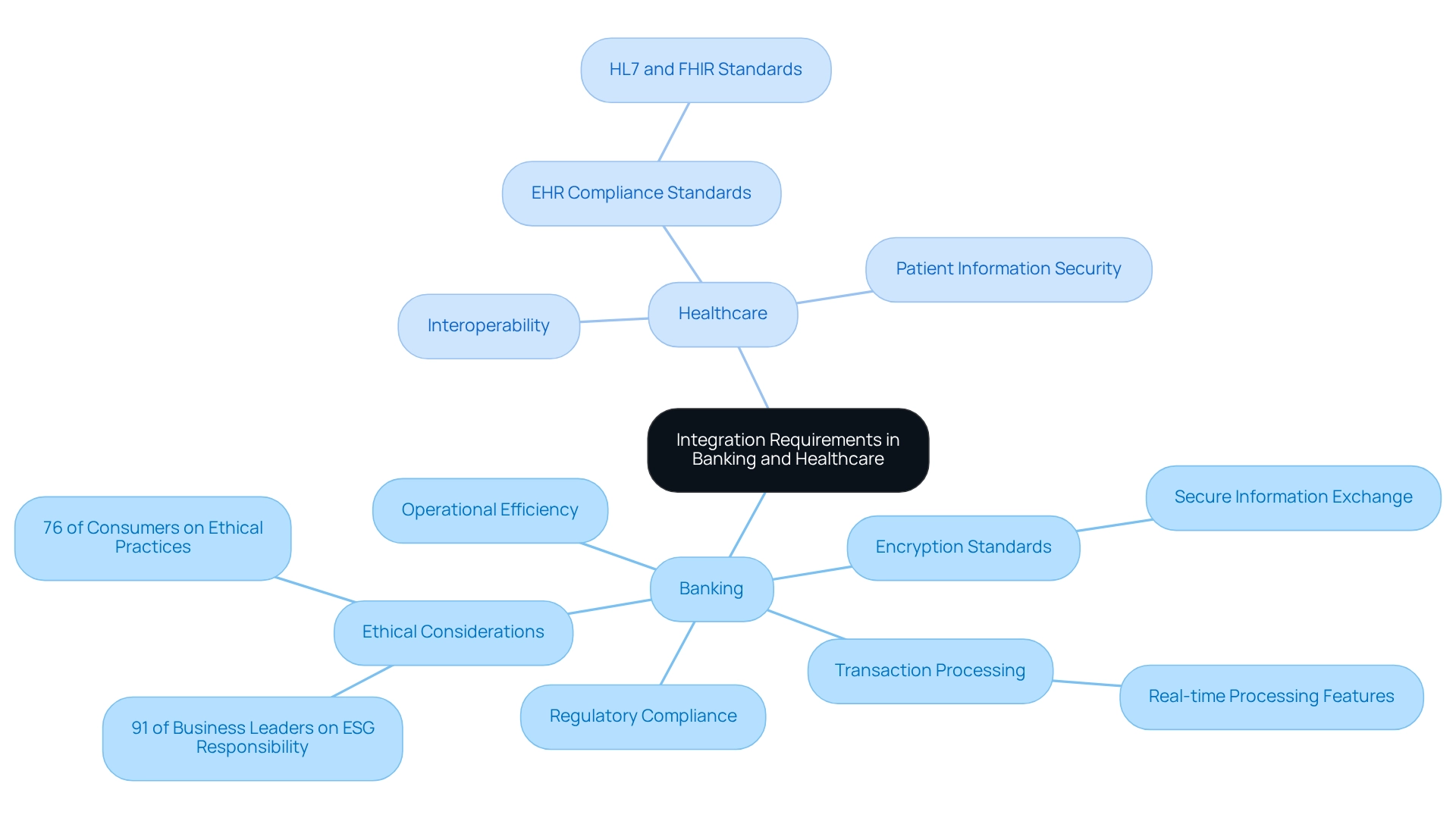

In the banking industry, unification needs are paramount for ensuring operational efficiency and regulatory compliance. We recognize that Avato’s hybrid connectivity platform is crucial in this landscape, enabling seamless information connection and empowering businesses to future-proof their operations. Essential elements include:

- Real-time transaction processing features

- Adherence to financial regulations

- Secure information exchange between core banking networks and third-party applications

What’s more, banks often require that their connections with payment processing networks comply with stringent encryption standards to safeguard customer information during transactions. This necessity is underscored by the fact that 91% of business leaders acknowledge their responsibility to address environmental, social, and governance (ESG) issues, reflecting an increasing emphasis on ethical practices in financial operations. Furthermore, 76% of consumers would withdraw support from companies that mistreat employees and communities, highlighting the critical role of ethical considerations in banking.

In the healthcare sector, connectivity needs focus on achieving interoperability among electronic health record (EHR) systems, which is vital for secure patient information sharing among providers. Compliance with standards such as HL7 or FHIR is essential to facilitate seamless data exchange, ensuring that patient information is both accessible and protected. As we navigate these unification landscapes, understanding the integration requirements and their implications becomes essential for tailoring strategies that align with industry standards and enhance operational capabilities.

Moreover, with 77% of corporate risk and compliance professionals prioritizing updates on ESG developments, the incorporation landscape is evolving. Banks that embrace digital transformation, supported by robust coordination strategies like those offered by Avato, are poised to thrive in this dynamic environment. As illustrated in the case study “Regulatory Impact on Banking Innovation,” the regulatory frameworks in the US and Canada significantly influence how banks innovate, with the US concentrating on aggressive technology adoption while Canada emphasizes building strong customer relationships. This nuanced understanding is vital for banks to effectively customize their integration requirements across various markets. Additionally, DBS Bank’s ecosystem approach exemplifies how external data collaboration complements internal integration requirements, showcasing a practical example of successful integration strategies.

Conclusion

Defining integration requirements is not just a necessary step; it is a pivotal factor for organizations aiming to thrive in today’s interconnected environment. These requirements establish the essential conditions for various systems to communicate effectively, including technical specifications, security protocols, and performance metrics. By clarifying these elements, we can significantly enhance project success rates and mitigate the risks associated with integration challenges. The statistics we present underscore the importance of agility and continuous learning in managing integration projects, reinforcing that well-defined requirements are indispensable for navigating the complexities of digital transformation.

The role of integration requirements extends beyond mere technicalities; they are fundamental to achieving operational efficiency and customer satisfaction, particularly in sectors like banking and healthcare. Successful case studies, such as our collaboration with Coast Capital and Empresas CMPC, exemplify how clear integration criteria lead to streamlined operations and improved service delivery. Furthermore, as we prepare for future digital initiatives, understanding specific integration needs will be vital for ensuring seamless data connectivity and compliance with industry standards.

In conclusion, as we embark on our digital transformation journeys, the significance of robust integration requirements cannot be overstated. They not only facilitate effective collaboration between disparate systems but also empower us to adapt to evolving market demands. By investing in well-articulated integration strategies, we position ourselves for sustainable success, driving innovation while safeguarding sensitive data and enhancing overall operational capabilities. Embracing this proactive approach will ultimately pave the way for a more integrated and efficient future.