Overview

The article underscores the architecture of core banking systems and its critical importance for IT managers in contemporary financial institutions. It asserts the necessity for robust and flexible architectures that seamlessly integrate advanced technologies, such as AI and cloud computing. These innovations are vital for enhancing operational efficiency, ensuring regulatory compliance, and improving customer experiences. As a result, financial institutions can maintain their competitive edge in a rapidly evolving market.

Are you ready to embrace these changes and lead your institution towards greater efficiency and customer satisfaction?

Introduction

In the rapidly evolving world of finance, core banking systems serve as the essential foundation upon which modern banking operates. These centralized platforms not only streamline critical functions such as transaction processing and account management but also significantly enhance customer experience by ensuring seamless access to banking services across various channels.

As the industry navigates the complexities of digital transformation, the integration of cutting-edge technologies—such as artificial intelligence, cloud computing, and big data analytics—is reshaping the landscape.

This article delves into the significance of core banking systems, exploring their evolution from rigid legacy architectures to agile, modular solutions that meet the demands of today’s dynamic market.

With insights from industry experts and case studies highlighting successful transformations, readers will gain a comprehensive understanding of the challenges and innovations driving the future of core banking.

Are you ready to discover how these advancements can revolutionize your banking experience?

Defining Core Banking Systems: An Overview

The core banking system architecture serves as the backbone of contemporary financial operations, functioning as centralized platforms that oversee essential functions such as account management, transaction processing, and customer data handling. By facilitating seamless access to financial services across various branches and channels, these platforms empower clients to manage their accounts and execute transactions effortlessly, regardless of their location.

The importance of core banking system architecture is paramount; it is vital for maintaining operational efficiency and ensuring a consistent customer experience across diverse financial services. As the financial landscape evolves, the integration of advanced technologies such as artificial intelligence, cloud computing, blockchain, and big data analytics into core banking systems is increasingly prevalent. This technological evolution not only enhances service delivery but also aids financial institutions in adapting to shifting market demands.

Recent statistics indicate that the on-premise deployment segment of core financial platforms is projected to dominate the global market, valued at approximately USD 3,605 million, with a compound annual growth rate (CAGR) of 4.25% during the forecast period. In contrast, the SaaS/hosted deployment segment is expected to secure the largest market share and highest CAGR, driven by the growing feasibility and adoption of cloud services.

Expert insights underscore the critical role of centralized platforms in transaction processing. Brooke Ybarra, senior vice president of innovation strategy at the American Bankers Association, emphasizes that the pandemic has accelerated the adoption of mobile financial services, compelling institutions to invest in innovative technologies that enhance transaction security and seamlessness on-the-go.

This investment underscores the necessity of robust core banking system architecture in achieving operational efficiency and fulfilling customer expectations.

Successful transformations of core banking system architecture have been documented in various case studies, including those involving Avato’s hybrid unification platform. Avato has been recognized for its dedication to streamlining complex project implementations, enabling financial institutions to modernize their operations while minimizing costs and enhancing operational capabilities. For instance, Avato’s platform allows financial institutions to upgrade and extend the value of outdated infrastructures, facilitating swift integration of isolated networks and resulting in improved data accessibility and operational agility.

Moreover, the core banking system architecture offers real-time monitoring and alerts on performance, further boosting operational efficiency. Such advancements are essential for financial institutions striving to maintain competitiveness in an increasingly digital landscape.

In conclusion, the core banking system architecture is indispensable for the efficient functioning of these entities, directly impacting operational efficiency and customer satisfaction. As the sector continues to evolve, the integration of cutting-edge technologies, including generative AI, into these systems—supported by Avato’s expertise in hybrid integration—will be crucial for financial institutions to thrive in a dynamic environment.

The Evolution of Core Banking Systems: From Legacy to Modern Solutions

Core financial networks have undergone a significant transformation since their inception. Initially, banks operated on large, outdated infrastructures that were not only rigid but also costly to maintain. With advancements in technology, the financial sector has shifted towards modular and cloud-native solutions, offering enhanced flexibility, scalability, and integration capabilities.

By 2025, the architecture of core banking systems will be characterized by the extensive use of APIs and microservices. These modern structures empower financial institutions to swiftly adapt to client needs and regulatory changes, significantly reducing operational costs. Avato’s Secure Hybrid Integration Platform is pivotal in this transition, enabling institutions to maximize and extend the value of their legacy systems while simplifying complex integrations.

Statistics reveal that a substantial percentage of financial institutions have migrated from legacy systems to modern solutions, with many reporting enhanced efficiency and profitability. For instance, banks that have implemented collaborative data strategies have witnessed their cost-to-income ratios decline by an average of 6.3 percentage points over three years, underscoring the effectiveness of contemporary approaches in optimizing processes. This improvement in financial efficiency highlights how effective data collaboration can bolster institutional profitability.

Moreover, the financial benefits of modern solutions are underscored by the projection that 72 percent of revenue growth for firms in Brazil will stem from cross-selling, illustrating the potential for increased profitability through enhanced collaboration and customer engagement. Avato’s platform not only facilitates this integration but also provides real-time tracking and notifications on system performance, ensuring 24/7 uptime and reliability for complex systems across finance, healthcare, and government sectors.

Expert insights suggest that while not all fintechs are equally affected by market fluctuations, certain sectors and growth phases exhibit resilience, emphasizing the importance of adaptability in foundational financial solutions. A North American FinTech executive remarked, “It’s a bit of back to basics. On a core product or offering, 18 to 24 months ago, you would have built additional pieces on it to upsell and cross-sell.”

This perspective underscores the necessity for financial institutions to focus on their core banking system architecture as they evolve.

Furthermore, trust in financial innovation remains robust, with 86% of Canadians expressing confidence in their institutions for secure digital services. This trust is essential as financial institutions continue to enhance their core banking system architecture to meet evolving customer preferences and improve service delivery.

Success stories abound, illustrating how institutions have leveraged modern core banking system architecture, supported by Avato’s Hybrid Integration Platform, to streamline operations and elevate customer experiences. For example, banks utilizing Avato’s platform have reported significant reductions in operational costs, further validating the platform’s efficacy. Industry leaders assert that the transition from legacy to modern financial solutions is not merely a technological upgrade but a strategic necessity for maintaining competitiveness in an increasingly dynamic market.

As the landscape continues to evolve, the emphasis on integrating advanced technologies, such as generative AI, will be crucial in shaping the future of core financial services.

Types of Core Banking System Architectures: A Comparative Analysis

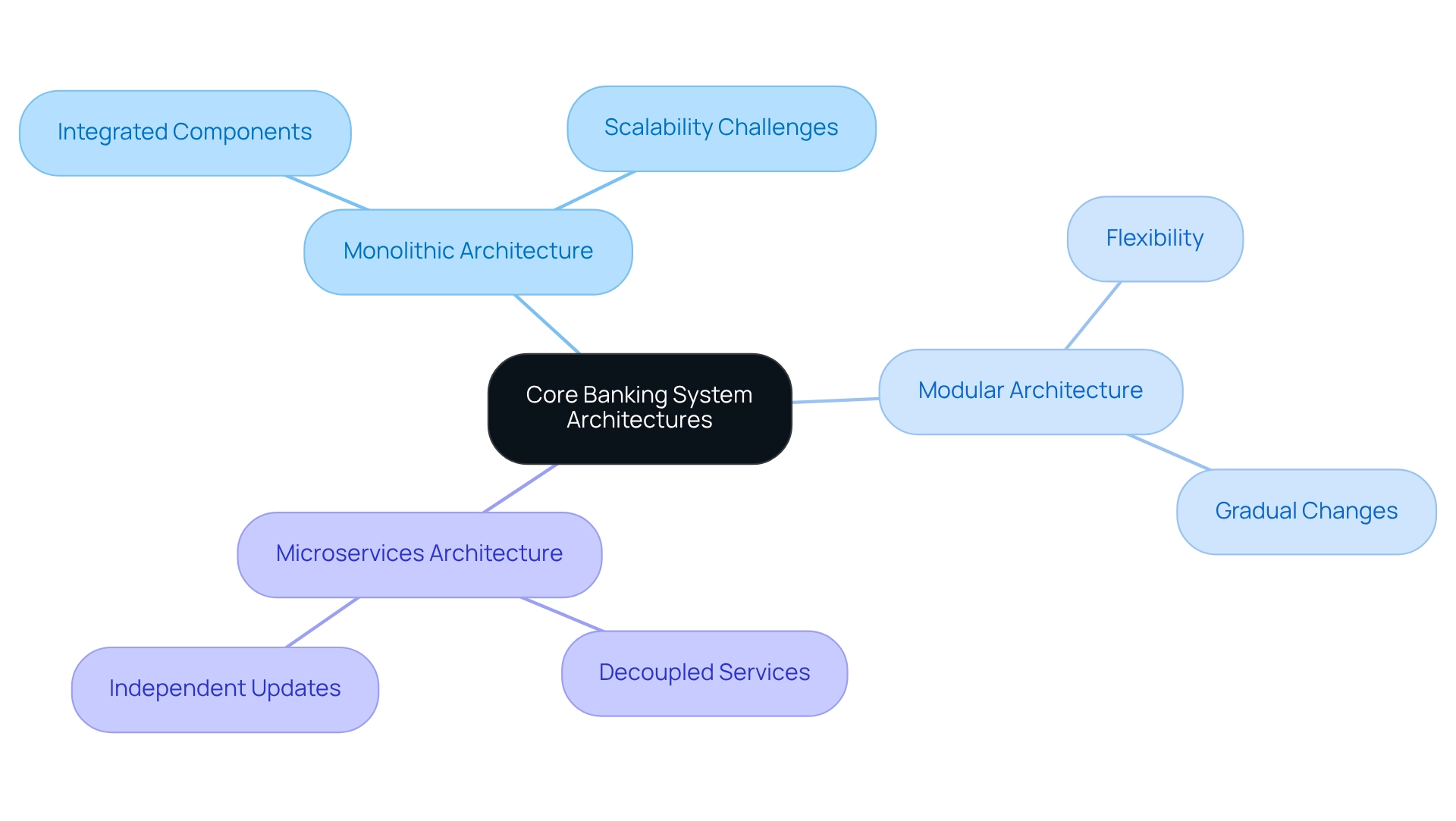

Core banking system architecture can be classified into three primary types: monolithic, modular, and microservices-based. Monolithic architectures signify conventional structures where all components are closely integrated, complicating modifications and updates. This rigidity often leads to challenges in adapting to new market demands or regulatory changes.

In contrast, modular architectures provide enhanced flexibility, enabling financial institutions to make changes gradually without the requirement for a total overhaul. This adaptability is crucial in a rapidly evolving financial landscape, where agility can significantly impact competitiveness. As Gustavo Estrada pointed out, ‘Avato has streamlined intricate projects and provided outcomes within preferred timelines and financial limits,’ emphasizing the significance of modular approaches in enabling efficient project management.

Avato’s dedicated hybrid integration platform plays a pivotal role in this context, empowering banks to streamline their integration strategies and enhance business value. By unlocking isolated assets, Avato enables seamless data connectivity, which is essential for optimizing operational efficiency and ensuring long-term viability.

Microservices architectures take this flexibility a step further by decoupling services, enabling independent updates and scalability. This approach not only enhances operational efficiency but also allows for more effective resource management. For instance, a recent case study on the transformation of a financial application from a monolithic to a microservices architecture demonstrated substantial improvements in performance metrics.

The microservices application successfully processed all requests during stress tests, while the monolithic system encountered errors, highlighting the operational advantages of this architecture.

As of 2025, the market share for core banking system architecture reflects a growing trend towards microservices, driven by their ability to enhance scalability and efficiency. Statistics indicate that the adoption of microservices architecture in banking has surged, with many institutions recognizing the need for a more agile and responsive IT infrastructure.

However, each architecture comes with its own set of advantages and challenges. Monolithic architectures may provide ease in deployment but face challenges with scalability. Modular structures offer a balance of flexibility and control, while microservices architectures, despite their advantages, necessitate careful consideration of performance metrics and organizational readiness for successful implementation.

The transition from monolithic systems to microservices necessitates a thorough evaluation of these factors to ensure a smooth migration.

Expert opinions emphasize the significance of assessing core banking system architecture according to particular financial requirements and future growth strategies. As the sector keeps progressing, grasping the subtleties of these core financial architectures will be crucial for IT managers seeking to foster innovation and efficiency within their organizations, especially through the strategic use of Avato’s hybrid connection solutions. Furthermore, engaging stakeholders efficiently and designing new business processes are essential measures that Avato endorses, guaranteeing that clients can prepare for the future and adjust to evolving demands.

Challenges in Core Banking System Transformation: Navigating the Complexities

Transforming core banking system architecture presents a multitude of challenges, particularly in data migration, integration with existing frameworks, and adherence to regulatory standards. A significant obstacle for banks lies in managing legacy data formats, complicating the transition to contemporary infrastructures. Furthermore, the demand for real-time processing capabilities introduces an additional layer of complexity.

Industry insights reveal that nearly 70% of banking IT leaders identify data migration issues as a primary concern during system transformations, underscoring the critical need for effective strategies. Arvato addresses these challenges by ensuring round-the-clock availability for essential connections, which is vital for maintaining operational reliability during transitions.

Moreover, managing stakeholder expectations is crucial, as alignment between IT initiatives and business objectives can often be misaligned. To effectively navigate these challenges, banks should consider adopting a phased implementation strategy for Avato’s hybrid connection platform. This approach facilitates incremental changes that can be more easily managed and assessed, thereby minimizing risks and enhancing adaptability.

Prioritizing stakeholder engagement throughout the process ensures that all parties are informed and invested in the transformation journey. As noted by Gustavo Estrada, a customer of Avato, “Avato has simplified complex projects and delivered results within desired time frames and budget constraints,” emphasizing the importance of effective integration solutions in managing expectations.

Investing in robust change management strategies is essential for success. This includes comprehensive training initiatives for personnel on new methods and procedures, which can significantly enhance data migration success rates. A case study on Avato’s integrated approach for core operations and AML/CFT solutions illustrates this point: financial institutions that successfully migrated their AML frameworks alongside their core banking system architecture reported improved data management, enhanced cost efficiency, and better risk management capabilities.

This integrated approach not only streamlines processes but also enhances compliance, reducing compatibility issues and proving to be more cost-effective.

Furthermore, Avato’s collaboration with Coast Capital demonstrates the effectiveness of its hybrid unification solutions. Since the solution’s launch in February 2013, Avato has facilitated various interfaces and enabled significant system transitions with minimal downtime, including a remarkable 63-second interruption during a complete switch of Coast Capital’s telephone services in June 2016. This case study highlights Avato’s capability to manage intricate connections while ensuring operational continuity.

Expert opinions underscore the importance of fostering a culture of innovation and collaboration within financial institutions. As acknowledged by Finastra, a supportive organizational culture can greatly influence the success of core financial transformations. Additionally, regulatory compliance and security assessments are essential components of Avato’s hybrid solutions, ensuring that institutions meet necessary standards while adopting new technologies.

By addressing these challenges directly and implementing strategic solutions, including Avato’s hybrid platform, financial institutions can navigate the complexities of core banking system architecture transformations more effectively.

Integration Strategies for Core Banking Systems: Ensuring Seamless Connectivity

To achieve seamless connectivity, banks must adopt robust unification strategies that effectively leverage APIs and middleware solutions. Avato’s Secure Hybrid Integration Platform is designed to enhance and extend the value of legacy infrastructures, streamlining complex integrations while ensuring 24/7 availability and reliability. These technologies are crucial for facilitating communication between core financial systems and various applications, including customer relationship management (CRM) systems, payment gateways, and third-party services.

By implementing an API-first strategy, financial institutions can significantly enhance their agility and responsiveness to evolving market demands. This flexibility not only enables the rapid delivery of innovative services but also ensures compliance with stringent regulatory standards.

Recent statistics underscore the growing importance of API adoption in the financial sector, with a year-on-year growth of 21% for consumers and 11% for businesses from June 2022 to June 2023. This trend highlights the urgent need for financial institutions to streamline operations, especially in the context of banking-as-a-service (BaaS) opportunities that emerged in 2023, which offer substantial potential for U.S. financial entities to elevate their service offerings.

Successful integration strategies are illustrated by case studies that showcase the transformative impact of Avato’s hybrid integration platform on the connectivity of core banking system architecture. For instance, Avato’s collaboration with Coast Capital exemplifies how the platform facilitated significant operational shifts with minimal downtime, allowing the bank to operate efficiently and effectively. The solution became operational in February 2013, and over the years, Avato deepened its involvement at Coast Capital, supporting various interfaces and enabling substantial system changes with only a 63-second outage during the transition of the entire telephone service and contact center telephony system in June 2016.

Moreover, the Workspace Updates Feed in Postman has proven invaluable in fostering collaboration among development teams by keeping all members informed about API changes. This reduces the risk of overlooked updates and cultivates a more cohesive working environment.

Expert insights further emphasize the critical role of APIs in connecting financial systems. Technology leaders, including Gustavo Estrada, acknowledge that effective integration strategies not only simplify complex projects but also deliver results within desired timelines and budget constraints. As organizations navigate the intricacies of modern finance, leveraging APIs and middleware, particularly through Avato’s dependable technology stack, will be essential for maintaining a competitive advantage and adapting to the fast-paced financial landscape.

Additionally, the real-time tracking and notifications capability of Avato’s platform empowers financial institutions to proactively monitor performance, significantly reducing operational costs and enhancing overall efficiency.

Regulatory Compliance in Core Banking Architecture: Key Considerations

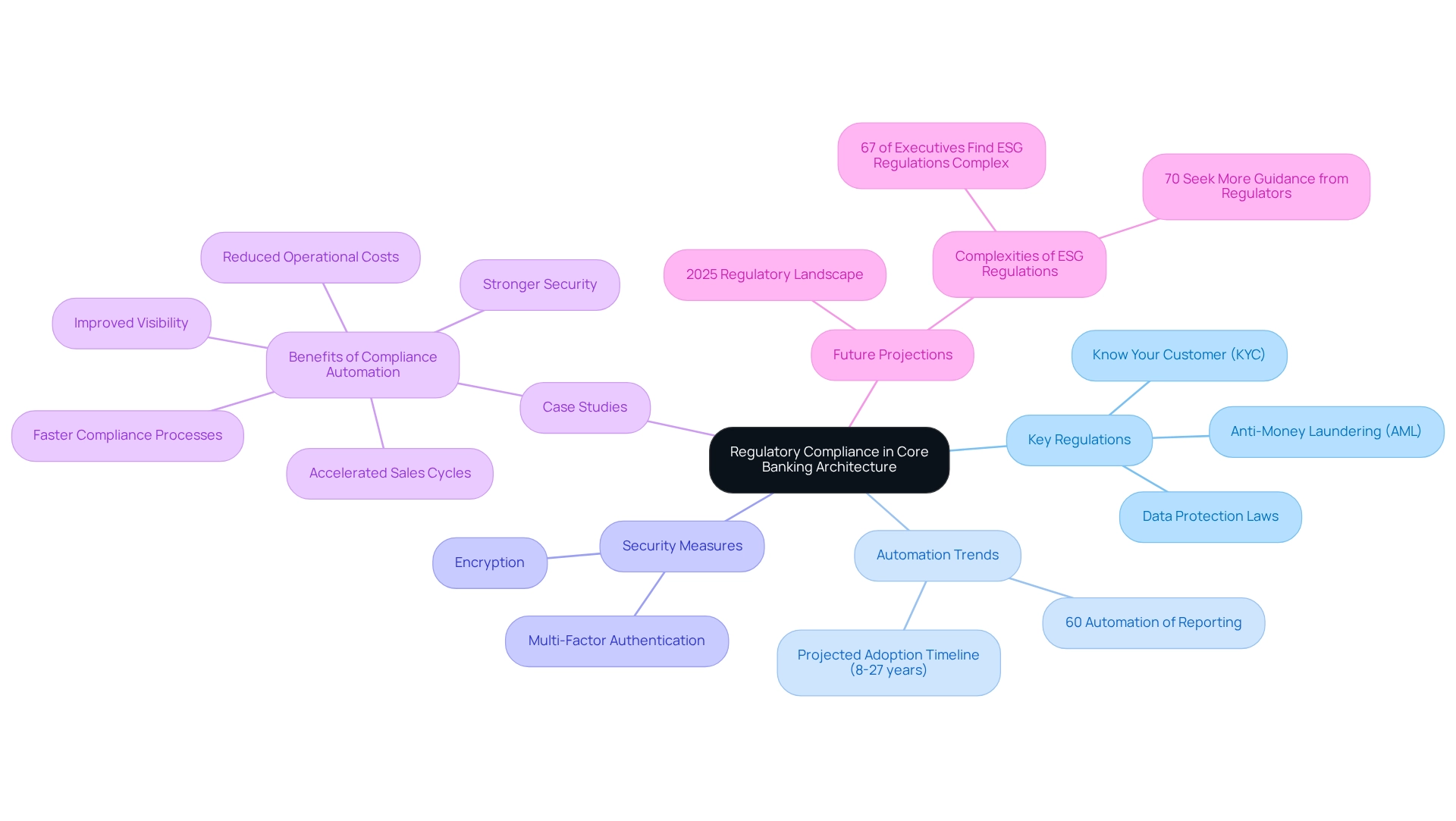

Regulatory compliance stands as a cornerstone in the design and implementation of core financial systems. As institutions navigate a complex landscape of regulations—including anti-money laundering (AML), know your customer (KYC), and data protection laws—approximately 60% of financial institutions have automated their reporting capabilities for regulatory compliance. This trend reflects a growing commitment to efficiency and accuracy in meeting regulatory demands.

To ensure compliance, it is imperative to integrate robust security measures, such as encryption and multi-factor authentication, into core banking system architecture. These measures protect sensitive customer data while automated reporting capabilities enable financial institutions to generate timely reports that adhere to regulatory requirements, significantly reducing manual errors. Additionally, maintaining detailed audit trails is essential for transparency and accountability, allowing institutions to demonstrate compliance during audits.

As regulations continue to evolve, financial institutions must remain vigilant and adaptable. Continuous updates to their systems are necessary to mitigate risks and avoid penalties. Compliance officers emphasize the importance of proactive measures, asserting that “staying ahead of regulatory changes is not merely a best practice; it’s essential for survival in today’s financial environment.”

Case studies illustrate the tangible benefits of implementing compliance automation platforms. Organizations utilizing compliance automation, such as Secureframe, report stronger security, faster compliance processes, and reduced operational costs. These advancements not only enhance regulatory adherence but also improve overall operational efficiency, enabling banks to concentrate on their core business objectives.

The impact of AML and KYC regulations on core banking system architecture is profound. These regulations necessitate a shift towards an architecture capable of managing complex data requirements while ensuring integration and security for compliance. By 2025, the landscape of regulatory compliance in core financial systems will continue to evolve, with 67% of global executives acknowledging the complexities of ESG regulations and seeking clearer guidance from regulators.

This reality underscores the critical need for banks to invest in technology that supports compliance and adapts to changing regulatory frameworks, ensuring they maintain a competitive edge in the industry.

Moreover, the adoption of automation technologies is projected to take between eight to 27 years, influenced by factors such as regulation and investment. This timeline highlights the importance of early adoption and strategic planning in effectively navigating the compliance landscape. As Michael Chui noted, “We identified 63 generative AI use cases spanning 16 business functions that could deliver total value in the range of $2.6 trillion to $4.4 trillion in economic benefits annually when applied across industries,” emphasizing the potential of advanced technologies in enhancing compliance automation.

Future Trends in Core Banking Architecture: Preparing for Tomorrow’s Challenges

The financial landscape is experiencing a profound transformation, propelled by several key trends that are reshaping the core architecture of banking systems. A significant shift is the rising adoption of cloud-native solutions, with approximately 30% of companies now employing techniques such as GitOps and containers. This trend not only enhances operational efficiency but also reinforces the reliance on cloud computing as a modern strategy for data protection.

In fact, half of surveyed businesses regard cloud computing as essential for disaster recovery and workload migration, underscoring a strong commitment to data security and operational continuity.

Furthermore, the emergence of open financial services fosters enhanced collaboration and innovation within the financial sector. This approach allows financial institutions to securely exchange information with external providers, promoting the development of new financial products and services that elevate customer experience.

In addition, the integration of artificial intelligence (AI) and machine learning (ML) is increasingly prevalent in banking systems. A considerable number of financial institutions are exploring AI and ML capabilities to improve decision-making processes and gain deeper customer insights. Leading FinTech experts predict that AI and ML will be crucial in automating routine tasks, enhancing fraud detection, and personalizing customer interactions.

Notably, generative AI is emerging as a powerful asset in financial services, with a remarkable 60% increase in its application for customer experience, particularly in the development of sophisticated chatbots and virtual assistants.

As banks navigate these advancements, the exploration of blockchain technology is also gaining momentum. This technology promises secure transactions and improved transparency, further revolutionizing the banking experience.

To effectively prepare for these changes, financial institutions must invest in core banking system architecture that can seamlessly adapt to emerging technologies and evolving customer expectations. Avato’s dependable, future-proof hybrid unification platform is essential for assisting businesses in meeting these demands. By maximizing and extending the value of legacy platforms, simplifying complex integrations, ensuring 24/7 uptime and reliability, and providing real-time monitoring and alerts on performance, Avato empowers financial institutions to thrive in an increasingly competitive landscape.

Additionally, the platform significantly reduces expenses, making it a strategic option for financial institutions. As Omar Bashir observes, “Most providers invest significantly into enhancing their infrastructure to be as secure as possible — attaining a level of security far beyond what most financial institutions could sustain independently,” emphasizing the critical need for secure and flexible financial frameworks.

Key Takeaways for IT Managers: Strategic Planning in Core Banking Architecture

Strategic planning is essential for IT managers navigating the complexities of core banking system architecture, particularly in the context of preparing for open banking. Key takeaways include:

- Align IT with Business Goals: Clearly defining objectives and ensuring that IT initiatives support overarching business strategies is crucial. This alignment not only enhances operational efficiency but also drives organizational success. In fact, 58% of organizations indicate that their performance management frameworks fall short in effectively monitoring strategic performance, underscoring the critical need for improved alignment.

- Adopt Modular Architectures: Embracing modular and flexible designs enables simpler upgrades and connections in the future. This approach is increasingly prioritized by IT managers, with a significant percentage recognizing its importance in adapting to evolving business needs and technological advancements. Utilizing current legacy structures via hybrid integration platforms can aid this shift, ensuring that banks do not forfeit valuable assets for new technologies.

- Invest in Change Management: Robust change management practices are vital for facilitating smooth transitions during system transformations. Successful change management minimizes disruption and fosters a culture of adaptability within the organization, ensuring that teams are prepared for new processes and technologies. As noted by an industry expert, effective change management involves cognitive, emotional, and physical engagement, which is essential for fostering a supportive environment during transitions.

- Stay Informed on Regulations and Technologies: Keeping abreast of regulatory requirements and emerging technologies is essential for maintaining compliance and competitiveness in the banking sector. As the landscape evolves, IT managers must proactively integrate sustainability and innovation into their strategic planning to enhance their organization’s reputation and long-term success. This involves taking into account environmental sustainability as an essential element of strategic initiatives and ensuring that unification solutions adhere to stringent security protocols to reduce risks related to open banking.

- Harness Generative AI: The incorporation of generative AI can significantly enhance customer experience and operational efficiency. With a 60% rise in its application for customer interactions, financial institutions can utilize AI-driven solutions to optimize processes and enhance service delivery.

By following these principles, IT managers can effectively guide their organizations through the complex terrain of core banking system architecture, ensuring that they remain agile and competitive in 2025 and beyond. Furthermore, leveraging case studies like Avato’s Hybrid Integration Platform can provide valuable insights into successful strategic planning and integration practices in the banking sector.

Conclusion

Core banking systems serve as the bedrock of the modern banking sector, transitioning from rigid legacy architectures to flexible, modular solutions that address the dynamic demands of today’s financial landscape. The integration of advanced technologies—such as artificial intelligence, cloud computing, and big data analytics—has become a necessity for banks aiming to enhance operational efficiency and customer satisfaction.

This article underscores the significance of strategic planning and robust integration strategies. By adopting modular and microservices-based architectures, banks can achieve heightened agility and responsiveness, enabling them to adapt to regulatory changes and market demands more effectively. Case studies illustrate how organizations leveraging Avato’s hybrid integration platform have successfully navigated these transitions, minimizing operational downtime while maximizing the value of their legacy systems.

Looking forward, trends like open banking and the growing reliance on AI will continue to shape the future of core banking architecture. As financial institutions brace for these changes, investing in flexible systems and fostering a culture of innovation will be paramount. The capacity to integrate seamlessly while ensuring compliance with evolving regulations will determine which banks thrive in this competitive landscape.

In conclusion, embracing these advancements transcends mere adaptation; it is about spearheading the movement towards a more efficient, customer-centric banking experience. The future of banking is in the hands of those who can navigate these complexities with foresight and strategic vision, ensuring they remain competitive and relevant in an ever-evolving market.