Overview

We focus on the transformative power of IoT integration solutions that significantly enhance banking efficiency and security. By leveraging advanced technologies such as MQTT, RESTful APIs, and OPC UA, we empower financial institutions to improve operational performance and facilitate real-time communication.

What challenges are holding your team back from achieving optimal compliance and security?

These solutions not only enable adaptability to modern demands but also ensure that operations remain secure and efficient. As a result, we invite you to explore how these innovative integrations can redefine your banking experience.

Introduction

In the rapidly evolving landscape of banking, we recognize that the integration of Internet of Things (IoT) technologies is revolutionizing how financial institutions operate. By enhancing communication through protocols like MQTT and simplifying interactions with RESTful APIs, we are leveraging innovative solutions to streamline processes and improve customer experiences. As we navigate the complexities of regulatory compliance and operational efficiency, tools such as OPC UA and iPaaS are proving essential in bridging the gap between legacy systems and modern applications.

This article delves into the various IoT-driven strategies that not only optimize banking operations but also pave the way for a more sustainable and responsive financial ecosystem. By exploring real-world applications and the transformative potential of these technologies, we highlight how banks can stay competitive in an increasingly digital world.

What’s holding your team back from embracing these advancements?

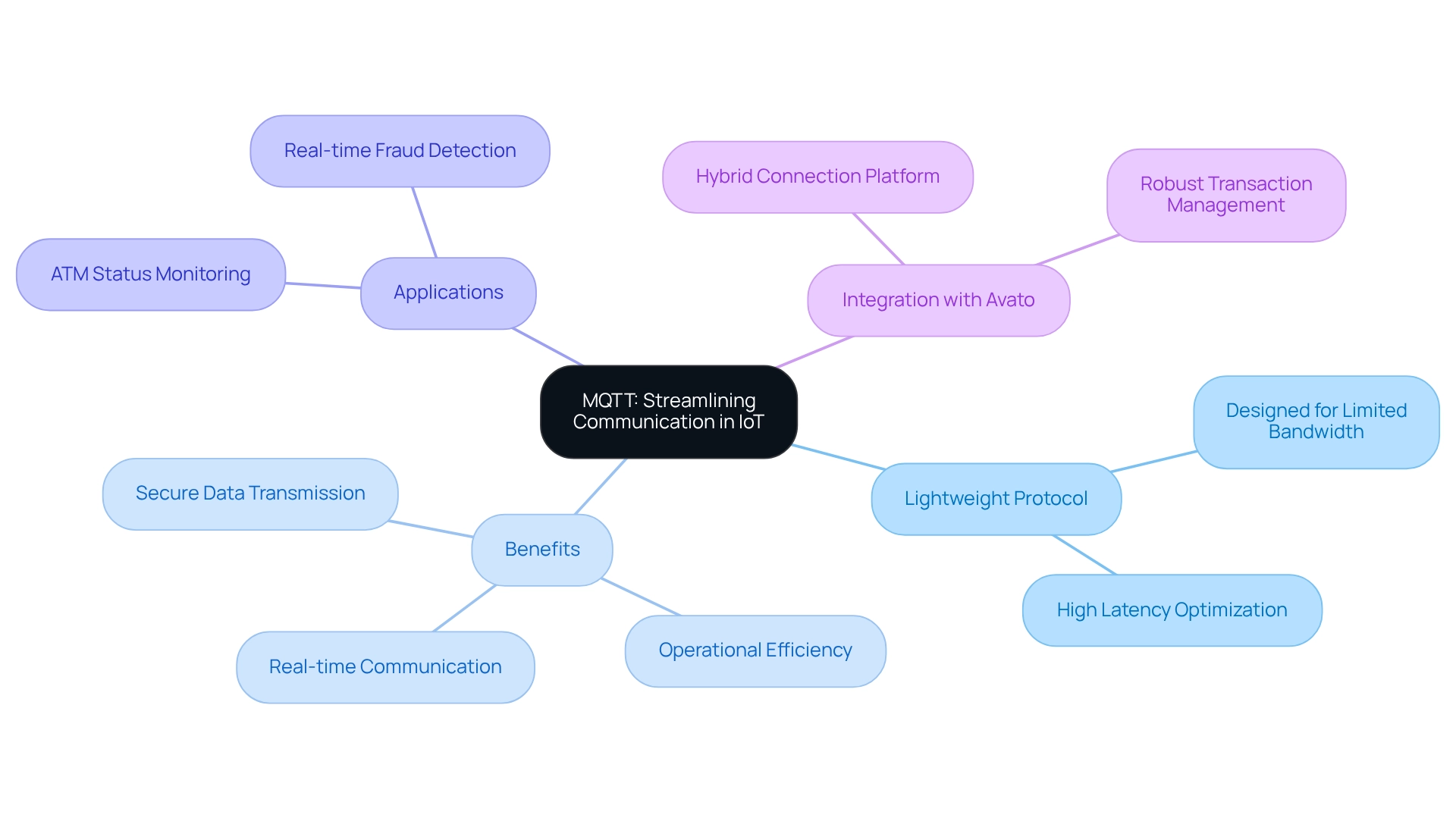

MQTT: Streamlining Communication in IoT

MQTT (Message Queuing Telemetry Transport) stands as a pivotal messaging protocol, expertly crafted for lightweight communication. Its design excels in environments characterized by limited bandwidth and high latency, making it an ideal choice for IoT integration solutions in banking.

We leverage Avato’s dedicated hybrid connection platform to significantly enhance operational efficiency. By enabling devices to communicate in real-time, MQTT accelerates transaction processing and elevates customer experiences.

Our secure hybrid integration platform, featuring robust transaction management and the capability to connect diverse platforms, ensures that critical data is transmitted safely and efficiently through IoT integration solutions. This empowers financial institutions to link multiple devices without straining their networks.

For instance, banks can utilize MQTT to monitor ATM statuses or implement real-time fraud detection solutions, greatly enhancing operational responsiveness.

We pride ourselves on our commitment to 24/7 uptime and dependability, ensuring that our partners can navigate the complexities of modern banking with confidence.

RESTful APIs: Enabling Seamless Device Interaction

RESTful APIs (Representational State Transfer) are crucial in facilitating seamless interactions between IoT devices and financial networks. By allowing applications to communicate over HTTP, we simplify the integration of diverse services and devices, including IoT integration solutions. Financial institutions leverage RESTful APIs to connect mobile applications with backend infrastructures, ensuring secure access to accounts and transaction functionalities for users. This adaptability enhances user experience and empowers financial institutions to swiftly respond to changing market demands by incorporating new technologies and services without significant alterations to existing infrastructures.

The significance of RESTful APIs is underscored by their growing adoption in the financial sector. By 2025, we anticipate that financial institutions will increasingly depend on fintech partnerships, which often utilize RESTful APIs to boost operational efficiency. These APIs foster smoother collaborations by enabling various platforms to communicate effectively, streamlining processes and minimizing operational silos. For instance, Citizens Bank’s integration of merchant acquiring services exemplifies how RESTful APIs can provide a comprehensive view of accounts payable and receivable, enhancing the value proposition for business clients through real-time data access and transaction processing. Moreover, the user experience in mobile finance is profoundly shaped by RESTful APIs. They streamline processes, reduce latency, and bolster security, all of which are critical as transaction volumes continue to surge. As these volumes increase rapidly, banks must prioritize engagement with quicker payments, highlighting the necessity of RESTful API integration and IoT integration solutions to maintain a competitive edge in an increasingly digital landscape.

Avato’s Hybrid Integration Platform plays a pivotal role in this ecosystem by enhancing and extending the value of traditional infrastructures, simplifying complex integrations, and significantly reducing costs through its IoT integration solutions. With real-time monitoring and alerts on system performance, we ensure 24/7 uptime and reliability, which are essential for financial operations. The ongoing developments in open finance regulations further emphasize the importance of RESTful APIs, enabling cross-border interoperability and fostering consumer-focused applications, paving the way for a more integrated financial ecosystem. Insights from industry leaders predict a transformative year for financial services in 2025, focusing on agility, innovation, and seamless customer experiences—all supported by robust RESTful API frameworks.

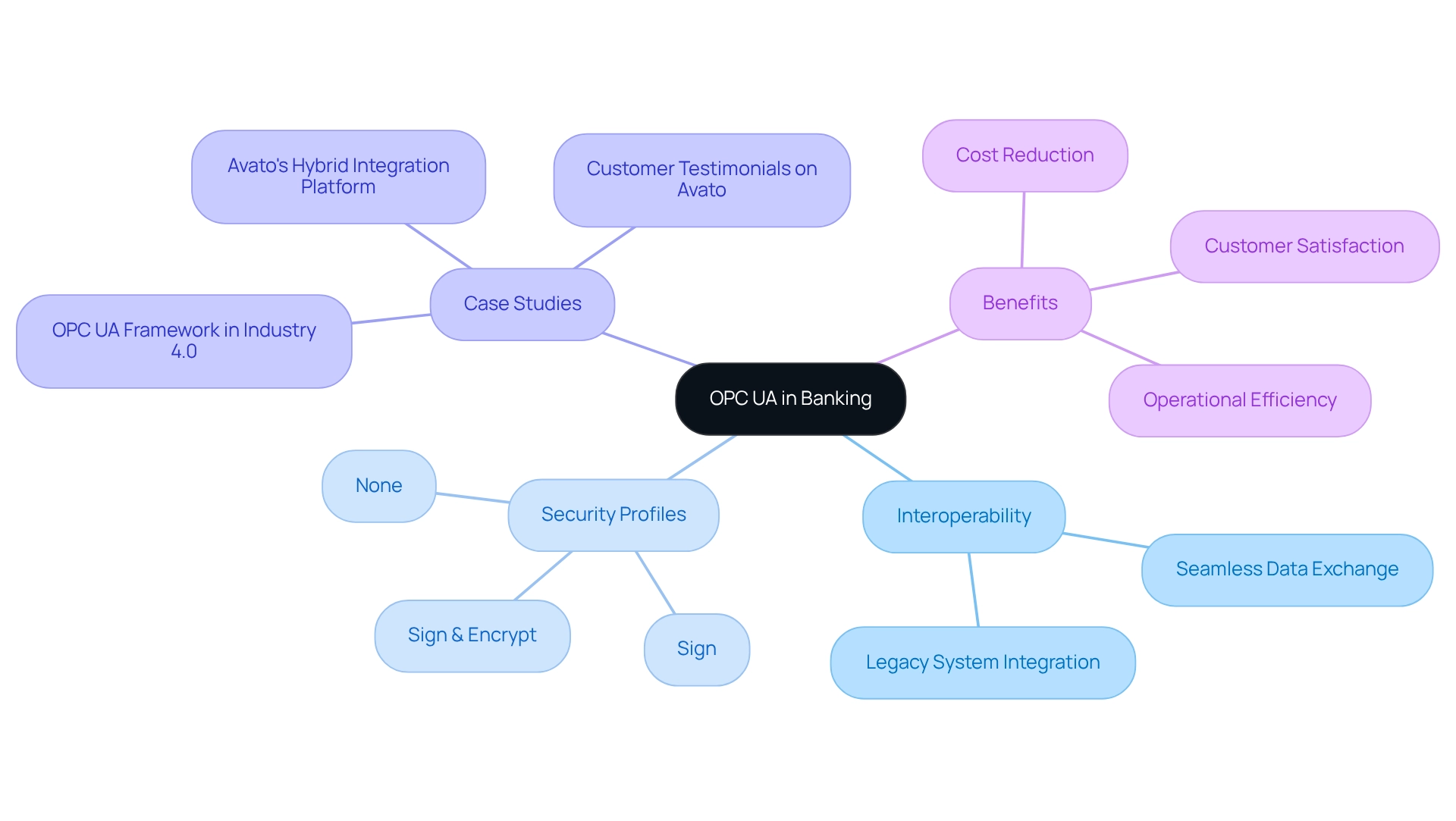

OPC UA: Ensuring Interoperability Across Systems

OPC UA represents a pivotal advancement in machine-to-machine communication, designed to ensure interoperability across diverse systems and devices. This capability is particularly valuable in the banking sector, where legacy systems often coexist. By facilitating seamless data exchange, we enable compliance and reporting, allowing financial institutions to aggregate data from multiple sources to meet stringent regulatory requirements. Our adoption of OPC UA not only enhances operational efficiency but also significantly reduces integration costs. In fact, financial institutions implementing OPC UA have reported improved data flow and shortened timeframes for integrating new technologies into their existing infrastructure.

Recent developments in 2025 underscore our ongoing commitment to reducing obstacles to interoperability, supporting financial institutions in their digital transformation efforts. As Stefan Hoppe, President of the OPC Foundation, noted, “In 2007, he introduced the world’s first OPC UA enabled product: an OPC UA Server integrated into the company’s embedded PLC controllers.” This historical context highlights the significance of OPC UA in our industry. The framework’s capability to define various security profiles—None, Sign, and Sign & Encrypt—ensures that data integrity and confidentiality are upheld, which is crucial in the highly regulated financial sector. These profiles enhance security measures, allowing banks to safeguard sensitive information effectively.

Case studies illustrate the effectiveness of OPC UA in banking systems. For instance, organizations that have embraced the OPC UA framework have accelerated their shift to Industry 4.0, resulting in improved connectivity and data flow. This is corroborated by endorsements from industry leaders such as John Johnstone from OSME Pacific and Gustavo Estrada from BC Provincial Health Services Authority, who highlight the protocol’s role in streamlining complex collaborative projects and enhancing overall operational capabilities through Avato’s Hybrid Integration Platform. Avato’s expertise in hybrid unification has proven transformative for financial institutions, enabling them to achieve cost reductions, faster product delivery, and improved customer satisfaction.

As we navigate the complexities of regulatory compliance, OPC UA emerges as a vital tool for enhancing data exchange and ensuring that institutions can leverage IoT integration solutions to innovate without compromising security or efficiency. With our established track record and continuous improvements, OPC UA, along with Avato’s dedicated hybrid integration platform and IoT integration solutions, is poised to play an even more significant role in the future of interoperability in finance.

iPaaS: Simplifying Complex Integrations

We understand that integrating various applications and data sources can be a daunting challenge, particularly in the context of digital transformation in banking. iPaaS solutions offer a unified platform that simplifies these complexities, especially through our IoT integration solutions. By leveraging Avato’s Hybrid Integration Platform, we empower banks to enhance and extend the value of their legacy infrastructure while seamlessly connecting it to modern applications. This capability facilitates real-time data sharing, significantly boosts operational efficiency, and reduces costs.

For instance, our platform enables the integration of customer relationship management (CRM) solutions with transaction processing frameworks, providing a holistic view of customer interactions. This not only elevates customer service but also strengthens compliance efforts by ensuring that all relevant data is accessible and current. Furthermore, our platform features real-time monitoring and alerts on system performance, ensuring reliability and responsiveness. With support for 12 levels of interface maturity, we enable financial institutions to balance the speed of integration with the sophistication necessary to future-proof their technology stack.

What’s holding your team back from achieving this level of integration? Let us help you navigate the complexities of modern banking technology and unlock the full potential of your systems. Together, we can ensure that your organization remains competitive and agile in an ever-evolving landscape.

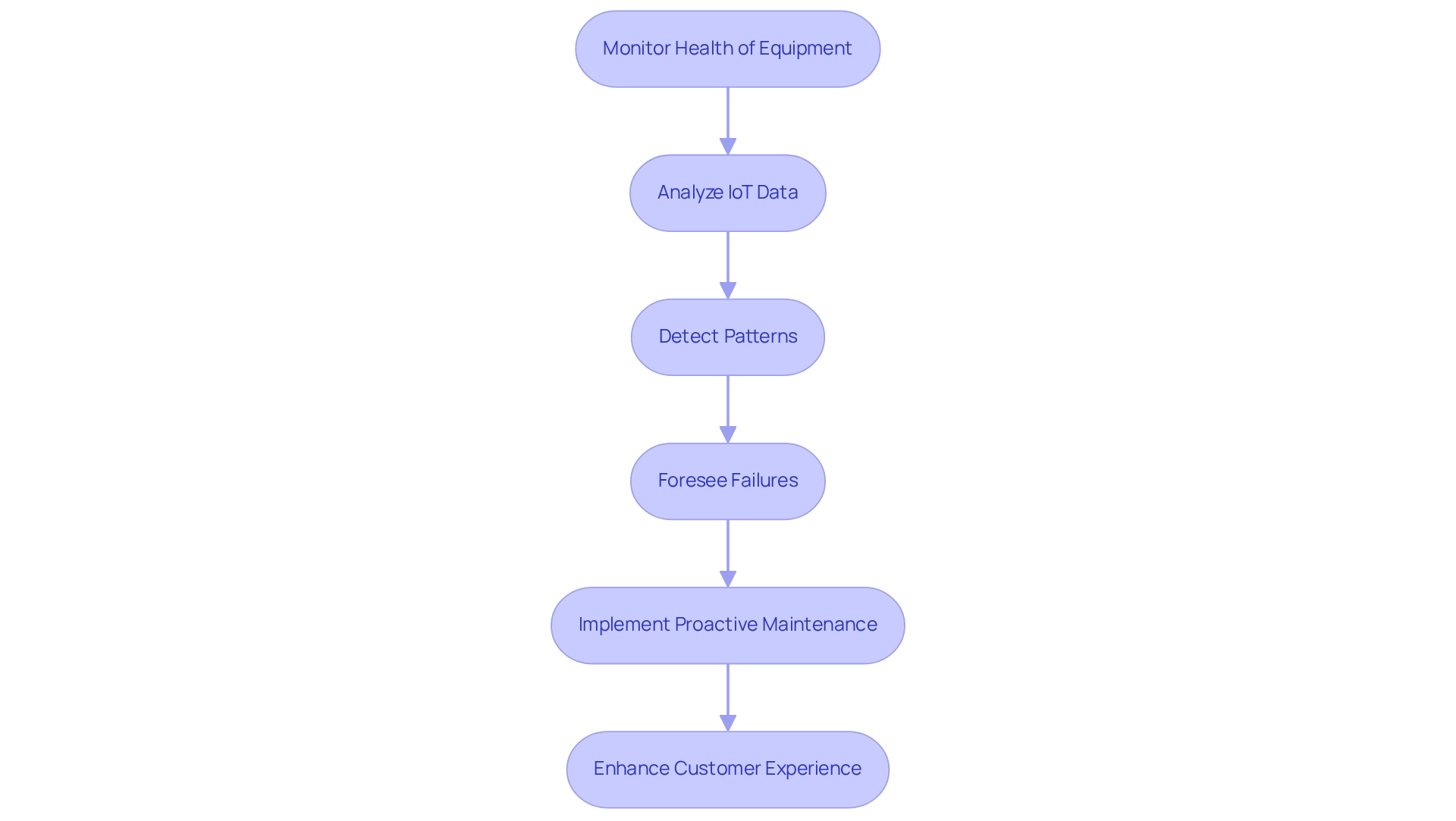

Predictive Maintenance: Enhancing Operational Efficiency

We harness IoT data through predictive maintenance to continuously monitor the health of banking equipment and infrastructure, enabling us to foresee failures before they occur. By analyzing data from various sensors, we can detect patterns that signal potential issues, allowing for proactive maintenance rather than reactive fixes. This strategy not only minimizes downtime but also reduces maintenance costs, as we can resolve problems before they escalate.

For instance, in a notable case study, we implemented predictive maintenance for our ATM network, successfully predicting up to 50% of potential failures. This initiative resulted in a 2% increase in ATM availability, allowing each machine to serve customers for an additional 10,000 minutes annually, significantly enhancing customer experience and operational efficiency.

Furthermore, the integration of generative AI has revolutionized customer engagement in financial services, leading to a 60% increase in its use for customer experience through sophisticated chatbots and virtual assistants. As the trend toward digitalization continues, incorporating AI and machine learning in predictive maintenance is set to redefine our maintenance practices in financial services, ensuring that ATMs and branch equipment remain operational and accessible for customer use.

To effectively implement predictive maintenance strategies, we focus on leveraging IoT integration solutions and investing in training for our staff to maximize the benefits of these technologies.

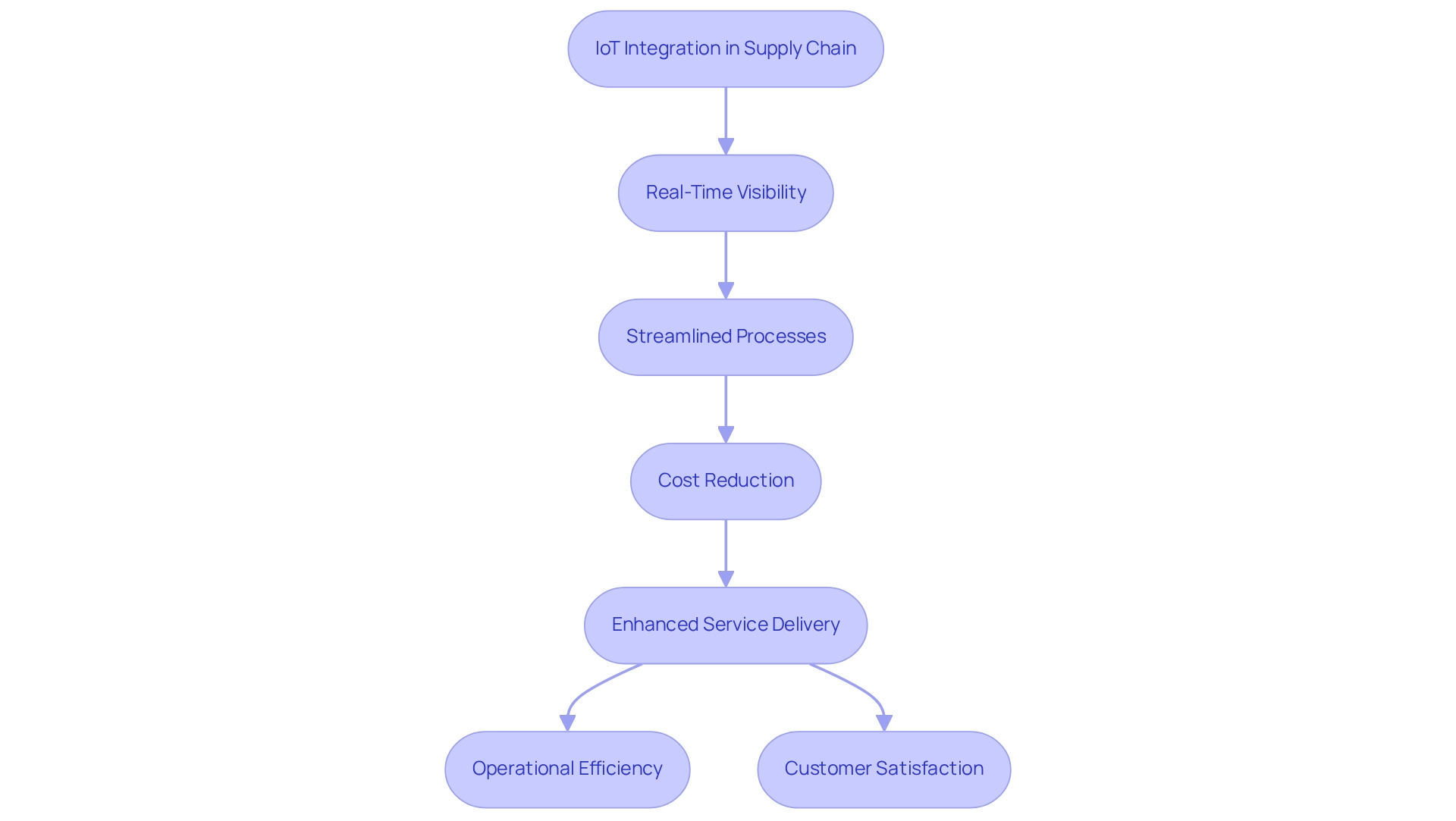

Smart Supply Chain: Optimizing Logistics and Inventory

Intelligent supply chains are revolutionizing logistics and inventory management through IoT integration solutions, a critical necessity for financial institutions managing physical assets like cash and equipment. By leveraging IoT sensors and advanced analytics, we enable real-time visibility into inventory levels and logistics operations. This capability streamlines processes, reduces costs, and enhances service delivery.

For example, we can efficiently oversee cash flow between branches and ATMs, ensuring optimal stock levels while minimizing surplus inventory. Such proactive management not only boosts operational efficiency but also elevates customer satisfaction by guaranteeing consistent service availability. Furthermore, automated reordering based on preset thresholds ensures prompt stock replacement, effectively lowering the risk of stockouts.

As our sector increasingly prioritizes sustainability, the integration of IoT solutions based on blockchain is poised to unlock new avenues for innovation, further enhancing logistics efficiency in finance. Real-world examples demonstrate that IoT adoption in banking supply chain management yields significant benefits, including cost savings and improved operational capabilities, positioning us to maintain a competitive edge in a rapidly evolving market.

Our hybrid connection solutions enhance the capabilities of legacy frameworks, showcasing how effective unification can lead to substantial cost efficiency and faster product delivery. For instance, our collaboration with Coast Capital, which launched in February 2013, highlights our ability to support multiple interfaces and facilitate major system transitions with minimal downtime.

Our platform is designed for secure transactions, trusted by banks, healthcare, and government, ensuring that integration projects maintain 24/7 uptime with no tolerance for defects or outages. As Przemek Szleter noted, ‘Well-implemented IoT infrastructure can help with automation adoption and cut costs in waste management, logistics operations, and goods monitoring.’ This underscores the importance of IoT integration solutions in optimizing financial logistics, while our IoT solutions foster immediate enhancements in supply chain efficiency, complementing IoT initiatives and further improving operational capabilities.

Energy Management: Driving Sustainability and Cost Savings

Energy management systems are revolutionizing how we monitor and optimize energy consumption in banking facilities. By leveraging IoT technologies, we can utilize data from smart meters and sensors to pinpoint inefficiencies and implement targeted strategies that minimize energy waste. This approach not only leads to significant cost reductions but also bolsters our sustainability efforts, enhancing our reputation as a responsible corporate entity. For instance, we can deploy energy management solutions to optimize the efficiency of heating, ventilation, and air conditioning (HVAC) systems, ensuring they operate at peak performance while creating a comfortable environment for both clients and staff.

Recent data indicates that energy management solutions can reduce energy usage by as much as 30%, a crucial factor for financial institutions aiming to lower operational expenses and meet sustainability goals. As we progressively adopt IoT technologies, the integration of these solutions for energy management becomes essential in promoting our sustainability initiatives. Notably, we are now employing real-time tracking of energy consumption, allowing for immediate adjustments that enhance efficiency and reduce carbon footprints.

Practical examples underscore the effectiveness of these technologies; numerous financial institutions have reported substantial improvements in energy efficiency after adopting IoT integration solutions. For example, a leading financial organization successfully decreased its energy expenses by 25% in the first year of implementing an advanced energy management solution. This not only highlights the financial benefits but also illustrates the potential for us to contribute to broader sustainability initiatives through innovative technology adoption. As Gustavo Estrada noted, Avato has the capability to simplify complex projects, which is vital for us as we strive to enhance our energy management processes.

Moreover, examining industry benchmarks reveals that IBM Corporation has successfully implemented energy management systems that optimize energy consumption, showcasing the potential for us to adopt similar solutions. Current trends, such as BECIS offering Energy as a Service (EaaS), further reinforce the necessity of integrating advanced energy management solutions in banking to elevate sustainability and operational efficiency.

Fleet Management: Improving Efficiency and Reducing Costs

We recognize that fleet management solutions, enhanced by IoT integration, can significantly transform vehicle operations within financial institutions. By leveraging GPS tracking and telematics, we enable these institutions to effectively monitor vehicle performance, optimize routing, and minimize fuel consumption. This strategic approach not only generates substantial cost savings—potentially up to 5%, as highlighted by Fireman’s Fund—but also strengthens the reliability of cash transport services.

For instance, we can utilize data analytics to identify vehicle usage patterns, facilitating proactive maintenance planning that reduces the likelihood of breakdowns and ensures vehicle availability. Furthermore, our real-time tracking capabilities empower banks to swiftly address any issues that may arise during transport, thereby enhancing overall operational efficiency.

Recent trends indicate a rising adoption of IoT integration solutions in financial fleet management, with many institutions acknowledging the critical role these solutions play in maintaining a competitive advantage and improving service delivery. Additionally, companies like Fleetsmart provide telematics technology at cost-effective prices starting from £6.95 per vehicle per month, making it accessible for institutions of varying sizes.

The case study titled ‘Enhancing Customer Satisfaction with GPS Technology’ illustrates how improved tracking and management of fleet operations can lead to superior service delivery and increased customer satisfaction. Investing in GPS tracking systems is advantageous not only for large fleets but also for individual vehicle owners, underscoring the versatility and importance of these technologies in the banking sector.

Environmental Monitoring: Enhancing Sustainability Efforts

Environmental monitoring solutions are critical for financial institutions aiming to track their environmental impact and ensure compliance with regulations. By leveraging IoT integration solutions that deploy sensors to monitor air quality, energy usage, and waste management, we can gain valuable insights into our operations and pinpoint areas for enhancement. This approach not only supports our sustainability initiatives but also bolsters our reputation as responsible corporate citizens.

For example, we can utilize environmental monitoring data to implement strategies that reduce our carbon footprint, such as:

- Optimizing energy consumption in our branches

- Optimizing energy consumption in our data centers

What’s holding your institution back from embracing these transformative solutions? Let’s take action together to enhance our commitment to sustainability and position ourselves as leaders in the financial sector.

Smart Agriculture: Optimizing Farming Practices

Smart Agriculture: Optimizing Farming Practices

We recognize that smart agriculture solutions harness IoT technologies to optimize farming practices, presenting significant advantages for banks engaged in agricultural financing. By utilizing data from sensors and advanced analytics, farmers can effectively monitor soil conditions, crop health, and weather patterns. This data-driven approach empowers them to make informed decisions that boost productivity and sustainability. Notably, the incorporation of IoT can lead to a 25% reduction in fertilizer expenses through optimized nutrient usage, further enhancing the financial feasibility of these practices.

For financial institutions, supporting smart agriculture initiatives not only promotes sustainable investment opportunities but also improves loan performance within the agricultural sector. By leveraging Avato’s specialized hybrid connection platform, we can create funding solutions that motivate farmers to embrace IoT integration, resulting in enhanced yields and a minimized environmental impact. Avato’s expertise in simplifying complex connections ensures that we effectively support our clients in this evolving landscape. As Tony LeBlanc from the Provincial Health Services Authority noted, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.”

Moreover, insights from the case study ‘Future Research Directions in Precision Agriculture’ emphasize the need for affordable precision agriculture solutions, which are essential for financial institutions contemplating investments in this area. As the evolution of IoT integration solutions in agriculture continues, it is crucial for us to stay updated on these advancements to support our clients effectively. End-to-end farm management solutions optimize operations and decision-making, offering us a clearer understanding of how to support smart agriculture initiatives. As Gustavo Estrada emphasized, Avato simplifies complex projects, enabling banks to leverage technology effectively in agricultural financing. This comprehensive approach will ultimately lead to better loan performance and sustainable growth in the agricultural sector.

Conclusion

The integration of IoT technologies is fundamentally transforming the banking sector, enhancing operational efficiency and customer experiences. From MQTT facilitating real-time communication to RESTful APIs enabling seamless device interactions, we are increasingly adopting these innovations to streamline processes. The use of OPC UA ensures interoperability across legacy systems, while iPaaS simplifies complex integrations, allowing us to maximize the value of existing infrastructures.

Moreover, predictive maintenance and smart supply chain management leverage IoT data to enhance operational efficiency and reduce costs. Energy management systems are driving sustainability efforts, enabling us to monitor and optimize energy consumption effectively. Fleet management solutions improve vehicle operations, ensuring reliable cash transport services. Environmental monitoring supports compliance and enhances corporate responsibility, while smart agriculture initiatives foster sustainable practices in the agricultural financing sector.

In conclusion, embracing IoT-driven strategies is not just a response to technological advancement; it is a necessity for us as banks aiming to remain competitive in an increasingly digital landscape. As these technologies continue to evolve, they offer unprecedented opportunities for operational optimization, customer engagement, and sustainable growth. What steps will we take to harness these advancements and lead the way in the future of banking?