Overview

Selecting and implementing a compliance management platform is a critical endeavor that requires a thorough assessment of organizational needs. Are you equipped to navigate the complexities of compliance? Evaluating essential features is paramount, as a well-chosen platform not only enhances efficiency but also mitigates risks and fosters transparency.

Furthermore, ensuring integration with existing systems is vital for seamless operation. Ultimately, a strategically selected compliance management platform supports organizations in effectively navigating complex regulatory landscapes.

Take action now to empower your organization with the tools necessary for compliance success.

Introduction

In an increasingly complex regulatory landscape, organizations face the daunting challenge of navigating a myriad of legal requirements and internal policies. Compliance management platforms have emerged as essential tools in this endeavor, automating critical tasks such as risk assessments and reporting. Furthermore, these integrated systems enhance operational efficiency, particularly in high-stakes industries like banking and healthcare.

As regulatory scrutiny intensifies, the demand for sophisticated compliance solutions has surged. Trends indicate a significant shift towards automation and real-time monitoring, making it imperative for organizations to adapt.

This article delves into the key features, benefits, and best practices for implementing compliance management platforms. By doing so, it provides a roadmap for organizations aiming to bolster their compliance efforts and effectively mitigate risks.

Understanding Compliance Management Platforms: An Overview

Compliance management platforms function as integrated systems that empower organizations to navigate the complexities of regulatory requirements, internal policies, and industry standards. By automating critical tasks such as risk evaluations, policy oversight, and reporting, these platforms significantly streamline regulatory processes. This capability is particularly vital in sectors like banking and healthcare, where regulatory scrutiny is intense and the stakes are high.

Recent statistics indicate that 27% of security and IT professionals view mitigating internal audit fatigue as a primary challenge within adherence programs. This underscores the urgent need for robust oversight solutions that alleviate such burdens. Furthermore, starting in 2025, a notable trend has emerged: 77% of corporate risk and oversight professionals emphasize the importance of staying informed about the latest Environmental, Social, and Governance (ESG) advancements. This signals a shift towards more comprehensive regulatory frameworks that encompass broader societal impacts.

Industry leaders recognize the essential role of compliance management platforms in ensuring regulatory adherence. Ayush Saxena, a senior security and regulatory author, points out the increasing complexity of compliance environments, asserting that organizations must adopt a compliance management platform to effectively navigate these challenges.

Real-world examples further illustrate the effectiveness of regulatory oversight systems. In healthcare, organizations have successfully implemented these systems to enhance regulatory adherence, demonstrating their significance in managing regulatory risks proficiently. Additionally, a case study on third-party risk oversight reveals that 58% of regulatory teams struggle with evaluating vendor responsiveness, a challenge that holds particular weight in the banking sector.

This highlights the necessity for improved supervision and the integration of regulatory oversight tools to ensure that external partners meet established standards.

As we delve deeper into the features and benefits of regulatory tools, it becomes clear that their importance in banking and healthcare cannot be overstated. These systems serve as a compliance management platform that not only facilitates adherence to regulatory requirements but also boosts operational efficiency, ultimately positioning organizations to excel in an increasingly regulated landscape.

Key Features to Look for in a Compliance Management Platform

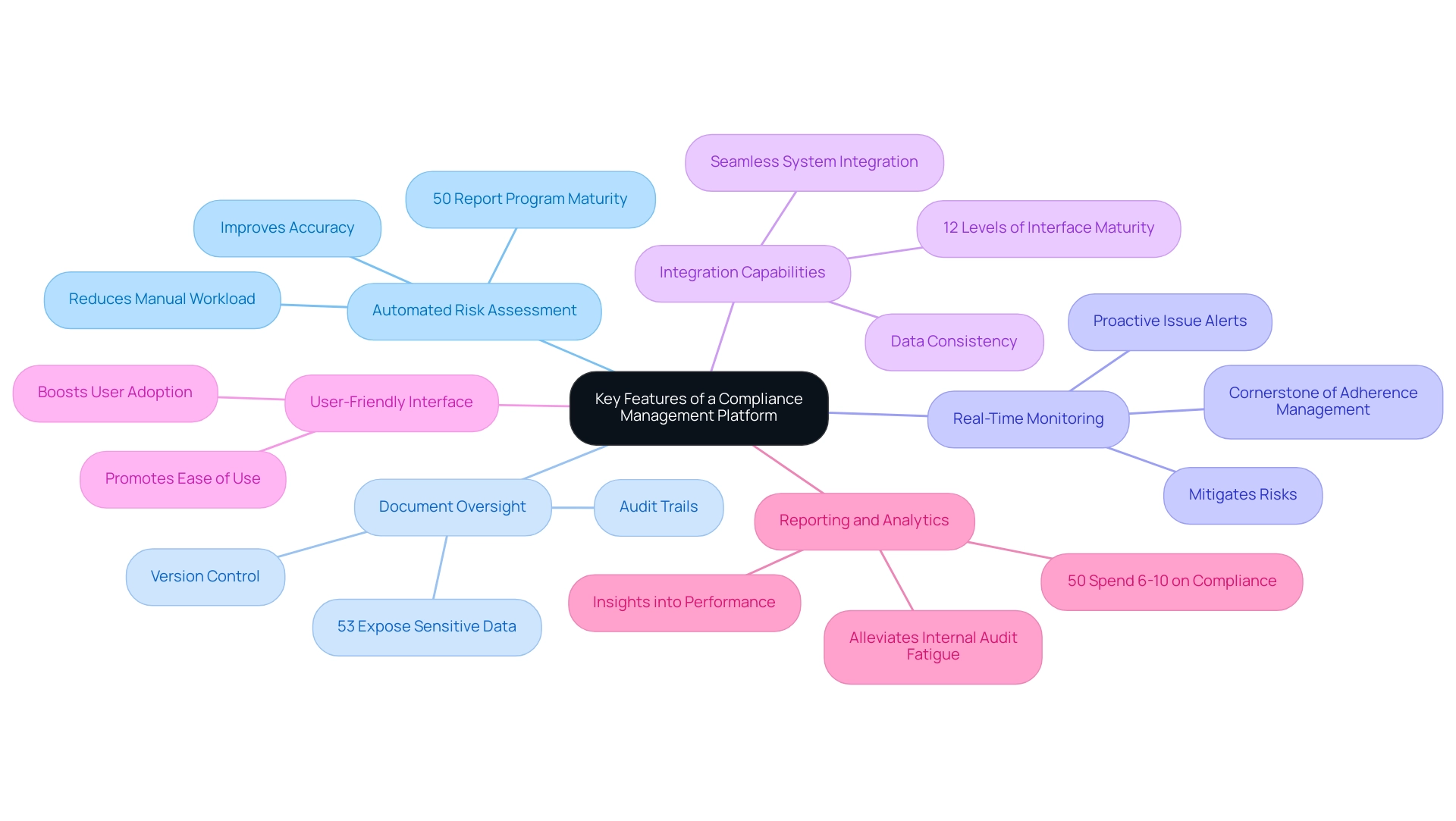

When selecting a regulatory oversight platform, it is crucial to consider several key characteristics that enhance efficiency and effectiveness in managing regulatory requirements:

- Automated Risk Assessment: This feature empowers organizations to automatically evaluate risks associated with regulatory obligations, significantly reducing manual workload while improving accuracy. Notably, 50% of risk and adherence specialists report that their programs are mature, underscoring the growing trend toward automation in regulatory strategies.

- Document Oversight: Effective document oversight tools are essential for maintaining regulatory documentation. These tools must include version control and audit trails to ensure all changes are tracked and accessible, which is vital for regulatory audits. Alarmingly, 53% of companies leave sensitive data exposed to unauthorized personnel, making robust document oversight indispensable in safeguarding sensitive information.

- Real-Time Monitoring: Continuous supervision of adherence status is imperative. Platforms equipped with real-time monitoring capabilities can alert organizations to potential issues before they escalate, thereby mitigating risks. Experts assert that real-time monitoring is a cornerstone of effective adherence management, enabling proactive rather than reactive strategies. Avato’s Hybrid Integration Platform enhances this capability by providing real-time alerts on system performance, ensuring compliance managers can act swiftly to address any concerns.

- Integration Capabilities: The ability to seamlessly integrate with existing systems is paramount. This ensures data consistency across platforms and streamlines workflows, particularly in sectors like banking where data integrity is non-negotiable. Avato’s platform allows entities to unlock data and systems in weeks, not months, supporting 12 levels of interface maturity, balancing speed with the sophistication necessary for future-proofing technology stacks. Furthermore, Avato simplifies intricate integrations, enabling organizations to adapt to evolving regulatory demands.

- User-Friendly Interface: An intuitive design is vital for promoting ease of use among all staff involved in regulatory tasks. A user-friendly interface can significantly boost user adoption and reduce training time, streamlining adherence processes.

- Reporting and Analytics: Comprehensive reporting tools offer insights into adherence performance and pinpoint areas for improvement. With 27% of security and IT professionals identifying internal audit fatigue as a top challenge, effective reporting can alleviate some of this burden by delivering clear, actionable data. Moreover, since 50% of businesses allocate 6-10% of their income to regulatory expenses, strong reporting tools can assist firms in managing these costs more efficiently.

Looking ahead to 2025, advancements in regulatory oversight technology continue to evolve, yet many companies still rely on manual processes. Notably, 60% of Governance, Risk, and Compliance (GRC) users still utilize spreadsheets, highlighting an urgent need for further automation. By prioritizing these essential features, banking IT managers can select a compliance management platform that not only meets current demands but also positions their organization for future success.

As Gustavo Estrada noted, Avato streamlines complex projects and delivers outcomes within preferred timelines and financial constraints, establishing itself as a significant ally in tackling regulatory challenges. Additionally, the cost reductions associated with using Avato’s Hybrid Integration Platform further enhance its appeal, enabling organizations to allocate resources more efficiently.

Benefits of Implementing a Compliance Management Platform

Implementing a compliance management platform delivers significant advantages that can revolutionize organizational operations, especially in regulated sectors like banking. The key benefits include:

- Increased Efficiency: The automation of regulatory tasks drastically reduces manual effort, enabling teams to redirect their focus toward strategic initiatives that propel growth and innovation. This transformation not only boosts productivity but also cultivates a culture of continuous improvement.

- Risk Mitigation: By ensuring strict compliance with regulatory requirements, organizations can substantially diminish the risk of incurring non-compliance penalties. This proactive approach to regulation protects against potential financial and reputational damage, which is increasingly vital in today’s intricate regulatory environment. Notably, 53% of companies permit sensitive data files to be accessible to unauthorized personnel, underscoring the urgent need for robust regulatory oversight tools to protect sensitive information.

- Improved Transparency: Real-time monitoring and comprehensive reporting capabilities provide firms with invaluable insights into their regulatory standing. This transparency enables proactive oversight of potential issues, facilitating timely interventions that can avert regulatory breaches before they arise.

- Cost Savings: Streamlined processes and a reduction in manual errors yield significant operational cost savings over time. Organizations that implement regulatory oversight systems often report substantial cost reductions, which can be reinvested into other critical areas of the business.

- Enhanced Stakeholder Trust: Demonstrating a strong commitment to compliance not only elevates an entity’s reputation but also builds trust with clients and authorities. In a landscape where 76% of consumers would withdraw support from companies perceived as neglecting their responsibilities, fostering stakeholder trust is essential. Moreover, industry leaders emphasize that 91% of business executives believe their company has a duty to address environmental, social, and governance (ESG) issues, highlighting the crucial role of regulatory oversight in fostering a responsible business culture.

As organizations progressively adopt regulatory automation technologies, the compliance management platform emerges as a vital tool in addressing sophisticated cybersecurity challenges, and its importance cannot be overstated. For example, regulatory teams are grappling with the management of third-party risks, with many lacking a comprehensive inventory of third parties accessing their networks. This situation accentuates the necessity for robust oversight systems, such as a compliance management platform, that not only streamline operations but also enhance security and trust throughout.

The surge in cyberattacks targeting third parties further underscores the imperative for effective third-party risk management strategies within regulatory programs.

How to Select the Right Compliance Management Platform for Your Organization

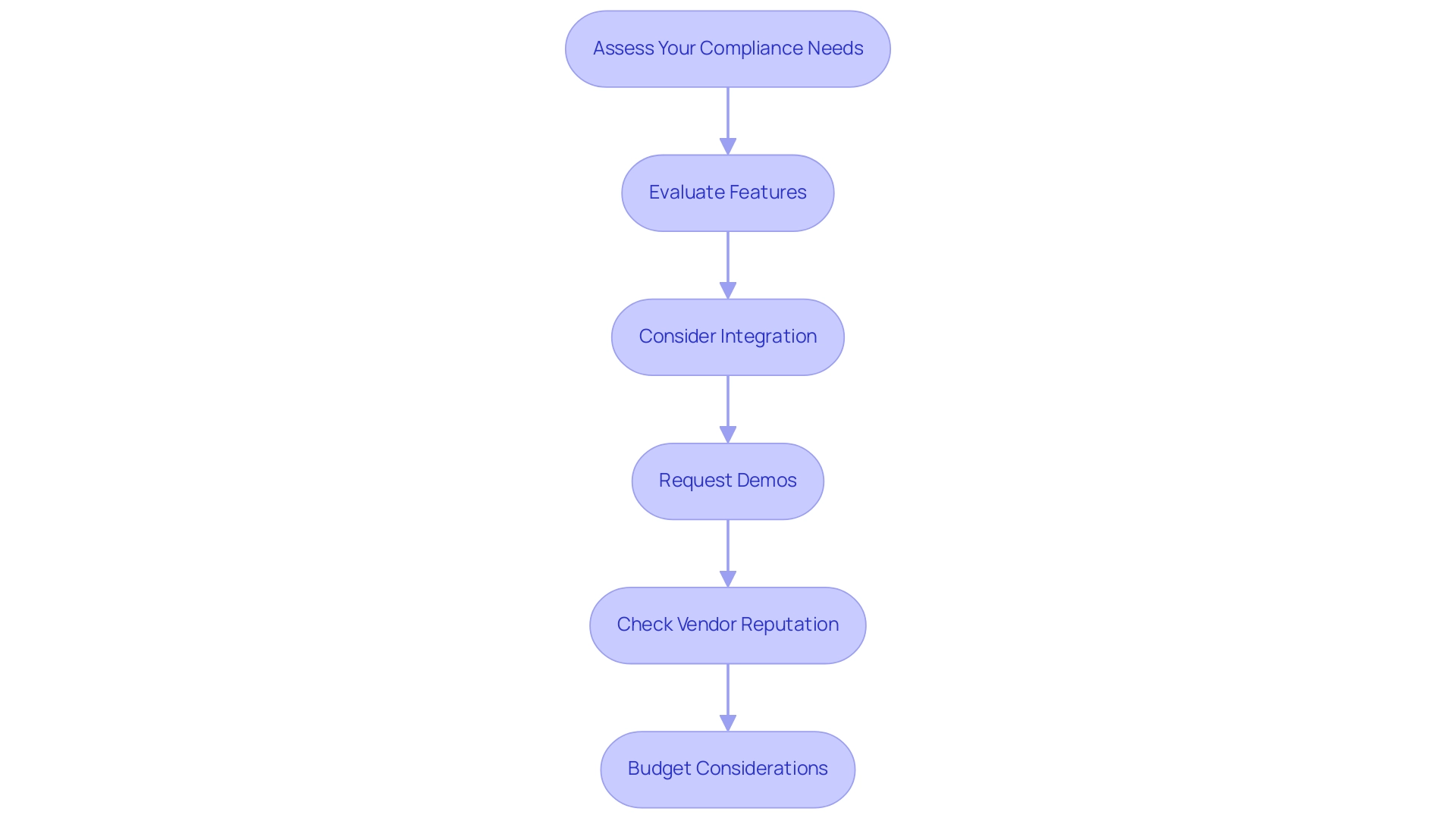

To select the right compliance management platform, follow these essential steps:

-

Assess Your Compliance Needs: Begin by identifying the specific regulations and standards that apply to your organization. This foundational step ensures that your choice aligns with legal and industry requirements.

-

Evaluate Features: Compare systems based on critical features such as real-time monitoring, automated reporting, and user-friendly interfaces. Research indicates that organizations typically assess an average of 15 to 20 features when choosing a compliance management platform, making it crucial to prioritize those that meet your unique compliance requirements.

-

Consider Integration: Ensure the system can seamlessly connect with your existing systems. This capability is vital for facilitating data flow and maintaining consistency across your operations, particularly in complex environments like banking. Involving stakeholders early in the process can help clarify integration needs and ensure that the selected system can adapt to future technological advancements. Avato’s solutions are crafted to facilitate this integration, simplifying the alignment of compliance efforts with operational frameworks.

-

Request Demos: Interact with vendors to ask for demonstrations of their systems. Observing the system in action allows you to assess usability and determine if it meets your organization’s needs effectively. This step also provides an opportunity to discuss how the platform can model your new business processes and activity flows, particularly with Avato’s innovative tools.

-

Check Vendor Reputation: Conduct thorough research on the vendor’s history, customer reviews, and support options. A solid reputation in the sector suggests dependability and can greatly influence your adherence success. Understanding the challenges of vendor-provided integration solutions is crucial to avoid pitfalls in connected banking.

-

Budget Considerations: Evaluate the total cost of ownership, which includes implementation, ongoing maintenance, and potential hidden costs. With regulatory needs evolving, understanding the financial implications is essential for sustainable investment.

In 2023, only 14.3% of organizations attained full PCI adherence, a significant decline from 43.4% in 2020, emphasizing the urgency of choosing a strong management system. Furthermore, 27% of security and IT experts recognized alleviating internal audit fatigue from repeated evaluations as a primary challenge in regulatory programs. This underscores the importance of choosing a compliance management platform to alleviate such issues.

As Rick Stevenson noted, “173 countries have ISO members representing them,” emphasizing the global significance of adhering to established standards. Moreover, the case study of EMC demonstrates the financial consequences of insufficient adherence to regulations; in 2011, the company faced $66 million in recovery expenses due to a cyber-attack triggered by an employee opening a harmful Excel file. This example emphasizes the essential need for employee awareness regarding cybersecurity and the function of oversight in protecting against such threats.

By following these steps, banking organizations can navigate the complexities of regulatory adherence, enhance their operational resilience, and future-proof their systems against evolving challenges.

Best Practices for Implementing a Compliance Management Platform

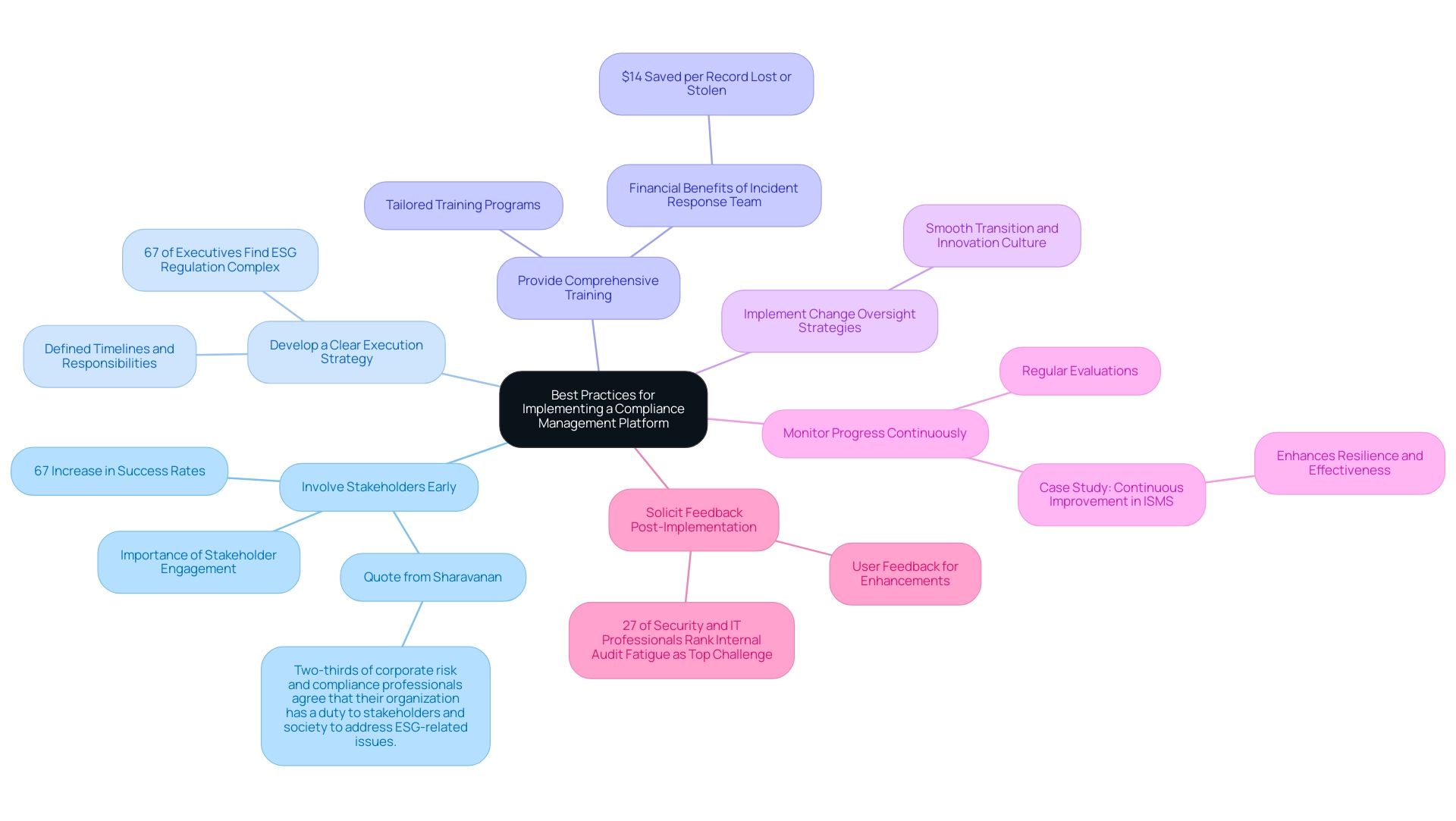

To ensure a successful execution of Avato’s adherence management system, consider the following best practices:

- Involve Stakeholders Early: Engaging key stakeholders from various departments is crucial. This approach not only gathers valuable input but also fosters buy-in, which is essential for the system’s success. As Saravanan observes, two-thirds of corporate risk and regulatory experts concur that the entity has a responsibility to stakeholders and society to tackle ESG-related matters. Furthermore, studies show that entities with robust stakeholder involvement experience a 67% rise in the chances of successful adherence system implementations.

- Develop a Clear Execution Strategy: A clearly defined execution strategy is essential. Outline specific timelines, responsibilities, and milestones to keep the project on track. This structured approach helps mitigate the complexities that 67% of executives find in ESG regulations, providing clarity and direction.

- Provide Comprehensive Training: Invest in comprehensive training programs tailored to Avato’s hybrid integration platform to ensure your staff is comfortable with the new system. Adequate training for all users is essential to maximize adoption and minimize resistance. A dedicated training program can significantly enhance user confidence and competence in utilizing the new system. Moreover, having a dedicated incident response team saves businesses an average of $14 per record lost or stolen, underscoring the financial advantages of effective adherence to regulations.

- Implement Change Oversight Strategies: Alongside training, implementing change oversight strategies is crucial to smooth the transition and foster a culture of innovation within your organization. This proactive strategy aids in tackling any opposition to change and guarantees that staff are well-prepared to adjust to Avato’s adherence platform.

- Monitor Progress Continuously: Regular evaluations of the implementation process enable timely modifications to address any challenges that arise. This proactive monitoring is key to maintaining momentum and ensuring the project stays aligned with its goals. Ongoing enhancement is a fundamental element of regulatory oversight, as demonstrated by the case study on Continuous Improvement in ISMS, which strengthens the system’s resilience in a shifting regulatory environment.

- Solicit Feedback Post-Implementation: After the system goes live, gathering user feedback is essential. This feedback loop aids in recognizing areas for enhancement, ensuring the system evolves to meet user needs effectively. Moreover, 27% of security and IT experts identified alleviating internal audit exhaustion from repeated evaluations as the primary challenge in regulatory programs, highlighting the necessity of tackling user issues.

By following these best practices, organizations can greatly improve their prospects for a successful implementation of Avato’s compliance management platform, ultimately resulting in improved operational efficiency and adherence to standards.

Navigating Challenges in Compliance Management Platform Implementation

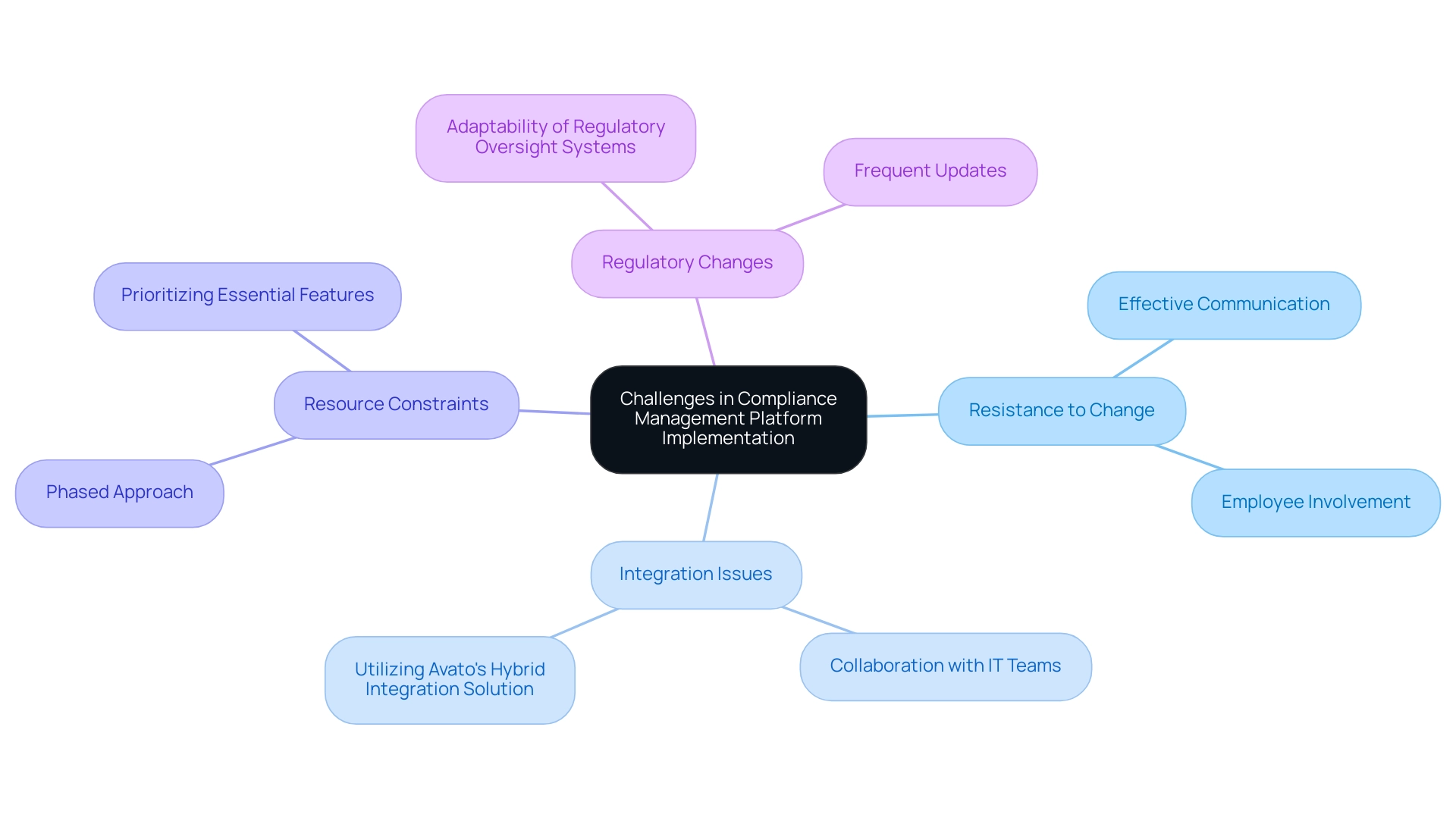

Common challenges encountered during the implementation of compliance management platforms include:

- Resistance to Change: A significant barrier to successful implementation is employee reluctance to adopt new systems. Research by Jodie Haughton indicates that 44% of employees do not understand the necessity for change, highlighting the need for effective communication. To mitigate this resistance, it is crucial to articulate the benefits of the new system clearly and involve employees in the transition process, fostering a sense of ownership and acceptance.

- Integration Issues: Technical difficulties often arise when merging regulatory oversight systems with existing frameworks. These challenges can lead to delays and increased costs. To address this, collaboration with IT teams and vendors is essential to ensure compatibility and streamline the integration process. Avato’s hybrid integration solution is specifically designed to tackle these integration issues, simplifying the complexities of connecting isolated legacy systems efficiently. Customers have praised Avato for its ability to deliver results within desired time frames and budget constraints, showcasing its effectiveness in overcoming these challenges and reinforcing its role in transforming legacy systems. As Tony Leblanc from the Provincial Health Services Authority noted, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.”

- Resource Constraints: Limited budgets and personnel can significantly hinder the implementation of compliance management platforms. Organizations should prioritize essential features and phases, allowing for a phased approach that manages resources effectively while still achieving regulatory goals. This strategic prioritization can help mitigate the impact of resource limitations.

- Regulatory Changes: The landscape of regulations is constantly evolving, making it challenging for companies to keep up. Choosing a regulatory oversight system that provides adaptability and frequent updates is essential to address these changes. This adaptability ensures that entities remain compliant without incurring excessive costs or operational disruptions.

By recognizing these frequent obstacles and utilizing approaches to address them, businesses can boost their likelihood of successful implementation of a compliance management platform, ultimately resulting in enhanced operational capabilities and decreased expenses. Furthermore, leveraging technology, as indicated by the statistic that 96% of daily AI users would like AI to help managers identify growth opportunities, can play a crucial role in navigating these challenges effectively. Avato differentiates itself from competitors by providing speed, security, and simplicity in integration, reinforcing its competitive advantage in addressing the challenges faced by organizations in banking, healthcare, and government sectors.

Moreover, engaging stakeholders and employing the appropriate technology are crucial actions in guaranteeing a seamless transition to new regulatory oversight systems.

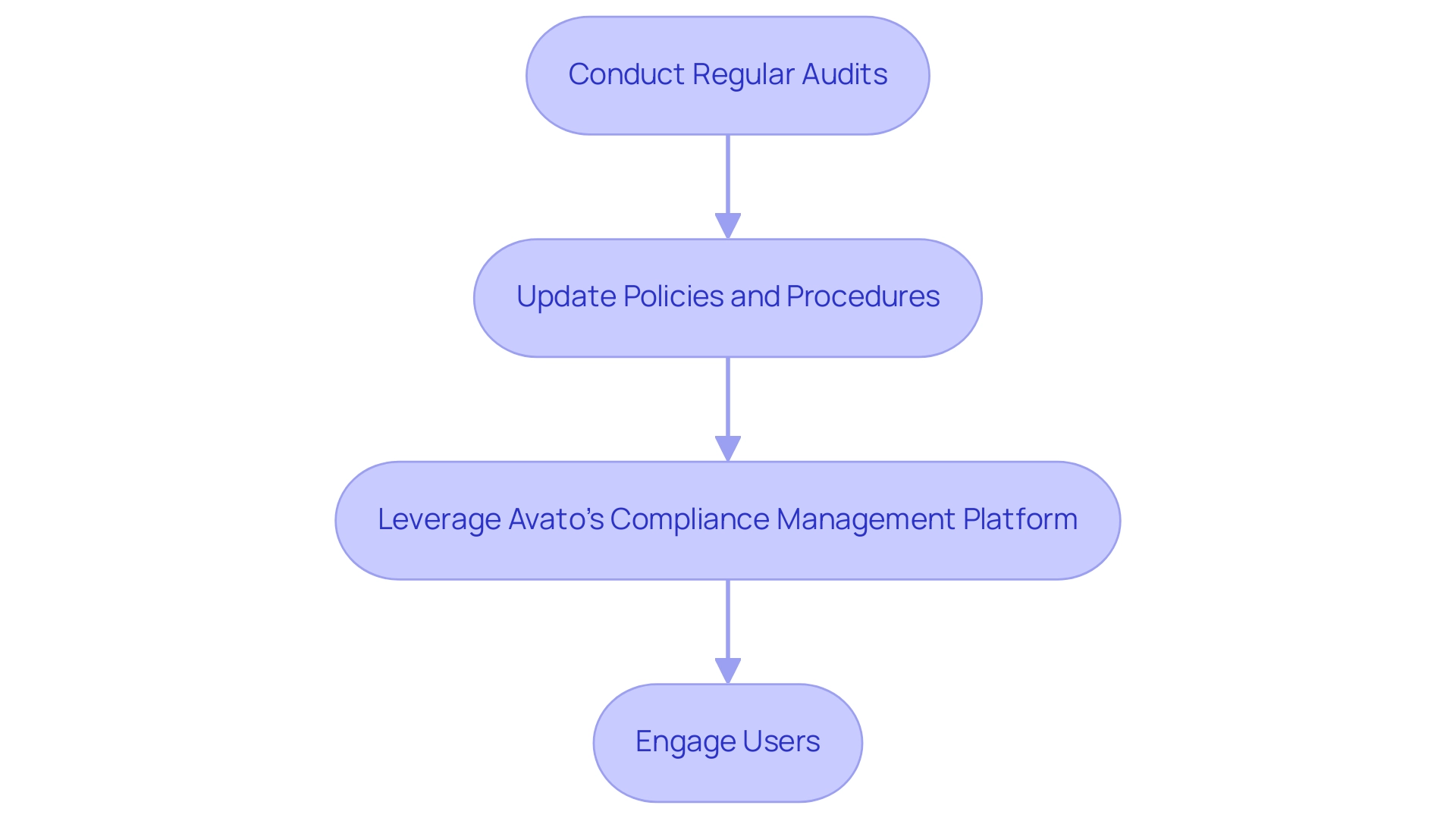

Maintaining and Optimizing Your Compliance Management Platform

To effectively maintain and optimize your compliance management platform in 2025, consider the following strategies:

- Conduct Regular Audits: Implement a schedule for periodic audits to evaluate compliance status. Regular audits not only help identify areas for improvement but also foster a culture of accountability in the compliance management platform. Research indicates that organizations that conduct frequent audits see a significant increase in adherence to regulations, with 89% of Secureframe users reporting accelerated time-to-regulation across multiple frameworks. As CM Oliver notes, “This study is of use to other researchers, since it provides a compliance management platform that helps in conceptualizing audits within their specific organisational context,” highlighting the importance of structured audits.

- Update Policies and Procedures: It is crucial to regularly review and revise the compliance management platform’s regulatory policies to ensure alignment with evolving regulations and organizational practices. This proactive method guarantees that your compliance management platform remains relevant and efficient in addressing current challenges. Given that 67% of executives find ESG regulations complex and seek more guidance from regulators, staying updated is essential for navigating these complexities.

- Leverage Avato’s Compliance Management Platform: Utilize Avato’s robust data analytics capabilities within the compliance management platform to continuously monitor performance and uncover trends that may necessitate attention. Insights from regulatory experts indicate that utilizing a compliance management platform for analytics can greatly improve system optimization, enabling organizations to make informed choices based on real-time information. By integrating Avato’s analytics capabilities, you can optimize operations, improve customer experiences, and identify new opportunities for innovation within your hybrid integration solutions.

- Engage Users: Actively solicit feedback from users to enhance the system’s usability and effectiveness. Engaging users not only enhances their experience but also provides valuable insights into potential areas for enhancement. A study on feedback mechanisms in audit processes analyzed how audits can facilitate feedback among healthcare professionals, flattening perceived hierarchies and encouraging collaboration. The result indicated that audits generate opportunities for constructive feedback among professionals, which enhances teamwork and communication, ultimately improving the quality of results.

By applying these best methods, entities can guarantee that their compliance management platform not only sustains oversight systems efficiently but also enhances them for better performance in a progressively intricate regulatory environment.

Future Trends in Compliance Management Platforms

Future trends in regulatory management platforms are set to significantly reshape the landscape in 2025 and beyond. Key developments include:

- Increased Automation: The movement towards automation in regulatory processes is anticipated to accelerate, as entities increasingly adopt solutions that minimize manual tasks. This shift not only enhances efficiency but also mitigates the risk of human error, allowing teams to concentrate on strategic initiatives rather than routine activities.

- AI and Machine Learning Integration: The integration of AI and machine learning technologies is poised to revolutionize risk assessment and monitoring capabilities. These advanced tools empower entities to proactively identify regulatory risks and respond swiftly, ensuring compliance with guidelines while optimizing resource allocation. Current adoption rates indicate that over 60% of entities are exploring AI applications in regulatory oversight, reflecting a growing recognition of its potential benefits.

- Cloud-Based Solutions: The transition to cloud-based regulatory oversight systems is expected to continue, driven by the demand for scalability and adaptability. Organizations are increasingly favoring cloud solutions that facilitate real-time data access and collaboration, which are essential for maintaining compliance in dynamic regulatory environments.

- Emphasis on Data Privacy: As data privacy regulations evolve, adherence oversight systems must adapt to meet new requirements. This focus on data privacy is not merely a regulatory obligation but also a competitive advantage, as entities that prioritize data protection can build trust with clients and stakeholders.

- Expert Predictions: Industry leaders predict that by 2025, oversight tools will increasingly leverage predictive analytics to foresee regulatory issues before they arise. This proactive approach will enable entities to implement corrective measures swiftly, thereby minimizing potential disruptions.

- Case Studies on Automation Trends: Notable case studies illustrate the effective application of automation in regulatory oversight. For instance, organizations that have embraced automated workflows report a 30% reduction in incidents related to regulations, underscoring the tangible benefits of adopting technology in this domain.

- Avato’s Contribution: Founded in 2010, Avato exemplifies these trends with its specialized hybrid integration solution, simplifying complex regulatory projects and enhancing business value. The name ‘Avato’ signifies a profound commitment to architecting technology solutions. Since its inception, Avato has successfully transformed financial institutions by facilitating seamless and secure data connectivity. As noted by Gustavo Estrada from BC Provincial Health Services Authority, Avato is lauded for its ability to deliver results within desired timelines and budget constraints. The platform’s combination of speed, security, and simplicity in integration further amplifies its value in compliance management, evidenced by specific outcomes such as a 63-second outage during a major system transition at Coast Capital. In summary, the future of compliance management platforms is characterized by a robust integration of automation, AI, and cloud technologies, all aimed at enhancing efficiency, ensuring data privacy, and fostering proactive compliance strategies. Avato’s intuitive UI and strong organizational support position it as a leading choice for banking IT managers navigating these evolving trends.

Conclusion

The integration of compliance management platforms into organizational operations has transitioned from being a luxury to an absolute necessity in today’s regulatory environment. These platforms streamline compliance processes through automation and enhance operational efficiency, especially in high-stakes sectors such as banking and healthcare. Key features like automated risk assessments, real-time monitoring, and robust document management are critical in mitigating risks and ensuring adherence to regulatory requirements.

Furthermore, the benefits of implementing such platforms extend beyond mere compliance. They foster increased efficiency, significant cost savings, and improved stakeholder trust, all of which contribute to a robust organizational reputation. As organizations confront ongoing challenges such as evolving regulations and internal audit fatigue, selecting the right platform becomes imperative. A methodical approach to assessing compliance needs, evaluating features, and engaging stakeholders can significantly enhance implementation success.

Looking ahead, trends such as increased automation, AI integration, and cloud-based solutions will continue to shape compliance management. These advancements promise to simplify compliance tasks while allowing organizations to proactively manage risks and ensure ongoing adherence to regulations. By embracing these technologies, organizations can position themselves for success in an increasingly complex regulatory landscape, ultimately transforming compliance from a burden into a strategic advantage.