Overview

We recognize that modernizing banking legacy systems is not just necessary; it is imperative for enhancing operational efficiency and maintaining competitiveness in today’s rapidly evolving financial landscape. Outdated systems significantly hinder our ability to meet customer expectations and regulatory demands.

To address these challenges, we advocate for strategies such as:

- Incremental upgrades

- Cloud adoption

- Robust stakeholder engagement

These approaches facilitate successful modernization, ultimately improving our agility, cost management, and security. What’s holding your team back from embracing these transformative changes? By taking decisive action now, we can ensure that our banking systems are not just functional but optimized for the future.

Introduction

In today’s rapidly changing financial services landscape, legacy systems present a formidable challenge for banks determined to stay competitive. These outdated technology platforms, often decades old, are deeply embedded in our core banking functions, yet they stifle innovation and agility.

As we face mounting pressures from fintech competitors, regulatory demands, and rising customer expectations, the urgency for modernization has never been greater. We must navigate the complexities of integrating new technologies while preserving operational integrity.

Here, the integration of advanced solutions like generative AI emerges as a beacon of hope. This article explores the pressing need for us to modernize our legacy systems, highlighting the myriad benefits of doing so and outlining effective strategies for a successful transition.

What’s holding your team back from embracing this change?

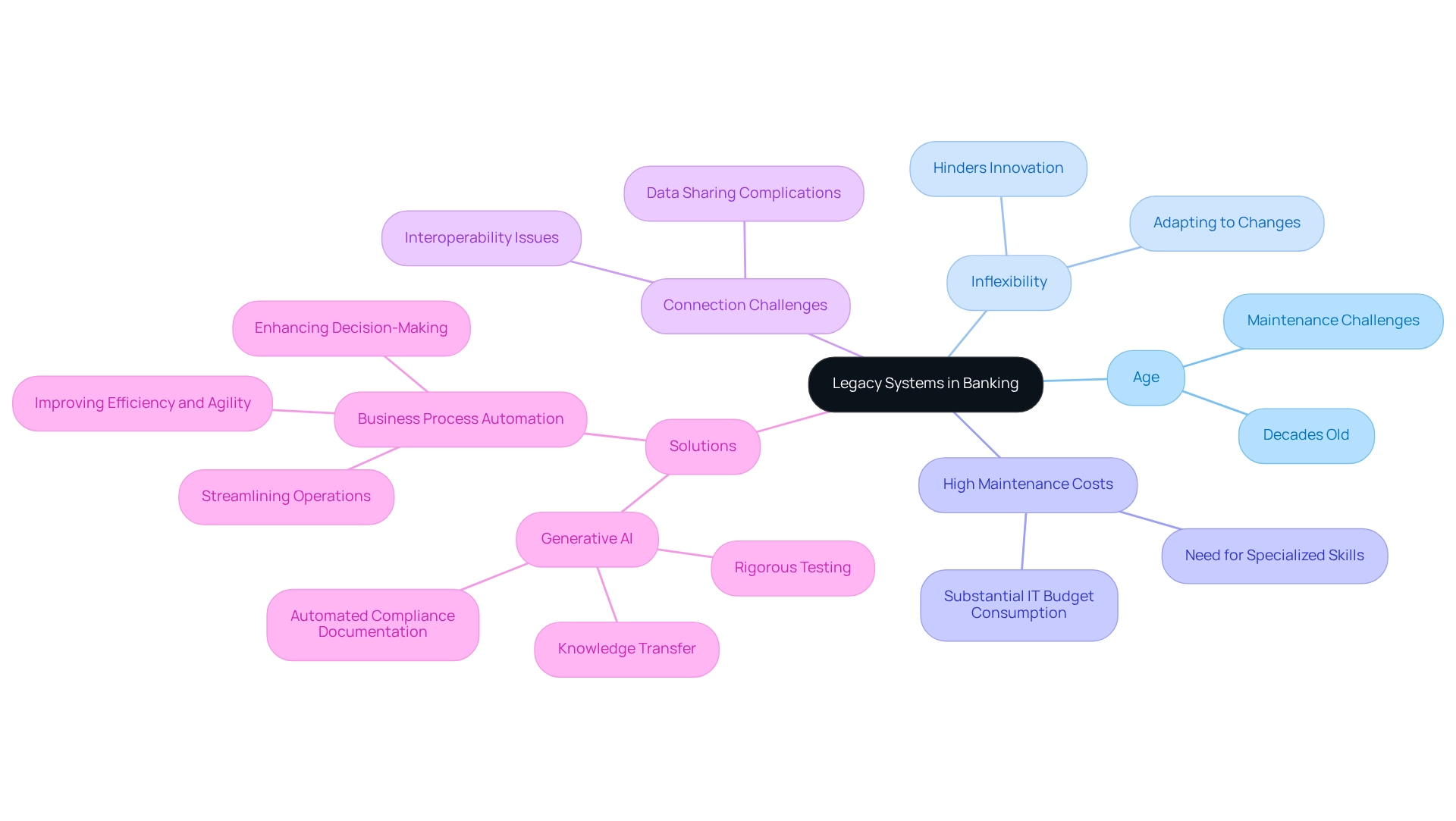

Define Legacy Systems in Banking

Legacy frameworks in banking are often referred to as banking legacy systems, representing outdated technology platforms that persist within financial institutions, typically constructed with older programming languages and architectures. These frameworks are vital to core banking functions, encompassing transaction processing, customer account management, and compliance reporting. Key features of banking legacy systems include:

- Age: Many banking legacy systems are decades old, leading to significant challenges in maintenance and connection with contemporary technologies.

- Inflexibility: Banking legacy systems often lack the agility necessary to adapt to evolving business requirements or regulatory changes, hindering innovation.

- High Maintenance Costs: The upkeep of banking legacy systems can consume a substantial portion of IT budgets, primarily due to the need for specialized skills and resources.

- Connection Challenges: Operating in silos, banking legacy systems complicate data sharing and interoperability with newer applications, creating barriers to efficient operations.

As of 2025, approximately 70% of banks still rely on banking legacy systems, which exacerbates economic and operational costs. The longer organizations maintain these banking legacy systems, the more pronounced these costs become. Expert opinions emphasize that the incorporation of generative AI can alleviate some of these challenges. For instance, Gustavo Estrada, a customer, noted that Avato simplifies complex projects and delivers results within desired time frames and budget constraints. This combination guarantees thorough testing of new frameworks and automatically produces compliance-related documentation, addressing gaps caused by personnel turnover in the banking sector.

We believe Avato’s hybrid platform empowers businesses to future-proof their operations by seamlessly linking legacy frameworks with modern applications, enhancing data flow and operational efficiency. Case studies illustrate that organizations implementing business process automation strategies can achieve notable improvements in efficiency and agility, leading to enhanced financial outcomes. Particularly, the incorporation of automation in finance has transformed operational workflows, underscoring the pressing requirement for financial institutions to update their banking legacy systems to remain competitive in a swiftly changing environment. Moreover, generative AI aids knowledge transfer by offering thorough documentation, which is essential in tackling the difficulties presented by banking legacy systems.

Recognize the Need for Modernization

The necessity for modernization in banking is underscored by several critical factors:

- Competitive Pressure: Fintech companies and neobanks are leveraging advanced technologies to deliver superior services, compelling traditional banks to modernize their systems to retain customer loyalty. Notably, 22% of executives recognize economic uncertainty as a barrier to executing digital transformations, highlighting the urgency for financial institutions to innovate. Our proficient unification services, encompassing enterprise architecture and project management, can assist financial institutions in navigating these challenges by providing experienced collaboration partners who understand the intricacies of updating outdated frameworks.

- Regulatory Compliance: As regulations become increasingly rigorous, financial institutions must ensure their frameworks can swiftly adapt to new compliance demands. This adaptability is essential for avoiding penalties and maintaining operational integrity. Our hybrid integration platform is designed to simplify this process, enabling financial institutions to meet compliance requirements effectively.

- Operational Efficiency: Operational efficiency is compromised by banking legacy systems, as outdated technologies often lead to inefficiencies, resulting in elevated operational costs and sluggish responses to market dynamics. Many conventional financial institutions struggle to integrate new digital technologies with their banking legacy systems, with over 70% of industry leaders acknowledging the significance of embedded finance, yet only 20% currently offering such solutions. Furthermore, a 2023 survey revealed that 67% of financial institutions cited difficulty in hiring qualified tech talent as a major obstacle to their digital transformation efforts. We address these challenges by providing a specialized hybrid integration platform that streamlines the connection of diverse networks, enhancing operational efficiency.

- Customer Expectations: Today’s consumers demand seamless, digital-first banking experiences. Banking legacy systems often hinder financial institutions’ ability to meet these expectations, making updates essential for customer satisfaction and loyalty. Our client-focused solutions empower financial institutions to connect traditional frameworks with contemporary demands, thereby enhancing B2B customer experiences.

Given these challenges, upgrading banking legacy systems has become a necessity for survival in an increasingly competitive environment, rather than just a choice. As Vikram Bhat, a leader in the financial services sector, emphasizes, “Nurturing talent and adopting innovation are essential for financial institutions to manage these pressures effectively.” Additionally, cloud migration and robust data infrastructure are vital components of core framework enhancement, further supporting operational efficiency and regulatory compliance. Consequently, financial institutions must prioritize these elements to remain competitive.

Contact us to learn how we can assist in your digital transformation.

Explore Benefits of Modernization

Modernizing banking legacy systems is not just an option; it is a necessity for staying competitive in today’s financial landscape.

- Enhanced Agility: Our modern systems empower banks to swiftly adapt to market fluctuations and evolving customer expectations, ensuring they remain responsive and relevant.

- Cost Reduction: By streamlining operations through modernization, we significantly lower maintenance costs, allowing us to reallocate resources towards innovation and growth initiatives. For instance, Avato’s Hybrid Integration Platform reduces costs while maximizing and extending the value of banking legacy systems. Upgraded platforms facilitate improved customer experience by providing personalized services and accelerating transaction processing, leading to heightened customer satisfaction. Institutions utilizing modern unification platforms, such as ours, have reported enhanced engagement and loyalty, achieving results within desired timeframes and budget limitations. Exceptional customer experiences are increasingly recognized as the only sustainable platform for competitive differentiation, as highlighted in a 2023 XPLM-commissioned study. Moreover, leveraging generative AI enhances customer engagements, especially through advanced chatbots and virtual aides.

- Improved Data Management: Our updated frameworks enhance data integration and analytical abilities, enabling financial institutions to make better decisions based on thorough insights. A significant challenge that our progress addresses is the issue of data silos, which 76% of executives believe hinder cross-departmental exchange, creating a competitive disadvantage.

- Increased Security: New technologies often incorporate advanced security features, essential for safeguarding sensitive customer information against rising threats. The 2023 Cost of a Data Breach Report by IBM indicates that the average cost of data breaches has reached $4.45 million globally. Organizations utilizing security AI and automation can considerably lower breach expenses by nearly $1.8 million and reduce breach durations by an average of 108 days, underscoring the importance of contemporary security measures.

- Real-Time Monitoring: Our platform provides real-time oversight and notifications on performance, ensuring that financial institutions can proactively tackle issues before they impact operations.

The impact of modernization on customer experience is profound. Financial institutions that embrace these changes report enhanced engagement and loyalty. At Avato, we accelerate the unification of isolated frameworks and fragmented data, providing the connected foundation enterprises require to simplify, standardize, and modernize their operations. This not only improves operational capabilities but also enables financial institutions to better meet the needs of their clients in 2025 and beyond.

Implement Strategies for Successful Modernization

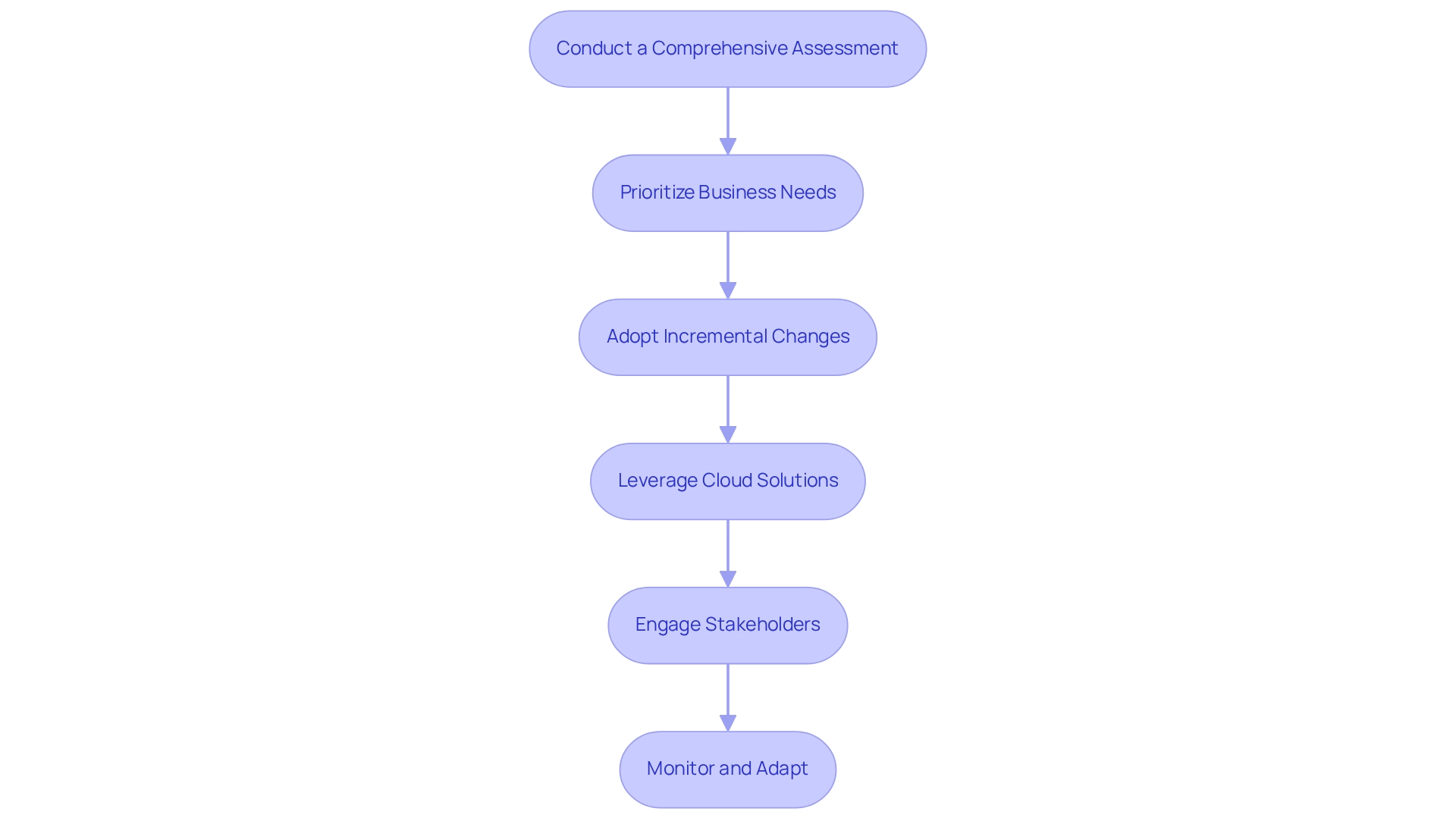

To effectively modernize legacy systems, we must implement strategic initiatives that drive impactful change.

-

Conduct a Comprehensive Assessment: We begin by evaluating existing systems to pinpoint pain points and identify areas ripe for improvement. This essential step is vital for comprehending the present environment and preparing for successful advancement. Collaborating with solution providers like Avato, known for simplifying complex connectivity challenges, enables us to create a thorough strategy that aligns with our institution’s objectives and the evolving needs of our clients.

-

Prioritize Business Needs: We align development initiatives with strategic business objectives to ensure our efforts are relevant and impactful. This alignment not only justifies investments but also secures crucial stakeholder support.

-

Adopt Incremental Changes: Rather than pursuing a complete overhaul, we consider phased upgrades. This approach minimizes disruption and allows for adjustments based on real-time feedback, making the transition smoother. Avato’s hybrid integration platform supports this phased implementation strategy, enhancing adaptability and minimizing risks.

-

Leverage Cloud Solutions: We embrace cloud technologies, projected to grow from 26% to 56% adoption in the banking sector by 2025. This substantial rise signifies our industry’s transition towards advancement, providing the scalability, flexibility, and cost-effectiveness vital for contemporary banking operations.

-

Engage Stakeholders: We involve key stakeholders throughout the update process. Early engagement helps address concerns and fosters buy-in, which is essential for the success of any transformation initiative. Utilizing tools and methodologies to accurately illustrate the current state and ideal state ensures all voices are heard. As Piyush Gupta, CEO of DBS Bank, stated, “Core transformation provided us the foundation to become a truly data-driven organization.” The insights gained have transformed our product development, risk management, and customer engagement strategies.

-

Monitor and Adapt: We continuously assess the performance of new setups and remain prepared to make necessary modifications. This ongoing evaluation ensures that our improvement efforts remain aligned with business needs and regulatory requirements. By future-proofing our infrastructure to incorporate new tools with current assets, we ensure long-term viability.

By implementing these strategies, we can navigate the challenges of outdated technology modernization, ultimately enhancing our operational capabilities and compliance stance. For instance, financial institutions that integrate compliance functions into their core systems can lower regulatory reporting expenses by as much as 40%, significantly alleviating compliance-related risks. This proactive approach not only addresses immediate challenges but also positions us to thrive in a rapidly changing financial landscape. Our expertise in core banking modernization is crucial for successfully navigating these efforts.

Conclusion

Modernizing legacy systems in banking is not merely a strategic choice; it is an imperative response to the evolving demands of the financial services landscape. Legacy systems are increasingly becoming a liability, hindering our ability to innovate and adapt to competitive pressures, regulatory changes, and customer expectations. The integration of advanced technologies, such as generative AI, provides us with a pathway to overcome these challenges, enhancing operational efficiency and improving customer experiences.

The urgency for modernization is underscored by the pressing need for us to remain relevant in a market dominated by agile fintech competitors. By embracing modernization, we can achieve significant benefits, including:

- Reduced operational costs

- Enhanced data management

- Improved security measures

Furthermore, implementing strategic approaches to modernization—such as conducting comprehensive assessments, prioritizing business needs, and leveraging cloud solutions—ensures a smoother transition that aligns with our organizational goals and customer demands.

In conclusion, the path to modernization is unequivocal. We must prioritize the transition from outdated legacy systems to more agile, integrated solutions that not only meet regulatory requirements but also elevate customer satisfaction. As the financial landscape continues to evolve, those of us who invest in modernization will be better positioned to thrive, ensuring we meet the needs of today’s consumers while preparing for the challenges of tomorrow. The time for action is now; embracing change is vital for our survival and success in the rapidly changing world of banking.