Overview

In today’s rapidly evolving banking landscape, app orchestration is not just an option; it is a necessity. By automating repetitive tasks, we maximize efficiency, streamline workflows, and enhance our operational capabilities. This integration not only reduces manual errors and processing times but also significantly improves customer satisfaction. As we integrate various applications, we foster greater operational agility and achieve substantial cost reductions. Ultimately, this leads to a more responsive and innovative banking environment.

What’s holding your team back from embracing this change? We understand the complexities involved, but the benefits of an integrated approach are clear. Our experience shows that organizations that adopt app orchestration see marked improvements in both their operational efficiency and customer engagement.

We invite you to join us in transforming your banking operations. By leveraging our expertise in app orchestration, you can ensure your institution remains competitive and forward-thinking. Let’s work together to create a banking environment that not only meets but exceeds customer expectations.

Introduction

In the rapidly evolving landscape of banking, operational efficiency is no longer merely a goal; it has become a necessity. As we strive to enhance our services and remain competitive, app orchestration emerges as a transformative tool that automates processes, integrates legacy systems, and streamlines workflows. By leveraging such innovative technologies, we can not only reduce operational costs but also improve customer satisfaction and compliance.

What’s holding your team back from embracing this change? This article delves into the multifaceted benefits of app orchestration in banking, highlighting how it fosters agility, enhances security, and drives innovation.

Ultimately, we pave the way for a more efficient and responsive financial sector. Let us explore how we can work together to harness these advancements for our mutual benefit.

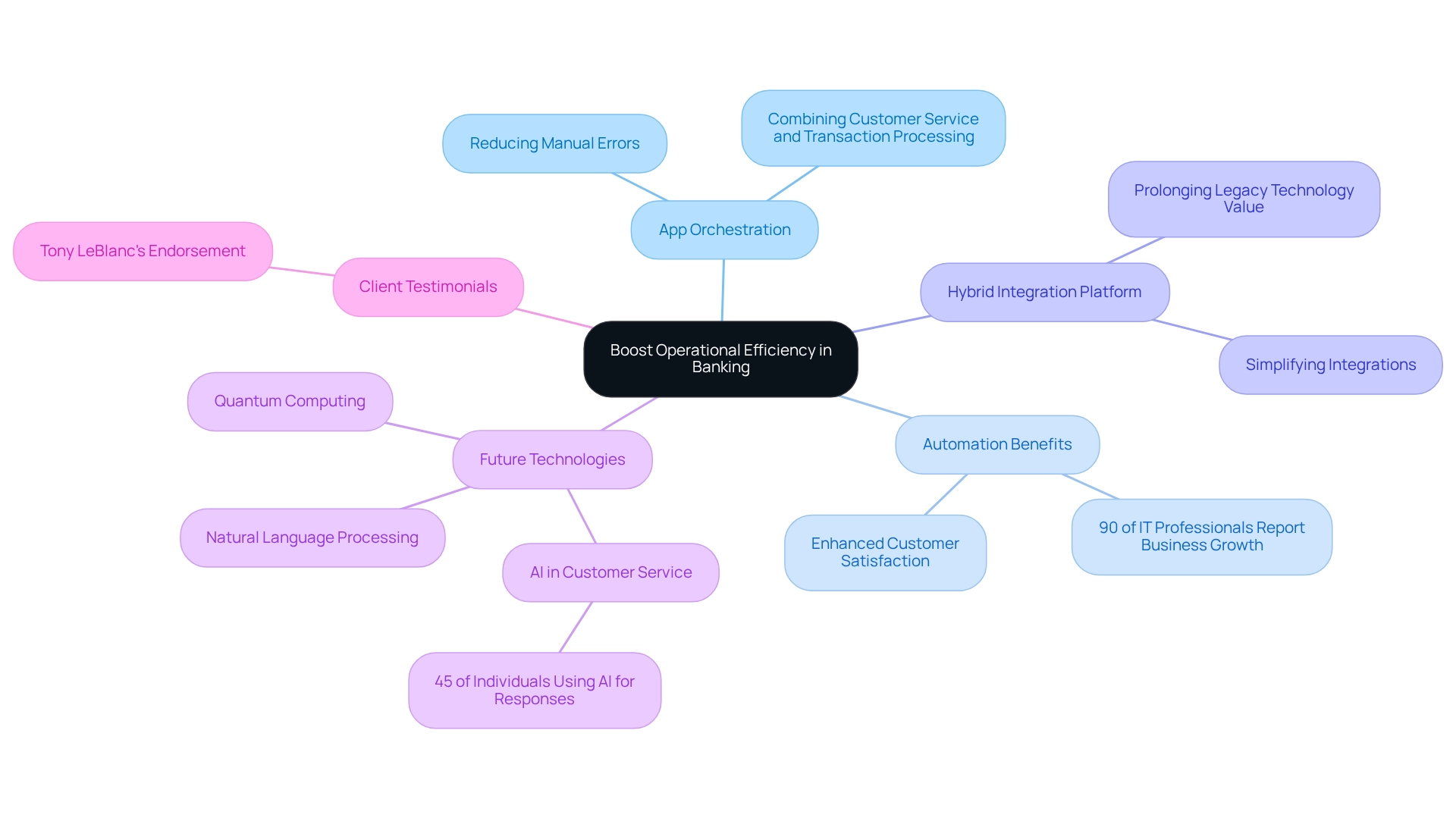

Boost Operational Efficiency

In banking, we recognize that implementing app orchestration significantly enhances operational efficiency by automating repetitive tasks. This approach reduces manual errors and processing times, addressing a critical challenge in our industry. For instance, when we combine customer service applications with transaction processing platforms, we can achieve quicker response times and increased customer satisfaction. Our Hybrid Integration Platform plays a vital role in this process, enabling financial institutions to enhance and prolong the value of their legacy technologies while simplifying intricate integrations. A significant statistic reveals that 90% of IT experts have noted business expansion linked to process automation, underscoring the transformative effect of our management tools.

Furthermore, we see that the retail automation market is projected to grow significantly, reflecting the increasing importance of automation in enhancing operational efficiency across various sectors. By ensuring seamless interaction among various systems, we assist financial institutions in creating a cohesive operational framework that not only streamlines processes but also reduces the risk of errors. As the banking sector continues to evolve, the automation of tasks such as customer service and transaction processing is becoming increasingly vital. Recent advancements in application management, supported by our secure platform, are paving the way for financial institutions to enhance their operational capabilities, ultimately leading to improved service delivery and customer experiences.

What’s more, with around 45% of individuals intending to utilize AI to assist in replying to messages and emails, the trend of app orchestration in customer service is emerging as significant. As we consider the future, innovations such as quantum computing and natural language processing will further improve the capability of application management in providing efficient and effective banking services. Testimonials from clients, such as Tony LeBlanc from the Provincial Health Services Authority, highlight the professionalism and knowledge of our team, reinforcing the effectiveness of our platform in driving operational efficiency. Together, let’s embrace these advancements to elevate our banking services.

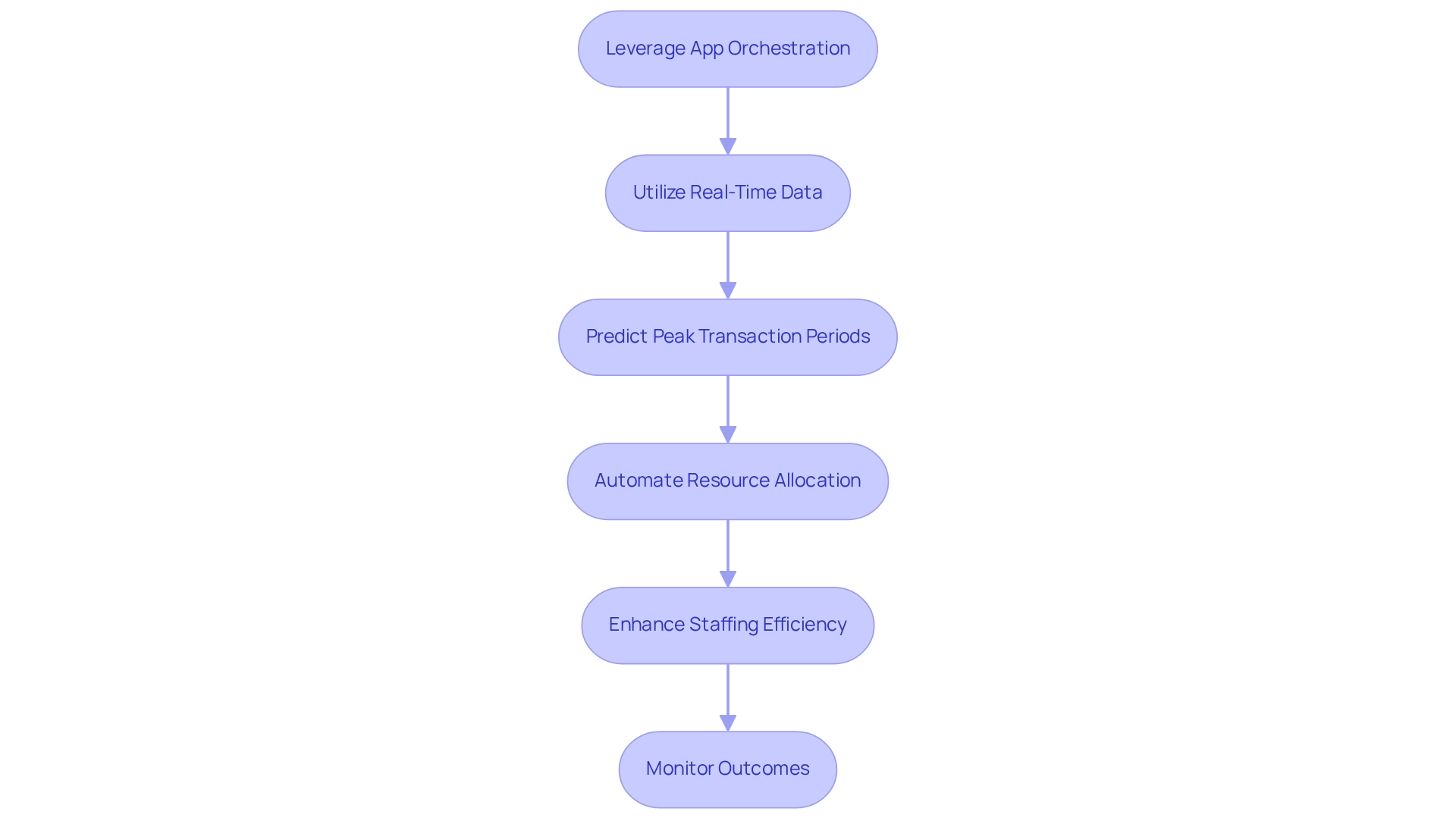

Optimize Resource Management

We can significantly enhance resource management by leveraging app orchestration to automate the allocation of both human and technological resources based on real-time data. What if we could predict peak transaction periods? By utilizing analytics, we can assign personnel more efficiently, ensuring high customer service levels while preventing overstaffing during quieter periods.

A notable example is First Horizon Institution, which successfully implemented a branch performance visualization dashboard, resulting in a remarkable 23% increase in branch profitability within just one year. Furthermore, during the pandemic, financial institutions demonstrated remarkable agility in adapting their strategies while adhering to regulatory requirements, as highlighted by Rich Corriss. This underscores the importance of effective resource management.

By employing app orchestration, we can automate resource distribution, enhancing staffing effectiveness during busy transaction periods. This not only bolsters our operational capabilities but also contributes to a sustainable competitive advantage in an increasingly data-driven financial landscape.

As we recognize the value of data visualization as a core competency, ongoing investment in these technologies will be essential for maintaining a leading edge in the market. Avato plays a vital role in this transformation by simplifying complex integrations and ensuring round-the-clock uptime for critical operations, reinforcing the reliability of our resource management solutions.

As Jim Delapa noted, optimizing sales and service capacity is an iterative process, highlighting the continuous improvement necessary in resource management.

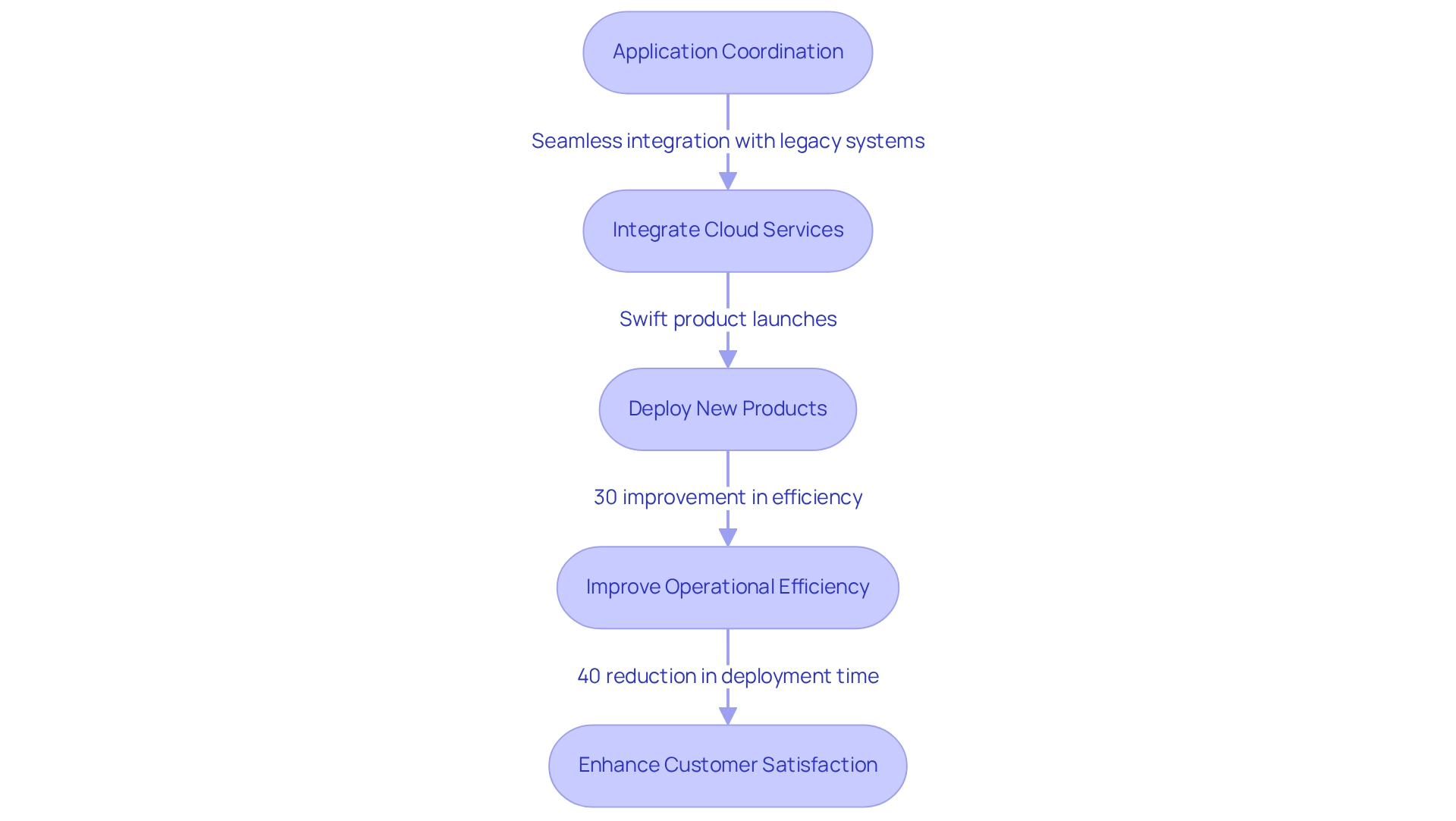

Enhance Scalability

Application coordination empowers us to scale operations effectively by seamlessly integrating cloud services with legacy systems. This capability enables us to deploy new products swiftly, as app orchestration allows various applications to function cohesively. For instance, we can introduce innovative financial products to market in a matter of weeks rather than months, significantly reducing time-to-market. Additionally, the scalability benefits of app orchestration allow us to adjust our services dynamically to meet fluctuating demands without extensive reconfiguration of existing infrastructures. Our secure hybrid connection platform ensures 24/7 uptime for critical links, which is essential for maintaining operational reliability in the banking sector. This platform not only streamlines intricate connections but also enhances the value of legacy systems, allowing us to access isolated assets and generate business value. Recent statistics suggest that organizations utilizing app orchestration have experienced up to a 30% improvement in operational efficiency, enabling them to respond to market changes more effectively.

Case studies emphasize successful implementations where we have swiftly launched new financial products through app orchestration. For example, a prominent financial institution employed our hybrid connection platform, which boasts a modular design providing unmatched flexibility to modify and expand specific banking functions, to enhance its product launch process. This resulted in a 40% reduction in deployment time and enhanced customer satisfaction.

Expert opinions underscore the importance of scalability in banking, particularly as institutions face increasing pressure to innovate while maintaining compliance with regulatory standards. As cloud services advance, the combination of these technologies with traditional systems will be essential for us to remain competitive in 2025 and beyond. Nonetheless, although cloud providers present robust security protocols, threats like data breaches and unauthorized access persist, requiring thoughtful evaluation of our integration strategies.

Furthermore, recent advancements in cloud testing have enabled us to replicate real-world scenarios on a broader scale, offering flexibility and cost efficiency relative to conventional on-premises approaches. This trend further highlights the need for strong application coordination strategies to maximize efficiency and adaptability in the banking sector.

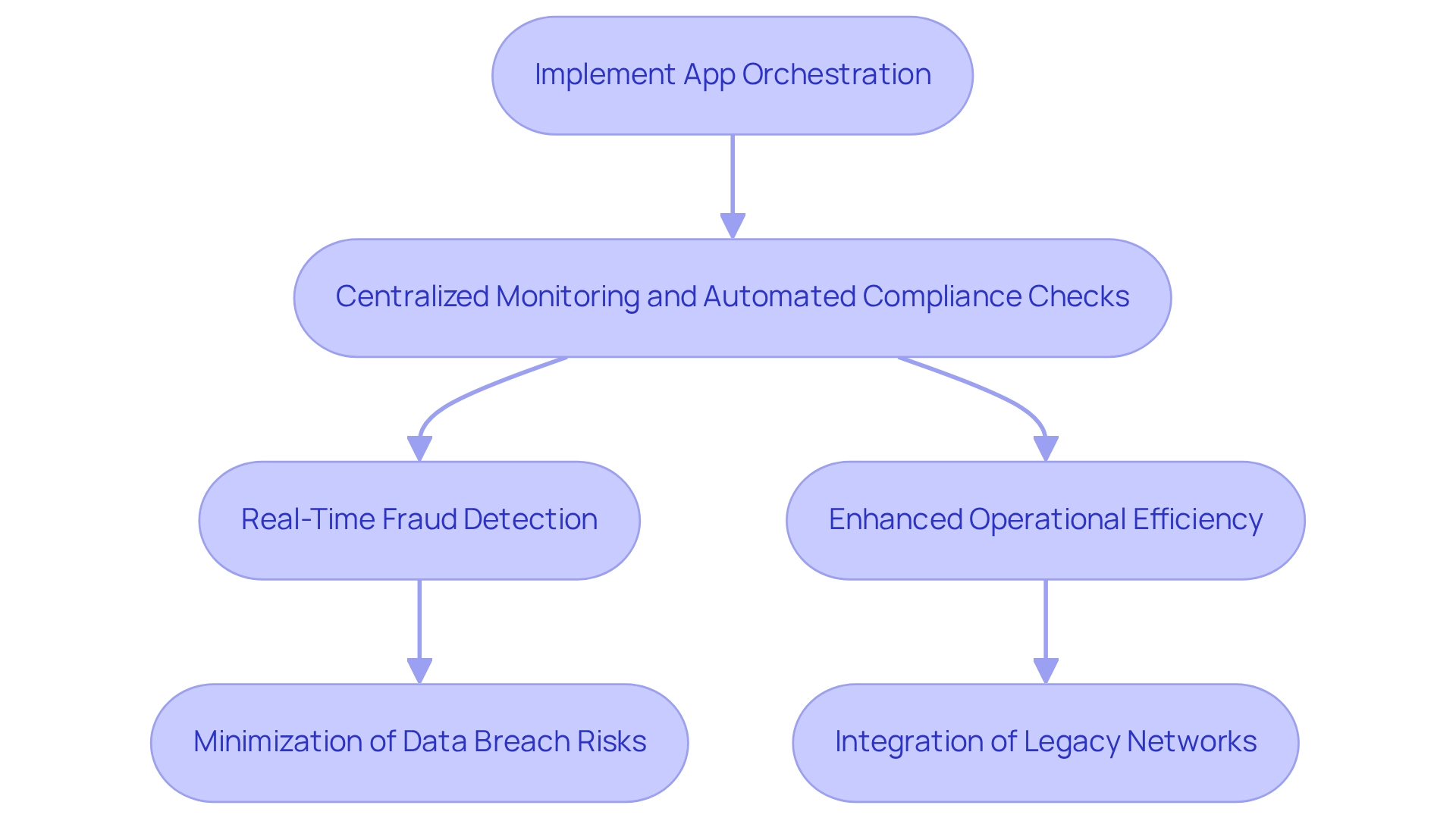

Strengthen Security Protocols

Implementing app orchestration enables us to significantly enhance our security protocols through centralized monitoring and automated compliance checks. By combining security applications with transaction processing networks, we can achieve real-time fraud detection, which is essential given that insider threats represent roughly 34% of all data breaches in our sector. This proactive approach not only minimizes risks associated with data breaches but also enhances our overall operational efficiency.

Our secure hybrid connection platform is designed for secure transactions, establishing it as a reliable solution for banks, healthcare, and government entities. With an emphasis on 24/7 availability and dependability, we facilitate the smooth integration of disconnected legacy networks, accelerating digital transformation efforts. For instance, Bank of America and JPMorgan Chase have effectively employed centralized oversight tools to enhance their fraud detection procedures. These systems enable continuous oversight of transactions, allowing for immediate responses to suspicious activities.

As organizations increasingly invest in cybersecurity technologies, the focus on compliance with industry-specific guidelines becomes paramount for protecting sensitive data. Expert insights highlight that the integration of app orchestration can enhance security protocols, fostering a more resilient banking environment. Gal Ringel, CEO and Co-Founder at Mine, emphasizes, “With a new wave of AI set to revolutionize how we live and work, data privacy has never been more important than it is today,” underscoring the critical need for real-time monitoring and alerts in banking security. This ensures that we can adapt swiftly to emerging threats, thereby maintaining a competitive edge in the financial services landscape.

Furthermore, case studies demonstrate that enhanced security measures not only protect against breaches but also drive the development of innovative financial products that prioritize security, ultimately providing businesses with a significant advantage in the market. According to the NVIDIA 2025 survey, nearly 70% of firms reported at least a 5% revenue increase attributable to AI implementations, highlighting the financial benefits of integrating advanced security measures. To further strengthen our defenses, we encourage banks to adopt specific technologies such as machine learning algorithms for anomaly detection and automated compliance tools that align with regulatory requirements.

Streamline Workflows

App orchestration is pivotal in streamlining workflows by automating inter-departmental processes. Consider the loan approval process: by integrating credit scoring, document verification, and customer communication systems, we can significantly reduce approval times. This enhancement not only boosts operational efficiency but also elevates the overall customer experience.

Organizations that embrace app coordination report workflow efficiency improvements of up to 30%, enabling banks to respond more swiftly to customer needs. According to the recent NVIDIA 2025 State of AI in Financial Services survey, nearly 70% of firms experienced at least a 5% revenue increase due to AI implementations, highlighting the financial advantages of such automation.

As the banking sector increasingly adopts automation technologies, streamlining these processes becomes essential for maintaining competitiveness and ensuring customer satisfaction. Furthermore, the US BPA market is projected to account for approximately 84.3% of the global market share by 2033, underscoring the urgent need for banking institutions to innovate and adopt app orchestration solutions. Additionally, 50% of business leaders plan to automate more repetitive tasks within their organizations, signaling a significant trend towards automation in the industry.

What could be the consequences of failing to adopt these technologies? A loss of market share and disrupted cash flow are real risks, emphasizing the necessity of innovation.

Our hybrid integration platform is designed to accelerate secure integration, allowing financial institutions to leverage these advancements effectively. As Tony LeBlanc from the Provincial Health Services Authority remarked, ‘Good team. Good people to work with. Extremely professional. Extremely knowledgeable.’ This reflects our commitment to supporting organizations in their digital transformation initiatives.

Integrate Legacy Systems Seamlessly

App orchestration is essential for seamlessly connecting legacy frameworks with contemporary applications, enabling us to leverage existing infrastructure while embracing new technologies. By utilizing APIs to link conventional banking infrastructures with modern customer relationship management (CRM) tools, we significantly enhance data flow and improve customer interactions—all without necessitating extensive upgrades.

Our Hybrid Connection Platform exemplifies this approach, maximizing and extending the value of legacy frameworks while simplifying complex connections. Statistics reveal that a third of all digital transformation failures stem from legacy constraints, underscoring the need for effective unification strategies. Effective integration not only mitigates these risks but also fosters agility; updating outdated frameworks is a critical factor in enhancing responsiveness to market changes and customer needs. The case study titled ‘Agility Through Legacy System Replacement’ illustrates how replacing obsolete technologies can drive agility, enabling us to react swiftly to evolving market demands.

Numerous banks have successfully leveraged APIs to connect legacy frameworks with modern applications, demonstrating the potential for enhanced operational efficiency. Expert insights indicate that the selection of APIs should align with specific use cases and future business requirements, ensuring our integration efforts are both strategic and sustainable. As Gustavo Estrada aptly noted, ‘Avato has the ability to simplify intricate projects and deliver outcomes within preferred time frames and budget limitations,’ particularly relevant in the context of integrating legacy infrastructures in banking. Furthermore, our platform provides real-time monitoring and alerts on performance, enhancing operational oversight. As the banking sector advances, app orchestration will be crucial for linking legacy systems, sustaining a competitive advantage, and addressing the increasing needs of our clients.

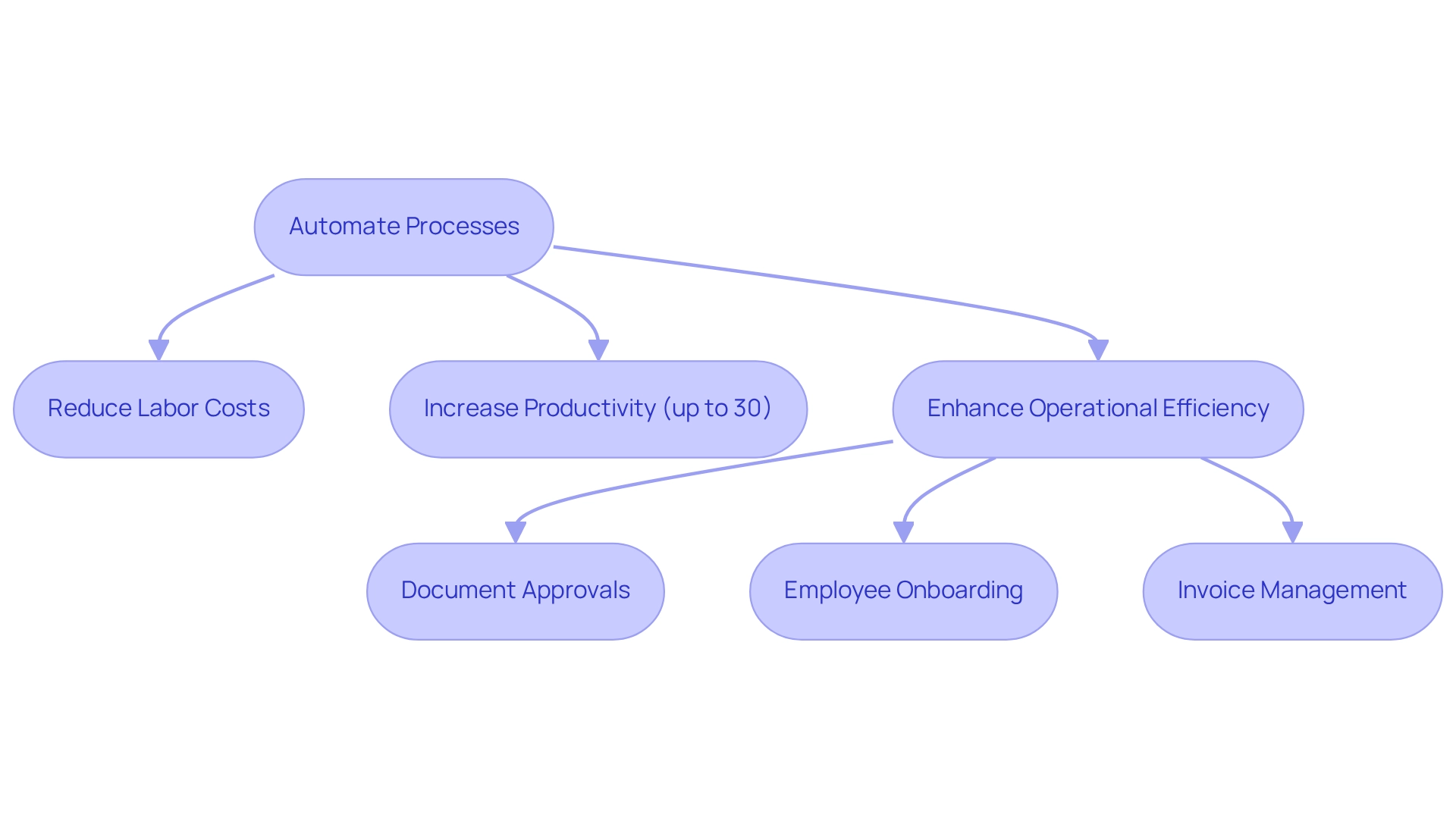

Reduce Operational Costs

By leveraging app orchestration to automate processes, we can achieve substantial reductions in operational costs for financial institutions. Streamlining routine tasks such as data entry, document approvals, and report generation allows us to redirect staff efforts toward higher-value activities. This shift not only lowers labor costs but also enhances overall productivity. Organizations that have implemented automation in their workflows have reported significant improvements in efficiency, with some noting productivity increases of up to 30% in routine banking tasks.

Furthermore, the incorporation of Avato’s secure hybrid connectivity platform enables us to enhance operations even further. A recent analysis highlighted that 77.6% of AI applications in the finance sector focus on automating processes, underscoring the trend toward leveraging technology for efficiency gains. Our platform maximizes and extends the value of legacy systems, simplifies complex integrations, and provides real-time monitoring and alerts on system performance, significantly reducing costs. Common use cases for workflow automation include:

- Document approvals

- Employee onboarding

- Invoice management

showcasing the versatility of automation in enhancing operational efficiency. Case studies show that banks employing application management have successfully decreased operational expenses while preserving service quality, with some institutions indicating cost savings of over 20% and enhanced turnaround times.

Expert opinions emphasize that the future of banking hinges on our ability to balance technological innovation with human expertise. As stated by industry leaders, “The future of finance will belong to those who can successfully balance technological innovation with human expertise.” As automation continues to transform the industry, financial institutions that adopt app orchestration will not only lower expenses but also improve their competitive advantage in an increasingly digital environment. Furthermore, we ensure 24/7 uptime for critical integrations, reinforcing the reliability of our solutions in maintaining operational efficiency. Recommendations for policymakers and banking executives on effective AI implementation further highlight the strategic importance of automation in banking.

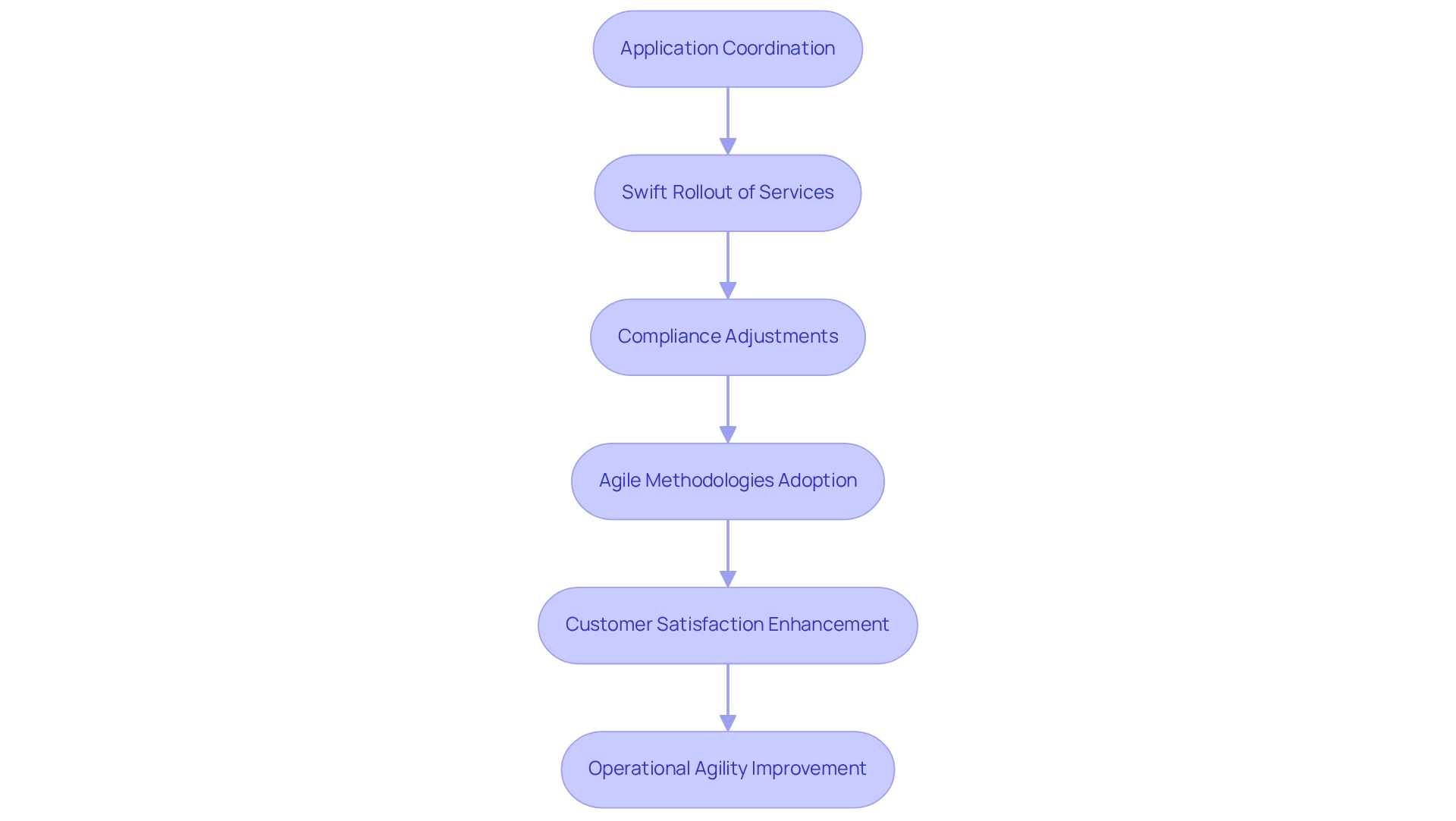

Increase Agility and Responsiveness

Application coordination significantly enhances our financial institution’s agility, enabling the swift rollout of new services and features. When confronted with new regulatory mandates, we can quickly modify our systems and processes through coordination, ensuring compliance without facing significant delays or service interruptions. Recent data indicates that the COVID-19 pandemic has accelerated the need for digital transformation in the financial sector, compelling us to adopt agile methodologies to remain competitive.

As we look to 2025, we are increasingly utilizing coordination to deploy services rapidly, responding to regulatory changes with remarkable efficiency. A significant instance involves one of our prominent financial institutions that employed coordination to introduce a new compliance feature within weeks of a regulatory announcement, highlighting the effectiveness of agile responses in a fast-paced environment. Our Hybrid Integration Platform plays a crucial role in this transformation, delivering a connected foundation that simplifies and modernizes integration processes. Key aspects of our platform encompass support for 12 levels of interface maturity, ensuring that we can balance speed with the complexity required for future-proofing our technology stack.

Expert insights indicate that enhancing agility through app orchestration not only streamlines our operations but also boosts customer satisfaction by providing timely services. The ability to pivot quickly in response to market demands is becoming a cornerstone of competitive advantage in banking. Moreover, case studies demonstrate that banks utilizing coordination strategies have reported significant enhancements in their operational agility, allowing them to navigate the complexities of the financial landscape effectively.

Statistics indicate that organizations that adopt app orchestration experience a notable increase in their responsiveness to market changes, with many reporting agility improvements of over 30%. This trend underscores the significance of investing in integration solutions to enhance our operational capabilities and maintain a competitive edge in the evolving banking sector. As Abeeku Sam Edu mentions, implementing and utilizing new BDA tools alongside current digital resources can enhance financial service stability, further highlighting the essential role of coordination in contemporary banking. Additionally, investing in human capital, as highlighted in the case study on technological skills in the BFSI sector, is essential for us to leverage these orchestration technologies effectively. Our expertise in hybrid connectivity ensures that we can achieve these goals with speed and reliability. As Tony LeBlanc from the Provincial Health Services Authority states, ‘We speed up the integration of isolated networks and fragmented information, providing the connected foundation enterprises require to simplify, standardize, and modernize.

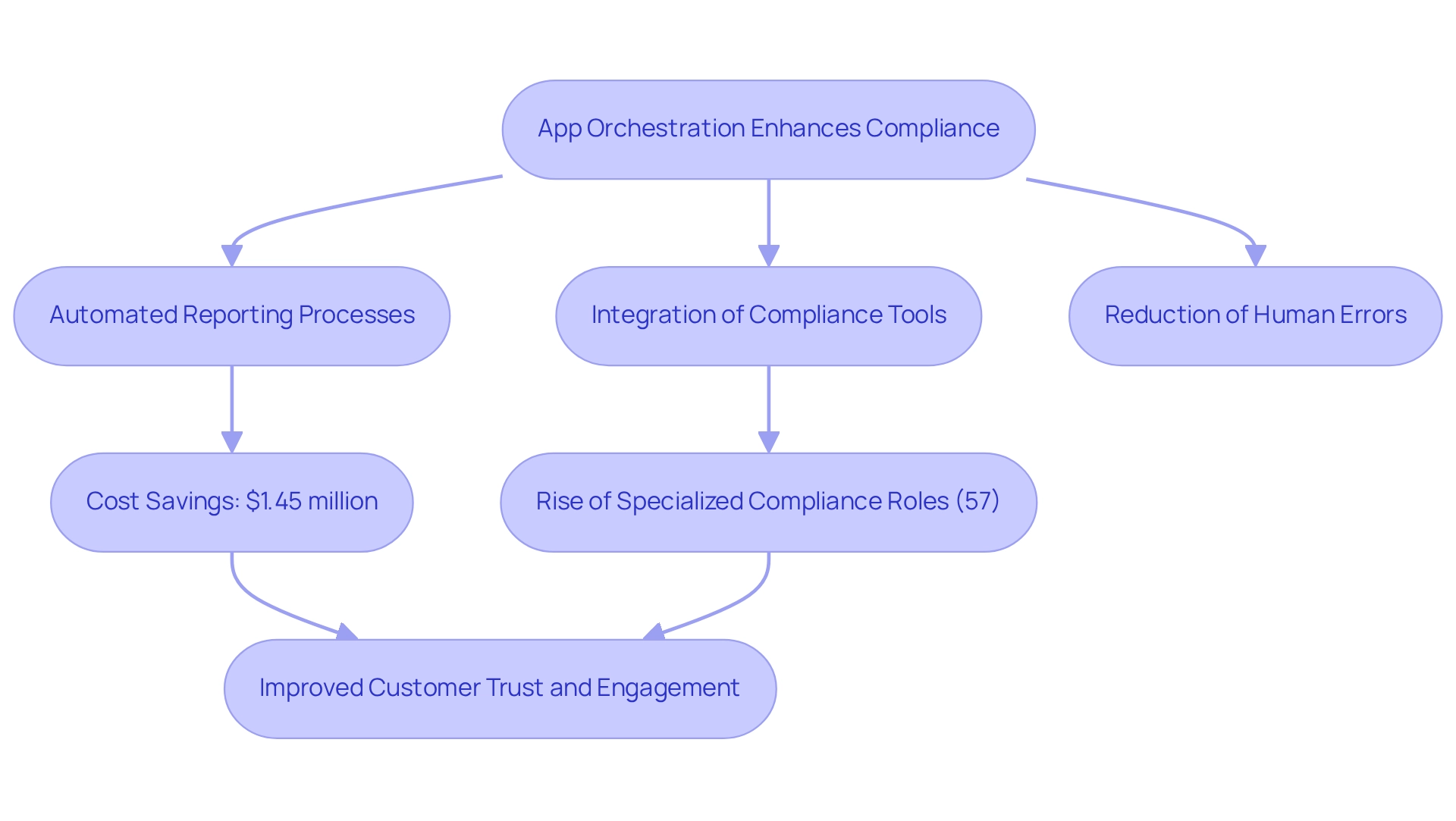

Enhance Compliance and Governance

App orchestration significantly enhances compliance and governance by automating reporting and monitoring processes. By integrating compliance management tools with transaction processing applications, we ensure that all transactions are automatically logged and monitored for adherence to regulatory standards, thereby minimizing the risk of human error. As we look toward 2025, automated reporting processes are set to play a pivotal role in banking compliance, with organizations leveraging these technologies to streamline operations and improve accuracy.

Our Hybrid Integration Platform empowers financial institutions to maximize the value of their legacy systems while simplifying complex integrations. Recent data shows that organizations implementing compliance technology have saved, on average, $1.45 million in compliance costs, underscoring the financial benefits of automation. As Ayush Saxena notes, “Organizations that enabled compliance technology saved, on average, $1.45 million in compliance costs,” highlighting the critical need to address compliance challenges effectively. Moreover, 57% of corporate risk and compliance experts indicate a rise in specialized positions within their organizations, illustrating the increasing significance of focused compliance roles that can be enhanced through application integration solutions.

Case studies illustrate the effectiveness of app orchestration in enhancing compliance. For instance, the implementation of robotic process automation (RPA) in financial services has proven crucial for automating manual tasks, thereby reducing human errors and improving operational efficiency. This aligns with our case study on the significance of RPA, which emphasizes its role in streamlining compliance processes. Furthermore, generative AI has emerged as a valuable tool, enabling financial organizations to produce synthetic data for training machine learning models, which enhances predictive capabilities and supports data-driven decision-making within the system framework.

As the landscape of compliance governance evolves, the adoption of app orchestration solutions will be essential for financial institutions aiming to strengthen their compliance frameworks. By automating reporting processes and providing real-time monitoring and alerts, we can ensure regulatory adherence while fostering a culture of transparency and accountability, ultimately leading to improved customer trust and engagement. Our commitment to ensuring 24/7 uptime for critical integrations further solidifies our value proposition in supporting compliance and governance in banking.

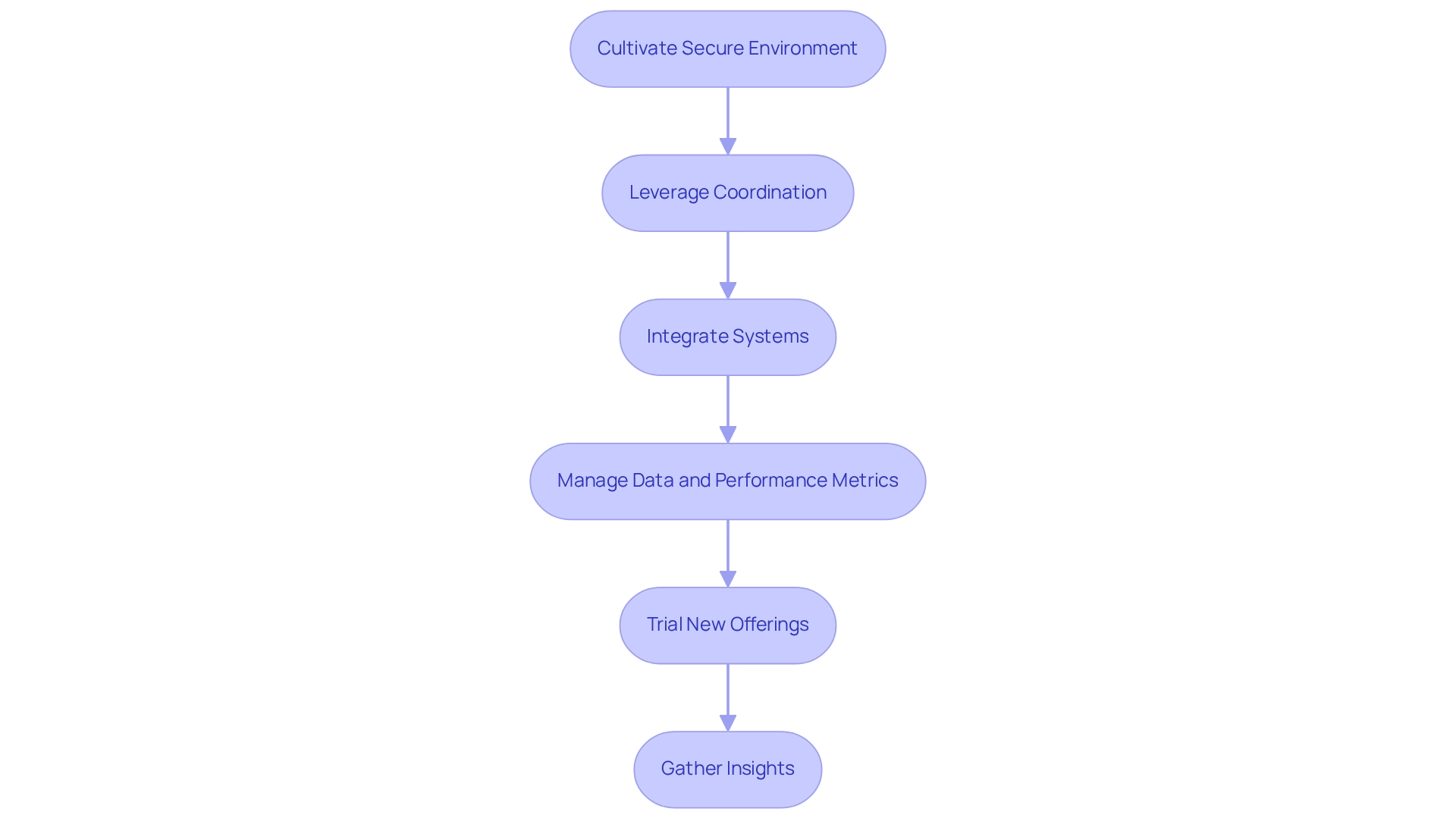

Foster Innovation and Experimentation

We enable financial institutions to cultivate a secure environment for experimentation, allowing for the confident testing of new financial products and services. By leveraging coordination, we can seamlessly integrate various systems, facilitating the efficient management of data and performance metrics during these trials. This strategy not only fosters innovation but also significantly mitigates the risks typically associated with launching new initiatives.

For instance, financial institutions utilizing our app management, particularly through Avato’s hybrid integration platform, have reported enhanced innovation rates. Our platform maximizes and extends the value of legacy systems, simplifies intricate integrations, and provides real-time monitoring and alerts on system performance, thereby considerably reducing costs. Research indicates that organizations employing such strategies can decrease operating expenses by up to 22% by 2030, as coordination optimizes processes and maximizes resource allocation. This is particularly crucial in the banking sector, where the ability to swiftly respond to market demands is vital.

Numerous banks, including those leveraging our solutions, have successfully implemented pilot initiatives for new financial products through coordination. A prominent example is our collaboration with Coast Capital, where our solution went live in February 2013, enabling the transition of their entire telephone banking system with minimal downtime. These initiatives have empowered institutions to trial new offerings in a controlled environment, gathering invaluable insights that shape future strategies. Gustavo Estrada, a customer, remarked on our capability to simplify complex projects and deliver results within the desired timelines and budget constraints, underscoring the effectiveness of our orchestration capabilities. As the banking landscape continues to evolve, fostering innovation through app orchestration will be essential for institutions striving to maintain a competitive edge. By establishing a structured framework for experimentation, supported by our robust technology that ensures 24/7 uptime and reliability, we can enhance operational capabilities and ensure that banks are well-prepared to tackle future challenges.

Conclusion

The implementation of app orchestration in banking is not just beneficial; it is pivotal for enhancing operational efficiency, optimizing resource management, and driving innovation. By automating repetitive tasks and integrating legacy systems, we can significantly reduce operational costs while improving customer satisfaction. The ability to streamline workflows and enhance scalability ensures that we can respond swiftly to market changes and regulatory requirements, positioning ourselves for success in an increasingly competitive landscape.

Furthermore, app orchestration strengthens security protocols through centralized monitoring and automated compliance checks, addressing the critical need for robust data protection. By fostering an environment conducive to innovation, we can experiment with new products and services, thereby maintaining a competitive edge. Statistics underscore the transformative impact of these technologies, with many organizations reporting substantial improvements in efficiency and responsiveness.

As the banking sector continues to evolve, we cannot overstate the importance of embracing app orchestration. Financial institutions that leverage these advancements will not only enhance their operational capabilities but also secure their place in the future of banking. Investing in tools like Avato’s hybrid integration platform will be essential for achieving these goals, ensuring that we remain agile, compliant, and innovative in the face of ongoing challenges.