Overview

This article delves into the effective integration of the Temenos T24 (now Temenos Transact) solution within financial institutions, aimed at enhancing operational efficiency and elevating customer experience. By outlining key integration capabilities, benefits, best practices, and future trends, it becomes evident that leveraging a hybrid integration platform is crucial.

How can financial institutions streamline their processes and improve customer interactions? The answer lies in embracing this innovative approach.

Furthermore, ensuring compliance in the ever-evolving financial landscape is paramount. This integration not only simplifies operations but also positions institutions to meet future challenges head-on.

Introduction

In the rapidly evolving landscape of banking technology, Temenos T24, now known as Temenos Transact, stands out as a cornerstone for financial institutions aiming to modernize their operations through robust integration capabilities. How can financial institutions leverage technology to enhance efficiency and customer satisfaction? With its ability to seamlessly connect with various systems via APIs, middleware, and direct database connections, this core banking solution not only enhances operational efficiency but also enriches customer experiences.

As banks navigate the complexities of digital transformation, understanding how to effectively utilize these integration methods becomes essential. From real-time data exchange to compliance with regulatory standards, the strategic implementation of Temenos Transact is poised to redefine how banks engage with their clients and adapt to market dynamics. This positions them for success in an increasingly competitive environment. Are you ready to embrace the future of banking?

Understanding Temenos T24: An Overview of Its Integration Capabilities

Temenos T24, now rebranded as Temenos Transact, emerges as a premier core banking solution, renowned for its robust connectivity capabilities. It offers a diverse array of connection methods, including:

- APIs

- Middleware

- Direct database connections

This facilitates seamless integration with third-party systems and services. This adaptability is vital for financial institutions striving to modernize operations and elevate customer experiences.

The architecture of Temenos Transact is meticulously crafted to enable real-time data exchange, empowering financial institutions to swiftly respond to market fluctuations and evolving customer demands. Current trends in central financial systems underscore the increasing importance of such capabilities, as institutions seek to streamline operations and enhance service delivery. For instance, ABRIS recently completed a remote deployment of GAMMA for Banque Internationale à Luxembourg, successfully integrating automation features into the bank’s system. This case exemplifies the practical application of these connection methods and the reliability of solutions that ensure 24/7 uptime for critical connections.

Looking ahead to 2025, experts assert that leveraging the Temenos T24 integration solution alongside Temenos Transact’s connectivity features can substantially boost operational efficiency. The platform’s reliable technology stack, in conjunction with Avato’s dedicated hybrid connection platform—which includes functionalities like real-time monitoring and alerts on system performance—not only aids businesses in adapting to shifting demands but also positions them to maintain a competitive edge in the rapidly evolving financial landscape. As Takis Spiliopoulos, CFO, remarked, “We generated USD 141.7m of free cash flow in Q4-24 under our old definition, or USD 121.1m under our new definition including IFRS 16 leases and interest costs,” highlighting the financial advantages of operational efficiency.

Furthermore, the latest updates on Temenos Transact connection methods indicate a focus on modular core solutions, as emphasized by Temenos CEO Jean-Pierre Brulard. This strategic approach seeks to extend market leadership while enhancing the flexibility and scalability of financial operations. As organizations continue to navigate the complexities of digital transformation, grasping the Temenos T24 integration solution and its integration capabilities—alongside a hybrid integration platform rooted in a deep commitment to architecting technology solutions—is crucial for mastering the integration process and achieving long-term success.

Key Benefits of Integrating Temenos T24 in Banking Operations

Incorporating the Temenos T24 integration solution into financial operations presents a multitude of advantages that can significantly transform how institutions engage with their clients and manage their processes, particularly through the utilization of a Hybrid Integration Platform.

- Enhanced Customer Experience: With real-time data access enabled by Avato’s platform, financial institutions can provide personalized services and respond to customer inquiries with remarkable speed. This capability not only elevates satisfaction but also cultivates loyalty, as clients value timely and relevant interactions. Statistics indicate that financial institutions employing advanced unification solutions may witness a 20% increase in customer satisfaction ratings by 2025, underscoring the importance of modernizing financial systems. As Michael J. Hsu noted, some financial institutions may ‘feel like hostages’ to their legacy technology, emphasizing the urgent need for integration.

- Operational Efficiency: The Temenos T24 integration solution optimizes banking processes, reducing the necessity for manual intervention. The Hybrid Platform simplifies complex connections, resulting in expedited transaction times and diminished operational costs, allowing financial institutions to allocate resources more effectively. Additionally, the platform offers real-time monitoring and alerts regarding system performance, facilitating proactive management of operations and further enhancing efficiency.

- Scalability: T24’s modular design, coupled with Avato’s secure connection features, empowers financial institutions to expand their operations seamlessly. As institutions grow, they can leverage the Temenos T24 integration solution to broaden their services without extensive infrastructure modifications, ensuring agility in a competitive environment.

- Regulatory Compliance: Effective integration bolsters data management and reporting capabilities, which are essential for adhering to regulatory standards. Banks can achieve compliance more efficiently, minimizing the risk of penalties and enhancing their reputation.

- Innovation Enablement: By integrating with FinTech solutions via Avato’s platform, banks can rapidly adopt new technologies and services. This adaptability is vital in a fast-evolving market, enabling institutions to remain ahead of the curve and meet changing customer expectations.

The impact of these benefits is highlighted by recent trends in the financial sector. For instance, the unification of critical financial systems has been shown to significantly improve customer engagement metrics. Furthermore, as industry experts emphasize, the ability to deliver real-time financial solutions is becoming a crucial differentiator in the marketplace.

Real-world examples effectively illustrate these advantages. UK FinTech companies such as Liberis and iwoca have successfully embedded finance into their platforms, enabling SMEs to access financing directly through their software. This strategy not only enhances customer experience by providing financing at the point of need but also diversifies revenue streams for financial institutions. Additionally, Hellenic Bank’s partnership with Backbase resulted in a 16% increase in their clientele, showcasing the positive outcomes of integrating modern banking solutions.

In conclusion, the implementation of the Temenos T24 integration solution, supported by Avato’s Hybrid Integration Platform, transcends mere technical enhancement; it represents a strategic decision that empowers banks to elevate customer experiences, enhance operational efficiencies, and foster innovation, positioning them for future success.

Step-by-Step Guide to Integrating Temenos T24: Best Practices and Strategies

To effectively integrate Temenos T24, consider the following best practices:

- Assess Your Current Systems: Begin by thoroughly evaluating your existing systems to identify key connection points with T24. Understanding your current architecture is crucial for a seamless transition.

- Define Collaboration Objectives: Clearly articulate your collaboration goals. Whether aiming for improved data flow, enhanced customer service, or compliance with new regulatory requirements, having defined objectives will guide your strategy. With 99% of companies preparing for stricter disclosure requirements, ensuring compliance should be a top priority in your incorporation objectives.

- Choose the Right Combination Method: Select the most suitable combination approach based on your specific needs. Options include API-based connections for flexibility, middleware solutions for complex environments, or direct database links for straightforward implementations. Utilizing XSLT can greatly improve XML data transformation processes, decreasing effort and minimizing programming mistakes through its connection with schemas. Additionally, the use of schemas can lead to substantial cost savings by catching errors early in the development process, which is essential for effective unification.

- Develop a Detailed Integration Plan: Create a comprehensive roadmap that outlines timelines, required resources, and assigned responsibilities. This plan should also consider potential challenges and mitigation strategies, ensuring a structured approach to implementation. The competitive landscape, as highlighted in the case study “Opportunities in Wealth Management,” shows that banks must navigate regulatory scrutiny while seeking to capitalize on market opportunities. Engaging stakeholders early in the process will help ensure that requirements are accurately captured and addressed.

- Implement Incrementally: Begin the incorporation process with a pilot project. This enables you to test the combination in a controlled environment, identify any issues, and refine your approach before a full-scale rollout.

- Monitor and Optimize: Utilize real-time monitoring tools to track system performance post-integration. Continuous monitoring enables you to make necessary adjustments, ensuring optimal operation and responsiveness to any emerging issues. As Thomas French observes, the rise of fraud in the digital era requires secure practices to protect sensitive data. Additionally, the use of schemas can lead to significant cost savings by catching errors early in the development process.

In 2025, as the financial sector faces increasing regulatory scrutiny and demands for agility, these best practices will be essential for successful integrations. Greg Sullins from Newgen Software Inc anticipates a transformative year for the financial sector, focusing on agility, innovation, and customer experience through AI-powered automation. By following these steps, banks can navigate the complexities of the Temenos T24 integration solution while positioning themselves for future success.

Leveraging Hybrid Integration Platforms for Seamless Temenos T24 Integration

Hybrid connection platforms are essential for the seamless integration of the Temenos T24 solution within financial environments. These platforms offer several key advantages:

- Flexibility: They enable the connection of both on-premises and cloud-based systems, ensuring cohesive operation across the financial infrastructure.

- Speed: By optimizing the merging process, hybrid platforms allow banks to achieve their objectives more swiftly than traditional methods, unlocking data and systems in weeks rather than months.

- Security: With robust security features, these platforms effectively mitigate risks associated with data breaches and compliance challenges, which are critical in the highly regulated banking sector.

- Real-Time Monitoring: Comprehensive tools for real-time performance oversight ensure that connections remain efficient and responsive to changing demands, significantly enhancing decision-making speed by 25%, as evidenced in case studies.

- Cost-Effectiveness: By minimizing the need for extensive custom development, hybrid connection platforms considerably reduce overall connection costs, making them a financially viable option for banks.

- 12 Levels of Interface Maturity: The platform supports 12 levels of interface maturity, enabling financial institutions to balance connection speed with the sophistication needed to future-proof their technology stack.

The importance of hybrid connectivity in finance is underscored by recent statistics indicating that organizations utilizing such platforms experience a 25% increase in decision-making speed. Furthermore, with 25,000 organizations expanding through connectivity platforms, the effectiveness and widespread adoption of these solutions are clear. As the market for hybrid connection platforms continues to grow, major participants dominate the public cloud sector, yet the uptake of alternatives is becoming increasingly vital for financial institutions aiming to modernize operations and maintain a competitive edge.

Real-world examples demonstrate that banks using the Temenos T24 integration solution not only achieve faster outcomes but also enhance their operational capabilities, positioning themselves for success in a rapidly evolving digital landscape. Gustavo Estrada, a satisfied customer, highlighted Avato’s ability to simplify complex projects and deliver results within desired time frames and budget constraints, further affirming the platform’s effectiveness.

Ensuring System Performance: Real-Time Monitoring in Temenos T24 Integration

To ensure optimal performance of your Temenos T24 connection, it is essential to implement effective real-time monitoring strategies, informed by an initial assessment of your current systems.

- Leverage Advanced Monitoring Tools: Utilize robust tools such as Prometheus and Grafana to continuously track system health and performance metrics. These platforms provide comprehensive dashboards that visualize data in real-time, enabling quick identification of anomalies.

- Establish Proactive Alert Systems: Configure alerts for critical performance indicators, such as transaction processing times and system response rates. This proactive approach allows teams to address potential issues before they escalate, minimizing disruptions to operations.

- Conduct Regular Performance Audits: Schedule periodic reviews of system performance and connection points. These audits help identify bottlenecks and areas for improvement, ensuring that the system remains efficient and effective over time.

- Analyze Data Trends for Optimization: Employ analytics to examine usage patterns and system resource allocation. Understanding these trends can inform decisions on scaling resources or adjusting configurations to enhance performance.

- Foster Stakeholder Engagement: Involve relevant teams, including IT, compliance, and operations, in the monitoring process. Collaborative oversight ensures that all aspects of the amalgamation are considered, facilitating a swift response to any emerging issues.

- Implement Continuous Monitoring Solutions: Consider integrating solutions that provide dynamic risk profiling and continuous monitoring, similar to those utilized in KYC Hub’s transaction monitoring systems. These solutions leverage advanced algorithms to maintain compliance and effectively manage risks. As highlighted in a case study, the use of deep learning algorithms ensures high precision in identifying potential threats, which is crucial for maintaining compliance in today’s regulatory environment.

- Stay Informed on Industry Developments: Keep abreast of the latest news and trends in system performance monitoring within the financial sector. For instance, the introduction of time-specific obligations tools emphasizes the need for timely reporting and compliance, which can be supported by effective monitoring strategies. Financial institutions are progressively embracing a risk-oriented method to AML activities, highlighting the significance of proactive oversight in compliance and risk management.

By implementing these strategies, organizations can improve the reliability and performance of their Temenos T24 integration solution, ensuring they meet the evolving requirements of the financial sector. Avato, with its commitment to designing technology foundations, streamlines intricate projects and provides outcomes within specified time frames and budget limitations, reinforcing the importance of effective oversight in achieving unification objectives.

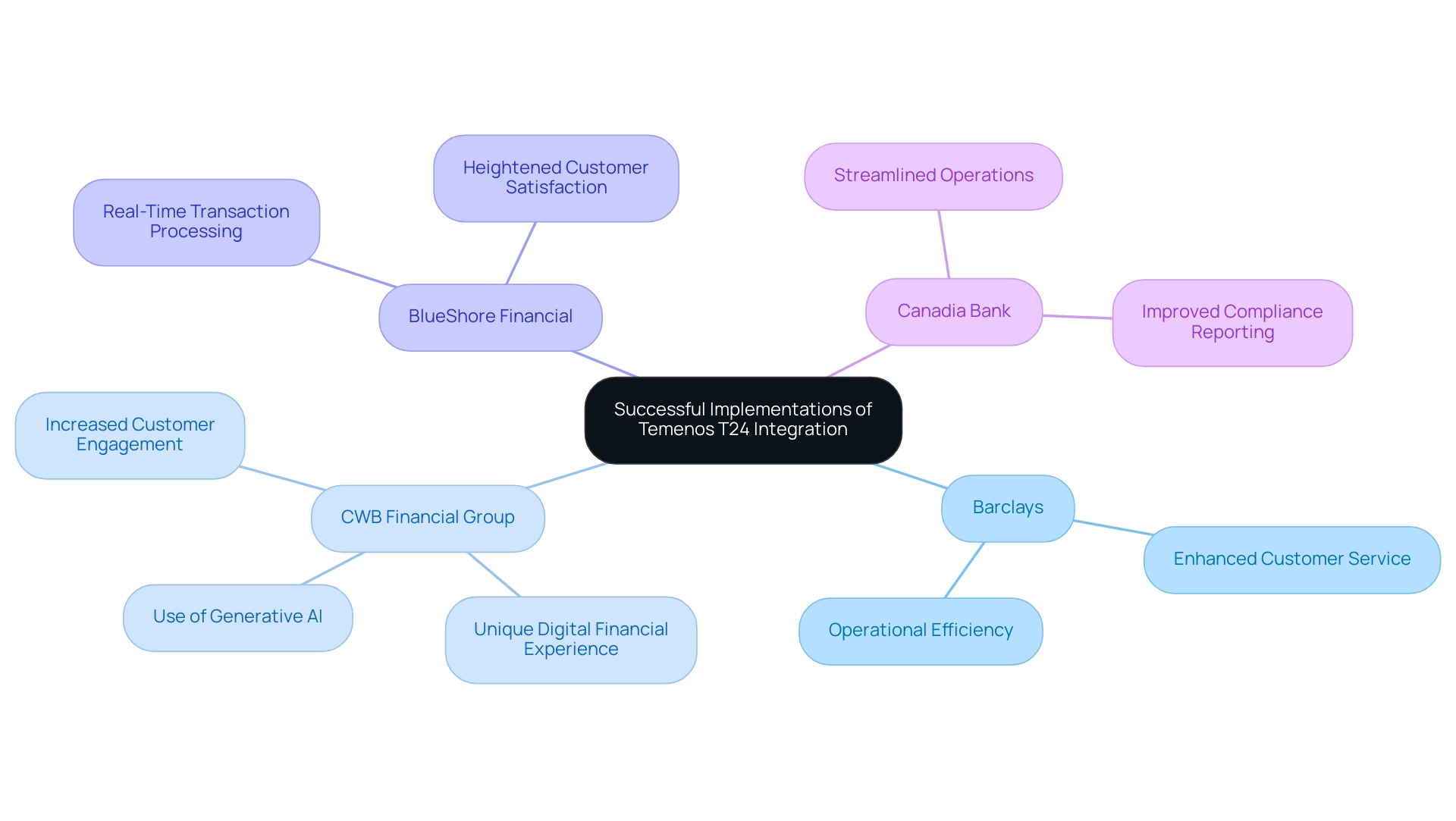

Case Studies: Successful Implementations of Temenos T24 Integration

Numerous banks have successfully adopted Temenos T24 integration, showcasing its transformative impact on banking operations.

Barclays has seen significant improvements in its essential financial operations through the incorporation of T24, leading to enhanced customer service and operational efficiency. This strategic move has enabled the bank to respond more swiftly to customer needs and market demands. It demonstrates how the Temenos T24 integration solution, alongside Avato’s hybrid integration platform, helps businesses adapt to changing demands and maintain a competitive edge.

CWB Financial Group, a Canadian institution, utilized T24 to create a unique digital financial experience, markedly increasing customer engagement. By leveraging T24’s capabilities alongside generative AI, CWB has positioned itself as a leader in digital innovation within the banking sector. Its Temenos T24 integration solution enhances customer interactions through sophisticated chatbots and virtual assistants.

BlueShore Financial’s successful incorporation of T24 into its ATM and POS systems has facilitated real-time transaction processing, resulting in heightened customer satisfaction. This advancement highlights the significance of seamless technology integration in enhancing customer experiences. As Dušan Barać notes, “Core banking refers to a centralized online real-time exchange banking that collects deposits and distributes credits,” underscoring the importance of T24 in modern banking.

Canadia Bank has streamlined operations and improved compliance reporting following its T24 implementation. This adaptability highlights the effectiveness of the Temenos T24 integration solution in navigating the complexities of a dynamic regulatory environment, ensuring compliance while enhancing operational efficiency.

These case studies illustrate the considerable operational efficiency advances that financial institutions can achieve after implementing the Temenos T24 integration solution. Furthermore, a study by the European Central Bank underscores the significance of unification in enhancing operational efficiency, particularly regarding cash and payment instruments used at points of sale. Additionally, the effect of IT expenditure on financial performance, as observed in Nigerian financial institutions, indicates that investments in the Temenos T24 integration solution, supported by Avato’s robust platform, can lead to improved financial metrics, emphasizing the platform’s importance in the competitive financial sector.

As Tony LeBlanc from the Provincial Health Services Authority states, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.” This testimonial highlights the trust and reliability that Avato brings to its projects, further validating the successes achieved by these banks.

Future Trends in Temenos T24 Integration: What to Expect

As the banking landscape evolves, several key trends are shaping the future of Temenos T24 integration:

- Expanded Application of AI and Machine Learning: The incorporation of AI and machine learning technologies is set to transform data analysis and decision-making processes within financial institutions. By 2025, these advancements will empower financial institutions to deliver more personalized banking experiences, tailoring services to individual customer needs and preferences.

- Greater Emphasis on Security: In light of rising cyber threats, banks are prioritizing security measures in their integration strategies. This focus on safeguarding sensitive data is crucial as institutions navigate the complexities of digital transformation while ensuring compliance with regulatory standards. Avato’s Secure Hybrid Connection Platform is designed to provide robust security features, including encryption and access controls, ensuring that sensitive data remains protected throughout the connection process.

- Expansion of Open Finance: The growth of open finance is driving the demand for flexible integration solutions. This trend enables financial institutions to collaborate more effectively with fintechs and third-party providers by utilizing the Temenos T24 integration solution, facilitating innovation and competition. The role of open finance in financial forecasting is particularly noteworthy, as it enables access to richer datasets and real-time insights, enhancing predictive capabilities. As emphasized in a recent case analysis, open banking is transforming how financial information is exchanged among financial institutions, FinTech companies, and external service providers, ultimately resulting in more extensive connections and advanced predictive capabilities by 2025.

- Cloud Adoption: As more financial institutions transition to cloud-based solutions, strong connection strategies become essential for linking legacy systems with new cloud services. Avato’s Hybrid Connectivity Platform maximizes and extends the value of legacy systems by utilizing the Temenos T24 integration solution to simplify complex connections and significantly reduce costs. This transition not only improves operational efficiency but also supports the scalability required to meet evolving market demands. Furthermore, the platform provides real-time oversight and notifications regarding system performance, ensuring that financial institutions can proactively handle their connections.

- Focus on Customer-Centric Solutions: Future connections will increasingly prioritize customer experience. By leveraging data analytics, banks can create tailored services that enhance customer satisfaction and loyalty, ultimately driving business growth. Avato’s commitment to ensuring 24/7 uptime for critical connections further highlights the significance of reliability in these strategies.

These trends underscore the importance of adopting advanced unification tactics to remain competitive in the rapidly evolving financial sector. As European banks face cost increases outpacing revenue growth, a dedication to enhanced cost discipline and innovative unification solutions will be crucial as they move into 2025. As noted by Gustavo Estrada, a customer, “Avatar has simplified complex projects and delivered results within desired time frames and budget constraints,” reinforcing the effectiveness of integration solutions in the banking sector.

Conclusion

Embracing Temenos Transact as a core banking solution presents financial institutions with a transformative pathway toward enhanced operational efficiency and superior customer experiences. Its extensive integration capabilities—spanning APIs to middleware—empower banks to adapt swiftly to market changes and customer demands, facilitating seamless connectivity with third-party systems. The real-world successes of organizations like Barclays and CWB Financial Group illustrate the tangible benefits achievable, including improved customer engagement and streamlined operations.

The strategic implementation of Temenos Transact, bolstered by Avato’s Hybrid Integration Platform, simplifies complex integration processes and fosters a culture of innovation. As banks increasingly prioritize agility and customer-centric solutions, leveraging these advanced technologies is essential for maintaining a competitive edge in a rapidly evolving landscape. The emphasis on security, compliance, and the adoption of AI-driven insights further underscores the importance of robust integration strategies.

Looking ahead, the future of banking integration is poised for exciting advancements. The ongoing trends of open banking, cloud adoption, and enhanced data analytics signal a shift toward more personalized and efficient banking experiences. By investing in the integration capabilities of Temenos Transact, financial institutions position themselves for success, ensuring they can navigate the complexities of digital transformation while delivering exceptional value to their clients. The time to embrace these changes is now, as the banking sector stands at the brink of a technological revolution.