Overview

The primary objective of this article is to serve as a comprehensive guide for banking IT managers aiming to master the T24 banking system effectively. This focus is reinforced by an in-depth examination of T24’s modular design, real-time processing capabilities, and integration strategies, all of which significantly enhance operational efficiency and customer satisfaction. By doing so, the article equips IT managers with the critical knowledge necessary to navigate the complexities of modern banking challenges and implement successful technology solutions.

Introduction

In the rapidly evolving landscape of banking technology, the T24 banking system stands out as a cornerstone for financial institutions striving for agility and efficiency. Developed by Temenos, this core banking solution features a modular architecture that empowers banks to customize their operations to meet specific market demands, ensuring competitiveness in an increasingly digital world. With real-time processing capabilities and robust multi-currency support, T24 not only enhances operational efficiency but also elevates customer experiences, paving the way for banks to thrive amidst the challenges of modernization.

As financial institutions confront compliance, cybersecurity, and the integration of legacy systems, the strategic implementation of T24, complemented by Avato’s innovative integration solutions, becomes essential. This article explores the multifaceted advantages of T24, outlines best practices for its implementation, and examines the future trends in banking technology that will shape the industry in the years to come.

Understanding the T24 Banking System: A Comprehensive Overview

The T24 banking system, developed by Temenos, stands as a premier core solution tailored to meet the intricate needs of modern financial institutions. With its modular design, financial institutions can customize their frameworks to address specific operational requirements, enabling a more agile response to market fluctuations. Key features include real-time processing capabilities for immediate transaction handling and multi-currency support, which is essential for institutions operating across diverse markets.

In 2025, Temenos T24 is anticipated to uphold a substantial market share, indicative of its robust adoption throughout the financial sector. The platform boasts an extensive range of features, spanning client management to transaction handling, ensuring that institutions can deliver seamless services to their clients. This versatility is crucial as financial institutions increasingly emphasize digital transformation initiatives to enhance customer experiences and operational efficiency.

Avato, derived from the Hungarian term for ‘of dedication,’ plays a vital role in this landscape with its dedicated hybrid unification platform. This platform empowers banks to maximize and extend the value of their legacy infrastructure while simplifying complex integrations. By unlocking isolated assets, Avato enables financial institutions to generate significant business value, ensuring 24/7 availability and reliability for intricate financial infrastructures.

Success stories proliferate, illustrating the effective implementation of the T24 banking system across various financial environments. For instance, institutions that have integrated the T24 banking system with Avato’s platform have reported notable improvements in processing times and customer satisfaction, underscoring the solution’s capacity to optimize operations.

Expert insights suggest that the ongoing updates to T24’s features in 2025 will further enhance its capabilities, rendering it an even more attractive option for organizations aiming to modernize their core frameworks. Statistics indicate that investment in cloud migration and robust data infrastructure is essential for the modernization of core financial systems. The on-premise deployment segment is projected to dominate the global market, accounting for USD 3,605 million at a CAGR of 4.25%.

As the financial landscape evolves, integrating risk and compliance into early transformation initiatives has emerged as a strategic approach, enabling banks to achieve sustainable cost reductions while mitigating regulatory risks. This proactive strategy is crucial for maintaining competitiveness in an increasingly regulated environment.

Overall, the T24 banking system not only addresses the current needs of financial institutions but also prepares them for future growth, making it an indispensable resource for IT managers in the finance sector navigating the complexities of financial technology. Avato’s platform specifically meets the needs of these managers by simplifying integrations, reducing costs, and enhancing real-time monitoring, ultimately supporting their strategic objectives.

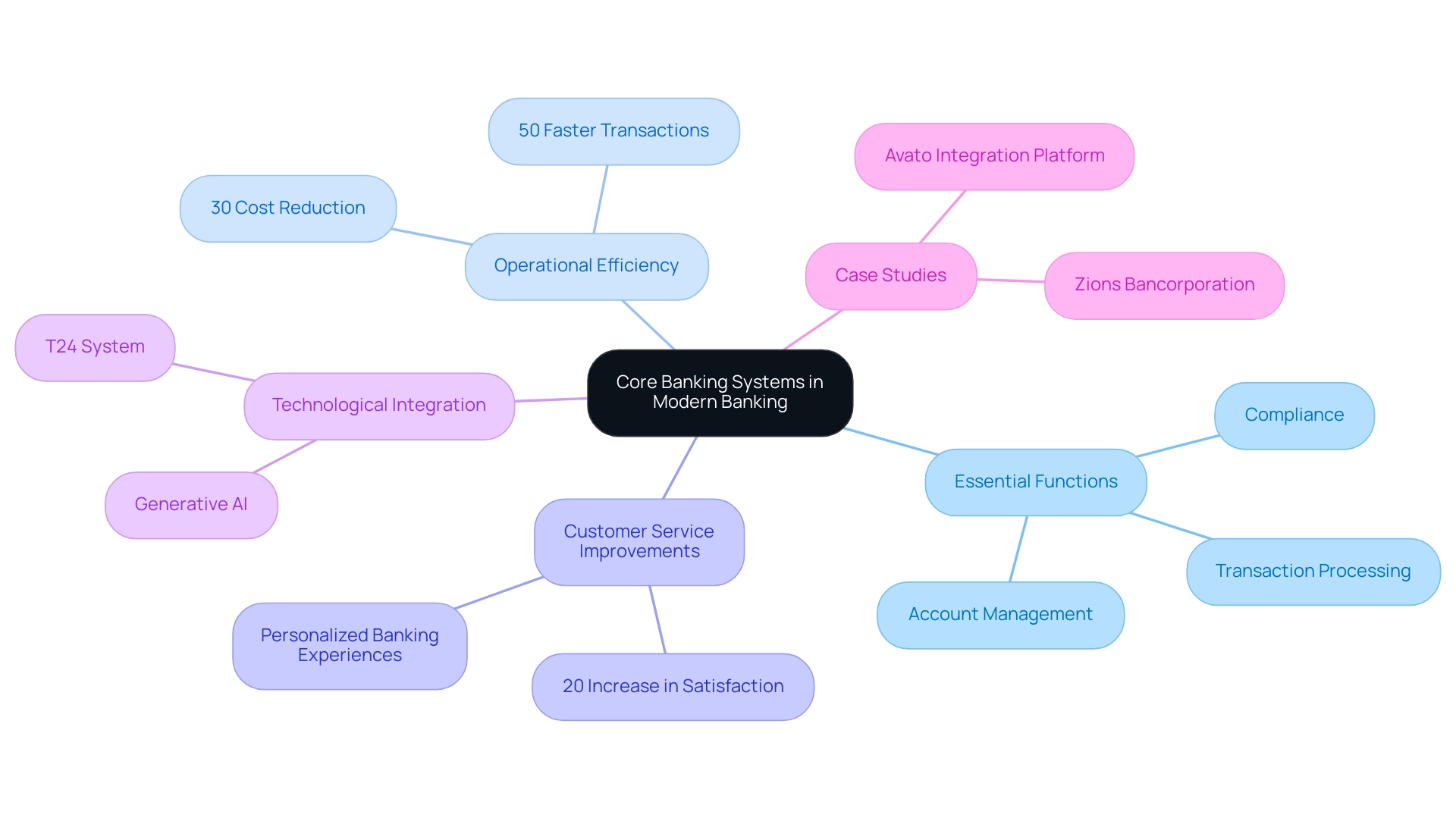

The Role of Core Banking Systems in Modern Banking Operations

Core financial networks are indispensable to the operations of financial institutions, underpinning essential functions such as account management, transaction processing, and compliance with regulatory standards. By 2025, the operational efficiency of these networks will be paramount; statistics reveal that financial institutions leveraging contemporary core solutions can reduce operational expenses by up to 30% while accelerating transaction speeds by 50%. The T24 banking system distinguishes itself in this landscape, offering advanced capabilities that empower banks to rapidly adapt to market fluctuations and evolving customer expectations.

This agility is vital for IT managers dedicated to optimizing their institutions’ performance.

The importance of core systems in modern finance is undeniable. They streamline processes and enhance customer service by facilitating personalized banking experiences. For example, banks utilizing the T24 banking system report significant improvements in customer satisfaction scores, with many achieving a 20% increase in positive feedback due to expedited service delivery and more tailored product offerings.

Moreover, the integration of generative AI is transforming customer interactions, evidenced by a 60% rise in its application for enhancing customer experience through sophisticated chatbots and virtual assistants.

Case studies illustrate the transformative potential of core banking frameworks. Zions Bancorporation, for instance, has adeptly navigated the challenges posed by legacy technology through incremental modernization strategies, proving that gradual upgrades can substantially enhance compatibility with contemporary software. Avato’s integration platform is pivotal in this process, enabling the seamless integration of legacy technologies and ensuring banks can modernize their infrastructures without incurring significant downtime.

Furthermore, generative AI is emerging as a valuable tool for rewriting outdated code, further streamlining the modernization of core financial infrastructures and optimizing document processing and report generation.

Expert insights underscore that the role of core financial platforms transcends basic functionality; they are crucial to the strategic positioning of financial institutions in a competitive market. Val Srinivas, a senior research leader in Banking & Capital Markets, asserts that as banks continue to invest in cloud migration and robust data infrastructures, the advantages of the T24 banking system become increasingly apparent. Avato guarantees round-the-clock availability for critical connections, essential for institutions to address current needs and anticipate future challenges in the financial sector.

Ultimately, the influence of core financial systems on customer service and operational efficiency in 2025 will dictate the success of financial institutions in an ever-evolving industry. As Tony Leblanc from the Provincial Health Services Authority remarks, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable,” underscoring Avato’s commitment to excellence in integration solutions.

Navigating Compliance and Cybersecurity Challenges in Banking IT

In the banking sector, adherence to regulations such as GDPR and AML is critical for maintaining operational integrity and customer trust. IT managers must ensure that their T24 banking system, along with other systems, is not only compliant but also capable of adapting to evolving regulatory landscapes. As of 2025, compliance statistics indicate that a significant number of financial institutions are grappling with the complexities of these regulations. Many executives express a need for clearer guidance from regulators; notably, 70% of executives seek more guidance on ESG regulations, which 67% find overly complex.

Cybersecurity threats remain a pressing concern, as financial organizations are increasingly targeted by cybercriminals. To mitigate these risks, implementing comprehensive security measures is essential. Multi-factor authentication, encryption, and regular vulnerability assessments are critical components of a strong cybersecurity strategy. IT managers should also remain aware of emerging threats, as the landscape is continually changing.

Avato’s expert unification services play a crucial role in tackling these challenges. By partnering with managed service providers globally, Avato offers a full team to execute data transformation projects or augment internal teams as needed. This support is crucial for banks updating their legacy infrastructure in the T24 banking system, which can hinder compliance efforts.

For example, Zions Bancorporation has successfully managed core financial modernization by utilizing generative AI to improve outdated systems and enhance connectivity capabilities. This incremental approach not only addresses compliance challenges but also strengthens cybersecurity measures, demonstrating the effectiveness of advanced technologies in modernization efforts.

As the financial sector continues to evolve, IT managers must prioritize both compliance and cybersecurity. By adopting a proactive stance and utilizing advanced technologies, they can safeguard sensitive data and ensure their institutions remain resilient against potential threats. Avato streamlines intricate projects and provides outcomes within specified timelines and budget limits, emphasizing the significance of efficient solutions in tackling these challenges.

Through stakeholder involvement and process modeling, Avato enables IT managers in finance to prepare their frameworks for the future and enhance unification strategies. Specifically, Avato suggests utilizing tools such as [insert specific technologies and tools here] to improve collaboration efforts. Additionally, client testimonials, such as [insert client testimonial here], illustrate Avato’s effectiveness in overcoming compliance and cybersecurity challenges.

Integrating T24 with Legacy Systems: Strategies for Success

Integrating the T24 banking system with legacy platforms presents significant challenges, yet it is crucial for the modernization of financial infrastructure. A strategic, phased approach is essential for IT managers, commencing with a thorough evaluation of existing systems to identify connection points and potential bottlenecks.

Utilizing APIs and middleware is a key strategy for facilitating seamless data exchange between the T24 banking system and legacy systems. Recent statistics indicate that 69% of financial professionals view perceived risks associated with migrating to newer technologies as a barrier to deploying next-generation solutions. Therefore, employing APIs not only mitigates these risks but also enhances the adaptability and scalability of banking operations. This enables organizations to manage complexity and achieve improved business results through tech-enabled tools and expert insights.

Involving stakeholders throughout the process is essential to ensure that all requirements are met and potential issues are proactively addressed. This collaborative method fosters a shared understanding of the unification goals and aids in aligning the project with business objectives. Routine testing and validation of the connection are also vital, as they help preserve integrity and performance, ensuring that the link meets the operational requirements of the bank.

To maximize performance, ongoing monitoring and robust analytical capabilities are essential. These tools facilitate continuous evaluation of the hybrid setup’s performance, empowering IT managers to enhance operations, improve customer experiences, and uncover new opportunities for innovation. Avato’s hybrid unification platform plays a pivotal role in this process, simplifying the connection of isolated legacy systems and fragmented data, thereby enhancing overall operational efficiency.

Case studies underscore the challenges posed by legacy systems in banking, such as data silos and limited scalability, which hinder the adoption of modern AI solutions within the T24 banking system. To effectively leverage AI’s potential, banks must prioritize data modernization by centralizing data, improving data quality, and embracing cloud solutions. This foundational work is essential for successful AI incorporation and overall operational efficiency.

Avato addresses these challenges by offering a robust hybrid unification platform that streamlines the connection of isolated legacy frameworks and fragmented data.

The strategic significance of XML technologies cannot be overstated in this context. XML ensures data interoperability and longevity, facilitating seamless connections across various systems. By enhancing XML data integrity through Schematron validation, Avato’s hybrid unification strategy further solidifies the reliability of data exchanges.

As banks navigate these complexities, incorporating risk and compliance into early transformation initiatives can significantly mitigate risks and eliminate inefficiencies that contribute to rising operating costs. Avato’s solutions integrate regulatory compliance and security audits into the implementation process, ensuring that all aspects of the implementation are aligned with industry standards. By adopting these best practices for legacy integration, IT managers in finance can ensure a smoother transition to the T24 banking system, ultimately enhancing business outcomes and maintaining a competitive advantage in the industry.

As Gustavo Estrada noted, Avato is praised for its ability to simplify complex projects and deliver results within desired time frames and budget constraints.

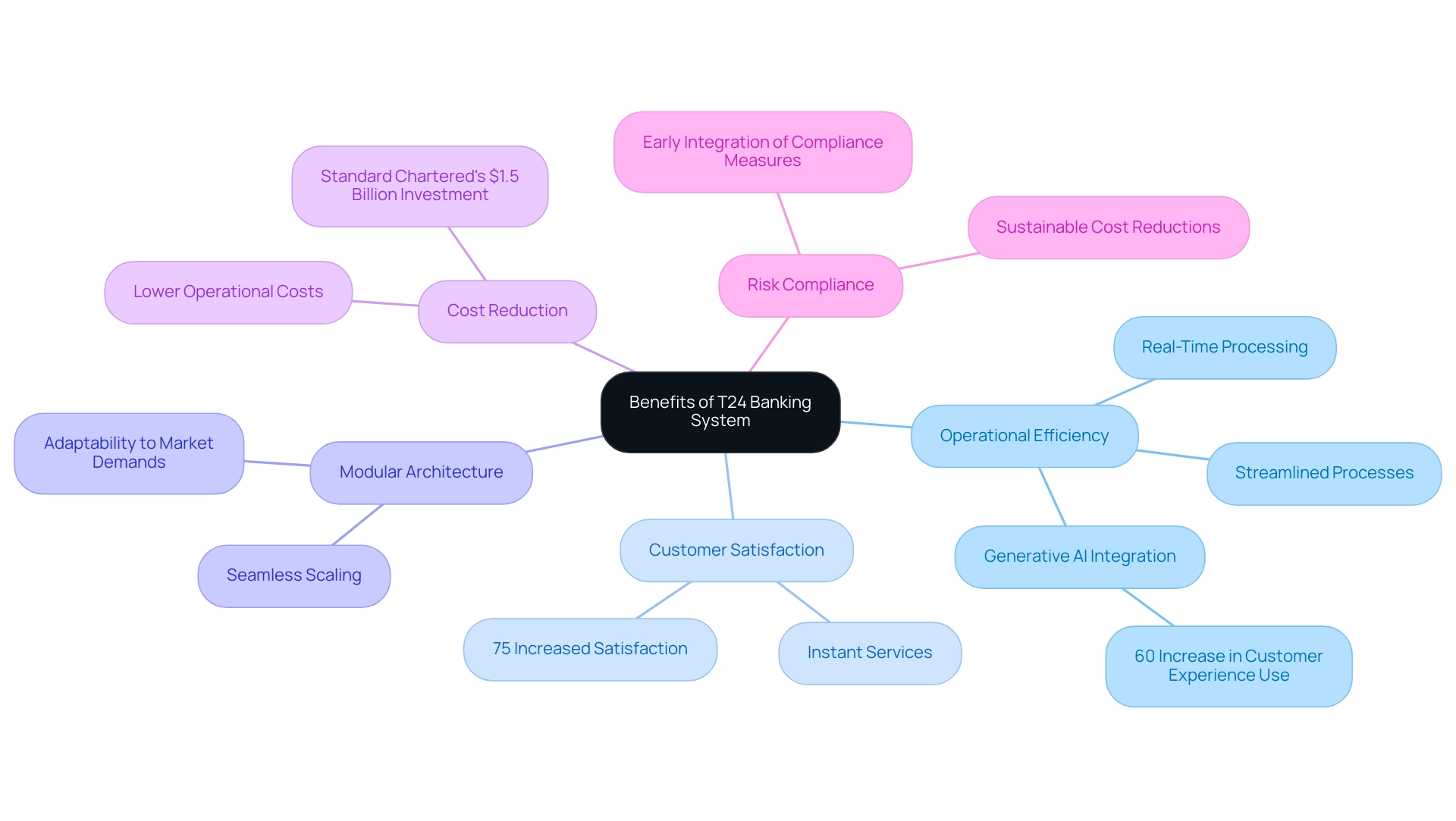

Benefits of Implementing the T24 Banking System

Implementing the T24 banking system offers numerous advantages that significantly enhance operational efficiency, elevate customer experiences, and provide greater flexibility in product offerings. One of T24’s standout features is its real-time processing capabilities, enabling financial institutions to deliver instant services to customers, thereby fostering satisfaction and loyalty. In today’s fast-paced banking environment, where customer expectations continually rise, this immediacy is crucial.

The modular architecture of T24 allows financial institutions to scale operations seamlessly, adapting to evolving market demands without extensive overhauls. This adaptability is essential for maintaining a competitive edge in a landscape characterized by rapid technological advancements and shifting consumer preferences.

Moreover, T24 streamlines processes and minimizes manual interventions, which lowers operational costs and enhances profitability. The incorporation of generative AI into T24 amplifies these benefits, as evidenced by a 60% increase in its use for customer experience in financial services, particularly in developing sophisticated chatbots and virtual assistants. Case studies, such as ‘Transforming Banking with Temenos Transact and Aspire Systems,’ illustrate that financial institutions integrating T24 have seen substantial enhancements in operational metrics, with many reporting decreases in processing durations and operational costs.

This integration not only enhances operational capabilities but also customer-centric services, positioning financial institutions to thrive in a competitive financial landscape.

Statistics indicate that by 2025, banks implementing the T24 system have seen a marked increase in customer satisfaction, with surveys revealing that over 75% of users reported enhanced service experiences. This serves as a testament to T24’s ability to meet the demands of contemporary finance while ensuring compliance with regulatory standards.

Furthermore, industry insights suggest that integrating risk and compliance measures early in transformation initiatives, such as those involving T24, can lead to sustainable cost reductions and mitigate regulatory risks. As Vikram, Vice Chair and US Financial Services Industry Leader at Deloitte, notes, modern banking solutions are essential for achieving operational efficiency. This proactive approach safeguards institutions and positions them for long-term success in a competitive financial landscape.

Additionally, the financial commitment from institutions towards modernization is evident, as seen with Standard Chartered’s investment of US$1.5 billion in its ‘Fit for Growth’ program. This strengthens the case for adopting T24 as a strategic option for financial institutions seeking to enhance their operational capabilities.

Overall, the advantages of adopting the T24 banking system, developed by Avato, are clear: increased operational efficiency, heightened customer satisfaction, and the ability to adapt to future challenges, establishing it as a vital option for banks aiming to succeed in the digital era.

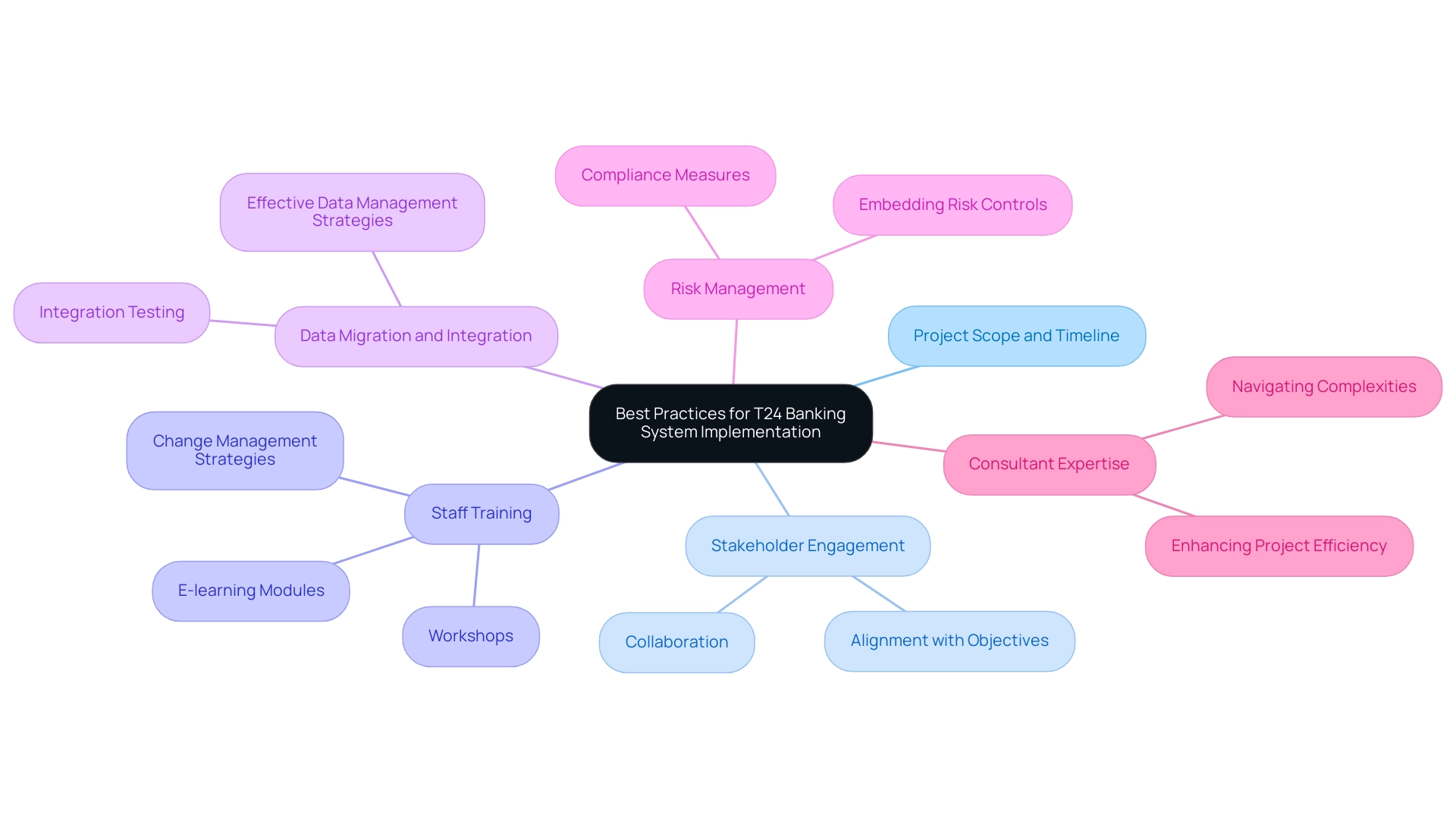

Best Practices for Implementing the T24 Banking System

To achieve a successful implementation of the T24 banking system, IT managers must adhere to several critical best practices. Establishing a clear project scope and timeline is essential. Engaging all relevant stakeholders from the outset fosters collaboration and ensures alignment with the project’s objectives. This engagement is crucial; studies indicate that projects with strong stakeholder involvement are significantly more likely to succeed.

Thorough training for staff is another vital component, ensuring team members are proficient in the new system’s functionalities. Investing in comprehensive training programs, such as hands-on workshops and e-learning modules, along with implementing change management strategies, will enhance staff comfort with the new platform and foster a culture of innovation within the organization. Regular communication about project progress and addressing concerns promptly helps maintain stakeholder engagement and mitigates resistance to change.

Prioritizing data migration and integration testing is essential to minimize disruptions during the transition. Effective data management strategies can significantly reduce operational risks, as highlighted in recent case studies where banks successfully integrated risk controls early in their transformation initiatives, leading to sustainable cost reductions. By embedding risk and compliance measures early, organizations can ensure a smoother transition and mitigate potential issues.

Additionally, leveraging the expertise of experienced consultants can provide valuable insights and guidance throughout the implementation process. Their knowledge can help navigate complexities and enhance the overall efficiency of the project. As Gustavo Estrada noted, “Avato has simplified complex projects and delivered results within desired time frames and budget constraints,” underscoring the importance of effective project management and stakeholder engagement in the context of T24 implementation.

As the banking landscape evolves, particularly in 2025, adopting these best practices is crucial for a smooth T24 banking system implementation. Organizations that prioritize effective project management and stakeholder engagement will be better positioned to thrive in this dynamic environment. Furthermore, Avato’s reliable, future-proof technology stack supports these efforts, ensuring that businesses can adapt to changing demands and maintain a competitive edge.

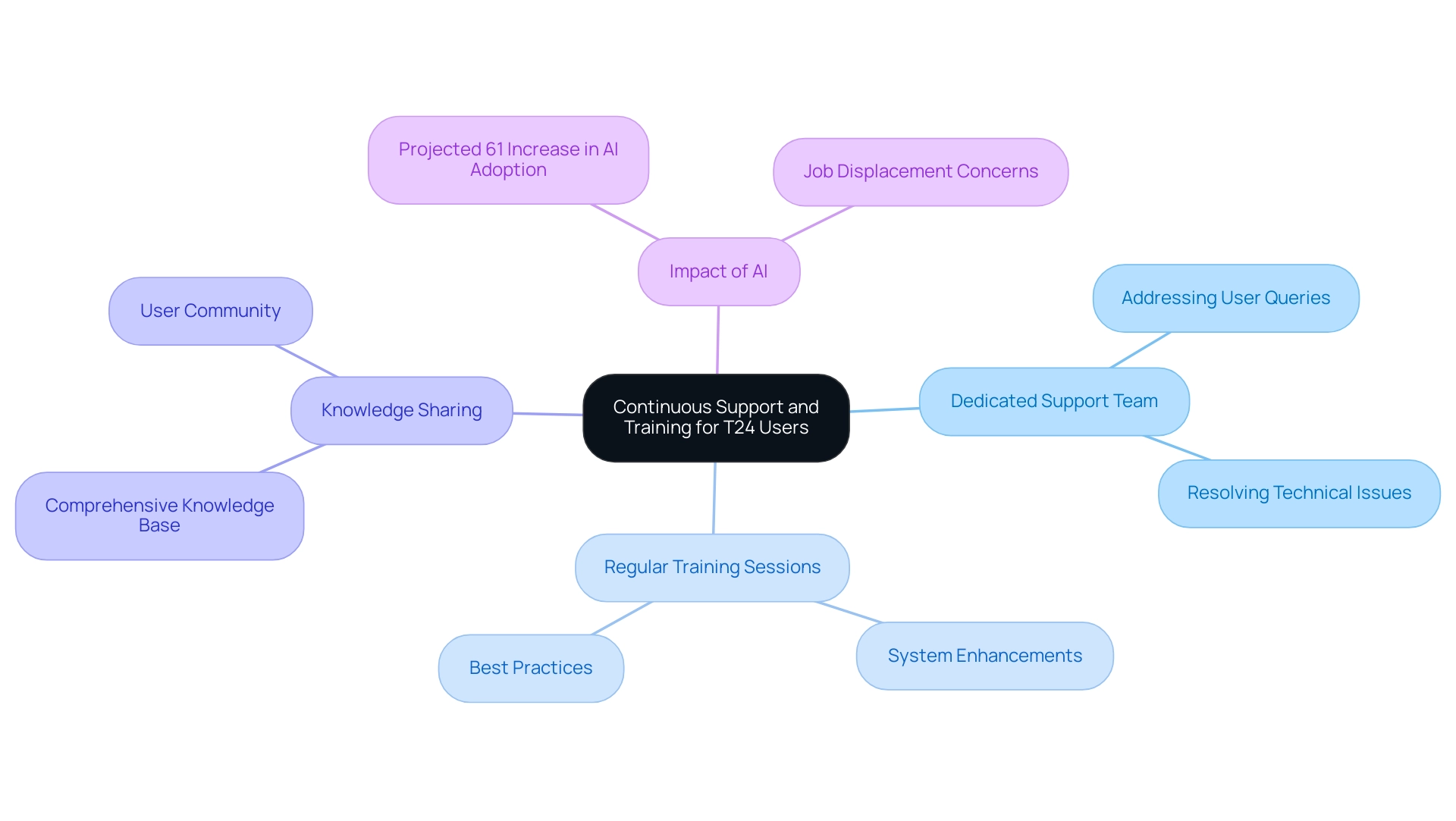

Ensuring Continuous Support and Training for T24 Users

Post-implementation, continuous support and training for T24 users are paramount to maximizing the platform’s effectiveness. Avato’s Expert Integration Services, supported by an international team of full-service integration partners, ensure that businesses have access to skilled integration resources when needed. Establishing a dedicated support team is crucial for promptly addressing user queries and resolving technical issues, thereby ensuring that users feel confident and supported in their roles.

Regular training sessions should be scheduled to keep staff informed about system enhancements and best practices, which is essential in an industry characterized by rapid technological advancements. Moreover, creating a comprehensive knowledge base or fostering a user community can significantly enhance knowledge sharing and promote a culture of continuous learning. This approach not only empowers users but also encourages collaboration and innovation within the organization. As the financial sector evolves, particularly with the projected 61% increase in AI adoption by 2025, the importance of effective user support becomes even more pronounced.

Banks must ensure that their employees are well-equipped to navigate these changes and leverage the full potential of the T24 banking system. Investing in user support and training related to the T24 banking system is not merely a best practice; it is a strategic necessity. As Gustavo Estrada noted, Avato simplifies complex projects and delivers results within desired time frames and budget constraints, highlighting the critical role of effective user support in achieving similar outcomes with T24. With two-thirds of individuals believing that large banks prioritize profits over supporting savers, providing robust support can help rebuild trust and enhance customer satisfaction.

Furthermore, as financial institutions face challenges such as the potential displacement of up to 50% of jobs in the sector due to AI, prioritizing user training and support will be critical in maintaining a competitive edge and ensuring operational resilience in 2025. Additionally, potential clients often inquire about integration costs, timelines, and the availability of demos, which Avato is prepared to address through its comprehensive service offerings, including project rescue options.

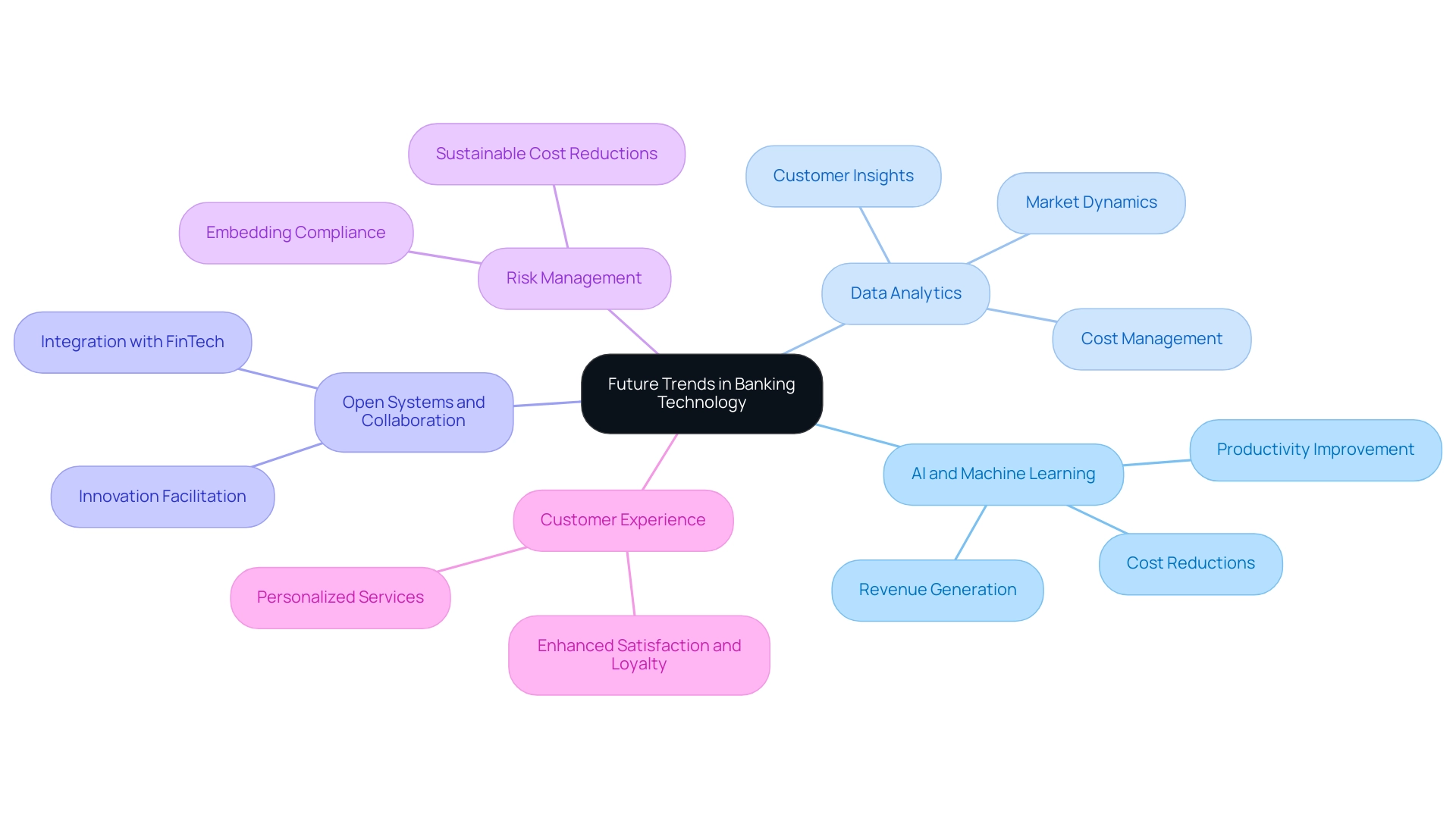

Future Trends in Banking Technology: Preparing for Change

The financial sector is currently experiencing a profound transformation, propelled by several pivotal trends that are reshaping technology and operations. Notably, the rise of artificial intelligence (AI) and machine learning is revolutionizing customer interactions and enhancing operational efficiencies. According to Deloitte’s recent report, over half of financial executives express a desire to improve productivity through generative AI, with 38% anticipating that these efficiencies will lead to significant cost reductions.

This shift not only streamlines processes but also enables financial institutions to provide more personalized services to their customers, ultimately enhancing satisfaction and loyalty.

Data analytics is becoming increasingly vital, empowering these institutions to gain deeper insights into customer behavior and preferences. This capability is essential as deposit costs are projected to rise to 2.03% in 2025, markedly higher than the previous five-year average of 0.9%. By leveraging advanced analytics, financial institutions can better understand market dynamics and customer needs, positioning themselves to respond effectively to these changes and manage the impact of rising costs.

The trend towards open systems and API-driven architectures fosters greater collaboration between traditional financial institutions and FinTech companies. This collaborative environment is crucial for innovation, allowing financial institutions to swiftly integrate new technologies and services. Case studies focusing on the integration of risk controls in financial transformations underscore the importance of embedding risk and compliance measures early in these initiatives.

By adopting this approach, banks can achieve sustainable cost reductions while mitigating regulatory risks, ultimately enhancing security and efficiency in their operations.

As competition intensifies, particularly in wealth management where top banks hold only a 32% market share globally, IT managers must remain vigilant about these trends. Insights from NVIDIA’s 2025 survey reveal that nearly 70% of firms reported at least a 5% revenue increase attributable to AI implementations, underscoring AI’s dual role as both a revenue generator and an efficiency enhancer. The need for innovative technology solutions to capture market share is paramount.

Embracing AI and machine learning, alongside a robust data analytics strategy, will be essential for enhancing banking operations and improving customer experiences in the evolving landscape of 2025. Avato stands at the forefront of this transformation, providing pioneering hybrid connection solutions that empower financial institutions to lead the AI revolution and harness generative AI for improved customer experience and operational efficiency. Our commitment to architecting the technology foundations required for connected customer experiences ensures that your organization can thrive in this new era.

Don’t hesitate—connect with Avato today to explore how our hybrid integration platform can elevate your business and drive significant results.

Conclusion

The T24 banking system, bolstered by Avato’s integration solutions, is indispensable for financial institutions striving for operational efficiency and customer satisfaction in an increasingly competitive landscape. Its modular architecture facilitates customization, empowering banks to swiftly adapt to market demands. The system’s real-time processing and multi-currency support significantly enhance customer experiences, positioning banks for success in the digital era.

As compliance and cybersecurity challenges escalate, the strategic implementation of T24 becomes paramount. By leveraging advanced technologies and best practices, banks can modernize their operations while fortifying defenses against regulatory risks and cyber threats. The integration of legacy systems with T24 through Avato’s platform unlocks substantial value, enabling seamless operations and adherence to evolving regulations.

Looking forward, emerging trends such as AI and data analytics are set to further transform banking operations. Continuous support and training for T24 users will be essential in maximizing the system’s potential, equipping institutions to adeptly navigate ongoing industry changes.

In conclusion, T24 transcends mere technological solution; it is a strategic asset that amplifies operational capabilities and enhances customer satisfaction. By investing in T24 and proactive integration strategies, financial institutions can secure their competitive edge and thrive in an ever-evolving banking landscape.