Overview

The article examines the pressing challenges encountered in IT management within banking infrastructure and outlines strategies for overcoming them. It asserts that legacy systems, regulatory compliance, cybersecurity threats, and evolving customer expectations are pivotal issues. Furthermore, it emphasizes that modern technical solutions—such as cloud computing, API integration, and data analytics—are essential for banks aiming to enhance their infrastructure and maintain competitiveness in a rapidly evolving financial landscape. By adopting these solutions, banks can not only address existing challenges but also position themselves for future success.

Introduction

In the rapidly evolving landscape of finance, the backbone of banking operations—its infrastructure—has never been more critical. Financial institutions are tasked with delivering seamless services while navigating complex regulatory environments and rising customer expectations. Consequently, the importance of robust systems and technologies is increasingly evident.

This article delves into the essential components of banking infrastructure, emphasizing its significance and the challenges faced in IT management. Furthermore, it explores the regulatory frameworks that shape its evolution and highlights innovative technical solutions that empower banks to modernize operations and enhance customer experiences in an age defined by digital transformation.

As the sector braces for the future, understanding these dynamics is crucial for any institution aiming to thrive in a competitive marketplace.

Define Banking Infrastructure and Its Importance

Banking infrastructure is the essential backbone that empowers financial institutions to operate efficiently and securely. It encompasses a comprehensive range of hardware, software, networks, and data management systems that facilitate transactions, manage client accounts, and ensure compliance with regulatory standards. The significance of robust banking infrastructure cannot be overstated; it is crucial for delivering reliable services, fostering customer trust, and enabling swift adaptation to evolving market demands.

A well-structured infrastructure not only supports seamless operations but also enhances customer experiences and mitigates risks associated with financial transactions. Recent trends in mortgage loans in Canada illustrate how understanding market dynamics can inform lending practices, enabling financial institutions to better serve their mortgage clients. This underscores the critical role of banking infrastructure in effectively analyzing and responding to market trends.

Furthermore, starting in 2024, the boards of directors of Canada’s six largest financial institutions will consist of an average of 46% women. This commitment to diversity is poised to enhance decision-making and client relations, ultimately influencing infrastructure strategies.

Data reveals that 45% of the total volume of cash-futures basis trades is concentrated in 2-year futures contracts, highlighting the necessity for agile and responsive banking infrastructure to manage such complexities. A reliable, future-proof technology stack, like that offered by Avato, is essential for institutions to navigate these challenges effectively. Avato’s hybrid integration platform guarantees 24/7 uptime and reliability, allowing banks to simplify complex integrations and maximize the value of legacy systems while significantly reducing costs.

In addition, with support for 12 levels of interface maturity, Avato empowers institutions to future-proof their operations. By 2025, the importance of banking infrastructure will only grow, as it becomes increasingly vital for institutions to uphold client trust and operational integrity in a rapidly changing economic landscape. As Gustavo Estrada pointed out, Avato streamlines intricate projects and delivers results within specified timelines and budget constraints, emphasizing the necessity of investing in strong banking infrastructure to meet the needs of clients and the market alike.

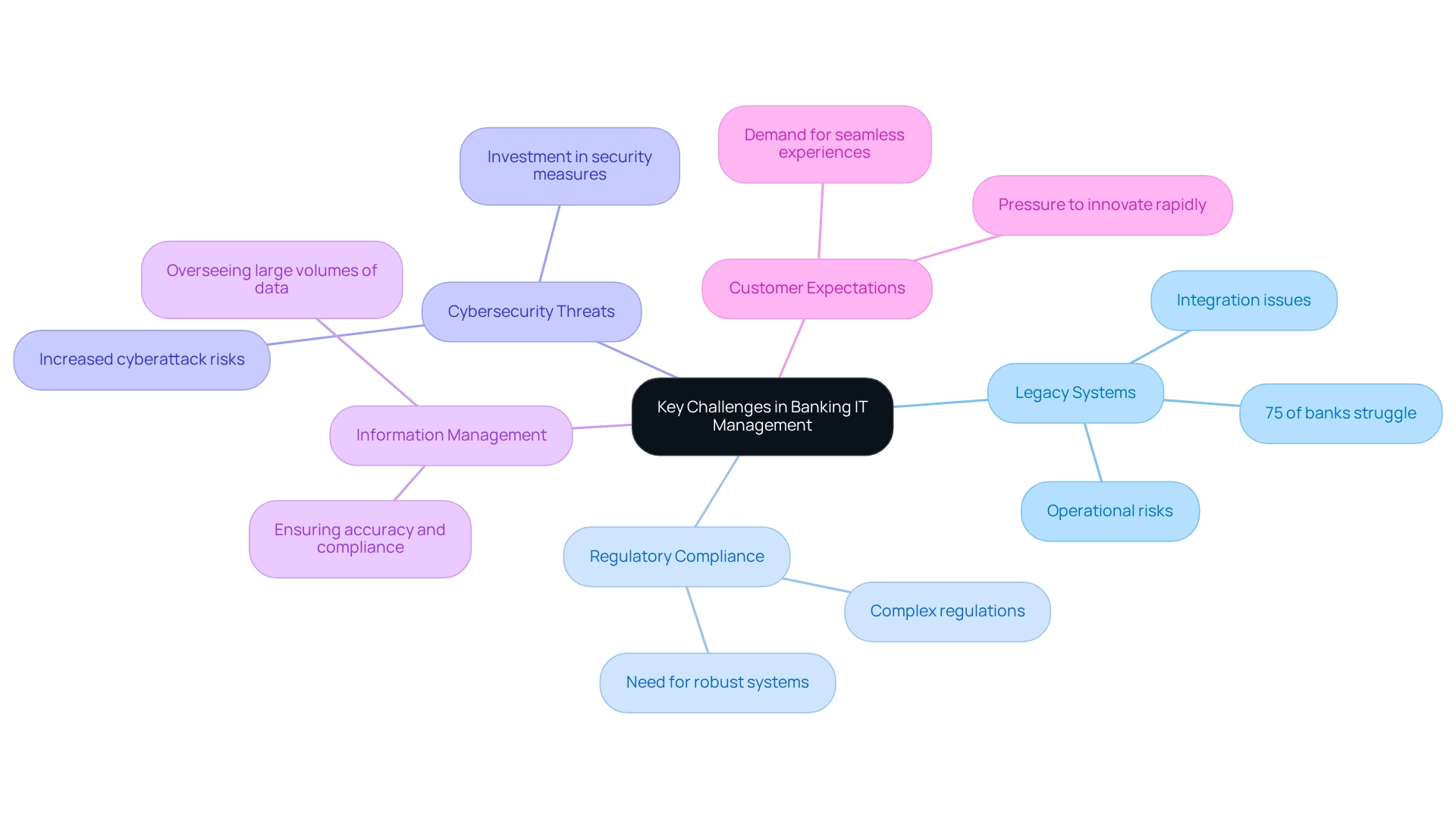

Identify Key Challenges in Banking IT Management

Banks face several critical challenges in IT management, particularly in 2025. Legacy Systems present a significant hurdle, with a staggering 75% of banks struggling to implement new digital solutions due to their reliance on outdated technology. These legacy systems hinder integration with modern solutions, resulting in inefficiencies and heightened operational risks. The inability to adapt quickly to market demands stifles innovation and competitiveness.

Regulatory Compliance is another pressing issue. The financial sector is governed by a complex web of regulations that require robust systems capable of adapting to evolving requirements. Banks must ensure their banking infrastructure supports compliance efforts without compromising operational efficiency.

Cybersecurity Threats are escalating as digital banking expands, increasing the risks associated with cyberattacks. Banks are compelled to invest in advanced security measures to protect sensitive client information, making cybersecurity a top priority in IT management strategies. Information Management presents its own challenges, as effectively overseeing large volumes of information while ensuring accuracy and compliance is crucial. Banks must implement systems that not only manage data effectively but also provide insights that drive decision-making and enhance user experiences.

Customer Expectations have transformed with the rise of FinTech, demanding seamless, fast, and personalized banking experiences. Traditional financial institutions face immense pressure to innovate rapidly to meet these expectations, which can be particularly challenging when constrained by legacy systems.

To address these challenges, a case study highlighting strategic investment in technology reveals that aligning technology spending with corporate strategy can significantly enhance an institution’s banking infrastructure. By connecting technology investments to key valuation factors and specific business results, financial institutions can revolutionize their approach to IT management. This transformation is anticipated to save financial institutions $1.5 billion in the long term and improve banking infrastructure by decreasing the time to market for new products by 20%.

Moreover, the integration of generative AI has emerged as a powerful tool in financial services, with a 60% increase in its use for enhancing customer experience through sophisticated chatbots and virtual assistants. This technology not only streamlines operations but also boosts productivity across various departments. Gustavo Estrada emphasizes the importance of simplifying complex projects, stating that Avast has the ability to deliver results within desired time frames and budget constraints. This capability is essential for financial institutions seeking to enhance their banking infrastructure to address the challenges presented by legacy systems and improve operational efficiency.

Furthermore, Avato’s solutions are designed to tackle regulatory compliance and facilitate stakeholder engagement, ensuring that financial institutions can model their processes effectively and future-proof their systems.

Explore Regulatory Frameworks Impacting Banking Infrastructure

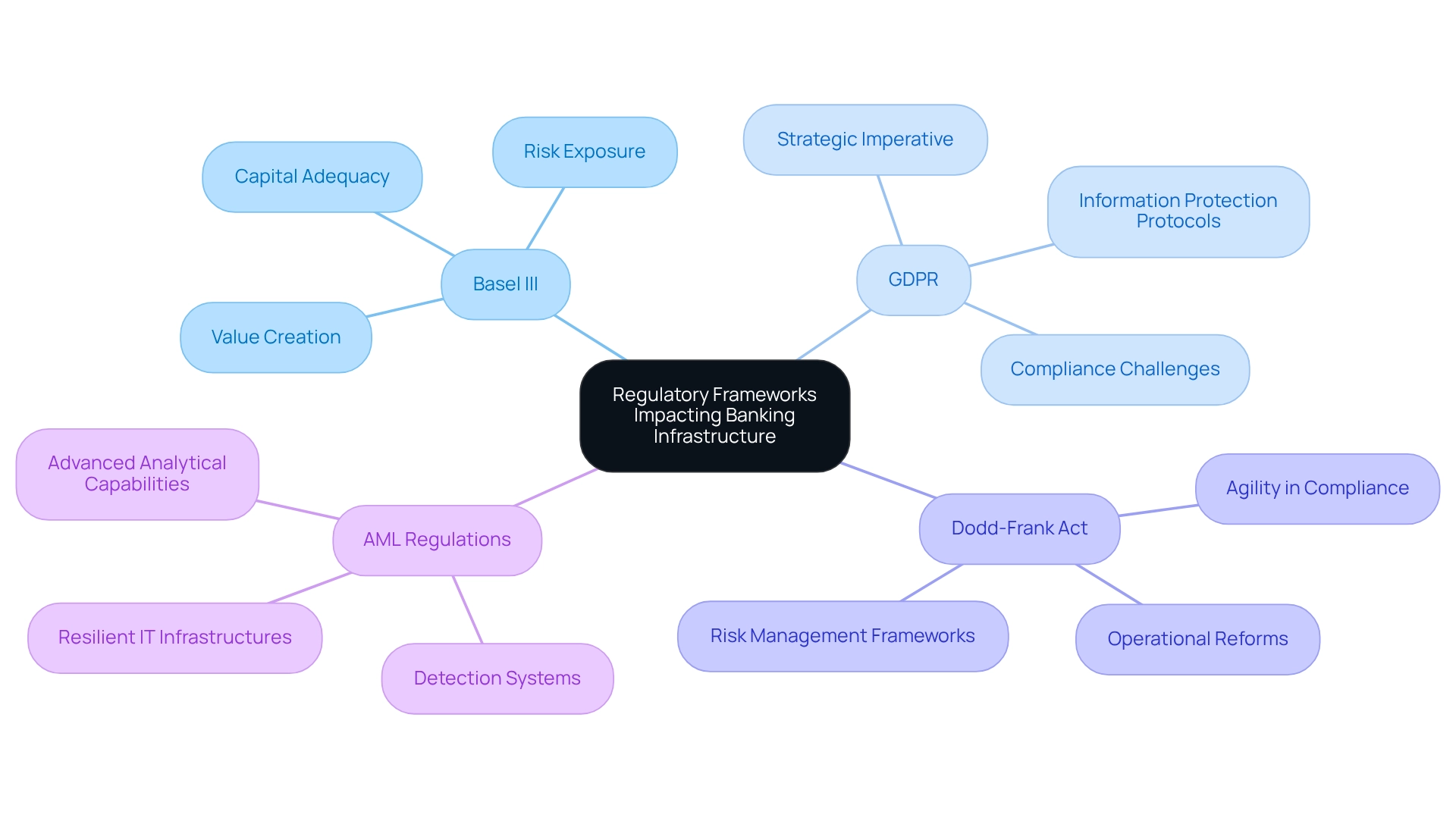

Regulatory frameworks are pivotal in shaping the banking infrastructure of the financial sector. Key regulations include:

-

Basel III: This framework establishes rigorous standards for capital adequacy, stress testing, and market liquidity risk. It significantly affects how financial institutions handle their capital and risk exposure. Recent analyses indicate that only 14 percent of financial institutions are positioned to create substantial value based on their financial metrics. This suggests a potential path for these entities to achieve high performance, contrasting sharply with the 62 percent of publicly traded companies outside of this sector that meet similar thresholds. How can financial institutions leverage this insight? Avato’s Hybrid Integration Platform can assist them in maximizing and extending the value of their legacy systems, enabling compliance with these rigorous standards more effectively.

-

GDPR: The General Data Protection Regulation requires rigorous information protection protocols, fundamentally affecting how financial institutions manage client information. Adherence to GDPR is not merely a legal requirement but also a strategic imperative. Financial institutions face growing scrutiny regarding privacy practices. Recent statistics indicate that a notable proportion of financial institutions are still struggling with full compliance, highlighting the urgency for strong information management systems. Can your institution afford to fall behind? Avato’s platform simplifies complex integrations and provides real-time monitoring and alerts on system performance, which are crucial for maintaining compliance.

-

Dodd-Frank Act: This U.S. regulation imposes comprehensive reforms on financial institutions, affecting their operational practices and compliance requirements. It necessitates a reevaluation of risk management frameworks to ensure adherence to evolving standards. Agility in compliance strategies is paramount. Avato’s secure hybrid integration capabilities can significantly reduce costs while ensuring 24/7 uptime and reliability, essential for navigating these regulatory changes.

-

Anti-Money Laundering (AML) Regulations: Banks are required to implement sophisticated systems to detect and report suspicious activities. The demand for advanced analytical capabilities is critical in maintaining compliance and protecting against financial crimes. This reinforces the need for resilient IT infrastructures. How quickly can your institution adapt to AML requirements? Avato’s Hybrid Integration Platform speeds up the connection of isolated legacy systems, improving analytics capabilities and allowing financial institutions to react swiftly to AML requirements.

Grasping these regulations is crucial for financial organizations to build compliant and resilient banking infrastructure. Empowering them to manage the complexities of the financial landscape effectively is not just a goal; it’s a necessity.

Implement Technical Solutions for Banking Infrastructure

To enhance banking infrastructure, institutions can implement several technical solutions that are vital for modern operations.

-

Cloud Computing: The adoption of cloud services enables banks to scale operations efficiently, lower expenses, and enhance information accessibility. By 2025, cloud computing is anticipated to play a crucial role in financial services, with organizations utilizing its capabilities to simplify processes and improve user experiences. How prepared is your institution for this shift?

-

API Integration: Utilizing APIs enables smooth connectivity between legacy systems and contemporary applications, significantly enhancing information flow and operational efficiency. Recent advancements in open finance have streamlined information connectivity, allowing users to effortlessly link to essential financial applications. A case study on open banking solutions indicates that this has resulted in a rise in sign-ups by up to 25%, showcasing the positive effect of API integration on user engagement. Avato’s hybrid integration platform can further enhance this process by providing a middle layer that converts information into open formats, ensuring compatibility across various applications.

-

Data Analytics Tools: Utilizing sophisticated analytics allows financial institutions to derive valuable insights from their information, improving decision-making and customer service. For instance, companies such as Flexport have unlocked 32% more capital for logistics partners through efficient information utilization. This demonstrates the transformative influence of analytics in financial institutions, highlighting the necessity for banks to utilize insights from information. As Liran Zelkha, co-founder of a leading firm, stated, “We use the app-level insights in the dashboard to equip our teams with better data to manage risk and compliance.”

-

Cybersecurity Solutions: Investing in robust cybersecurity measures, such as multi-factor authentication and encryption, is essential for protecting sensitive information. As the financial sector faces increasing regulatory scrutiny, including the complexity of 1033 compliance, a multifaceted approach to compliance, including risk management, is crucial. Open banking will necessitate even stricter security measures, making it essential for financial institutions to optimize their integration solutions to reduce vulnerabilities.

-

Agile Methodologies: Adopting agile practices in IT management increases responsiveness to market changes and client needs, promoting a culture of ongoing enhancement. This adaptability is crucial in a time when customer expectations are quickly changing, and financial institutions must innovate to remain competitive. Avato’s dedication to architecting technology foundations supports this agility, enabling financial institutions to future-proof their operations through seamless data and system integration.

By integrating these solutions, banks can not only modernize their banking infrastructure but also position themselves for sustainable growth in a digital-first landscape. Are you ready to take the next step in transforming your banking operations?

Conclusion

Banking infrastructure serves as the backbone for financial institutions, underpinning efficient operations, ensuring regulatory compliance, and fostering customer trust. Robust systems empower banks to swiftly adapt to market fluctuations and meet the escalating expectations of their clientele.

However, the path is fraught with challenges, including outdated legacy systems and persistent cybersecurity threats. To overcome these hurdles, the integration of cutting-edge technologies such as cloud computing and data analytics becomes imperative for streamlining operations and elevating customer experiences.

Regulatory frameworks like Basel III and GDPR impose additional demands on banking infrastructure, necessitating agile IT systems capable of rapidly adjusting to compliance requirements. As the financial landscape continuously evolves, the adoption of innovative solutions is essential for banks to not only meet regulatory standards but also to excel in a digital-first environment.

In conclusion, the future of banking infrastructure hinges on strategic technology investments and a steadfast commitment to modernization. By addressing existing challenges and harnessing advanced solutions, financial institutions can secure sustainable growth while fulfilling the expectations of customers and stakeholders alike. Ultimately, to lead in this competitive marketplace, banks must drive transformation within their sector, positioning themselves for success in an ever-changing financial landscape.