Overview

We recognize the critical need for mastering system integration techniques to enhance banking efficiency. Integrating diverse financial systems is not just beneficial; it is essential for achieving improved operational effectiveness and customer satisfaction.

By employing various integration methods, such as middleware and API-driven approaches, we can transform our operations. A prime example is DBS Bank’s automation of regulatory reporting, which resulted in significant cost reductions and operational improvements. This case underscores the tangible benefits that effective integration can deliver.

Let us work together to harness these techniques and elevate our banking operations.

Introduction

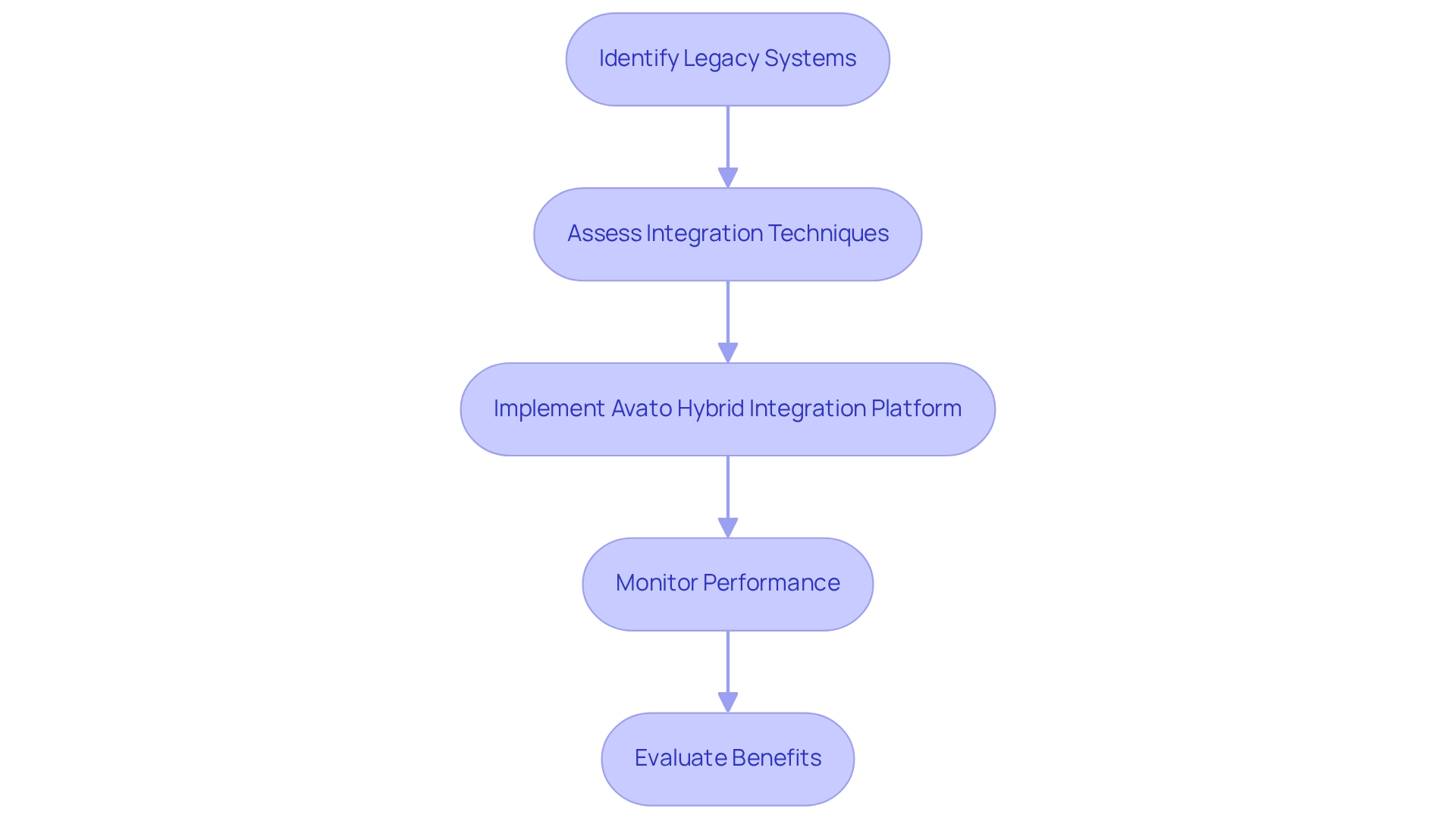

In the rapidly evolving landscape of banking, we recognize that system integration is a critical pillar for operational success. By connecting disparate systems and enhancing data exchange, we can streamline processes, improve customer service, and make informed decisions. As financial institutions navigate the complexities of modern technology, platforms like Avato’s Hybrid Integration Platform emerge as essential tools, enabling us to leverage legacy systems while reducing integration costs.

With a significant percentage of organizations investing in integration strategies, the banking sector is witnessing transformative changes that not only boost efficiency but also enhance customer experiences. What’s holding your team back?

This article explores the multifaceted world of system integration in banking, highlighting methods, best practices, and real-world examples that illustrate the profound impact of seamless connectivity on the industry’s future.

Define System Integration in Banking

The unification of financial services is not just a trend; it is a necessity. By employing system integration techniques, we link diverse financial frameworks, applications, and platforms, enabling seamless data transfer and enhancing operational effectiveness. This integration is vital for modern financial institutions, allowing systems such as core banking, customer relationship management (CRM), and payment processing to interact efficiently. By merging these frameworks, we optimize operations, elevate customer support, and enhance decision-making capabilities.

At the forefront of this integration is the Avato Hybrid Integration Platform, which plays a crucial role in helping financial institutions enhance and extend the value of their legacy infrastructures while simplifying complex connections. With real-time tracking and performance notifications, we significantly reduce costs associated with merging efforts.

Recent trends reveal that 67% of businesses invest in connections to boost close rates, particularly relevant in banking, where timely and accurate data is essential for decision-making and customer interactions. For example, DBS Bank automated its regulatory reporting, achieving an impressive 26% reduction in compliance costs. This reduction not only enhances operational efficiency but also allows us to allocate resources more effectively, ultimately improving customer service and satisfaction.

A notable case study is Compeer Financial, which faced challenges with its outdated document generation platform reliant on Microsoft InfoPath. After transitioning to ActiveDocs, they achieved centralized content management and robust connectivity with nCino and Salesforce, significantly improving IT security and resilience. This transformation exemplifies contemporary system integration techniques for connecting systems, showcasing how we can address similar challenges and adapt to evolving business needs. Furthermore, it underscores the importance of a well-defined consolidation plan, such as that offered by Avato, to minimize disruptions and ensure data integrity during transitions. Ensuring transparency and continuous communication with clients throughout the merging process is crucial for success, fostering trust and collaboration, which ultimately leads to superior outcomes.

Key Benefits of Utilizing Avato’s Hybrid Merging Platform:

- We maximize and extend the value of legacy systems.

- We simplify complex connections.

- We provide real-time monitoring and alerts on performance.

- We significantly reduce expenses linked with merging efforts.

- We enhance operational efficiency and customer satisfaction.

Explore System Integration Methods

In today’s rapidly evolving banking landscape, effective integration is crucial for success. There are several approaches for integration, each with its advantages and challenges that we must consider:

- Point-to-Point Integration: This straightforward method links two entities directly. While it is easy to execute, it can become intricate and difficult to manage as the number of networks grows.

- Middleware-Based Integration: Middleware serves as a link between various platforms, enabling them to communicate without direct connections. This method enhances flexibility and scalability, which is vital for financial institutions aiming to maximize the value of their legacy systems.

- API-Driven Integration: APIs (Application Programming Interfaces) facilitate real-time interactions between various platforms. This method is increasingly favored due to its ability to enable quick and secure data exchanges, a critical factor as banks prepare for open banking initiatives.

- Event-Driven Integration: This approach utilizes events to initiate data exchanges between platforms, allowing for real-time processing and adaptability to changes in data—essential for maintaining operational efficiency.

- Enterprise Service Bus (ESB): An ESB offers a centralized platform for connecting various applications and services, promoting a more organized and efficient architecture for collaboration. Our Hybrid Integration Platform exemplifies this approach, ensuring 24/7 uptime and reliability for complex frameworks in banking, healthcare, and government. It also provides real-time oversight and notifications regarding performance, which are essential for preserving operational integrity and ensuring compliance with security standards.

Each approach has its distinct use cases, and we encourage banks to assess their specific needs, existing frameworks, and future objectives when selecting system integration techniques for a unification strategy. By leveraging our solutions, financial institutions can streamline complex connections, reduce costs, and enhance security, ultimately accelerating their digital transformation initiatives while maximizing the value of their legacy frameworks.

Highlight Benefits of Best Practices in Banking Integration

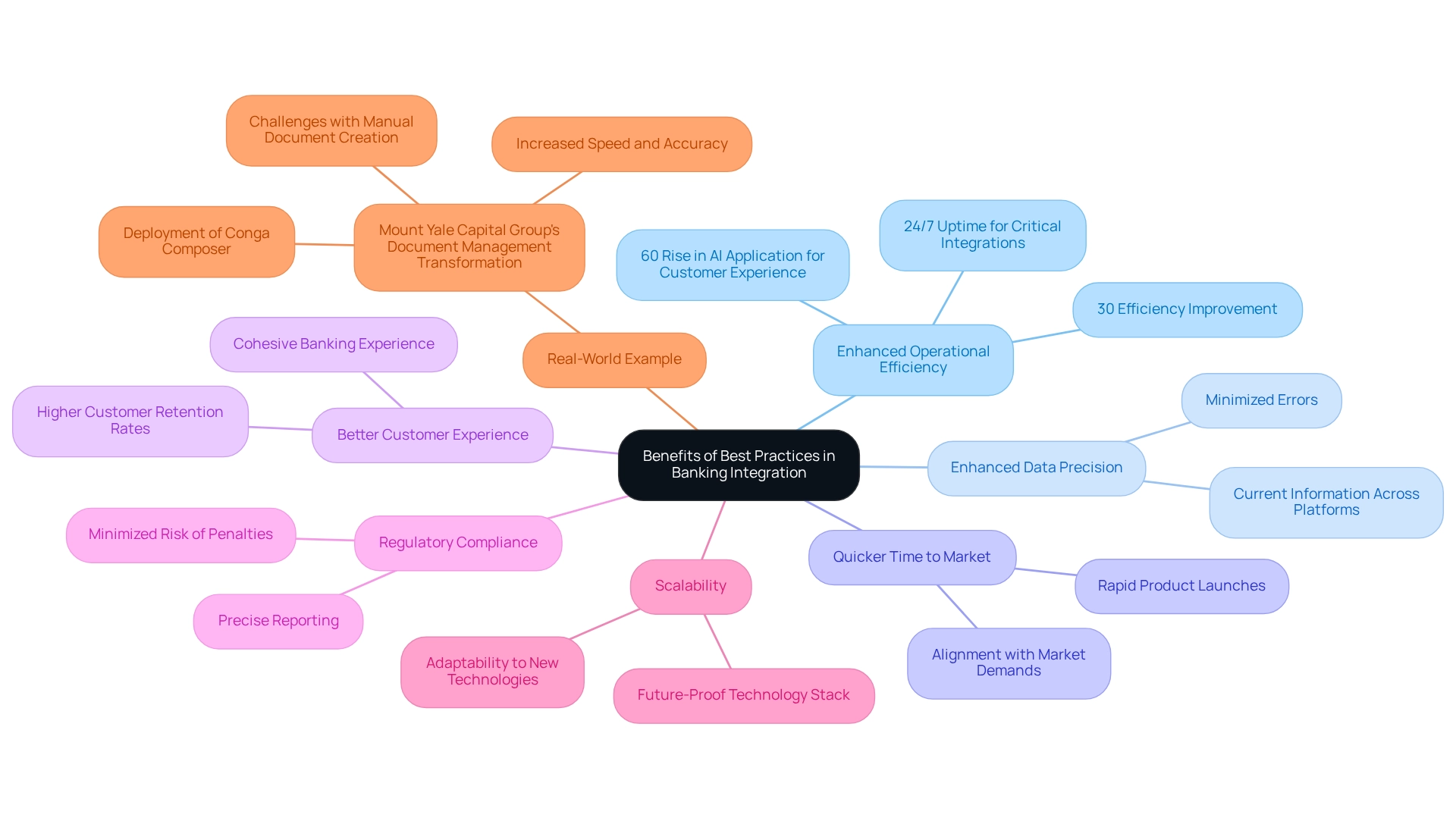

Implementing best practices in banking system integration yields a multitude of advantages that we cannot overlook:

-

Enhanced Operational Efficiency: System unification eliminates redundant processes, automates routine tasks, and streamlines workflows, resulting in substantial time and cost savings. Statistics indicate that organizations implementing unification strategies can experience operational efficiency enhancements of up to 30%. Furthermore, we guarantee 24/7 uptime for essential connections, crucial for secure transactions, thereby enhancing operational reliability. The incorporation of generative AI has also led to a 60% rise in its application for customer experience, particularly through advanced chatbots and virtual assistants, further boosting operational efficiency.

-

Enhanced Data Precision: By reducing manual data input, integration minimizes errors and ensures that all platforms reflect the most current information. This precision is vital for informed decision-making, allowing financial institutions to respond swiftly to market shifts.

-

Quicker Time to Market: Unified solutions empower banks to launch new products and services more rapidly, aligning with market demands and customer needs in real-time. This agility is essential in a competitive landscape where speed can determine success.

-

Better Customer Experience: A seamless unification of customer-facing systems fosters a cohesive and personalized banking experience, significantly enhancing customer satisfaction and loyalty. Banks that prioritize unification often report higher customer retention rates. Our hybrid integration platform plays a pivotal role in transforming financial institutions by delivering a connected foundation that simplifies and modernizes customer interactions.

-

Regulatory Compliance: Integrated frameworks facilitate adherence to regulatory requirements by providing precise reporting and audit trails, thereby minimizing the risk of penalties. This is particularly critical in the banking sector, where regulatory scrutiny is intense.

-

Scalability: As financial institutions expand, integrated systems can effortlessly adapt to new technologies and processes, ensuring agility and competitiveness in a rapidly changing environment. Our focus on a reliable, future-proof technology stack allows businesses to adjust to evolving demands, ensuring they remain at the forefront of the industry. This adaptability is crucial for long-term sustainability.

-

Real-World Example: For instance, Mount Yale Capital Group faced challenges with manual document creation and management, necessitating significant effort to handle multiple accounts and documents. By deploying Conga Composer, they unified siloed datasets, significantly increasing the speed and accuracy of document creation, and improving the process of sending documents for signature, enhancing transparency and efficiency.

By embracing these best practices and utilizing system integration techniques, we not only enhance our operational capabilities but also position ourselves for future growth and innovation. As Tony LeBlanc from the Provincial Health Services Authority states, “Good team. Good people to work with. Extremely professional. Extremely knowledgeable.” This focus on professionalism and expertise is essential for effective banking integration.

Conclusion

The importance of system integration in banking cannot be overstated. By connecting various banking systems and platforms, we can achieve enhanced operational efficiency, improved data accuracy, and a superior customer experience. The role of solutions like Avato’s Hybrid Integration Platform is crucial, as they allow us to maximize the value of legacy systems while facilitating seamless data exchange and reducing integration costs.

Different integration methods, from point-to-point to API-driven approaches, offer us a range of options to suit our specific needs. By selecting the right strategy, we can streamline processes, respond swiftly to market changes, and remain competitive in a fast-paced environment. Implementing best practices in system integration not only leads to significant time and cost savings but also fosters scalability and regulatory compliance, ensuring that we are well-equipped for future growth.

Ultimately, the journey towards effective system integration is about more than just technology; it’s about transforming how we operate and serve our customers. As the banking sector continues to evolve, embracing integration strategies will be essential for delivering exceptional service, fostering customer loyalty, and staying ahead in a rapidly changing landscape. The question remains: are we ready to harness the power of system integration for a brighter, more efficient future?