Overview

In today’s rapidly evolving financial landscape, the effective implementation of Core Banking as a Service (CBaaS) is not just an option; it is a necessity for financial institutions aiming to thrive. We understand the complexities involved in this transition, and we are here to guide you through essential steps and considerations.

- Assessing your business needs is crucial. What challenges does your institution face?

- Choosing the right provider is equally important; the right partnership can make all the difference in achieving your goals.

- Ensuring data security and regulatory compliance cannot be overlooked, as these elements are vital for a successful transition to cloud-based banking solutions.

By embracing CBaaS, you enhance not only operational efficiency but also customer experience. Let us partner with you on this journey towards a more agile and responsive banking future.

Introduction

In the rapidly evolving landscape of finance, we recognize that Core Banking as a Service (CBaaS) is revolutionizing how banks operate. This cloud-based model enhances efficiency and flexibility, allowing us to leverage APIs and integrate our services seamlessly. As we pave the way for new financial products, we do so without the burden of extensive infrastructure.

As the industry shifts from legacy systems to modern cloud solutions, understanding the key concepts, challenges, and opportunities presented by CBaaS becomes crucial for us as banking professionals. From ensuring regulatory compliance to enhancing customer experiences, the journey through CBaaS is filled with potential for growth and innovation.

We must make it a pivotal focus to thrive in the digital age.

Define Core Banking as a Service: Key Concepts and Terminology

Core banking as a service (CBaaS) represents a transformative model that empowers financial institutions to deliver essential functionalities through cloud-based services. By leveraging this method, we enable external providers to harness financial capabilities via APIs, facilitating the creation of innovative financial products without the burden of extensive financial infrastructure. Key concepts associated with CBaaS include:

- Core Finance: The foundational backend system responsible for processing daily financial transactions and maintaining account updates.

- APIs (Application Programming Interfaces): Essential tools that enable seamless communication between different software applications, crucial for integrating diverse financial services.

- Cloud Computing: The provision of computing services over the internet, offering scalable and flexible solutions tailored to the finance sector.

- Banking as a Service (BaaS): A broader framework that encompasses CBaaS, where financial institutions extend their services to non-financial entities, fostering innovative financial solutions.

The core finance software market is witnessing significant growth, with the on-premise segment projected to hold the largest share in 2024. This trend reflects the escalating demand for integrated financial solutions across various regions, including North America, Europe, and Asia Pacific. As we embrace core banking as a service, we unveil new revenue sources and enhance operational effectiveness, which is exemplified by the growth of Banking-as-a-Service (BaaS) and embedded finance. This model is revolutionizing how financial institutions operate, enabling us to seamlessly incorporate financial services into third-party platforms. The expansion of core banking as a service (BaaS) is particularly fueled by its capability to deliver the essential infrastructure for financial institutions to provide their services in a more adaptable and innovative manner.

Our hybrid integration platform, Avato, plays a vital role in this landscape, ensuring that financial entities achieve 24/7 uptime and reliability for their complex systems. With support for 12 levels of interface maturity, we streamline intricate projects and deliver results within established time frames and budget constraints, empowering financial institutions to navigate the evolving core financial landscape. Expert opinions highlight the advantages of core banking as a service, underscoring its role in simplifying complex financial operations and enabling rapid service deployment. As the landscape of core finance continues to evolve, it is essential for IT managers in the sector to stay informed about the latest trends and developments in core banking as a service, leveraging these advancements for a competitive edge.

Trace the Evolution of Core Banking Systems: From Legacy to Cloud Solutions

The evolution of core banking as a service platforms is a testament to the transformative technological advancements that have reshaped the financial landscape. Initially, financial institutions relied on legacy systems—mainframe computers and proprietary software that were often rigid and costly to maintain. This rigidity limited their ability to adapt to changing market conditions. At Avato, we address these challenges head-on with our hybrid connection platform, maximizing and extending the value of legacy infrastructures. Our solution allows financial institutions to unlock isolated assets and generate business value while significantly lowering expenses associated with maintaining outdated frameworks.

As we progressed into the 1990s, banks began to adopt client-server architecture, enhancing data management and user interfaces, which in turn improved operational efficiency. We streamline intricate integrations, enabling smoother transitions and better oversight of these networks, ultimately reducing the costs and complexities tied to integration. The early 2000s saw the rise of web-based banking applications, which greatly improved accessibility and customer experience, allowing clients to manage their finances more conveniently. With our real-time monitoring and alerts on system performance, we ensure that financial institutions can optimize the operation of these solutions, further enhancing their value proposition. Today, we witness a significant shift as more financial institutions migrate to cloud-based solutions like core banking as a service, with projections indicating that by 2025, over 60% will employ cloud technologies. This transition to core banking as a service provides scalability, cost reductions, and enhanced security, enabling banks to innovate swiftly and respond effectively to market demands. Our secure hybrid integration platform facilitates the seamless integration of isolated legacy systems, making this transition not only smoother but also more efficient while contributing to substantial cost savings.

As the landscape continues to evolve, the shift from legacy systems to cloud solutions remains a critical focus for financial institutions striving to maintain competitiveness. The effectiveness of our contemporary financial solutions is underscored by customer testimonials, which highlight how we have simplified complex projects and delivered results within desired time frames and budget constraints. What’s holding your team back? Let us partner with you to navigate this transformation and unlock new opportunities.

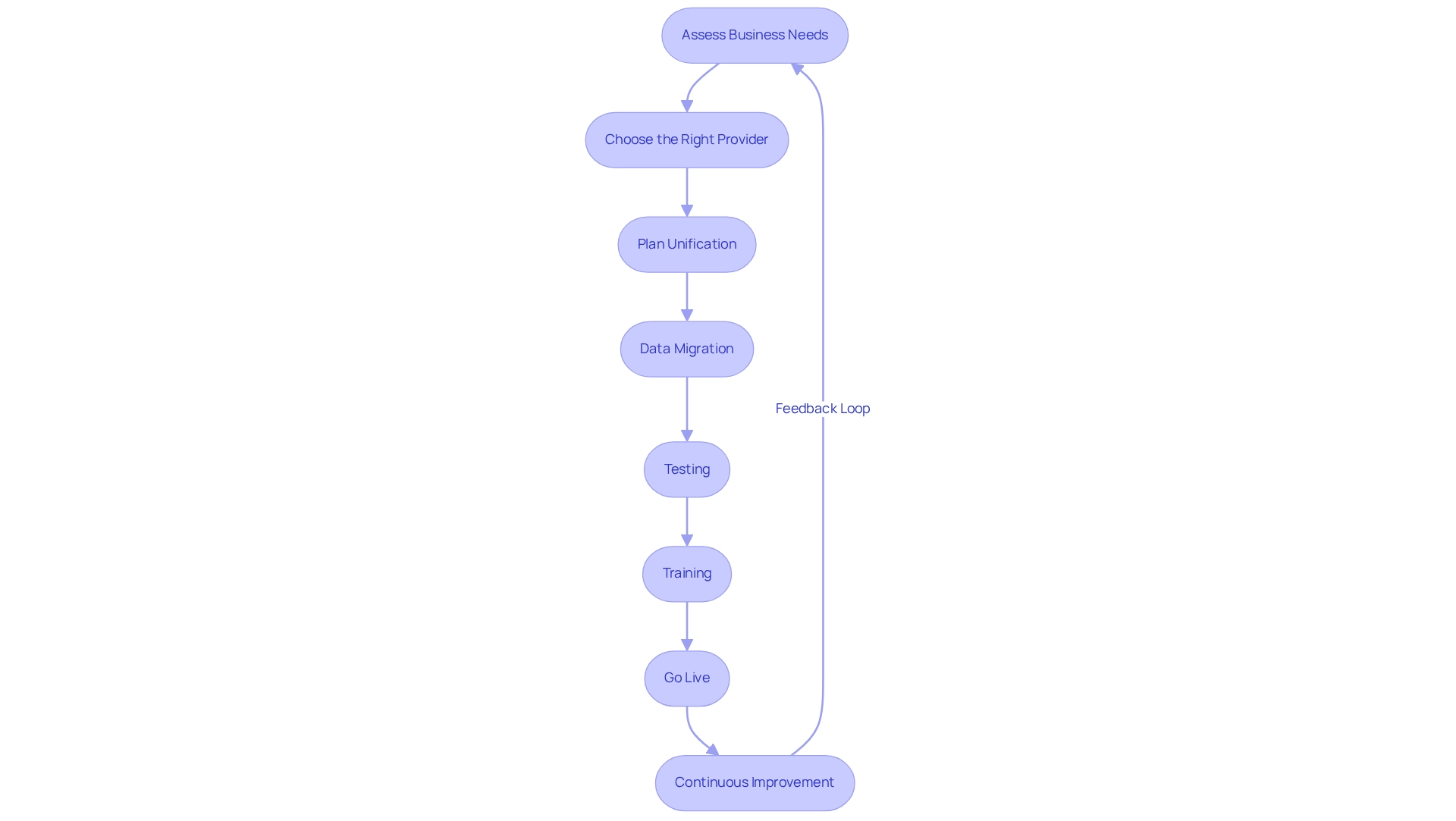

Implement Core Banking as a Service: Steps for Successful Integration

To implement Core Banking as a Service (CBaaS) effectively, we must follow these essential steps:

-

Assess Business Needs: We begin by identifying our organization’s specific requirements and how CBaaS can fulfill them. This assessment is crucial for aligning the service with our strategic goals.

-

Choose the Right Provider: We evaluate potential CBaaS providers based on their technology offerings, security protocols, and compliance with industry regulations. Choosing a provider with a solid track record is essential for our long-term success, particularly as core banking as a service takes root in Canada.

-

Plan Unification: We create a detailed unification plan that outlines timelines, required resources, and key milestones. A well-structured plan minimizes disruptions and ensures a smoother transition. Given that the corporate banking segment is expected to dominate the market, adopting effective core banking as a service strategies during this phase is essential. We consider utilizing current legacy frameworks with a middle layer to enable integration, as this can improve efficiency and lower expenses.

-

Data Migration: We concentrate on a smooth transfer of information from outdated platforms to the new environment, emphasizing data integrity and security. Recognizing the complexities of data migration is essential to avoid delays and potential downtime for critical applications. Engaging professional services can help us navigate these challenges effectively.

-

Testing: We conduct a thorough evaluation of the new setup to identify and resolve any issues before going live. This step is essential to guarantee that the setup functions as intended and meets our performance expectations.

-

Training: We provide comprehensive instruction for our staff to ensure they are comfortable and proficient with the new setup. Effective training enhances user adoption and minimizes resistance to change, which is crucial as we transition to open banking frameworks.

-

Go Live: We launch the new framework while closely monitoring performance to address any immediate concerns. This phase is essential for guaranteeing that the transition is successful and that users can utilize the platform effectively.

-

Continuous Improvement: We regularly assess performance and gather user feedback to make necessary adjustments and enhancements. This ongoing assessment aids in preserving system relevance and efficiency, ensuring that our incorporation strategy remains strong as new tools and technologies arise.

By proactively tackling challenges during the core banking as a service implementation, we can maximize benefits and ensure a successful incorporation. As Tom aptly puts it, “This is the stuff that I really love,” emphasizing the excitement and potential that comes with successful integration.

Analyze Challenges and Opportunities in Core Banking as a Service

Implementing core banking as a service presents a unique set of challenges and opportunities for financial institutions.

Challenges:

- Regulatory Compliance: Navigating the complex landscape of regulatory requirements is a significant challenge. We must ensure that our new technologies comply with stringent regulations, which can be both time-consuming and resource-intensive. As regulations continue to evolve in 2025, we must remain agile in our compliance strategies.

- Data Security: Safeguarding sensitive customer information during migration is paramount. With financial institutions experiencing an average of 700 cyber attacks weekly—a remarkable 53% rise from the prior year—strong security measures are crucial to protect against data breaches. This cultural shift to emphasize cybersecurity at every level is essential for reducing risks linked to digital transformation.

- Connection with Legacy Systems: Many banks still function on obsolete legacy systems, complicating the connection process. This challenge can hinder the seamless transition to core banking as a service, requiring careful planning and execution. Our expertise in hybrid connectivity can play a pivotal role in simplifying these complex linkages, ensuring a smoother transition.

Opportunities include enhanced customer experience, as core banking as a service (CBaaS) improves the delivery of personalized and efficient banking services, significantly boosting customer satisfaction and loyalty. The incorporation of generative AI technologies, such as sophisticated chatbots and virtual assistants, can further enhance customer interactions, leading to a more engaging experience. For instance, a recent case study demonstrated a 60% rise in customer involvement through AI-driven solutions.

- Cost Efficiency: By embracing cloud technology, we can optimize operations, lower expenses, and distribute resources more effectively, ultimately improving profitability. Our hybrid integration platform facilitates this by speeding up secure system integration, enabling us to concentrate on creativity, and the inherent flexibility of core banking as a service allows us to swiftly adapt to market changes, leading to the rapid introduction of new products and services that meet evolving customer needs. As the banking sector increasingly embraces advanced technologies like AI and machine learning, the potential for growth in the IT security market is substantial, projected to reach $195.5 billion by 2029. This shift underscores the importance of prioritizing cybersecurity at all organizational levels to mitigate risks associated with digital transformation. Furthermore, as noted by Gustavo Estrada, our ability to simplify complex projects can be instrumental in overcoming these challenges, allowing us to focus on delivering innovative solutions while ensuring compliance and security. Testimonials from clients highlight our effectiveness in integration projects, reinforcing the value of our solutions.

Conclusion

The transformative power of Core Banking as a Service (CBaaS) is reshaping the financial landscape, as we witness banks moving from legacy systems to agile cloud-based solutions. By leveraging APIs and cloud computing, we can enhance operational efficiency, reduce costs, and deliver innovative products without the constraints of traditional banking infrastructure. This evolution from rigid legacy systems to flexible CBaaS models highlights our need for adaptability in today’s fast-paced market.

However, the journey to successful CBaaS implementation is not without its challenges. Regulatory compliance, data security, and the integration of existing legacy systems require careful planning and execution. Yet, these hurdles also present significant opportunities for us to enhance customer experiences, streamline operations, and foster innovation. By prioritizing robust security measures and embracing advanced technologies, we can effectively navigate the complexities of digital transformation.

Ultimately, the adoption of CBaaS marks a pivotal shift in the banking sector, positioning us to thrive in an increasingly competitive environment. Embracing this model not only facilitates growth and efficiency but also paves the way for a more responsive and customer-centric banking experience. As the industry continues to evolve, we must stay informed and proactive to harness the full potential of CBaaS and drive our organizations towards future success.