Overview

In today’s rapidly evolving banking landscape, the integration of IT systems is not just beneficial—it’s essential. Key system integration methodologies we advocate for banking IT managers include:

- Point-to-point integration

- Middleware integration

- API-based integration

- Event-driven integration

Each of these approaches offers unique advantages that can significantly enhance operational efficiency.

Navigating the complexities of modern banking presents challenges, particularly regarding legacy system compatibility and regulatory compliance. We understand these pain points, and that’s why adopting these integration methodologies is crucial. By doing so, financial institutions can not only address these challenges but also achieve sustainable growth and improve service delivery.

We invite you to explore how these methodologies can transform your operations and position your institution for success in a competitive market. Together, we can navigate the future of banking technology with confidence.

Introduction

In the rapidly evolving landscape of the banking sector, we recognize that system integration is a pivotal strategy for enhancing operational efficiency and delivering superior customer experiences. As financial institutions grapple with the complexities of diverse applications, legacy systems, and stringent regulatory demands, the need for seamless integration becomes increasingly critical. Recent trends indicate a shift towards collaborative data practices, enabling us to navigate macroeconomic challenges while optimizing our operations.

This article delves into the nuances of system integration methodologies, highlighting the importance of adopting innovative solutions like Avato’s platforms, which simplify complex integration processes and drive sustainable growth. As we prepare for a future that demands agility and responsiveness, understanding the various integration strategies will be essential for IT managers aiming to stay competitive in this dynamic environment.

Understanding System Integration

Unification—the integration of diverse subsystems or components into a cohesive entity that operates seamlessly—is a critical aspect of modern finance. In our sector, this means unifying various applications, databases, and legacy infrastructures to optimize operations, enhance information flow, and improve customer experiences. We recognize that efficient system integration methodologies are essential for achieving operational effectiveness, particularly in the highly regulated finance environment, where compliance and safety are paramount.

Recent trends reveal a transformative shift in how we approach unification, emphasizing collaborative data practices that foster sustainable growth amid macroeconomic challenges. As Val Srinivas, a senior research leader in finance and capital markets, notes, “Financial institutions’ most fundamental challenge will be attaining sustainable growth despite these macroeconomic headwinds.” This highlights our urgent need to enhance operations through effective coordination strategies, especially as the net interest income for the US banking sector is projected to decline in 2025.

Our case studies showcase the success of platforms like Avato, which have revolutionized connection processes in complex environments. Customers consistently report that Avato simplifies intricate connection projects, delivering results within expected time frames and budget constraints. The Avato Hybrid Connection Platform not only enhances and expands the value of legacy technologies but also manages complex linkages effortlessly, providing real-time monitoring and notifications on performance. This capability not only boosts operational efficiency but also reduces costs, enabling us to adapt to evolving demands. Moreover, the integration of generative AI into customer service applications, such as advanced chatbots and virtual assistants, has seen a remarkable 60% increase in usage, significantly enhancing customer experience and operational efficiency.

We understand that network unification is vital in banking. The ability to connect various networks efficiently is essential for maintaining a competitive edge and ensuring all components function cohesively. As we move toward 2025, with a focus on modernizing operations and improving service delivery in an increasingly digital landscape, the importance of system integration methodologies will only grow. Our unification solutions are designed to help banks navigate these financial pressures, empowering them to leverage collaborative data practices and generative AI to achieve sustainable growth.

Exploring System Integration Methods

System integration methodologies in banking present an array of approaches, each offering unique advantages and challenges. We recognize that the primary methods include:

- Point-to-Point Integration: This approach directly connects two systems, making it straightforward to implement. However, we must acknowledge that it can lead to scalability issues as the number of connections increases, complicating maintenance and updates.

- Middleware Integration: By utilizing a middleware layer, this method facilitates communication between disparate systems, providing enhanced flexibility and scalability. Our experience shows that middleware implementation has proven beneficial for financial institutions, allowing them to streamline operations and enhance overall efficiency. Success stories emphasize its effectiveness in handling complex combinations while reducing downtime. As Gustavo Estrada noted, “Avato has the ability to simplify complex projects and deliver results within desired time frames and budget constraints,” underscoring the value of middleware in achieving integration goals. This method is especially pertinent as we prepare for open finance, where utilizing current infrastructures can avoid unnecessary resource spending. It is crucial for us to ensure that middleware solutions comply with stringent security protocols to mitigate potential vulnerabilities.

- API-Based Integration: By employing Application Programming Interfaces (APIs), this method enables real-time communication and data sharing between systems. We have witnessed a surge in the adoption of APIs in financial services, with statistics indicating a remarkable API availability of 99.92% in February 2025. This high availability not only underscores the reliability of API-based integration but also enhances responsiveness and operational agility, allowing us to adapt quickly to changing demands. As open finance progresses, the role of APIs becomes increasingly vital in establishing secure and dependable connections for information sharing. We must ensure compliance with security standards in this context.

- Event-Driven Integration: This method leverages events to trigger actions across systems, facilitating real-time data processing and updates. It is particularly beneficial in dynamic financial environments where timely information is crucial for decision-making.

As the financial sector continues to evolve, the incorporation of fintech solutions is transforming our environment, presenting both opportunities and challenges. The layered architecture in API finance exemplifies how structured interactions can enhance functionalities and streamline operations, ultimately improving service delivery. With the most substantial Banking-as-a-Service (BaaS) opportunities concentrating on operational efficiency, grasping these system integration methodologies is crucial for us as IT managers seeking to navigate the intricacies of contemporary financial frameworks. Furthermore, preparing our networks for the future and engaging stakeholders are essential measures in guaranteeing effective incorporation strategies.

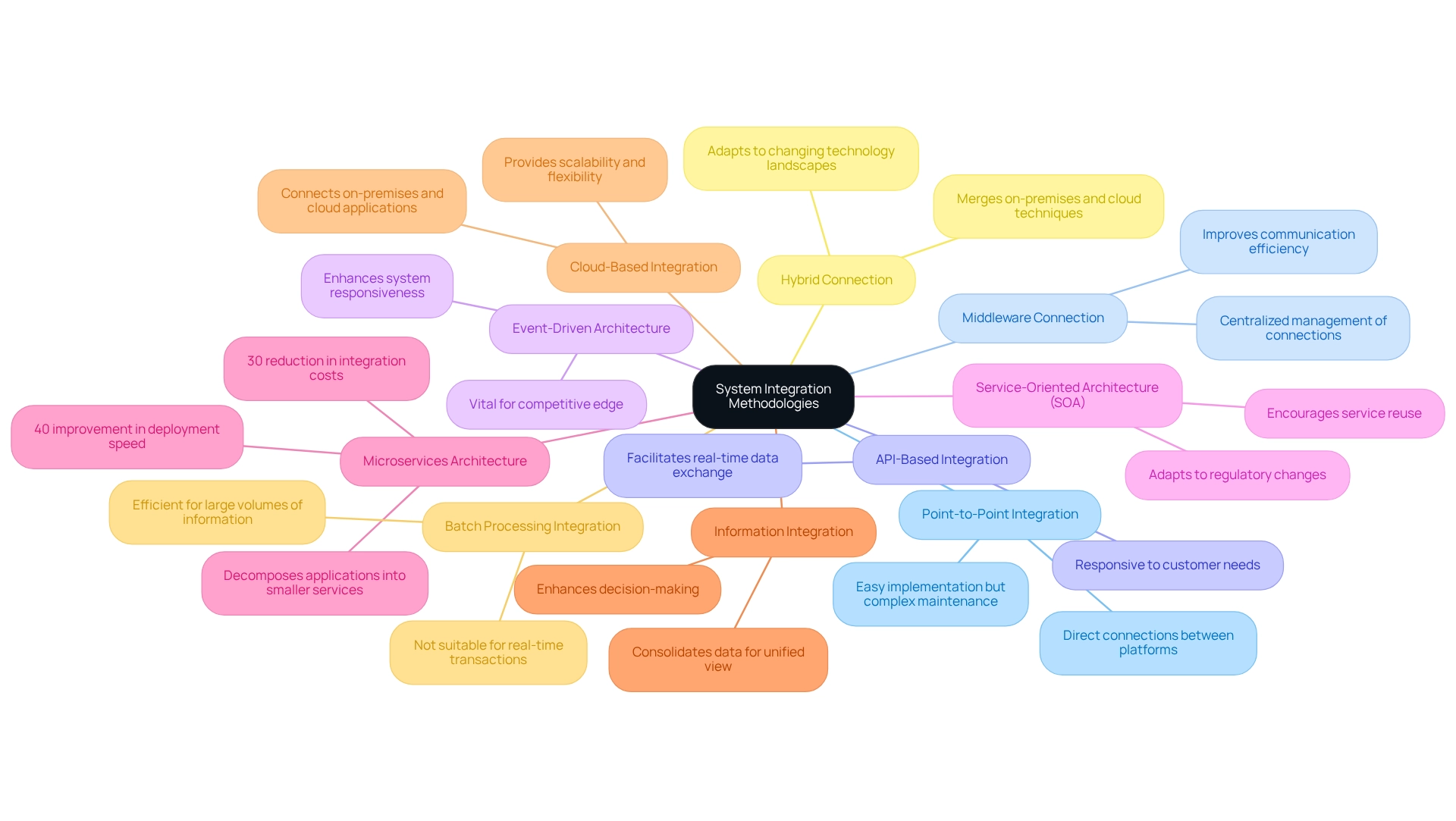

Top 10 System Integration Methodologies

In the rapidly evolving banking sector, the integration of systems is not just beneficial; it is essential. As IT managers, we must consider ten critical integration methodologies that can significantly enhance our operational efficiency:

- Point-to-Point Integration: This straightforward method connects platforms directly, making implementation easy. However, as the number of networks increases, we may encounter complexity and maintenance challenges.

- Middleware Connection: By providing a centralized platform for managing various connections, middleware streamlines communication between distinct systems, thereby improving overall efficiency.

- API-Based Integration: Crucial for modern financial applications, API-based integration facilitates real-time data exchange, enabling us to respond swiftly to customer needs and market dynamics.

- Event-Driven Architecture: This approach enhances system responsiveness by allowing applications to react to real-time events, which is vital for maintaining our competitive edge in the fast-paced financial landscape.

- Service-Oriented Architecture (SOA): SOA encourages the reuse of services across different applications, reducing redundancy and fostering a more agile IT environment. As Chris Skinner, an independent commentator on financial markets, notes, SOA is essential for adapting to regulatory changes and evolving customer demands.

- Microservices Architecture: By decomposing applications into smaller, independent services, microservices architecture allows for individual deployment and scaling. This flexibility is particularly advantageous in banking, where rapid innovation is crucial. Organizations that have adopted microservices report a 30% reduction in integration costs and a 40% improvement in deployment speed.

- Information Integration: This methodology focuses on consolidating data from various sources into a unified view, which enhances decision-making and compliance with regulatory requirements.

- Cloud-Based Integration: Utilizing cloud services, this approach connects on-premises and cloud applications, providing the scalability and flexibility essential for contemporary banking operations.

- Batch Processing Integration: Ideal for non-time-sensitive operations, batch processing enables banks to efficiently manage large volumes of information, although it may not meet the demands of real-time transactions.

- Hybrid Connection: By merging on-premises and cloud connection techniques, hybrid connection offers the benefits of both environments, allowing us to adapt to changing technology landscapes while maintaining oversight of critical operations. Avato’s hybrid unification platform exemplifies this approach, enabling seamless connections of isolated systems and fragmented data, which is vital for our modern banking operations.

As the banking sector continues to evolve, adopting these integration methodologies will be crucial for us as IT managers in enhancing operational efficiency and ensuring compliance with emerging regulations. The effectiveness of microservices architecture is underscored by its ability to simplify connection processes and improve service delivery. Customer testimonials from leaders like Tony LeBlanc at the Provincial Health Services Authority highlight the tangible benefits of these collaborative strategies, showcasing how Avato can drive successful project outcomes within budget and time constraints. Furthermore, understanding the underlying factors driving increased budgets—such as compensation, regulatory compliance, and technology investments—is essential as we navigate the complexities of system integration. Additionally, the re-proposal of the Basel III Endgame may influence global bank competitiveness, making it imperative for us to remain informed and adaptable.

Navigating Challenges in System Integration

Navigating Challenges in System Integration

System integration in banking presents several significant challenges that we must address.

- Legacy System Compatibility: Many banks rely on outdated IT systems, complicating integration with modern technologies. Our specialized connection services assist in bridging this gap by offering proficient partners who comprehend the intricacies of legacy technologies. A survey by Talend revealed that nearly half of finance professionals identified legacy systems as the primary obstacle to innovation, highlighting the urgent need for careful planning and potential upgrades. This challenge is further illustrated by the case study titled ‘Challenges Faced by Traditional UK High Street Banks,’ which emphasizes the gap between the banking industry’s understanding of big information advantages and the actual execution, underscoring the necessity for prioritizing information amalgamation and quality.

- Information Quality Problems: Inconsistent or low-quality information can significantly obstruct merging efforts. Financial organizations frequently encounter difficulties concerning information accuracy and completeness, requiring comprehensive cleansing and validation procedures. Our hybrid unification platform simplifies digital transformation through organized requirements management that utilizes system integration methodologies, ensuring that information quality is prioritized. The effect of information quality on unification efforts cannot be exaggerated, as it directly affects the effectiveness of decision-making and operational efficiency.

- Security Issues: The combination of different systems elevates the risk of information breaches. Therefore, implementing robust security measures is essential to protect sensitive information and maintain customer trust. Our solutions are crafted with security as a priority, guaranteeing that connection processes comply with the highest standards of data protection.

- Regulatory Compliance: Banks must navigate a complex landscape of industry regulations during merging processes. Ensuring compliance can complicate unification efforts, requiring additional resources and careful oversight. Our expertise in regulated industries positions us as a valuable partner in managing these compliance challenges effectively.

- Resource Constraints: Limited budgets and a shortage of skilled personnel can impede the integration process. It is crucial for banking IT managers to prioritize and plan effectively to maximize available resources. Our global partnership services provide access to a full team that can augment internal capabilities, ensuring that projects are executed efficiently.

- Change Management: Opposition to change from employees can greatly influence the acceptance of new processes. Effective training and communication strategies are vital to facilitate a smooth transition and ensure that employees are on board with new technologies. We emphasize customer-centric solutions, helping organizations manage change effectively.

Real-world examples illustrate how banks can overcome these challenges. For instance, proactive testing of new technologies through pilot projects has proven effective in reducing the risks associated with full-scale implementation. As Gustavo Estrada, a customer, noted, “We have the ability to simplify complex projects and deliver results within desired time frames and budget constraints.” By addressing legacy system compatibility and emphasizing data quality, banks can improve their unification efforts using system integration methodologies and remain competitive in a changing market.

- Actionable Tip: Banking IT managers should consider implementing pilot projects for new technologies to test their effectiveness and mitigate risks before full-scale deployment. To learn more about how we can assist with your integration challenges, contact us today.

Conclusion

In the ever-evolving landscape of banking, we recognize that effective system integration is not just a strategy; it is a vital necessity for enhancing operational efficiency and ensuring exceptional customer experiences. The integration of diverse applications, databases, and legacy systems streamlines our operations while addressing the pressing challenges posed by regulatory demands and macroeconomic fluctuations. Recent trends underscore the importance of adopting innovative solutions, such as our Avato integration platforms, which empower banks to navigate complexities and drive sustainable growth.

Understanding the various methodologies of system integration—ranging from point-to-point to API-based and hybrid integration—equips us with the tools necessary to optimize our operations. Each method presents unique advantages and challenges, yet the overarching goal remains the same: to foster agility and responsiveness in an increasingly digital landscape. As we prepare for a future marked by continuous change, the integration of fintech solutions and the implementation of robust security measures become paramount.

The path to successful system integration is fraught with challenges, including legacy system compatibility, data quality issues, and resource constraints. However, by leveraging expert solutions like Avato and prioritizing strategic planning, we can overcome these hurdles and position ourselves for success. As the banking sector continues to evolve, embracing effective integration strategies will be essential for maintaining a competitive edge and delivering exceptional service to our customers. The future of banking hinges on our ability to integrate systems seamlessly, ensuring that we remain agile and responsive in a rapidly changing environment.