Overview

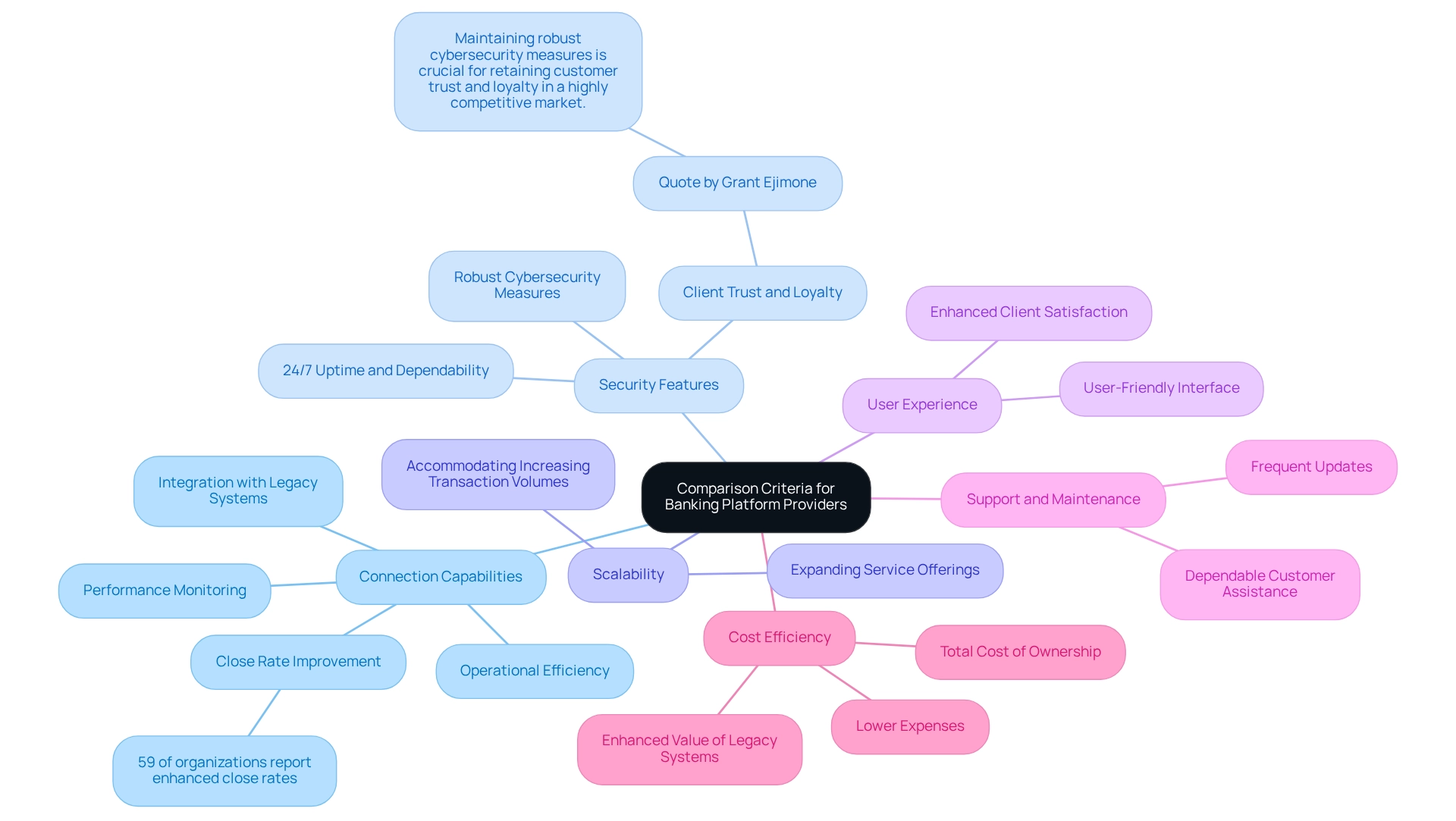

We recognize that the key criteria for evaluating banking platform providers encompass:

- Connection capabilities

- Security features

- Scalability

- User experience

- Support and maintenance

- Cost efficiency

These criteria are not just checkboxes; they are essential for ensuring smooth integration, protecting sensitive data, accommodating growth, enhancing customer satisfaction, and managing operational costs. By focusing on these elements, we empower organizations to maintain a competitive edge in the ever-evolving banking landscape. What’s holding your team back from achieving this excellence? Let us guide you in making informed decisions that drive your success.

Introduction

In today’s rapidly evolving financial landscape, selecting the right banking platform presents a significant challenge for organizations of all sizes. As customer expectations become increasingly complex and regulatory requirements grow more stringent, we recognize the necessity of evaluating banking platform providers against a comprehensive set of key criteria.

This article explores the essential factors we must consider, including:

- Integration capabilities

- Security features

- Scalability

- User experience

Furthermore, we will highlight the standout features of leading platforms, such as:

- Real-time data processing

- Advanced analytics

We will also delve into the myriad benefits these solutions offer. Whether for small community banks or large financial institutions, understanding the suitability of various platforms is vital for enhancing operational efficiency and delivering superior customer experiences in today’s competitive market.

Comparison Criteria for Banking Platform Providers

When we assess banking platform providers, several essential criteria warrant our careful consideration:

- Connection Capabilities: Smooth connectivity with current systems and data sources is crucial for reducing disruption during implementation. Our hybrid solution excels in linking with legacy systems, greatly improving operational efficiency and lowering expenses. This is demonstrated by the fact that 59% of organizations report enhanced close rates due to successful connections. Additionally, our system offers real-time monitoring and notifications regarding performance, allowing us to proactively handle our connections.

- Security Features: Given the sensitive nature of banking data, robust security measures are imperative to protect against breaches and ensure compliance with regulations. Our secure hybrid integration system guarantees 24/7 uptime and dependability, which is essential for preserving client trust and loyalty in a highly competitive market. As noted by industry expert Grant Ejimone, “Maintaining robust cybersecurity measures is crucial for retaining customer trust and loyalty in a highly competitive market.” This emphasizes the importance of robust security features in banking systems.

- Scalability: Our system must be capable of growing alongside our organization, accommodating increasing transaction volumes and expanding service offerings without compromising performance.

- User Experience: A user-friendly interface is essential for enhancing client satisfaction and operational efficiency, facilitating easier navigation for both our staff and clients.

- Support and Maintenance: Dependable customer assistance and frequent updates are essential for quickly resolving problems and ensuring our system is in line with technological progress.

- Cost Efficiency: Understanding the total cost of ownership—including licensing, implementation, and ongoing maintenance—is crucial for effective budgeting and financial planning. Our solution significantly lowers expenses while enhancing the value of legacy systems, rendering it an attractive option for banking platform providers.

In the current landscape, where the banking cybersecurity sector faces evolving threats and opportunities, these criteria become even more significant. Platforms like ours, born from a dedication to solving complex problems, excel in integration capabilities that not only streamline operations but also position us as leaders in the market. This enables organizations to adapt swiftly to changing demands and maintain a competitive edge.

Key Features of Leading Banking Platforms

Leading banking platforms are equipped with a variety of features that significantly enhance operational efficiency and customer experience.

-

Real-Time Data Processing: We enable instant transaction processing and reporting, which is essential for preserving client trust and ensuring operational agility. Our Hybrid Integration Platform allows for real-time monitoring and notifications on system performance, ensuring that we can manage high volumes of transactions effortlessly.

-

Advanced Analytics: By utilizing advanced analytics, we gain valuable insights into client behavior and operational performance. The incorporation of continuous monitoring and analytics within our solutions enhances transaction analysis and fraud detection, enabling us to react proactively to potential threats.

-

Omni-Channel Support: This feature ensures a consistent experience for our clients across various channels, including mobile, web, and in-branch services, which is essential for meeting the diverse needs of patrons today.

-

Regulatory Compliance Tools: Our built-in compliance features help us adhere to local and international regulations, significantly reducing the risk of non-compliance penalties and enhancing operational integrity. Our system is designed to ensure compliance with stringent security protocols, particularly important as open banking evolves.

-

Customizable Workflows: The ability to adjust processes to particular requirements improves flexibility and responsiveness to market shifts, enabling us to adapt swiftly to changing client demands.

-

API Integration: By facilitating connections with external services and applications, our API integration broadens system functionality and enhances client offerings, making it easier for us to innovate and improve service delivery. This system enhances the value of legacy technologies, enabling us to build on current assets instead of starting anew.

These features collectively position our banking platform providers as essential tools for modern financial institutions, enabling us to operate efficiently while delivering exceptional client experiences. Furthermore, our solutions greatly lower expenses related to unification and operational inefficiencies. As highlighted by Gustavo Estrada, a customer, “The company has the ability to simplify complex projects and deliver results within desired time frames and budget constraints,” showcasing the effectiveness of our integration solutions in banking. Additionally, our architecture ensures real-time efficiency, scalability, and reliability for Internet banking analytics, reinforcing our potential for future advancements in financial analytics.

Benefits of Top Banking Platforms

Top banking platform providers deliver a multitude of benefits that can profoundly enhance our organization’s performance.

- Enhanced Efficiency: By automating routine tasks, we significantly reduce manual errors, allowing our staff to concentrate on higher-value activities. This change not only streamlines operations but also enhances overall productivity, a key benefit emphasized by our hybrid integration platform, which accelerates secure system integration for banking, healthcare, and government.

- Enhanced Client Experience: With tailored services and faster response times, we can attain greater client satisfaction and loyalty. Recent trends reveal that 80% of financial institutions have invested in mobile-first strategies to boost user engagement, a crucial factor in today’s competitive landscape. Our solutions leverage generative AI to further improve user interactions, offering personalized financial guidance and assistance.

- Cost Savings: Transitioning to streamlined operations and reducing reliance on outdated legacy systems can lead to substantial cost reductions over time, enabling us to allocate resources more effectively. Our dedication to streamlining intricate connections ensures that financial organizations can update their systems without incurring high expenses.

- Increased Agility: The ability to swiftly adapt to market changes and evolving customer demands enhances our competitiveness, allowing us to stay ahead in a rapidly changing environment. Our hybrid integration platform enables us to future-proof our operations through seamless data and system integration, ensuring we remain agile.

- Data-Driven Insights: Access to advanced analytics empowers us to identify trends and opportunities, facilitating informed strategic decision-making. The penetration rate of online banking in the U.S. has increased from 2019 to 2023, with 66% of the population utilizing online banking, projected to exceed 79% by 2029. This underscores the significance of data in shaping our future strategies, a key focus for us as we provide integrated solutions that enhance operational visibility.

- Risk Mitigation: Robust security features and compliance tools are essential for protecting against fraud and regulatory penalties, ensuring that we can operate securely in a complex regulatory environment. Our platform’s architecture is crafted for secure transactions, establishing it as a reliable ally for organizations that prioritize security.

As William Blake once said, “What is now proved was once only imagined.” These benefits highlight the essential function that banking platform providers, such as those driven by us, serve in improving operational capacities and user experiences, ultimately propelling success in the financial services industry.

Suitability of Banking Platforms for Various Needs

In today’s dynamic banking landscape, various banking platform providers are emerging to meet distinct organizational needs.

-

Small to Medium-Sized Banks often seek cost-effective solutions that incorporate essential features, enabling rapid implementation to enhance service delivery and customer satisfaction. Our hybrid system assists these banks in accessing isolated assets, effectively generating business value.

-

Large Financial Institutions require robust platforms capable of supporting high transaction volumes, facilitating intricate connections, and integrating advanced security measures to safeguard sensitive data. Our skilled integration services provide the necessary assistance to navigate these complexities seamlessly.

-

Digital-First Banks prioritize user experience and innovative features, catering to tech-savvy clients who demand seamless interactions. We connect legacy systems with contemporary expectations, ensuring a smooth transition and improved customer experiences.

-

Regulated Industries operate within stringent financial regulations, necessitating systems with robust compliance capabilities. Our commitment to designing technological frameworks aids these sectors in achieving compliance while enhancing their integration strategies.

-

Community Banks focus on fostering individualized client interactions and community involvement, aiming to cultivate strong connections with their clientele. We emphasize understanding specific needs, enabling community banks to enhance customer engagement effectively.

-

Fintech Companies require highly adaptable systems that connect with various third-party services, empowering them to offer distinctive financial products and services in a competitive market. Our hybrid integration solutions deliver the flexibility and scalability fintechs need to innovate and grow.

As the banking landscape continues to evolve, understanding the specific needs of each segment is essential for selecting the right banking platform providers that align with organizational goals and enhance operational efficiency. Let’s explore how we can partner together to meet these challenges head-on.

Conclusion

The evaluation of banking platform providers reveals critical criteria that we must consider to navigate today’s complex financial landscape effectively. The following elements are pivotal in ensuring that a platform not only meets our immediate needs but also adapts to future demands:

- Integration capabilities

- Security features

- Scalability

- User experience

- Support and maintenance

- Cost efficiency

These elements are foundational to facilitating seamless operations while maintaining compliance and customer trust.

Leading banking platforms, such as those offered by Avato, are equipped with advanced features that empower financial institutions to enhance their operational efficiency and customer experience. Key features include:

- Real-time data processing

- Advanced analytics

- Omni-channel support

- Customizable workflows

These features collectively position these platforms as indispensable tools in a competitive environment.

The numerous benefits derived from adopting top banking platforms cannot be overlooked. These platforms are designed to drive our organizational success through:

- Improved efficiency

- Enhanced customer satisfaction

- Significant cost savings

- Increased agility

The ability to harness data-driven insights further equips us to make informed strategic decisions, ultimately positioning us favorably in a dynamic market.

As the banking sector continues to evolve, selecting a platform that aligns with our specific organizational needs—whether for small community banks, large financial institutions, or innovative fintech companies—is essential. By understanding these varying requirements and leveraging the strengths of leading banking platforms, we can enhance our operational capabilities and deliver superior customer experiences, ensuring we remain competitive in the ever-changing financial landscape.