Overview

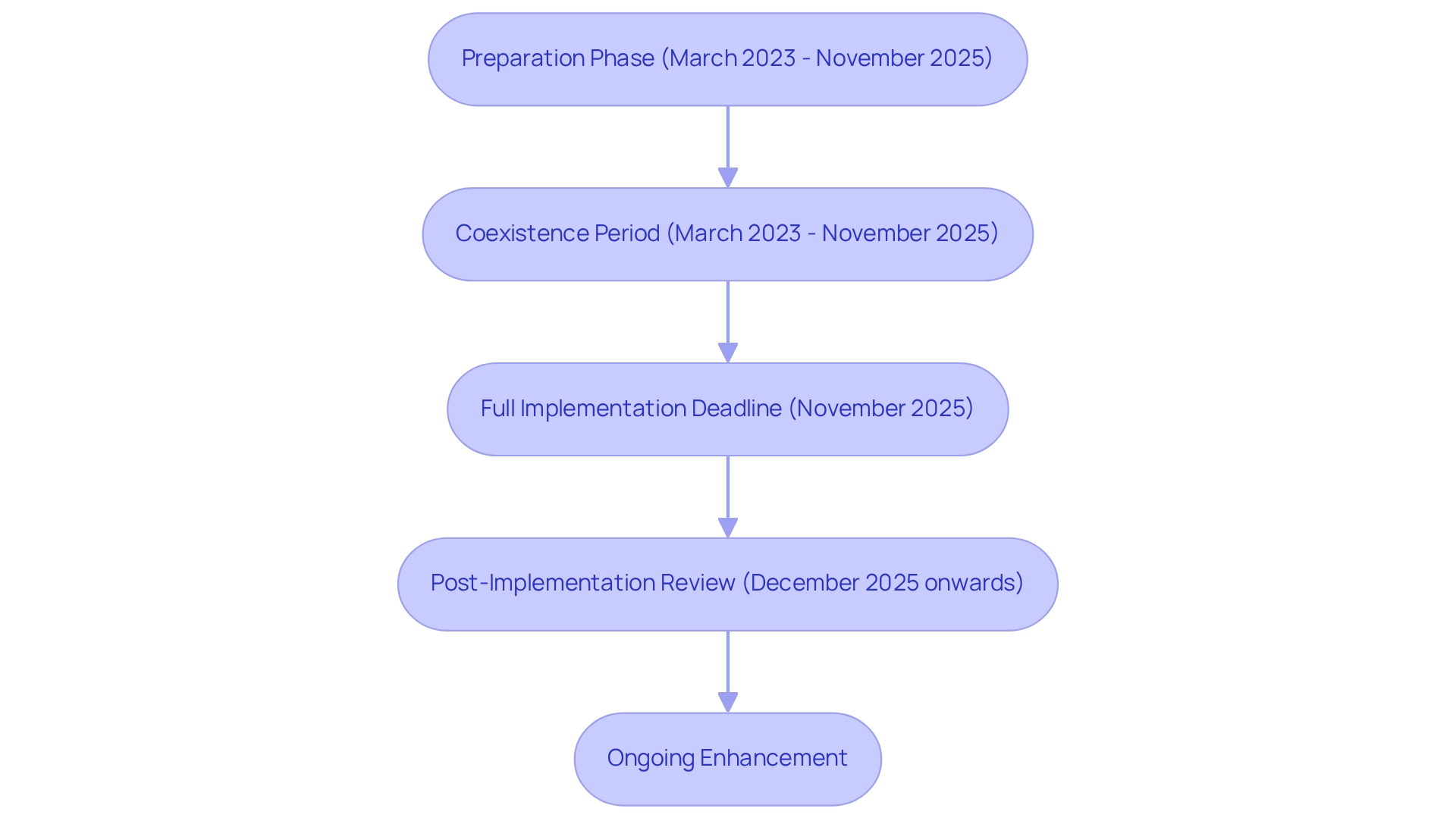

We recognize that the ISO 20022 migration timeline is pivotal for financial institutions, encompassing essential phases such as:

- Preparation

- Coexistence

- Full implementation

- Post-implementation review

- Ongoing enhancement

This migration is not merely a regulatory requirement; it is an opportunity to significantly improve operational efficiency, compliance, and customer service. However, we must also confront challenges like system compatibility and data quality that institutions face. Navigating these complexities is crucial to ensuring a successful transition by the November 2025 deadline.

What strategies are you implementing to meet this critical timeline?

Introduction

In the dynamic realm of financial services, we recognize that the migration to ISO 20022 represents a pivotal moment for institutions striving to enhance operational efficiency and customer engagement. This international standard for electronic data interchange offers a multitude of benefits, ranging from richer data exchanges to improved compliance and fraud detection. However, the journey toward successful implementation is laden with challenges, including:

- System compatibility

- The necessity for comprehensive training

As we navigate this complex transition, leveraging innovative technologies such as Avato’s Hybrid Integration Platform can simplify the process, ensuring a smoother shift to the new messaging standard. Our migration timeline encompasses several critical phases, emphasizing best practices that empower financial institutions not only to meet regulatory demands but also to position themselves for future growth in a competitive market.

Define ISO 20022 and Its Importance in Financial Messaging

ISO 20022 is not just a standard; it is a transformative global framework designed for electronic data exchange among monetary entities. By providing a cohesive structure for crafting messages that accurately represent diverse economic business domains, it facilitates richer and more structured data exchanges. This advancement significantly enhances the clarity and efficiency of monetary transactions. Our commitment to this standard is vital across various monetary services, including payments, securities, and trade finance, making it essential for organizations striving to boost operational efficiency and elevate customer service.

By embracing ISO standards, we empower financial institutions to enhance compliance with regulatory obligations, improve fraud detection capabilities, and streamline payment processes. For instance, the transition to the ISO standard has been shown to reduce the time spent on payment inquiries, which typically account for 2-5% of daily transactions and require an average of 3-4 minutes per investigation. This newfound efficiency not only elevates customer satisfaction but also significantly reduces operational costs.

Our Hybrid Integration Platform at Avato plays a pivotal role in this transition by maximizing and extending the value of legacy systems, simplifying complex integrations, and dramatically lowering costs. Key features of our platform include real-time tracking and notifications regarding system performance, ensuring round-the-clock availability and reliability—crucial elements for the effective execution of ISO standards.

However, we recognize that implementing ISO is not without its challenges. Corporations may encounter issues such as low character limits for messaging and compatibility problems for structured addresses in specific jurisdictions. Addressing these challenges is essential for a successful transition, as they can hinder the efficiency improvements that ISO promises.

Furthermore, as monetary organizations navigate the complexities of ISO implementation, they can glean insights from case studies, such as how Asian banks are leveraging blockchain technology to serve unbanked populations. This innovative approach not only addresses the challenges of reaching underserved communities but also exemplifies the transformative potential of adopting contemporary standards like ISO to enhance inclusion and operational capabilities. As Gustavo Estrada noted, “Avato has the ability to simplify complex projects and deliver results within desired time frames and budget constraints,” underscoring the importance of reliable technology in this process. As we approach 2025, the significance of the ISO 20022 migration timeline in monetary messaging will only grow, enabling organizations to adapt to evolving market demands and maintain a competitive edge.

Outline the ISO 20022 Migration Timeline for Financial Institutions

The transition to the ISO 20022 migration timeline presents a pivotal opportunity for financial organizations, encompassing several essential stages with specific timelines that we must adhere to:

- Preparation Phase (March 2023 – November 2025): In this initial phase, we conduct a thorough evaluation of our current systems, enabling us to implement necessary modifications to effectively support ISO messaging. Our hybrid integration platform is instrumental in this process, assisting us in streamlining the integration of diverse systems and ensuring a seamless transition. Key features such as automated data mapping and real-time monitoring significantly enhance our efforts.

- Coexistence Period (March 2023 – November 2025): During this period, both the legacy MT format and the new ISO MX format will be operational. We must ensure our systems are capable of processing both formats to facilitate a smooth transition. Our platform empowers monetary organizations to navigate this transition by offering organized requirements management, aiding in the modernization of legacy systems to fulfill all essential functionalities.

- Full Implementation Deadline (November 2025): By this deadline, we are required to fully adopt ISO for cross-border payments. The coexistence of MT and MX formats will conclude, necessitating that all transactions be processed solely using the ISO standard. Our solutions are designed to streamline this process, ensuring compliance and enhancing business value through features like comprehensive reporting and analytics.

- Post-Implementation Review (December 2025 onwards): Following complete implementation, we should conduct thorough evaluations of our systems and processes to ensure compliance and identify opportunities for improvement. We promote ongoing enhancement by providing resources and support that enable us to leverage the advantages of ISO, including enhanced data analysis and customer insights.

- Ongoing Enhancement: As the financial landscape evolves, we must remain adaptable, continuously upgrading our systems to fully harness the benefits of ISO 20022. Our commitment to building robust technological frameworks supports this continuous transformation, ensuring we can effectively respond to future changes, particularly in light of the ISO 20022 migration timeline as the November 2025 deadline approaches, leading numerous banks to intensify their testing, training, and client outreach efforts to ensure compliance. We encourage executives to treat the ISO 20022 migration timeline as a strategic initiative, validating system readiness and aligning data governance processes for a seamless transition to the new standard. The transition to ISO format is recognized as a crucial milestone for the payments sector, as highlighted by a Senior Platform Leader at Wells Fargo. Presently, the ISO standard is utilized in over 70 nations, underscoring its global significance and the need for financial institutions to prepare adequately. Furthermore, Swift collaborates with the partner community to provide access to information, specifications, tools, and testing services to facilitate the industry’s adoption of ISO. This collaborative effort emphasizes the importance of optimizing trading and investment processes with data standards, highlighting the relevance of the migration timeline to our operational objectives.

Get your copy now to discover how we can assist you in navigating the ISO migration process.

Identify Key Challenges in the ISO 20022 Migration Process

The challenges posed by the ISO 20022 migration timeline are significant for financial institutions, and we must address them head-on.

- System Compatibility is a pressing issue, as many legacy systems are not compatible with the new ISO format. This incompatibility necessitates extensive upgrades or complete replacements to ensure compliance and functionality. Statistics show that approximately 60% of monetary institutions encounter compatibility issues with their existing systems during this transition. Our hybrid integration platform supports 12 levels of interface maturity, enabling organizations to effectively manage these compatibility challenges.

- Data Quality and Mapping is another critical area. Accurate mapping of data from the traditional MT format to the new MX format is essential. Inadequate data quality can lead to transaction errors and compliance issues, jeopardizing operational integrity. Our platform facilitates precise data mapping, ensuring high-quality data transfer and compliance.

- Training and Change Management are vital for a successful transition to ISO standards. This process requires extensive training for staff on new guidelines and procedures, which can be resource-intensive and time-consuming, impacting overall productivity during the ISO 20022 migration timeline. We provide resources and support to streamline this training process, helping teams adapt more swiftly.

- Regulatory Compliance presents a complex landscape of regulations that vary by jurisdiction. Institutions must ensure that their efforts in the ISO 20022 migration timeline align with all relevant compliance requirements. Our solutions are designed to help organizations maintain compliance throughout the migration process.

- Coordination with Partners is essential for a successful migration. Effective collaboration with various stakeholders, including payment networks and other monetary entities, is crucial for achieving a seamless transition and minimizing service disruptions. We enhance stakeholder engagement through our integration capabilities, ensuring all parties are aligned.

In addressing these challenges, we can draw insights from case studies, such as ‘Capacity-Building for ISO Benefits,’ which underscore the necessity for banks to comprehend the transformative potential of ISO beyond mere compliance. Furthermore, as noted by Gustavo Estrada from BC Provincial Health Services Authority, “Avato has the ability to simplify complex projects and deliver results within desired time frames and budget constraints.” This highlights the importance of leveraging robust integration platforms like ours, which accelerate secure system integration across banking, healthcare, and government sectors, guaranteeing 24/7 uptime for critical integrations. By utilizing our hybrid integration platform, organizations can maintain operational integrity and gain a competitive edge in their industries.

Best Practices for a Successful ISO 20022 Migration

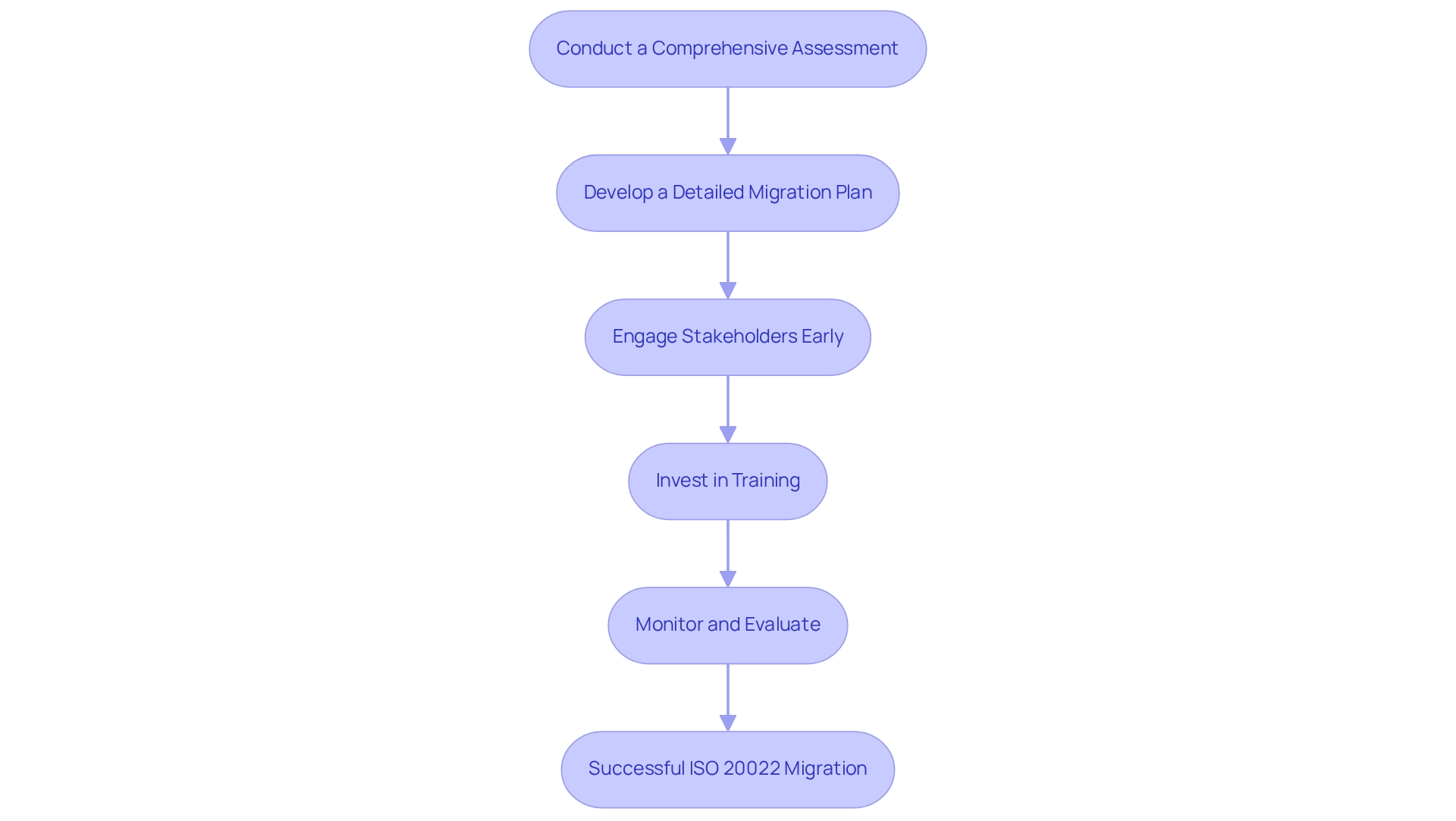

To ensure a successful transition to the ISO standard, we must adopt best practices that will guide financial institutions through this complex process.

-

Conduct a Comprehensive Assessment: We begin by evaluating existing systems, processes, and data quality to identify gaps and areas needing improvement before migration starts. This assessment is crucial; it lays the groundwork for a smooth transition. As noted by Alexis Sisko from EY Banking and Payments Consulting, successful data processing will be a key measure of success, leading to notable cost savings by lowering processing costs and minimizing the need for frequent manual touchpoints. By leveraging XSLT during this phase, we can significantly streamline the transformation of XML data structures, reducing labor and minimizing programming errors through the use of schemas. This approach also contributes to cost savings by preventing errors that could lead to costly fixes.

-

Develop a Detailed Migration Plan: Next, we create a roadmap that outlines each phase of the migration, including timelines, responsibilities, and resource allocation. A well-structured plan is essential for managing the complexities of the migration process. We ensure 24/7 uptime for critical integrations, highlighting the importance of reliability during this transition. Continuous monitoring and analytics play a vital role in maximizing integration performance, allowing us to make real-time adjustments and improvements.

-

Engage Stakeholders Early: We must involve all relevant stakeholders—IT, compliance, and operations teams—in the planning process to ensure alignment and support. Early engagement fosters collaboration and mitigates resistance, which is vital for project success.

-

Invest in Training: Offering thorough training for our staff is essential to familiarize them with the new ISO standards and processes. This investment not only reduces resistance to change but also enhances the overall competency of the team in handling the new system.

-

Monitor and Evaluate: After implementation, we will continuously monitor the system’s performance and gather feedback to identify areas for further improvement and ensure compliance. Regular evaluation helps us adapt to any challenges that arise post-migration. The shift to the ISO standard will greatly alter data structures within banks, especially in converting from outdated formats to the new XML-based messages. This shift presents an opportunity for banks to enrich their analytics and create personalized customer offers, aligning with their global data strategy. Our hybrid integration platform has already demonstrated its transformational impact on financial institutions, leading to cost reductions, faster product delivery, and improved customer satisfaction. By adhering to these best practices, we can significantly enhance our chances of a successful ISO 20022 migration timeline, ultimately leading to improved data processing efficiency and cost savings.

Conclusion

The migration to ISO 20022 is not merely an option; it represents a transformative opportunity for financial institutions. We can enhance operational efficiency, improve customer engagement, and meet evolving regulatory demands. By adopting this international standard, we stand to benefit from richer data exchanges, streamlined payment processes, and enhanced fraud detection capabilities. Yet, this journey is not without its challenges, including system compatibility, data quality, and the need for comprehensive training.

Successfully navigating this migration requires a well-structured approach. We must conduct thorough assessments of our existing systems, develop detailed migration plans, and engage all stakeholders early in the process. Investing in staff training is crucial for building competence in handling the new standards, while continuous monitoring post-implementation ensures ongoing compliance and performance optimization.

Leveraging innovative solutions like Avato’s Hybrid Integration Platform can significantly ease our transition. This platform provides the necessary tools to address compatibility issues and streamline complex integrations. As we approach the November 2025 deadline, it is imperative that we treat this migration as a strategic initiative, validating our readiness and aligning governance processes to fully capitalize on the benefits of ISO 20022.

In conclusion, the successful migration to ISO 20022 is not just a regulatory requirement; it is a strategic move that positions us for future growth and competitiveness in the market. Embracing this change will not only enhance our operational capabilities but also pave the way for innovative solutions that meet the demands of an increasingly data-driven financial landscape. Institutions that prioritize this transition will be better equipped to thrive in a rapidly evolving industry.