Overview

We recognize that successfully implementing a new core banking system is critical for financial institutions aiming to thrive in today’s dynamic landscape. Our structured approach encompasses essential steps:

- Defining objectives

- Assessing current frameworks

- Engaging stakeholders

- Executing the implementation process

These elements are not merely procedural; they are fundamental to enhancing operational efficiency and ensuring compliance amidst evolving regulations. What challenges is your organization facing in this journey? By addressing these key areas, we can collectively navigate the complexities of integration, ultimately driving value and success in your operations. Let us partner with you to transform your banking system effectively.

Introduction

In the rapidly evolving landscape of modern banking, core banking systems serve as the backbone of financial institutions, empowering us to manage operations with unparalleled efficiency. These centralized platforms are not merely essential for processing transactions and maintaining accurate records; they also play a pivotal role in enhancing customer experience and ensuring compliance with regulatory standards. As the demand for digital transformation intensifies, the significance of robust core banking solutions becomes increasingly apparent—especially in light of recent data breaches that underscore the need for secure systems.

With North America projected to lead the global core banking software market in the coming years, it is imperative that we strategically plan and execute our core banking system implementations. This approach will unlock the full potential of our operations and enable us to deliver superior customer service.

What critical steps should we take for successful implementation? From defining objectives to evaluating system performance, we must ensure that our banks remain competitive and capable of navigating the complexities of today’s financial environment.

Define Core Banking Systems and Their Importance

Core financial platforms serve as the backbone of our operations, enabling us to effectively manage client accounts, transactions, and risk management. These networks are crucial for delivering seamless financial services across various branches and channels. They empower us to handle daily transactions with precision, maintain accurate financial records, and provide our clients with real-time access to their accounts.

The significance of these fundamental financial networks is underscored by their ability to enhance operational efficiency, improve customer experience, and ensure compliance with regulatory standards. As competition heightens and the demand for digital transformation increases, adopting a new core banking system becomes an indispensable asset for fostering growth and innovation. We recognize, as Aditi Shivarkar points out, that advancements in ICT are vital for the evolution of these frameworks, emphasizing their critical role in modern finance.

Recent trends indicate that North America is poised to lead the global fundamental software market from 2025 to 2034, driven by substantial investments from government banks and financial institutions. This growth is further bolstered by innovations in cloud technology, which facilitate the integration of cutting-edge solutions. Successful implementations of central financial frameworks have demonstrated significant benefits, including streamlined operations and improved client satisfaction, showcasing the positive impact of these investments. Additionally, the relevance of these frameworks is highlighted by alarming statistics regarding data breaches in the financial sector, such as the Flagstar Bancorp incident in March 2021, which compromised sensitive personal information. This incident reinforces the necessity for secure and efficient financial solutions, including a new core banking system, that not only enhance operational capabilities but also protect client data, thereby strengthening the case for robust infrastructures. In this landscape, our hybrid integration platform at Avato plays a pivotal role, enabling financial institutions to optimize and extend the value of their legacy systems while simplifying complex integrations. Our commitment to addressing intricate challenges allows banks to access data and networks in weeks rather than months, ensuring continuous uptime and reliability—essential for maintaining client trust and operational integrity. Furthermore, our platform significantly reduces costs, making it an attractive option for financial organizations.

In conclusion, as financial entities navigate the complexities of modern finance, embracing centralized financial platforms, supported by our advanced integration solutions, is crucial for achieving operational excellence and delivering exceptional client experiences. The continuing advancements in our industry shape the landscape, making it imperative for banks to remain proactive and ahead of the curve.

Plan Your Core Banking System Implementation

To successfully plan our core banking system implementation, we must adhere to the following steps:

- Define Objectives: We begin by clearly articulating the goals of our implementation. These may include enhancing customer service, improving operational efficiency, or ensuring compliance with regulatory standards. Common objectives often encompass streamlining processes and increasing data accessibility.

- Assess Current Frameworks: Next, we conduct a thorough evaluation of our existing structures to pinpoint gaps and areas needing enhancement. This evaluation is essential for choosing a new core banking system that aligns with our strategic objectives. For instance, deposit management functionalities in core banking platforms automate processes like account opening and interest calculation, addressing regulatory compliance and operational efficiency. Furthermore, leveraging our existing legacy systems can be beneficial, as it allows us to build on our current assets rather than starting from scratch, which can save time and resources.

- Engage Stakeholders: It is crucial to actively involve key stakeholders, including IT, operations, and customer service teams. Their insights are invaluable for gathering input and fostering buy-in throughout the implementation process, ensuring that all perspectives are considered. As Gustavo Estrada noted, “Avato has the ability to simplify complex projects and deliver results within desired time frames and budget constraints,” highlighting the importance of effective project management. Mobilizing stakeholders early helps ensure that requirements are accurately captured from the outset.

- Develop a Project Timeline: We must construct a comprehensive timeline that outlines milestones, deadlines, and responsibilities for each phase of the implementation. This structured approach helps maintain focus and accountability.

- Budgeting: Formulating a budget that encompasses software costs, training expenses, and potential downtime during the transition is essential. As organizations increasingly depend on cloud solutions, we should consider the anticipated growth of cloud technologies in the financial sector, projected to rise from 26% to 56% of the market by 2025.

- Risk Assessment: Identifying potential risks associated with the implementation is vital, as is devising proactive mitigation strategies. Effective risk management includes maintaining a risk register, developing contingency plans, and engaging third-party experts for independent verification. Additionally, we must ensure that our integration solution complies with stringent security protocols and consider using a middle layer for data translation to enhance integration capabilities. Preparing our infrastructure for the future is crucial to adjust to changing integration requirements.

By adhering to these steps, we can manage the intricacies of the new core banking system implementation more efficiently, guaranteeing a smoother transition and alignment with our strategic goals.

Execute the Implementation Process

Implementing a new core banking system is not just a task; it’s a strategic endeavor that demands a structured approach. We understand that executing this implementation requires several critical steps:

- Kick-off Meeting: We begin with a comprehensive meeting involving all stakeholders to outline the project scope, objectives, and timelines, ensuring alignment from the outset.

- System Configuration: Our team customizes the core financial platform to meet the specific requirements of your institution. This involves setting up user roles, permissions, and workflows to enhance operational efficiency.

- Data Migration: We strategically plan and execute the transfer of data from the legacy framework to the new platform. This meticulous process includes data cleaning and validation to guarantee accuracy and integrity. Notably, industry statistics indicate that the average duration of data migration processes in financial services can vary significantly, underscoring the importance of careful planning.

- Integration: We seamlessly incorporate the new core banking system with existing applications and services, facilitating effective communication and data exchange between systems. Leveraging Avato’s hybrid integration platform enhances customer service and operational efficiency, supporting secure transactions across various sectors, including banking and healthcare.

- Testing: Our thorough evaluations identify and resolve any issues before the platform goes live. This phase includes user acceptance testing (UAT) to confirm that the solution meets business requirements.

- Training: We conduct extensive training sessions for staff to ensure they are proficient in utilizing the new platform and fully comprehend its features, which is essential for a seamless transition.

- Go-Live: Finally, we officially launch the new core banking system, while closely monitoring its performance and promptly addressing any immediate challenges. As highlighted in case studies, successful data migration strategies can significantly impact the overall implementation process and its outcomes.

These steps are essential for ensuring a successful implementation, enhancing service quality and improving operational efficiency. Ultimately, this leads to better process visibility and productivity. Furthermore, the integration of generative AI technologies can revolutionize client engagement and operational workflows. As Jim Marous, co-publisher of The Financial Brand, aptly states, ‘The proper implementation strategy can revolutionize financial operations and customer experiences.’ We invite you to partner with us in this transformative journey.

Evaluate and Support the New System

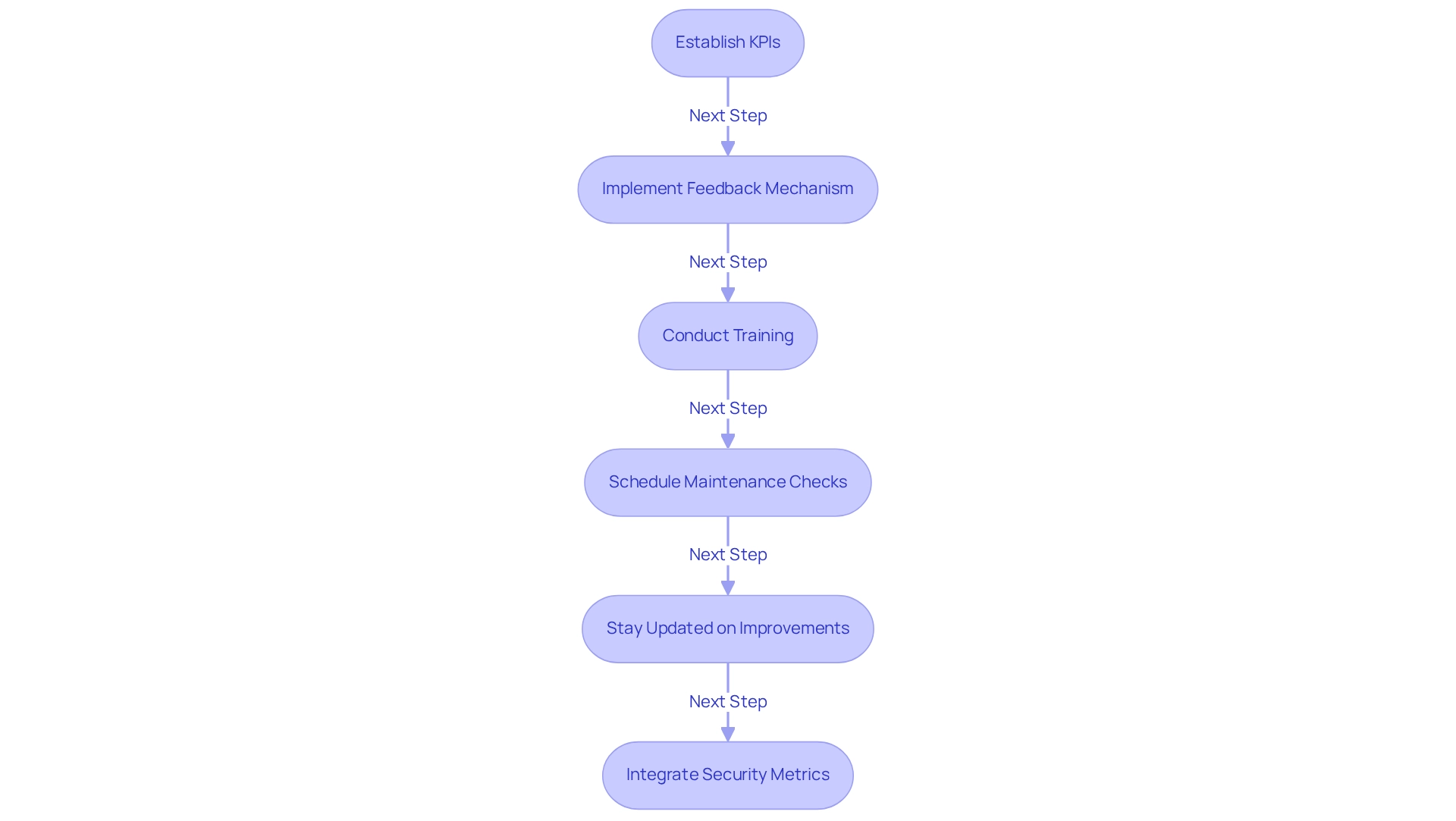

Assessing the performance of the new core banking system is not just beneficial; it is essential for ensuring its long-term success and effectiveness. We must establish key performance indicators (KPIs) that evaluate the framework’s effectiveness. Key metrics encompass transaction speed, uptime, and user satisfaction rates, providing a comprehensive perspective on the operational health of the platform. Notably, only 43% of CFOs truly oversee relationship and customer profitability, underscoring the necessity for strong performance metrics in assessing the effectiveness of the new core banking system.

Furthermore, we must implement a robust feedback mechanism that allows users to report issues and suggest improvements. Consistently assessing this feedback aids in recognizing patterns and opportunities for improvement, guaranteeing that the framework evolves to meet user requirements efficiently. Continuous training sessions for our staff are also crucial to keep them informed about new features and best practices. This ensures that users can leverage the platform’s full capabilities, ultimately boosting productivity and user satisfaction.

In addition, scheduling routine maintenance checks is vital to ensure smooth operations. Proactive maintenance helps us address technical issues promptly, minimizing downtime and maintaining operational continuity. A well-executed deployment process is essential, as it reduces delays and ensures continuity, allowing the financial software to operate effectively post-launch.

We must also stay informed about improvements and new functionalities from our primary service provider. Strategizing for regular enhancements enables us to capitalize on technological progress, ensuring that our infrastructure remains competitive and efficient. By concentrating on these aspects, we can effectively assess and support our new core banking system, leading to enhanced performance and user satisfaction after implementation.

At Avato, we exemplify the importance of a reliable integration partner in this process. Our hybrid integration platform not only enhances business value but also empowers organizations to future-proof their operations through seamless data and system integration. Additionally, integrating security evaluation metrics—such as the number of incidents, response times to breaches, and costs associated with security incidents—into our evaluation framework ensures a comprehensive assessment.

Conclusion

The implementation of core banking systems is not just a step; it is a transformative leap for financial institutions aiming for operational excellence and enhanced customer experiences. By defining clear objectives, assessing our current systems, and engaging stakeholders, we can establish a solid foundation for our core banking initiatives. This structured planning phase is essential for aligning the new system with our strategic goals, ensuring that the transition is seamless and effective.

Executing the implementation process demands meticulous attention to detail, from configuration and data migration to rigorous testing and training. Each step is crucial in minimizing disruptions and maximizing the system’s potential. Furthermore, leveraging advanced integration platforms like Avato can significantly enhance the efficiency and security of these systems, facilitating smoother operations in a competitive landscape.

Once our core banking system is live, continuous evaluation and support become vital for maintaining its effectiveness. Establishing performance metrics, fostering user feedback, and committing to regular maintenance and updates ensure that the system evolves alongside the needs of our organization and customers. Our commitment to ongoing training and adaptation not only boosts user proficiency but also enhances overall satisfaction.

In conclusion, the successful implementation and management of core banking systems transcend merely adopting new technology; they represent a fundamental transformation of banking operations to meet the demands of a rapidly changing financial environment. By prioritizing these strategies, we can secure our position in the market, safeguard customer trust, and ultimately deliver superior service. The journey toward operational excellence begins with a robust core banking system, and the time to act is now.