Overview

Financial services digital transformation is fundamentally achieved through the comprehensive integration of advanced technologies such as cloud computing, AI, and data analytics. These technologies are essential for enhancing operational efficiency and elevating customer experiences. However, challenges such as legacy systems and regulatory compliance persist.

So, how can organizations effectively navigate these obstacles? Strategic steps—including:

- Assessing current states

- Defining clear objectives

- Investing in technology

are vital for successfully managing this transformation and meeting evolving market demands. By embracing these approaches, financial institutions can not only overcome existing hurdles but also position themselves for future success.

Introduction

In an era characterized by rapid technological advancement, the financial services sector is experiencing a profound transformation driven by digital integration. This significant shift not only redefines institutional operations but also reshapes the customer experience, compelling organizations to innovate or face obsolescence.

As financial institutions adopt technologies such as artificial intelligence, cloud computing, and data analytics, they confront considerable challenges, including:

- Legacy systems

- Regulatory compliance

The journey toward digital transformation is not merely a trend; it is a critical necessity for survival in a competitive landscape where customer expectations evolve at an unprecedented pace.

How can organizations navigate these complexities to thrive? This article delves into the intricacies of digital transformation in financial services, exploring key technologies, challenges, and strategic steps that can empower organizations in this new digital age.

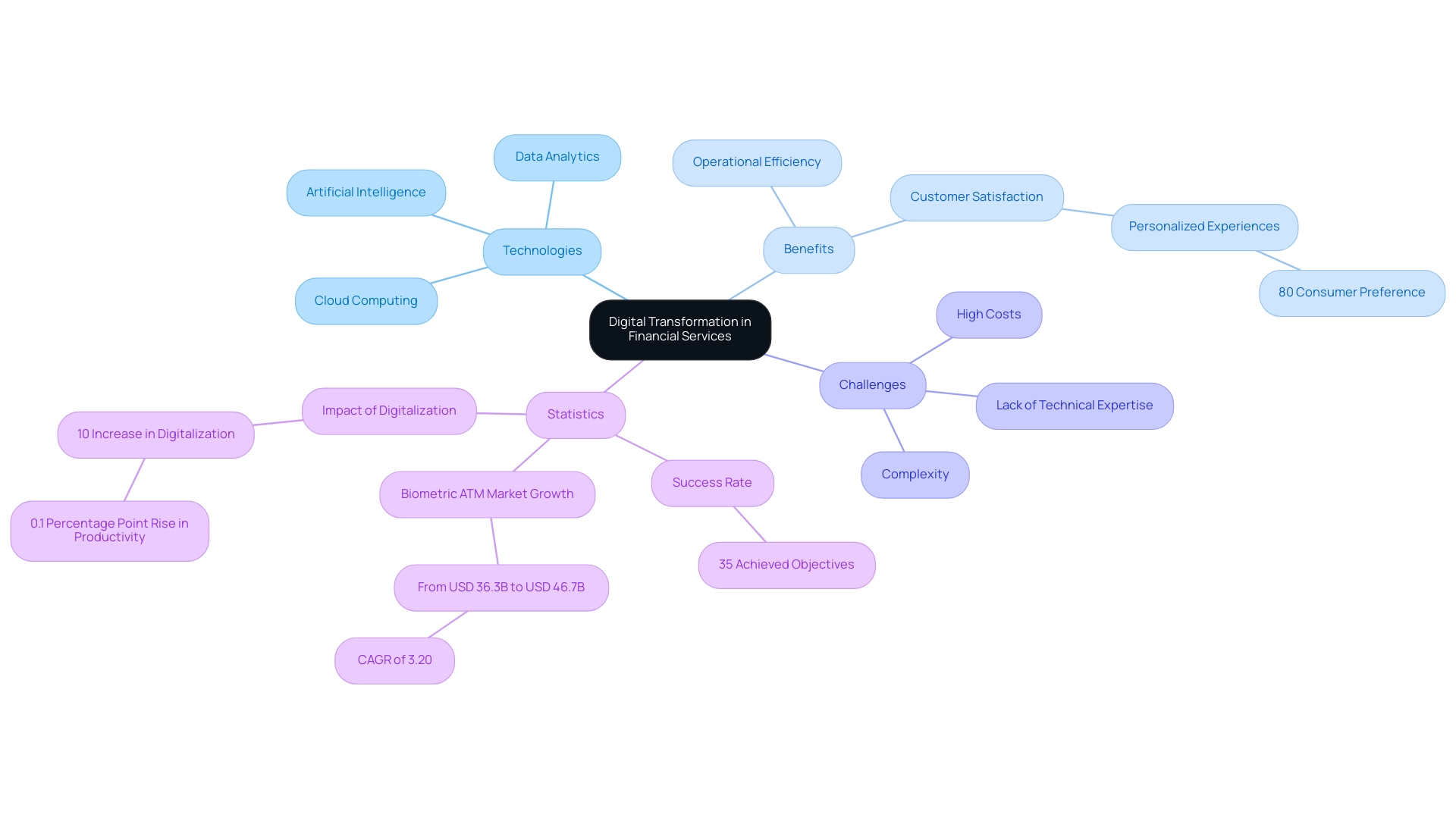

Understanding Digital Transformation in Financial Services

The financial services digital transformation necessitates the comprehensive integration of digital technology across all operational facets of a monetary entity, fundamentally reshaping how these organizations function and deliver value to their clients. This transformation within the financial services sector is propelled by the imperative to enhance operational efficiency, improve user experiences, and remain competitive in an increasingly digital-first landscape.

As Gustavo Estrada from BC Provincial Health Services Authority highlights, effective digital transformation simplifies complex projects and yields results within desired time frames and budget constraints, underscoring the pivotal role of technology in attaining operational excellence. To thrive, monetary institutions must embrace cutting-edge technologies such as cloud computing, artificial intelligence, and data analytics. These innovations not only streamline processes but also empower organizations to meet the evolving expectations of their clients.

The transition from traditional banking practices to financial services digital transformation is not merely a trend; it has become essential for survival in today’s economic climate.

Emerging opportunities in digital banking are particularly noteworthy, with 80% of consumers expressing a preference for personalized monetary experiences. This shift emphasizes the necessity of tailoring services to address individual customer needs, which can significantly bolster customer loyalty and satisfaction. Avato’s dedicated hybrid integration platform equips financial institutions with the essential tools for effective integration and personalization, ultimately enhancing business value.

By unlocking isolated assets, Avato enables organizations to leverage their existing data and systems, fostering a more cohesive and responsive operational environment.

However, the journey toward financial services digital transformation is laden with challenges. Research indicates that only 35% of businesses have successfully achieved their digital change objectives, with complexity, lack of technical expertise, and high costs identified as major hurdles. Avato confronts these challenges by providing a robust platform that simplifies integration processes and offers the necessary support to navigate technical obstacles.

Despite these challenges, the benefits of financial services digital transformation are substantial. For example, a study conducted across 21 OECD nations revealed that a 10% increase in the digitalization of the finance sector corresponds with a 0.1 percentage point rise in productivity growth for the average industry, particularly benefiting intangible-intensive sectors and small to medium-sized enterprises (SMEs).

As the finance sector continues to evolve, the anticipated growth of the biometric ATM market—from USD 36.3 billion in 2023 to USD 46.7 billion by 2032—illustrates the increasing reliance on advanced technologies to enhance security and client service. This growth underscores the necessity for monetary organizations to adopt financial services digital transformation to remain competitive and meet customer demands. Avato’s secure hybrid integration platform ensures round-the-clock availability and reliability, positioning it as a vital ally in this transformation process.

In summary, the integration of digital technology is not merely advantageous but essential for banking entities striving for financial services digital transformation to satisfy the requirements of the contemporary market.

The Role of Technology in Financial Services Transformation

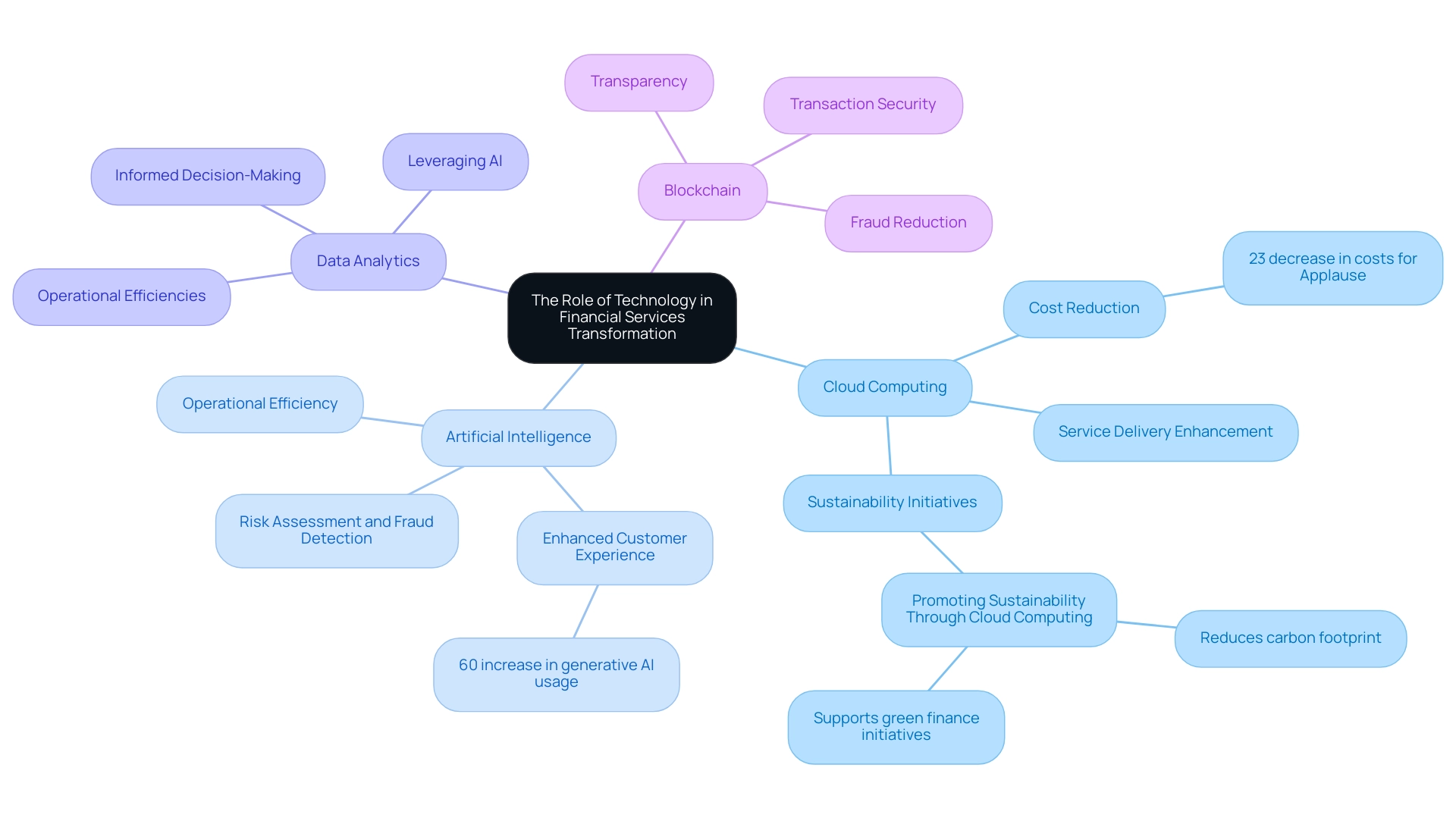

Technology stands as the cornerstone of digital transformation in monetary services, with several key technologies leading the charge.

- Cloud Computing: As institutions increasingly migrate workloads to the cloud, they benefit from a scalable and flexible IT infrastructure. This shift not only reduces operational costs but also enhances service delivery. Recent statistics reveal that cloud adoption in the banking sector is on the rise, with many organizations reporting significant reductions in cloud spending. For instance, companies like Applause have experienced a 23% decrease in costs after optimizing their cloud strategies, underscoring the financial benefits of this transition. Avato’s Hybrid Integration Platform accelerates this process by offering features such as seamless data integration, real-time analytics, and robust security measures, ensuring secure and efficient system integration that supports these cloud initiatives.

- Artificial Intelligence (AI): AI is revolutionizing service in banking, with chatbots and personalized recommendations becoming commonplace. By 2025, the integration of AI in service is expected to significantly enhance satisfaction and operational efficiency. Moreover, generative AI has emerged as a powerful tool in enhancing user experience, with a 60% increase in its use for developing sophisticated chatbots and virtual assistants. Additionally, AI plays a crucial role in risk assessment and fraud detection, enabling banks to proactively manage threats and enhance security measures. Avato’s solutions leverage the transformative impact of AI, promoting revenue growth and efficiency improvements across the sector through features like predictive analytics and automated decision-making.

- Data Analytics: The capability to utilize vast amounts of data is transforming decision-making processes within monetary institutions. Advanced data analytics tools empower organizations to gain deeper insights into clients and drive operational efficiencies, ultimately leading to more informed strategic decisions. This capability is essential for leveraging AI effectively and ensuring that services can adapt to changing market demands.

- Blockchain: This technology is redefining transaction security and transparency in the sector. By providing secure and immutable transaction records, blockchain reduces fraud and fosters trust among stakeholders, which is essential in an industry where integrity is paramount, thereby supporting the financial services digital transformation. The adoption of these technologies not only streamlines operations but also enhances customer experiences and drives innovation. For instance, a case study on promoting sustainability through cloud computing illustrates how monetary organizations are leveraging cloud technology to reduce their carbon footprint, aligning with green finance initiatives and demonstrating a commitment to environmental stewardship. This case study showcases the tangible benefits of cloud adoption, highlighting how it supports sustainability objectives while also addressing operational needs.

However, as monetary entities embrace these advancements, they must also navigate regulatory challenges. Ensuring data residency and compliance with local regulations is critical, particularly as banks increasingly rely on cloud computing. Institutions that effectively address these challenges will be better positioned to maintain a competitive edge in an increasingly digital marketplace.

By embracing these technological advancements and leveraging Avato’s Hybrid Integration Platform, which integrates these key technologies seamlessly, banking IT managers can ensure their organizations are well-equipped to thrive in this evolving environment.

Challenges in Achieving Digital Transformation

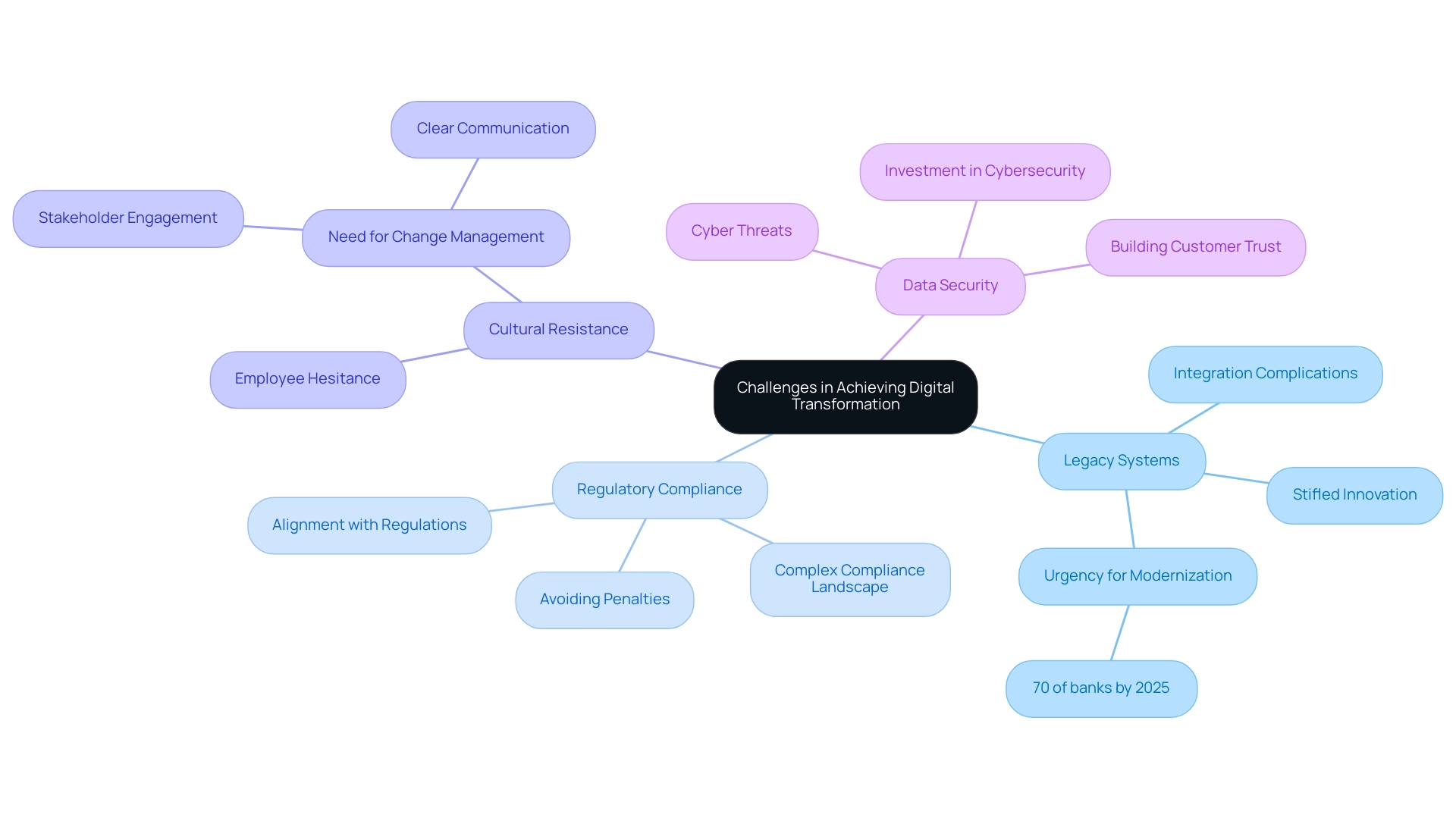

Financial institutions encounter a myriad of challenges as they embark on their digital transformation journeys, each of which can significantly impact their ability to innovate and remain competitive.

- Legacy Systems: A significant number of financial institutions continue to depend on outdated legacy systems that are often incompatible with modern technologies. This reliance complicates integration efforts and stifles innovation, making it difficult for organizations to respond swiftly to market changes. In 2025, it is estimated that nearly 70% of banks will still grapple with these legacy systems, underscoring the urgency for effective integration strategies. Avato plays a crucial role in transforming these legacy systems, simplifying complex integrations, and delivering cost-effective solutions that enable banks to modernize their operations. As Vikram, Vice Chair and US Financial Services Industry Leader at Deloitte, notes, the challenges posed by legacy systems necessitate a robust approach to transformation.

- Regulatory Compliance: The services sector is heavily regulated, and navigating the complex landscape of compliance while implementing new technologies poses a formidable challenge. Institutions must ensure that their digital initiatives align with regulatory requirements, which can vary significantly across jurisdictions. Avato’s hybrid integration platform is architected for secure transactions, allowing financial institutions to integrate new tools while maintaining compliance, thus avoiding costly penalties and reputational damage.

- Cultural Resistance: Change is often met with resistance, particularly in organizations with long-standing processes. Employees may be hesitant to adopt new technologies or workflows, which can impede progress. To overcome this barrier, effective change management strategies are essential, including clear communication of the benefits of digital evolution and ongoing support for staff during the transition. Avato emphasizes stakeholder engagement to ensure that all parties are aligned and informed throughout the transformation process.

- Data Security: As financial institutions digitize their operations, safeguarding sensitive client data becomes increasingly critical. The rise in cyber threats necessitates robust security measures to protect against data breaches and ensure compliance with data protection regulations. Institutions must prioritize investments in cybersecurity to build trust with their customers and maintain their competitive edge. Avato’s solutions are crafted with security as a priority, offering a rock-solid foundation for digital change initiatives.

The urgency for modernization is further highlighted by the projected growth of the Biometric ATM Market, expected to rise from USD 36.3 Billion in 2023 to USD 46.7 Billion by 2032. This trend emphasizes the necessity for monetary organizations to innovate and integrate new technologies to stay competitive.

Moreover, the case study titled “Economic Inequalities Highlighted During Black History Month” underscores the significance of tackling economic disparities and the role of digital innovation in enhancing access to monetary services for marginalized communities.

Addressing these challenges requires a strategic approach that encompasses stakeholder engagement, comprehensive planning, and a commitment to investing in both training and technology. By proactively addressing these challenges with Avato’s hybrid integration platform, monetary entities can pave the way for successful digital change, ultimately enhancing their operational capabilities and customer experiences.

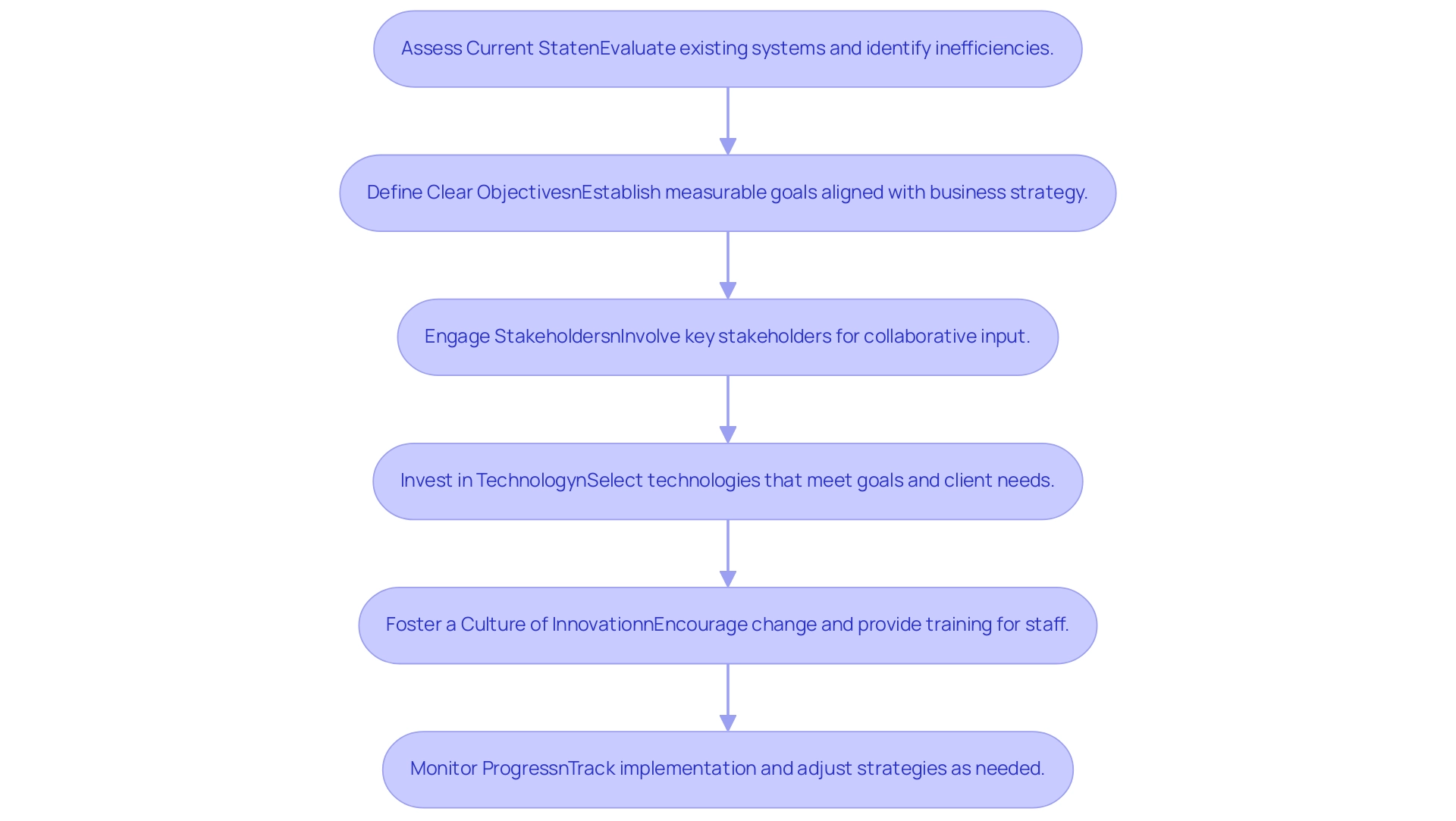

Strategic Steps for Implementing Digital Transformation

To successfully implement digital change, financial institutions must consider the following strategic steps:

-

Assess Current State: Conduct a thorough evaluation of existing systems, processes, and technologies. This assessment identifies inefficiencies and areas ripe for improvement, laying the groundwork for a successful financial services digital transformation. By leveraging existing legacy systems while integrating new technologies, institutions can prevent unnecessary resource expenditure and enhance operational efficiency—an essential factor in financial services digital transformation.

-

Define Clear Objectives: Establish specific, measurable goals for the change initiative. These objectives should align with the institution’s overall business strategy, ensuring that every effort contributes to broader organizational aims. Notably, 26% of senior executives view high costs as a major barrier to financial services digital transformation, underscoring the necessity of addressing cost issues in these initiatives.

-

Engage Stakeholders: Involve key stakeholders from various departments early in the process. Their insights and buy-in are crucial for fostering a collaborative environment and ensuring that diverse perspectives are considered in the transformation strategy. This engagement is vital for successful change management, especially as organizations prepare for the complexities of financial services digital transformation in the context of open banking.

-

Invest in Technology: Select and implement technologies that not only align with the institution’s goals but also satisfy client needs. With 72% of CEOs developing aggressive digital investment strategies, prioritizing the right technology is essential for remaining competitive in financial services digital transformation. For instance, leading banks are employing biometric technologies to enhance security and streamline verification processes, reflecting a significant trend toward user convenience and security, as nearly 46% of US companies are replacing passwords with biometrics. Avato’s hybrid integration platform, built on Red Hat’s JBoss Middleware, offers a robust solution for modernizing these technologies while ensuring compliance with stringent security protocols. Additionally, Avato provides services that contribute to financial services digital transformation, including enterprise architecture, project management, and technical analysis to support these technological investments.

-

Foster a Culture of Innovation: Encourage a mindset that embraces change and innovation, particularly regarding financial services digital transformation, among employees. Offering training and assistance can help foster this environment, enabling staff to share ideas and solutions that promote change. As Salesforce notes, 71% of customers are more likely to trust a company with their personal data if its use is clearly explained, which highlights the importance of transparency in customer data usage during financial services digital transformation. Avato’s expert integration services can support this training, ensuring staff are well-equipped to navigate new systems and processes.

-

Monitor Progress: Continuously track the implementation process and measure progress against established objectives. This ongoing assessment enables organizations to adjust strategies as necessary, ensuring they remain on course to achieve their goals. By utilizing Avato’s global partnership services, banks can ensure they have the right support and resources to adapt to the evolving landscape of open banking. Moreover, addressing potential security weaknesses by employing strong integration solutions that adhere to the utmost security standards is essential.

By following these strategic steps, institutions can establish a structured approach to financial services digital transformation that maximizes their chances of success. Avato distinguishes itself by providing unparalleled value through speed, security, and ease of integration, significantly enhancing operational capabilities and supporting these change initiatives.

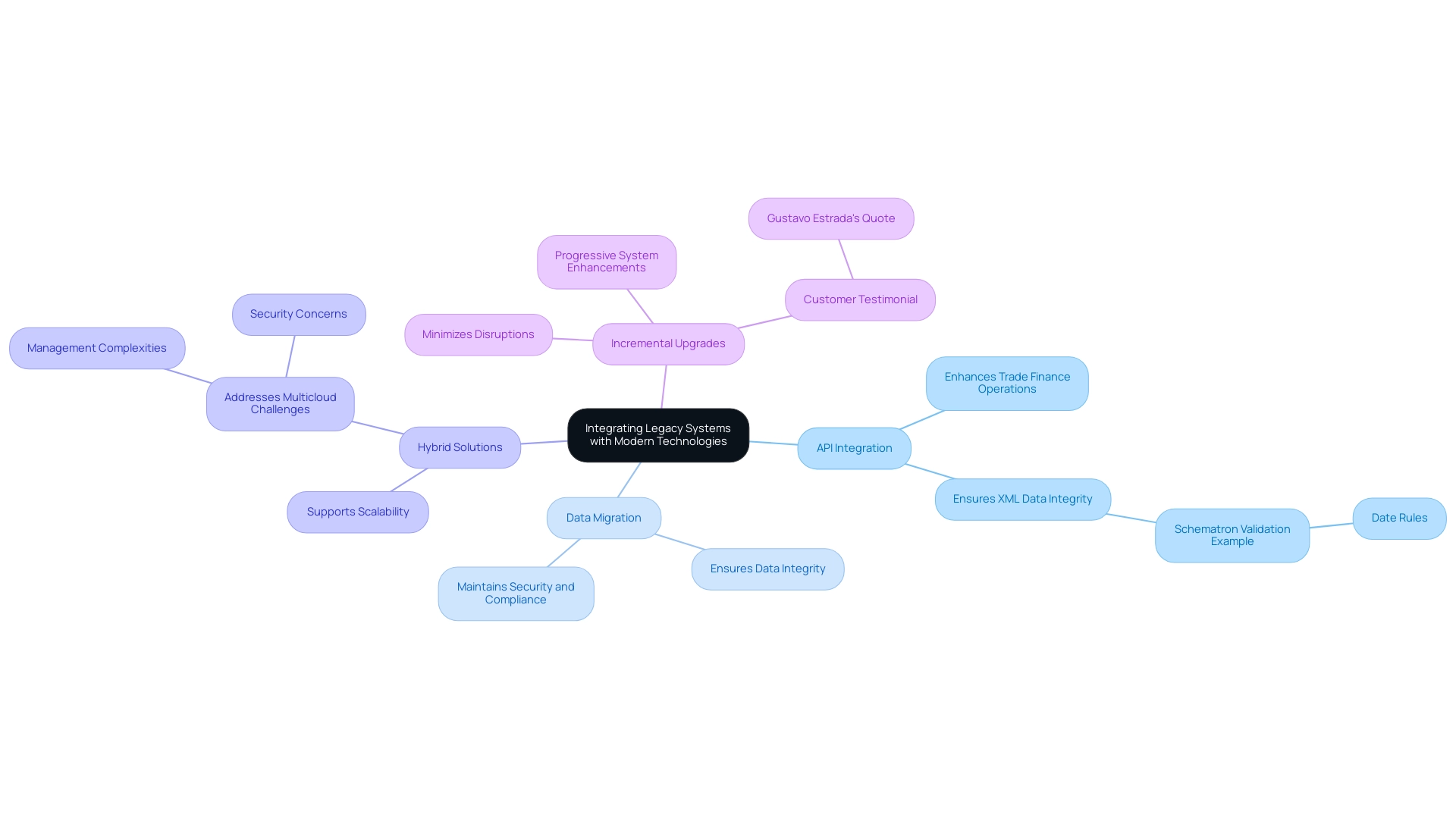

Integrating Legacy Systems with Modern Technologies

Integrating legacy systems with contemporary technologies is essential for achieving successful digital transformation in the services sector. Consider the following key strategies:

- API Integration: Leverage Application Programming Interfaces (APIs) to bridge the gap between legacy systems and new applications. This approach facilitates seamless data flow and enhances functionality, crucial as 90% of world trade relies on efficient trade finance operations. Avato’s hybrid integration platform excels in enhancing trade finance operations by ensuring smooth data flow between systems, thereby supporting the critical infrastructure of global trade. Furthermore, by implementing Schematron validation, Avato guarantees the integrity of XML data, preventing errors that could disrupt operations. An example of a Schematron rule that illustrates this is:

<schema xmlns="http://purl.oclc.org/dsdl/schematron">

<pattern>

<title>Date rules</title>

<rule context="Contract">

<assert test="ContractDate < current-date()">ContractDate should be in the past because future contracts are not allowed.</assert>

</rule>

</pattern>

</schema>

-

Data Migration: A meticulous plan for migrating data from legacy systems to modern platforms is vital. Ensuring data integrity and security throughout this process mitigates risks and builds trust in the new systems. Avato’s solutions are designed to simplify this process, allowing organizations to transition smoothly while maintaining data security and compliance through rigorous schema validation.

-

Hybrid Solutions: Implementing hybrid integration platforms enables organizations to maintain both legacy and modern systems. This flexibility not only supports scalability but also addresses the complexities associated with multicloud deployments, where 95% of organizations report challenges in management and security. Avato’s platform is specifically tailored to tackle these challenges, providing a robust framework for managing diverse cloud environments while ensuring data integrity through structured schemas.

-

Incremental Upgrades: Instead of a complete overhaul, consider incremental upgrades. This strategy enables gradual modernization, minimizing disruptions to ongoing operations while progressively enhancing system capabilities. As noted by Gustavo Estrada, a customer of Avato, “Avato has simplified complex projects and delivered results within desired time frames and budget constraints,” highlighting the effectiveness of this approach.

By effectively integrating legacy systems, monetary organizations can significantly enhance their operational capabilities and reduce the risks linked to digital transformation. Success stories from organizations that have embraced API integration, particularly those utilizing Avato’s solutions, illustrate its role in streamlining processes and enhancing service delivery. Notably, Avato’s work with Coast Capital exemplifies its capabilities, where the integration facilitated a seamless transition with minimal downtime.

Moreover, monetary organizations must invest in training and resources to effectively manage multicloud technologies, ensuring they can leverage the full potential of these advancements. The case study titled “Hybrid Multi-Cloud Implementation” emphasizes the significance of Avato’s solutions in achieving successful digital transformation.

Leveraging Data and Analytics for Transformation

Data and analytics serve as crucial catalysts for digital transformation in financial services, unlocking various opportunities for effective leverage:

-

Consumer Insights: By harnessing data analytics, financial organizations can uncover valuable insights into behavior and preferences. This enables the creation of personalized services and targeted marketing strategies that resonate with clients, ultimately enhancing client satisfaction and loyalty. Leveraging Avato’s Hybrid Integration Platform can further accelerate this process by ensuring secure and efficient system integration, as outlined in our comprehensive guide to successful digital transformation.

-

Operational Efficiency: Analyzing operational data allows banks to identify inefficiencies within their processes. By streamlining these operations, organizations can significantly reduce costs and enhance service delivery, leading to a more agile and responsive entity. The integration of generative AI technologies can enhance efficiency in the context of financial services digital transformation, particularly in automating routine tasks and improving decision-making processes. For instance, case studies have shown that banks utilizing generative AI have reduced processing times by up to 30%, significantly improving operational workflows.

-

Risk Management: Advanced analytics play a pivotal role in enhancing risk assessment and fraud detection capabilities. By implementing sophisticated analytical tools, banks can ensure compliance with regulatory standards while strengthening security measures against potential threats. The transformative impact of AI in financial services digital transformation is profound, as it revolutionizes how organizations approach security and risk management, with some entities reporting a 40% decrease in fraud incidents after adopting AI-driven solutions.

-

Predictive Analytics: Utilizing predictive models empowers financial institutions to forecast trends and anticipate customer needs. This proactive approach enables banks to adapt their offerings in real-time, ensuring they remain competitive in a rapidly evolving market. The integration of cloud-native analytics is projected to provide real-time insights and seamless integration, significantly enhancing operational capabilities by 2033.

A recent survey of nearly 160 global banks highlights the growing importance of cloud-native analytics, which is projected to provide real-time insights and seamless integration, significantly enhancing operational capabilities by 2033. Key findings from the survey indicate that banks investing in financial services digital transformation by modernizing their IT infrastructure and forming strategic partnerships with fintechs are better positioned to leverage advanced data analytics effectively. Furthermore, investing in employee training in data science and analytics-driven decision-making is vital for optimizing these advantages. Case studies focusing on improving bank performance through data analytics demonstrate how organizations can enhance their economic operations and obtain objective insights that propel strategic enhancements. For instance, benchmarking against peers and industry averages allows banks to evaluate their strengths and weaknesses without the risk of human error. A notable outcome from these initiatives is the ability to actively monitor digital engagement metrics, enabling banks to enhance user experiences, mitigate churn risks, and uncover new revenue opportunities, fostering long-term growth and deepening client relationships.

As Gustavo Estrada noted, the ability to simplify complex projects and deliver results within desired time frames and budget constraints is vital for successful change. By efficiently utilizing data analytics, along with the features provided by Avato’s solutions, organizations can make informed choices that drive their financial services digital transformation initiatives and improve overall performance.

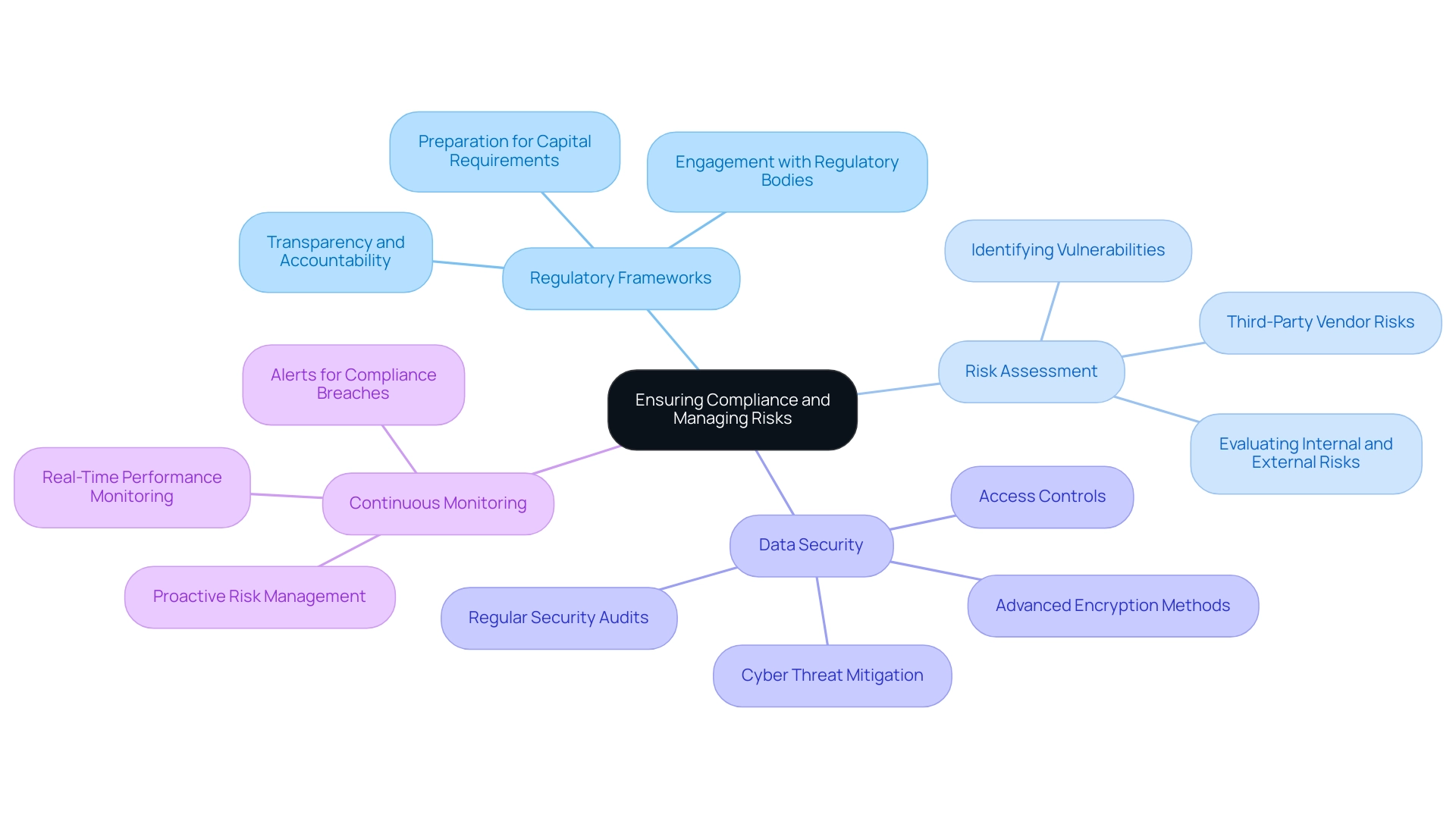

Ensuring Compliance and Managing Risks

Compliance and risk management stand as essential pillars in the digital transformation of financial services. To adeptly navigate this complex landscape, consider these key aspects:

-

Regulatory Frameworks: Staying abreast of the evolving regulatory landscape is crucial. Financial organizations must ensure that their digital transformation initiatives are strictly aligned with compliance requirements, especially as regulations adapt to technological advancements. By 2025, frameworks will likely emphasize transparency and accountability, necessitating proactive engagement with regulatory bodies. As banks prepare for the re-proposal of capital requirements, comprehending these frameworks becomes even more critical.

-

Risk Assessment: Conducting comprehensive risk assessments is vital for pinpointing potential vulnerabilities linked to new technologies and processes. This involves evaluating both internal and external risks, including those arising from third-party vendors. With 39% of businesses adopting cloud technology, understanding the associated risks is increasingly important for maintaining operational integrity. Organizations that integrate compliance and risk management into their digital transformation not only enhance operational resilience but also position themselves favorably in a competitive market.

-

Data Security: Implementing robust data security measures is non-negotiable for safeguarding sensitive client information. Financial organizations must adopt advanced encryption methods, access controls, and regular security audits to protect data and maintain customer trust. The focus on data protection is underscored by the rising occurrence of cyber threats targeting the economic sector. Avato’s hybrid integration platform plays a pivotal role in ensuring secure data connectivity, enabling organizations to protect their assets while enhancing business value. The platform’s features, such as real-time data monitoring and automated compliance checks, are designed to address the specific challenges of data security in the banking services sector.

-

Continuous Monitoring: Establishing ongoing monitoring processes is essential for ensuring compliance and swiftly addressing emerging risks. This encompasses real-time performance monitoring and alerts that assist organizations in reacting to possible compliance breaches or security incidents before they escalate. As noted by Gustavo Estrada, “Avato has simplified complex projects and delivered results within desired time frames and budget constraints,” highlighting the importance of effective management in navigating these challenges.

By prioritizing these considerations, institutions can effectively manage the complexities of financial services digital transformation while safeguarding their operations and reputation. Successful case studies, such as that of Tim Coy at Deloitte, demonstrate that organizations managing compliance and risk effectively can enhance their operational capabilities in the economic sector. Avato, deriving its name from the Hungarian word for ‘dedication,’ embodies a commitment to architecting the technology foundation required to power rich, connected user experiences.

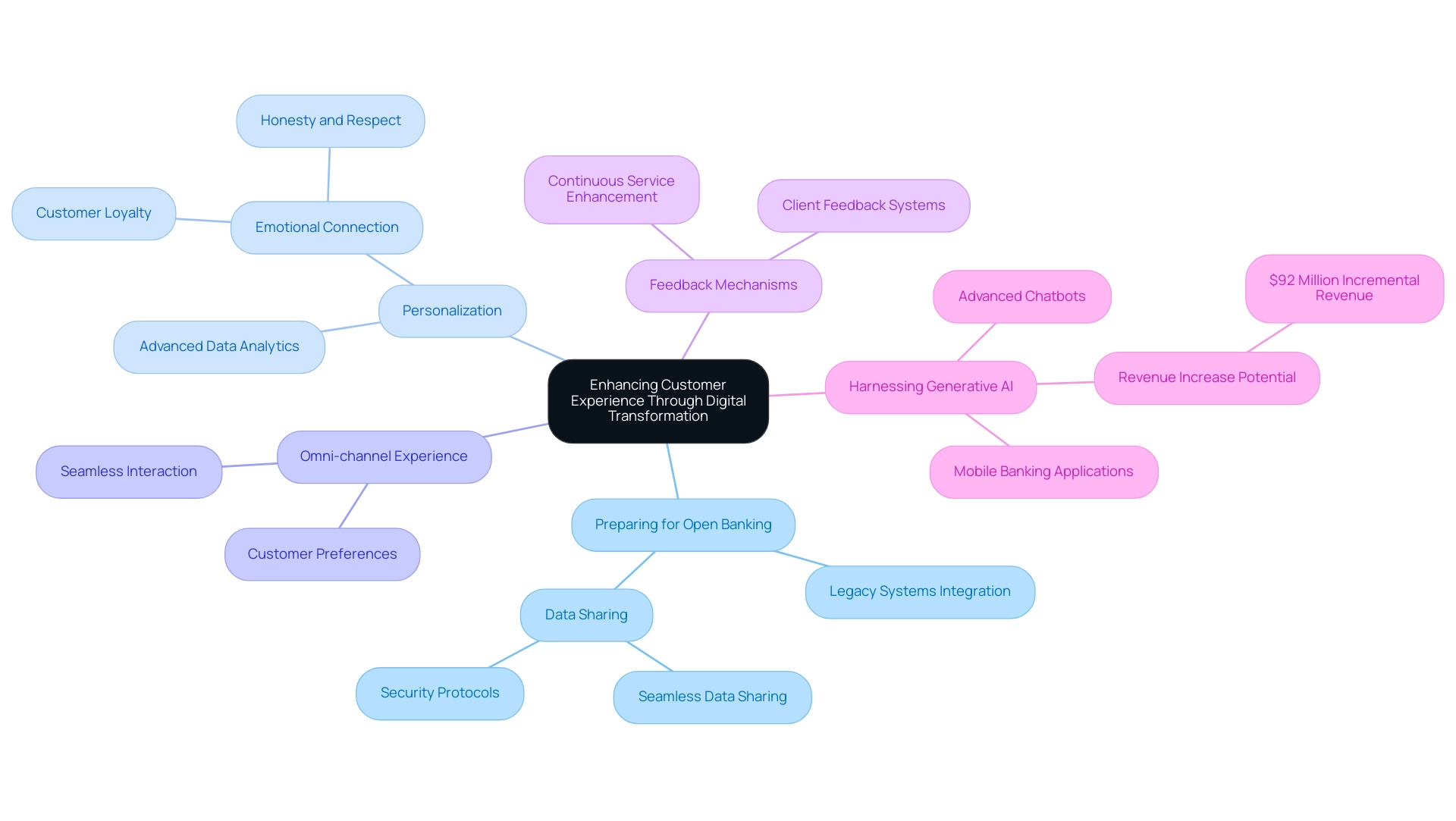

Enhancing Customer Experience Through Digital Transformation

Digital transformation in financial services presents a vital opportunity for monetary organizations to significantly enhance user experience. Consider these key strategies:

- Preparing for Open Banking: As financial institutions prepare for open banking, it is essential to leverage existing legacy systems through strategic integration. Utilizing Avato’s hybrid integration platform enables banks to improve client experiences while contributing to the digital transformation of financial services and ensuring compliance with stringent security protocols. This method facilitates seamless data sharing across applications, fostering innovation and operational efficiency. Specifically, banks should implement a middle layer that supports digital transformation by translating data into open formats, ensuring compatibility across various systems and enhancing security measures to safeguard sensitive information.

- Personalization: Advanced data analytics should be harnessed to deliver tailored services and recommendations that align with individual preferences. This approach enhances satisfaction and fosters deeper emotional connections, which research indicates are crucial for loyalty. A case study titled “Leveraging Emotional Connection to Boost Loyalty” reveals that clients value honesty and respect in their interactions, underscoring the emotional nature of experiences.

- Omni-channel Experience: It is imperative to create a seamless interaction across all platforms, ensuring individuals can engage with the institution through their preferred channels—be it mobile, online, or in-person. This consistency is vital, as 90% of US citizens express a desire to save money each month, often seeking guidance from their banks through various channels.

- Feedback Mechanisms: Establishing robust systems for gathering client feedback is essential for continuous service enhancement and effectively addressing pain points. Involving clients in this manner can lead to increased loyalty and trust. For instance, case studies demonstrating successful implementations of feedback systems can provide valuable insights into best practices for the digital transformation of financial services.

- Harnessing Generative AI: Introducing cutting-edge digital tools, such as mobile banking applications and online planning resources, improves convenience and accessibility. The emergence of generative AI in the digital transformation of financial services, particularly in developing advanced chatbots and virtual assistants, can optimize operations and enhance client interactions. These innovations not only meet evolving client expectations but also position banks to capture incremental revenue, with estimates suggesting a direct bank could see an increase of $92 million. As noted by Gustavo Estrada from BC Provincial Health Services Authority, Avato simplifies complex projects, which is essential for effectively implementing these innovative solutions.

By prioritizing client experience through these strategies, monetary organizations can cultivate stronger relationships with their patrons, ultimately driving loyalty and long-term success in an increasingly competitive landscape.

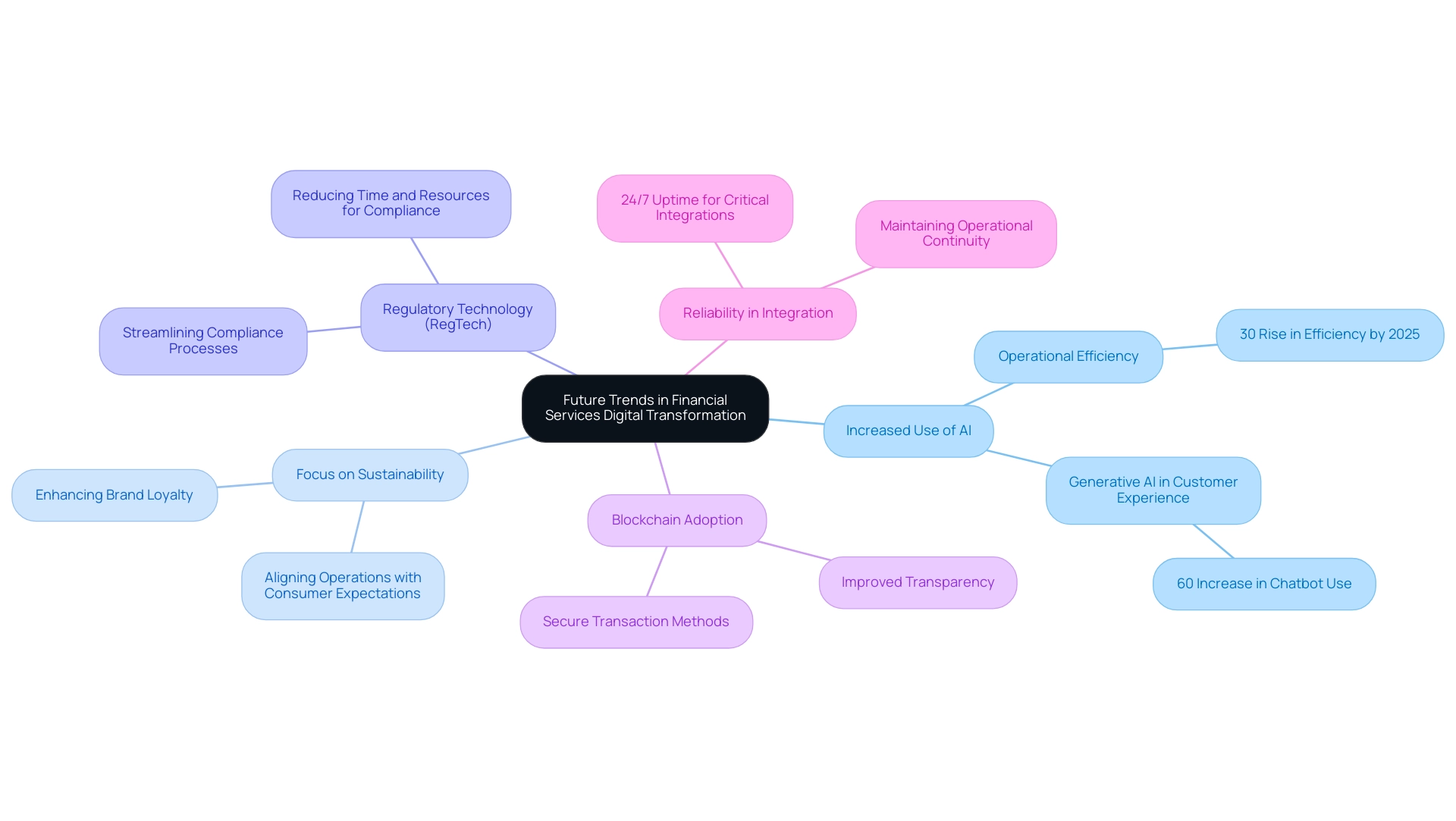

Future Trends in Financial Services Digital Transformation

As the financial services sector undergoes rapid transformation, several pivotal trends are emerging that will significantly influence the landscape of digital transformation in 2025 and beyond:

-

Increased Use of AI: Artificial intelligence is poised to revolutionize the industry by automating processes, enhancing customer interactions, and bolstering risk management. By 2025, it is anticipated that AI will lead to a 30% rise in operational efficiency across banking entities, enabling them to respond swiftly to market shifts and client requirements. Avato’s hybrid integration platform plays a crucial role in this shift, empowering financial organizations to spearhead the AI revolution by seamlessly integrating AI capabilities into their operations. The integration of generative AI, in particular, is transforming customer experience, with a 60% increase in its use for developing sophisticated chatbots and virtual assistants.

-

Focus on Sustainability: Financial organizations are increasingly prioritizing sustainability, aligning their operations and offerings with consumer expectations. This shift not only meets regulatory demands but also enhances brand loyalty among environmentally conscious consumers, further supported by Avato’s commitment to creating integrated solutions that promote sustainable practices.

-

Regulatory Technology (RegTech): The adoption of RegTech solutions is becoming essential for navigating the complexities of regulatory environments. Institutions leveraging these technologies can streamline compliance processes, reducing the time and resources spent on regulatory adherence. Avato’s expertise in hybrid integration guarantees that these solutions are implemented with speed and reliability, enabling organizations to focus on their core operations.

-

Blockchain Adoption: The exploration of blockchain technology is gaining momentum as organizations seek secure transaction methods and improved transparency. By integrating blockchain, monetary services can enhance trust and efficiency in transactions, which is crucial in an era marked by increasing digital interactions. Avato’s integration solutions assist this transition, allowing organizations to harness the full potential of blockchain technology.

-

Reliability in Integration: As organizations pursue digital transformation, ensuring reliability is paramount. Avato guarantees 24/7 uptime for critical integrations, which is essential for maintaining operational continuity in a rapidly evolving landscape. This reliability is crucial as monetary organizations adjust to the growing demands of digital transactions and customer expectations.

These trends are not just speculative; they are rooted in the changing needs of consumers and the operational requirements of financial organizations. For instance, the payments sector has experienced a significant shift towards electronic transactions, accelerated by the COVID-19 pandemic, prompting organizations to rethink their strategies in light of changing consumer preferences and technological advancements. As noted by Gustavo Estrada, a customer, “Avatar has simplified complex projects and delivered results within desired time frames and budget constraints,” highlighting the importance of effective integration solutions in navigating these changes.

By proactively anticipating these trends, monetary organizations can adapt their strategies effectively, ensuring they remain competitive in the digital age. The integration of AI and blockchain, specifically, will be crucial in shaping the future of monetary services, fostering innovation while tackling the challenges presented by a rapidly evolving environment. Additionally, the rise of IoT devices can track employee movements and habits, helping to reduce management and utility costs, further enhancing operational efficiency.

Finally, the ongoing de-globalization of financial institutions, driven by increased digitization and risk aversion, underscores the need for agile and responsive digital transformation efforts.

Conclusion

Digital transformation in financial services has evolved from an option to an absolute necessity for survival in an increasingly competitive landscape. The integration of advanced technologies such as AI, cloud computing, data analytics, and blockchain is not just beneficial; it is crucial for enhancing operational efficiency and improving customer experiences. Financial institutions face numerous challenges, including legacy systems and regulatory compliance, yet they must embrace innovative solutions that streamline operations.

Successful digital transformation strategies highlight the importance of:

- Assessing current capabilities

- Defining clear objectives

- Engaging stakeholders

- Investing in the right technologies

By fostering a culture of innovation and continuously monitoring progress, organizations can adapt to the ever-evolving demands of the market. Furthermore, leveraging data analytics drives operational improvements and enables personalized customer experiences, essential for building loyalty and trust.

As the financial services sector advances, embracing trends such as AI automation, sustainability, and the adoption of RegTech solutions becomes essential. Institutions prioritizing these advancements while effectively managing compliance and risk will position themselves favorably in the market. Ultimately, the journey toward digital transformation is complex. However, with the right strategies and tools in place, financial institutions can thrive in this new digital age, ensuring they meet and exceed customer expectations while driving long-term growth.